|

시장보고서

상품코드

1683983

중국의 살균제 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)China Fungicide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

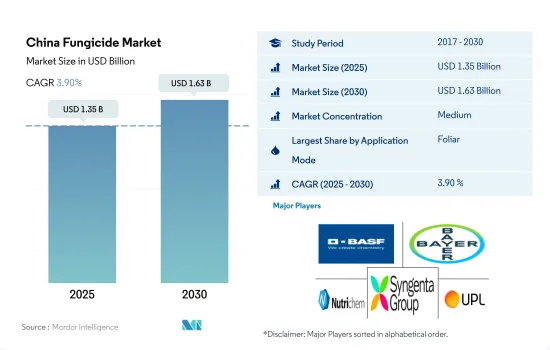

중국의 살균제 시장 규모는 2025년에 13억 5,000만 달러로 추정되고, 2030년에는 16억 3,000만 달러에 이를 전망이며, 예측 기간 2025년부터 2030년까지 CAGR은 3.90%를 나타낼 것으로 예측됩니다.

속효성으로 엽면 살포가 중국의 살균제 시장을 독점

- 중국에서는 살균제 제조 산업이 확립되어 있으며, 여러 국내 기업이 살균제 제제와 유효 성분을 생산하고 있습니다. 중국에서 사용되는 주요 살균제로는 트리아졸계, 스트로빌린계, 벤즈이미다졸계, 디티오카르바메이트계, 퀴논 외부 억제제(QoI) 등이 있습니다. 이 살균제는 작용 방식이 다르며 특정 곰팡이 병원균을 표적으로 합니다. 중국은 2022년 아시아태평양 살균제 시장의 31.5%를 차지했습니다.

- 엽면 살포가 중국의 살균제 시장을 독점했으며 2022년에는 60.1%의 점유율을 차지했습니다. 엽면에 살포되는 살균제는 곰팡이 병원균에 신속하게 작용할 수 있습니다. 보통 살균제는 식물체 내에서 빠르게 흡수되고 전이하도록 제형화됩니다. 이를 통해 살균제는 병에 걸린 조직에 도달하여 균류를 억제하거나 사멸시키고 병의 진행을 억제하며 추가 피해를 예방할 수 있습니다.

- 종자 처리는 2022년 중국 살균제 시장의 14.1%를 차지했습니다. 곰팡이 감염은 식물을 약화시키고 개발을 억제합니다. 살균제 종자 처리는 질병의 피해를 예방하거나 낮추어 식물의 건강과 활력을 유지하는 데 도움이 됩니다. 이를 통해 식물은 더 많은 에너지를 성장과 개발로 돌릴 수 있어 건강하고 생산적인 작물로 이어집니다. 2017년부터 2022년까지 종자 처리제 시장 가치는 9,190만 달러 증가했습니다.

- 중국에서 살균제의 수출도 2026년까지 증가할 것으로 예상됩니다. 2021년, 이 나라는 1억 1,020만kg의 살균제를 수출했습니다. 2026년에는 수출량이 1억 2,560만kg에 달할 것으로 예측됩니다. 이 요인은 예측 기간 동안 CAGR 3.7%를 나타낼 것으로 예상되는 살균제 시장을 더욱 견인할 수 있습니다.

중국의 살균제 시장 동향

최대 잔여 수준 규정을 설정하고 병해 방제를 위한 다른 대안을 채택함으로써 헥타르당 살균제 소비량이 크게 감소했습니다.

- 과거 기간 동안 중국에서는 헥타르당 살균제 소비량이 약 16% 감소했습니다. 중국 정부는 살균제의 사용을 관리하는 규제와 정책을 시행했습니다. 여기에는 농산물 중 살균제의 최대 잔류 수준 제한 설정과 안전하고 책임있는 사용을 위한 지침을 수립하는 등이 포함됩니다. 이러한 규제를 시행함으로써 중국은 살균제가 적절한 예방 조치를 취한 후에 신중하게 사용되도록 하는 것을 목표로 하고 있습니다.

- 중국은 종합적인 병해충 관리(IPM) 전략의 실시를 적극적으로 장려하고 있으며, 그 전략에는 예방 조치, 생물학적 방제 기술 및 살균제와 같은 농약의 적절한 사용이 포함됩니다. 이 종합적인 접근법은 살균제의 사용률을 낮추는 데 성공했습니다.

- 중국 정부는 또한 전통적인 육종과 유전자 변형 기술에 의한 내병성 작물 품종의 개발 등 병해 방제의 대체 방법도 모색해 왔습니다. 병해에 대한 작물의 자연 저항성을 높이는 데 중점을 두어 중국은 살균제에 대한 의존성을 줄였습니다.

- 중국은 살균제의 대안으로 생물학적 방제제를 활용해 왔습니다. 이러한 생물학적 방제제는 식물 병원균의 증식을 억제하거나 억제할 수 있는 박테리아 및 진균과 같은 유익한 미생물을 포함합니다. 이러한 생물 방제제를 작물에 적용하면 살균제의 사용량을 줄일 수 있습니다.

- 농가는 윤작이나 토양 관리 등의 기술을 채용하여 병해를 효과적으로 예방 및 관리하고 있습니다. 이 기술은 중국에서 헥타르 당 살균제 소비를 줄였습니다.

만코제브, 프로피네브, 지람은 중국에서 가장 많이 사용되는 살균제 성분입니다.

- 만코제브, 프로피네브, 지람은 중국에서 가장 일반적으로 사용되는 살균제 성분입니다. 2021년 중국의 살균제 수출량은 110,250,000kg으로 독일, 프랑스, 중국에 이어 4위였습니다. 1997년 이후 수출은 평균 전년 대비 2.2% 증가했습니다. 2026년에는 1억 2,564만kg에 달할 것으로 예측됩니다.

- 만코제브는 넓은 스펙트럼의 접촉 살균제로, 나타네, 양상추, 밀, 사과, 토마토, 테이블 포도, 와인 포도, 전구 양파, 당근, 퍼스 닙, 에샬롯, 듀럼밀의 탄저병, 피슘병, 엽반병, 우동병, 보트리티스병, 녹병 , 딱지병 등 많은 진균병해의 방제에 사용됩니다. 2022년 가격은 톤당 7,700달러였습니다.

- 프로피네브는 디티오카르바민산염계 접촉 살균제로 2022년 가격은 톤당 3,500달러였습니다. 프로피네브는 토마토, 배추, 오이, 망고, 화훼 등의 작물에 적용됩니다. 망고의 조기 만고병, 배추의 탄저병, 감자의 베와병, 오이의 베와병, 토마토 만고병의 예방과 치료에 사용됩니다.

- 지람은 카르바마트계 농업용 살균제입니다. 식물의 엽면 살포가 가능하지만, 토양이나 종자의 처리에도 이용됩니다. 폼프루트, 스톤프루트, 견과류, 덩굴성 식물, 야채, 관엽 식물에 사용할 수 있으며, 특히 사과와 배 딱지, 기타 과수 작물의 알테르나리아, 셉토리아, 복숭아 시가, 샷홀, 녹병, 흑부병, 탄저병의 방제에 사용됩니다. 지람의 2022년 가격은 톤당 3,300달러였습니다.

- 유효 성분 가격은 국내 날씨, 병해 발생, 에너지 가격, 인건비 등의 요인에 크게 영향을 받습니다.

중국의 살균제 산업 개요

중국의 살균제 시장은 적당히 통합되어 상위 5개사에서 63.77%를 차지하고 있습니다. 이 시장 주요 기업은 다음과 같습니다. BASF SE, Bayer AG, Nutrichem, Syngenta Group 및 UPL Limited.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약 및 주요 조사 결과

제2장 보고서 제안

제3장 서문

- 조사 전제조건 및 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 1헥타르당 농약 소비량

- 유효성분의 가격 분석

- 규제 프레임워크

- 중국

- 밸류체인 및 유통채널 분석

제5장 시장 세분화

- 적용 모드별

- 약제 살포

- 엽면 살포

- 훈증

- 종자 처리

- 토양 치료

- 작물 유형별

- 상업 작물

- 과일 및 야채

- 곡물

- 콩류 및 지방종자

- 잔디 및 관상용

제6장 경쟁 구도

- 주요 전략적 움직임

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일(세계 수준 개요, 시장 수준 개요, 주요 사업 부문, 재무, 직원 수, 주요 정보, 시장 순위, 시장 점유율, 제품 및 서비스, 최근 동향 분석 포함)

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Jiangsu Yangnong Chemical Co. Ltd

- Nutrichem Co. Ltd

- Rainbow Agro

- Syngenta Group

- UPL Limited

- Wynca Group(Wynca Chemicals)

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계의 개요

- 개요

- Porter's Five Forces 분석 프레임워크

- 세계 밸류체인 분석

- 시장 역학(DROs)

- 정보원 및 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The China Fungicide Market size is estimated at 1.35 billion USD in 2025, and is expected to reach 1.63 billion USD by 2030, growing at a CAGR of 3.90% during the forecast period (2025-2030).

Foliar application dominated the Chinese fungicide market owing to its quick action

- China has a well-established fungicide manufacturing industry, with several domestic companies producing fungicide formulations and active ingredients. Major fungicide classes used in China include triazoles, strobilurins, benzimidazoles, dithiocarbamates, and quinone outside inhibitors (QoIs). These fungicides have different modes of action and target specific fungal pathogens. China accounted for 31.5% of the Asia-Pacific fungicide market in 2022.

- Foliar application dominated the Chinese fungicide market and accounted for a share of 60.1% in 2022. Fungicides applied in foliar can provide rapid action against fungal pathogens. They are typically formulated to have quick absorption and translocation properties within the plant. This allows the fungicide to reach the affected tissues and inhibit or kill the fungi, reducing disease progression and preventing further damage.

- Seed treatment accounted for 14.1% of the Chinese fungicide market in 2022. Fungal infections can weaken and stunt the development of plants. Fungicide seed treatments can help plants maintain their health and vigor by preventing or lowering disease damage. This allows the plants to allocate more energy toward growth and development, leading to healthier and more productive crops. The market value of seed treatment between 2017 and 2022 increased by USD 91.9 million.

- Exports of fungicides from China are also projected to increase by 2026. In 2021, the country exported 110.2 million kg of fungicides. By 2026, exports are projected to reach 125.6 million kg. This factor may further drive the fungicide market, which is anticipated to register a CAGR of 3.7% during the forecast period.

China Fungicide Market Trends

Setting regulations for controlling maximum residue levels and adopting other alternatives for disease control significantly reduced per-hectare fungicide consumption

- During the historical period, China witnessed a notable decrease of approximately 16% in the consumption of fungicides per hectare, attributed to several reasons. The Chinese government has implemented regulations and policies to control the use of fungicides. These include setting limits on the maximum residue levels of fungicides in agricultural products and establishing guidelines for their safe and responsible use. By enforcing these regulations, China aims to ensure that fungicides are used judiciously and with proper precautions.

- China has actively encouraged the implementation of integrated pest management (IPM) strategies, which encompass preventive measures, biological control techniques, and judicious application of pesticides, such as fungicides. This comprehensive approach has successfully led to a decrease in the rate of fungicide usage.

- The Chinese government has also explored alternative methods of disease control, including the development of disease-resistant crop varieties through traditional breeding or genetic modification techniques. By focusing on enhancing the natural resistance of crops to diseases, China has reduced the reliance on fungicides.

- China has been utilizing biological control agents as an alternative to fungicides. These agents include beneficial microorganisms, such as bacteria and fungi, which can suppress or inhibit the growth of plant pathogens. Applying these biocontrol agents to crops could lead to a reduction in the rate of fungicide usage.

- The farmers adopted techniques, such as crop rotation and soil management, to prevent and manage diseases effectively. These techniques reduced the consumption of fungicide per hectare in China.

Mancozeb, propineb, and ziram are the most commonly used fungicide ingredients in China

- Mancozeb, propineb, and ziram are the most commonly used fungicide ingredients in China. In 2021, the country exported 110,250,000 kg of fungicides and was fourth behind Germany, France, and China. On average, exports have grown by 2.2% Y-o-Y since 1997. Exports are projected to reach 125,640,000 kg by 2026.

- Mancozeb is a broad-spectrum contact fungicide that is used to control a number of fungal diseases, such as anthracnose, pythium blight, leaf spot, downy mildew, botrytis, rust, and scab, in oilseed rape, lettuce, wheat, apples, tomatoes, table grapes, wine grapes, bulb onions, carrots, parsnip, shallots, and durum wheat. It was priced at USD 7.7 thousand per metric ton in 2022.

- Propineb is a dithiocarbamate contact fungicide, priced at USD 3.5 thousand per metric ton in 2022. Propineb is applicable to tomato, Chinese cabbage, cucumber, mango, flowers, and other crops. It is used in preventing and treating early late blight of mango, anthracnose of Chinese cabbage, potato downy mildews, cucumber downy mildew, and tomato late blight.

- Ziram is a carbamate, agricultural fungicide. It can be applied to the foliage of plants, but it is also used for soil and/or seed treatment. It can be used in pome fruit, stone fruit, nuts, vines, vegetables, and ornamentals, particularly to control scabs in apples and pears, as well as Alternaria, Septoria, peach leaf curl, shot-hole, rusts, black rot, and anthracnose in other fruit crops. Ziram was priced at USD 3.3 thousand per metric ton in 2022.

- The active ingredient prices are majorly influenced by factors like weather conditions, disease outbreaks, energy prices, and labor costs in the country.

China Fungicide Industry Overview

The China Fungicide Market is moderately consolidated, with the top five companies occupying 63.77%. The major players in this market are BASF SE, Bayer AG, Nutrichem Co. Ltd, Syngenta Group and UPL Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 China

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application Mode

- 5.1.1 Chemigation

- 5.1.2 Foliar

- 5.1.3 Fumigation

- 5.1.4 Seed Treatment

- 5.1.5 Soil Treatment

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 BASF SE

- 6.4.2 Bayer AG

- 6.4.3 Corteva Agriscience

- 6.4.4 FMC Corporation

- 6.4.5 Jiangsu Yangnong Chemical Co. Ltd

- 6.4.6 Nutrichem Co. Ltd

- 6.4.7 Rainbow Agro

- 6.4.8 Syngenta Group

- 6.4.9 UPL Limited

- 6.4.10 Wynca Group (Wynca Chemicals)

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

샘플 요청 목록