|

시장보고서

상품코드

1683988

유럽의 살균제 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Europe Fungicide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

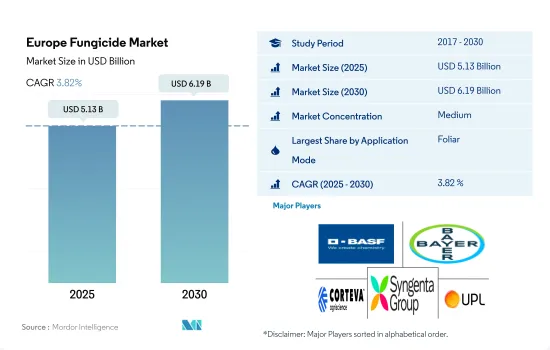

유럽의 살균제 시장 규모는 2025년에 51억 3,000만 달러로 추정되고, 2030년에는 61억 9,000만 달러에 이를 전망이며, 예측 기간 2025년부터 2030년까지 CAGR은 3.82%를 나타낼 것으로 예측됩니다.

작물 보호를 위한 효과적인 방법에 대한 요구는 모든 적용 방법에서 시장 성장에 박차를 가하고 있습니다.

- 유럽에서는 작물을 보호하고 높은 수율을 보장하기 위해 다양한 살포 방법으로 살균제의 성장을 볼 수 있습니다. 그 중에서도 엽면 살포가 시장을 독점하였고, 2022년에는 28억 2,000만 달러를 차지했습니다. 이 방법은 과일, 야채, 곡물 등 다양한 작물에서 일반적으로 사용됩니다. 유럽의 농가들은 엽면 살포를 사용하여 작물을 균류 병해로부터 보호하는 이점을 인식하고 있으며, 엽면 살포 방법 수요 증가로 이어지고 있습니다.

- 종자 처리는 2023년에서 2029년 사이의 예측 기간 동안 유럽의 살균제 시장에서 가장 빠르게 성장하는 부문 중 하나이며 CAGR은 3.6%를 나타낼 것으로 예상됩니다. 이 방법은 발아 및 초기 성장 단계에서 곰팡이 병원체로부터 조기에 보호하고 보다 건강한 식물의 정착을 보장합니다. 유럽에서는 정밀 농업 채용이 증가하고 있습니다. 종자 처리는 낭비를 제거하면서 살균제를 효율적으로 사용할 수 있기 때문에 정밀 농업 전략에 적합합니다.

- 화학 관개법은 2023년부터 2029년까지 연평균 복합 성장률(CAGR) 3.4%를 나타낼 것으로 예측됩니다. 마이크로 관개의 채용이 증가하고 점적 관개의 면적이 확대되는 것이 이 부문의 성장을 가속하고 있습니다.

- 토양 처리 시장 가치는 예측 기간(2023-2029년)에 9,090만 달러 증가할 것으로 예측됩니다. 토양 건전성의 중요성과 그것이 작물의 생산성에 미치는 영향에 관한 농가와 농업 이해 관계자의 인식 증가가 살균제 수요를 촉진하고 있습니다. 이 때문에 유럽의 살균제 시장은 예측 기간(2023-2029년)에 3.7%의 연평균 복합 성장률(CAGR)이 전망되고 있습니다.

스페인은 유럽 살균제 시장을 독점

- 유럽의 살균제 시장은 역사적 기간에 꾸준한 성장을 이루고 있으며, 이 지역은 2022년 세계 살균제 시장의 금액 기준으로 28.4%의 점유율을 차지했습니다. 프로티오코나졸은 이 지역에서 가장 일반적으로 사용되는 살균제입니다.

- 유럽에서는 밀이 압도적으로 중요한 작물입니다. 이 지역은 세계 최대의 밀 생산지이며, 2021년에는 1억 3,900만 톤이 생산되었습니다. 유럽은 주식용 곡물의 최대 수출국이자 생산국이기 때문에 이 지역에서는 주로 곡물 및 곡류에 살균제가 사용되고 있습니다. 곡물 및 곡류 부문은 2022년 금액 기준으로 59.2% 시장 점유율을 차지했습니다.

- 프랑스, 이탈리아 및 스페인은 유럽에서 살균제 총 사용량의 약 64%를 차지합니다. 스페인은 2022년 금액 기준으로 18.1%의 최대 점유율을 차지했습니다. 이는 이 나라가 밀과 옥수수 등 주요 작물 생산에서 우위를 차지하기 때문입니다. 그러나 포도의 만고병, 조고병, 우동병, 후자리움 고병, 셉트리아병, 세균성 역병 등의 질병이 이 지역의 주요 작물을 공격하는 일반적인 질병입니다. 살균제 저항성의 발생은 효과적인 병해 관리를 위한 살균제의 선택을 좁히기 위해 중요한 과제가 되고 있습니다. 러시아, 네덜란드 등 각국 정부는 새로운 병해와 그에 대항하는 효과적인 살균제를 발견하기 위한 연구 이니셔티브에 투자하고 있으며, 농가를 지원하는 제도를 시작하고 있습니다.

- 정부에 의한 이러한 정책과 농민의 의식 고조가 작물 보호 관행의 채용을 더욱 뒷받침하고 있습니다. 이러한 요인이 시장 성장에 기여하고 예측 기간(2023-2029년)의 CAGR은 3.7%를 나타낼 것으로 예상됩니다.

유럽의 살균제 시장 동향

병해의 만연 및 작물 손실 증가가 살균제의 소비량 증가로 이어지고 있습니다.

- 유럽에서는 작물 병해와 관련된 경제적 손실이 증가하여 살균제 소비가 증가하고 있습니다. 소비량은 2019년부터 2022년까지 1헥타르당 32.7% 증가했습니다. 이 지역에서 살균제의 사용은 기후 조건의 변화, 살균제 내성의 개발 및 침입 진균종에 의해 증가할 것으로 예측되고 있습니다.

- 곡물 및 곡류에 영향을 미치는 진균병에는 녹병, 우동병, 스매트병, 후자리움균핵병이 있습니다. 이러한 병해는 곡물 및 곡류에 큰 위협이며 수확량의 감소와 수확물의 품질 저하를 초래할 수 있습니다. 예를 들어, 밀 녹병은 무처리 감수성 밀에서 최대 100%의 작물 손실을 유발할 수 있습니다. 이러한 요인으로부터 유럽에서는 이러한 병해를 방제 및 관리하고 보다 높은 수율과 작물의 품질 향상을 확보하기 위해 살균제가 널리 사용되고 있습니다.

- 이탈리아에서는 살균제 소비량이 크게 증가하고 있습니다. 살균제의 소비량은 2022년에 전년부터 2,300g/ha 증가했습니다. 이는 작물병의 발생이 증가하고, 농업 생산이 확대되고, 작물의 수율과 품질을 향상시키고자 하는 욕망이 있기 때문입니다.

- 식품 생산은 미래 인구를 유지하는 데 필요합니다. 식량 생산의 확대는 더 많은 농지를 활용하고 헥타르 당 수확량을 늘려 달성할 수 있습니다. 헥타르 당 수율을 높이는 중요한 수단 중 하나는 식물 보호 제품의 사용입니다. 살균제와 같은 제품은 식물을 해로운 질병으로부터 보호하는 데 도움이 되기 때문입니다.

- 따라서 작물의 병해 발생이 증가하고 작물을 보호하고 수율을 증가시키기 위해 살균제의 소비가 증가할 것으로 예상됩니다.

테부코나졸은 다른 살균제 활성 성분에 비해 가장 높은 가격을 유지합니다.

- 트리아졸계 살균제의 일종인 테부코나졸은 식물병해의 치료와 예방을 모두 가능하게 하는 전신성으로 알려진 유효성분입니다. 테부코나졸은 곰팡이, 박테리아 및 바이러스에 효과적으로 대항하고 식물을 보호하기 위해 여러 가지 일반적인 살균제 제품에 사용됩니다. 테부코나졸의 전신적 접근은 포자의 확산을 막고, 성장을 억제하며, 포도, 체리, 아몬드, 곡물, 캐놀라 등의 작물에 영향을 미치는 유해한 곰팡이에 대한 인기있는 선택입니다. 2022년 가격은 톤당 8,700달러였습니다.

- 농업에서 널리 사용되는 살균제인 아조시스트로빈은 항진균제로서 가장 광범위한 활성 스펙트럼을 가지고 있습니다. 아조시스트로빈은 강력한 활성 성분으로 작용하며 밀 재배를 중심으로 다양한 작물에서 널리 사용됩니다. 엽반, 녹, 우동, 곰팡이, 넷 블로치, 전염병 등의 중요한 병해를 효과적으로 방제합니다. 특히 독일은 아조시스트로빈의 대부분을 인도에서 수입하고 있으며, 2022년 시장 가격은 톤당 4,400달러에 달했습니다.

- 메탈락실은 감자, 포도, 상추, 오이와 같은 야채와 같은 작물에 일반적으로 살포됩니다. 메탈락실은 감자에서는 만고병, 포도나 야채에서는 베토병 등의 병해를 효과적으로 방제합니다. 메탈락실의 사용은 이러한 곰팡이 감염을 관리하는 데 도움이 되며 유럽 농업에서 보다 건강하고 생산적인 작물 수율에 기여합니다. 2018년부터 2022년까지 메탈락실 가격은 현저한 상승을 경험했으며, 미터당 235.7달러의 상승이 되었습니다. 현재 미터톤당 4,400달러입니다.

유럽의 살균제 산업 개요

유럽의 살균제 시장은 중간 정도로 통합되어 있으며 상위 5개사에서 64.73%를 차지하고 있습니다. 이 시장 주요 기업은 다음과 같습니다. BASF SE, Bayer AG, Corteva Agriscience, Syngenta Group 및 UPL Limited.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약 및 주요 조사 결과

제2장 보고서 제안

제3장 서문

- 조사 전제조건 및 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 1헥타르당 농약 소비량

- 유효성분의 가격 분석

- 규제 프레임워크

- 프랑스

- 독일

- 이탈리아

- 네덜란드

- 러시아

- 스페인

- 우크라이나

- 영국

- 밸류체인 및 유통채널 분석

제5장 시장 세분화

- 적용 모드별

- 화학 관개

- 잎면 살포

- 훈증

- 종자 처리

- 토양 치료

- 작물 유형별

- 상업 작물

- 과일 및 야채

- 곡물

- 콩류 및 지방종자

- 잔디 및 관상용

- 국가별

- 프랑스

- 독일

- 이탈리아

- 네덜란드

- 러시아

- 스페인

- 우크라이나

- 영국

- 기타 유럽

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일(세계 수준 개요, 시장 수준 개요, 주요 사업 부문, 재무, 직원 수, 주요 정보, 시장 순위, 시장 점유율, 제품 및 서비스, 최근 동향 분석 포함)

- ADAMA Agricultural Solutions Ltd.

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Nufarm Ltd

- Sumitomo Chemical Co. Ltd

- Syngenta Group

- UPL Limited

- Wynca Group(Wynca Chemicals)

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계의 개요

- 개요

- Porter's Five Forces 분석 프레임워크

- 세계 밸류체인 분석

- 시장 역학(DROs)

- 정보원 및 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The Europe Fungicide Market size is estimated at 5.13 billion USD in 2025, and is expected to reach 6.19 billion USD by 2030, growing at a CAGR of 3.82% during the forecast period (2025-2030).

The need for effective methods for crop protection is fueling the market's growth in all application methods

- Europe is witnessing the growth of fungicides in various application modes to protect crops and ensure high yields. Among these modes, foliar application dominated the market, which accounted for USD 2.82 billion in 2022. This method is commonly used in various crops, including fruits, vegetables, and cereals. Farmers in Europe are increasingly recognizing the benefits of using foliar applications to protect their crops from fungal diseases, leading to higher demand for foliar methods.

- Seed treatment is expected to be one of the fastest-growing segments in the European fungicide market during the forecast period 2023-2029, registering a CAGR of 3.6%. This method provides early protection against fungal pathogens during germination and early growth stages, ensuring healthier plant establishment. The adoption of precision agriculture practices has increased in Europe. Seed treatment fits well into precision agriculture strategies, as it allows for the efficient use of fungicides while reducing wastage.

- The chemigation method is anticipated to register a CAGR of 3.4% during 2023-2029. The expansion of area under drip irrigation with the rising adoption of micro-irrigation is driving the growth of this segment.

- The market value of soil treatment is expected to increase by USD 90.9 million during the forecast period (2023-2029). The rising recognition among farmers and agricultural stakeholders regarding the significance of soil health and its influence on crop productivity is driving the demand for fungicides. Thus, the European fungicide market is expected to witness a CAGR of 3.7% during the forecast period (2023-2029).

Spain dominates the European fungicide market

- The fungicides market in Europe witnessed steady growth during the historical period, with the region occupying a share of 28.4% by value of the global fungicides market in 2022. Prothioconazole is the most commonly used fungicide in the region.

- Wheat is by far the most important crop throughout Europe. The region is the world's largest wheat producer and contributed 139 million metric tons in 2021. Fungicides are primarily used in grains and cereals in the region, as Europe is also the largest exporter and producer of staple grains. The grains and cereals segment occupied a market share of 59.2% by value in 2022.

- France, Italy, and Spain account for approximately 64% of the total use of fungicides in Europe. Spain held the largest share of 18.1% by value in 2022. This is due to the predominance of these countries in the production of major crops, such as wheat and corn. However, diseases like grape late blight, early blight, powdery mildew, downy mildew, Fusarium wilting, Septoria, and bacterial blight are the common diseases attacking major crops in the region. The occurrence of fungicide resistance presents a significant challenge as it limits fungicide choices for effective disease management. Governments of various countries, such as Russia and the Netherlands, are investing in research initiatives to discover new diseases and effective fungicides to combat them, along with launching supportive schemes for farmers.

- Such policies initiated by governments and a rise in awareness among farmers have further encouraged the adoption of crop protection practices. Such factors are expected to contribute to the market's growth, which is anticipated to record a CAGR of 3.7% during the forecast period (2023-2029).

Europe Fungicide Market Trends

The increasing disease infestation and rising crop losses are leading to an increase in the consumption of fungicides

- Europe is experiencing an increase in the consumption of fungicides due to the rising economic losses associated with crop diseases. The consumption increased by 32.7% per hectare in 2022 from 2019. Fungicide use in the region is predicted to increase because of changes in climatic conditions, the development of fungicide resistance, and invasive fungal species.

- The fungal diseases affecting grains and cereals include rust, powdery mildew, smut, and fusarium head blight. These diseases pose a substantial threat to grains and cereals, as they may result in yield losses and reduce the quality of the harvested crops. For instance, wheat rust may cause crop losses of up to 100% in untreated susceptible wheat. Due to these factors, fungicides are extensively used in Europe to control and manage these diseases, ensuring higher yields and better crop quality.

- The region has witnessed a significant increase in the consumption of fungicides in Italy. The consumption of fungicides increased by 2.3 thousand g/ha in 2022 from the previous year. It was because of the rising occurrence of crop diseases, the expansion of agricultural production, and the desire to enhance crop yields and quality.

- Food production is required to sustain the future population. Growth in food production may be achieved with the use of more farmland and an increase in yield per hectare. One of the important means to bring about high yields per hectare is the use of plant protection products because products such as fungicides help protect plants from harmful diseases.

- Therefore, due to the increasing occurrence of crop diseases and to protect and increase yields of the crops, the consumption of fungicides is expected to increase.

Tebuconazole holds the highest price compared to other active ingredients of fungicide

- Tebuconazole, part of the triazole fungicide family, is an active ingredient known for its systemic nature, providing both curative and preventive control over plant diseases. Tebuconazole is used in several different popular fungicide products to protect plants, effectively countering fungi, bacteria, and viruses. Tebuconazole's systemic approach hinders spore spread and curbing growth, making it a popular choice against harmful fungi affecting crops like grapes, cherries, almonds, cereals, canola, and other crops. Its value in 2022 stood at USD 8.7 thousand per metric ton.

- Azoxystrobin, a widely used fungicide in agriculture, has the broadest spectrum of activity as an antifungal agent. It serves as a potent active ingredient and is extensively utilized across various crops, with a significant focus on wheat farming. It effectively controls important diseases such as leaf spots, rusts, powdery mildew, downy mildew, net blotch, and blight. Notably, Germany imports most of its azoxystrobin from India, and its market value in 2022 amounted to USD 4.4 thousand per metric ton.

- Metalaxyl is commonly applied to crops such as potatoes, grapes, and vegetables like lettuce and cucumbers. Metalaxyl effectively controls diseases such as late blight in potatoes and downy mildew in grapes and vegetables. Its application helps manage these fungal infections, contributing to healthier and more productive crop yields in European agriculture. Between 2018 and 2022, the price of metalaxyl experienced a notable rise, with an increase of USD 235.7 per metric ton. Currently, it stands at USD 4.4 thousand per metric ton.

Europe Fungicide Industry Overview

The Europe Fungicide Market is moderately consolidated, with the top five companies occupying 64.73%. The major players in this market are BASF SE, Bayer AG, Corteva Agriscience, Syngenta Group and UPL Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 France

- 4.3.2 Germany

- 4.3.3 Italy

- 4.3.4 Netherlands

- 4.3.5 Russia

- 4.3.6 Spain

- 4.3.7 Ukraine

- 4.3.8 United Kingdom

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application Mode

- 5.1.1 Chemigation

- 5.1.2 Foliar

- 5.1.3 Fumigation

- 5.1.4 Seed Treatment

- 5.1.5 Soil Treatment

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

- 5.3 Country

- 5.3.1 France

- 5.3.2 Germany

- 5.3.3 Italy

- 5.3.4 Netherlands

- 5.3.5 Russia

- 5.3.6 Spain

- 5.3.7 Ukraine

- 5.3.8 United Kingdom

- 5.3.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd.

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 Corteva Agriscience

- 6.4.5 FMC Corporation

- 6.4.6 Nufarm Ltd

- 6.4.7 Sumitomo Chemical Co. Ltd

- 6.4.8 Syngenta Group

- 6.4.9 UPL Limited

- 6.4.10 Wynca Group (Wynca Chemicals)

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

샘플 요청 목록