|

시장보고서

상품코드

1683993

인도네시아의 살충제 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Indonesia Insecticide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

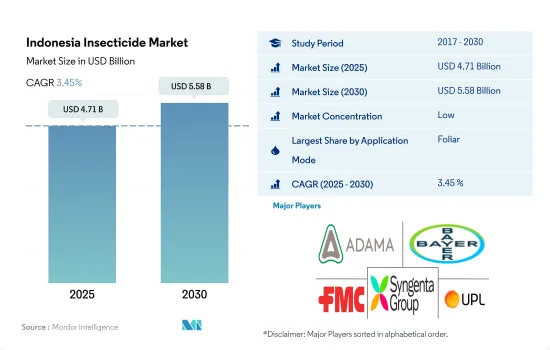

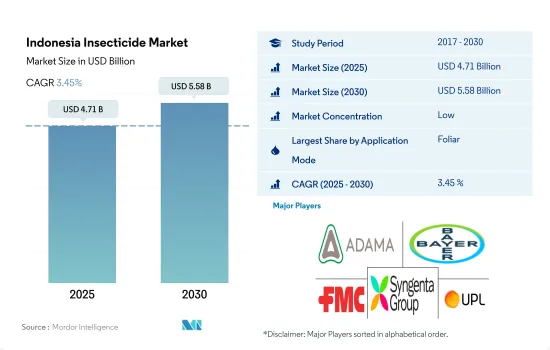

인도네시아의 살충제 시장 규모는 2025년에 47억 1,000만 달러로 추정·예측되며, 2030년에는 55억 8,000만 달러에 달하며, 예측 기간(2025-2030년)의 CAGR은 3.45%로 성장할 것으로 예측됩니다.

해충 방제 및 살포량 감소는 생산 비용을 절감하고 살충제 시장의 엽면 살포 모드를 촉진

- 살충제 엽면 살포 방법은 대상 해충의 방제 효과가 높고 살포량이 적기 때문에 인기를 끌고 있습니다. 살충제 엽면살포법은 2022년 55.9%의 가장 높은 점유율을 차지했으며, 같은 해 시장 가치는 240만 달러였습니다.

- 살충제 엽면살포법이 널리 사용되는 이유는 해충의 위협에 효과적으로 대처하여 식용 작물, 특히 인도네시아 국민 대다수의 주식인 쌀을 보호할 수 있기 때문입니다.

- 살충제를 이용한 종자 처리는 종자 및 어린 묘목의 해충을 관리하고 종자 및 토양 매개 해충을 보호할 수 있으므로 인도네시아에서 그 중요성이 커지고 있습니다. 살충제로 종자를 처리하면 작물 생육 초기에 이러한 생물에 의한 해로운 영향을 효과적으로 예방하거나 줄일 수 있으며, 작물의 정착을 촉진하고 전반적인 건강 상태를 개선할 수 있으며, 2022년 현재 이 방법은 시장 가치의 16.7%(약 7억 5,220만 달러)를 차지합니다.

- 인도네시아의 야자수 작물에서 줄기좀벌과 흰가루병으로 인해 최대 30%의 심각한 수확량 손실이 발생하고 있습니다. 이러한 해충을 방제하기 위해서는 이미다클로프리드, 티아메톡삼, 카르바릴, 비펜트린과 같은 살충제를 이용한 토양 처리가 효과적입니다. 따라서 토양 처리 적용 방식은 예측 기간 중 CAGR 3.4%를 나타낼 것으로 예상됩니다.

- 훈증 분야는 2022년에 3억 7,990만 달러에 달하는 놀라운 성장을 이루었습니다. 이러한 인기 증가는 훈증 방법의 효과로 인해 훈증 방법은 농산물을 해충 관련 피해로부터 효과적으로 보호하고 궁극적으로 농산물의 품질과 시장 가치를 향상시킬 수 있습니다.

인도네시아 살충제 시장 동향

해충으로 인한 농작물 손실 확대,살충제 채택 증가,살충제 제품의 발전이 시장을 주도할 수 있습니다.

- 살충제는 주로 농작물을 공격하는 해충을 방제하고 관리하기 위해 사용됩니다. 곤충, 진드기, 기타 절지동물과 같은 해충은 농작물에 큰 피해를 입혀 수확량 감소와 품질 저하로 이어질 수 있습니다. 살충제는 이러한 해충의 피해를 줄이고 작물을 보호하여 충분한 식량 생산을 보장하는 데 도움이 됩니다. 인도네시아의 살충제 사용량은 지난 수십년간 증가하고 있습니다. 인도네시아의 헥타르당 살충제 소비량은 2017-2022년 25.2% 증가했습니다.

- 곤충은 식물 병해의 매개체로 작용하여 작물에 해를 끼치는 질병을 매개합니다. 곤충은 섭식을 통해 직접적으로 식물에 해를 끼치기도 하고, 식물의 손상된 부위에 병원균을 보내 간접적으로 식물에 해를 끼치기도 하며, 거기서 병원균이 식물 전체로 퍼져나갑니다. 살충제는 곤충 매개충을 방제하고 질병의 전염을 최소화하여 작물의 건강을 보호하고 생산 손실을 줄이기 위해 사용됩니다.

- 2021년 2월까지 인도네시아에 등록된 살충제 브랜드는 1,059개이며, 67개 작물/대상에 대해 80개 유효성분으로 구성되어 있습니다. 인도네시아에 등록된 유효성분의 90% 이상이 피레스로이드, 유기인산염, 아벨멕틴 및 밀베마이신, 네오니코티노이드, 카르바마트, 네레스톡신 유사체, 페닐피라졸(피프롤)의 조합으로 구성되어 있습니다. 살충제의 브랜드와 유효성분이 다양하다는 것은 농가가 다양한 작물과 농업 시스템에서 곤충 관리 요구를 충족시킬 수 있는 다양한 선택권을 가지고 있음을 보여줍니다. 다양한 살충제가 등록되어 있다는 것은 인도네시아 농업에서 해충 방제의 중요성과 농가에 농작물을 보호할 수 있는 효과적인 수단을 제공하려는 노력을 반영합니다.

대부분의 유효성분은 기타 국가에서 수입되므로 해당 국가의 유효성분 가격은 환율, 수입관세, 관세에 따라 달라집니다.

- 인도네시아는 세계 최고의 농업 국가입니다. 그러나 기본적인 농자재 부족에 직면해 있으며, 특히 국내 농약 산업이 부족합니다. 인도네시아는 살충제 수입에 크게 의존하고 있습니다. 대부분의 살충제와 유효성분은 중국에서 수입하고 있습니다. 따라서 가격은 환율, 수입 관세, 관세에 따라 달라집니다.

- 2022년, 시퍼메트린은 톤당 2만 600달러로 평가되었습니다. 얼룩무늬 총채벌레, 분홍색 총채벌레, 애벌레, 애벌레 등 다양한 유형의 곤충을 방제하는 효과가 있으며, 농업 업계에서 널리 사용되고 있습니다. 이러한 효과로 인해 해충으로부터 농작물을 보호하고 성공적인 수확을 원하는 농가에 이미다클로프리드는 인기 있는 선택이 되고 있습니다.

- 이미다클로프리드는 강력한 네오니코티노이드계 살충제로 효과적인 침투성과 잔류성을 가지고 있습니다. 흡즙성 곤충, 흰점박이꽃무지, 파리, 잎벌레, 흰개미 등 다양한 곤충을 방제할 수 있습니다. 농작물에 적합하고 살포량이 적기 때문에 농가에서 널리 보급되고 있습니다. 이 활성 성분의 가격은 2017-2022년 77.9% 상승하여 1톤당 17,000달러에 달했습니다.

- 말라티온은 유기인산계에 속합니다. 식물, 과일, 채소, 조경, 관목을 대상으로 하는 다양한 해충을 방제하기 위해 이용되는 경우가 많습니다. 말라티온을 기반으로 하는 제품은 액체, 분진, 습윤성 분말, 유제 등 다양한 형태가 있습니다. 인도네시아에서는 말라티온을 포함한 다양한 제품이 판매되고 있습니다.

- 유효 성분의 가격은 살충제 시장 경쟁 구도에 영향을 미칠 수 있습니다. 보다 경쟁력 있는 가격으로 유효성분을 조달할 수 있는 기업은 타사보다 우위를 점할 수 있습니다.

인도네시아의 살충제 산업 개요

인도네시아의 살충제 시장은 단편화되어 있으며, 상위 5사에서 1.68%를 차지하고 있습니다. 이 시장의 주요 기업은 다음과 같습니다. ADAMA Agricultural Solutions Ltd, Bayer AG, FMC Corporation, Syngenta Group and UPL Limited(알파벳순).

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월의 애널리스트 지원

목차

제1장 개요와 주요 조사 결과

제2장 리포트 오퍼

제3장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 1헥타르당 농약 소비량

- 유효 성분의 가격 분석

- 규제 프레임워크

- 인도네시아

- 밸류체인과 유통 채널 분석

제5장 시장 세분화

- 사용 방법

- 화학 관개

- 엽면살포

- 훈증

- 종자 처리

- 토양 처리

- 작물 유형

- 상업 작물

- 과일·채소

- 곡물

- 두류·지방 종자

- 잔디·관상용

제6장 경쟁상황

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 개요(세계 레벨의 개요, 시장 레벨의 개요, 주요 사업 부문, 재무, 직원 수, 주요 정보, 시장 랭크, 시장 점유율, 제품·서비스, 최근 동향 분석 포함)

- ADAMA Agricultural Solutions Ltd

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Nufarm Ltd

- PT Biotis Agrindo

- Syngenta Group

- UPL Limited

- Wynca Group(Wynca Chemicals)

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계의 개요

- 개요

- Porter's Five Forces 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원과 참고 문헌

- 도표

- 주요 인사이트

- 데이터 팩

- 용어집

The Indonesia Insecticide Market size is estimated at 4.71 billion USD in 2025, and is expected to reach 5.58 billion USD by 2030, growing at a CAGR of 3.45% during the forecast period (2025-2030).

Targeted pest controlling and reduction in application rates reduce the production cost, which will drive the foliar application mode of the insecticide market

- The foliar mode of insecticide application has gained popularity due to its effectiveness in controlling target pests and lower dosage rates. The foliar method of insecticide application accounted for the highest share of 55.9% in 2022, with a market value of USD 2.4 million in the same year.

- The widespread adoption of the foliar application method of insecticides stems from its ability to safeguard food crops, notably rice, which serves as a staple for most Indonesians, by effectively combating the menace of pests.

- Insecticide seed treatment is gaining importance in Indonesia as it can manage pests in seeds and young seedlings, protecting seed and soil-borne insect pests. Treating seeds with insecticides effectively prevents or reduces the harmful impacts caused by these organisms in the initial stage of crop growth, resulting in enhanced crop establishment and overall health. As of 2022, this method accounted for 16.7% of the market value, approximately USD 752.2 million.

- Severe yield losses of up to 30% of oil palm crops in Indonesia are attributed to stem weevils and white grubs. These insect pests can be controlled by performing soil treatment using insecticides like imidacloprid, thiamethoxam, carbaryl, and bifenthrin. Thus, the soil treatment application mode is expected to register a CAGR of 3.4% during the forecast period.

- The fumigation segment experienced impressive growth and reached a value of USD 379.9 million in 2022, primarily driven by farmers' growing acceptance of fumigation practices. This surge in popularity can be credited to the effectiveness of fumigation methods, which effectively protect agricultural products from pest-related damages, ultimately elevating their quality and market value.

Indonesia Insecticide Market Trends

Growing crop losses by insect pests, rise in the adoption of pesticides, and advancements in insecticide products may drive the market

- Insecticides are primarily used to control and manage pests that attack agricultural crops. Pests such as insects, mites, and other arthropods can cause significant damage to crops, leading to yield losses and reduced quality. Insecticides help mitigate these pest pressures, protecting crops and ensuring sufficient food production. The level of insecticide use in Indonesia has increased over the last few decades. The consumption of insecticides in Indonesia per hectare increased by 25.2% from 2017 to 2022.

- Insects also act as vectors for plant diseases, transferring diseases that can harm crops. They damage plants directly by feeding and indirectly by delivering pathogens to wounded places of plants, from where pathogens spread throughout the plant. Insecticides are used to control insect vectors and minimize disease transmission, hence protecting crop health and reducing production losses.

- Until February 2021, there were 1,059 insecticide brands registered in Indonesia consisting of 80 different active ingredients for 67 crops/targets. More than 90% of the active ingredients registered in Indonesia consisted of a combination of pyrethroids, organophosphates, avermectins and milbemycins, neonicotinoids, carbamates, nereistoxin analogs, and phenylpyrazoles (fiproles). Having a diverse range of insecticide brands and active ingredients indicates that farmers have a wide variety of options for addressing insect management needs in various crops and agricultural systems. The wide range of registered insecticides reflects the importance of pest control in Indonesian agriculture and the efforts to provide farmers with effective tools to protect their crops.

Active ingredient prices in the country are dependent on currency exchange rates, import tariffs, and duties because most of the active ingredients are imported from other countries

- Indonesia is a prominent agricultural nation globally. However, it faces a shortage of basic agricultural inputs, notably in its indigenous pesticide industry. The country relies heavily on importing insecticides. Most of the insecticides and active ingredients are imported from China. Consequently, their prices are dependent on currency exchange rates, import tariffs, and duties.

- In 2022, cypermethrin was valued at USD 20.6 thousand per metric ton. It has been widely adopted in the agricultural industry for its effectiveness in controlling various types of insects, including spotted ball worms, pink ball worms, early spot borers, and hairy caterpillars. Its effectiveness has made it a popular choice for farmers seeking to protect their crops from pests and ensure a successful harvest.

- Imidacloprid is a powerful neonicotinoid insecticide with effective systemic and residual properties. It can control a wide range of insects, including sucking insects, beetles, flies, leaf miners, and termites. It is suitable for crops and has low application rates, hence widely popular among farmers. The price of this active ingredient increased by 77.9% to USD 17.0 thousand per metric ton from 2017 to 2022.

- Malathion belongs to the organophosphate family. It is often utilized to manage various insect infestations that target plants, fruits, vegetables, landscaping, and shrubs. Malathion-based products come in various forms, such as liquids, dust, wettable powders, or emulsions. In Indonesia, there are a variety of products available that contain malathion.

- Active ingredient prices can influence the competitive landscape of the insecticide market. Companies that can source active ingredients at more competitive prices may have a competitive advantage over others.

Indonesia Insecticide Industry Overview

The Indonesia Insecticide Market is fragmented, with the top five companies occupying 1.68%. The major players in this market are ADAMA Agricultural Solutions Ltd, Bayer AG, FMC Corporation, Syngenta Group and UPL Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 Indonesia

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application Mode

- 5.1.1 Chemigation

- 5.1.2 Foliar

- 5.1.3 Fumigation

- 5.1.4 Seed Treatment

- 5.1.5 Soil Treatment

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 Corteva Agriscience

- 6.4.5 FMC Corporation

- 6.4.6 Nufarm Ltd

- 6.4.7 PT Biotis Agrindo

- 6.4.8 Syngenta Group

- 6.4.9 UPL Limited

- 6.4.10 Wynca Group (Wynca Chemicals)

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

샘플 요청 목록