|

시장보고서

상품코드

1683994

인도네시아의 살균제 : 시장 점유율 분석, 산업 동향, 성장 예측(2025-2030년)Indonesia Fungicide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

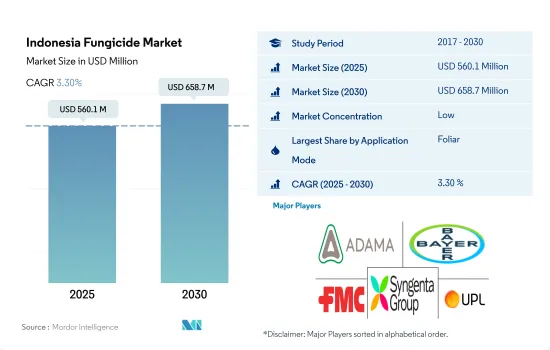

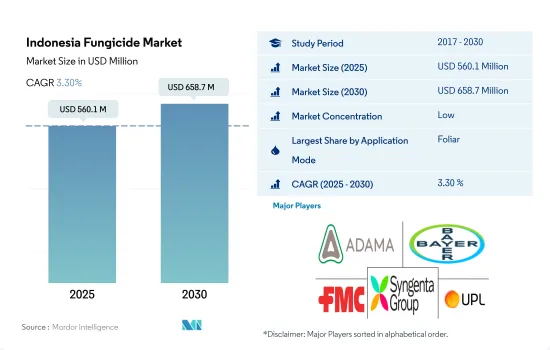

인도네시아의 살균제 시장 규모는 2025년에 5억 6,010만 달러로 예측되고, 2030년에는 6억 5,870만 달러에 이를 것으로 예측되며, 예측기간(2025-2030년)의 CAGR은 3.30%를 나타낼 것으로 전망됩니다.

증가하는 곰팡이병은 팜유, 커피, 쌀, 옥수수와 같은 주요 작물에 피해를 주며 살균제 사용률을 높입니다.

- 인도네시아의 열대 기후는 농작물 재배에 이상적인 환경을 제공하고 곰팡이병의 급속한 확산으로 농업 부문에 심각한 문제를 야기하고 있습니다. 이에 따라 인도네시아의 농부들은 이러한 곰팡이병을 퇴치하기 위해 다양한 방법을 사용하고 있으며, 살균제는 효과적인 해결책이 되고 있습니다. 특정 질병과 작물 단계에 따라 농부들은 이러한 질병의 영향을 제어하고 완화하기 위해 다양한 적용 모드를 구현하고 있습니다.

- 농부들은 주로 엽면 살포 방식을 채택하고 있으며, 이는 2022년 60.7%의 높은 시장 점유율을 차지했습니다. 이러한 선호도는 효과적인 질병 제어와 성장 효율성 및 스트레스 내성 개선 등 식물 건강에 대한 추가적인 이점을 통해 성장기 내내 생산성을 향상시킬 수 있기 때문일 수 있습니다.

- 종자 처리 살균제는 팜유, 커피, 쌀, 옥수수와 같은 작물의 토양 매개성 질병을 퇴치하는 데 적합합니다. 이러한 사전 예방적 접근 방식을 통해 재배자는 작물 초기 단계에서 질병을 효과적으로 방제하여 작물의 건강과 수확량에 미치는 영향을 완화할 수 있습니다. 2022년 종자 처리 살균제 소비량은 13.8%의 비중을 차지했습니다.

- 화학 처리 적용 모드는 2022년 12.3%의 시장 가치 점유율을 차지했는데, 이는 주로 관개 시스템 현대화에 대한 국가의 최우선 과제에 기인하며, 중국 쌀의 95%가 이러한 관개 시스템에서 생산됩니다. 현대식 관개 시스템의 채택이 증가함에 따라 살균제 살포에 대한 화학 처리 방식 채택이 더욱 증가하고 있습니다.

- 농부들은 농작물에 살균제를 적용하는 대체 방법으로 다른 훈증 및 토양 처리 방법을 활용하며, 특정 곰팡이병과 작물 유형에 따라 적절한 방법을 선택합니다.

인도네시아의 살균제 시장 동향

옥수수와 같은 주요 작물의 곰팡이병으로 인한 작물 감염 증가와 생산성 향상에 대한 필요성이 시장을 견인할 수 있습니다.

- 인도네시아는 과일, 채소, 커피, 차, 향신료 등 다양한 고부가가치 작물을 재배합니다. 이러한 작물은 품질과 시장성에 직접적인 영향을 미칠 수 있는 곰팡이병에 취약한 경우가 많습니다. 살균제는 이러한 귀중한 작물을 보호하고 생산성과 경제적 가치를 보장하는 데 도움이 됩니다.

- 생산성을 높이기 위해 많은 농부들이 고수익 작물 품종과 온실 재배와 같은 집약적인 농업 방식을 채택하고 있습니다. 이러한 관행은 수확량 증가에 도움이 되지만 곰팡이병의 발생과 확산에 유리한 조건을 조성할 수도 있습니다. 집약적 생산 시스템에서 이러한 질병을 통제하고 예방하기 위해서는 살균제가 필요합니다. 인도네시아의 살균제 소비량은 최근 몇 년 동안 증가했습니다. 특히 2017년부터 2022년까지 살균제 사용량은 28.7%나 크게 증가했습니다.

- 곰팡이는 시간이 지남에 따라 진화하고 살충제에 대한 내성을 개발할 수 있습니다. 따라서 내성 곰팡이 균주를 퇴치하고 효과적인 질병 방제를 유지하기 위해서는 새롭고 효과적인 살균제를 사용해야 합니다. 예를 들어, 인도네시아에서는 페로노스클레로스포라(Peronosclerospora)균에 의한 노균병으로 인해 옥수수 생산량이 심각하게 제한되고 있습니다. 노균병에 취약한 품종은 약 90-100%의 수확량 손실이 발생할 수 있습니다. 노균병은 메탈락실의 지속적인 사용으로 인해 내성이 생겼습니다. 따라서 메탈락실 대신 사용할 수 있는 다른 살균제를 확보하는 것이 필수적입니다.

- 기후 변화로 인해 온도, 습도, 강우량 등의 기상 패턴이 변화하고 있습니다. 이러한 변화는 곰팡이병의 유병률과 심각성에 영향을 미칠 수 있습니다. 살균제는 변화된 기후 조건에서 번성하는 질병을 관리하는 데 사용되어 농부들이 질병으로 인한 손실로부터 작물을 보호하는 데 도움이 됩니다.

무역, 농업 및 화학물질 수입과 관련된 정부 정책은 수입 과정에 영향을 미칠 수 있으며 수입 살균제 가격에 영향을 미칠 수 있습니다.

- 만코제브, 지람, 프로피넵은 인도네시아에서 널리 사용되는 살균제입니다. 이 살균제는 디티오카바메이트 계열에 속하며 다양한 작물의 곰팡이병을 광범위하게 방제하는 것으로 알려져 있습니다.

- 만코제브는 과일, 채소, 견과류, 밭작물 등 다양한 농작물과 전문 잔디 관리에 사용되는 접촉식 살균제입니다. 감자 무름병, 잎마름병, 딱지병, 녹병 등 다양한 종류의 곰팡이병에 효과적입니다. 또한 감자, 옥수수, 수수, 토마토, 시리얼 곡물의 종자 처리제로도 사용할 수 있습니다. 인도는 인도네시아에 만코제브를 공급하는 주요 국가입니다. 2022년 가격은 1톤당 7,700달러로 평가되었으며 2019년부터 14.9% 크게 상승했습니다.

- 프로피넵은 포도, 채소, 과수 등 다양한 작물의 곰팡이병을 방제하는 데 사용되는 전신 및 접촉 살균제입니다. 노균병, 잿빛곰팡이병, 흰가루병과 같은 질병에 효과적입니다. 2022년 가격은 톤당 3,500달러였습니다.

- 지람은 1톤당 3,300달러로 평가된 또 다른 디티오카르바민산계 살균제로, 이 살균제는 감귤류, 사과, 감자 등 다양한 작물의 병 방제에 널리 사용되고 있습니다. 특히 감자의 역병과 역병 등 특정 곰팡이로 인한 질병에 효과적입니다.

- 이 나라는 살균제의 주요 수입국 중 하나이며 대부분의 살균제를 인도, 미국, 중국에서 수입하고 있습니다. 무역, 농업 및 화학물질 수입과 관련된 정부 정책은 수입 과정에 영향을 미칠 수 있으며 수입 살균제 가격에 영향을 미칠 수 있습니다.

인도네시아의 살균제 산업 개요

인도네시아의 살균제 시장은 세분화되어 상위 5개사에서 1.82%를 차지하고 있습니다. 이 시장 주요 기업은 다음과 같습니다. ADAMA Agricultural Solutions Ltd, Bayer AG, FMC Corporation, Syngenta Group and UPL Limited(알파벳 순).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 지원

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 헥타르당 농약 소비량

- 유효성분의 가격 분석

- 규제 프레임워크

- 인도네시아

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 적용 모드

- 화학 처리

- 잎 표면 살포

- 훈증

- 종자 처리

- 토양 처리

- 작물 유형

- 상업 작물

- 과일 및 채소

- 곡물

- 콩류 및 유지종자

- 잔디 및 관상용

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일(세계 수준 개요, 시장 수준 개요, 주요 사업 부문, 재무, 직원 수, 주요 정보, 시장 순위, 시장 점유율, 제품 및 서비스, 최근 동향 분석 포함)

- ADAMA Agricultural Solutions Ltd

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Nufarm Ltd

- PT Biotis Agrindo

- Syngenta Group

- UPL Limited

- 윈카 그룹(Wynca Chemicals)

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계의 개요

- 개요

- Five Forces 분석 프레임워크

- 세계의 밸류 체인 분석

- 시장 역학(DROs)

- 출처 및 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The Indonesia Fungicide Market size is estimated at 560.1 million USD in 2025, and is expected to reach 658.7 million USD by 2030, growing at a CAGR of 3.30% during the forecast period (2025-2030).

Growing fungal diseases damages major crops, like palm oil, coffee, rice, and maize, increasing the fungicide adoption rate

- Indonesia's tropical climate provides an ideal environment for crop cultivation and the rapid proliferation of fungal diseases, posing significant challenges to the agricultural sector. In response, farmers in the country are employing various methods to combat these fungal diseases, with fungicides being an effective solution. Depending on the specific disease and crop stage, farmers are implementing different application modes to control and mitigate the impact of these diseases.

- Farmers predominantly adopted the foliar application method, which represented a significant market share of 60.7% in 2022. This preference can be attributed to effective disease control and additional benefits to plant health, including improved growth efficiency and stress tolerance, resulting in enhanced productivity throughout the growing season.

- Seed treatment fungicides are suitable to combat soil-borne diseases in crops like palm oil, coffee, rice, and maize. This proactive approach enables growers to effectively control diseases at the early crop stage, mitigating their impact on crop health and yield. In 2022, the consumption of seed treatment fungicides represented a share of 13.8%.

- The chemigation application mode occupied the market value share of 12.3% in 2022, which is majorly attributed to the country's top priority on modernizing the irrigation systems, and 95% of the country's rice is produced from these irrigation systems. The rising adoption of modern irrigation systems further increases the adoption of chemigation modes for applying fungicides.

- Farmers utilize other fumigation and soil treatment as alternative modes of applying fungicides to their crops, selecting the appropriate method based on the specific fungal disease and crop type.

Indonesia Fungicide Market Trends

Growing crop infestations due to fungal diseases in major crops like maize and need for increasing higher productivity may drive the market

- Indonesia cultivates various high-value crops, such as fruits, vegetables, coffee, tea, and spices. These crops are often susceptible to fungal diseases that can directly impact their quality and marketability. Fungicides help protect these valuable crops and ensure their productivity and economic value.

- With the aim of increasing productivity, many farmers have adopted intensive agricultural practices, such as high-yield crop varieties and greenhouse cultivation. These practices, while beneficial for increasing yields, can also create favorable conditions for the development and spread of fungal diseases. Fungicides are necessary to control and prevent these diseases in intensive production systems. Fungicide consumption in Indonesia has increased in recent years. Specifically, between 2017 and 2022, there was a significant growth of 28.7% in fungicide usage.

- Fungi can evolve and develop resistance to pesticides over time. This has necessitated the use of new and more effective fungicides to combat resistant fungal strains and maintain effective disease control. For instance, in Indonesia, the output of maize is severely constrained by downy mildew brought on by Peronosclerospora spp. Susceptible varieties can have yield losses of around 90 to 100%. Downy mildew has developed resistance due to the continual usage of metalaxyl. As a result, it is essential to have other fungicides that may be used in place of metalaxyl.

- Climate change has led to shifts in weather patterns, including changes in temperature, humidity, and rainfall. These changes can influence the prevalence and severity of fungal diseases. Fungicides are used to manage diseases that thrive under altered climatic conditions, helping farmers protect their crops from disease-related losses.

Government policies related to trade, agriculture, and chemical imports can impact the import process and may affect the prices of imported fungicides

- Mancozeb, ziram, and propineb are widely used fungicides in Indonesia. These fungicides belong to the dithiocarbamate group and are known for their broad-spectrum control of fungal diseases in various crops.

- Mancozeb is a contact fungicide that is used on a variety of crops, including fruits, vegetables, nuts, and field crops, and professional turf management. It is effective against many types of fungal diseases, such as potato blight, leaf spot, scab, and rust. Additionally, it can be used as a seed treatment for potatoes, corn, sorghum, tomatoes, and cereal grains. India is a major supplier of mancozeb to Indonesia. In 2022, the price was valued at USD 7.7 thousand per metric ton and significantly increased by 14.9% from 2019.

- Propineb is a systemic and contact fungicide used to control fungal diseases in various crops, such as grapes, vegetables, and tree fruits. It is effective against diseases like downy mildew, gray mold, and powdery mildew. The price in 2022 accounted for USD 3.5 thousand per metric ton.

- Ziram is another dithiocarbamate fungicide that was valued at USD 3.3 thousand per metric ton, and this fungicide is widely used for disease control in various crops, including citrus, apples, and potatoes. It is particularly effective against diseases caused by certain fungi, including early and late blight in potatoes.

- The country is one of the major importers of fungicides, and most of its fungicides are imported from India, the United States, and China. Government policies related to trade, agriculture, and chemical imports can impact the import process and may affect the prices of imported fungicides.

Indonesia Fungicide Industry Overview

The Indonesia Fungicide Market is fragmented, with the top five companies occupying 1.82%. The major players in this market are ADAMA Agricultural Solutions Ltd, Bayer AG, FMC Corporation, Syngenta Group and UPL Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 Indonesia

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application Mode

- 5.1.1 Chemigation

- 5.1.2 Foliar

- 5.1.3 Fumigation

- 5.1.4 Seed Treatment

- 5.1.5 Soil Treatment

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 Corteva Agriscience

- 6.4.5 FMC Corporation

- 6.4.6 Nufarm Ltd

- 6.4.7 PT Biotis Agrindo

- 6.4.8 Syngenta Group

- 6.4.9 UPL Limited

- 6.4.10 Wynca Group (Wynca Chemicals)

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

샘플 요청 목록