|

시장보고서

상품코드

1684004

미국의 잔디 및 관상용 식물 보호 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)US Turf and Ornamental Protection - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

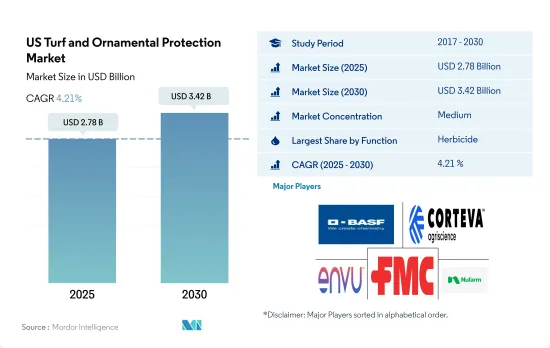

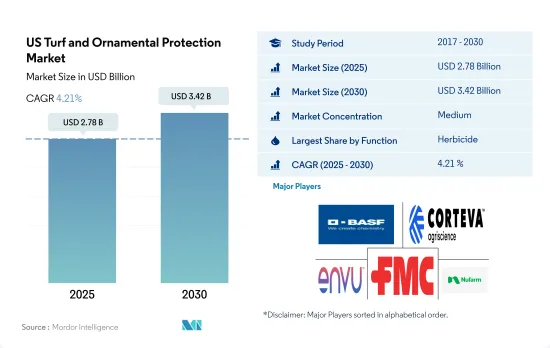

미국의 잔디 및 관상용 식물 보호 시장 규모는 2025년에 27억 8,000만 달러로 추정되고, 2030년에는 34억 2,000만 달러에 이를 것으로 예측되며, 예측기간(2025-2030년)의 CAGR은 4.21%를 나타낼 전망입니다.

화훼 생산자 수 증가로 식물 보호 화학물질 사용량 증가

- 잔디 및 관상용 부문은 2022년 미국 전체 식물 보호 화학물질 시장의 13.1%를 차지했습니다. 이 부문은 공원, 정원, 운동장, 조경 등 다양한 공간을 포괄합니다. 이러한 공간은 일반적으로 미적 매력과 전반적인 건강에 영향을 미칠 수 있는 해충과 관련된 어려움에 직면합니다.

- 2021년 미국에는 17개 주에 9,558개의 화훼 생산업체가 분포되어 있습니다. 17개 주 내에서 생산자 수는 전년 대비 8% 증가했습니다. 가장 높은 매출은 연간 침구 및 정원용 식물로 23억 달러에 달했습니다. 재배와 생산자 수가 계속 증가함에 따라 농약 사용량도 그에 상응하여 증가하고 있습니다.

- 2022년에는 제초제가 53.3%의 점유율로 시장을 지배했습니다. 이는 잡초 감염이 만연하기 때문입니다. 잔디 및 관상용 식물은 일반적으로 크랩그라스, 구스그라스, 헛개나무그라스, 여치꼬리 등 다양한 잡초의 영향을 받습니다. 따라서 이러한 문제를 해결하고 식물의 건강과 외관을 유지하기 위해 제초제 사용이 증가했습니다.

- 살충제는 2022년 시장 점유율의 37.5%를 차지했습니다. 북방 및 남방 가면을 쓴 채퍼, 아시아 정원 딱정벌레, 바구미, 빌벌레, 일본 딱정벌레, 동양 딱정벌레, 유럽 채퍼, 컷웜 및 기타 친치 벌레는 잔디 및 관상용 부문에 영향을 미치는 일반적인 해충입니다.

- 잔디 및 관상용 부문의 식물 보호 시장은 곰팡이병, 곤충, 잡초 문제가 증가함에 따라 예측 기간 동안 4.5%의 연평균 성장률(CAGR)로 성장할 것으로 예상됩니다.

미국의 잔디 및 관상용 식물 보호 시장 동향

다양한 용도로 잔디 및 관상용 식물의 채택이 증가함에 따라 이러한 식물의 재배 면적이 확대되어 시장을 주도 할 수 있습니다.

- 네오니코티노이드는 잔디 관리에서 흰 땅벌레 방제를 위한 예방 물질로 가장 일반적으로 사용됩니다. 잔디 및 관상용 식물은 미국에서 네오니코티노이드 사용량의 약 4%를 차지합니다. 공원, 골프장, 정원, 공공장소 등 잘 관리된 잔디 및 관상용 조경에 대한 수요가 증가하면서 해충을 방제하고 원하는 외관을 유지하기 위한 농약 사용량이 증가하고 있습니다.

- 미국의 화훼 수요 증가로 인해 2017년부터 2022년까지 잔디 및 관상용 면적은 2017년부터 2022년에 걸쳐 64만 9,800헥타르 증가했습니다. 재배 면적의 증가와 품질 요건 충족은 같은 기간 동안 농약 소비량 증가로 이어졌습니다.

- 주택 소유주, 조경사, 부동산 관리자는 조경의 가치와 매력을 유지하기 위해 해충 관리의 중요성을 더 잘 인식하고 있으며, 이로 인해 살충제 제품 채택이 증가하고 있습니다. 골프장, 스포츠 경기장, 공공 공원은 품질을 유지하기 위해 해충 관리가 필요한 경우가 많으며, 이는 잔디 부문의 살충제 소비에 기여하고 있습니다.

- 또한 잡초, 곤충, 질병 등 잔디 및 관상용 공간에 영향을 미치는 해충의 증가는 향후 몇 년 동안 효과적인 방제를 위한 살충제 소비 증가로 이어질 수 있습니다. 도시 지역이 확장됨에 따라 녹지 공간이 더욱 밀집되어 해충이 번식하기 좋은 환경이 조성되고, 이로 인해 해충 관리 솔루션에 대한 수요가 증가할 수 있습니다.

- 기후 패턴의 변화는 해충의 개체 수에 영향을 미쳐 향후 살충제 소비를 증가시킬 수 있습니다.

진딧물, 딱정벌레, 점박이 공벌레, 분홍색 공벌레, 초기 반점 보러, 털보 애벌레 등 다양한 곤충을 방제하는 데 효과적이며 국내에서의 제한된 가용성으로 인해 가격이 상승하고 있습니다.

- 2022년 사이퍼메트린의 가격은 톤당 2만 1,200달러였습니다. 진딧물, 딱정벌레, 점박이총채벌레, 분홍총채벌레, 조기점박이응애, 털보리응애 등 다양한 종류의 곤충을 방제하는 데 효과적이어서 잔디 및 관상용 식물에 널리 사용되어 왔습니다. 그 효과로 인해 해충으로부터 식물을 보호하고 성공적인 수확을 보장하려는 농부들에게 인기가 있습니다.

- 염소화 트리아진 그룹에 속하는 전신 제초제인 아트라진은 일년생 풀과 광엽 잡초가 출현하기 전에 표적 방제하는 데 사용됩니다. 아트라진을 함유한 농약 제제는 옥수수, 스위트콘, 수수, 사탕수수, 밀, 마카다미아넛, 구아바 등 농업용 외에도 스포츠 잔디, 골프장 잔디, 상업용 및 주거용 잔디 등 다양한 잔디 및 관상용에 사용할 수 있도록 승인되어 있습니다. 아트라진의 2022년 가격은 톤당 1만 3,800달러였습니다.

- 말라티온은 진딧물, 벼룩, 기타 여러 가지 귀중한 관상용 식물의 흡즙 해충을 포함한 광범위한 해충을 방제하는 데 사용됩니다. 미국에서 광범위하게 재배되며 말라티온을 자주 사용하는 식물은 국화, 상록수, 장미, 동백, 진달래 등입니다. 말라티온의 2022년 가격은 톤당 12,600달러였습니다.

- 만코제브는 미국에서 노지 및 온실 식물용으로 분류된 광범위한 스펙트럼의 접촉 살균제입니다. 이 제품은 잎, 줄기, 줄무늬 녹병, 보트리티스 마름병, 잎 반점병, 세르코스포라 마름병 등 광범위한 곰팡이 질병을 예방합니다. 감자, 옥수수, 수수, 토마토, 곡물 등의 식물을 위한 종자 처리제로도 사용됩니다. 2022년 시장가치는 톤당 7,800달러에 달했습니다.

미국의 잔디 및 관상용 식물 보호 산업의 개요

미국의 잔디 및 관상용 식물 보호 시장은 적당히 통합되어 있으며 상위 5개사에서 46.20%를 차지하고 있습니다. 이 시장 주요 기업은 다음과 같습니다. BASF SE, Corteva Agriscience, Environmental Science US LLC(Envu), FMC Corporation and Nufarm Ltd(알파벳 순).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 지원

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 헥타르당 농약 소비량

- 유효성분의 가격 분석

- 규제 프레임워크

- 미국

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 기능

- 살균제

- 제초제

- 살충제

- 연체동물 살충제

- 살선충제

- 적용 모드

- 화학 처리

- 잎 표면 살포

- 훈증

- 종자 처리

- 토양 처리

제6장 경쟁 구도

- 주요 전략적 움직임

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일(세계 수준 개요, 시장 수준 개요, 주요 사업 부문, 재무, 직원 수, 주요 정보, 시장 순위, 시장 점유율, 제품 및 서비스, 최근 동향 분석 포함)

- American Vanguard Corporation

- BASF SE

- Corteva Agriscience

- Environmental Science US LLC(Envu)

- FMC Corporation

- Gowan Company

- Mitsui & Co. Ltd(Certis Belchim)

- Nufarm Ltd

- Syngenta Group

- UPL Limited

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계의 개요

- 개요

- Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 출처 및 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The US Turf and Ornamental Protection Market size is estimated at 2.78 billion USD in 2025, and is expected to reach 3.42 billion USD by 2030, growing at a CAGR of 4.21% during the forecast period (2025-2030).

An increase in the number of floriculture producers drives the usage of crop protection chemicals

- The turf and ornamental segment accounted for 13.1% of the total US crop protection chemicals market in 2022. This segment encompasses a wide range of spaces, including parks, gardens, sports fields, and landscaping. These areas commonly encounter difficulties related to pests that can impact their aesthetic appeal and overall health.

- In 2021, 9,558 floriculture producers spread across 17 states in the United States. Within those 17 states, the number of producers witnessed an 8% rise from the previous year. The highest sales were recorded in annual bedding and garden plants, amounting to USD 2.3 billion. As cultivation and the number of producers continue to grow, there is a corresponding increase in the use of pesticides.

- In 2022, herbicides dominated the market with a majority share of 53.3%. This is due to the prevalence of weed infestation. Turf and ornamental crops are commonly affected by various weeds, including crabgrass, goosegrass, barnyardgrass, and foxtail. As a result, the use of herbicides has increased to combat these challenges and maintain the health and appearance of the crops.

- Insecticides accounted for 37.5% of the market share in 2022. Northern and southern masked chafers, Asiatic Garden beetles, weevils, billbugs, Japanese beetles, oriental beetles, European chafers, cutworms, and other chinch bugs are common insect pests affecting the turf and ornamental sector.

- The crop protection chemicals market in the turf and ornamental sector is projected to grow during the forecast period with an estimated CAGR of 4.5%, driven by the increasing problems with fungal disease, insects, and weeds.

US Turf and Ornamental Protection Market Trends

Growing adoption of turf & ornamental crops in various applications, extending cultivation area under these crops may drive the market

- Neonicotinoids are the most commonly used in turf care as a preventive material for the control of white grubs. Turf and ornamental crops comprise about 4% of neonicotinoid usage in the United States. There is a rising demand for well-maintained turf and ornamental landscapes, such as in parks, golf courses, gardens, and public spaces, leading to higher pesticide usage to control pests and maintain the desired appearance.

- The area under the turf and ornamental increased by 649.8 thousand hectares between 2017 and 2022 due to the rising demand for flowers in the United States. The increase in cultivation area and meeting the quality requirements led to the increase in the consumption of pesticides during the same period.

- Homeowners, landscapers, and property managers are more aware of the importance of pest management to maintain the value and appeal of their landscapes, leading to higher adoption of pesticide products. Golf courses, sports fields, and public parks often require pest management to maintain their quality, contributing to the consumption of pesticides in the turf segment.

- Additionally, an increase in pest pressures affecting turfs and ornamental areas, such as weeds, insects, or diseases, could lead to an increase in the consumption of pesticides for effective control during the coming years. As urban areas expand, green spaces become more concentrated, creating conducive environments for pests to thrive, which could lead to a higher demand for pest management solutions.

- Changing climate patterns can influence pest populations, which may drive the consumption of pesticides in the coming years.

Effectiveness in controlling various insects such as aphids, beetles, spotted ball worms, pink ball worms, early spot borers, hairy caterpillars, and limited availability in the country is increasing the price of it

- In 2022, cypermethrin was priced at USD 21.2 thousand per metric ton. It has been widely adopted in turf & ornamental crops for its effectiveness in controlling various types of insects, including aphids, beetles, spotted ball worms, pink ball worms, early spot borers, and hairy caterpillars. Its effectiveness has made it popular for farmers seeking to protect their crops from pests and ensure a successful harvest.

- Atrazine, a systemic herbicide belonging to the chlorinated triazine group, is utilized for targeted control of annual grasses and broadleaf weeds before their emergence. Pesticide formulations containing atrazine are approved for application on various turf & ornamental such as sports turf, golf course turf, and commercial and residential lawns, in addition to agricultural applications like corn, sweet corn, sorghum, sugarcane, wheat, macadamia nuts, and guava. Atrazine was priced at USD 13.8 thousand per metric ton in 2022.

- Malathion is used to control a wide range of pests, including aphids, fleas, and other sucking pests on several valuable ornamental crops. Crops extensively grown in the United States and frequently use malathion are chrysanthemums, evergreens, roses, camellias, and azaleas. Malathion was priced at USD 12.6 thousand per metric ton in 2022.

- Mancozeb is a broad-spectrum contact fungicide labeled for outdoor and greenhouse crops in the United States. It protects against a wide spectrum of fungal diseases, including leaf, stem, stripe rusts, botrytis blight, leaf spot, and Cercospora blight. It serves as a seed treatment for crops such as potatoes, corn, sorghum, tomatoes, and cereal grains. In 2022, its market value reached USD 7.8 thousand per metric ton.

US Turf and Ornamental Protection Industry Overview

The US Turf and Ornamental Protection Market is moderately consolidated, with the top five companies occupying 46.20%. The major players in this market are BASF SE, Corteva Agriscience, Environmental Science US LLC (Envu), FMC Corporation and Nufarm Ltd (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 United States

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Function

- 5.1.1 Fungicide

- 5.1.2 Herbicide

- 5.1.3 Insecticide

- 5.1.4 Molluscicide

- 5.1.5 Nematicide

- 5.2 Application Mode

- 5.2.1 Chemigation

- 5.2.2 Foliar

- 5.2.3 Fumigation

- 5.2.4 Seed Treatment

- 5.2.5 Soil Treatment

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 American Vanguard Corporation

- 6.4.2 BASF SE

- 6.4.3 Corteva Agriscience

- 6.4.4 Environmental Science US LLC (Envu)

- 6.4.5 FMC Corporation

- 6.4.6 Gowan Company

- 6.4.7 Mitsui & Co. Ltd (Certis Belchim)

- 6.4.8 Nufarm Ltd

- 6.4.9 Syngenta Group

- 6.4.10 UPL Limited

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms