|

시장보고서

상품코드

1684056

의료기기용 MLCC 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Medical Devices MLCC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

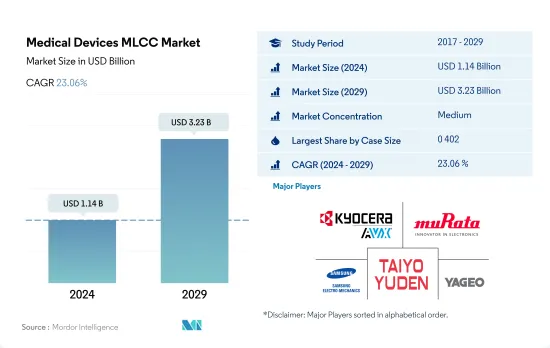

의료기기용 MLCC 시장 규모는 2024년에 11억 4,000만 달러로 평가되었고, 2029년에는 32억 3,000만 달러에 이를 것으로 예측되며, 예측 기간(2024-2029년) 중 CAGR 23.06%로 성장할 전망입니다.

진화하는 의료기기에서 MLCC의 영향력이 높아집니다.

- 세계의 의료기기용 MLCC 시장은 헬스케어 지출 증가 및 선진 의료기기에 대한 수요에 견인되어 큰 성장을 이루고 있습니다. 시장은 케이스 사이즈에 따라 구분되며, 주요 사이즈는 명확한 기술적 진보를 제공하며 특정 의료 요구를 충족합니다.

- 0 402 MLCC는 소형이면서 대용량이므로 최첨단 의료기기에 필수적인 부품입니다. 만성 질환 관리, 환자 건강 증진, 헬스케어 혁신의 추진에 있어서 매우 중요한 역할을 하고 있습니다. 관절염과 암과 같은 만성 질환 증가는 0 603 MLCC 수요에 박차를 가하고 있습니다. 이러한 부품은 조기 발견과 정확한 진단을 위해 MRI 및 CT 스캔을 수행하는 장비에 필수적입니다.

- AI를 탑재한 의료용 로봇 및 웨어러블 의료용 센서의 출현이, 0 805 MLCC 수요를 밀어 올리고 있습니다. 이러한 부품은 의료기기의 AI와 로봇 기능에 전력을 공급하고 수술 로봇과 재활 로봇이 그 동향을 선도하고 있습니다. 1 206 MLCC는 AI 주도 진단 도구 및 웨어러블 의료 센서에서 중요한 역할을 합니다. 암이나 심방세동과 같은 질환이 계속 확산되는 가운데 정확하고 효율적인 진단이 가장 중요합니다.

- 특정 의료용 임플란트의 요구에 대응하는 과정에서 1 210 MLCC는 인구 역학 변화 및 미용 시술에 의해 추진되는 의료용 임플란트의 다양한 상황과 일치합니다. 인구 고령화 및 미용 수술이 증가함에 따라 특수 의료용 임플란트에 대한 수요가 증가하고 있습니다. 다른 케이스 사이즈 부문은 진화하는 의료 기술에 적응하고 명확한 장치 설계 및 공간 제약을 지원합니다.

의료기기의 기술 혁신은 대륙을 넘어 MLCC의 성장을 가속하고 있습니다.

- 아시아태평양은 헬스케어 시장에서 큰 비즈니스 기회에 힘입어 의료기기 산업의 역동적인 허브로 등장했습니다. 세계 심장병 부담의 60%를 차지하는 인도는 의료기기 제조 능력을 확립하기 위해 420억 달러를 투자하여 일본과의 협력을 목표로 하고 있습니다. 이 파트너십은 환자 모니터 및 심장 카테터와 같은 첨단 장비 제조에서 MLCC의 활용과 일치합니다.

- 북미의 헬스케어 사정은 심장병이나 뇌졸중 등 만성질환의 부담이 큰 것이 특징입니다. MLCC는 이러한 문제에 대응하는 컴팩트하고 신뢰할 수 있는 의료기기를 생산할 수 있는 능력을 제공합니다. 수백만 명의 미국인들이 만성 질환을 앓고 생활하기 때문에 MLCC를 통합한 의료 솔루션에 대한 수요가 증가하고 있으며 환자의 결과를 향상시키는 데 MLCC가 중요한 역할을 한다는 것이 강조되고 있습니다.

- 유럽에서 가장 큰 헬스케어 시장은 노화 및 만성 질환 증가에 의해 견인되고 있습니다. MLCC를 탑재한 웨어러블 의료기기는 당뇨병이나 심혈관 장애와 같은 질환의 관리에 도움이 되고 있습니다. 소형화된 컴포넌트 수요는 MLCC의 능력과 일치하여 전력 관리 및 무선 연결을 위해 웨어러블 장비로의 통합을 용이하게 합니다.

- 기타 중동 및 아프리카(MEA)를 포함한 세계 기타 지역(RoW)에는 기회와 도전이 있습니다. MEA 지역은 의료기기와 의약품에 큰 잠재력을 보여줍니다. 중동의 헬스케어 부문은 의료기술 및 의약품에 대한 투자를 원동력으로 2026년까지 4,080억 AED의 수익에 이를 것으로 예측되고 있습니다. MLCC를 포함한 것을 포함한 선진 의료기기에 대한 수요가 급증하고 있어, 이 지역의 헬스케어 확대 및 기술 중시의 자세에 합치하고 있습니다.

세계의 의료기기용 MLCC 시장 동향

의료 사물 인터넷 보급 및 장비의 기술 진보가 헬스케어 지출 촉진

- 헬스케어 업계는 혁신적인 웨어러블 디바이스의 채용 확대 등 현저한 기술 진보를 경험하고 있으며, MLCC에 있어 유망한 시장이 되고 있습니다. 의료 및 헬스케어 용도에서 사용되는 상호 연결 장치를 포함한 의료 사물 인터넷(IoMT)의 인기 증가는 앞으로 수년에 걸쳐 MLCC에 수많은 기회를 창출할 것으로 보입니다. (1)

- COVID-19 팬데믹 기간 동안 세계 헬스케어 지출은 크게 급증했으며 2020년에는 세계 GDP의 10.8%에 해당하는 9조 달러에 이르렀습니다. 주목할 점은 이 지출의 배분이 소득층에 따라 크게 다르다는 것입니다. 정부 지출은 2020년 의료비 증가의 주요 요인이었습니다. 모든 소득층에서 1인당 정부 보건 지출이 증가하여 전년도 성장률을 웃돌았습니다. (2)

- 임박한 팬데믹 및 대재해에 대한 헬스케어 준비 태세를 강화하기 위해 조사, 긴급 대응 능력 및 건강 관리 인프라에 대한 투자가 증가하고 있습니다. 정부와 의료기관은 가능한 건강 위기를 관리하고 그 영향을 줄이기 위해 조사, 긴급 대응 훈련, 인프라 강화 등 사전 대책의 필요성을 인식하고 있습니다. 신속하고 효율적인 긴급 대응을 확보함으로써 이러한 분야에 대한 의료 지출 수요가 높아지고 있습니다.

웨어러블 기술 시장의 전략적 적응이 의료기기용 MLCC 수요 증강

- 2020년 세계의 히어러블, 손목시계, 팔찌 및 기타 웨어러블 시장은 현저한 급성장을 이루었고, 출하액은 4억 4,470만 달러에 이르렀으며, 전년 대비 28.38%의 큰 성장률을 보였습니다. 그러나 2021년에는 전년대비 19.99%로 성장률이 둔화되었고 기세는 다소 둔화되었습니다. 그 결과 2022년에는 7.7% 감소했으나 이는 주로 거시경제 정세가 엄격하여 2021년의 예외적인 실적에 필적하는 실적을 달성하기 어려웠기 때문입니다.

- 이러한 침체는 시장 포화에 부분적으로 기인합니다. 웨어러블 디바이스 부문은 전년도에 상당한 확대를 보였으며 상당수의 잠재 고객이 이미 그러한 디바이스를 채택했기 때문에 수요 감소로 이어졌습니다. 수요를 유발하고 기세를 되찾기 위해 벤더는 저가형 대체품 제공, 매력적인 거래 제안 제공, 대출 옵션 제공, 구독 서비스 도입 등 전략적 수단을 채택하고 있습니다. 게다가 다양한 기능 세트와 가격대의 장비를 도입하여 제품 포트폴리오를 다양화하고 그 주변에 견고한 생태계를 구축하고 있는 기업은 시장이 성장 궤도를 되찾은 후 보상을 얻는 입장에 있습니다.

의료기기용 MLCC 업계 개요

의료기기용 MLCC 시장은 적당히 통합되어 상위 5개사에서 57.03%를 차지하고 있습니다. 이 시장 주요 기업은 다음과 같습니다. Kyocera AVX Components Corporation(Kyocera Corporation), Murata Manufacturing, Samsung Electro-Mechanics, Taiyo Yuden 및 Yageo Corporation(알파벳순 정렬).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 주요 요약 및 주요 조사 결과

제2장 보고서 제안

제3장 서문

- 조사 전제조건 및 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 헬스케어 지출

- 세계의 의료비

- 의료기기 도입률

- 세계 의료기기 보급률

- 웨어러블 판매

- 세계의 의료용 웨어러블 판매 대수

- 규제 프레임워크

- 밸류체인 및 유통채널 분석

제5장 시장 세분화

- 케이스 사이즈별

- 0 402

- 0 603

- 0 805

- 1 206

- 1 210

- 기타

- 전압별

- 100V-500V

- 500V 이상

- 100V 미만

- 정전 용량별

- 10μF-100μF

- 10μF 미만

- 100μF 이상

- 유전 유형별

- 클래스 1

- 클래스 2

- 지역별

- 아시아태평양

- 유럽

- 북미

- 세계 기타 지역

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- Kyocera AVX Components Corporation(Kyocera Corporation)

- Maruwa Co ltd

- Murata Manufacturing Co., Ltd

- Nippon Chemi-Con Corporation

- Samsung Electro-Mechanics

- Samwha Capacitor Group

- Taiyo Yuden Co., Ltd

- TDK Corporation

- Vishay Intertechnology Inc.

- Walsin Technology Corporation

- Yageo Corporation

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Porter's Five Forces 분석 프레임워크

- 세계 밸류체인 분석

- 시장 역학(DROs)

- 정보원 및 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The Medical Devices MLCC Market size is estimated at 1.14 billion USD in 2024, and is expected to reach 3.23 billion USD by 2029, growing at a CAGR of 23.06% during the forecast period (2024-2029).

The influence of MLCCs in the evolving medical device landscape is growing

- The global medical devices MLCC market is experiencing significant growth, driven by growing healthcare expenditure and demand for advanced medical devices. The market is segmented by case size, with key sizes offering distinct technological advancements and addressing specific medical needs.

- Due to their compact size and high capacity, 0 402 MLCCs are critical components in cutting-edge medical devices. They play a pivotal role in managing chronic ailments, improving patients' well-being, and driving healthcare innovations. The increasing prevalence of chronic diseases like arthritis and cancer spurs the demand for 0 603 MLCCs. These components are essential in devices that carry out MRIs and CT scans for early detection and accurate diagnosis.

- The emergence of AI-powered medical robots and wearable medical sensors drives demand for 0 805 MLCCs. These components power AI and robotic functionalities in medical devices, with surgical robots and rehabilitation robots leading the trend. The 1 206 MLCCs play a crucial role in AI-driven diagnostic tools and wearable medical sensors. As diseases like cancer and atrial fibrillation continue to become more prevalent, accurate and efficient diagnostics have become paramount.

- In the process of addressing specific medical implant needs, 1 210 MLCCs align with the diverse landscape of medical implants driven by demographic shifts and aesthetic procedures. With the aging population and an increase in aesthetic surgeries, the demand for specialized medical implants is growing. The other case sizes segment addresses distinct device designs and spatial constraints, adapting to evolving medical technology.

Medical device innovations are fueling the growth of MLCCs across continents

- Asia-Pacific emerged as a dynamic hub for the medical device industry, driven by substantial opportunities in healthcare markets. With a remarkable 60% share of the global heart disease burden, India aims to collaborate with Japan by investing USD 42 billion to establish medical equipment manufacturing capabilities. This partnership aligns with the utilization of MLCCs in producing advanced devices like patient monitors and cardiac catheters.

- North America's healthcare landscape is marked by a high burden of chronic diseases like heart disease and stroke. MLCCs offer the capacity to create compact and reliable medical devices that cater to these challenges. With millions of Americans living with chronic diseases, the demand for medical solutions that integrate MLCCs has increased, emphasizing their crucial role in enhancing patient outcomes.

- The European healthcare market, the largest in the region, is driven by the aging population and increasing chronic diseases. Wearable health devices equipped with MLCCs aid in managing conditions like diabetes and cardiovascular disorders. The demand for miniaturized components aligns with MLCCs' capabilities, facilitating their integration into wearable devices for power management and wireless connectivity.

- The Rest of the World (RoW) encompassing the Middle East & Africa (MEA) presents opportunities and challenges. The MEA region shows substantial potential for medical devices and pharmaceuticals. The Middle East's healthcare sector is projected to reach a revenue of AED 408 billion by 2026, driven by investments in medical technology and pharmaceuticals. The demand for advanced medical devices, including those incorporating MLCCs, is surging, aligning with the region's healthcare expansion and focus on technology.

Global Medical Devices MLCC Market Trends

The increasing popularity of the Internet of Medical Things and technological advancements in devices are propelling healthcare spending

- The healthcare industry is experiencing significant technological advancements, including the growing adoption of innovative and wearable devices, making it a promising market for MLCCs. The increasing popularity of the Internet of Medical Things (IoMT), which involves interconnected devices used in medical and healthcare applications, will create numerous opportunities for MLCCs over the coming years. [1]

- During the COVID-19 pandemic, there was a substantial surge in global healthcare expenditure, which reached USD 9 trillion, equivalent to 10.8% of the global GDP, in 2020. Notably, the distribution of this expenditure varied significantly among different income groups. Government expenditure was the primary catalyst behind the overall rise in health spending in 2020. In all income groups, per capita government spending on health witnessed an upswing, surpassing the growth rate observed in previous years. [2]

- To boost healthcare readiness for impending pandemics or health catastrophes, increased investments are being made in research, emergency response capabilities, and healthcare infrastructure. Governments and healthcare organizations recognize the necessity for proactive measures like research, emergency response training, and infrastructure enhancements to manage and lessen the effects of possible health crises. Ensuring prompt and efficient emergency responses has increased the demand for healthcare expenditure in these areas.

Strategic adaptions in the wearables technology market augmenting the demand for medical devices MLCCs

- In 2020, the global market for hearables, watches, wristbands, and other wearables experienced a remarkable surge, with shipments reaching USD 444.7 million, representing a substantial growth rate of 28.38% compared to the previous year. However, the momentum slightly slowed down in 2021, as the growth rate moderated to 19.99% compared to the preceding year. Consequently, in 2022, the industry witnessed a decline of 7.7%, mainly driven by challenging macroeconomic conditions and the difficulty in achieving comparable results to the exceptional performance observed in 2021.

- This decline can be partially attributed to market saturation, wherein the wearable device sector had witnessed substantial expansion in the prior years, leading to diminished demand as a significant number of potential customers had already adopted such devices. To stimulate demand and regain momentum, vendors are adopting strategic measures, such as offering lower-cost alternatives, introducing attractive trade-in offers, providing financing options, and implementing subscription services. Furthermore, companies that diversify their product portfolio by incorporating devices with varying feature sets and price points, while building a robust ecosystem around them, stand to reap rewards once the market regains its growth trajectory.

Medical Devices MLCC Industry Overview

The Medical Devices MLCC Market is moderately consolidated, with the top five companies occupying 57.03%. The major players in this market are Kyocera AVX Components Corporation (Kyocera Corporation), Murata Manufacturing Co., Ltd, Samsung Electro-Mechanics, Taiyo Yuden Co., Ltd and Yageo Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Healthcare Expenditure

- 4.1.1 Global Health Care Expenditure

- 4.2 Medical Devices Adoption Rate

- 4.2.1 Global Medical Devices Adoption Rate

- 4.3 Wearables Sales

- 4.3.1 Global Medical Wearables Sales

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Case Size

- 5.1.1 0 402

- 5.1.2 0 603

- 5.1.3 0 805

- 5.1.4 1 206

- 5.1.5 1 210

- 5.1.6 Others

- 5.2 Voltage

- 5.2.1 100V to 500V

- 5.2.2 Above 500V

- 5.2.3 Less than 100V

- 5.3 Capacitance

- 5.3.1 10 μF to 100 μF

- 5.3.2 Less than 10 μF

- 5.3.3 More than 100 μF

- 5.4 Dielectric Type

- 5.4.1 Class 1

- 5.4.2 Class 2

- 5.5 Region

- 5.5.1 Asia-Pacific

- 5.5.2 Europe

- 5.5.3 North America

- 5.5.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Kyocera AVX Components Corporation (Kyocera Corporation)

- 6.4.2 Maruwa Co ltd

- 6.4.3 Murata Manufacturing Co., Ltd

- 6.4.4 Nippon Chemi-Con Corporation

- 6.4.5 Samsung Electro-Mechanics

- 6.4.6 Samwha Capacitor Group

- 6.4.7 Taiyo Yuden Co., Ltd

- 6.4.8 TDK Corporation

- 6.4.9 Vishay Intertechnology Inc.

- 6.4.10 Walsin Technology Corporation

- 6.4.11 Yageo Corporation

7 KEY STRATEGIC QUESTIONS FOR MLCC CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms