|

시장보고서

상품코드

1911824

유럽의 이륜차 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2026-2031년)Europe Two-Wheeler - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

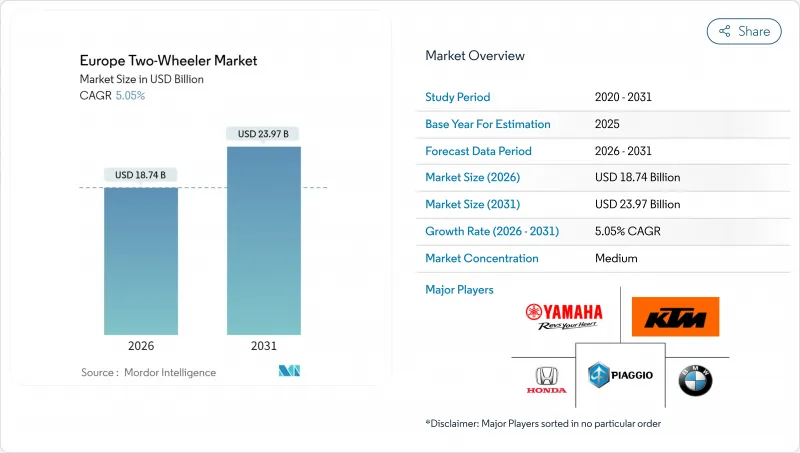

유럽의 이륜차 시장은 2025년 178억 4,000만 달러로 평가되었고, 2026년에는 187억 4,000만 달러로 성장할 전망이며, 2026-2031년 CAGR 5.05%로 성장을 지속하여, 2031년까지 239억 7,000만 달러에 달할 것으로 예측됩니다.

이 성장세는 유로 5 배출 규제 시행, 급성장하는 배송 경제 및 지역 배터리 공급망에 대한 EU 자금 지원에 기인하고 있습니다. 오토바이는 고속도로에서의 범용성으로부터 주도적 입장을 유지하는 반면, 스쿠터는 밀집한 도시 중심부에서 존재감을 높이고 있습니다. 배터리 교체 네트워크를 통한 초기 비용 절감 및 도시의 청정 에어 존에서 내연 기관 모델에 대한 규제 강화로 전동 추진 시스템은 틈새 시장에서 주류로 전환하고 있습니다. 가격의 양극화가 진행되고 있습니다. 1,000달러 미만의 엔트리 스쿠터는 폭넓은 층에 지지를 계속하고 있는 반면, 3,001달러 이상의 프리미엄 전동 오토바이는 접속성, 안전 기술, 구독 대응 구동 시스템을 요구하는 라이더의 교체 수요에 의해 가장 급격한 성장을 이루고 있습니다. 경쟁은 중간 정도이며, 기존 브랜드는 유통망 및 브랜드 가치에 의존하는 한편, 전동 전문 제조업체는 소비자 직접 판매 채널과 모듈식 소프트웨어 갱신을 활용해, 모델 사이클의 단축을 도모하고 있습니다.

유럽의 이륜차 시장 동향 및 인사이트

저총소유비용(TCO) 이륜차를 요구하는 EC 배송 차량 급증

온라인 쇼핑의 상승으로 이륜차는 마지막 마일 물류의 핵심을 담당하고 있습니다. 2024년 현재 유럽에 13,000개가 넘는 Amazon의 배송 파트너 네트워크가 규모를 상징합니다. 플릿 구매자는 가동 중지 시간을 최소화하기 위해 견고한 프레임, 텔레매틱스 및 배터리 교체 대응성을 강조합니다. 총소유비용이 구입 가격을 웃돌기 때문에 제조업체 희망 소매 가격이 높은 전동 스쿠터도 선택되고 있습니다. 운송업체는 서비스 계약으로 대량 주문을 하기 때문에 OEM 제조업체는 모듈형 배터리 팩과 예지 보전 API를 제공해야 합니다. 이 상업 전환으로 레저 라이더 이외 수요가 다양해지고, 경기 감속기 동안 유럽의 이륜차 시장의 회복력을 지원하고 있습니다.

유로 5 배출 규제 전환이 방아쇠가 되는 선행 구매 및 모델 쇄신

유로 5 규제로 인해 제조업체는 엔진 업그레이드 및 전기화 프로그램의 가속화를 강요하고 있으며, 가격 상승 전에 구형 모델을 확보하려는 라이더가 일시적으로 구매를 앞두고 있습니다. OEM 제조업체는 구형 재고를 소화하면서, 프리미엄인 유로 5 대응 모델을 추진해, 장래의 전동 라인 자금 조달에 도움이 되는 일시적인 이익률 향상을 누리고 있습니다. 이 규제는 특히 주류 126-150cc 클래스에 영향을 미치고 모델 사이클의 급속한 업데이트를 촉구하며 규제 적합 배기 후 처리 시스템에 대한 수요를 유발합니다. 판매점에서는 2025년 규제 시행을 앞두고 쇼룸 방문객 수가 증가하고 있다는 보고가 있으며, 단기적인 판매 대수를 밀어 올리는 동시에 장기적인 제로 방출 제품으로의 이행을 가속화하고 있습니다.

리튬 스팟 가격 변동이 EV 제조업체 희망 소매 가격의 안정성에 영향

2024년 탄산리튬 가격이 난고하자 제조업체는 월별 가격 개정 또는 이익률 압박을 흡수할지 여부를 선택했습니다. 위험 회피 계약으로 급등의 일부는 완화되지만, 소규모 전기자동차 전문 제조업체는 재무 기반이 취약하기 때문에 생산 지연 위험이 발생하고 있습니다. 전지 화학의 연구 개발에서는 리튬 사용량을 삭감하는 망간 다량 정극재가 모색되고 있습니다만, 실용화는 2026년 이후가 될 전망입니다.

부문 분석

2025년 오토바이 시장에서 유럽 점유율의 81.02%를 차지했습니다. 통근이나 레저 투어링에 있어서의 범용성의 높이가 반영되고 있습니다. 엔진 효율 향상 및 안전 전자기기의 진화가 애호가의 지지를 유지하고 프리미엄 어드벤처 모델과 스포츠 모델이 평균 판매 가격을 밀어 올리고 있습니다. 스쿠터는 기반 규모가 작은 반면, 대도시권에 있어서 정체 요금, 주차장 부족, EC 배송 수요에 의해 CAGR 7.9%를 달성하고 있습니다. 전동 스쿠터는 간소화된 구동 시스템이 서비스 다운타임을 단축하고 상업적 우위성을 강화하기 때문에 도시 지역의 플릿 입찰을 이끌고 있습니다. 제조업체는 차고 콘센트가 없는 아파트 거주자를 대상으로 착탈식 배터리 스쿠터를 판매합니다. 높은 배출 가스 지역을 제한하는 도시가 늘어남에 따라 스쿠터 등록 대수는 기존의 남유럽 거점을 넘어 독일과 북유럽 국가로 확대되어 오토바이 판매 대수와의 차이를 줄이고 있습니다.

내연기관은 기존 인프라와 검증된 신뢰성으로 인해 2025년에도 유럽의 이륜차 시장 점유율의 90.86%를 유지합니다. 유로 5 엔진은 고속도로 성능을 저하시키지 않으면서 배출 가스를 줄이고 지역 및 투어링 라이더 수요를 유지합니다. 전기식은 점유율 9.14%이면서, 충전망의 확충 및 배터리 교환 거점 증가에 의해 CAGR 6.88%를 기록했습니다. 도시에서는 저배출 가스 기준의 ICE 오토바이에 대한 과세 금지 정책이 진행되고, 도시 통근이나 배송 업무에서는 전기식이 표준화하고 있습니다. 에너지, 보험 및 유지 보수를 포괄하는 구독 번들은 초기 배터리 고비용을 상쇄합니다. 급속 충전기 부족으로 인해 지역에서의 보급은 늦어졌지만, 계획중인 EU 대체 연료 회랑으로 인해 2027년 이후에는 격차가 줄어들 수 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 애널리스트에 의한 3개월간의 지원

자주 묻는 질문

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 주요 업계 동향

- 인구 및 도시화율

- 1인당 GDP(구매력 평가) 및 가처분 소득의 중앙값

- 자동차 구입 및 수송비(CVP)에 있어서 소비자 지출

- 연료 가격

- 이륜차 및 자동차 대출 금리 및 대출 액세스

- 이륜차의 보급률 및 보유 대수

- 판매점 및 서비스 네트워크의 밀도

- 이륜차 무역 및 수익(수입 및 수출)

- 전동화 대응 상황(인프라 및 전력)

- 배터리 팩의 가격과 화학 조성의 조합

- 배터리 교환 스테이션(네트워크 밀도 및 이용률)

- 신형 모델 파이프라인 및 OEM 커버리지

- 밸류체인의 현지화 및 조립 능력

- 규제 프레임워크

- 차량 기준, 안전성 및 주행 적성

- CBU/CKD/SKD의 관세, 부가가치세(VAT), 현지 조달률(LC)에 관한 규칙

- 전동화, 에너지 및 환경 정책

- 자전거 택시, 배송 차량 및 자금 조달에 관한 규칙

제5장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 유로 5 배출 규제 이행에 수반하는 선행 구입 및 모델 쇄신의 움직임

- 저총 소유 비용(TCO)의 이륜차를 요구하는 EC 배송 차량의 급속한 확대

- 배터리 교환 비즈니스 모델이 도시 사용자의 EV 초기 비용 저감

- 젊은층의 구독형 모빌리티 서비스에 대한 기호

- OEM의 모듈러 플랫폼에 의한 6개월 모델 사이클의 실현

- EU 넷 제로 산업법에 의한 지역 배터리 공급망에 대한 자금 지원

- 시장 성장 억제요인

- 25세 미만 라이더에 대한 고액의 보험료

- 주요 도시의 공유 스쿠터 이용 제한 강화

- 리튬 스팟 가격의 변동이 EV 제조업체 희망 소매 가격의 안정성에 영향

- 딜러 네트워크 통합으로 지방 서비스 액세스 감소

- 밸류체인 및 공급망 분석

- 규제 상황

- 기술 전망

- Porter's Five Forces

- 신규 참가업체의 위협

- 공급기업의 협상력

- 구매자의 협상력

- 대체품의 위협

- 업계 간 경쟁

제6장 시장 규모 및 성장 예측(금액 및 수량)

- 차량 유형별

- 오토바이

- 스쿠터

- 추진별

- 내연기관(ICE)

- 전기

- 엔진 용량 및 모터 출력별

- 내연기관(ICE)

- 110cc 이하

- 111-125 cc

- 126-150 cc

- 151-200 cc

- 201-250 cc

- 250-350 cc

- 350-500 cc

- 500cc 이상

- 전기

- 최대 1.0kW

- 1.1-3.0 kW

- 3.1-5.0 kW

- 5.0kW 이상

- 내연기관(ICE)

- 가격대별

- 1,000달러 이하

- 1,000-1,500 USD

- 1,501-2,000 USD

- 2,001-3,000 USD

- 3,001-5,000 USD

- 5,000달러 이상

- 최종 사용자별

- B2C

- B2B

- 라이드 쉐어, 바이크 택시, 렌탈 및 관광

- 배송 및 물류

- 법인 및 중소기업용 플릿

- 기타(정부 및 기관, NGO)

- 판매 채널별

- 온라인

- 오프라인

- 지역별

- 독일

- 프랑스

- 이탈리아

- 스페인

- 영국

- 네덜란드

- 스웨덴

- 폴란드

- 오스트리아

- 벨기에

- 노르웨이

- 체코 공화국

- 포르투갈

- 그리스

제7장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- BMW Motorrad

- Ducati Motor Holding SpA

- Harley-Davidson Inc.

- Honda Motor Co., Ltd.

- KTM AG

- Piaggio and C. SpA

- Royal Enfield(Eicher Motors)

- Suzuki Motor Corporation

- Triumph Motorcycles Ltd

- Yamaha Motor Co., Ltd.

- Niu Technologies

- Yadea Group Holdings Ltd

- Zero Motorcycles Inc.

- Kawasaki Motors Ltd

- Peugeot Motocycles

제8장 시장 기회 및 장래 전망

- 화이트 스페이스 및 미충족 요구의 평가

제9장 CEO를 위한 주요 전략적 과제

AJY 26.01.30The Europe two-wheeler market is expected to grow from USD 17.84 billion in 2025 to USD 18.74 billion in 2026 and is forecast to reach USD 23.97 billion by 2031 at 5.05% CAGR over 2026-2031.

Momentum stems from Euro 5+ emission enforcement, the fast-growing delivery economy, and EU funding for local battery supply chains. Motorcycles are leading because of their highway versatility, while scooters are gaining ground in dense urban cores. Electric propulsion moves from niche to mainstream as battery-swap networks lower upfront cost and urban clean-air zones tighten rules on internal-combustion models. Price polarization grows: sub-USD 1,000 entry scooters sustain mass appeal, yet premium electric bikes above USD 3,001 post the sharpest gains as riders trade up for connectivity, safety tech, and subscription-ready drivetrains. Competition is moderate; legacy brands rely on dealer reach and brand equity, whereas electric specialists exploit direct-to-consumer channels and modular software updates to shorten model cycles.

Europe Two-Wheeler Market Trends and Insights

Rapid Expansion of E-Commerce Delivery Fleets Demanding Low-TCO 2Ws

Online shopping's rise places two-wheelers at the heart of last-mile logistics; Amazon's network of over 13,000 European delivery partners in 2024 typifies the scale. Fleet buyers favor robust frames, telematics, and battery-swap readiness to minimize downtime. Total cost of ownership now eclipses sticker price, making electric scooters preferable despite higher MSRP. Delivery operators lock in bulk orders with service contracts, pressuring OEMs to provide modular battery packs and predictive maintenance APIs. This commercial pivot diversifies demand beyond leisure riders and supports the European two-wheeler market's resilience during economic slowdowns.

Euro 5+ Emission Shift Triggering Pre-Buy and Model Refresh

Euro 5+ standards compel manufacturers to upgrade engines and accelerate electric programs, causing a short-lived pre-buy surge as riders lock in older models before price rises. OEMs clear legacy inventory while pushing premium Euro 5+ offerings, enjoying temporary margin lifts that help bankroll future electric lines. The regulation particularly influences the dominant 126-150 cc class, prompting rapid model cycles and fueling demand for compliant exhaust after-treatment systems. Dealers report elevated showroom traffic ahead of the 2025 enforcement window, reinforcing near-term volume but advancing the long-term shift toward zero-tailpipe-emission products.

Lithium-Spot-Price Volatility Hitting EV MSRP Stability

Lithium carbonate swung in 2024, forcing manufacturers either to re-price monthly or absorb margin hits. Hedging contracts mitigate some spikes, but smaller electric specialists lack balance-sheet heft, threatening production delays. Battery chemistry R&D seeks manganese-rich cathodes to reduce lithium intensity, yet commercialization lies beyond 2026.

Other drivers and restraints analyzed in the detailed report include:

- EU Net-Zero Industry Act Funding Local Battery Supply Chains

- OEM Modular Platforms Enabling 6-Month Model Cycles

- High Insurance Premiums for Below 25-Year-Old Riders

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Motorcycles controlled 81.02% of the European two-wheeler market share in 2025, reflecting their versatility for commuting and leisure touring. Continuous engine efficiency gains and safety electronics keep loyalists invested, while premium adventure and sport models lift average selling prices. Scooters, although smaller in base, deliver an 7.9% CAGR thanks to congestion charges, parking scarcity, and e-commerce courier demand in megacities. Electric scooters lead urban fleet tenders because simplified drivetrains trim service downtime, reinforcing their commercial edge. Manufacturers market detachable-battery scooters targeting apartment dwellers who lack garage outlets. As more cities restrict high-emission zones, scooter registrations broaden beyond traditional Southern European strongholds into Germany and the Nordics, closing the gap with motorcycle volumes.

Internal-combustion engines retain 90.86% of the European two-wheeler market share in 2025, buoyed by legacy infrastructure and proven reliability. Euro 5+ engines post cleaner emissions without compromising highway performance, keeping demand alive among rural and touring riders. Though with only an 9.14% share, electric variants post a 6.88% CAGR as charging grids densify and battery-swap nodes proliferate. Urban policies increasingly tax or ban low-Euro-class ICE bikes, making electric the default for city commuting and delivery jobs. Subscription bundles that wrap energy, insurance, and maintenance offset upfront battery premiums. Rural adoption lags as fast chargers remain sparse, but planned EU alternative-fuels corridors may narrow the divide after 2027.

The Europe Two-Wheeler Market Report is Segmented by Vehicle Type (Motorcycles and Scooters), Propulsion (ICE and Electric), Engine Capacity/Motor Power (Up To 110cc, and More), Price Band (Up To USD 1, 000, and More), End User (B2C and B2B), Sales Channel (Online and Offline), and by Country. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- BMW Motorrad

- Ducati Motor Holding S.p.A.

- Harley-Davidson Inc.

- Honda Motor Co., Ltd.

- KTM AG

- Piaggio and C. SpA

- Royal Enfield (Eicher Motors)

- Suzuki Motor Corporation

- Triumph Motorcycles Ltd

- Yamaha Motor Co., Ltd.

- Niu Technologies

- Yadea Group Holdings Ltd

- Zero Motorcycles Inc.

- Kawasaki Motors Ltd

- Peugeot Motocycles

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Key Industry Trend

- 4.1 Population and Urbanization Rate

- 4.2 GDP per Capita (PPP) and Median Disposable Income

- 4.3 Consumer Spend on Vehicle Purchase/Transport (CVP)

- 4.4 Fuel Prices

- 4.5 Interest Rate for 2-Wheeler/Auto Loans and Credit Access

- 4.6 2-Wheeler Penetration and Parc

- 4.7 Dealer/Service Network Density

- 4.8 Two-Wheeler Trade and Revenue (Imports/Exports)

- 4.9 Electrification Readiness (Infrastructure and Power)

- 4.10 Battery Pack Price and Chemistry Mix

- 4.11 Battery Swapping Stations (Network Density and Utilization)

- 4.12 New Model Pipeline and OEM Coverage

- 4.13 Value-Chain Localization and Assembly Capacity

- 4.14 Regulatory Framework

- 4.14.1 Vehicle Standards, Safety and Roadworthiness

- 4.14.2 CBU/CKD/SKD Duties, VAT and Local-Content Rules

- 4.14.3 Electrification, Energy and Environmental Policy

- 4.14.4 Rules for Bike-Taxi, Delivery Fleets and Financing

5 Market Landscape

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Euro 5+ Emission Shift Triggering Pre-Buy and Model Refresh

- 5.2.2 Rapid Expansion of E-Commerce Delivery Fleets Demanding Low-TCO 2Ws

- 5.2.3 Battery-Swap Business Models Lowering Up-Front EV Cost for Urban Users

- 5.2.4 Youth Preference for Subscription-Based Mobility Services

- 5.2.5 OEM Modular Platforms Enabling 6-Month Model Cycles

- 5.2.6 EU Net-Zero Industry Act Funding Local Battery Supply Chains

- 5.3 Market Restraints

- 5.3.1 High Insurance Premiums for Below 25-Year-Old Riders

- 5.3.2 Tightened Shared-Scooter Caps in Tier-1 Cities

- 5.3.3 Lithium-Spot-Price Volatility Hitting EV MSRP Stability

- 5.3.4 Dealer Network Consolidation Reducing Rural Service Access

- 5.4 Value / Supply-Chain Analysis

- 5.5 Regulatory Landscape

- 5.6 Technological Outlook

- 5.7 Porter's Five Forces

- 5.7.1 Threat of New Entrants

- 5.7.2 Bargaining Power of Suppliers

- 5.7.3 Bargaining Power of Buyers

- 5.7.4 Threat of Substitutes

- 5.7.5 Industry Rivalry

6 Market Size and Growth Forecasts (Value (USD) and Volume (Units))

- 6.1 By Vehicle Type

- 6.1.1 Motorcycles

- 6.1.2 Scooters

- 6.2 By Propulsion

- 6.2.1 Internal Combustion Engine (ICE)

- 6.2.2 Electric

- 6.3 By Engine Capacity / Motor Power

- 6.3.1 Internal Combustion Engine (ICE)

- 6.3.1.1 Up to110 cc

- 6.3.1.2 111-125 cc

- 6.3.1.3 126-150 cc

- 6.3.1.4 151-200 cc

- 6.3.1.5 201-250 cc

- 6.3.1.6 250-350 cc

- 6.3.1.7 350-500 cc

- 6.3.1.8 Above 500 cc

- 6.3.2 Electric

- 6.3.2.1 Up to 1.0 kW

- 6.3.2.2 1.1-3.0 kW

- 6.3.2.3 3.1-5.0 kW

- 6.3.2.4 Above 5.0 kW

- 6.3.1 Internal Combustion Engine (ICE)

- 6.4 By Price Band

- 6.4.1 Up to USD 1,000

- 6.4.2 USD 1,000-1,500

- 6.4.3 USD 1,501-2,000

- 6.4.4 USD 2,001-3,000

- 6.4.5 USD 3,001-5,000

- 6.4.6 Above USD 5,000

- 6.5 By End User

- 6.5.1 B2C

- 6.5.2 B2B

- 6.5.2.1 Ride-Hail / Bike-Taxi / Rental / Tourism

- 6.5.2.2 Delivery and Logistics

- 6.5.2.3 Corporate and SME Fleets

- 6.5.2.4 Others (Government and Institutional, NGO)

- 6.6 Sales Channel

- 6.6.1 Online

- 6.6.2 Offline

- 6.7 Geography

- 6.7.1 Germany

- 6.7.2 France

- 6.7.3 Italy

- 6.7.4 Spain

- 6.7.5 United Kingdom

- 6.7.6 Netherlands

- 6.7.7 Sweden

- 6.7.8 Poland

- 6.7.9 Austria

- 6.7.10 Belgium

- 6.7.11 Norway

- 6.7.12 Czech Republic

- 6.7.13 Portugal

- 6.7.14 Greece

7 Competitive Landscape

- 7.1 Market Concentration

- 7.2 Strategic Moves

- 7.3 Market Share Analysis

- 7.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 7.4.1 BMW Motorrad

- 7.4.2 Ducati Motor Holding S.p.A.

- 7.4.3 Harley-Davidson Inc.

- 7.4.4 Honda Motor Co., Ltd.

- 7.4.5 KTM AG

- 7.4.6 Piaggio and C. SpA

- 7.4.7 Royal Enfield (Eicher Motors)

- 7.4.8 Suzuki Motor Corporation

- 7.4.9 Triumph Motorcycles Ltd

- 7.4.10 Yamaha Motor Co., Ltd.

- 7.4.11 Niu Technologies

- 7.4.12 Yadea Group Holdings Ltd

- 7.4.13 Zero Motorcycles Inc.

- 7.4.14 Kawasaki Motors Ltd

- 7.4.15 Peugeot Motocycles

8 Market Opportunities and Future Outlook

- 8.1 White-Space and Unmet-Need Assessment