|

시장보고서

상품코드

1685672

수용성 폴리머 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Water-soluble Polymer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

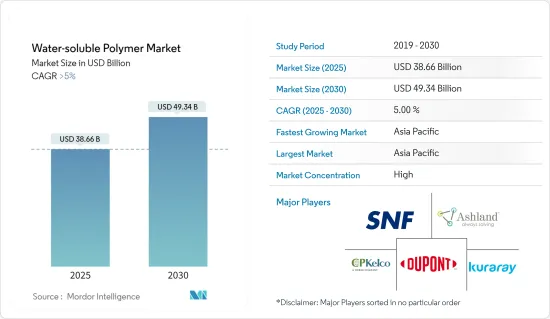

수용성 폴리머 시장 규모는 2025년에 386억 6,000만 달러, 2030년에는 493억 4,000만 달러에 이를 것으로 예측되며, 예측 기간 중(2025-2030년) CAGR은 5%로 성장할 것으로 예상됩니다.

COVID-19 팬데믹은 수용성 폴리머 시장에 부정적인 영향을 미쳤습니다. 산업 활동의 감소, 공급망의 혼란, 소비자 행동의 변화는 이러한 산업에서 수용성 폴리머 수요에 영향을 미쳤습니다. 수처리, 섬유, 퍼스널케어, 식품 가공 등 수용성 폴리머를 이용하는 많은 산업은 유행기간 동안 가동 정지나 일시적인 가동 정지에 휩싸였습니다. 그러나 경제 상황이 개선되고 프로젝트가 재개되면 위의 산업에서 사용되는 폴리머 수요가 증가했습니다.

시장 성장을 뒷받침하는 요인은 북미에서 셰일가스 산업의 성장과 세계 수처리 산업으로부터의 수용성 폴리머 수요가 증가하고 있습니다.

그러나 원료가격 변동이 예측기간 동안 수용성 폴리머 시장의 성장을 방해할 것으로 예상됩니다.

바이오 아크릴 아미드에 대한 수요가 증가하고 제약 산업에서 수용성 폴리머의 용도가 확대되는 것은 예측 기간 동안 제조업체에게 다양한 기회를 제공할 것으로 예상됩니다.

아시아태평양은 세계의 수용성 폴리머 시장을 독점하고 있으며 예측 기간 동안 가장 높은 CAGR을 유지할 것으로 예상됩니다.

수용성 폴리머 시장 동향

예측기간 동안 수처리산업이 시장을 독점할 전망

- 수질 및 환경 보호에 대한 엄격한 규정은 수처리 솔루션에 대한 수요를 촉진하고 있습니다. 수용성 폴리머는 폐수와 식수원으로부터 유기물, 부유물질, 중금속 등의 오염물질을 제거하고 규제기준에 적합시킴으로써 수처리 공정에서 중요한 역할을 하고 있습니다.

- 하수처리장 등의 지자체 인프라와 화학처리시설, 펄프 및 제지공장, 섬유제조공장 등 산업 인프라에 대한 투자가 수용성 폴리머를 포함한 수처리 약품에 대한 수요를 끌어올리고 있습니다. 이 고분자는 지방 자치 단체 및 산업계의 폐수 처리 공정에서 슬러지 탈수, 침전, 농축 등 다양한 목적으로 사용됩니다.

- 댈러스 연방준비은행이 발표한 데이터에 따르면 미국을 제외한 세계 산업 생산은 2023년 1월 0.67 증가했습니다.

- 독일 수처리 시장은 유럽 최대입니다. 주로 동국 북부 지역에서의 수처리 활동의 활성화가 수처리용 폴리머 수요를 끌어 올리고 있습니다. 연방환경자연보호부에 따르면 이 나라의 급수 및 배수처리산업은 연간 약 220억 유로(약 233억 3,000만 달러)를 차지하고 있습니다.

- 2024년 1월, Gradiant's H+E는 독일에서 최대급 반도체 공장을 위한 수처리 시설의 건설을 수주했습니다. 프로젝트는 곧 시작될 예정이며 2025년에 완성될 예정입니다.

- 인도 정부 쟈르 샤크티성이 발표한 보고서에 따르면 2022 회계연도에 농촌 인구의 61.5%가 파이프 시스템을 통해 부지 내에서 안전하고 충분한 식수를 이용할 수 있게 되었습니다고 합니다. 최근 몇 년동안 인도 농촌 지역에서 안전한 식수를 이용할 수 있는 사람의 수는 2016 회계 연도의 40% 미만에서 크게 증가하고 있습니다.

- 지속 가능한 물 관리 실천과 수처리 공정에서 환경 친화적인 화학 물질의 사용이 중요해지고 있습니다. 생분해성과 무해한 수용성 폴리머는 효과적인 수처리를 보장하면서 환경 실적를 줄이려는 환경 의식이 높은 산업과 정부에게 선호되는 옵션입니다.

- 이러한 요인으로 인해 수처리 산업의 성장이 예측 기간 동안 시장을 견인할 것으로 예상됩니다.

예측기간 동안 아시아태평양이 시장을 독점할 전망

- 아시아태평양에서는 산업화가 급속히 진행되고 있으며, 수처리, 식품 가공, 의약품, 퍼스널케어, 농업 등 다양한 산업에서 수용성 폴리머 수요가 증가하고 있습니다.

- 농업은 많은 아시아태평양 국가에서 중요한 산업입니다. 수용성 폴리머는 농업에 있어서 토양 개량, 침식 방지, 건조 및 반건조 지역에서의 보수성 향상을 위해서 사용되고 있습니다. 농업의 현대화와 기계화에 따라 이러한 중합체 수요가 증가할 것으로 예상됩니다.

- 인도네시아 통계국과 인도네시아 농업부에 따르면 인도네시아의 팜유 생산량은 2017년 3,494만 톤에서 2022년에는 4,558만 톤으로 증가했다고 밝혔습니다.

- 필리핀 통계국이 발표한 데이터에 따르면, 필리핀에서 옥수수 생산량은 2022년 826만 톤에 이르렀으며 2016년 722만 톤에서 증가했습니다.

- 아시아태평양 건설 산업은 특히 중국, 인도, 동남아시아에서 활황을 보이고 있습니다. 수용성 폴리머는 시멘트계, 모르타르, 그라우트 등의 건축자재에 널리 사용되어 시장에서의 우위성에 기여하고 있습니다.

- 국토교통성이 발표한 보고서에 따르면 일본의 건설투자 총액은 2018년 61조 8,300억 위안(4,100억 달러)에서 2023년에는 70조 3,200억 위안(4,700억 달러)으로 증가했습니다.

- 위의 요인들로 인해 예측 기간 동안 아시아태평양은 수용성 폴리머 시장을 독점할 것으로 예상됩니다.

수용성 폴리머 산업 개요

수용성 폴리머 시장은 세분화됩니다. 주요 기업(특정 순서 없이)로는 SNF Group, Ashland, DuPont, CP Kelco US Inc., and Arkema 등을 들 수 있습니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 및 지원

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 북미의 셰일 가스 산업 성장

- 아시아태평양의 수처리 산업의 급성장

- 억제요인

- 원재료 가격 변동

- 기타 억제요인

- 산업 밸류체인 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

제5장 시장 세분화

- 유형

- 폴리아크릴아미드

- 폴리비닐알코올

- 구아검

- 젤라틴

- 크산탄검

- 폴리아크릴산

- 폴리에틸렌글리콜

- 기타 유형(셀룰로오스 에테르, 펙틴, 전분)

- 최종 사용자 산업

- 수처리

- 음식

- 퍼스널케어와 위생

- 석유 및 가스

- 펄프 및 제지

- 제약

- 기타 최종 사용자 산업(농약)

- 지역

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 인도네시아

- 말레이시아

- 태국

- 베트남

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 터키

- 러시아

- 노르딕

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 콜롬비아

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 나이지리아

- 이집트

- 카타르

- 아랍에미리트(UAE)

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 시장 점유율(%)**, 랭킹 분석

- 주요 기업의 전략

- 기업 프로파일

- Arkema

- Ashland

- BASF SE

- CP Kelco US Inc.

- DuPont

- Gantrade Corporation

- Kemira

- Kuraray Co. Ltd

- Merck KGaA

- Mitsubishi Chemical Corporation

- Nouryon

- Polysciences Inc.

- SNF Group

- Sumitomo Seika Chemicals Co. Ltd

제7장 시장 기회와 앞으로의 동향

- 바이오 아크릴 아미드에 대한 수요 증가

- 제약업계의 용도 확대

The Water-soluble Polymer Market size is estimated at USD 38.66 billion in 2025, and is expected to reach USD 49.34 billion by 2030, at a CAGR of greater than 5% during the forecast period (2025-2030).

The COVID-19 pandemic negatively affected the water-soluble polymer market. Reduced industrial activity, supply chain disruptions, and changes in consumer behavior affected demand for water-soluble polymers in these industries. Many industries utilizing water-soluble polymers, such as water treatment, textiles, personal care, and food processing, experienced slowdowns or temporary shutdowns during the pandemic. However, as economic conditions improved and projects resumed, the demand for polymers used in the abovementioned industries increased.

The factors driving the market's growth are the growing shale gas industry in North America and the rising demand for water-soluble polymers from the global water treatment industry.

However, fluctuations in raw material prices are expected to hamper the growth of the water-soluble polymer market during the forecast period.

The rising demand for bio-based acrylamide and growing applications of water-soluble polymers in the pharmaceutical industry are expected to offer various opportunities for manufacturers during the forecast period.

Asia-Pacific dominated the global water-soluble polymer market, and it is projected to hold the highest CAGR during the forecast period.

Water-soluble Polymer Market Trends

The Water Treatment Industry is Expected to Dominate the Market during the Forecast Period

- Stringent regulations for water quality and environmental protection drive the demand for water treatment solutions. Water-soluble polymers play a crucial role in water treatment processes by aiding in the removal of contaminants, such as organic matter, suspended solids, and heavy metals, from wastewater and drinking water sources to meet regulatory standards.

- Investments in municipal infrastructure, such as sewage treatment plants, and industrial infrastructure, including chemical processing facilities, pulp and paper mills, and textile manufacturing plants, drive the demand for water treatment chemicals, including water-soluble polymers. These polymers are utilized for various purposes, such as sludge dewatering, sedimentation, and thickening, in both municipal and industrial wastewater treatment processes.

- Global industrial production, excluding the United States, increased by 0.67 in January 2023, according to the data published by the Federal Reserve Bank of Dallas.

- The German water treatment market is the largest in Europe. The increasing water treatment activities, primarily in the country's northern region, are boosting the demand for water treatment polymers. According to the Federal Ministry for the Environment and Nature Conservation, the country's water supply and wastewater treatment industries account for about EUR 22 billion ( approximately USD 23.33 billion) annually.

- In January 2024, Gradiant's H+E won a contract in Germany to build a water treatment facility for one of the largest semiconductor fabs. The project is expected to commence soon and be completed in 2025.

- According to the report published by the Ministry of Jal Shakti of the Government of India, 61.5% of the rural population had access to safe and adequate drinking water in their premises through a pipe system during the financial year 2022. In recent years, the number of rural people in India who have access to safe drinking water has increased significantly, from less than 40% in the financial year 2016.

- There is a growing emphasis on sustainable water management practices and the use of eco-friendly chemicals in water treatment processes. Water-soluble polymers that are biodegradable and non-toxic are preferred choices for eco-conscious industries and governments aiming to reduce their environmental footprint while ensuring effective water treatment.

- Due to these factors, the growth in the water treatment industry is anticipated to drive the market over the forecast period.

Asia-Pacific is Expected to Dominate the Market during the Forecast Period

- Asia-Pacific is experiencing rapid industrialization, leading to increased demand for water-soluble polymers across various industries such as water treatment, food processing, pharmaceuticals, personal care, and agriculture.

- Agriculture is a significant industry in many Asia-Pacific countries. Water-soluble polymers are used in agriculture for soil conditioning, erosion control, and improving water retention in arid and semi-arid regions. As agricultural practices modernize and mechanize, the demand for these polymers is expected to rise.

- According to Statistics Indonesia and the Ministry of Agriculture Indonesia, the production volume of palm oil in Indonesia increased from 34.94 million metric tons in 2017 to 45.58 million metric tons in 2022.

- According to the data published by the Philippine Statistics Authority, the production volume of corn in the Philippines reached 8.26 million metric tons in 2022, which increased from 7.22 million metric tons in 2016.

- The Asia-Pacific construction industry is booming, especially in China, India, and Southeast Asia. Water-soluble polymers are extensively used in construction materials such as cementitious systems, mortars, and grouts, contributing to their dominance in the market.

- According to the report released by the Ministry of Land, Infrastructure, Transport and Tourism, the total investment in construction in Japan increased from CNY 61.83 trillion (USD 0.41 trillion) in 2018 to CNY 70.32 trillion (USD 0.47 trillion) in 2023.

- Based on the abovementioned factors, Asia-Pacific is expected to dominate the water-soluble polymer market during the forecast period.

Water-soluble Polymer Industry Overview

The water-soluble polymer market is fragmented in nature. The major players (not in any particular order) include SNF Group, Ashland, DuPont, CP Kelco U.S. Inc., and Arkema.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Shale Gas Industry in North America

- 4.1.2 Surging Water Treatment Industry in Asia-Pacific

- 4.2 Restraints

- 4.2.1 Fluctuating Prices of Raw Materials

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Polyacrylamide

- 5.1.2 Polyvinyl Alcohol

- 5.1.3 Guar Gum

- 5.1.4 Gelatin

- 5.1.5 Xanthan Gum

- 5.1.6 Polyacrylic Acid

- 5.1.7 Polyethylene Glycol

- 5.1.8 Other Types (Cellulose Ethers, Pectin, and Starch)

- 5.2 End-user Industry

- 5.2.1 Water Treatment

- 5.2.2 Food and Beverage

- 5.2.3 Personal Care and Hygiene

- 5.2.4 Oil and Gas

- 5.2.5 Pulp and Paper

- 5.2.6 Pharmaceutical

- 5.2.7 Other End-user Industries (Agrochemicals)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Indonesia

- 5.3.1.6 Malaysia

- 5.3.1.7 Thailand

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Turkey

- 5.3.3.7 Russia

- 5.3.3.8 NORDIC

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Egypt

- 5.3.5.5 Qatar

- 5.3.5.6 United Arab Emirates

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arkema

- 6.4.2 Ashland

- 6.4.3 BASF SE

- 6.4.4 CP Kelco U.S. Inc.

- 6.4.5 DuPont

- 6.4.6 Gantrade Corporation

- 6.4.7 Kemira

- 6.4.8 Kuraray Co. Ltd

- 6.4.9 Merck KGaA

- 6.4.10 Mitsubishi Chemical Corporation

- 6.4.11 Nouryon

- 6.4.12 Polysciences Inc.

- 6.4.13 SNF Group

- 6.4.14 Sumitomo Seika Chemicals Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for Bio-based Acrylamide

- 7.2 Growing Application in the Pharmaceutical Industry