|

시장보고서

상품코드

1851237

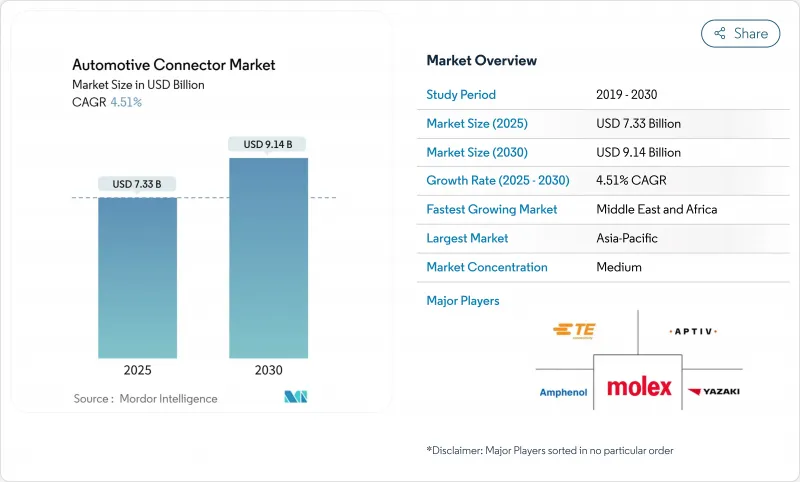

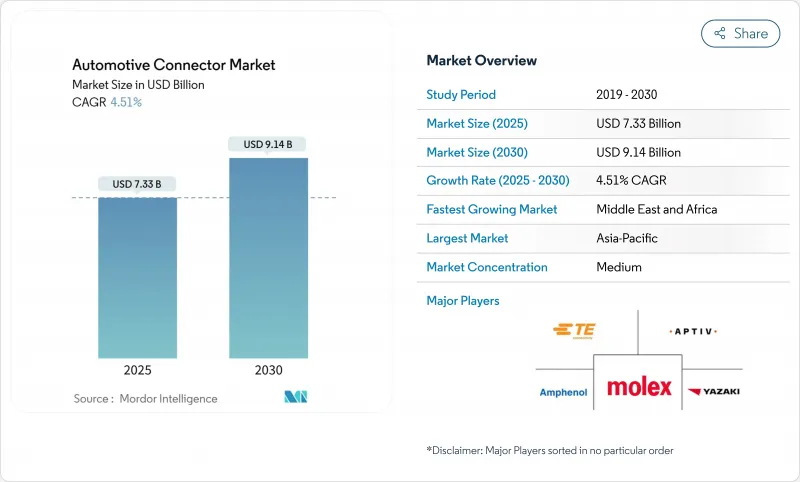

자동차 커넥터 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Automotive Connector - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

2025년 자동차 커넥터 시장 규모는 73억 3,000만 달러에 이를 것으로 추정됩니다.

2030년에는 91억 4,000만 달러에 달할 것으로 예상되며, 자동차 플랫폼이 전기화 및 소프트웨어 정의 아키텍처로 전환함에 따라 CAGR 4.51%를 나타낼 전망입니다.

내연 파워트레인과 관련된 수요가 두드러지게 되는 한편, 고전압·고속 데이터 상호 접속이 확대하기 때문입니다. 분산형 ECU에서 존형 전자 구조로의 전환은 하네스의 길이를 줄이고 차량 중량을 줄입니다. 커넥터의 복잡성이 증가함에 따라 고밀도 혼합 신호 기능이없는 레거시 공급업체는 변위 위험이 있습니다. 엄격한 안전 규정, 데이터가 풍부한 ADAS 기능, 800V 배터리 시스템은 IP67/IP6K9K 표준을 준수하면서 전력 및 멀티기가비트 신호를 전송하는 밀폐형 고성능 인터페이스 주문을 증가시킵니다. OEM이 내결함성 링크, 무선 업데이트 및 사이버 보안 데이터 경로를 요구하는 동안 반도체 등급 제조 정밀도와 소프트웨어 통합 지원을 결합한 공급업체가 승자가 됩니다.

세계의 자동차 커넥터 시장 동향과 인사이트

가속하는 전동화와 고전압 E 파워트레인

48V 및 800V 전기 아키텍처로의 전환은 기존의 12V 시스템을 넘어 전기 터보 충전, 회생 브레이크 및 고출력 충전 기능을 지원하므로 커넥터 요구 사항을 근본적으로 변경쟁니다. Aptiv의 고전압 인터커넥트는 현재 최대 250A의 전류 커패시턴스로 400V-1,000V의 전압 범위를 지원하여 보다 빠른 충전 및 효율 향상으로 업계의 변화를 지원합니다.

48V 마일드 하이브리드 시스템의 출현으로 듀얼 전압 아키텍처의 과제가 발생하고 12V 레거시 시스템과 48V 전원 네트워크를 안전하게 분리 및 관리하기 위한 과제가 커넥터에 요구되고 있습니다. TE Connectivity의 AMP HVA 280 시스템은 이러한 진화의 예이며, 최대 850V 용도에서 안전성을 높이기 위해 고전압 인터록과 2단계 플로팅 래치를 통합합니다. 이 전동화의 파도는 승용차뿐만 아니라 상용차로도 확대되고, 이튼의 전력 연결 솔루션은 대형 용도에서 효율적인 에너지 전달을 가능하게 하고, 보다 넓은 수송 전동화 지령을 지원합니다. 하나의 차량에서 여러 전압 영역을 관리하는 복잡성은 절연을 유지하고 진단 기능을 제공하며 다양한 작동 조건에서 페일 세이프 동작을 보장 할 수있는 정교한 커넥터 시스템에 대한 수요를 촉진합니다.

세계 안전·배기 가스 규제 강화

EU는 신차에 자동 긴급 브레이크와 전방 충돌 경보를 탑재할 것을 의무화하고 있는 등 규제 프레임워크은 고급 안전 시스템을 점점 더 의무화하고 있으며 센서의 통합과 실시간 데이터 처리에 대한 커넥터 수요를 직접 촉진하고 있습니다. NHTSA를 통한 차량 간 통신 표준의 추진은 5.9GHz DSRC 및 셀룰러 V2X 프로토콜을 지원할 수 있는 고주파, 저지연 커넥터에 대한 새로운 요구사항을 만들어 냈습니다. CISPR 25 전자기 호환성 표준은 특히 10GHz 이상의 전도 방사선에 대해 점점 더 엄격 해지고 있으며 커넥터 제조업체는 고급 차폐 및 필터링 기능을 통합해야합니다.

소프트웨어 정의를 자동차로 옮기는 것은 무선 업데이트와 지속적인 모니터링 시스템이 신호 무결성과 사이버 보안 기능을 강화한 커넥터를 요구하기 때문에 이러한 요구 사항을 증폭합니다. 중국의 신에너지 차량 지령과 캘리포니아 주 선진 클린카Ⅱ규제는 특히 배터리 관리 시스템이나 충전 인프라 등의 커넥터 사양에 지역적인 차이를 일으키기 때문에 세계 공급업체는 비용 효율을 유지하면서 다양한 규제 환경에 적응할 수 있는 플랫폼과 유연한 솔루션을 개발할 필요가 있습니다.

불안정한 구리·금속 상품 가격

신재생에너지 및 전기자동차 분야에서공급제약과 수요의 급증으로 구리 가격이 상승하고 자동차 커넥터공급체인 전체에 큰 비용압력을 주고 있습니다. 전기자동차는 기존의 내연 기관차보다 상당히 많은 구리를 필요로 하며, 하나의 전기자동차가 약 83kg의 구리를 사용하는 반면, 기존 자동차는 23kg입니다. 구리 클래드 알루미늄과 구리 클래드 스틸 도체를 포함한 Copperweld의 바이메탈 솔루션은 전기 성능 특성을 유지하면서 구리 사용량을 최대 83%까지 줄일 수 있는 잠재력을 제공합니다. 구리 채굴이 정치적으로 불안정한 지역에 집중되어 공급망의 위험이 더욱 커집니다. 동시에 무역 마찰과 수출 규제는 가격 변동을 더욱 악화시키고 자동차 OEM은 위험 회피 전략과 장기 공급 계약을 이행해야 하며 커넥터 조달 및 설계 최적화의 유연성이 제한될 수 있습니다.

부문 분석

파워트레인 용도는 2024년 자동차 커넥터 시장 규모의 33.60%로 최대 시장 점유율을 유지했습니다. 이는 ICE와 하이브리드 파워트레인 모두에서 엔진 관리, 변속기 제어 및 연료 분사 시스템의 중요성이 지속되고 있음을 반영합니다. 그러나 ADAS와 자율주행시스템은 2025년부터 2030년까지의 CAGR이 17.8%가 되어 급성장하는 부문으로 떠오르는 고급 안전 기능에 대한 규제의 의무화와 보다 높은 수준의 차량 자동화에 대한 업계의 진전에 힘입어 있습니다.

안전 및 보안 용도는 에어백 시스템, 전자 안정 제어 및 충돌 회피 기술의 통합으로 인해 혜택을 누릴 수 있습니다. 동시에 차체 배선 및 배전 부문은 여러 기능을 더 적은 정교한 제어 장치에 통합하는 영역 아키텍처 구현에 적응합니다. 편안함, 편의성 및 엔터테인먼트 시스템은 프리미엄 기능에 대한 소비자의 기대가 모든 차량 부문에서 확대됨에 따라 꾸준한 성장을 이루고 있습니다. 동시에 내비게이션 및 계측기 용도는 고해상도 디스플레이와 증강현실 인터페이스를 지원하도록 진화합니다.

전기자동차에 특화된 충전 및 에너지 관리 용도의 출현은 기존 자동차 커넥터 시장에 존재하지 않았던 새로운 카테고리이며, 전기화 파워트레인을 향한 업계의 근본적인 변화를 부각하고 있습니다. 이 세분화의 전환은 기계적 차량 시스템에서 전자 차량 시스템으로의 광범위한 전환을 반영하며, 기존의 파워트레인 커넥터는 배터리 시스템, DC-DC 컨버터 및 회생 브레이크 네트워크를 관리할 수 있는 고전압 및 고전류 솔루션으로 대체하는 데 직면하고 있습니다. ADAS 용도의 급속한 성장은 이러한 시스템이 동시에 여러 소스의 센서 데이터를 실시간으로 처리해야 하기 때문에 고주파, 저지연 전송 전문 지식을 갖춘 커넥터 공급업체에게 기회를 제공합니다.

승용차는 2024년 자동차 커넥터 시장 점유율의 54.20%를 차지하며 생산량이 많아 1대당 전자 컨텐츠 증가의 혜택을 누렸습니다. 그러나 이륜차는 2030년까지 연평균 복합 성장률(CAGR) 11.5%로 가장 급성장하는 부문입니다. 소형 상용차는 전자상거래 성장과 라스트원 마일 딜리버리 최적화를 통해 안정적인 수요를 유지하고 있습니다. 반면에 중형 및 대형 상용차에서는 고급 텔레매틱스 및 차량 관리 시스템의 채용이 증가하고 있으며 견고하고 고성능 커넥터 솔루션이 필요합니다. 이러한 용도는 IP67/IP6K9K 정격 및 승용차 요구사항을 초과하는 극단적인 온도 범위에서의 작동이 요구되므로 상용차 부문은 커넥터의 내구성과 내환경성 혁신을 추진하고 있습니다.

이륜차의 성장은 도시화의 동향과 혼잡한 도심지에서의 전기 수송에 대한 규제의 지지를 반영하고, 공간에 제약이 있는 용도에 최적화된 소형 경량 커넥터에 대한 수요를 창출하고 있습니다. 상용차의 전동화는 운행 비용 절감과 배기 가스 규제 준수를 요구하는 운행 회사의 노력에 의해 가속화되고 있습니다. 이 때문에 급속 충전과 에너지 밀도가 높은 배터리 시스템을 지원하는 고전압 커넥터 수요가 높아집니다. 자율주행 기술이 다른 궤적을 따라 발전함에 따라, 승용차와 상용차의 구분은 점점 더 의미가 있게 되고, 상용차 용도는 제어된 운전 환경과 전용 인프라 투자를 통해 더 높은 자동화 수준을 조기에 달성할 수 있습니다.

지역 분석

아시아태평양은 2024년 자동차 커넥터 시장 수익의 38.60%를 차지해 선두를 유지했습니다. 이는 일렉트로닉스공급망이 밀집되어 있는 것, 자동차 생산 대수가 세계 제일인 것, 전기자동차나 전기 버스를 지지하는 국가 정책이 있기 때문입니다. 중국의 OEM은 존 하네스를 자사에서 제조하고 기술 이전 조항 하에서 2급 커넥터 제조업체를 현지 합작 회사에 끌어들이고 있습니다. 일본의 기존 기업은 스미토모 상사의 '30VISION'과 같은 CASE 프로그램을 추진해 800V 플랫폼에 최적화된 컴팩트하고 낮은 삽입력 모델을 발표하고 있습니다. 한국공급업체는 배터리 노하우를 셀 투 팩 아키텍처를 지원하는 고전류 기판 단자에 쏟고 있습니다. 동남아 국가들은 범용 압착에 걸리는 인건비는 낮지만 열대 호우에 대응하기 위해 IP67 등급을 요구하는 경향이 강해지고 있으며 자동차 커넥터 시장은 가격대를 불문하고 확대하고 있습니다.

중동 및 아프리카는 현재는 소규모이지만 정부계 펀드가 전기자동차 공장과 충전회랑을 설립하고 있기 때문에 2030년까지 연평균 복합 성장률(CAGR)은 15.20%에 이를 전망입니다. 사우디아라비아는 EV 클러스터를 육성하고 현지에서 고압 케이블을 조달하고 있습니다. 레오니의 아가디르 신공장은 북아프리카의 와이어 하네스 기세를 상징합니다. 어려운 열과 먼지가 고온 LCP 하우징과 강화 가스켓 플랜지 수요를 환기. 지역별 함량 규제는 다국적 기업에게 국산 폴리머 컴파운드의 인정을 촉구하고 탄력성을 높이면서도 중복된 검증을 요구하고 있습니다.

북미와 유럽은 성숙하면서도 기술 혁신이 풍부한 지역입니다. 미국 OEM은 핸즈프리 레벨 3 스택을 고급 트림에 통합하여 20Gbps 보드 커넥터와 실리콘 등급의 클린룸 공정 공급에 박차를 가하고 있습니다. 유럽의 기후 목표는 400kW의 급속 충전 허브를 가속시키고 온도 센서 내장 1,000V 접촉기를 의무화합니다. TE Connectivity의 녹색 스톡 프로그램은 잉여 재고를 재사용하여 매립 폐기물 및 탄소 발자국을 줄입니다. 2024년 공급망 충격은 주석 도금과 플라스틱 성형의 온쇼어링을 촉진하여 자동차 커넥터 시장에서 전략적 자율성을 확보했습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 가속하는 전동화와 e-파워트레인의 고전압화

- ADAS와 자율주행 기능의 급속한 보급

- 고속 데이터 링크가 필요한 소프트웨어 정의 자동차

- 세계 안전·배기 가스 규제 강화

- 존형 e/e 아키텍처로의 이행이 고밀도 커넥터를 촉진

- 차재 인포테인먼트와 커넥티비티 유닛의 급증

- 시장 성장 억제요인

- 구리와 금속 상품 가격의 변동

- 고기능 수지(PPS, LCP)의 부족

- 가혹한 자동차 환경에서의 신뢰성의 과제

- 10Gbps를 초과하는 신호 속도에서 EMI 컴플라이언스 장애물

- 가치/공급망 분석

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 규모와 성장 예측(단위 : 달러)

- 용도별

- 파워트레인

- 안전 및 보안

- 차체 배선 및 전력 분배

- 쾌적성, 편리성 및 엔터테인먼트

- 내비게이션 및 계기판

- ADAS 및 자율 주행 시스템

- 충전 및 에너지 관리(EV)

- 차량 유형별

- 승용차

- 소형 상용차

- 중형 및 대형 상용차

- 이륜차

- 버스 및 코치

- 추진 유형별

- 내연기관(ICE) 자동차

- 하이브리드 전기자동차(HEV)

- 플러그인 하이브리드 자동차(PHEV)

- 배터리 전기자동차(BEV)

- 연료전지 전기자동차(FCEV)

- 커넥터 유형별

- 전선 대 전선

- 전선 대 기판

- 기판 대 기판

- iO 및 원형

- FFC/FPC 및 마이크로

- 고속/고전압

- 연결 밀봉 방식별

- 밀봉

- 비밀봉

- 지역별

- 북미

- 미국

- 캐나다

- 기타 북미

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 인도네시아

- 베트남

- 필리핀

- 호주

- 뉴질랜드

- 기타 아시아태평양

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 튀르키예

- 남아프리카

- 이집트

- 나이지리아

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- TE Connectivity Ltd

- Yazaki Corporation

- Aptiv PLC

- Molex Inc.(Koch Industries)

- Sumitomo Wiring Systems Ltd

- Luxshare Precision Industry Co., Ltd

- Hirose Electric Co., Ltd

- JST Mfg Co., Ltd

- Amphenol Corporation

- Furukawa Electric Co., Ltd

- Rosenberger Hochfrequenztechnik GmbH

- Leoni AG

제7장 시장 기회와 향후 전망

KTH 25.11.12The automotive connector market size stands at USD 7.33 billion in 2025. It is forecast to reach USD 9.14 billion by 2030, advancing at a 4.51% CAGR as vehicle platforms move toward electrified and software-defined architectures.

Growth remains moderate on the surface, yet the mix changes quickly: demand linked to internal-combustion powertrains plateaus while high-voltage and high-speed data interconnects scale up. The shift from distributed ECUs to zonal electronic structures compresses harness length, trimming vehicle weight. It raises connector complexity, creating displacement risk for legacy suppliers that lack high-density, mixed-signal capabilities. Rigorous safety regulations, data-rich ADAS features, and 800 V battery systems propel orders for sealed, high-performance interfaces that carry power and multi-gigabit signals while meeting IP67/IP6K9K ratings. Suppliers that combine semiconductor-grade manufacturing precision with software integration support are positioned to win as OEMs demand fault-tolerant links, over-the-air updatability, and cyber-secure data paths.

Global Automotive Connector Market Trends and Insights

Accelerating Electrification and Higher-Voltage E-Powertrains

The transition to 48V and 800V electrical architectures fundamentally reshapes connector requirements, moving beyond traditional 12V systems to support electric turbocharging, regenerative braking, and high-power charging capabilities. Aptiv's high-voltage interconnects now support voltage ranges from 400V to 1000V with current capacities up to 250A, addressing the industry's shift toward faster charging and improved efficiency.

The emergence of 48V mild hybrid systems creates a dual-voltage architecture challenge, requiring connectors to safely isolate and manage 12V legacy systems and 48V power delivery networks. TE Connectivity's AMP+ HVA 280 system exemplifies this evolution, featuring integrated high-voltage interlocks and two-stage floating latches for enhanced safety in applications up to 850V. This electrification wave extends beyond passenger vehicles to commercial fleets, where Eaton's power connection solutions enable efficient energy transfer in heavy-duty applications, supporting the broader transportation electrification mandate. The complexity of managing multiple voltage domains within a single vehicle drives demand for sophisticated connector systems that can maintain isolation, provide diagnostic capabilities, and ensure fail-safe operation across diverse operating conditions.

Stricter Global Safety and Emission Mandates

Regulatory frameworks increasingly mandate advanced safety systems, with the EU requiring autonomous emergency braking and forward collision warning in new vehicles, directly driving connector demand for sensor integration and real-time data processing. The NHTSA's push for vehicle-to-vehicle communication standards creates new requirements for high-frequency, low-latency connectors capable of supporting 5.9 GHz DSRC and cellular V2X protocols. CISPR 25 electromagnetic compatibility standards have become increasingly stringent, particularly for conducted emissions above 10 GHz, forcing connector manufacturers to integrate advanced shielding and filtering capabilities.

The shift toward software-defined vehicles amplifies these requirements, as over-the-air updates and continuous monitoring systems demand connectors with enhanced signal integrity and cybersecurity features. China's New Energy Vehicle mandate and California's Advanced Clean Cars II regulation create regional variations in connector specifications, particularly for battery management systems and charging infrastructure, requiring global suppliers to develop platform-flexible solutions that can adapt to diverse regulatory environments while maintaining cost efficiency.

Volatile Copper and Metal Commodity Prices

Copper prices are rising, driven by supply constraints and surging demand from renewable energy and electric vehicle sectors, creating significant cost pressures across the automotive connector supply chain. Electric vehicles require significantly more copper than traditional ICE vehicles, with each EV containing approximately 83 kilograms of copper compared to 23 kilograms in conventional vehicles, amplifying the impact of price volatility on automotive connector costs. Copperweld's bimetallic solutions, including Copper-Clad Aluminum and Copper-Clad Steel conductors, offer potential alternatives that can reduce copper usage by up to 83% while maintaining electrical performance characteristics. The concentration of copper mining in politically unstable regions creates additional supply chain risks. At the same time, trade tensions and export restrictions further exacerbate price volatility, forcing automotive OEMs to implement hedging strategies and long-term supply contracts that may limit flexibility in connector sourcing and design optimization.

Other drivers and restraints analyzed in the detailed report include:

- Surge in In-Vehicle Infotainment and Connectivity Units

- Rapid ADAS and Autonomous Functionality Penetration

- Shortage of High-Performance Resins (PPS, LCP)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Powertrain applications maintain the largest market share at 33.60% of the automotive connector market size in 2024, reflecting the continued importance of engine management, transmission control, and fuel injection systems across both ICE and hybrid powertrains. However, ADAS and autonomous systems emerge as the fastest-growing segment at 17.8% CAGR from 2025-2030, driven by regulatory mandates for advanced safety features and the industry's progression toward higher levels of vehicle automation.

Safety and security applications benefit from the increasing integration of airbag systems, electronic stability control, and collision avoidance technologies. At the same time, body wiring and power distribution segments adapt to zonal architecture implementations that consolidate multiple functions into fewer, more sophisticated control units. Comfort, convenience, and entertainment systems experience steady growth as consumer expectations for premium features expand across all vehicle segments. At the same time, navigation and instrumentation applications evolve to support high-resolution displays and augmented reality interfaces.

The emergence of charging and energy management applications specifically for electric vehicles represents a new category that didn't exist in traditional automotive connector markets, highlighting the industry's fundamental transformation toward electrified powertrains. This segmentation shift reflects the broader transition from mechanical to electronic vehicle systems, where traditional powertrain connectors face displacement by high-voltage, high-current solutions capable of managing battery systems, DC-DC converters, and regenerative braking networks. The rapid growth in ADAS applications creates opportunities for connector suppliers with expertise in high-frequency, low-latency transmission, as these systems require real-time processing of sensor data from multiple sources simultaneously.

Passenger cars command 54.20% of the automotive connector market share in 2024, benefiting from high production volumes and increasing electronic content per vehicle. Yet, two-wheelers represent the fastest-growing segment at 11.5% CAGR through 2030. Light commercial vehicles maintain steady demand driven by e-commerce growth and last-mile delivery optimization. Meanwhile, medium and heavy commercial vehicles increasingly adopt advanced telematics and fleet management systems that require ruggedized, high-performance connector solutions. The commercial vehicle segments drive innovation in connector durability and environmental resistance, as these applications demand IP67/IP6K9K ratings and operation across extreme temperature ranges that exceed passenger car requirements.

The growth in two-wheelers reflects urbanization trends and regulatory support for electric transportation in congested city centers, creating demand for compact, lightweight connectors optimized for space-constrained applications. Commercial vehicle electrification accelerates as fleet operators seek to reduce operating costs and meet emission regulations. This drives demand for high-voltage connectors supporting rapid charging and energy-dense battery systems. The segmentation between passenger and commercial vehicles becomes increasingly relevant as autonomous driving technologies develop along different trajectories, with commercial applications potentially achieving higher automation levels sooner due to controlled operating environments and dedicated infrastructure investments.

The Automotive Connector Market Report is Segmented by Application (Powertrain, Safety and Security, and More), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Propulsion Type (ICE Vehicles, Hybrid Electric Vehicles, and More), Connector Type (Wire-To-Wire, Wire-To-Board, and More), Connection Sealing (Sealed and Unsealed), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained leadership with 38.60% of the automotive connector market revenue in 2024, thanks to dense electronics supply chains, the world's highest vehicle output, and state policies favoring electric cars and buses. Chinese OEMs build zonal harnesses in-house, pulling tier-two connector makers into local joint ventures under technology-transfer clauses. Japanese incumbents pursue CASE programs such as Sumitomo's "30VISION," launching compact, low-insertion-force models optimized for 800 V platforms. Korean suppliers channel battery know-how into high-current board terminals that support cell-to-pack architectures. Southeast Asian nations offer lower labor costs for commodity crimping yet increasingly demand IP67 ratings for tropical downpours, widening the automotive connector market across price tiers.

The Middle East and Africa, while small today, are poised for a 15.20% CAGR through 2030 as sovereign wealth funds seed electric-vehicle plants and charging corridors. Saudi Arabia bankrolls EV clusters and sources high-voltage cabling locally; Leoni's new Agadir plant exemplifies North-African wire harness momentum. Harsh heat and dust provoke demand for high-temperature LCP housings and reinforced gasket flanges. Regional content rules push multinationals to qualify domestic polymer compounds, adding resilience yet demanding duplicate validation runs.

North America and Europe represent mature but innovation-rich arenas. United States OEMs integrate hands-free Level 3 stacks on premium trims, spurring the supply of 20 Gbps board connectors and silicon-grade cleanroom processes. Europe's climate targets accelerate 400 kW fast-charge hubs, obliging 1,000 V contactors with embedded temperature sensors. Both regions chase circular-economy mandates; TE Connectivity's Green Stock program repurposes excess inventory, cutting landfill waste and carbon footprints. Supply chain shocks during 2024 catalyzed the on-shoring of tin plating and plastic molding to secure strategic autonomy within the automotive connector market.

- TE Connectivity Ltd

- Yazaki Corporation

- Aptiv PLC

- Molex Inc. (Koch Industries)

- Sumitomo Wiring Systems Ltd

- Luxshare Precision Industry Co., Ltd

- Hirose Electric Co., Ltd

- J.S.T. Mfg Co., Ltd

- Amphenol Corporation

- Furukawa Electric Co., Ltd

- Rosenberger Hochfrequenztechnik GmbH

- Leoni AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating electrification and higher-voltage e-powertrains

- 4.2.2 Rapid ADAS and autonomous functionality penetration

- 4.2.3 Software-defined vehicles requiring high-speed data links

- 4.2.4 Stricter global safety and emission mandates

- 4.2.5 Shift to zonal e/e architectures driving high-density connectors

- 4.2.6 Surge in in-vehicle infotainment and connectivity units

- 4.3 Market Restraints

- 4.3.1 Volatile copper and metal commodity prices

- 4.3.2 Shortage of high-performance resins (PPS, LCP)

- 4.3.3 Reliability challenges in harsh automotive environments

- 4.3.4 EMI compliance hurdles at more than 10 Gbps signal speeds

- 4.4 Value / Supply-Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value in USD)

- 5.1 By Application

- 5.1.1 Powertrain

- 5.1.2 Safety and Security

- 5.1.3 Body Wiring and Power Distribution

- 5.1.4 Comfort, Convenience and Entertainment

- 5.1.5 Navigation and Instrumentation

- 5.1.6 ADAS and Autonomous Systems

- 5.1.7 Charging and Energy Management (EV)

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Light Commercial Vehicles

- 5.2.3 Medium and Heavy Commercial Vehicles

- 5.2.4 Two-Wheelers

- 5.2.5 Bus and Coach

- 5.3 By Propulsion Type

- 5.3.1 Internal Combustion Engine (ICE) Vehicles

- 5.3.2 Hybrid Electric Vehicles (HEV)

- 5.3.3 Plug-in Hybrid Electric Vehicles (PHEV)

- 5.3.4 Battery Electric Vehicles (BEV)

- 5.3.5 Fuel-Cell Electric Vehicles (FCEV)

- 5.4 By Connector Type

- 5.4.1 Wire-to-Wire

- 5.4.2 Wire-to-Board

- 5.4.3 Board-to-Board

- 5.4.4 I/O and Circular

- 5.4.5 FFC/FPC and Micro

- 5.4.6 High-Speed / High-Voltage

- 5.5 By Connection Sealing

- 5.5.1 Sealed

- 5.5.2 Unsealed

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Indonesia

- 5.6.4.6 Vietnam

- 5.6.4.7 Philippines

- 5.6.4.8 Australia

- 5.6.4.9 New Zealand

- 5.6.4.10 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Turkey

- 5.6.5.4 South Africa

- 5.6.5.5 Egypt

- 5.6.5.6 Nigeria

- 5.6.5.7 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 TE Connectivity Ltd

- 6.4.2 Yazaki Corporation

- 6.4.3 Aptiv PLC

- 6.4.4 Molex Inc. (Koch Industries)

- 6.4.5 Sumitomo Wiring Systems Ltd

- 6.4.6 Luxshare Precision Industry Co., Ltd

- 6.4.7 Hirose Electric Co., Ltd

- 6.4.8 J.S.T. Mfg Co., Ltd

- 6.4.9 Amphenol Corporation

- 6.4.10 Furukawa Electric Co., Ltd

- 6.4.11 Rosenberger Hochfrequenztechnik GmbH

- 6.4.12 Leoni AG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment