|

시장보고서

상품코드

1685778

정밀 관개 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Precision Irrigation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

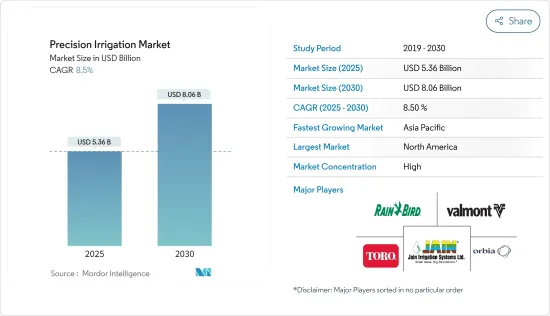

정밀 관개 시장 규모는 2025년에 53억 6,000만 달러에 달할 것으로 추정됩니다. 예측 기간 중(2025-2030년) CAGR은 8.5%를 나타낼 것으로 전망되고, 2030년에는 80억 6,000만 달러에 이를 것으로 예상됩니다.

주요 하이라이트

- 물 부족은 중요한 과제이며 정밀 관개 시스템의 장기적인 보급을 촉진하고 있습니다. 소비자 수요가 증가함에 따라 높은 작물 수확을 보장하기 위해 인공 관개의 필요성이 급증하고 있습니다. 게다가 세계 농지의 통합으로 농부들은 정밀 관개와 같은 고가의 시스템에 투자할 수 있게 되어 시장을 더욱 촉진하고 있습니다.

- 기술 개발은 다양한 지역에서 시장 확대를 더욱 촉진합니다. 예를 들어, 2020년 넬슨 일리게이션 코퍼레이션은 임팩트 피벗 스프링클러를 제외한 모든 센터 피벗 시스템에 쉽게 설치할 수 있는 R55VT 및 R75 엔드 오브 피벗 스프링클러를 발표했습니다. 기술의 저가격화와 효율화에 따라 정밀 관개기계의 채용률이 상승할 것으로 예상됩니다. 이 때문에 예측기간 중 시장성장률이 높아질 것으로 예상됩니다. 그러나 드립 시스템과 스프링클러 시스템과 같은 정밀 관개 시스템에는 기술적 복잡성이 수반되며, 이러한 시스템의 고가의 설치 비용이 보급의 방해가 되고 있습니다.

- 게다가 현대적이고 선진적인 정밀 관개 시스템을 도입하기 위한 저이자금 대출 및 보조금에 대한 유리한 정부 정책으로 인해 정밀 관개 시장은 앞으로 수년간 남미와 아시아태평양과 같은 신흥국 시장에서 급속히 확대될 가능성이 높습니다. 아시아태평양의 인지도 향상과 신기술에 대한 높은 적응성은 시장의 급성장을 이끌고 있습니다.

정밀 관개 시장 동향

온실 야채 생산의 급성장

자동 점적 관개는 특히 특수 온실 야채의 토양 수분 관리에 매우 중요합니다. 이러한 시스템을 완전히 자동화함으로써 생산자는 토양 수분과 물을 정확하게 관리할 수 있습니다. 또한 이러한 자동화는 수율당 수익을 증가시킬 것으로 예상됩니다.

물 부족은 유럽 각국의 야채 농부들에게 큰 도전이 되고 있습니다. 그 결과, 정밀 관개 시스템은 이 지역에서 빠르게 확산되고 있습니다. 2021년 벨기에 원예 경매 협회는 벨기에의 온실 야채 생산량이 40만 5,400톤에 달했고 토마토가 30만 4,100톤을 차지했다고 보고했습니다. 게다가 양호한 기후 조건과 작물 수율 향상과 투자 수익률에 대한 수요 증가에 힘입어 스웨덴의 온실 토마토 생산량은 2020년부터 2021년에 걸쳐 17.9% 급증했습니다.

무토양 재배는 주로 미국, 캐나다, 일본, 인도, 중동, 유럽에서 온실 야채 생산에 사용됩니다. 온실 야채는 충분한 양의 물을 필요로 하기 때문에 농가는 보다 높은 작물 생산성을 달성하기 위해 스프링클러나 점적 관개 시스템으로 전환하고 있어, 향후 시장 기업에 의한 기술 혁신이 채용의 동기가 되고 있습니다. 예를 들어, 2023년 8월, 네타핌은 시부푸리의 4개의 Better Life Farming(BLF) 센터를 통해 1,600헥타르의 토지에서 토마토의 보호를 재배하는 드립 관개 시스템을 제공하도록 격려했습니다.

북미가 시장을 독점

정밀 관개 시스템의 주요 거점은 북미에 있으며 미국이 이 지역 시장 점유율의 절반 이상을 차지하고 있습니다. 연방, 주, 지방의 물 개발 이니셔티브와 지하수 펌핑 기술의 발전은 미국의 관개 풍경을 크게 확장하고 있습니다. 2023년 미국 아마릴로의 텍사스 A&M 아그릴라이프 연구·보급 센터가 실시한 조사에 의하면, 표면 점적 관개 시스템의 평가와 사용에 의해 텍사스주 고지 평원의 반건조로 바람이 강한 지역에서의 고가치 야채 생산에 있어서의 물 이용 효율이 높았습니다. 토마토의 노지 재배는 생물학적 및 생물학적 스트레스 요인으로 인한 극단적인 손실을 초래할 수 있기 때문에 표면 점적 관개 시스템을 사용하더라도 경제적으로 실행 가능한 수확을 달성하기가 어렵습니다.

멕시코의 바히오 지방은 지하수를 대량으로 소비하는 것으로 알려진 보리의 주요 생산지입니다. 이 지역의 지하수위가 떨어지기 때문에 혁신적인 절수기술의 개발이 시급합니다. 2021년의 연구에서는 점적 관개와 보전 농업을 조합함으로써 보리 재배에 있어서의 물의 사용량을 40%나 삭감할 수 있는 것이 밝혀졌습니다. 이 발견은 이 지역의 보리 재배에 정밀 관개를 널리 채택하는 것을 지지합니다. 2021년 베오리아 워터테크놀로지스의 부문인 아과스칼리엔테스 수기금은 네이처 컨서런시 및 현지 지자체와 협력했습니다. 이들의 공동 활동은 아구아스칼리엔테스의 취약한 농가를 지원하고 점적 관개 설비에 대한 투자를 촉진함으로써 농장의 회복력을 강화하고 이러한 시스템의 보급을 촉진하는 것을 목적으로 하고 있었습니다.

게다가, 전문 지식이 풍부한 것으로 알려진 캐나다 농부들은 신기술의 도입이 빠르고, 이 지역에서 높은 성장률이 기대되고 있습니다. 캐나다 통계국에 따르면 캐나다 농부들은 2022년 농작물의 관개용수 사용량을 2020년 대비 23% 증가시켰습니다. 최근, 캐나다의 농장에서는 드립 관개의 보급이 현저하게 급증하고 있습니다. 캐나다 통계에 따르면 2022년에는 드립 관개를 채택한 농장 수가 2020년에 비해 33.2% 증가했습니다. 따라서 예측 불가능한 기후 조건과 혁신적인 절수 기술 채택 증가는 예측 기간 동안 북미 농업 생산에서 정밀 관개의 사용을 증가시킬 수 있습니다.

정밀 관개 산업 개요

정밀 관개 시장은 Orbia(Netafim Limited), Jain Irrigation Systems Limited, The Toro Company, Valmont 등이 주요 기업으로 굳어지고 있습니다. 시장 점유율은 Orbia(Netafim Limited)가 가장 높고 Jain Irrigation Systems Limited가 그 뒤를 잇습니다. 강력한 판매망을 확립하는 것은 전통 시장 기업이 취하는 주요 전략입니다. 또한, 접근성을 향상시키기 위해 광범위한 딜러와 최종 판매점 계약을 맺고 있는 기업도 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트·지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 시장 성장 억제요인

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 강도

제5장 시장 세분화

- 유형

- 스프링클러 관개

- 기존 스프링클러

- 중앙 피벗 스프링클러

- 측면 이동/선형 스프링클러

- 점적 관개

- 표면 점적 관개

- 지표하 점적 관개

- 정밀 이동식 점적 관개

- 기타 유형

- 스프링클러 관개

- 작물 유형

- 경작 작물

- 농장작물

- 과수원 및 포도원

- 잔디 및 관상용 작물

- 지역

- 북미

- 미국

- 캐나다

- 멕시코

- 기타 북미

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 아프리카

- 남아프리카

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 가장 채용된 전략

- 시장 점유율 분석

- 기업 프로파일

- Jain Irrigation Systems Ltd

- Lindsay Corporation

- Nelson Irrigation Corporation

- Netafim Ltd

- Rain Bird Corporation

- Rivulis Irrigation Ltd

- The Toro Company

- Valmont Industries Inc.

- Mahindra EPC Industries Limited

- Tl Irrigation Co.

- Deere & Company

제7장 시장 기회와 앞으로의 동향

KTH 25.04.02The Precision Irrigation Market size is estimated at USD 5.36 billion in 2025, and is expected to reach USD 8.06 billion by 2030, at a CAGR of 8.5% during the forecast period (2025-2030).

Key Highlights

- Water scarcity poses a significant challenge, driving the long-term adoption of precision irrigation systems. As consumer demand grows, the need for artificial irrigation has surged to secure high crop yields. Additionally, the consolidation of farmlands globally enables farmers to invest in costly systems like precision irrigation, further propelling the market.

- Technological developments are further catalyzing the expansion of the market across various regions. For example, in 2020, Nelson Irrigation Corporation introduced the R55VT and R75 End of Pivot Sprinklers, which can be easily attached to any center pivot system, excluding the impact pivot sprinklers. As technology is made affordable and efficient, the adoption rate of precision irrigation machinery is anticipated to increase. This is expected to increase the growth of the market during the forecast period. However, precision irrigation systems such as drip and sprinkler systems come with technical complexities, and the steep installation costs of these systems are hindering their widespread adoption.

- Moreover, due to favorable government policies regarding low-interest loans and subsidies for implementing modern and advanced precision irrigation systems, the precision irrigation market is likely to increase quickly in developing markets such as South America and Asia-Pacific in the coming years. Increasing awareness and high adaptability of new technologies in Asia-Pacific are driving market growth at a rapid pace.

Precision Irrigation Market Trends

Rapid Growth of Greenhouse Vegetable Production

Automatic drip irrigation is crucial in managing soil moisture, particularly for specialized greenhouse vegetables. By fully automating these systems, growers can precisely control soil moisture and water application. Moreover, such automation is anticipated to boost profits per yield.

Water scarcity poses significant challenges for vegetable farmers across various European nations. As a result, precision irrigation systems are rapidly gaining traction in the region. In 2021, the Association of Belgian Horticultural Auctions reported that Belgium's greenhouse vegetable production reached 405.4 thousand metric tons, with tomatoes accounting for 304.1 thousand metric tons. Additionally, bolstered by favorable climatic conditions and rising demand for enhanced crop yields and returns on investment, Sweden's greenhouse tomato production surged by 17.9% from 2020 to 2021.

Soilless cultivation is primarily used for greenhouse vegetable production in the United States, Canada, Japan, India, the Middle East, and Europe. As greenhouse vegetables require ample amounts of water, farmers are switching to sprinkler and drip irrigation systems to achieve higher crop productivity, and technological innovation by the market players in the future motivates the adoption. For instance, in August 2023, Netafim encouraged drip irrigation systems to be provided through four Better Life Farming (BLF) Centers in Shivpuri under protected cultivation for tomatoes on 1,600 hectares of land.

North America Dominates the Market

Precision irrigation systems find their primary hub in North America, with the United States leading the charge, commanding over half of the region's market share. Federal, state, and local water development initiatives and advancements in groundwater pumping technologies have significantly broadened the US irrigated landscape. In 2023, research conducted by the Texas A&M AgriLife Research and Extension Center, Amarillo, United States, stated that the evaluation and usage of Surface Drip Irrigation Systems escalated the water-use efficiency in high-value vegetable production in the semi-arid, windy region of the Texas high plains. It could be challenging for tomatoes in open-field conditions to achieve an economically viable crop, even when using a surface drip irrigation system, due to the potential for extreme losses to both biotic and abiotic stressors.

The Bajio region of Mexico is a leading producer of barley, a crop known for its substantial groundwater consumption. As groundwater levels in the region dwindle, there is an urgent call for innovative water-saving technologies. A 2021 study highlighted that a blend of drip irrigation and conservation agriculture could slash water usage in barley farming by as much as 40%. This finding is set to champion the broader adoption of precision irrigation in the region's barley farming. In 2021, the Aguascalientes Water Fund, a division of Veolia Water Technologies, collaborated with The Nature Conservancy and the local municipality. Their joint effort aimed to assist vulnerable farmers in Aguascalientes, encouraging them to invest in drip irrigation equipment, thereby bolstering farm resilience and potentially increasing the uptake of these systems.

Moreover, Canadian farmers, known for their expertise, are quick to adopt new technologies, leading to anticipated high growth rates in the region. According to Statistics Canada, Canadian farmers increased their water usage for crop irrigation by 23% in 2022 compared to 2020, which is majorly attributed to the drier climatic conditions in various regions throughout the country. In recent years, there has been a notable surge in the prevalence of drip irrigation on Canadian farms. According to Canadian statistics, in 2022, the number of farms adopting drip irrigation increased by 33.2% compared to 2020. Therefore, unpredictable climatic conditions and the growing adoption of innovative water-saving techniques may increase the use of precision irrigation in North American agricultural production during the forecast period.

Precision Irrigation Industry Overview

The precision irrigation market is consolidated with major companies such as Orbia (Netafim Limited), Jain Irrigation Systems Limited, The Toro Company, and Valmont. Orbia (Netafim Limited) held the highest market share, followed by Jain Irrigation Systems Limited. Establishing a strong distribution network is a prime strategy well-established market players follow. Moreover, some companies have signed definitive dealership agreements with a wide range of dealers to enhance accessibility.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Force Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Sprinkler Irrigation

- 5.1.1.1 Traditional Sprinklers

- 5.1.1.2 Center Pivot Sprinklers

- 5.1.1.3 Lateral Move/ Linear Sprinklers

- 5.1.2 Drip Irrigation

- 5.1.2.1 Surface Drip Irrigation

- 5.1.2.2 Sub-Surface Drip Irrigation

- 5.1.2.3 Precision Mobile Drip Irrigation

- 5.1.3 Other Types

- 5.1.1 Sprinkler Irrigation

- 5.2 Crop Type

- 5.2.1 Field Crops

- 5.2.2 Plantation Crops

- 5.2.3 Orchards and Vineyards

- 5.2.4 Turf and Ornamentals

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Jain Irrigation Systems Ltd

- 6.3.2 Lindsay Corporation

- 6.3.3 Nelson Irrigation Corporation

- 6.3.4 Netafim Ltd

- 6.3.5 Rain Bird Corporation

- 6.3.6 Rivulis Irrigation Ltd

- 6.3.7 The Toro Company

- 6.3.8 Valmont Industries Inc.

- 6.3.9 Mahindra EPC Industries Limited

- 6.3.10 T-l Irrigation Co.

- 6.3.11 Deere & Company