|

시장보고서

상품코드

1851933

미국의 농업 기계 시장 : 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)United States Agricultural Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

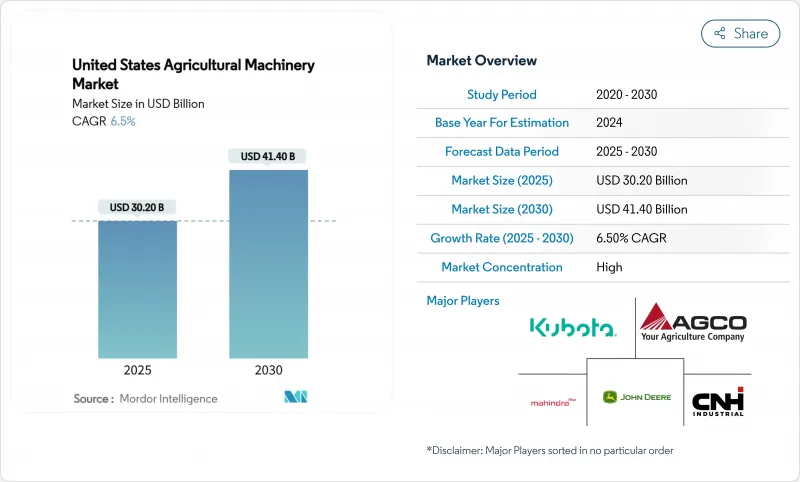

미국의 농업 기계 시장 규모는 2025년에 302억 달러, CAGR 6.5%로 성장하고, 2030년에는 414억 달러에 달할 것으로 예측되고 있습니다.

기후 변화를 고려한 실천, 정밀기술 개수, 전기투자에 대한 연방정부의 우대조치가 주기적인 시장 변동을 상쇄하는 데 도움이 됩니다. 설비소유자는 운영비용 절감과 지속가능성 목표 달성을 위한 기능 업그레이드에 주력하여 텔레매틱스, 예지보전, 자율주행 대응 시스템에 대한 수요가 높아집니다. 딜러의 통합은 판매 후 서비스 네트워크를 개선하고 임대 및 구독 옵션은 금리 상승의 영향을 완화하는 데 도움이 됩니다. 관개 분야는 물 부족 심각화와 배출 가스 규제 강화로 미국 농업 기계 시장에서 높은 성장률을 보이고 있습니다.

미국 농업 기계 시장 동향과 통찰

정밀 농업 복고풍 키트의 보급

레트로핏 솔루션을 통해 농부는 기존 농기의 수명을 연장하고 데이터 주도를 개선하여 비료 및 농약 사용량을 최대 30%까지 줄일 수 있습니다. 트랙터 1대당 50,000달러의 레트로핏에 대한 투자는 자율주행 대응 장비의 신규 도입에 필요한 40만 달러보다 훨씬 낮아 보통 3년 이내에 투자 회수가 가능합니다. 중간 규모의 연작 농가에서는 부채를 늘리지 않고 비용 경쟁력을 유지하기 위해 이러한 솔루션의 채택이 늘고 있습니다. 장비 딜러는 레트로 피트 키트의 설치 및 교정을 통해 추가 서비스 수익으로부터 이익을 얻고 고객과의 관계를 강화하고 수익성을 향상시킵니다. 모듈식 업그레이드의 채택이 진행됨에 따라 장비 교체 사이클이 늘어남에 따라 상대방 상표 제품 제조업체(OEM)는 판매량에서 소프트웨어 및 통합 서비스로 중점을 둡니다.

주요 OEM 제조업체의 전동화 로드맵

디어 앤 컴퍼니는 2026년 최초의 전 전기식 자율주행가능 트랙터를 출시할 계획으로 배터리 공급을 위해 크라이셀 일렉트릭에 투자하고 있습니다. AGCO는 2024년에 펜트 e100 바리오를 시험적으로 도입하여 전동 파워트레인에 초점을 맞춘 R&D 비용의 60% 증가에 힘입어 지원되었습니다. 현재 배터리 밀도에서 전동 트랙터는 120 마력 이하의 용도로 제한되며, 이는 과일, 야채 및 낙농장의 요구 사항을 충족합니다. 자연자원보전국(NRCS)은 구매비용의 50% 이상을 커버할 수 있는 비용부담 프로그램을 제공하여 소규모 농장의 경제적 장벽을 완화하고 있습니다. 제조업체 각 사는 미래의 배터리 기술 향상으로 보다 고마력의 용도가 가능하게 될 것으로 기대하고 있지만, 현재의 진행 상황은 부품 제조업체에 미국에서의 배터리와 인버터의 생산 확대를 촉구하고 있습니다.

딜러 기술자 부족

장비 서비스 산업은 현저한 노동력 부족에 직면하고 있습니다. 서비스 거점의 통폐합에 의해 실 점포의 수가 감소하고, 중요한 작가나 수확의 시기의 대응 시간이 길어지고 있습니다. 최신 정밀기기에는 농촌의 노동 시장에서 이용 가능한 스킬을 넘는 전문적인 진단능력이 요구되기 때문에 상대방 상표제품제조업체(OEM)는 원격지원·서비스 확대 및 모듈식 부품교환시스템의 도입을 강요하고 있습니다. 이러한 노동력 제약으로 인해 농부는 농업 기계의 구매를 제한합니다.

부문 분석

트랙터는 2024년 미국 농업 기계 시장에서 경작, 파종, 자재관리에 중요한 역할을 함으로써 51%의 점유율을 유지합니다. 이 부문의 수익 성장은 고마력 모델에 기인하고 있으며, 콤팩트 트랙터는 특수 농업 용도를 위해 전동 드라이브 트레인을 탑재하는 경우가 늘고 있습니다. 관개 장비는 부문으로는 작고 2030년까지 연평균 복합 성장률(CAGR) 9.4%로 가장 높은 성장률을 달성할 것으로 예측됩니다. 센터 피벗, 물방울 라인, 센서 제어 밸브와 같은 최신 관개 시스템은 실시간 토양 수분 데이터를 통합하여 물 소비량을 최대 25%까지 줄입니다. 이 성장은 서부 주 지하수 규정과 연방 정부의 WaterSMART 프로그램 인센티브와 일치합니다.

경작 및 재배 시스템에 있어서는 제조업체는 토양의 파괴를 줄이기 위해서 깊이 가변 경운 기술을 도입해, 불경기 농법 증가에도 불구하고 안정된 성장을 유지하고 있습니다. 첨단 파종 및 파종기계는 정확한 단일 곡물의 배치를 가능하게 하고, 출호율을 향상시키고, 정확한 양분 시용을 지원합니다. 수확 기계 수요는 연작 작물 가격과 관련이 있지만 예측 대지 속도 자동화를 특징으로하는 새로운 결합은 연비 효율과 처리 능력을 향상시키고 교체 수요를 촉진합니다. 농부는 새로운 기계를 구입하는 대신 자율 지침과 가변 속도 제어기를 갖춘 기존 기계를 업그레이드하기로 결정했으며, 그 결과 부품 및 디지털 서비스 판매가 기계 판매를 능가합니다. 장비 범주 전반에 걸쳐 센서 시스템과 ISOBUS 호환 컨트롤러는 브랜드 독립적인 생태계를 구축하고 제조업체의 잠금을 줄이고 트랙터 시장에서의 지위를 유지하기 위해 기존 제조업체가 개방형 API를 제공해야 합니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 정밀 농업(Precision-Ag) 레트로핏 키트의 광범위한 도입

- 주요 OEM에 의한 전동화 로드맵

- 텔레매틱스에 기초한 예지보전의 채택 증가

- 기후 스마트 보조금 인센티브

- 맞춤형 장비 리스 모델 급증

- 특수작물을 타겟으로 하는 벤처기업에 의한 로봇공학 스타트업

- 시장 성장 억제요인

- 딜러 기술자 부족

- 커넥티드 머시너리용 5G 커버리지의 지방에서의 부족

- 불안정한 상품 가격 변동이 농가의 설비 투자 억제

- 환경보호청의 제5차 배출가스 규제 대응에 필요한 기간

- 규제 상황

- 기술의 전망

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측

- 제품 유형별

- 트랙터

- 경운 및 경작 기계

- 경운기

- 헬로

- 경운기 및 로터리 경운기

- 기타 경작 및 재배 기계

- 파종기계

- 씨 뿌리기

- 파종기

- 살포기

- 기타 파종기계

- 수확기계

- 콤바인 수확기

- 사료 수확기

- 기타 수확기계

- 목초 및 사료 기계

- 잔디깎기

- 베일러

- 기타 목초 및 사료기계

- 관개 기계

- 스프링클러 관개

- 점적 관개

- 기타 관개 기계

- 기타 농업 기계

- 농장 규모별

- 500에이커 미만

- 500-2,000에이커

- 2,000에이커 이상

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Deere & Company

- CNH Industrial NV

- AGCO Corporation

- Kubota Corporation

- Mahindra & Mahindra Ltd.

- CLAAS KGaA mbH

- KUHN SAS

- Same Deutz-Fahr SPA

- Kinze Manufacturing

- Horsch, LLC

- Ploeger Oxbo Group BV

- Argo Tractors SpA

- Netafim Limited(An Orbia Business)

- Valmont Industries, Inc.

- Yanmar Holdings Co., Ltd.

제7장 시장 기회와 장래의 전망

SHW 25.11.25The United States agricultural machinery market size is valued at USD 30.2 billion in 2025 and is projected to grow at a CAGR of 6.5%, reaching USD 41.4 billion by 2030.

Federal incentives for climate-smart practices, precision technology retrofits, and electrification investments help counterbalance cyclical market fluctuations. Equipment owners focus on upgrading capabilities to reduce operational costs and achieve sustainability goals, increasing demand for telematics, predictive maintenance, and autonomous-ready systems. Dealer consolidation improves after-sales service networks, while leasing and subscription options help mitigate the impact of higher interest rates. The irrigation segments demonstrate higher growth rates in the United States agricultural machinery market, driven by increasing water scarcity and stricter emissions regulations.

United States Agricultural Machinery Market Trends and Insights

Widespread Adoption of Precision-Ag Retro-Fit Kits

Retro-fit solutions enable farmers to extend their existing fleet's lifespan while reducing fertilizer and pesticide usage by up to 30% through data-driven improvements. The investment of USD 50,000 per tractor for retrofitting is significantly lower than the USD 400,000 required for new autonomous-ready equipment, typically resulting in a return on investment within three years. Mid-scale row-crop farms increasingly adopt these solutions to maintain cost competitiveness without increasing debt. Equipment dealers benefit from additional service revenue through installation and calibration of retrofit kits, which strengthens customer relationships and improves profitability. The growing adoption of modular upgrades extends equipment replacement cycles, causing Original Equipment Manufacturers (OEMs) to shift their focus from unit sales to software and integration services.

Electrification Road-Maps by Major Original Equipment Manufacturers

Deere & Company plans to launch its first all-electric, autonomous-capable tractor in 2026 and has invested in Kreisel Electric for battery supply. AGCO introduced the Fendt e100 Vario to pilot fleets in 2024, supported by a 60% increase in research and development spending focused on electric powertrains. Current battery density limits electric tractors to under-120-horsepower applications, which align with the requirements of fruit, vegetable, and dairy farms. The Natural Resources Conservation Service (NRCS) offers cost-share programs that can cover over 50% of purchase costs, reducing financial barriers for small farms. While manufacturers expect future battery technology improvements to enable higher-horsepower applications, current progress has encouraged component suppliers to expand United States battery and inverter production.

Dealer Technician Shortage

The equipment service industry faces a significant labor shortage. The consolidation of service locations has reduced the number of physical stores, increasing response times during critical planting and harvest periods. Modern precision equipment requires specialized diagnostic capabilities that exceed the skills available in rural labor markets, compelling Original Equipment Manufacturers (OEMs) to expand remote support services and implement modular component replacement systems. These labor constraints have led farmers to restrict their purchases of agricultural machinery.

Other drivers and restraints analyzed in the detailed report include:

- Rising Adoption of Telematics-Based Predictive Maintenance

- Climate-Smart Grant Incentives

- Lengthy Environmental Protection Agency Tier 5 Emission Compliance Lead-Times

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Tractors maintain a 51% share of the United States agricultural machinery market in 2024, demonstrating their essential role in tillage, seeding, and material handling. The segment's revenue growth stems from high-horsepower models, while compact tractors increasingly incorporate electric drivetrains for specialty farming applications. Irrigation equipment, though a smaller segment, is projected to achieve the highest growth rate at 9.4% CAGR through 2030. Modern irrigation systems, including center pivots, drip lines, and sensor-controlled valves, integrate real-time soil moisture data, reducing water consumption by up to 25%. This growth aligns with Western state groundwater regulations and federal WaterSMART program incentives.

In plowing and cultivating systems, manufacturers incorporate variable-depth tillage technology to reduce soil disruption, maintaining steady growth despite increasing no-till farming practices. Advanced seeding and planting equipment enable precise single-kernel placement, improving emergence rates and supporting precise nutrient application. While harvesting machinery demand correlates with row-crop prices, new combines featuring predictive ground-speed automation improve fuel efficiency and throughput, driving replacement demand. Farmers increasingly opt to upgrade existing equipment with autonomous guidance and variable-rate controllers instead of purchasing new machinery, resulting in parts and digital service revenue exceeding equipment sales. Across equipment categories, sensor systems and ISOBUS-compatible controllers establish brand-independent ecosystems, reducing manufacturer lock-in and requiring traditional manufacturers to provide open APIs to maintain tractor market position.

The United States Agricultural Machinery Market Report is Segmented by Product Type (Tractors, Plowing and Cultivating Machinery, and More), and by Farm Size (Less Than 500 Acres, 500-2, 000 Acres, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Deere & Company

- CNH Industrial NV

- AGCO Corporation

- Kubota Corporation

- Mahindra & Mahindra Ltd.

- CLAAS KGaA mbH

- KUHN SAS

- Same Deutz-Fahr S.P.A.

- Kinze Manufacturing

- Horsch, LLC

- Ploeger Oxbo Group B.V.

- Argo Tractors S.p.A.

- Netafim Limited (An Orbia Business)

- Valmont Industries, Inc.

- Yanmar Holdings Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Widespread Adoption of Precision-Ag Retro-Fit Kits

- 4.2.2 Electrification Road-Maps by Major Original Equipment Manufacturers

- 4.2.3 Rising Adoption of Telematics-Based Predictive Maintenance

- 4.2.4 Climate-Smart Grant Incentives

- 4.2.5 Surge in Bespoke Equipment Leasing Models

- 4.2.6 Venture-Backed Robotics Start-Ups Targeting Speciality Crops

- 4.3 Market Restraints

- 4.3.1 Dealer Technician Shortage

- 4.3.2 Patchy Rural 5G Coverage for Connected Machinery

- 4.3.3 Volatile Commodity-Price Swings Curbing Farm Capital Expenditure

- 4.3.4 Lengthy Environmental Protection Agency Tier 5 Emission Compliance Lead-times

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Tractors

- 5.1.2 Plowing and Cultivating Machinery

- 5.1.2.1 Plows

- 5.1.2.2 Harrows

- 5.1.2.3 Cultivators and Tillers

- 5.1.2.4 Other Plowing and Cultivating Machinery

- 5.1.3 Planting Machinery

- 5.1.3.1 Seed Drills

- 5.1.3.2 Planters

- 5.1.3.3 Spreaders

- 5.1.3.4 Other Planting Machinery

- 5.1.4 Harvesting Machinery

- 5.1.4.1 Combine Harvesters

- 5.1.4.2 Forage Harvesters

- 5.1.4.3 Other Harvesting Machinery

- 5.1.5 Haying and Forage Machinery

- 5.1.5.1 Mowers

- 5.1.5.2 Balers

- 5.1.5.3 Other Haying and Forage Machinery

- 5.1.6 Irrigation Machinery

- 5.1.6.1 Sprinkler Irrigation

- 5.1.6.2 Drip Irrigation

- 5.1.6.3 Other Irrigation Machinery

- 5.1.7 Other Agricultural Machinery

- 5.2 By Farm Size

- 5.2.1 Less Than 500 acres

- 5.2.2 500-2,000 acres

- 5.2.3 More Than 2,000 acres

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Deere & Company

- 6.4.2 CNH Industrial NV

- 6.4.3 AGCO Corporation

- 6.4.4 Kubota Corporation

- 6.4.5 Mahindra & Mahindra Ltd.

- 6.4.6 CLAAS KGaA mbH

- 6.4.7 KUHN SAS

- 6.4.8 Same Deutz-Fahr S.P.A.

- 6.4.9 Kinze Manufacturing

- 6.4.10 Horsch, LLC

- 6.4.11 Ploeger Oxbo Group B.V.

- 6.4.12 Argo Tractors S.p.A.

- 6.4.13 Netafim Limited (An Orbia Business)

- 6.4.14 Valmont Industries, Inc.

- 6.4.15 Yanmar Holdings Co., Ltd.