|

시장보고서

상품코드

1851351

가변 주파수 드라이브(VFD) : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Variable Frequency Drives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

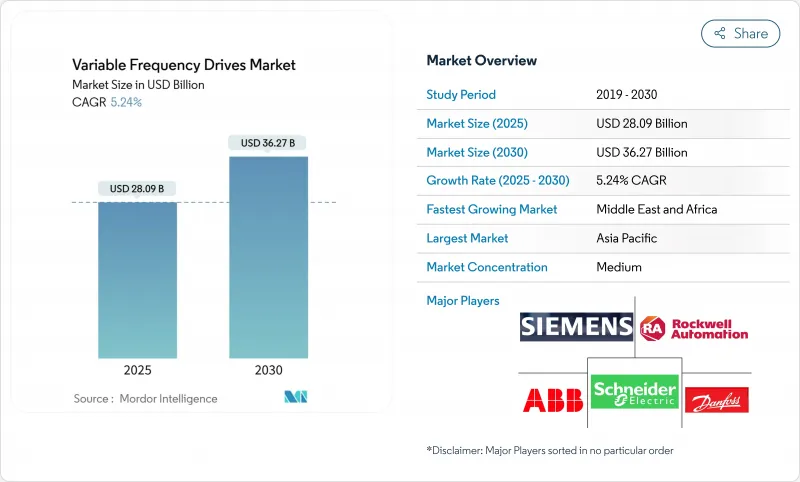

세계의 가변 주파수 드라이브(VFD) 시장 규모는 2025년에 280억 9,000만 달러가 되고, 2030년에는 362억 7,000만 달러에 이르며, CAGR 5.24%를 나타낼 것으로 예상됩니다.

모터 레벨의 효율화를 요구하는 강한 정책 압력, 에너지 절약에 의한 신속한 투자 회수, 생산 라인의 디지털화로의 이행에 의해 채용의 밑단은 꾸준히 확산되고 있습니다. 자본 지출 사이클이 엄격해지더라도 수요는 견고하며, VFD의 리노베이션이 에너지 다소비용 플랜트의 전력 비용을 즉시 절감하기 때문입니다. 광업 및 금속업계에 있어서 중전압 업그레이드 프로젝트, 중동에 있어서 해수담수화시설 건설, 상업빌딩에 있어서 HVAC 효율화 의무화 등이, 정리해 대응 가능한 기회를 확대했습니다. 이더넷, 사이버 보안 기능, 실리콘 카바이드 스위칭 장치를 포트폴리오에 통합한 공급업체는 마진을 보호하고 서비스 수익을 확보했습니다. SiC/GaN 칩의 부족과 전자 간섭 컴플라이언스 비용의 상승에 수반하는 역풍은 출하 대수의 신장을 약간 억제한 것, 복수년에 걸친 효율화 투자의 흐름을 좌절시키는 일은 없습니다.

세계의 가변 주파수 드라이브(VFD) 시장 동향과 인사이트

모터 레벨 에너지 최적화를 요구하는 디지털 네이티브 프로세스 플랜트

디지털 설계 플랜트는 생산 일정과 실시간 전력 가격에 맞게 모터 부하를 조정하기 위해 최신 VFD 내부의 예측 분석에 의존합니다. 예를 들어, 로크웰 오토메이션의 PowerFlex 755TS 플랫폼은 에지 분석을 번들링하여 여러 모터 라인 전체에서 에너지 사용을 줄이면서 다운타임을 줄였습니다. 반도체 제조 및 제약 시설은 수율이 정확한 속도 제어와 중단없는 서비스 연결에 의존하기 때문에 채택을 선도했습니다.

HVAC 및 물 분야에서 가변 토크 효율 규칙의 의무화

효율화에 관한 법규제에 의해 펌프나 에어 핸들링 유닛에 VFD의 통합은 양보할 수 없게 되었습니다. 미국 에너지부의 2028년 서큘레이터 펌프 규칙에서는 고급 드라이브와 결합된 전자 정류 모터가 의무화되었습니다. 이를 고려하여 Trane과 같은 OEM은 Danfoss와 다년간 구매 계약을 맺고 준수 VFD 공급을 보장했습니다.

690V 이상의 EMI/고조파 컴플라이언스 비용 상승

규제 당국이 690V 이상의 설비에 대한 IEEE 519의 제한을 강화했기 때문에 전자기 간섭 및 고조파 왜곡과 관련된 컴플라이언스 비용이 급증했습니다. 중전압 프로젝트는 초대형 리액터, 멀티펄스 변압기, 차폐 케이블이 필요하며, 재료비, 시운전비, 엔지니어링비가 추가되어 설치된 드라이브의 비용이 15% 이상 상승할 수 있습니다. 소규모 제조업체는 설계 및 인증 오버헤드를 더 적은 출하량으로 분산시켜야 하기 때문에 불균형한 영향을 받고 신규 진입을 억제하고 통합을 가속화할 수 있습니다.

부문 분석

1kV 미만의 저전압 유닛은 중소규모 공장에서 컨베이어, 믹서, HVAC 팬을 제어하는 주력 제품이었습니다. 2024년에는 62.4%의 매출을 획득하여 가변 주파수 드라이브(VFD) 시장을 지원했습니다. 비용 효율적인 설치, 풍부한 통합자 전문 지식, 풍부한 공급업체 카탈로그가 점유율을 유지했습니다. 병행하여 제철소와 지하 광산의 브라운필드 확장으로 조달은 1-6kV 솔루션으로 이동했으며, 중전압층의 CAGR은 6.8%를 나타낼 전망입니다. 995 V 송전망으로 업그레이드하는 광산에서는 케이블 인출을 제한하고 전압 안정성을 향상시키기 위해 전용 드라이브가 선택되었습니다.

중전압 장비의 가변 주파수 드라이브(VFD) 시장 규모는 2030년까지 104억 달러에 이를 것으로 예상되며, 고조파 완화를 위한 그리드 코드 요구사항을 높이는 재생에너지 인피드로부터 혜택을 누리고 있습니다. 벤더는 전체 고조파 왜곡을 3% 미만으로 억제하는 내아크성 하우징과 모듈식 액티브 프론트엔드 설계로 이에 대응했습니다. 6 kV를 넘는 고전압 제품은 틈새 하이드로 펌프 및 압연기 프로젝트를 지원했지만, 가격과 설치의 복잡성이 높아 보급은 제한적이었습니다.

20kW 미만의 초소형 드라이브는 공장이 자율 이동 로봇이나 스마트 빌딩 서브 시스템에 소형 모터를 통합하여 분산 제어를 채용했기 때문에 CAGR이 최고가 되는 7.2%를 나타낼 전망입니다. 센서가 많은 HVAC 조닝이나 식품 가공용 피더와 연동하여 출하 대수도 증가했습니다. 저전력(20-200kW) 모델은 여전히 2024년 매출의 40.3%를 지원하며 화학 및 물 사업의 원심 펌프 및 축류 팬에 필수적임을 입증했습니다.

개발자는 방열판의 용량을 확장하고 SiC 다이오드로 전환하여 사막의 태양전지 분야에서 차별화 요인인 60℃를 넘는 주위 온도에서의 동작 한계를 높였습니다. 600kW 이상의 고전력 가변 주파수 드라이브(VFD) 시장 점유율은 5% 미만에 그쳤지만, 파워 모듈 릴레이 및 고조파 필터 감사와 같은 장기 서비스 계약을 통해 매 판매마다 큰 애프터마켓 수익이 발생했습니다.

가변 주파수 드라이브(VFD) 시장 보고서는 전압 유형(저전압, 중전압, 고전압), 전력 정격(마이크로, 저, 중, 고), 드라이브 유형(AC 드라이브, DC 드라이브, 서보/벡터 드라이브 등), 용도(펌프, 팬, 송풍기 등), 최종 사용자 산업(인프라 및 건물, 식품 및 음료 가공, 기타), 지역(북미, 남미, 기타)로 구분됩니다.

지역 분석

아시아태평양은 2024년 매출의 46.3%를 차지해 선두를 유지했습니다. 이는 중국의 자동화된 가전공장과 모터의 효율 개수를 장려하는 인도의 생산 연동 인센티브 제도에 의해 지원되고 있습니다. VEICHI와 같은 현지 챔피언은 클라우드 게이트웨이를 번들로 지속적으로 모니터링하여 수출 판매를 확대하고 지역 비용 경쟁력을 강화했습니다. 일부 ASEAN 국가에서는 정부의 리베이트 제도와 IE3 모터 의무화 정책이 기준 수요를 유지하고 대만과 한국의 반도체 공장에서는 서보 드라이브 수주가 가속화되었습니다.

중동 및 아프리카에서는 해수 담수화 파이프라인과 구리 벨트 광산의 전기화로 인해 높은 내충격성을 가진 견고한 중전압 드라이브가 필요했기 때문에 CAGR 전망에서 최고의 7.3%를 나타낼 전망입니다. ACCIONA의 Shuqaiq 3 이정표는 물 안보의 필요성이 몇 메가와트의 펌프 드라이브 계약을 창출한다는 것을 돋보이게 했습니다. 아프리카 공익사는 자본에 제약이 있는 것, 개발 금융기관을 이용하여 VFD를 다용한 수처리 업그레이드의 자금을 조달하여 지역 수주를 확대했습니다.

북미와 유럽에서는 오래된 장비가 서비스 수명을 맞이하고 효율화 규제가 강화됨에 따라 갱신주기가 꾸준히 증가하고 있습니다. 전력회사의 리베이트 제도나 기업의 ESG 목표가 채용을 빨리, 특히 요금 인상이 적극적인 탈탄소화 목표에 합치했습니다. 유럽의 분말 야금 공장은 고조파 규제를 충족하기 위해 액티브 프론트 엔드 드라이브를 채택했으며 미국 중서부의 화학 공장에서는 예측 VFD 알고리즘으로 모터 부하를 조정하여 천연 가스 가격 변동을 이용했습니다. 사이버 보안 강화 요건은 입찰 평가 기간을 연장했지만 결국 패치 관리 및 보안 인증서 업데이트 패키지를 제공하는 공급업체의 서비스 수익을 확대했습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 모터 레벨의 에너지 최적화가 요구되는 디지털 네이티브인 프로세스 플랜트

- HVAC와 물 분야에서의 가변 토크 효율 규칙의 의무화

- 인더스트리 4.0 레트로 피트용 저지연 이더넷 대응 모터의 급증

- 해수 담수화와 물 재이용 인프라의 급속한 정비(중동 중심)

- 갱내굴 차량의 전기

- 인플레이션에 연동하는 전기요금이 VFD 개수의 ROI를 가속

- 시장 성장 억제요인

- 690V 클래스 이상의 EMI/고조파 대응 비용의 상승

- 개발도상국의 유틸리티에 있어서 설비투자의 억제

- 레거시 드라이브의 리프레시 사이클을 지연시키는 사이버 하드닝 비용

- 파워 일렉트로닉스 그레이드의 SiC/GaN 칩의 지속적 부족

- 거시경제 요인의 영향

- 투자분석

- 밸류체인 분석

- 규제 상황

- 기술 스냅샷

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 공급기업의 협상력

- 구매자의 협상력

- 대체품의 위협

- 경쟁도

제5장 시장 규모와 성장 예측

- 전압 유형별

- 저전압(1kV 미만)

- 중전압(1-6kV)

- 고전압(6kV 초과)

- 정격 출력별(kW)

- 마이크로(20 미만)

- 저(20-200)

- 중(200-600)

- 고(600 초과)

- 드라이브 유형별

- AC 드라이브

- DC 드라이브

- 서보/벡터 드라이브

- 다단계 및 매트릭스 드라이브

- 용도별

- 펌프

- 팬 및 송풍기

- 컴프레서

- 컨베이어

- HVAC 시스템

- 압출기 및 믹서

- 최종 사용자 업계별

- 인프라 및 건물

- 식음료 가공

- 에너지 및 발전

- 석유, 가스 및 석유화학

- 광업 및 금속

- 펄프 및 제지

- 상하수도

- 기타

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- 중동

- 사우디아라비아

- 아랍에미리트(UAE)

- 튀르키예

- 기타 중동

- 아프리카

- 남아프리카

- 나이지리아

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- ABB Ltd.

- Siemens AG

- Schneider Electric SE

- Danfoss A/S

- Rockwell Automation Inc.

- Mitsubishi Electric Corporation

- Yaskawa Electric Corporation

- Fuji Electric Co. Ltd.

- Eaton Corporation plc

- WEG Industries SA

- Nidec Corporation

- Toshiba Corporation

- Hitachi Ltd.

- Johnson Controls International plc

- Inovance Technology Co. Ltd.

- Delta Electronics Inc.

- Emerson Electric Co.

- LS Electric Co. Ltd.

- SEW-Eurodrive GmbH & Co KG

- Veichi Electric Co. Ltd.

- Control Techniques(Nidec)

- HARS Drives Co. Ltd.

- Vacon(Part of Danfoss)

- Parker Hannifin-SSD Drives

- Kollmorgen Corporation

- Bonfiglioli Riduttori SpA

제7장 시장 기회와 향후 전망

KTH 25.11.21The global variable frequency drives market size was valued at USD 28.09 billion in 2025 and is forecast to reach USD 36.27 billion by 2030, advancing at a 5.24% CAGR.

Strong policy pressure for motor-level efficiency, fast paybacks from energy savings, and the migration toward digitalized production lines have steadily widened the adoption base. Demand remained resilient even as capital-spending cycles tightened, because VFD retrofits deliver immediate electricity cost relief in energy-intensive plants. Medium-voltage upgrade projects in mining and metals, desalination build-outs in the Middle East, and HVAC efficiency mandates in commercial buildings collectively broadened the addressable opportunity. Suppliers that embedded Ethernet, cybersecurity features, and silicon-carbide switching devices into their portfolios protected margins and unlocked service revenues. Headwinds tied to SiC/GaN chip shortages and higher electromagnetic-interference compliance costs slightly tempered shipment growth yet did not derail the multiyear efficiency investment trend.

Global Variable Frequency Drives Market Trends and Insights

Digital-native process plants demanding motor-level energy optimisation

Digitally designed plants relied on predictive analytics inside modern VFDs to align motor load with production schedules and real-time electricity prices. Rockwell Automation's PowerFlex 755TS platform, for example, bundled edge analytics and delivered downtime cuts while trimming energy usage across multi-motor lines. Semiconductor fabrication and pharmaceutical facilities led adoption because yield depends on precise speed control and uninterrupted service connectivity.

Mandatory variable-torque efficiency rules in HVAC and water verticals

Efficiency legislation made VFD integration non-negotiable in pumps and air-handling units. The U.S. Department of Energy's 2028 circulator-pump rule in effect required electronically commutated motors paired with sophisticated drives. In anticipation, OEMs such as Trane locked multi-year purchase agreements with Danfoss to guarantee compliant VFD supply.

Rising EMI/harmonics compliance costs above 690 V

Compliance costs linked to electromagnetic interference and harmonic distortion rose sharply after regulators tightened IEEE 519 limits for installations above 690 V. Medium-voltage projects now require oversized reactors, multi-pulse transformers, and shielded cable runs, adding material, commissioning, and engineering expenses that can raise installed drive cost by more than 15%. Smaller manufacturers are disproportionately affected because the design and certification overhead must be spread across lower shipment volumes, which can deter new entrants and accelerate consolidation.

Other drivers and restraints analyzed in the detailed report include:

- Surge in low-latency Ethernet-enabled motors for Industry 4.0 retrofits

- Rapid build-out of desalination and water-reuse infrastructure

- Persistent shortage of power-electronics-grade SiC/GaN chips

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Low-voltage units below 1 kV remained the workhorse, controlling conveyors, mixers, and HVAC fans across small and mid-sized plants. In 2024 they captured 62.4% revenue, anchoring the variable frequency drives market. Cost-effective installation, plentiful integrator expertise, and abundant supplier catalogs sustained share. Parallelly, brownfield expansions in steel mills and underground mines shifted procurement toward 1-6 kV solutions, propelling the medium-voltage tier at a 6.8% CAGR. Mines upgrading to 995 V grids selected purpose-built drives to limit cable runs and improve voltage stability.

The variable frequency drives market size for medium-voltage equipment is forecast to reach USD 10.4 billion by 2030, benefiting from renewable energy in-feed, which heightens grid-code requirements for harmonic mitigation. Vendors responded with arc-resistant enclosures and modular active-front-end designs that cut total harmonic distortion below 3%. High-voltage products above 6 kV served niche hydro-pumping and rolling-mill projects; their uptake stayed limited by premium price tags and installation complexity.

Micro drives under 20 kW delivered the highest 7.2% CAGR as factories embraced distributed control, embedding small motors in autonomous mobile robots and smart building subsystems. Volume shipments climbed in tandem with sensor-rich HVAC zoning and food-processing feeders. Low-power (20-200 kW) models still underpinned 40.3% of 2024 revenue, proving indispensable to centrifugal pumps and axial fans across chemical and water utilities.

Developers enlarged heat-sink capacity and switched to SiC diodes to lift ambient operating limits beyond 60 °C, a critical differentiator in desert solar fields. The variable frequency drives market share for high-power classes above 600 kW remained below 5%, yet each sale generated sizable aftermarket revenue streams through long-term service agreements covering power-module relays and harmonic filter audits.

The Variable Frequency Drives Market Report is Segmented by Voltage Type (Low Voltage, Medium Voltage, High Voltage), Power Rating (Micro, Low, Medium, High), Drive Type (AC Drives, DC Drives, Servo/Vector Drives, and More), Application (Pumps, Fans and Blowers, and More), End-User Industry (Infrastructure and Buildings, Food and Beverage Processing, and More), and Geography (North America, South America, and More).

Geography Analysis

Asia-Pacific maintained leadership with 46.3% 2024 revenue, underpinned by China's automated appliance plants and India's production-linked incentive schemes that encouraged motor-efficiency retrofits. Local champions such as VEICHI scaled export sales by bundling cloud gateways for continuous monitoring, reinforcing regional cost competitiveness. Government rebate programs and mandatory IE3 motor policies in several ASEAN states sustained baseline demand, while semiconductor fabs in Taiwan and South Korea accelerated servo-drive orders.

The Middle East and Africa posted the highest 7.3% CAGR outlook as sovereign desalination pipelines and copper-belt mining electrification demanded rugged medium-voltage drives with high ingress protection. ACCIONA's Shuqaiq 3 milestone highlighted how water-security imperatives generate multi-megawatt pump-drive contracts. African utilities, though capital-constrained, tapped development-finance institutions to fund VFD-rich water-treatment upgrades, amplifying regional order books.

North America and Europe delivered steady replacement-cycle growth as older installations approached end-of-life and as stricter efficiency codes compelled upgrades. Utility rebate schemes and corporate ESG targets hastened adoption, especially where tariff escalation aligned with aggressive decarbonisation goals. European powder-metallurgy plants opted for active-front-end drives to meet harmonic quotas, while US Midwest chemical plants exploited natural-gas price volatility by modulating motor load with predictive VFD algorithms. Cyber-security hardening requirements extended bid evaluation timelines, yet ultimately enlarged service revenue for vendors offering patch-management and security-certificate renewal packages.

- ABB Ltd.

- Siemens AG

- Schneider Electric SE

- Danfoss A/S

- Rockwell Automation Inc.

- Mitsubishi Electric Corporation

- Yaskawa Electric Corporation

- Fuji Electric Co. Ltd.

- Eaton Corporation plc

- WEG Industries S.A.

- Nidec Corporation

- Toshiba Corporation

- Hitachi Ltd.

- Johnson Controls International plc

- Inovance Technology Co. Ltd.

- Delta Electronics Inc.

- Emerson Electric Co.

- LS Electric Co. Ltd.

- SEW-Eurodrive GmbH & Co KG

- Veichi Electric Co. Ltd.

- Control Techniques (Nidec)

- HARS Drives Co. Ltd.

- Vacon (Part of Danfoss)

- Parker Hannifin - SSD Drives

- Kollmorgen Corporation

- Bonfiglioli Riduttori S.p.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Digital-native process plants demanding motor-level energy-optimisation

- 4.2.2 Mandatory variable torque efficiency rules in HVAC and water verticals

- 4.2.3 Surge in low-latency, Ethernet-enabled motors for Industry 4.0 retrofits

- 4.2.4 Rapid build-out of desalination and water-reuse infrastructure (Middle-East focus)

- 4.2.5 Electrification of underground mining fleets

- 4.2.6 Inflation-linked electricity tariffs accelerating ROI on VFD retrofits

- 4.3 Market Restraints

- 4.3.1 Rising EMI / harmonics compliance costs above 690 V class

- 4.3.2 Cap-ex squeeze in developing-world utilities

- 4.3.3 Cyber-hardening spend delaying refresh cycles of legacy drives

- 4.3.4 Persistent shortage of power-electronics grade SiC/GaN chips

- 4.4 Impact of Macroeconomic Factors

- 4.5 Investment Analysis

- 4.6 Value Chain Analysis

- 4.7 Regulatory Landscape

- 4.8 Technology Snapshot

- 4.9 Porter's Five Forces Analysis

- 4.9.1 Threat of New Entrants

- 4.9.2 Bargaining Power of Suppliers

- 4.9.3 Bargaining Power of Buyers

- 4.9.4 Threat of Substitutes

- 4.9.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Voltage Type

- 5.1.1 Low Voltage (<1 kV)

- 5.1.2 Medium Voltage (1-6 kV)

- 5.1.3 High Voltage (>6 kV)

- 5.2 By Power Rating (kW)

- 5.2.1 Micro (<20)

- 5.2.2 Low (20-200)

- 5.2.3 Medium (200-600)

- 5.2.4 High (>600)

- 5.3 By Drive Type

- 5.3.1 AC Drives

- 5.3.2 DC Drives

- 5.3.3 Servo / Vector Drives

- 5.3.4 Multilevel and Matrix Drives

- 5.4 By Application

- 5.4.1 Pumps

- 5.4.2 Fans and Blowers

- 5.4.3 Compressors

- 5.4.4 Conveyors

- 5.4.5 HVAC Systems

- 5.4.6 Extruders and Mixers

- 5.5 By End-user Industry

- 5.5.1 Infrastructure and Buildings

- 5.5.2 Food and Beverage Processing

- 5.5.3 Energy and Power Generation

- 5.5.4 Oil, Gas and Petrochemicals

- 5.5.5 Mining and Metals

- 5.5.6 Pulp and Paper

- 5.5.7 Water and Wastewater

- 5.5.8 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Russia

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 UAE

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ABB Ltd.

- 6.4.2 Siemens AG

- 6.4.3 Schneider Electric SE

- 6.4.4 Danfoss A/S

- 6.4.5 Rockwell Automation Inc.

- 6.4.6 Mitsubishi Electric Corporation

- 6.4.7 Yaskawa Electric Corporation

- 6.4.8 Fuji Electric Co. Ltd.

- 6.4.9 Eaton Corporation plc

- 6.4.10 WEG Industries S.A.

- 6.4.11 Nidec Corporation

- 6.4.12 Toshiba Corporation

- 6.4.13 Hitachi Ltd.

- 6.4.14 Johnson Controls International plc

- 6.4.15 Inovance Technology Co. Ltd.

- 6.4.16 Delta Electronics Inc.

- 6.4.17 Emerson Electric Co.

- 6.4.18 LS Electric Co. Ltd.

- 6.4.19 SEW-Eurodrive GmbH & Co KG

- 6.4.20 Veichi Electric Co. Ltd.

- 6.4.21 Control Techniques (Nidec)

- 6.4.22 HARS Drives Co. Ltd.

- 6.4.23 Vacon (Part of Danfoss)

- 6.4.24 Parker Hannifin - SSD Drives

- 6.4.25 Kollmorgen Corporation

- 6.4.26 Bonfiglioli Riduttori S.p.A.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment