|

시장보고서

상품코드

1686203

베트남의 플라스틱 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Vietnam Plastics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

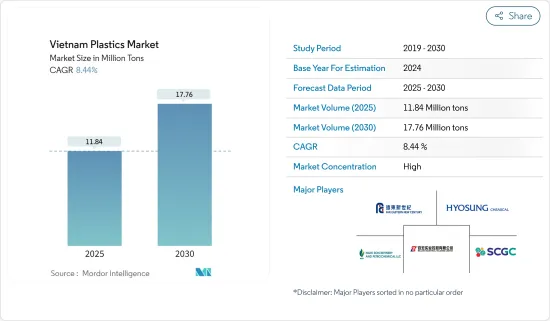

베트남의 플라스틱 시장 규모는 2025년에 1,184만 톤에 달할 것으로 추정됩니다. 예측 기간(2025-2030년)의 CAGR은 8.44%를 나타낼 것으로 전망되고, 2030년에는 1,776만 톤에 이를 것으로 예상됩니다.

COVID-19의 유행은 베트남 시장에 부정적인 영향을 미쳤습니다. 그러나 주요 최종 사용자 산업에서의 작업 재개는 시장이 유행 이전 수준에 도달한 것으로 추정합니다.

주요 하이라이트

- 단기적으로는 건설 업계 수요 증가가 시장 성장의 원동력이 될 것으로 예상됩니다.

- 원료와 완성 플라스틱의 수입에 대한 과도한 의존은 시장 성장을 방해할 것으로 예상됩니다.

- 외국 투자 증가는 시장 성장에 다양한 기회를 제공할 것으로 예상됩니다.

베트남의 플라스틱 시장 동향

압출 성형 기술이 시장을 독점

- 베트남에서는 압출 성형 기술이 PVC, PE 파이프, 알루미늄 및 플라스틱 파이프, 섬유, PVC 도어, 프레임, 지붕재, 벽재 등의 제품을 제조하는 데 사용됩니다. 압출 성형 공정은 생산 비용이 낮고 설치 시간이 짧습니다. 그러나 정밀도는 평범하고 주로 단면이 균일한 부품에 적합하며 복잡한 부품에는 적합하지 않습니다.

- 이 기술은 주로 건설 활동에 사용되며 주요 제품에는 PVC, HDPE, PPR 파이프, 프로파일 바, 플라스틱 도어 및 창문, 패널, 가구 등이 있습니다.

- 2020년 플라스틱 산업 개발 계획에 따라 플라스틱 산업은 포장용 플라스틱과 소비자용 플라스틱의 비율을 줄이고 건설용 플라스틱과 기술용 플라스틱의 비율을 늘리는 방향으로 재편성되었습니다.

- 베트남의 건설용 플라스틱 분야는 플라스틱 산업 전체의 약 1/4을 차지합니다. 건설 및 부동산 섹터의 개발이 플라스틱 건설 제품 수요를 밀어 올리고 있습니다.

- 또한 베트남 정부는 350개 이상의 산업지대에 100만호의 저렴한 주택을 건설하는 것을 목표로 하고 있습니다. 이러한 인프라 개발 프로젝트와 설치되는 공장 수 증가가 이 나라의 건설용 및 기술용 플라스틱 수요를 견조하게 늘리고 있습니다.

- 2022년 4월 베트남에서 최고급 PET 포장 사업자인 곡기어 산업, 서비스, 무역 합동 회사(NN)는 세계 지속가능한 화학기업인 인드라마 벤처스(IVL)에 인수되었습니다. 이 인수를 통해 IVL은 국내 주요 다국적 고객에게 종합 PET 제품의 제공을 확대하고 시장에서의 입지를 강화합니다.

- 2022년 9월, 미국 음료 회사 코카콜라 컴퍼니는 베트남에서 완전 재생 플라스틱 병을 도입했습니다. 이 회사는 베트남 규정과 식품 등급 rPET 포장에 관한 국제 기준을 모두 충족한다고 주장합니다.

- 이상의 점에서 압출 기술이 시장을 독점할 것으로 예상됩니다.

시장을 독점하는 포장 부문

- 베트남의 플라스틱 시장에서 가장 큰 점유율을 차지하는 것은 포장입니다. 경량, 내열성, 내약품성, 내식성 등의 요인으로부터 베트남 시장에서는 플라스틱이 포장용으로서 유력한 선택이 되고 있습니다.

- 포장 업계에서 플라스틱은 건강 관리 포장, 식품 및 식품 포장, 소비자 포장 상품, 소비자 및 개인 관리 포장, 가정 및 원예용 등에 사용됩니다.

- 폴리에틸렌 테레프탈레이트(PET)는 주로 식품 및 식품 산업에서 포장에 사용되는 주요 플라스틱 중 하나입니다. 휴대성, 디자인 유연성, 세척 용이성, 경량성, 방습성 등은 PET가 포장 목적에 적합한 몇 가지 특성입니다.

- 또한 취급 위험이 낮고, 독성이 낮고, 비스페놀 A(BPA)나 중금속이 포함되어 있지 않은 것도 식품 포장 업계를 위한 PET 시장에 유리하게 작용하고 있습니다.

- 향후 몇 년간의 성장률은 15%에서 20%로 포장 산업은 베트남에서 가장 급성장하고 있는 분야 중 하나입니다. 이 분야에서는 현재 900개가 넘는 공장이 조업하고 있으며, 그 약 70%가 남부지역, 주로 호치민시, 빈즌, 동나이에 입지하고 있습니다.

- 2022년 3월 유명한 식음료 회사인 테트라팩은 빈즌성에 있는 1억 4,120만 달러의 포장재 공장에 590만 달러를 추가 투자하여 베트남에 대한 자신감을 증명했습니다. 베트남 및 기타 지역 시장에서 아셉틱 포장 수요 증가에 대응하기 위해 이 추가 투자는 공장의 연간 생산량을 현재 115억 포장에서 165억 포장로 증가시킬 계획입니다.

- 따라서 앞서 언급한 측면에서 포장 부서는 시장을 독점할 것으로 예상됩니다.

베트남의 플라스틱 산업 개요

베트남의 플라스틱 시장은 플라스틱 수지의 생산에 종사하는 기업이 제한되어 통합 시장입니다. 이 시장의 주요 기업으로는 Far Eastern New Century, Nghi Son Refinery and Petrochemical(NSRP), Hyosung Chemicals, Billion Industrial Holdings Limited, SCG Chemicals Public Company Limited(TPC VINA) 등이 있습니다(특별한 순서 없음).

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트·지원

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 건설 부문으로부터 수요 증가

- 기타 촉진요인

- 성장 억제요인

- 원재료와 완성 플라스틱 수입에 대한 과도한 의존

- 플라스틱의 환경 문제에 대한 우려와 새로운 대체품의 이용 가능성

- 업계 밸류체인 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 강도

- 원재료 분석

제5장 시장 세분화

- 유형

- 종래의 플라스틱

- 폴리에틸렌

- 폴리프로필렌

- 폴리스티렌

- 폴리염화비닐

- 엔지니어링 플라스틱

- 폴리우레탄

- 플루오로폴리머

- 폴리아미드

- 폴리카보네이트

- 스티렌 공중합체(ABS 및 SAN)

- 열가소성 폴리에스테르

- 기타 엔지니어링 플라스틱

- 바이오플라스틱

- 종래의 플라스틱

- 성형 기술

- 블로우 성형

- 압출

- 사출 성형

- 기타 기술

- 용도

- 포장

- 전기 및 전자

- 건축 및 건설

- 자동차 및 수송

- 가정용품

- 가구 및 침구

- 기타 용도

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 시장 랭킹 분석

- 주요 기업의 전략

- 기업 프로파일

- Agc Inc.

- Billion Industrial Holdings Limited

- Far Eastern New Century Corporation

- Hyosung Chemical

- Lyondellbasell Industries Holdings Bv

- Nan Ya Plastics Corporation

- Nsrp Llc

- Scg Chemicals Public Company Limited

- Toray Industries Inc.

- Vietnam Oil And Gas Group

- Vietnam Polystyrene Co. Ltd

- Vinaplast

제7장 시장 기회와 앞으로의 동향

- 해외투자 증가

- 기타 기회

The Vietnam Plastics Market size is estimated at 11.84 million tons in 2025, and is expected to reach 17.76 million tons by 2030, at a CAGR of 8.44% during the forecast period (2025-2030).

The COVID-19 pandemic affected the Vietnamese market negatively. However, with the resumption of work in major end-user industries, the market is estimated to have reached pre-pandemic levels.

Key Highlights

- In the short term, the increasing demand from the construction industry is expected to drive market growth.

- Over-reliance on imports of raw materials and finished plastics is expected to hinder the growth of the market.

- An increase in foreign investments is expected to offer various opportunities for the growth of the market.

Vietnam Plastic Market Trends

Extrusion Technology to Dominate the Market

- In Vietnam, extrusion molding technology is used to make products such as PVC, PE pipe, aluminum and plastic pipe, fiber, PVC doors, frames, roofings, and wall coverings. An extrusion molding process involves lower production costs and faster setup time. However, it provides mediocre precision and is mostly suitable for uniform cross-section parts and not complex parts.

- This technology is used mainly in construction activities, and the main products include PVC, HDPE, PPR pipes, profile bars, plastic doors and windows, panels, and furniture.

- According to the plastic industry development plan of 2020, the plastics industry will be restructured toward reducing the proportion of packaging and consumer plastics and increasing the percentage of the construction and technical plastics segment.

- Vietnam's construction plastics segment accounts for around one-fourth of the total plastics industry. Developing the construction and real estate sector is boosting the demand for plastic construction products.

- In addition, the country's government aims to build a million affordable houses in more than 350 industrial zones. These infrastructural development projects and the increasing number of factories being installed are robustly increasing the demand for construction and technical plastics in the country.

- In April 2022, one of the top PET packaging businesses in Vietnam, Ngoc Nghia Industry - Service - Trading Joint Stock Company (NN), was acquired by Indorama Ventures Public Company Limited (IVL), a global sustainable chemical company. The acquisition will strengthen IVL's market position as it broadens its integrated PET product offering to significant multinational customers throughout the country.

- In September 2022, the US-based beverage company The Coca-Cola Company introduced fully recycled plastic bottles in Vietnam. The company claims to meet both Vietnamese regulations and international standards for food-grade rPET packaging.

- Based on the aforementioned aspects, extrusion technology is expected to dominate the market.

Packaging Segment to Dominate the Market

- Packaging accounts for the largest share of the Vietnamese plastics market. Factors like light weight and thermal, chemical, and corrosion resistance make plastics a viable choice for packaging purposes in the Vietnamese market.

- In the packaging industry, plastics are used for healthcare packaging, food and beverage packaging, consumer packaged goods, consumer and personal care packaging, and in the home and garden.

- Polyethylene terephthalate (PET) is one of the majorly used plastics for packaging purposes, mostly in the food and beverage industry. Portability, design flexibility, ease of cleaning, light weight, and protection against moisture are a few properties of PET that make them suitable for packaging purposes.

- In addition, low handling hazards, low toxicity, absence of Bisphenol A (BPA), and heavy metals favor the PET market for the food packaging industry.

- With a growth rate of 15% to 20% in the upcoming years, the packaging industry is one of Vietnam's fastest-growing sectors. Over 900 factories are currently in operation in the sector, with approximately 70% of them located in the Southern region, primarily in Ho Chi Minh City, Binh Duong, and Dong Nai.

- In March 2022, Tetra Pak, a well-known F&B company, with an additional USD 5.9 million investment into its USD 141.2 million packaging material factory in the province of Binh Duong, proved its confidence in Vietnam. To meet the growing demand for aseptic packages in Vietnam and other regional markets, the additional investment will increase the factory's annual output from the current 11.5 billion to 16.5 billion packages.

- Thus, based on the aforementioned aspects, the packaging segment is expected to dominate the market.

Vietnam Plastic Industry Overview

The Vietnamese plastics market is a consolidated market with a limited number of players engaged in the production of plastic resins. Some of the key players in the market include Far Eastern New Century, Nghi Son Refinery and Petrochemical (NSRP), Hyosung Chemicals, Billion Industrial Holdings Limited, and SCG Chemicals Public Company Limited (TPC VINA), among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Construction Sector

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Over-reliance on Imports of Raw Materials and Finished Plastics

- 4.2.2 Environmental Concerns of Plastics and the Availability of New Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Raw Material Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Traditional Plastics

- 5.1.1.1 Polyethylene

- 5.1.1.2 Polypropylene

- 5.1.1.3 Polystyrene

- 5.1.1.4 Polyvinyl Chloride

- 5.1.2 Engineering Plastics

- 5.1.2.1 Polyurethanes

- 5.1.2.2 Fluoropolymers

- 5.1.2.3 Polyamides

- 5.1.2.4 Polycarbonates

- 5.1.2.5 Styrene Copolymers (ABS and SAN)

- 5.1.2.6 Thermoplastic Polyesters

- 5.1.2.7 Other Engineering Plastics

- 5.1.3 Bioplastics

- 5.1.1 Traditional Plastics

- 5.2 Technology

- 5.2.1 Blow Molding

- 5.2.2 Extrusion

- 5.2.3 Injection Molding

- 5.2.4 Other Technologies

- 5.3 Application

- 5.3.1 Packaging

- 5.3.2 Electrical and Electronics

- 5.3.3 Building and Construction

- 5.3.4 Automotive and Transportation

- 5.3.5 Housewares

- 5.3.6 Furniture and Bedding

- 5.3.7 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Agc Inc.

- 6.4.2 Billion Industrial Holdings Limited

- 6.4.3 Far Eastern New Century Corporation

- 6.4.4 Hyosung Chemical

- 6.4.5 Lyondellbasell Industries Holdings Bv

- 6.4.6 Nan Ya Plastics Corporation

- 6.4.7 Nsrp Llc

- 6.4.8 Scg Chemicals Public Company Limited

- 6.4.9 Toray Industries Inc.

- 6.4.10 Vietnam Oil And Gas Group

- 6.4.11 Vietnam Polystyrene Co. Ltd

- 6.4.12 Vinaplast

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increase in Foreign Investments

- 7.2 Other Opportunities