|

시장보고서

상품코드

1686256

독일의 작물 보호 화학제품 시장(2025-2030년) : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측Germany Crop Protection Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

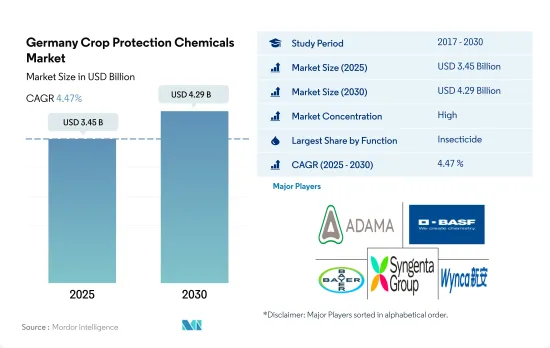

독일의 작물 보호 화학제품 시장 규모는 2025년에 34억 5,000만 달러로 추정 및 예측되고, 2030년에는 42억 9,000만 달러에 이를 전망이며, 예측 기간(2025-2030년) 동안 CAGR 4.47%로 성장할 것으로 예측됩니다.

곤충과 해충의 공격으로 인한 손실을 최소화할 필요성이 시장을 견인할 수 있습니다.

- 독일은 프랑스, 이탈리아에 이어 EU 3위의 농산물 생산국입니다.

- 살충제는 시장을 독점하고 있으며 2022년 독일 작물 보호 화학제품 시장의 63.3%를 차지했습니다. 그러나 해충의 발생 상황은 시간이 지남에 따라 변할 수 있으며 기후, 농업 관행 및 해충 관리 전략의 변화에 따라 달라질 수 있습니다. 독일에서 작물에 손실을 주는 것으로 알려진 주요 해충에는 콜로라도 감자잎벌레, 배추흰나비, 옥수수뿌리벌레, 진딧물, 유럽 조명충나방, 사과 코들링나방 등이 있습니다. 살충 활성 성분으로 가장 많이 사용되는 것은 카바메이트계와 피레스로이드계입니다.

- 제초제는 2022년에 독일의 작물 보호 화학제품 시장의 20.4%를 차지했습니다. 제초제에는 살포 시기에 따라 두 가지 유형이 있습니다. 제초제로 처리된 땅은 처리 후, 농작물을 재배하는 농업 목적으로 사용할 수 있습니다.

- 독일에서는 식량 수요가 증가함에 따라 충분한 식량을 생산해야 하는 압력이 높아지고 있으며, 이에 따라 곤충과 해충의 공격으로 인한 손실을 최소화할 필요성이 발생하고 있습니다.

독일 작물 보호 화학제품 시장 동향

해충 증가에 의해 농약의 살포량이 증가

- 2022년 독일에서는 1헥타르당 농약 소비량이 현저하게 증가하여 1헥타르당 6,400g의 대폭적인 증가를 보였습니다.

- 독일에서는 곤충이 밀, 쌀, 면화, 채소 등 다양한 작물에 영향을 미치면서 농업에 큰 과제를 가져오고 있습니다. 농약의 사용량으로는 살충제가 가장 많았으며 2022년의 평균 사용량은 1헥타르당 2,400g이었습니다.

- 살균제는 독일에서 농약 소비량 2위를 차지하고 있습니다. 2022년 평균 살포량은 헥타르당 2,200g이었습니다. 독일 농업에서 살균제 사용의 보급은 농법에 대한 의존도가 높고 작물을 곰팡이 감염으로부터 보호할 필요가 있기 때문입니다. 살균제는 작물에 해를 끼치고 수율을 감소시킬 수 있는 질병을 관리하는 데 매우 중요합니다.

- 2022년 헥타르당 제초제 살포량은 평균 1,800g이었습니다. 이는 제초제 사용이 작물의 수율을 양과 질 모두 향상시키기 위해 유리하고 경제적으로 실행 가능하다는 것을 인식한 결과입니다. 이 접근법은 잡초의 성장을 효과적으로 억제하는 동시에 노동 비용을 절감합니다.

가장 일반적으로 사용되는 제초제인 글리포세이트는 환경 문제와 곤충의 서식지를 보호하기 위해 2024년까지 사용이 금지되었습니다.

- 시펠메트린과 에마멕틴벤조에이트는 가격이 상승하는 주요 활성 성분입니다. 2022년 시펠메트린 가격은 1톤당 21,300달러로 2020년보다 14.6% 상승했습니다. 합성 피레스로이드계 살충제는 접촉 작용과 위장 작용을 모두 발휘하며, 나비, 딱정벌레, 파리, 노린재 등 폭넓은 곤충을 효과적으로 방제합니다. 잎을 떨어트리는 벌레와 과일 벌레를 제거하는 데 적합합니다.

- 2019년부터 2022년까지 에마멕틴벤조에이트 에스테르의 가격은 6% 상승했습니다. 이 활성 성분 기반의 살충제는 채소, 면화, 담배에 사용되며 멸강충, 요충, 배추좀나방, 과일 벌레, 잎말림 벌레와 같은 나비 해충을 퇴치합니다.

- 2022년에 1톤당 4,600달러에 판매되었던 아족시스트로빈은 농업에서도 특히 곡물에게 널리 이용되는 광역 스펙트럼의 침투성 살균제이며 다양한 질병을 예방합니다. 주목할만한 점은 독일이 아족시스트로빈의 대부분을 인도에서 수입하고 있다는 것입니다.

- 독일은 주로 인도, 베트남, 페루에 메탈락실을 수출하고 있습니다. 홉에서는 슈도페로노스포라 후물리가 발생하고, 감자와 토마토에서는 감자역병, 포도에서는 포도노균병, 양상추에서는 양상추 노균병, 그리고 다양한 채소에서 곰팡이가 발생합니다.

- 독일에서 가장 일반적으로 사용되는 제초제인 글리포세이트는 2022년에는 1톤당 1,200달러에 판매되었습니다. 환경 문제에 대한 우려와 곤충의 서식지를 지키기 위해 독일 정부는 2024년부터 글리포세이트를 금지하는 법안을 승인했습니다. 독일 농부들은 글리포세이트 사용량을 점진적으로 줄여 2024년까지 완전히 사용을 중단하게 되었습니다.

독일 작물 보호 화학제품 산업의 개요

독일 작물 보호 화학제품 시장은 상당히 통합되어 있으며 상위 5개 기업에서 71.10%를 차지하고 있습니다. 이 시장의 주요 기업은 ADAMA Agricultural Solutions Ltd, BASF SE, Bayer AG, Syngenta Group, Wynca Group(Wynca Chemicals)(알파벳순)입니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 1헥타르당 농약 소비량

- 유효 성분의 가격 분석

- 규제 프레임워크

- 독일

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 기능

- 살균제

- 제초제

- 살충제

- 연체동물 구제제

- 살선충제

- 적용 형태

- 약제 살포

- 잎면 살포

- 훈증

- 종자 처리

- 토양 처리

- 작물 유형

- 상업 작물

- 과일 및 채소

- 곡물

- 콩류 및 유지종자

- 잔디 및 관상용

제6장 경쟁 구도

- 주요 전략적 움직임

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- ADAMA Agricultural Solutions Ltd

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Nufarm Ltd

- PI Industries

- Syngenta Group

- UPL Limited

- Wynca Group(Wynca Chemicals)

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Porter's Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터팩

- 용어집

The Germany Crop Protection Chemicals Market size is estimated at 3.45 billion USD in 2025, and is expected to reach 4.29 billion USD by 2030, growing at a CAGR of 4.47% during the forecast period (2025-2030).

The need to minimize the losses caused due to the attack of insects and pests may drive the market

- Germany is the third-largest producer of agricultural goods in the European Union, following France and Italy.

- Insecticides dominated the market and accounted for 63.3% of the German crop protection chemicals market in 2022. However, the prevalence of insect pests can vary over time and may change due to changing climate, agricultural practices, and pest management strategies. Some major insect pests known to cause crop losses in Germany include the Colorado potato beetle, cabbage white butterfly, western corn rootworm, aphids, European corn borer, and apple codling moth. Carbamates and pyrethroids are the most commonly used insecticide-active ingredients.

- Herbicides accounted for 20.4% of the German crop protection chemicals market in 2022. Herbicides have two types, based on the time of application. Pre-plant herbicides are applied to the soil before planting to control the weeds before the crops are sown. These are typically selective and non-selective herbicides. The herbicide-treated land can then be used for agricultural purposes to grow crops. Pre-emergence herbicides can be applied before the weed seedlings emerge from the soil. When applied, these herbicides control the weeds as they grow out of the soil. However, they do not affect the weeds that are already grown.

- With the increasing demand for food in Germany, the country's pressure to produce sufficient food is increasing, which comes with the need to minimize the losses caused by the attack of insects and pests. The market is anticipated to register a CAGR of 3.7% during the forecast period.

Germany Crop Protection Chemicals Market Trends

Increasing pest proliferation is leading to higher application of pesticides

- In 2022, there was a notable rise in pesticide consumption per hectare in Germany, showing a significant increase of 6.4 thousand g per hectare. This considerable uptick can be mainly attributed to the profound effects of climate variations, marked by increased instances of droughts, heatwaves, and other circumstances that encourage the spread of fungal infections, weeds, and insect pests.

- In Germany, insects present a significant challenge to agriculture by affecting a range of crops, including wheat, rice, cotton, fruits, and vegetables. Their presence leads to considerable damage, resulting in lower yields and inferior quality production. This situation places farmers under financial strain and raises concerns about possible food scarcity. Insecticides take the forefront in terms of pesticide usage, with an average consumption of 2.4 thousand g per hectare in 2022. This trend reflects the necessity to counter insects and mitigate their detrimental effects on crop production.

- Fungicides take the second spot in pesticide consumption in Germany. The year 2022 recorded an average application of 2.2 thousand g per hectare. The prevalence of fungicide use in German agriculture is attributed to the nation's strong dependence on agricultural methods and the necessity to shield crops from fungal infections. Fungicides are crucial in managing diseases that can harm crops and diminish yields.

- In 2022, the rate of herbicide application per hectare averaged 1.8 thousand g. This phenomenon is a result of recognizing the advantageous and economically viable nature of using herbicides to improve crop yields in both quantity and quality. This approach effectively controls weed proliferation while also reducing labor costs.

The most commonly used herbicide glyphosate is expected to be banned by 2024 due to environmental concerns, as well as to preserve clean habitats for insects

- Cypermethrin and emamectin benzoate are some of the major active ingredients that are witnessing an increase in prices. In 2022, cypermethrin was priced at USD 21.3 thousand per metric ton, reflecting a 14.6% increase from 2020. This synthetic pyrethroid exhibits both contact and stomach action, effectively controlling a broad spectrum of insects, including lepidoptera, coleoptera, diptera, and hemiptera. It is suitable for managing defoliating caterpillars and fruit borers.

- Between 2019 and 2022, the price of emamectin benzoate rose by 6%. This active ingredient-based insecticide is used in vegetables, cotton, and tobacco to combat damaging lepidopteran pests like armyworms, pinworms, diamondback moths, fruit worms, and leafrollers.

- Azoxystrobin, priced at USD 4.6 thousand per metric ton in 2022, serves as a broad-spectrum systemic fungicide widely utilized in agriculture, particularly in cereals. It provides protection against various diseases. Notably, Germany imports most of its azoxystrobin from India.

- Germany predominantly exports metalaxyl to India, Vietnam, and Peru. It exhibits both protective and curative action, targeting diseases caused by Pseudoperonospora humuli in hops, Phytophthora infestans in potatoes and tomatoes, Plasmopara viticola in vines, Bremia lactucae in lettuce, and downy mildew in various vegetables.

- Glyphosate, the most commonly used herbicide in Germany, was priced at USD 1.2 thousand per metric ton in 2022. In response to environmental concerns and to preserve clean habitats for insects, the German cabinet approved legislation to ban glyphosate from 2024. Farmers in Germany are expected to gradually reduce their usage of glyphosate and cease its use completely by 2024.

Germany Crop Protection Chemicals Industry Overview

The Germany Crop Protection Chemicals Market is fairly consolidated, with the top five companies occupying 71.10%. The major players in this market are ADAMA Agricultural Solutions Ltd, BASF SE, Bayer AG, Syngenta Group and Wynca Group (Wynca Chemicals) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 Germany

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Function

- 5.1.1 Fungicide

- 5.1.2 Herbicide

- 5.1.3 Insecticide

- 5.1.4 Molluscicide

- 5.1.5 Nematicide

- 5.2 Application Mode

- 5.2.1 Chemigation

- 5.2.2 Foliar

- 5.2.3 Fumigation

- 5.2.4 Seed Treatment

- 5.2.5 Soil Treatment

- 5.3 Crop Type

- 5.3.1 Commercial Crops

- 5.3.2 Fruits & Vegetables

- 5.3.3 Grains & Cereals

- 5.3.4 Pulses & Oilseeds

- 5.3.5 Turf & Ornamental

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 Corteva Agriscience

- 6.4.5 FMC Corporation

- 6.4.6 Nufarm Ltd

- 6.4.7 PI Industries

- 6.4.8 Syngenta Group

- 6.4.9 UPL Limited

- 6.4.10 Wynca Group (Wynca Chemicals)

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms