|

시장보고서

상품코드

1686523

무인 항공기(UAV)(UAV) - 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Unmanned Aerial Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

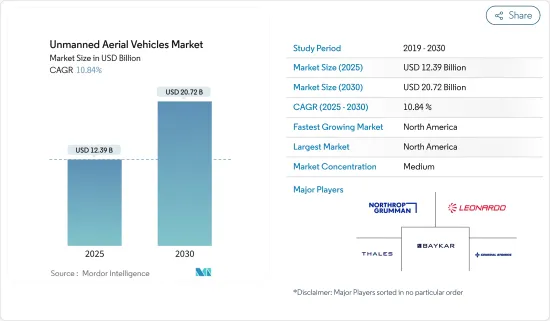

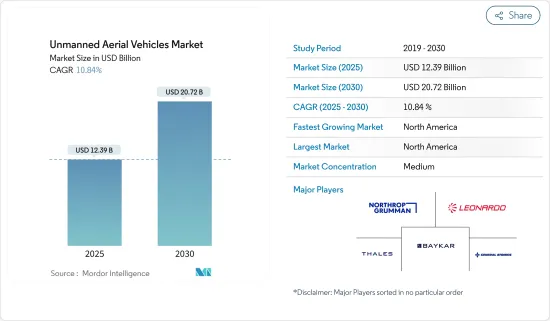

무인 항공기(UAV) 시장 규모는 2025년에 123억 9,000만 달러, 2030년에는 207억 2,000만 달러에 달할 것으로 예측되고 있습니다. 예측기간(2025년-2030년) CAGR은 10.84%를 나타낼 전망입니다.

UAV는 주로 인간이 조종하기 어려운 지역에 도달하고 횡단하기 위해 등장했습니다. UAV 시장은 지난 몇 년 동안 초기 단계에 있었으며, 상업 분야에서의 도입은 진행되지 않았습니다. 당초 UAV는 군용 장비로 간주되었지만 지난 5년간 상업 세계에서도 큰 존재감을 확립했습니다.

미국 연방항공국(FAA)과 유럽연합항공안전국(EASA)과 같은 관리기관에서 수백 개의 적용을 제외하고, UAV 수요는 인프라, 농업, 운송, 오락, 보안, 보험 등 다양한 산업에서 태어났습니다. 따라서 기업용 UAV는 소비자용 UAV보다 예측 기간 동안 크게 성장할 것으로 예상됩니다.

UAV 기술의 발전으로 제조업체는 다양한 센서 페이로드를 탑재할 수 있는 다양한 크기, 무게, 모양의 모델을 생산할 수 있어 다양한 용도로 유리하게 되었습니다. 그러나 세계의 일부 국가에서는 육안으로 UAV 비행에 대한 규제와 제한이 없기 때문에 시장의 잠재적 성장이 억제되고 있습니다. 보안 및 안전에 대한 우려, 훈련된 조종사 부족과 같은 기타 요인들도 UAV 시장 개척에 일정한 과제를 부과할 것으로 예상됩니다.

무인 항공기(UAV) 시장 동향

소형 UAV 부문이 시장에서 상위를 차지

소형 UAV는 길이 2미터까지 주행할 수 있는 무인 항공기(UAV)입니다.이 UAV는 일반적으로 회전날개 또는 고정날개 중 하나의 스타일을 특징으로 하고 있습니다. 가 다양한 군사 임무를 위해 나노 드론을 조달하고 있습니다. 공중 촬영, 3D 매핑, 측량, 석유 및 가스 파이프라인 모니터링 등, 소형 UAV의 용도가 확대되고 있는 것이, 소형 UAV 시장의 성장을 뒷받침하고 있습니다.

또, 정보, 감시 및 정찰(ISR)이나 전투 임무에의 소형 UAV의 채용 확대, 방위 분야에의 지출 증가가 예측 기간중 시장 성장을 뒷받침하고 있습니다.또, 다양한 상용 및 군사 용도의 소형 UAV를 설계 및 개발하기 위한 신흥 기업이나 정부·투자가로부터의 자금 조달 증가도 시장 성장을 가속하고 있습니다.

예를 들어 2023년 10월 Teledyne FLIR LLC는 센서를 업그레이드한 Black Hornet 나노드론의 최신 버전을 출시했습니다. 4는 전장 1피트 미만, 무게 1파운드의 소량입니다.30분 이상의 비행이 가능해, 항속 거리는 2km를 넘습니다.고감도의 주간 카메라, 비디오나 화상을 촬영할 수 있는 적외선 이미저, 소프트웨어 정의의 데이터 시스템을 탑재하고 있습니다.

북미가 예측기간 동안 가장 높은 성장을 보일 것으로 예측

북미는 UAV 시장에서 가장 높은 점유율을 차지하고 있으며 예측 기간 동안에도 지배가 계속됩니다. 연 7월 시점에서 약 90만기의 드론이 등록되어 있습니다.등록된 드론 중, 41만6,095기가 레크리에이션용으로, 36만9,528기가 상업용으로서 등록되어 있습니다.또, FAA는 33만1,573건의 원격 조종 증명서를 수여했습니다.

또한 미국 국방부는 역량을 강화하고 러시아와 중국과 같은 적대국으로부터의 위협에 대항하기 위해 혁신적이고 저비용 솔루션을 요구하고 있습니다. 2023년 3월, 미국 육군은 5사에 장래 전술 UAV계약을 발주했습니다.

또한 캐나다 국방군도 방위력 강화에 투자해 UAV를 조달하고 있습니다. 캐나다가 발표한 국가 방위 전략은 군사 작전을 실시하기 위한 중요한 개발로서 RPAS를 현대군에 통합하는 것으로 이어졌습니다.

무인 항공기(UAV) 산업 개요

UAV 시장은 반쯤 통합되어 있으며, 일부 지역 및 세계 기업들이 큰 점유율을 차지하고 있습니다. 시장의 주요 기업으로는 Northrop Grumman Corporation, THALES, Leonardo SpA, General Atomics, BAYKAR TECH 등이 있습니다. 방위 및 국토 안보 분야에서는 엄격한 안전 및 규제 정책이 신규 진입을 제한하고 있습니다. 그러나 상업 및 민생 분야에서는 규모의 경제가 이 분야를 지배하지 않기 때문에 많은 기업의 진입에 의해 급속한 성장이 예상됩니다.

기술력이 뛰어난 개발 기업은 UAV의 추진 시스템과 페이로드 특성의 기술적 진보에 크게 기여하여 개발 사이클이 단축되고 미니 UAV의 운용 능력이 크게 향상될 것으로 예상됩니다. UAV 플랫폼의 페이로드, 내구성 및 비행 거리는 OEM과 운영자의 가장 큰 관심사이기 때문에 대체 연료를 동력원으로 사용하는 UAV의 출현은 경쟁 시나리오에 큰 변화를 가져올 것으로 예상됩니다. UAV의 중요한 구성 요소와 부품을 구축하기 위해 복합 기반 재료를 사용하면 UAV 플랫폼의 능력이 향상되고 다양한 산업에서 널리 채택 될 수 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 시장 성장 억제요인

- 업계의 매력도 - Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자 및 소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- UAV 사이즈별

- 소형 UAV

- 중형 UAV

- 대형 UAV

- 유형별

- 고정날개(MALE, HALE, TUAV)

- VTOL(싱글 로터, 멀티로터)

- 비행거리별

- 육안 범위(VLOS)

- 육안 범위(BVLOS)

- 용도별

- 전투

- 비전투(화물 수송, ISR, 전투 피해 관리)

- 지역별

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 우크라이나

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 말레이시아

- 필리핀

- 인도네시아

- 기타 아시아태평양

- 라틴아메리카

- 멕시코

- 브라질

- 아르헨티나

- 콜롬비아

- 기타 라틴아메리카

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 튀르키예

- 이스라엘

- 이집트

- 기타 중동?아프리카

- 북미

제6장 경쟁 구도

- 벤더의 시장 점유율

- 기업 프로파일

- SZ DJI Technology Co. Ltd.

- Parrot SAS

- Delair SAS

- AeroVironment, Inc.

- Northrop Grumman Corporation

- Elbit Systems Ltd.

- General Atomics

- Israel Aerospace Industries Ltd.

- THALES

- The Boeing Company

- Microdrones GmbH(mdGroup Germany GmbH)

- BAYKAR TECH

- Leonardo SpA

- Textron Inc.

제7장 시장 기회

SHW 25.04.29The Unmanned Aerial Vehicles Market size is estimated at USD 12.39 billion in 2025, and is expected to reach USD 20.72 billion by 2030, at a CAGR of 10.84% during the forecast period (2025-2030).

UAVs have come into existence mainly to reach and traverse areas that are arduous for humans to maneuver. The UAV market was nascent for several years, and there was a lack of adoption in the commercial sector. Initially viewed as a military device, UAVs have established a significant presence in the commercial world over the past five years.

Over the years, with hundreds of exemptions from governing bodies like the US Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA), the demand for UAVs has emerged from various industries, like infrastructure, agriculture, transport, entertainment, security, insurance, and many more. Hence, enterprise UAVs are expected to grow more during the forecast period than consumer UAVs.

Advancements in UAV technologies have allowed manufacturers to produce various models in different sizes, weights, and shapes that can carry different sensor payloads, making them favorable across a broad application base. However, the lack of regulations and restrictions on flying UAVs beyond the visual line of sight in several countries worldwide has restrained the market's growth to its full potential. Other factors, such as security and safety concerns and scarcity of trained pilots, are also anticipated to challenge the development of the UAV market to a certain extent.

Unmanned Aerial Vehicles Market Trends

Small UAV Segment Held Highest Shares in the Market

Small UAVs are unmanned aerial vehicles that can span up to 2 meters long. These UAVs typically feature either a rotary-wing or fixed-wing style. Because of their small size, most small UAVs are flown at altitudes near 125 meters at speeds less than 50 meters per second. As several countries focus on enhancing their military surveillance capability, huge investments are being made in developing small drones. Militaries across the world have been procuring nano drones for different military missions. Growing applications of small UAVs in aerial photography, 3D mapping, surveying, and oil and gas pipeline monitoring, among others, have been propelling the growth of the small UAV market. Thus, the growing demand for small drones for various defense and applications drives the segment's growth during the forecast period.

Also, the growing adoption of small UAVs for intelligence, surveillance, and reconnaissance (ISR) and combat missions and rising spending on the defense sector drive the market growth during the forecast period. Increased start-ups and fundraising from governments and investors to design and develop small UAVs for various commercial and military applications have also boosted the market growth.

For instance, in October 2023, Teledyne FLIR LLC launched the latest edition of the Black Hornet nano-drone with upgraded sensors. The newly launched Black Hornet 4 is less than a foot long and weighs a fraction of a pound. It can fly for over 30 minutes and has a range of more than 2 kilometers (1.24 miles). It has a sensitive daytime camera, a thermal imager that can capture videos and images, and a software-defined data system. Such developments will drive the segment growth in the coming years.

North America is Projected to Show Highest Growth During the Forecast Period

North America held the highest shares in the UAV market and continued its domination during the forecast period. The growth is due to growing demand for UAVs for commercial and military applications and rising spending on procurement of autonomous drones. According to the Federal Aviation Administration (FAA), almost 900,000 drones were registered in the US as of July 2023. Of the registered drones, 416,095 were for recreational purposes, and 369,528 were registered for commercial operations. Also, the FAA awarded 331,573 remote pilot certificates.

Additionally, the US DoD constantly seeks innovative and low-cost solutions to enhance its capabilities and counter threats from adversaries like Russia and China. For instance, in April 2023, the Pentagon announced a new program focused on building thousands of autonomous systems, including UAVs, as the US seeks to better counter China's vast military buildup. In March 2023, the US Army awarded five companies future tactical UAV contracts. The companies selected were AeroVironment, Griffon Aerospace, Northrop Grumman, Sierra Nevada Corporation, and Textron Systems.

Also, the Canadian Defense Forces are investing in enhancing their defense capabilities and procuring UAVs. The MALE (medium-altitude low-endurance) UAV project of the Royal Canadian Air Force has entered the phase of operation analyses. The Remotely Piloted Aircraft Systems (RPAS) Project has been renamed. The national defense strategy released by Canada has led to the inclusion of RPAS into the modern military as a significant development for conducting military operations. Such programs will boost market growth across the region.

Unmanned Aerial Vehicles Industry Overview

The UAV market is semi-consolidated, with several local and global players holding significant shares. Some of the key players in the market are Northrop Grumman Corporation, THALES, Leonardo S.p.A., General Atomics, and BAYKAR TECH. The stringent safety and regulatory policies in the defense and homeland security segment are expected to restrict the entry of new players. However, the commercial and civil segment is expected to witness rapid growth due to the entry of many players, as economies of scale do not govern the segment.

Companies with superior technical capabilities are expected to contribute significantly toward technological advances in the propulsion systems and payload characteristics of UAVs, resulting in a shorter development cycle time and considerably augmenting the operational capabilities of mini-UAVs. Since a UAV platform's payload, endurance, and flight range are the primary concerns of OEMs and operators, the emergence of alternative fuel-powered UAVs is expected to cause significant changes in the competitive scenario. The use of composite-based materials for constructing critical components and parts of UAVs may increase the capabilities of the UAV platforms and fuel their widespread adoption across different industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By UAV Size

- 5.1.1 Small UAV

- 5.1.2 Medium UAV

- 5.1.3 Large UAV

- 5.2 By Type

- 5.2.1 Fixed-wing (MALE, HALE, and TUAV)

- 5.2.2 VTOL (Single Rotor and Multi Rotor)

- 5.3 By Range

- 5.3.1 Visual Range of Sight (VLOS)

- 5.3.2 Beyond Visual Line of Sight (BVLOS)

- 5.4 By Application

- 5.4.1 Combat

- 5.4.2 Non-combat (Cargo Delivery, ISR, and Battle Damage Management)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Ukraine

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Malaysia

- 5.5.3.6 Philippines

- 5.5.3.7 Indonesia

- 5.5.3.8 Rest of Asia-Pacific

- 5.5.4 Latin America

- 5.5.4.1 Mexico

- 5.5.4.2 Brazil

- 5.5.4.3 Argentina

- 5.5.4.4 Colombia

- 5.5.4.5 Rest of Latin America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Turkey

- 5.5.5.4 Israel

- 5.5.5.5 Egypt

- 5.5.5.6 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 SZ DJI Technology Co. Ltd.

- 6.2.2 Parrot SAS

- 6.2.3 Delair SAS

- 6.2.4 AeroVironment, Inc.

- 6.2.5 Northrop Grumman Corporation

- 6.2.6 Elbit Systems Ltd.

- 6.2.7 General Atomics

- 6.2.8 Israel Aerospace Industries Ltd.

- 6.2.9 THALES

- 6.2.10 The Boeing Company

- 6.2.11 Microdrones GmbH (mdGroup Germany GmbH)

- 6.2.12 BAYKAR TECH

- 6.2.13 Leonardo S.p.A

- 6.2.14 Textron Inc.