|

시장보고서

상품코드

1686531

중남미의 배터리 시장 : 시장 점유율 분석, 산업 동향, 성장 예측(2025-2030년)South and Central America Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

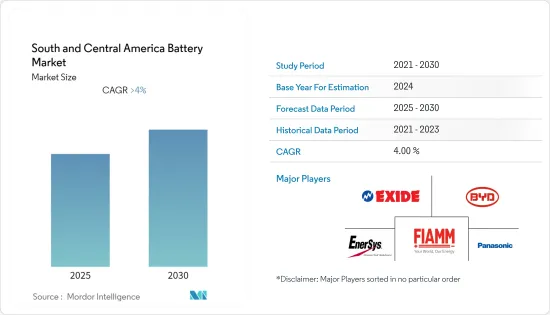

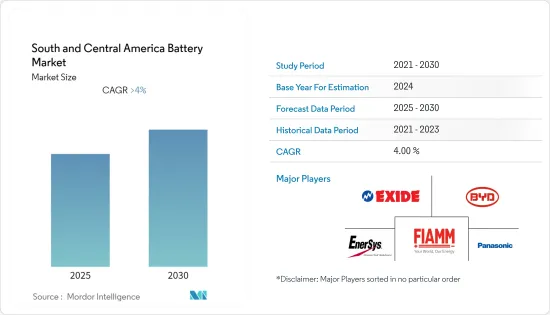

중남미의 배터리 시장은 예측 기간 동안 CAGR 4% 이상을 기록할 전망입니다.

2020년에는 COVID-19의 대유행이 시장에 악영향을 미쳤습니다. 현재 시장은 팬데믹 전 수준에 도달했습니다.

주요 하이라이트

- 장기적으로 보면 중남미의 배터리 시장을 견인하는 주요 요인으로는 리튬 이온 배터리 가격 하락, 전기자동차의 보급 확대, 신재생 에너지 분야의 확대 등을 들 수 있습니다. 또한 데이터센터가 클라우드 서비스를 위한 디지털 인프라를 진화시키고 있기 때문에 데이터센터의 수요 증가도 시장을 견인할 가능성이 높습니다. 차세대 클라우드 서비스에는 블록체인 네트워크가 채택될 가능성이 있습니다.

- 한편, 원재료의 수급 미스매치가 시장의 성장을 방해할 가능성이 높습니다.

- 브라질과 아르헨티나와 같은 국가에서 데이터센터의 성장 및 상업 인프라를 위한 경제 개척 증가는 중남미의 배터리 시장에 절대적인 기회를 가져올 것으로 예상됩니다.

- 브라질은 소비재 수요 증가 및 이 나라에 대한 투자 증가로 중남미 시장을 독점할 것으로 예상됩니다.

중남미의 배터리 시장 동향

시장을 독점하는 리튬 이온 배터리

- 리튬 이온 배터리 산업의 초기 단계에서는 가전 부문이 배터리의 주요한 소비자였습니다. 그러나 최근에는, 전기자동차(EV) 판매가 성장하고 있는 것으로부터, 전기자동차(EV) 제조업체가 리튬 이온 배터리의 최대 소비자가 되고 있습니다.

- EV는 CO2나 NOX 등의 온실 효과 가스를 배출하지 않기 때문에 종래의 내연 기관차(ICE)에 비해 환경 부하가 낮습니다. 이 장점으로부터, 많은 나라가 보조금 및 정부 프로그램을 도입해 EV의 사용을 장려하고 있습니다.

- 2022년 7월, 브라질 정부는 리튬 수출 규제를 완화하는 행정 명령을 내렸습니다. 현재 브라질의 리튬이온 생산량은 세계의 1.5%를 차지하며 CBL과 AMG 브라질 2개사가 조업하고 있습니다.

- 2022년 11월, 아르헨티나는 필요한 설비가 중국에서 라플라타시에 도착한 후, 이 나라 최초의 리튬 배터리 공장의 조업을 개시할 계획을 발표했습니다. 이 공장은, 과학기술 혁신성의 지원 아래, 국립 라플라타 대학(UNLP), YPF-Tecnologia(Y-TEC), 국립 과학기술 연구 평의회(CONICET)에 의해 건설됩니다.

- 이러한 요인으로부터, 리튬 이온 배터리는 예측 기간중, 중남미의 배터리 시장을 독점할 것으로 예상됩니다.

시장을 독점하는 브라질

- 브라질은 주로 소비재 수요가 높기 때문에 소비자용 배터리의 최대 시장 중 하나입니다. 브라질에서는 소비자용 전자기기의 수요가 증가하고 있으며, 이것이 조사 대상인 시장을 크게 끌어올릴 가능성이 있습니다.

- 브라질에서는 1차 배터리의 주요 공급국은 중국, 미국, 독일 등입니다. 브라질에서의 1차 배터리 수입액은 수출액을 훨씬 웃돌고 있으며, 이는 1차 배터리 요건을 충족하기 위해 수입 의존도가 높다는 것을 보여줍니다. 브라질의 1차 배터리 수요는 해외 제조 기업의 판매점 네트워크 및 채널 파트너가 담당하고 있습니다.

- 브라질의 배터리 수요는 2014년부터 2024년 사이에 약 2.7%의 성장률을 나타낸 것으로 평가되는 전력 수요에 의해 뒷받침되어 대기 전력원 수요 증가로 이어집니다.

- Rota 2030 프로그램은 운수 부문에서의 에너지 효율 개선을 목적으로 하고 있으며, 브라질의 전기자동차 시장을 크게 뒷받침하고 있습니다. 전기자동차 도입 급증은 예측 기간 동안 브라질의 배터리 시장에 큰 추진력을 줄 것으로 보입니다.

- 2022년 2월 현재 네덜란드 Advanced Metallurgical Group(AMG)의 브라질 자회사인 AMG Mineracao는 브라질에서 연간 13만 톤의 정광 리튬 생산 능력을 가지고 있습니다. 한편, 캐나다를 거점으로 하는 시그마 리튬 리소시즈 산하의 시그마 미네라카오는, 그로타 드 시릴로에 있는 콤플렉스로 22만 톤의 정광 생산 능력을 계획하고 있었습니다.

- 2022년 4월, 브라질의 광산회사 CBMM은 도시바와 공동 개발한 기술을 사용하여 급속 충전 전동 자전거용 니오브 배터리 셀공급을 개시할 계획을 발표했습니다. 도시바는 최종 사용자와의 기술 검증을 위해 4,000개의 배터리 셀을 생산할 예정입니다.

- 이 때문에 브라질은 예측 기간중, 중남미의 배터리 시장에 호영향을 줄 것으로 예상됩니다.

중남미의 배터리 산업 개요

중남미의 배터리 시장은 적당히 단편화되어 있습니다. 주요 기업에는 Exide Industries Ltd, BYD Company Ltd, FIAMM Energy Technology SpA, Panasonic Corporation, EnerSys 등이 있습니다.(순부동)

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 조사 방법

제3장 주요 요약

제4장 시장 개요

- 서문

- 시장 규모 및 수요 예측(-2027년)

- 최근 동향 및 개발

- 정부 규제 및 정책

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 공급망 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 세분화

- 유형별

- 1차 배터리

- 2차 배터리

- 기술별

- 납축배터리

- 리튬 이온 배터리

- 기타 기술

- 용도별

- 자동차용

- 산업용 배터리(동력용, 거치형(텔레콤, UPS, 에너지 저장 시스템(ESS) 등))

- 소비자 전자기기

- 기타 용도

- 지역별

- 브라질

- 아르헨티나

- 콜롬비아

- 기타 중남미

제6장 경쟁 구도

- M&A, 합작사업, 제휴 및 협정

- 주요 기업의 전략

- 시장 점유율 분석

- 기업 프로파일

- BYD Company Ltd

- Duracell Inc.

- EnerSys

- Panasonic Corporation

- Saft Groupe SA

- Exide Industries Ltd

- Clarios

- FIAMM Energy Technology SpA

제7장 시장 기회 및 향후 동향

AJY 25.04.29The South and Central America Battery Market is expected to register a CAGR of greater than 4% during the forecast period.

The COVID-19 outbreak negatively impacted the market in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the long term, major factors driving the South and Central American battery market include declining lithium-ion battery prices, increasing adoption of electric vehicles, and the growing renewable energy sector. Increasing demand from data centers is also likely to drive the market as data centers are evolving digital infrastructures for cloud services. The next generation of cloud service may be adopted to incorporate a blockchain network.

- On the other hand, the demand-supply mismatch of raw materials is likely to hinder the market's growth.

- Increasing the growth in data centers and economic development in countries like Brazil and Argentina for commercial infrastructure are expected to create immense opportunities for the South and Central American battery market.

- Brazil is expected to dominate the market in South and Central America due to the rising demand for consumer goods and increasing investments in the country.

South and Central America Battery Market Trends

Lithium-ion Batteries to Dominate the Market

- In the early stages of the lithium-ion battery industry, the consumer electronics sector was the major consumer of batteries. However, in recent years, electric vehicle (EV) manufacturers have become the biggest consumers of lithium-ion batteries due to the growing sales of EVs.

- EVs do not emit CO2, NOX, or any other greenhouse gases and, hence, have a lower environmental impact compared to conventional internal combustion engine (ICE) vehicles. Due to this advantage, many countries are encouraging the use of EVs by introducing subsidies and government programs.

- In July 2022, the Brazilian government issued an executive order to relax the rules on lithium export. Currently, Brazil accounts for 1.5% of global production of lithium-ion, and two companies are operational in the region, i.e., CBL and AMG Brazil.

- In November 2022, Argentina announced its plans to begin operations at its first lithium battery plant after the necessary equipment arrived in the city of La Plata from China. The plant will be constructed by Universidad Nacional de La Plata (UNLP), YPF-Tecnologia (Y-TEC), and the National Scientific and Technical Research Council (CONICET), with the support of the Ministry of Science, Technology, and Innovation.

- Owing to such factors, lithium-ion batteries are expected to dominate the South and Central American battery market during the forecast period.

Brazil to Dominate the Market

- Brazil is one of the largest markets for consumer batteries, mainly due to the high demand for consumer goods. The demand for consumer electronics in Brazil is increasing, which may offer a significant boost for the market studied.

- In Brazil, the major supplier countries for primary batteries include China, the United States, and Germany. The import value of primary batteries in Brazil is way higher than the export, which signifies the high dependency on imports to meet the requirements of primary batteries. Distributor networks and channel partners of overseas manufacturing firms cater to the demand for primary batteries in Brazil.

- The battery demand in Brazil is boosted by the demand for electricity, which is anticipated to register a growth rate of about 2.7% during 2014-2024, leading to an increasing requirement of standby sources of electricity.

- The Rota 2030 program is aimed at improving energy efficiency in the transportation sector, which is a major boost for the Brazilian electric vehicle market. The surge in the deployment of electric vehicles is likely to provide a significant impetus to the Brazilian battery market during the forecast period.

- As of February 2022, AMG Mineracao, a Brazilian subsidiary of Dutch Advanced Metallurgical Group (AMG), had an annual lithium production capacity of 130 thousand metric ton of concentrate in Brazil. Meanwhile, Sigma Mineracao, part of Canada-based Sigma Lithium Resources, had planned a capacity of 220 thousand ton of concentrate in its complex at Grota do Cirilo.

- In April 2022, Brazilian mining company CBMM announced its plans to start using technology it developed with Toshiba to supply niobium battery cells for fast-charging electric motorcycles. Toshiba is planning to produce 4,000 battery cells to validate the technology with the end user.

- Therefore, due to such factors, Brazil is expected to have a positive impact on the battery market in South and Central America during the forecast period.

South and Central America Battery Industry Overview

The South and Central American battery market is moderately fragmented. Some of the major players (in particular order) include Exide Industries Ltd, BYD Company Ltd, FIAMM Energy Technology SpA, Panasonic Corporation, and EnerSys.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Primary Battery

- 5.1.2 Secondary Battery

- 5.2 Technology

- 5.2.1 Lead-acid Battery

- 5.2.2 Lithium-ion Battery

- 5.2.3 Other Technologies

- 5.3 Application

- 5.3.1 Automotive

- 5.3.2 Industrial Batteries (Motive, Stationary (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- 5.3.3 Consumer Electronics

- 5.3.4 Other Applications

- 5.4 Geography

- 5.4.1 Brazil

- 5.4.2 Argentina

- 5.4.3 Colombia

- 5.4.4 Rest of South and Central America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Market Share Analysis

- 6.4 Company Profiles

- 6.4.1 BYD Company Ltd

- 6.4.2 Duracell Inc.

- 6.4.3 EnerSys

- 6.4.4 Panasonic Corporation

- 6.4.5 Saft Groupe SA

- 6.4.6 Exide Industries Ltd

- 6.4.7 Clarios

- 6.4.8 FIAMM Energy Technology SpA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

샘플 요청 목록