|

시장보고서

상품코드

1686579

인도의 전력 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)India Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

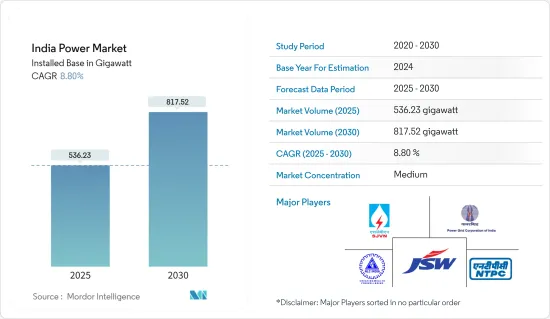

인도의 전력 시장 규모는 2025년 536.23 기가와트로 추정되고, 2030년에는 817.52 기가와트로 확대될 전망이며, 예측 기간인 2025-2030년 CAGR 8.8%로 성장할 것으로 예측됩니다.

주요 하이라이트

- 중기적으로는 정부의 지원 정책, 인프라 정비에 의한 전력 수요 증가, 인구 증가 등의 요인이 예측 기간 중 시장을 견인할 것으로 보입니다.

- 한편, 발전, 송전, 배전망의 설치 및 근대화에는 막대한 투자가 필요하고, 민간부문의 투자가 약한 것이 인도의 전력 시장 성장을 방해할 것으로 예상됩니다.

- 그러나 인도에는 풍부한 태양방사조도가 있어, 연간을 통해 태양에너지를 받아들이고 있습니다. 이 때문에 특히 라자스탄 주, 구자라트 주, 안도라 프라데시 주 등 국내에서 가장 일조량이 많은 곳에서 태양 에너지를 이용할 절호의 기회가 생겨나고 있습니다. 외국으로부터의 투자나 대규모 전력 프로젝트와 맞물려 상기 요인이 인도의 전력 시장을 성장시킬 호기가 되고 있습니다.

인도 전력 시장 동향

화력 발전이 시장을 독점

- 인도에는 석탄이 대량으로 매장되어 있어 발전용 연료로서 입수하기 쉽고, 비교적 저렴합니다. 석탄 매장량이 많기 때문에 인도는 주요 생산국이자 소비국이며 화력 발전소는 증대하는 전력 수요를 충족시키기 위한 매력적인 선택지가 되고 있습니다.

- 게다가 인도에는 석탄 화력 발전을 위한 인프라가 확립되어 있습니다. 수많은 탄광, 수송망, 석탄 화력 발전소가 이미 가동되고 있습니다. 이러한 기존 인프라가 화력 발전 시장의 우위성을 뒷받침하는 기반이 되고 있습니다.

- 또한 2022년 9월 인도 에너지성은 증가하는 전력 수요에 대응하기 위해 2030년까지 56GW의 석탄 화력 발전 용량을 추가할 준비를 진행하고 있다고 발표했습니다. 이 석탄 화력 발전 용량의 증가는 현재 285개 석탄 화력 발전소에 의한 204GW의 석탄 연료 발전을 약 25% 상회하게 됩니다.

- 2023년 11월 인도는 화력 발전에 크게 의존하고 있으며, 총 설비 용량은 2390.7만kW로 국내 발전 용량의 56% 이상을 차지했습니다.

- 또한 화력발전소, 특히 석탄을 사용하는 발전소는 신재생 에너지 등 대체 에너지와 비교하여 비용 경쟁력이 있습니다. 화력발전소 설립을 위한 초기 설비 투자는 종종 저액이며, 연료비를 포함한 운전 비용은 변동하기 쉬운 석유 및 가스 가격에 비해 비교적 안정되어 있습니다.

- 화력 발전소는 안정적이고 신뢰성이 높은 전력 공급을 할 수 있기 때문에 베이스로드 수요(소비자의 일상적인 요구를 충족시키기 위해 최소한의 필요한 전력)를 충족시키기에 적합합니다. 안정적인 전력 공급이 가능한 것이 시장에서 화력 전력의 우위성으로 이어지고 있습니다.

- 따라서 위와 같이 예측 기간 중에는 화력 발전 부문이 시장을 독점할 가능성이 높습니다.

정부 정책 및 지원이 시장을 견인할 전망

- 정부 정책과 지원은 전력 분야의 성장에 필요한 명확한 로드맵, 재정적 인센티브, 규제 프레임 워크 및 인프라 개발을 제공하기 위해 인도 전력 시장의 중요한 촉진요인입니다. 신재생 에너지, 에너지 효율, 그리드 통합, 디지털화를 추진함으로써 정부는 투자를 유치하고 혁신을 촉진하며 인도의 지속 가능하고 신뢰성 높은 전력 시장으로의 이행을 촉진하는 환경을 만들어 내고 있습니다.

- 인도 정부는 에너지 믹스 전체에서 차지하는 자연 에너지의 비율을 높이기 위해 야심적인 자연 에너지 목표를 설정하고 있습니다. 국가 태양광 발전 미션(National Solar Mission), 국가 풍력 발전 미션(National Wind Energy Mission), 다양한 주 차원의 재생 에너지 정책 등의 정책은 재생 에너지 발전 프로젝트 개발에 인센티브를 부여하고 지원하고 있습니다. 이러한 이니셔티브는 투자를 유치하고 규제 프로세스를 합리화하며 재정적 인센티브를 제공하여 재생 에너지 성장에 유리한 환경을 확보하는 것을 목적으로 하고 있습니다.

- 국가의 지속가능한 변혁을 촉진하기 위해 정부는 2030년까지 신재생가 에너지 설비 용량 500기가와트(GW)를 달성한다는 매우 큰 목표를 내걸고 있습니다. 이 목표에는, 태양광 발전이 280 GW, 풍력 발전이 140 GW의 도입이 포함되어 나라 전체에서 중요한 그린 혁명을 추진하는 것을 목표로 하고 있습니다.

- 2022년 인도의 신재생 에너지 설비 용량은 162GW를 넘어섰으며, 2021년의 147GW와 비교해, 신재생 에너지의 적응이 진행되고 있는 것을 나타내고 있어, 결과적으로 인도의 전력 시장을 견인하고 있습니다.

- 2023년 3월 인도는 신재생 에너지 부문 확대를 위한 명확한 길을 그렸고, 그 성장을 위한 명확한 로드맵을 나타냈습니다. 이 비전의 일환으로서 인도는 2024년 3월까지, 합계 발전 용량 40 기가 와트의 울트라 메가 솔라 파크의 설립에 임했습니다. 이 야심찬 이니셔티브는 재생 에너지 인프라를 확대하고 지속 가능한 미래를 키우겠다는 인도의 확고한 헌신을 보여줍니다.

- 또한 정부는 신재생 에너지 도입 및 에너지 효율화 대책을 촉진하기 위해 다양한 재정적 인센티브와 보조금을 제공하고 있습니다. 여기에는 자본 보조금, 발전량 기반 인센티브, 세제 혜택, 양허적 대출, 실행 가능성 갭 자금 등이 포함됩니다. 이러한 인센티브는 신재생 에너지 프로젝트를 재정적으로 매력적으로 만들고 전력 시장에 민간 부문의 진입을 촉진합니다.

- 따라서 위와 같이 정부의 지원정책이 예측 기간 중 시장을 견인할 것으로 예상됩니다.

인도의 전력 산업 개요

인도의 전력 시장은 반 고정적입니다. 이 시장의 주요 기업에는 NTPC Ltd, NLC India Ltd, SJVN Ltd, JSW Group, Power Grid Corporation India Ltd 등이 있습니다.(순부동)

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 조사 방법

제3장 주요 요약

제4장 시장 개요

- 서문

- 인도 발전 설비 용량 예측2028년)

- 발전 설비 용량의 주별 점유율(%)(2022년)

- 인도의 발전 및 소비량 예측(단위 : 테라와트시)(-2028년)

- 최근 동향 및 개발

- 정부의 규제 및 정책

- 시장 역학

- 성장 촉진요인

- 에너지 수요 증가

- 전력 부문에 대한 정부의 지원

- 성장 억제요인

- 재정 능력

- 성장 촉진요인

- 공급망 분석

- PESTLE 분석

제5장 시장 세분화

- 전력별

- 화력

- 수력

- 신재생 에너지

- 기타

- 송배전

제6장 경쟁 구도

- M&A, 합작사업, 제휴 및 협정

- 주요 기업의 전략

- 기업 프로파일

- Adani Group

- JSW Group

- NHPC Ltd

- NLC India Ltd.

- NTPC Ltd.

- Power Grid Corporation India Ltd.

- Reliance Power Limited

- SJVN Ltd.

- Tata Power Company Limited

- Torrent Power Ltd.

제7장 시장 기회 및 향후 동향

- 신재생 에너지 성장

The India Power Market size in terms of installed base is expected to grow from 536.23 gigawatt in 2025 to 817.52 gigawatt by 2030, at a CAGR of 8.8% during the forecast period (2025-2030).

Key Highlights

- Over the medium period, factors such as supportive government policies, rising electricity demand due to infrastructural activities, and rising population are expected to drive the market during the forecasted period.

- On the other hand, huge investment is required to set up and modernize power generation, transmission & distribution networks, and weak private sector investments are expected to hinder the growth of the Indian power market.

- Nevertheless, India has abundant availability of solar irradiance and receives solar energy throughout the year. This has created enormous opportunities to exploit solar energy from the sunniest sites in the country, especially Rajasthan, Gujarat, and Andhra Pradesh. The factor above, clubbed with foreign investment and extensive power projects, provides an opportunity to grow the power market in India.

India Power Market Trends

Thermal Source for Power Generation to Dominate the Market

- India has significant coal reserves, a readily available and relatively affordable fuel source for power generation. The country's large coal reserves have made it a major producer and consumer, making thermal power plants an attractive option for meeting the growing electricity demand.

- Moreover, India has a well-established infrastructure for coal-based thermal power generation. Numerous coal mines, transportation networks, and coal-fired power plants are already operating. This existing infrastructure provides a foundation for the market's dominance of thermal power generation.

- Furthermore, in September 2022, the Ministry of Energy India announced that the country is preparing to add as much as 56 GW of coal-fired generation capacity by 2030 to meet the growing electricity demand. The increase in coal-fired capacity would represent about a 25% jump above the country's current 204 GW of coal-fueled generation from 285 coal thermal power plants.

- As of November 2023, India heavily relies on thermal power sources for generating electricity, with a total installed capacity of 239.07 GW, accounting for more than 56% of the country's electricity generation capacity.

- Additionally, thermal power plants, especially those using coal, have been cost-competitive compared to alternative sources such as renewable energy. The initial capital investment for setting up thermal power plants is often lower, and the operating costs, including fuel costs, have been relatively stable compared to volatile oil and gas prices.

- Thermal power plants can provide a consistent and reliable supply of electricity, making them suitable for meeting the base load demand, which is the minimum level of power required to meet the everyday needs of consumers. The ability to provide a stable power supply has contributed to the dominance of thermal sources in the market.

- Therefore, as mentioned above, the thermal power sector will likely dominate the market during the forecasted period.

Government Policies and Support are Expected to Drive the Market

- Government policies and support are crucial drivers of the Indian power market as they provide a clear roadmap, financial incentives, regulatory frameworks, and infrastructure development necessary for the sector's growth. By promoting renewable energy, energy efficiency, grid integration, and digitalization, the government creates an enabling environment that attracts investments, fosters innovation, and facilitates the transition toward a sustainable and reliable power market in India.

- The Indian government has set ambitious renewable energy targets to increase the share of renewables in the overall energy mix. Policies such as the National Solar Mission, National Wind Energy Mission, and various state-level renewable energy policies provide incentives and support for developing renewable power projects. These initiatives aim to attract investments, streamline regulatory processes, provide financial incentives, and ensure a favorable environment for renewable energy growth.

- To catalyze a sustainable transformation in the nation, the government has established a formidable objective of achieving 500 gigawatts (GW) of installed renewable energy capacity by 2030. This target encompasses the installation of 280 GW from solar power and 140 GW from wind power sources, aiming to drive a significant green revolution across the country.

- As of 2022, the country has more than 162 GW of installed renewable energy capacity compared to 147 GW in 2021, signifying the increasing adaption of renewable energy in the country, consequently driving the power market in India.

- In March 2023, India charted a definitive path for expanding its renewable energy sector, outlining a clear roadmap for its growth. As part of this vision, the country is committed to establishing Ultra Mega Solar Parks with a combined generation capacity of 40 gigawatts by March 2024. This ambitious initiative demonstrates India's steadfast dedication to scaling up its renewable energy infrastructure and fostering a sustainable future.

- Additionally, the government offers various financial incentives and subsidies to promote renewable energy deployment and energy efficiency measures. These include capital subsidies, generation-based incentives, tax benefits, concessional financing, and viability gap funding. Such incentives make renewable projects financially attractive and encourage private sector participation in the power market.

- Therefore as per the above mentioned point, supportive government policies are expected to drive the market during the forecasted period.

India Power Industry Overview

The Indian power market is semi-consolidated. Some key players in this market (not in a particular order) include NTPC Ltd, NLC India Ltd, SJVN Ltd, JSW Group, and Power Grid Corporation India Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 India Installed Power Generating Capacity Forecast, till 2028

- 4.3 Share of Installed Power Generation Capacity (%), by State, India, 2022

- 4.4 Electricity Generation and Consumption Forecast, in Terawatt Hours, India, till 2028

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.1.1 Increasing Energy Demand

- 4.7.1.2 Government Support for Power Sector

- 4.7.2 Restraints

- 4.7.2.1 Financial Viability

- 4.7.1 Drivers

- 4.8 Supply Chain Analysis

- 4.9 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Generation

- 5.1.1 Thermal

- 5.1.2 Hydro

- 5.1.3 Renewable

- 5.1.4 Others

- 5.2 Transmission and Distribution

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Adani Group

- 6.3.2 JSW Group

- 6.3.3 NHPC Ltd

- 6.3.4 NLC India Ltd.

- 6.3.5 NTPC Ltd.

- 6.3.6 Power Grid Corporation India Ltd.

- 6.3.7 Reliance Power Limited

- 6.3.8 SJVN Ltd.

- 6.3.9 Tata Power Company Limited

- 6.3.10 Torrent Power Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Renewable Energy Growth