|

시장보고서

상품코드

1686603

농업용 필름 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Agriculture Films - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

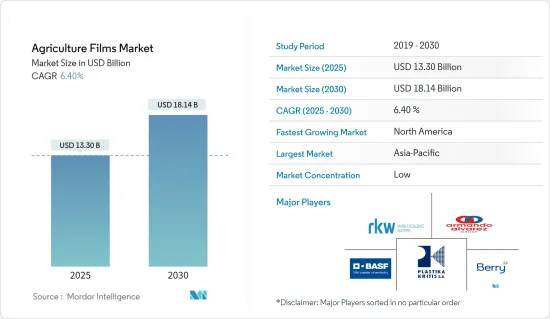

농업용 필름 시장 규모는 2025년에 133억 달러로 추정되고, 예측 기간인 2025-2030년 CAGR 6.4%로 성장할 전망이며, 2030년에는 181억 4,000만 달러에 달할 것으로 예측되고 있습니다.

농업용 필름은 토양 보호, 온실 재배, 멀칭 등 농업에서 폭넓게 사용되는 자재입니다. 이러한 필름은 토양 침식 및 압축 저감, 온도 조절, 영양 유지, 종자 발아 개선, 잡초 억제, 자외선으로부터의 보호 등 수많은 이점을 가져옵니다. 농업용 필름 시장은 보호된 재배 방법의 채택 증가, 작물 수확량 향상에 대한 주력, 멀칭 필름의 보급, 생분해성 옵션에 대한 수요 증가 등 몇 가지 요인에 의해 견인되고 있습니다. 인구 증가 및 경지 면적 감소로 인한 세계 식량안보 우려가 농업 생산성을 향상시키는 수단으로 농업용 필름의 수요를 더욱 높이고 있습니다.

농업용 필름의 주요 용도는 멀칭이며, 필름을 사용한 토양 멀칭은 세계의 농업에서 점점 널리 사용되고 있습니다. 환경문제에 대한 우려로 생분해성 필름에 대한 소비자 기호가 높아지고 있는 것도 이 성숙 시장의 중요한 촉진요인이 되고 있습니다. 멀칭 필름은 옥수수나 콩 재배에 널리 사용되고 있습니다. 대학과 연구자들은 농업에서 멀칭 필름 사용을 강화하는 방법을 적극적으로 연구하고 있으며, 보다 지속 가능한 솔루션에 초점을 맞추고 있습니다. 2024년에는 리하이대 연구진이 작물에 영양분을 공급하는 생분해성 멀칭 필름을 개발해 기존 플라스틱 필름을 대체할 친환경 대체품을 제공했습니다. 게다가 미국 농무성(USDA)과 그 국립 식품 농업 연구소는, 'PARTNERSHIP : Engineering Nutrient-Enhanced Mulch Film to Improve Degradation and Soil Health'라고 제목을 붙이는 프로젝트에 대해, 74만 4,000달러의 연구 조성금을 수여했습니다. 2024년 7월부터 2028년 6월까지의 여러 해에 걸친 이 대처에는, 매사추세츠 대학 로웰교, 애리조나주 마리코파의 미국 농무성 농업 연구국, 이스라엘의 벤구리온 대학의 전문가에 의한 공동 연구가 포함됩니다.

농업용 필름은 작물을 저온으로부터 지키기 위해, 온실이나 사료 포장 등 다양한 농법으로 널리 사용되고 있습니다. 캐나다는 겨울이 길기 때문에 기온이 낮아 농작물의 생육이 방해됩니다. 따라서 수입 의존도를 낮추기 위해 온실과 같은 보호된 재배 방법의 사용이 증가하고 있어 온실용 필름의 수요를 견인하고 있습니다. 캐나다의 온실 재배 면적은 몇 년 전부터 확대되고 있습니다. 캐나다 농무부에 따르면 2023년에는 캐나다에서 920개의 상업 온실 채소 사업이 진행되어 80만 2,163톤의 채소가 생산되었습니다. 이는 2022년과 비교하여 7%의 생산량 증가입니다. 온타리오 주는 2023년에도 온실 채소 시장의 리더로 남아 캐나다 전체 생산량의 72%를 차지했습니다. 그 다음은 브리티시컬럼비아주가 14%, 퀘벡이 8%였습니다. 나머지 주는 합계 총 생산량의 6%를 차지했습니다. 이러한 온실 산업 성장이 시장의 온실용 필름 수요를 촉진하고 있습니다.

환경 문제에 대한 관심이 생분해성 농업용 필름 수요 증가를 뒷받침하고 있습니다. 이러한 친환경 대체품은 잡초를 억제하고 온도를 조정하며 토양의 영양분과 수분을 유지하고 식물의 안정성을 높이는 데 도움이 됩니다. 세계 각국의 정부는 지속 가능한 농업과 친환경 농법을 추진하고 있으며, 이것이 향후 수년간의 시장 성장을 지원할 것으로 예측되고 있습니다.

농업용 필름 시장 동향

온실용 용도가 시장을 독점

온실용 필름은 계절을 불문하고 작물의 수량을 늘릴 수 있기 때문에 생산자들 사이에서 인기를 끌고 있습니다. 전통적인 농법에 비해 온실의 생산 능력이 높은 것과 인구증가 및 기후변화의 과제로 인한 식량수요의 증대가 맞물려 이 분야의 성장을 촉진할 것으로 예상됩니다. 온실 환경은 작물 재배에 제어된 환경을 제공하고, 식물의 유전자를 강화하고, 보다 건강한 품종의 성장을 촉진할 가능성이 있습니다. 온실에 사용되는 폴리카보네이트 기반의 투명 플라스틱 필름은 유리 구조에 비해 온도 조절과 단열성이 우수합니다. 이러한 요소와 온실용 필름의 비용 대비 효과가 높아 이 분야의 수요를 뒷받침할 것으로 보입니다.

세계 인구 증가와 식량 안보에 대한 관심 고조가 보호 농업의 채용을 촉진하고 있습니다. 이 방법은 작물의 생육 기간을 연장하고 수확량을 증가시키기 때문에 결과적으로 농업용 플라스틱의 수요를 끌어올리고 있습니다. 이 재료들은 작물의 품질을 향상시키면서 헥타르당 생산량을 확보하고 대폭 증가시키기 위해 매우 중요합니다. 농업용 필름은 날씨, 해충, 잡초와 관련된 작물의 부패 위험을 줄이고, 특히 온실에서는 생애주기 전체를 통해 작물의 품질을 향상시키는 데 도움이 됩니다. 폴리에틸렌은 농업용 필름에 많이 쓰이는 소재로 온실이나 터널 안에서 작물을 보호하고 수확량을 향상시킵니다.

또한 특히 GCC 지역에서는 자급률 향상을 위해 온실 생산을 확대하고 있는 국가가 여러 개 있습니다. 이 지역에서는 많은 온실 시설이 개발되어 증산으로 이어지고 있습니다. 예를 들어 농업부에 따르면 2023년 카타르의 온실 생산 면적은 666.4 헥타르, 수확량은 67,263.6톤이었습니다. 마찬가지로 러시아 연방 농업부에 따르면 러시아의 온실 채소 생산량은 2023년에 사상 최고인 158만 톤에 달했고, 온실 면적은 3,280헥타르에 달했습니다. 주요 작물은 토마토, 오이, 가지, 피망, 채소, 양상추 등입니다. 온실을 이용한 과일과 채소의 생산이 증가하고 있기 때문에 이 분야에 대한 투자가 촉진되어 결과적으로 농업용 필름의 수요가 증가하고 있습니다.

제조업체는 농업용 필름의 성능과 수명을 향상시키기 위해 다양한 첨가제를 포함하고 있습니다. 이들 첨가제에는 농약내성제, 자외선(UV) 흡수제, 방담화합물 등이 있어 온실용 필름의 내구성 및 효력을 향상시키고 있습니다. 나노기술 및 초고온 재료 등의 기술을 이용한 선진 농업용 필름 개발로 예측 기간 동안 온실 용도의 이러한 제품 수요가 촉진될 것으로 예상됩니다.

아시아태평양이 최대 시장

아시아태평양은 세계의 온실 채소 재배 면적의 절반 가까이를 차지하고 있습니다. 이 지역의 농업용 필름 시장을 견인하는 주요 요인으로는 대규모 온실 채소 재배, 고부가가치로 수출 지향적인 과일 및 채소 생산에 대한 중점화, 번성한 농업 산업 등을 들 수 있습니다. 환경 의식의 고조로 소비자는 생분해성 필름을 선호하게 되어 시장 성장을 더욱 자극하고 있습니다. 1인당 농지 이용 가능 면적이 계속 감소하고 있기 때문에 생산성 향상이 매우 중요해지고 있습니다. 유엔식량농업기구(FAO)의 통계연감 '세계식량과 농업 2023'에 따르면 2023년 베트남의 1인당 농지 이용 가능 면적은 약 0.3헥타르로 세계 최저 수준이었습니다. 이는 이 나라의 높은 인구 밀도와 제한된 토지 자원을 반영하고 있습니다. 생산량을 해치지 않고 농지 부족에 대처하기 위한 고수확 작물에 대한 요구는 온실 재배에 의해 충족될 가능성이 있고, 이 분야에서의 농업용 필름의 이용이 증가할 가능성이 있습니다.

인도의 농업에서는 멀칭이 여전히 전통적인 방법으로 널리 사용되고 있습니다. 그러나 NGO 톡식 링크스와 마니팔 고등교육 아카데미의 2022년 조사를 통해 인도 농지의 미세 플라스틱 오염의 중대한 문제가 밝혀졌습니다. 이 문제는 작물 보호를 위해 멀칭 필름이 많이 사용되는 것에 기인하고 있습니다. 밭이나 온실 커버로 사용되는 이 필름들은 분해되어 직경 5mm 이하의 플라스틱 입자를 방출합니다. 이러한 미세 플라스틱은 토양 깊숙한 곳까지 침투하여 작물, 나아가 인간의 건강에 영향을 미칠 수 있습니다. 이러한 우려로 인도에서는 생분해성 필름이나 퇴비화 가능 필름의 채용이 진행될 것으로 예측됩니다.

사일리지 생산은 전통적인 사료를 대체하는 경제적 선택으로 아시아의 여러 나라에서 인기를 끌고 있습니다. 지방자치단체는 소에게 고품질의 사료를 공급하고 축산을 강화하기 위해 사일리지 생산을 적극적으로 추진하고 있습니다. 예를 들어 2021년 포옌성 경제국은 베트남 국립종자주식회사와 협력해 이 성에서 옥수수 사일리지 생산 및 소비의 연계 모델을 실시했습니다. 이러한 대처에 의해, 동지역에서의 사일리지 생산이 촉진되어, 이 분야에 있어서의 농업용 필름의 수요를 견인할 것으로 예상됩니다. 게다가 싱가폴의 난요이공대학에 의한 2020년의 연구에서는, 폴리카프롤락톤, 폴리에틸렌, 폴리비닐 알코올, 아크릴레이트계 폴리머등의 합성 폴리머가, 토양을 덮어 수분의 손실을 막는 멀칭으로서 사용할 수 있는 것이 판명되었습니다. 이 분야에서 연구 개발 활동의 활발화가, 농업용 필름 시장의 성장에 한층 더 공헌하고 있습니다.

또한 아시아태평양, 특히 호주 농가에서는 작물의 생산성과 품질을 향상시키기 위해 보호 농법을 채택하는 경우가 늘어나고 있습니다. 2022년 협동연구센터는 '온실 양상추 에너지 사용과 생산성에 미치는 스마트 유리 필름의 영향'이라는 제목의 프로젝트를 시행했습니다. 이 연구에서는, 온실 양상추 생산에 있어서의 에너지 절약 스마트 유리와 광시프트 LLEAF 필름의 성능을 평가했습니다. 웨스턴 시드니 대학(WSU)의 작물 과학자는, 업계 파트너인 LLEAF Pty Ltd와 Rijk Zwaan의 지원을 받아, 이 프로젝트에서 Hort Innovation과 협력했습니다. 농업용 필름에 관한 이러한 조사 연구는 시장에 긍정적인 영향을 줄 것으로 예상됩니다.

농업용 필름 산업 개요

농업용 필름 시장은 소수의 유력 기업과 여러 소규모 및 지역 기업이 존재하기 때문에 단편화되어 있습니다. Berry Global Inc., BASF SE, Armando Alvarez Group, RKW Group, and Plastika Kritis SA 등이 시장의 주요 기업들입니다. 주요 업계 참가자들은 생분해성으로 보존기간이 긴 제품을 상품화하기 위해 연구개발에 많은 투자를 하고 있습니다. 주요 기업은 미래의 지속 가능한 제품 혁신을 확실히 하기 위해 바이오 테크놀로지 기업과 제휴하고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 온실 재배 농산물의 수확 면적 증가

- 농업에서 멀칭 필름의 이용 확대

- 주요 기업에 의한 기술 혁신

- 시장 성장 억제요인

- 높은 초기 투자

- 플라스틱의 환경에 악영향

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 유형별

- 저밀도 폴리에틸렌

- 선형 저밀도 폴리에틸렌

- 고밀도 폴리에틸렌

- 에틸비닐아세테이트(EVA) 및 에틸렌부틸아크릴레이트(EBA)

- 재생품

- 기타 유형(폴리프로필렌 농업용 필름, 폴리아미드 농업용 필름, 에틸렌비닐알코올 공중합 수지, PVC)

- 용도별

- 비닐 하우스

- 사일리지

- 멀칭

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 기타 북미

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 호주

- 일본

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 아프리카

- 남아프리카

- 이집트

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 가장 채용된 전략

- 시장 점유율 분석

- 기업 프로파일

- AB Rani Plast Oy

- BASF SE

- Berry Global Inc.

- Plastika Kritis SA

- Novamont SpA

- ExxonMobil Chemical

- Armando Alvarez Group

- Group Barbier

- RKW Group

- INDVECO Group

제7장 시장 기회 및 향후 동향

AJY 25.04.29The Agriculture Films Market size is estimated at USD 13.30 billion in 2025, and is expected to reach USD 18.14 billion by 2030, at a CAGR of 6.4% during the forecast period (2025-2030).

Agricultural films are materials used extensively in farming for soil protection, greenhouse cultivation, and mulching. These films provide numerous benefits, including reduced soil erosion and compaction, temperature regulation, nutrient retention, improved seed germination, weed suppression, and protection against UV radiation. The agricultural film market is driven by several factors, including the increasing adoption of protected cultivation practices, a focus on enhancing crop yields, the widespread use of mulching films, and the growing demand for biodegradable options. Global food security concerns, stemming from a rising population and declining arable land, are further bolstering the demand for agricultural films as a means to improve agricultural productivity.

Mulching is a key application of agricultural films, with soil mulching using films becoming increasingly common in global agriculture. The growing consumer preference for biodegradable films, driven by environmental concerns, serves as a significant driver for this mature market. Mulch films are widely used in corn and soybean cultivation. Universities and researchers are actively studying ways to enhance the use of mulch films in agriculture, focusing on more sustainable solutions. In 2024, Lehigh University researchers developed biodegradable mulch films that deliver nutrients to crops, offering an environmentally friendly alternative to traditional plastic films. Additionally, the United States Department of Agriculture (USDA) and its National Institute of Food and Agriculture awarded a USD 744,000 research grant for a project titled "PARTNERSHIP: Engineering Nutrient-Enhanced Mulch Film to Improve Degradation and Soil Health." This multi-year initiative, running from July 2024 through June 2028, involves collaboration among experts from the University of Massachusetts Lowell, the USDA Agricultural Research Service in Maricopa, Arizona, and Ben Gurion University in Israel.

Agricultural films are widely used in various farming practices, including greenhouses and fodder packaging, to protect crops from cold temperatures. Canada's predominantly low temperatures due to long winters hinder crop growth, leading to a reliance on imports to meet demand. Consequently, the use of protected cultivation methods like greenhouses is increasing to reduce import dependency, driving the demand for greenhouse films. The area under greenhouse cultivation in Canada has been expanding for several years. According to the Ministry of Canada, in 2023, Canada had 920 commercial greenhouse vegetable operations, producing 802,163 metric tons of vegetables. This represented a 7% increase in production compared to 2022. Ontario remained the leader in the greenhouse vegetable market in 2023, accounting for 72% of Canada's total production. British Columbia followed with 14%, and Quebec with 8%. The remaining provinces collectively contributed 6% to the total production. This growth in the greenhouse industry is fueling the demand for greenhouse films in the market.

Environmental concerns are driving increased demand for biodegradable agricultural films. These eco-friendly alternatives help suppress weeds, regulate temperature, preserve soil nutrients and moisture, and enhance plant stability. Governments worldwide are promoting sustainable agriculture and eco-friendly farming practices, which is projected to support market growth in the coming years.

Agriculture Films Market Trends

Greenhouse Applications Dominate the Market

Greenhouse films are gaining popularity among growers due to their ability to increase crop yields across all seasons. The higher production capacity of greenhouses compared to traditional farming methods, coupled with the rising food demand from population growth and climate change challenges, is expected to drive the growth of this segment. Greenhouse environments provide a controlled setting for crop cultivation, potentially enhancing plant genetics and promoting the growth of healthier varieties. Polycarbonate-based clear plastic films used in greenhouses offer superior temperature regulation and insulation compared to glass structures. These factors, combined with the cost-effectiveness of greenhouse films, are likely to fuel demand in this segment.

The growing global population and increasing food security concerns are driving the adoption of protected agriculture. This method extends crop growing seasons and increases yields, consequently boosting the demand for agricultural plastics. These materials are crucial for securing and significantly increasing output per hectare while enhancing crop quality. Agricultural films help reduce crop spoilage risks associated with weather, pests, and weeds, improving overall crop quality throughout the lifecycle, particularly in greenhouses. Polyethylene is a commonly used material for agricultural films, protecting crops and improving yields in greenhouses and tunnels.

In addition, several countries have expanded greenhouse production to enhance self-sufficiency, particularly in the GCC region. This area has seen the development of numerous greenhouse facilities, leading to increased production. For example, according to the Department of Agriculture, Qatar's greenhouse production in 2023 covered 666.4 hectares and yielded 67,263.6 metric tons. Similarly, the Ministry of Agriculture of the Russian Federation reported that greenhouse vegetable production in Russia reached a record 1.58 million tons in 2023, across 3.28 thousand hectares of greenhouse space. The primary crops included tomatoes, cucumbers, eggplants, bell peppers, greens, and lettuce. This growth in fruit and vegetable production through greenhouses is driving investments in the sector, consequently increasing the demand for agricultural films.

Manufacturers are incorporating various additives into agricultural films to enhance their performance and longevity. These additives include agrochemical resistance agents, ultraviolet (UV) absorbers, and anti-fogging compounds, which improve the durability and efficacy of greenhouse films. The development of advanced agricultural films using technologies such as nanotechnology and ultra-thermic materials is expected to drive demand for these products in greenhouse applications during the forecast period.

Asia-Pacific is the Largest Market

The Asia-Pacific region accounts for nearly half of the global greenhouse vegetable cultivation area. Key factors driving the agricultural film market in the region include extensive greenhouse vegetable cultivation, growing emphasis on high-value and export-oriented fruit and vegetable production, and a thriving agriculture industry. Rising environmental awareness has led consumers to prefer biodegradable films, further stimulating market growth. Increasing productivity has become crucial due to the continuous decline in per capita farmland availability. According to the Food and Agriculture Organization's (FAO) Statistical Yearbook World Food and Agriculture 2023, Vietnam's per capita agricultural land availability in 2023 was approximately 0.3 hectares per person, one of the world's lowest rates. This reflects the country's high population density and limited land resources. The need for high-yielding crops to address farmland scarcity without compromising production volumes may be met through greenhouse farming, potentially increasing the use of agricultural films in this sector.

Mulching remains a traditional and widely used method in Indian agriculture. However, a 2022 research study by NGO Toxic Links and Manipal Academy of Higher Education revealed a significant microplastic contamination problem in India's agricultural fields. This issue stems from the extensive use of mulch films for crop protection. These films, used in fields or as greenhouse covers, degrade and release plastic particles smaller than 5 millimeters in diameter. These microplastics can penetrate deep into the soil, potentially affecting crops and, subsequently, human health. These concerns are projected to drive the adoption of biodegradable and compostable films in India.

Silage production is gaining traction in various Asian countries as an economical alternative to traditional forage. Local authorities are actively promoting silage production to provide high-quality forage for cattle and enhance livestock production. For instance, in 2021, the Economic Office of Pho Yen collaborated with the Vietnam National Seed Joint Stock Company to implement a corn silage production and consumption linkage model in the province. These initiatives are boosting silage production in the region, which is anticipated to drive the demand for agricultural films in this segment. Additionally, a 2020 study by Nanyang Technological University in Singapore found that synthetic polymers such as polycaprolactone, polyethylene, polyvinyl alcohol, and acrylate-based polymers can be used as mulch to cover soil and prevent moisture loss. The increasing research and development activities in this area are further contributing to the growth of the agricultural film market.

Moreover, Farmers in Asia-Pacific, especially in Australia, are increasingly adopting protected agricultural practices to improve crop productivity and quality. In 2022, the Cooperative Research Centre conducted a project titled 'Smart Glass film impacts on energy use and Productivity in greenhouse lettuce'. This study evaluated the performance of energy-saving smart glass and light-shifting LLEAF film in greenhouse lettuce production. Crop scientists at Western Sydney University (WSU) collaborated with Hort Innovation on this project, supported by industry partners LLEAF Pty Ltd and Rijk Zwaan. Such research studies on agriculture films are anticipated to positively impact the market.

Agriculture Films Industry Overview

The agricultural films market is fragmented due to the presence of a few prominent players and several small-scale and regional players. Berry Global Inc., BASF SE, Armando Alvarez Group, RKW Group, and Plastika Kritis SA are some of the major players in the market. Major industry participants have been investing heavily in R&D for commercializing biodegradable and longer shelf-life products. The key companies are partnering with biotechnology firms to ensure sustainable product innovation in the future.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Harvested Area of Greenhouse Produce

- 4.2.2 Growing Use of Mulch Films in Agriculture

- 4.2.3 Innovations by Major Players

- 4.3 Market Restraints

- 4.3.1 High Initial Investment

- 4.3.2 Adverse Effects of Plastics on Environment

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Low-Density Polyethylene

- 5.1.2 Linear Low-Density Polyethylene

- 5.1.3 High-Density Polyethylene

- 5.1.4 Ethyl Vinyl Acetate (EVA)/Ethylene Butyl Acrylate (EBA)

- 5.1.5 Reclaims

- 5.1.6 Other Types (Polypropylene Agricultural Films, Polyamide Agricultural Films, Ethylene Vinyl-Alcohol Copolymer Resins, and PVC)

- 5.2 Application

- 5.2.1 Greenhouse

- 5.2.2 Silage

- 5.2.3 Mulching

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Australia

- 5.3.3.4 Japan

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Egypt

- 5.3.5.3 Rest of Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 AB Rani Plast Oy

- 6.3.2 BASF SE

- 6.3.3 Berry Global Inc.

- 6.3.4 Plastika Kritis SA

- 6.3.5 Novamont SpA

- 6.3.6 ExxonMobil Chemical

- 6.3.7 Armando Alvarez Group

- 6.3.8 Group Barbier

- 6.3.9 RKW Group

- 6.3.10 INDVECO Group