|

시장보고서

상품코드

1686622

진단용 방사성 의약품 및 조영제 시장 : 시장 점유율 분석, 산업 동향, 성장 예측(2025-2030년)Global Diagnostic Radiopharmaceuticals and Contrast Media - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

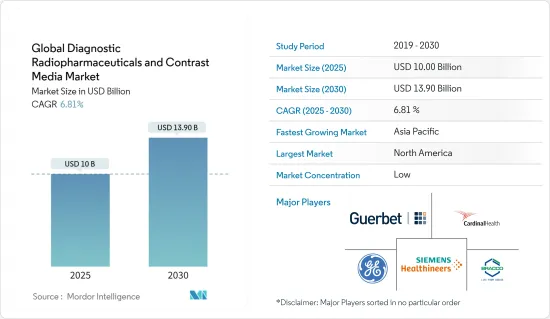

세계의 진단용 방사성 의약품 및 조영제 시장 규모는 2025년에 100억 달러로 추정되고, 예측 기간인 2025-2030년 CAGR 6.81%로 성장할 전망이며, 2030년에는 139억 달러에 달할 것으로 예측됩니다.

COVID-19 팬데믹은 조사 대상 시장의 성장에 영향을 미칠 것으로 예상됩니다. Journal of Nuclear Medicine지에 게재된 조사연구에 따르면 2020년 7월 많은 국가에서 방사성 의약품 공급 문제가 발생해 저소득층이 가장 고통받았습니다. 더욱이 2020년 9월 발표된 연구 '코로나19로 인한 핵의학량 급감'으로 실시된 조사에 따르면 미국에서는 팬데믹 동안 예정됐던 진단 및 치료 핵영상 처리가 각각 50%에서 75% 정량적으로 감소했습니다. 따라서 팬데믹 기간 동안은 앞서 언급한 요인에 의해 단기적으로 부정적인 영향을 받을 것으로 예상됩니다.

진단용 방사성 의약품 및 조영제 시장은 기술 개발, 다양한 질환에서 진단 용도의 확대, 정부 지원의 확대, 암이나 심혈관 질환 등의 만성 질환의 세계 증가에 의해 예측 기간 중에 성장할 것으로 예상됩니다. Globocan 2020의 팩트시트에 따르면 세계에서 새롭게 암으로 진단된 환자는 추정 1,929만 2,789명, 암으로 인한 사망자 수는 약 995만 8,133명이었습니다. 게다가 국제암연구기관(IARC)의 추계에 의하면, 2040년까지, 암에 의한 세계 부담은, 새롭게 2,750만 명의 암 환자가 발생해, 1,630만 명이 사망한다고 예측되고 있습니다. 따라서 암 부담의 증대는 진단과 효과적인 치료에 대한 수요를 촉진하고 조사된 시장의 성장을 촉진할 것으로 예상됩니다. 또한 저침습 치료법의 개발이 화상 기기의 사용을 촉진하고 있습니다. 이러한 이미지 가이던스의 수요 증가는 시장을 촉진할 것으로 예상됩니다. 또한 새로운 기술 개발에 대한 정부의 노력과 자금 지원은 조사 시장의 성장을 촉진할 것으로 예측되고 있습니다. 예를 들어 2019년 7월 미국 정부에 의해 'Medicare Diagnostic Radiopharmaceutical Payment Equity Act of 2019'라고 명명된 새 법안이 통과되었습니다. 이 새로운 법안은 화상 진단 서비스에 대한 메디케어 지불 방법을 변경함으로써 위중한 신경 질환에 대한 고타깃으로 보다 정확한 진단과 치료에 대한 접근을 확대하는 것을 목적으로 하고 있습니다. 그러나 방사성 의약품의 반감기가 짧은 것, 규제의 틀이 엄격한 것, 설비 투자가 고액인 것이 시장 성장에 방해가 될 것으로 예상됩니다.

진단용 방사성 의약품 및 조영제 시장 동향

순환기 하위 부문이 최대 시장 점유율을 획득, 예측 기간 동안에도 우위를 유지할 전망

심혈관 질환의 부담 증가가 이 분야의 성장을 견인할 것으로 보입니다. 미국심장협회(American Heart Association)의 2019년 조사에 따르면 심혈관질환 발생률은 해마다 증가하고 있으며 앞으로도 증가할 것으로 예측되었습니다. 세계보건기구(WHO)의 2020년 최신 정보에 따르면 허혈성 심장질환은 전 세계 총 사망자 수의 16%를 차지했습니다. 2000년 이후 사망자 수가 가장 증가하고 있는 것은 허혈성 심질환으로 2019년에는 전 세계적으로 200만 명 이상 증가해 890만 명이 사망했습니다. 게다가 영국 심장재단센터에 따르면 2018년 영국에서는 약 740만 명이 심장 및 순환기 질환과 함께 살고 있었습니다. 영국에서는 매년 75세 미만 43,000명 이상이 심장 및 순환기 질환으로 사망하고 있습니다. SPECT란 단광자 방사 단층 촬영의 약자로, 비침습적인 검사법으로, 심근의 이상 관류 영역을 정확하게 특정할 수 있습니다. 또한 심근의 기능적 능력을 판정하는 데도 사용됩니다. 살아있는 조직과 비가역적으로 손상된 조직을 분리합니다. 이 진단법은 관상동맥에 폐색이 있는지 여부, 환자가 관상동맥 조영을 받아야 하는지 여부를 의사가 판단하는 데 도움이 됩니다. SPECT에서는 99mTc-tetrofosmin(Myoview, GE 헬스케어), 99mTc-sestamibi(Cardiolite, Bristol-Myers Squibb), 염화탈륨-201 등의 심장 특이적 방사성 의약품이 투여됩니다. 따라서 심혈관질환 유병률 상승 및 진단의 기술적 진보 등의 요인이 예측 기간에 걸쳐 조사 대상 부문의 성장을 촉진할 것으로 예상됩니다.

북미가 최대 시장 점유율을 획득, 예측 기간 동안에도 그 우위성을 유지할 전망

진단용 방사성 의약품 및 조영제 시장 전체에서는 북미가 압도적인 점유율을 차지하고 미국이 이 시장에 대한 주요 공헌국이 되고 있습니다. 북미 지역에서는 심장 질환의 부담도 큽니다. 미국심장협회 조사보고서 2018에 따르면 미국의 심혈관질환으로 인한 사망원인 1위(43.8%)는 관상동맥성 심질환이며, 그 다음으로 뇌졸중(16.8%), 심부전(9.0%), 고혈압(9.4%), 동맥질환(3.1%), 기타 심혈관질환(17.9%)으로 나타났습니다. 2018년에 발표된 Global Health and Wellness Report에 따르면 미국 성인 인구의 40% 가까이가 심혈관 질환을 진단받았습니다. 방사성 의약품 및 조영 이미지는 심장 진단에 큰 가능성을 보이기 때문에 조사된 시장은 북미 지역에서 추진할 가능성이 높습니다. 또한 2020년에는, 에너지성의 국가 핵 안전 보장국(NNSA)이 북미 방사선 학회에 3년간 75만 달러의 조성금을 수여했습니다. 이것에 의해, 이러한 핵 화상 서비스를 필요로 하는 세계의 일부로, 이 중요한 지식에의 액세스를 확대할 수 있습니다. 또한 제품 인가의 증가가 시장 성장을 촉진할 것으로 예상됩니다. 예를 들면, 2019년 9월, Curium Pharma와 PadioMedix Inc.는 성인 환자의 소마토스타틴 수용체 양성신경내분비종양(NET)의 국재진단을 위한 PET(양전자방사단층촬영)제인 Detectnet(Cu64 도타테이트 구리주사액)의 미국 식품의약국의 승인을 취득했습니다. 따라서 앞서 언급한 요인들로 인해 북미의 진단용 방사성 의약품 및 조영제 시장은 예측 기간 중에도 우위를 유지할 것으로 예상됩니다.

진단용 방사성 의약품 및 조영제 산업의 개요

진단용 방사성 의약품 및 조영제 시장의 경쟁은 적당하며 소수의 대기업이 세계 시장을 독점하고 있습니다. Bayer AG, GE Company(GE 헬스케어), Cardinal Health Inc., Siemens Healthineers, Bracco Imaging SpA, Curium Pharma, Guerbet Group과 같은 주요 시장 기업의 존재가, 시장 전체의 경쟁 기업간의 적대 관계를 높이고 있습니다. 주요 기업들은 세계적으로 경쟁이 치열한 시장에서 지위를 확보하기 위해 인수, 합병, 제휴, 공동연구, 신제품 출시, 연구개발 투자 등의 전략적 제휴를 통해 진화하고 있습니다. 예를 들면, 2020년 3월, Curium Pharma는, 미국에서 심장 PET 이미징용 루비듐-82 제너레이터의 제조에 사용되는 스트론튬-82의 제조에 종사하는 제바콜 몰레큘러의 매수를 완료했습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 의료용 화상 처리 기술의 진보

- 영상 유도에 의한 처치 및 진단 수요 증가

- 암 및 심장 질환의 높은 유병률

- 시장 성장 억제요인

- 높은 기술 비용

- 한정된 의료보험

- 방사성 의약품의 짧은 반감기

- 업계의 매력-Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자 및 소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 방사성 의약품

- 이미징 모달리티별

- SPECT

- Tc-99

- Tl-201

- Ga-67

- I-123

- 기타 SPECT

- PET

- F-18

- Rb-82

- 기타 PET

- 용도별

- 진단 용도

- SPECT 용도

- 심장병학

- 신경학

- 갑상선

- 기타 SPECT 용도

- PET 용도

- 종양학

- 순환기 내과

- 신경학

- 기타 PET 용도

- 치료 용도

- 갑상선

- 림프종

- 내분비 종양

- 기타 치료 용도

- 이미징 모달리티별

- 조영제

- 유형별

- 요오드계 조영제

- 가돌리늄계 조영제

- 마이크로 버블 조영제

- 바륨계 조영제

- 수기별

- X선 및 컴퓨터 단층 촬영(CT)

- 자기 공명 영상법(MRI)

- 초음파

- 용도별

- 심혈관 질환

- 종양학

- 소화기 질환

- 신경질환

- 기타 용도

- 유형별

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 기업 프로파일

- NTP Radioisotopes SOC Ltd

- Bayer AG

- Bracco Imaging SpA

- Curium Pharma

- GE Company(GE Healthcare)

- Guerbet Group

- Lantheus Holdings Inc.

- Cardinal Health Inc.

- Nano Therapeutics Pvt Ltd

- Siemens Healthineers

- Trivitron Healthcare

- Koninklijke Philips NV

- Triad Isotopes

- Spago Nanomedical AB

- Otsuka Pharmaceuticals Co. Ltd

제7장 시장 기회 및 향후 동향

AJY 25.04.29The Global Diagnostic Radiopharmaceuticals and Contrast Media Market size is estimated at USD 10.00 billion in 2025, and is expected to reach USD 13.90 billion by 2030, at a CAGR of 6.81% during the forecast period (2025-2030).

The COVID-19 pandemic is expected to have impacted the growth of the studied market. According to the research study published in the Journal of Nuclear Medicine, in July 2020, many countries were experiencing radiopharmaceutical supply issues, with lower-income regions suffering the worst. Furthermore, according to a survey conducted in the study 'Nuclear medicine volume plummets due to COVID-19' published in September 2020, the scheduled diagnostic and therapeutic nuclear imaging procedures were quantitatively reduced by 50% to 75% respectively in the United States during the pandemic. Thus, the studied market is expected to witness a short-term negative impact during the pandemic due to the aforementioned factors.

The diagnostic radiopharmaceuticals and contrast media market is expected to grow over the forecast period due to technological developments, increasing diagnostic applications in various diseases, growing government support, and rising cases of chronic diseases such as cancers and cardiovascular diseases globally. According to the Globocan 2020 fact sheet, an estimated 19,292,789 new cancer cases were diagnosed worldwide, with nearly 9,958,133 deaths due to cancers globally. Additionally, according to estimates from the International Agency for Research on Cancer (IARC), by 2040, the global burden of cancers is expected to grow to 27.5 million new cancer cases and 16.3 million deaths worldwide. Hence, the growing burden of cancers is expected to drive the demand for diagnostics and effective treatment, which drives the growth of the studied market. Furthermore, the development of minimally invasive therapeutic procedures has encouraged the usage of imaging equipment. This increase in the demand for image guidance is expected to propel the market. Also, Government initiatives and funding for the development of new techniques are anticipated to drive the growth of the studied market. For instance, in July 2019, a new bill named the Medicare Diagnostic Radiopharmaceutical Payment Equity Act of 2019 was passed by the government of the United States. The new bill aims to extend access to high-targeted and more precise diagnosis and treatment of severe neurological diseases by changing the way of making medicare payments for imaging services. However, a shorter half-life of radiopharmaceuticals, stringent regulatory framework, and high capital investments are expected to hinder market growth.

Diagnostic Radiopharmaceuticals and Contrast Media Market Trends

The Cardiology Sub-segment Captured the Largest Market Share, and It is Expected to Retain its Dominance Over the Forecast Period

The growing burden of cardiovascular diseases is expected to drive the growth of the studied segment. The incidence of cardiovascular diseases has increased over the years and is expected to increase in the future, as per a 2019 study by the American Heart Association. As per the 2020 updates of the World Health Organization, ischemic heart disease is responsible for 16% of the world's total deaths. Since 2000, the largest increase in deaths has been for ischemic heart disease, rising by more than 2 million to 8.9 million deaths in 2019 globally. Furthermore, according to the British Heart Foundation Centre, in 2018, around 7.4 million people were living with heart and circulatory diseases in the United Kingdom. More than 43,000 people under the age of 75 in the United Kingdom die from heart and circulatory diseases each year. SPECT, which stands for single-photon emission computed tomography, is a non-invasive procedure that can accurately identify areas of abnormal myocardial perfusion. It is also used to determine the functional capacity of the heart muscle. It separates living tissue from irreversibly damaged tissue. This diagnostic procedure helps physicians determine if there are blockages in the coronary (heart) arteries and if the patient should undergo a coronary angiogram. In SPECT, cardiac-specific radiopharmaceuticals, such as 99mTc-tetrofosmin (Myoview, GE healthcare), 99mTc-sestamibi (Cardiolite, Bristol-Myers Squibb), or Thallium-201 chloride are administered. Hence, factors such as the rising prevalence of cardiovascular diseases and technological advancements in diagnostics are expected to drive the growth of the studied segment over the forecast period.

North America Captured the Largest Market Share, and It is Expected to Retain its Dominance Over the Forecast Period

North America dominated the overall diagnostic radiopharmaceuticals and contrast media market, with the United States accounting for the major contributor to the market. In the North American region, the burden of Cardiac disorder is also high. According to the American Heart Association Research Report 2018, coronary heart disease was the leading cause (43.8%) of deaths attributable to cardiovascular disease in the United States, followed by stroke (16.8%), heart failure (9.0%), high blood pressure (9.4%), diseases of the arteries (3.1%), and other cardiovascular diseases (17.9%). According to the Global Health and Wellness Report published in 2018, nearly 40% of the adult population in the United States were diagnosed with cardiovascular conditions. As radiopharmaceuticals and contrast imaging show huge potential in the diagnosis of cardiac, the studied market is likely to propel in the North American region. Additionally, in 2020, the Department of Energy's National Nuclear Security Administration (NNSA) awarded a three-year, USD 750,000 grant to the Radiological Society of North America. This will help expand access to this vital knowledge to a part of the world that needs these nuclear imaging services. Furthermore, the increase in product approvals is expected to drive market growth. For instance, in September 2019, Curium Pharma and PadioMedix Inc. received the United States Food and Drug Administration approval for its Detectnet (copper Cu 64 dotatate injection), which is a positron emission tomography (PET) agent for the localization of somatostatin receptor-positive neuroendocrine tumors (NETs) in adult patients. Hence, owing to the aforementioned factors, the North American diagnostic radiopharmaceuticals and contrast media market is expected to retain its dominance over the forecast period.

Diagnostic Radiopharmaceuticals and Contrast Media Industry Overview

The diagnostic radiopharmaceuticals and contrast media market is moderately competitive, with a few major players dominating the global market. The presence of major market players, such as Bayer AG, GE Company (GE Healthcare), Cardinal Health Inc., Siemens Healthineers, Bracco Imaging SpA, Curium Pharma, and Guerbet Group, is increasing the overall competitive rivalry of the market. The major players are evolving through strategic alliances such as acquisitions, mergers, partnerships, collaborations, new product launches, and investment in research and development to secure a position in a globally competitive market. For instance, in March 2020, Curium Pharma completed the acquisition of Zevacor Molecular, which is involved in the production of Strontium-82, which is used in the production of Rubidium-82 generators for cardiac PET imaging in the United States.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Technology Advancements in Medical Imaging

- 4.2.2 Increasing Demand for Image-guided Procedures and Diagnostics

- 4.2.3 High Prevalence of Cancers and Cardiac Diseases

- 4.3 Market Restraints

- 4.3.1 High Costs of the Techniques

- 4.3.2 Limited Health Insurance Coverage

- 4.3.3 Short Half-life of Radiopharmaceuticals

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Radiopharmaceuticals

- 5.1.1 By Type of Imaging Modality

- 5.1.1.1 SPECT

- 5.1.1.1.1 Tc-99

- 5.1.1.1.2 Tl-201

- 5.1.1.1.3 Ga-67

- 5.1.1.1.4 I-123

- 5.1.1.1.5 Other SPECTs

- 5.1.1.2 PET

- 5.1.1.2.1 F-18

- 5.1.1.2.2 Rb-82

- 5.1.1.2.3 Other PETs

- 5.1.2 By Application

- 5.1.2.1 Diagnostic Application

- 5.1.2.1.1 SPECT Applications

- 5.1.2.1.1.1 Cardiology

- 5.1.2.1.1.2 Neurology

- 5.1.2.1.1.3 Thyroid

- 5.1.2.1.1.4 Other SPECT Applications

- 5.1.2.1.2 PET Application

- 5.1.2.1.2.1 Oncology

- 5.1.2.1.2.2 Cardiology

- 5.1.2.1.2.3 Neurology

- 5.1.2.1.2.4 Other PET Applications

- 5.1.2.2 Therapeutic Application

- 5.1.2.2.1 Thyroid

- 5.1.2.2.2 Lymphoma

- 5.1.2.2.3 Endocrine Tumors

- 5.1.2.2.4 Other Therapeutic Applications

- 5.1.1 By Type of Imaging Modality

- 5.2 Contrast Media

- 5.2.1 By Type

- 5.2.1.1 Iodinated Contrast Media

- 5.2.1.2 Gadolinium-based Contrast Media

- 5.2.1.3 Microbubble Contrast Media

- 5.2.1.4 Barium-based Contrast Media

- 5.2.2 By Procedure

- 5.2.2.1 X-ray/Computed Tomography (CT)

- 5.2.2.2 Magnetic Resonance Imaging (MRI)

- 5.2.2.3 Ultrasound

- 5.2.3 By Application

- 5.2.3.1 Cardiovascular Disease

- 5.2.3.2 Oncology

- 5.2.3.3 Gastrointestinal Disorders

- 5.2.3.4 Neurological Disorders

- 5.2.3.5 Other Indications

- 5.2.1 By Type

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle-East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle-East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 NTP Radioisotopes SOC Ltd

- 6.1.2 Bayer AG

- 6.1.3 Bracco Imaging SpA

- 6.1.4 Curium Pharma

- 6.1.5 GE Company (GE Healthcare)

- 6.1.6 Guerbet Group

- 6.1.7 Lantheus Holdings Inc.

- 6.1.8 Cardinal Health Inc.

- 6.1.9 Nano Therapeutics Pvt Ltd

- 6.1.10 Siemens Healthineers

- 6.1.11 Trivitron Healthcare

- 6.1.12 Koninklijke Philips NV

- 6.1.13 Triad Isotopes

- 6.1.14 Spago Nanomedical AB

- 6.1.15 Otsuka Pharmaceuticals Co. Ltd