|

시장보고서

상품코드

1686624

이소프로파일알코올(IPA) : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Isopropyl Alcohol (IPA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

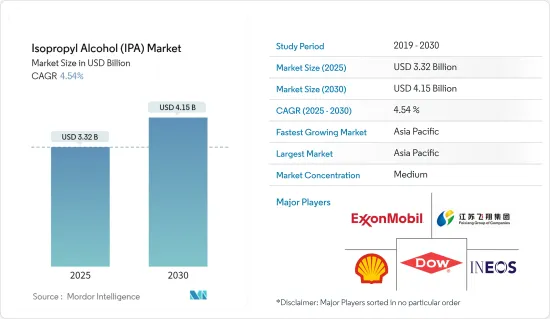

이소프로파일알코올(IPA) 시장 규모는 2025년에 33억 2,000만 달러로 추정되고, 2030년에는 41억 5,000만 달러에 달할 것으로 예측되며, 예측기간(2025-2030년) CAGR 4.54%로 성장할 전망입니다.

코로나19 팬데믹은 전 세계 이소프로필알코올 시장에 큰 영향을 미쳤습니다. 처음에는 이소프로필알코올의 주요 소비처 중 하나인 포장 및 농업 부문의 중단으로 인해 수요가 감소했습니다. 그러나 코로나19 팬데믹 기간 중에도 의료 산업의 수요로 인해 시장은 소폭의 성장률을 기록했습니다.

주요 하이라이트

- 중기적으로는 의약품 산업의 이소프로필알코올 수요 증가와 퍼스널 케어 및 화장품 산업에서의 이소프로필알코올 활용 증가가 시장 성장을 견인할 것으로 보입니다.

- 반면에 이소프로필알코올의 대체 제품의 가용성은 시장의 주요 관심사 중 하나입니다.

- 바이오 기반 이소프로필알코올의 혁신은 향후 몇 년 동안 시장에 기회를 창출할 것으로 보입니다.

- 아시아태평양이 시장을 독점할 것으로 예상됩니다.

이소프로필알코올(IPA) 시장 동향

시장을 독점하는 건강 관리 산업

- 이소프로필알코올(IPA)은 여러 가지 면에서 의료 산업에 도움이 되는 것으로 입증되었습니다. 우수한 물리적, 화학적 특성과 안정성으로 인해 의약품 제조에 필수적인 벌크 의약품 및 약물 제형 생산에 중요한 응용 분야를 찾습니다. 손 소독제, 방부제 및 소독제의 활성 성분입니다.

- 의료 부문에서 IPA는 의료 장비와 표면을 소독하고, 주사를 위한 피부 준비, 손 소독제 및 소독용 물티슈의 성분으로 광범위하게 사용됩니다.

- IPA는 미국 식품의약국(FDA)에서 일반의약품(OTC) 소독제의 활성 성분으로 규제하고 있습니다. 여기에는 손 소독제와 피부 소독제가 포함됩니다.

- 최근 몇 년 동안 의약품 시장은 빠르게 성장하고 있습니다. 2023년 세계의 의약품 시장 규모는 1조 6,000억 달러로 2022년 1조 4,800억 달러에서 약간 증가했습니다. 또한 아스트라제네카에 따르면 미국의 의약품 매출은 2022년 6,080억 달러에 비해 2023년에는 6,780억 달러에 달했습니다.

- 세계의 주요 제약 기업으로는 썬 파마, 디비스 랩, 닥터 레이디스 랩, 시플러, 카딜라 헬스, 토렌트 퍼머, 알켄 랩, 애봇 인디아 등이 있습니다.

- 아스트라제네카에 따르면 2024년 예상 제약 매출은 6,330억 달러로 북미가 가장 큰 비중을 차지하고, 유럽연합(영국 제외)이 2,870억 달러, 동남아 및 동아시아가 2,320억 달러로 그 뒤를 이을 것으로 예상됩니다.

- 인도의 제약 산업은 다양한 프로젝트에 대한 지속적인 투자로 인해 2024년 말에는 650억 달러, 2030년에는 1,300억 달러에 달할 것으로 예상됩니다.

- 식품의약품관리국에 따르면 구자라트에서는 2022-2023년도에 139건 이상의 의약품 제조 프로젝트가 승인되었으며, 투자 총액은 700억 루피(8억 4,014만 달러) 이상에 달했습니다. 대부분의 신규 제조 시설은 초현대식 기술을 갖추고 있으며 수출 지향적입니다.

- 미국은 세계 최대 규모의 제약 산업을 보유하고 있습니다. 아스트라제네카에 따르면 미국은 전 세계 제약 매출의 45% 이상, 전 세계 생산의 22%를 차지하며 제약 판매를 주도하고 있습니다. 2024년 미국의 예상 제약 매출은 6,330억 달러로 예상됩니다.

- 유럽은 제약 산업의 본고장입니다. 유럽 제약 산업 및 협회(EFPIA)는 유럽 제약 제조업체의 상당수를 대표합니다. 현재 36개의 국가 제약 협회와 39개의 유럽 주요 제약 회사가 회원으로 가입되어 있습니다.

- 위에서 언급한 요인은 예측 기간 동안 시장에 영향을 미칠 가능성이 높습니다.

시장을 독점하는 아시아태평양

- 아시아태평양이 전체 시장을 지배하고 있습니다. 화학 산업에 대한 투자, 이 지역의 화장품 및 의약품 수요 증가와 같은 요인이 이소프로필알코올 시장의 성장을 견인할 것으로 예상됩니다.

- European Coatings의 보고서에 따르면 세계 산업화의 중심지인 중국은 놀라운 10,000개의 페인트 제조업체를 자랑합니다. 특히 일본 페인트, 악조노벨, PPG 인더스트리즈 등 대기업이 중국에 제조 거점을 두고 있습니다.

- 중국 도료 공업 협회의 통계에 따르면 2023년 중국의 도료 생산량은 357억 7,200만 톤에 달하고, 전년대비 4.5% 증가했습니다. 수출은 19.6% 증가한 26만 2,000톤으로 급증하고 국내 소비는 4.2% 증가한 356억 6,300만톤으로 이 부문의 강력한 성장을 뒷받침하고 있습니다.

- 중국 소비자들이 점점 더 외적인 아름다움을 중시하고 화장품을 일상 생활에 받아들이면서 중국 화장품 시장은 견고한 상승세를 보이고 있습니다. 이러한 급증세는 라이프스타일의 변화와 아름다움에 대한 관심이 높아짐에 따라 더욱 가속화되고 있습니다. 특히 국가통계국이 발표한 2023년 중국의 화장품 소매 매출은 4,142억 위안(-584억 2,000만 달러)에 달하고, 전년대비 5.1% 증가했습니다. 이 성장은 놓치지 않고 화장품 시장은 이제 많은 투자자들의 관심을 끌고 있습니다.

- 인도의 이소프로필알코올 시장을 견인하는 주요 기업으로는 Deepak Fertilisers and Petrochemicals Corporation Ltd(DFPCL), 다우 케미컬, 엑손 모빌 등이 있습니다. 현지 수요가 증가함에 따라 국내 제조업체들은 생산 능력을 늘리기 위해 박차를 가하고 있습니다.예를 들어, GAIL(India) Limited는 2023년 8월 마하라슈트라주 Usar에 5만 톤의 이소프로필알코올(IPA) 생산 능력을 가진 최초의 특수 화학 플랜트를 설립할 계획을 발표했습니다. 이 움직임은 GAIL의 기존 석유화학/화학제품 포트폴리오를 300만톤/년에 강화하게 될 것 같습니다.

- 일본은 시세이도, 카오, 코세, 폴라 오르비스와 같은 거대 기업을 포함하여 약 3,000개의 뷰티 기업을 보유한 화장품 및 퍼스널 케어의 글로벌 허브입니다.

- 위에서 언급한 요인들은 예측 기간 동안 이 지역에 대한 수요에 영향을 미칠 것으로 보입니다.

이소프로필알코올(IPA) 산업 개요

이소프로필알코올(IPA) 시장은 그 특성상 부분적으로 통합되어 있습니다. 시장의 주요 기업으로는 Shell PLC, Ineos, ExxonMobil Corporation, Dow, Kailing Chemical(Zhangjiagang) 등이 있습니다(특정한 순서 없음).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 제약 산업에서 이소프로필알코올에 대한 수요 증가

- 퍼스널 케어 및 화장품 산업에서 이소프로필알코올의 활용 증가

- 억제요인

- 이소프로필알코올 대체 제품의 가용성

- 업계 밸류체인 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

제5장 시장 세분화

- 용도

- 공정 및 준비 용매

- 세척 및 건조제

- 코팅 및 염료 용매

- 중간체

- 기타 용도

- 최종 사용자 산업

- 화장품 및 퍼스널 케어

- 의료

- 전자

- 페인트 및 코팅

- 화학

- 기타 최종 사용자 산업

- 지역

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 말레이시아

- 태국

- 인도네시아

- 베트남

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 북유럽 국가

- 터키

- 러시아

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 콜롬비아

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 카타르

- 아랍에미리트(UAE)

- 나이지리아

- 이집트

- 남아프리카

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 시장 점유율(%) 분석

- 주요 기업의 전략

- 기업 프로파일

- Cnpc Jinzhou Petrochemical Company

- Deepak Fertilisers and Petrochemicals Corporation Ltd(dfpcl)

- Dow

- ENEOS Corporation

- Ineos

- Kailing Chemical(Zhangjiagang) Co. Ltd

- LCY GROUP

- LG Chem

- Mitsui Chemicals Inc.

- Shell PLC

- Yancheng Super Chemical Technology Co. Ltd.

- Zhejiang Xinhua Chemical Co. Ltd.

제7장 시장 기회와 앞으로의 동향

- 바이오 이소프로필알코올의 혁신

The Isopropyl Alcohol Market size is estimated at USD 3.32 billion in 2025, and is expected to reach USD 4.15 billion by 2030, at a CAGR of 4.54% during the forecast period (2025-2030).

The COVID-19 pandemic had a notable impact on the global isopropyl alcohol market. Initially, demand declined due to disruptions in the packaging and agriculture sectors, one of the key consumers of isopropyl alcohol. However, the market registered a slight growth rate due to demand from the medical industry even during the COVID-19 pandemic.

Key Highlights

- Over the medium term, rising demand for isopropyl alcohol from the pharmaceutical industry and growing utilization of isopropyl alcohol in the personal care and cosmetics industry are likely to drive the market's growth,

- On the flip side, the availability of substitute products for isopropyl alcohol remains one of the major concerns for the market.

- Innovation in bio-based isopropyl alcohol is likely to create opportunities for the market in the coming years.

- Asia-Pacific region is expected to dominate the market.

Isopropyl Alcohol (IPA) Market Trends

Healthcare Industry to Dominate the Market

- Isopropyl alcohol (IPA) has proven helpful for the healthcare industry in several ways. Due to its excellent physical and chemical properties and stability, it finds significant applications in producing bulk drugs and drug formulations, which are vital in pharmaceutical manufacturing. It is an active ingredient in hand sanitizers, antiseptics, and disinfectants.

- In the healthcare sector, IPA is extensively used to sanitize medical equipment and surfaces, prepare skin for injections, and as a component in hand sanitizers and disinfectant wipes.

- IPA is regulated by the Food and Drug Administration (FDA) as an active ingredient in over-the-counter (OTC) antiseptic products. These include hand sanitizers and skin disinfectants.

- In recent years, the pharmaceutical market has grown expeditiously. The global pharmaceuticals market was valued at USD 1.60 trillion in 2023, a marginal rise from the value of USD 1.48 trillion recorded in 2022. Further, as per AstraZeneca, the total pharmaceutical sales in the United States reached USD 678 billion in 2023, as compared to USD 608 billion in 2022.

- Some of the leading pharmaceutical companies in the world are Sun Pharma, Divis Labs, Dr. Reddy's Labs, Cipla, Cadila Health, Torrent Pharma, Alkem Lab, and Abbott India.

- According to AstraZeneca, the projected pharmaceutical sales in 2024 are expected to reach a value of USD 633 billion, with North America holding the major share, followed by the European Union (excluding the United Kingdom) accounting for USD 287 billion and Southeast and East Asia accounting for USD 232 billion.

- The pharmaceutical industry in India is expected to reach a value of USD 65 billion by the end of 2024 and USD 130 billion by 2030 due to continued investments in various projects.

- According to the Food and Drug Control Administration, in Gujarat, in FY 2022-2023, more than 139 drug manufacturing projects were approved, garnering a total investment of more than INR 70,000 million (USD 840.14 million). Most new manufacturing units are equipped with ultra-modern technology and are export-oriented.

- The United States has one of the world's largest pharmaceutical industries. According to AstraZeneca, the United States dominates pharmaceutical sales with a share of over 45% of global pharmaceutical sales and 22% of global production. The projected pharmaceutical sales for the United States in 2024 are expected to be USD 633 billion.

- Europe is the homeland of the pharmaceutical industry. The European Federation of Pharmaceutical Industries and Association (EFPIA) represents a sizable proportion of Europe's drug manufacturers. It currently includes 36 national pharmaceutical associations and 39 of Europe's leading pharmaceutical companies.

- The abovementioned factors will likely impact the market in the forecast period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region dominates the overall market. Factors such as investment in the chemical industry and increasing demand for cosmetic and pharmaceutical products in the region are expected to drive the growth of the isopropyl alcohol market.

- China, a global hub for industrialization, boasts a staggering 10,000 coatings manufacturers, as reported by European Coatings. Notably, major players like Nippon Paint, AkzoNobel, and PPG Industries have established manufacturing bases in the country.

- Figures from the China Coatings Industry Association reveal that in 2023, China's coatings production hit 35,772 million tons, marking a 4.5% increase from the previous year. Exports surged by 19.6% to 262,000 tons, while domestic consumption rose by 4.2% to 35,663 million tons, underlining the sector's robust growth.

- As Chinese consumers increasingly prioritize external beauty and embrace cosmetics in their daily routines, the nation's cosmetic market is witnessing a robust upswing. This surge is further fueled by shifting lifestyles and a heightened focus on beauty. Notably, in 2023, China's cosmetic retail sales, as reported by the National Bureau of Statistics, reached CNY 414.2 billion (~USD 58.42 billion), marking a 5.1% Y-o-Y increase. This growth has not gone unnoticed, with the cosmetics market now catching the eye of numerous investors.

- Key players driving the isopropyl alcohol market in India include Deepak Fertilisers and Petrochemicals Corporation Ltd (DFPCL), Dow Chemical, ExxonMobil, and others. Rising local demand has spurred domestic manufacturers to ramp up their production capacities. For instance, in August 2023, GAIL (India) Limited announced plans to set up its inaugural specialty chemical plant in Usar, Maharashtra, with a capacity of 50,000 tonnes of isopropyl alcohol (IPA). This move is likely to bolster GAIL's existing petrochemicals/chemicals portfolio to 3 million tpa.

- Japan stands as a global hub for cosmetics and personal care, boasting around 3,000 beauty companies, including industry giants like Shiseido, Kao, Kose, and Pola Orbis.

- The above-mentioned factors are likely to impact the demand for the market studied in the region during the forecast period.

Isopropyl Alcohol (IPA) Industry Overview

The isopropyl alcohol (IPA) market is partially consolidated in nature. Some of the major players in the market include (not in any particular order) Shell PLC, Ineos, ExxonMobil Corporation, Dow, and Kailing Chemical (Zhangjiagang) Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand for Isopropyl Alcohol from the Pharmaceutical Industry

- 4.1.2 Growing Utilization of Isopropyl Alcohol in the Personal Care and Cosmetics Industry

- 4.2 Restraints

- 4.2.1 Availability of Substitute Products for Isopropyl Alcohol

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value and Volume)

- 5.1 Application

- 5.1.1 Process and Preparation Solvent

- 5.1.2 Cleaning and Drying Agent

- 5.1.3 Coating and Dye Solvent

- 5.1.4 Intermediate

- 5.1.5 Other Applications

- 5.2 End-user Industry

- 5.2.1 Cosmetics and Personal Care

- 5.2.2 Healthcare

- 5.2.3 Electronics

- 5.2.4 Paints and Coatings

- 5.2.5 Chemicals

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Nordic Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Cnpc Jinzhou Petrochemical Company

- 6.4.2 Deepak Fertilisers and Petrochemicals Corporation Ltd (dfpcl)

- 6.4.3 Dow

- 6.4.4 ENEOS Corporation

- 6.4.5 Ineos

- 6.4.6 Kailing Chemical (Zhangjiagang) Co. Ltd

- 6.4.7 LCY GROUP

- 6.4.8 LG Chem

- 6.4.9 Mitsui Chemicals Inc.

- 6.4.10 Shell PLC

- 6.4.11 Yancheng Super Chemical Technology Co. Ltd.

- 6.4.12 Zhejiang Xinhua Chemical Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovation in Bio-based Isopropyl Alcohol