|

시장보고서

상품코드

1686628

주석 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Tin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

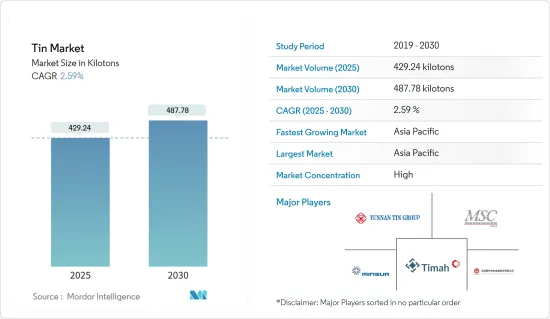

주석 시장 규모는 2025년에 429.24킬로톤으로 추정되고, 2030년에는 487.78킬로톤에 달할 것으로 예측되며, 예측기간(2025-2030년) CAGR 2.59%로 성장할 전망입니다.

주요 하이라이트

- 전기자동차 시장의 수요 급증과 전기 및 전자 산업의 응용 분야 증가가 예측 기간 동안 시장을 주도할 것으로 예상됩니다.

- 용기와 같은 금속 제품을 생산하기 위한 알루미늄 및 주석이 없는 강철과 같은 대체재의 존재는 시장의 성장을 방해하고 있습니다.

- 주석 재활용으로의 초점 이동은 향후 몇 년 동안 시장에 기회를 창출 할 것으로 예상됩니다.

- 아시아태평양은 시장을 독점하고 예측 기간 동안 가장 높은 CAGR을 나타낼 것으로 예상됩니다.

주석 시장 동향

시장 성장을 지배하는 전자 부문

- 주석은 전자 산업에서 땜납으로 사용되며 일반적으로 납 및 인듐과 함께 다양한 순도 및 합금에 자주 사용됩니다. 전체 주석 생산량의 약 50-70%가 전자 및 전기 산업에서 휴대전화, 태블릿 단말, 컴퓨터, 시계 및 기타 소비자 전자기기와 같은 다양한 제품에 사용됩니다.

- 예를 들어, 일본 전자정보기술산업협회(JEITA)에 따르면 2023년 전 세계 전자 및 IT 산업의 생산액은 3조 3,826억 달러로 추정되며 2022년 대비 마이너스 3%의 CAGR을 기록할 것으로 예상됩니다. 그러나 2024년에는 9% 성장하여 3조 6,868억 달러에 달할 것으로 예상됩니다.

- 전 세계적으로 스마트폰 수요가 크게 증가하고 있습니다. TelefonaktiebolagetLM Ericsson에 따르면 2023년 스마트폰 계약 수는 69억 7,000만 건으로 2022년 대비 약 5.3% 증가했습니다. 또한 스마트폰의 계약수는 2029년에는 80억 6,000만에 이르며, 전자 제품 용도에서 주석 소비가 증가할 것으로 예상됩니다.

- 또한 아시아태평양의 전자제품에 대한 수요는 주로 중국, 인도, 일본에서 옵니다. 중국은 낮은 인건비와 유연한 정책으로 인해 전자 제품 생산업체에게 탄탄하고 유리한 시장입니다. 중국 국가 통계국에 따르면 2023년 중국 전자 제조 산업의 연간 부가가치 성장률은 전년 대비 3.4% 증가했습니다.

- 유럽에서 독일의 전자 산업은 이 지역에서 가장 큰 규모입니다. ZVEI에 따르면 독일의 전자 디지털 산업 매출은 2023년에 2,420억 유로(2,619억 4,000만 달러)를 차지했으며, 2022년에 비해 CAGR은 7.56%였습니다. 또한 생산 측면에서 전기 및 디지털 산업은 2021년에 비해 2022년에 1.4%의 CAGR을 기록했습니다.

- 따라서 위에서 언급 한 요인으로 인해 전자 산업에서 주석 사용이 증가하고 있습니다.

아시아태평양이 시장을 독점

- 아시아태평양이 주석 시장을 독점하고 있습니다. 중국은 전 세계에서 주석의 최대 생산국이자 소비국 중 하나입니다.

- 주석 시장과 자동차 부문의 주요 기여자 중 하나인 자동차 산업은 제품 진화를 위한 준비를 하고 있습니다. 중국은 환경 오염이 심화됨에 따라 연비를 보장하고 배출가스를 최소화하는 제품 제조에 주력하고 있습니다.

- 주석은 다른 금속과 함께 연료 탱크, 실란트, 배선, 라디에이터, 시트 쿠션, 이음새 및 용접, 패스너, 나사, 너트, 볼트, 루핑 등 수많은 자동차 응용 분야에 사용됩니다.

- 아시아태평양은 세계에서 가장 가치 있는 자동차 제조업체의 본거지입니다. 중국, 인도, 일본, 한국과 같은 개발도상국들은 제조 기반을 강화하고 효율적인 공급망을 개발하여 수익성을 높이기 위해 노력하고 있습니다.

- 중국은 연간 판매량과 제조 생산량에서 여전히 세계 최대의 자동차 시장입니다. OICA에 따르면 2023년 중국의 자동차 생산량은 총 3,016만 대에 달해 매년 16%씩 두 자릿수 증가율을 기록할 것으로 예상됩니다.

- 인도자동차공업회(SIAM)에 따르면 2022-2023년도(2022년 4월-2023년 3월)의 인도 자동차 산업은 총 25억 9,931만 8,867대를 생산하여 2021-2022년에 비해 약 12.55% 증가했습니다. OICA에 따르면 2022년 대비 2023년 자동차 생산량은 33% 증가했습니다.

- 이 외에도 주석의 다른 주요 최종 사용자 산업으로는 전기 및 전자, 중공업, 포장 등이 있습니다. 중국의 정보통신기술(ICT) 부문은 지난 10년 동안 정부의 지원과 우호적인 디지털화 계획 및 정책에 힘입어 빠르게 성장했습니다.

- 따라서 이러한 모든 요인으로 인해 이 지역의 주석 시장은 예측 기간 동안 꾸준히 성장할 것으로 예상됩니다.

주석 산업 개요

주석 시장은 고도로 통합되어 있습니다. 주요 기업(특정한 순서 없음)으로는 YUNNAN TIN COMPANY GROUP LIMITED, Timah, MINSUR, Malaysia Smelting Corporation Berhad, Yunnan Chengfeng Nonferrous Metals 등이 있습니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 전기자동차 시장의 수요 급증

- 전기 및 전자 산업의 응용 분야 증가

- 기타 촉진요인

- 억제요인

- 대체재의 존재

- 기타 억제요인

- 산업 밸류체인 분석

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 소비자의 협상력

- 공급기업의 협상력

- 대체재의 위협

- 경쟁도

- 가격 분석

제5장 시장 세분화

- 제품 유형

- 금속

- 합금

- 화합물

- 용도

- 솔더

- 주석 도금

- 화학 물질

- 기타 용도(특수 합금, 납축전지)

- 최종 사용자 산업

- 자동차

- 전자

- 포장(식음료)

- 유리

- 기타 최종 사용자 산업(화학, 공구 제조, 의료기기)

- 지역

- 생산 분석

- 호주

- 볼리비아

- 브라질

- 버마

- 중국

- 콩고(킨샤사)

- 인도네시아

- 말레이시아

- 페루

- 베트남

- 기타 국가

- 소비 분석

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 이탈리아

- 프랑스

- 오스트리아

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 남아프리카

- 아랍에미리트(UAE)

- 기타 중동 및 아프리카

- 생산 분석

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 시장 점유율(%) 및 랭킹 분석

- 주요 기업의 전략

- 기업 프로파일

- ArcelorMittal

- Aurubis AG

- Avalon Advanced Materials Inc.

- Indium Corporation

- Jiangxi New Nanshan Technology Co. Ltd

- Malaysia Smelting Corporation Berhad

- MINSUR

- Thailand Smelting and Refining Co. Ltd

- Timah

- Yunnan Chengfeng Non-ferrous Metals Co. Ltd

- YUNNAN TIN COMPANY GROUP LIMITED

제7장 시장 기회와 앞으로의 동향

- 주석 재활용으로의 초점 이동

- 기타 기회

The Tin Market size is estimated at 429.24 kilotons in 2025, and is expected to reach 487.78 kilotons by 2030, at a CAGR of 2.59% during the forecast period (2025-2030).

Key Highlights

- Surging demand from the electric vehicle market and increasing applications in the electrical and electronics industry are expected to drive the market during the forecast period.

- The presence of substitutes like aluminum and tin-free steel for producing metallic products like containers is hindering the market's growth.

- Shifting focus toward recycling tin is expected to create opportunities for the market in the coming years.

- Asia-Pacific is expected to dominate the market and witness the highest CAGR during the forecast period.

Tin Market Trends

The Electronic Segment to Dominate the Market Growth

- Tin is used in the electronics industry as a solder and is often used in various purities and alloys, generally with lead and indium. About 50-70% of the overall tin produced is used in the electronics and electrical industry in various products, such as mobiles, tablets, computers, watches, clocks, and other consumer electronic devices.

- For instance, according to the Japan Electronics and Information Technology Industries Association (JEITA), the global electronics and IT industry's production was estimated at USD 3,382.6 billion in 2023, registering a negative CAGR of 3% Y-o-Y compared to 2022. However, in 2024, it is expected to grow by 9% and reach USD 3,686.8 billion.

- Globally, smartphone demand is increasing significantly. According to TelefonaktiebolagetLM Ericsson, smartphone subscriptions accounted for 6,970 million in 2023, an increase of about 5.3% compared to 2022. Also, the subscription will reach 8,060 million by 2029, enhancing tin consumption from electronics applications.

- Also, the demand for electronics products in Asia-Pacific mainly comes from China, India, and Japan. China is a robust and favorable market for electronics producers, owing to the country's low labor cost and flexible policies. According to the National Bureau of Statistics of China, the annual growth rate of value added in the electronics manufacturing industry in the country increased by 3.4% Y-o-Y in 2023.

- The German electronics industry in Europe is the largest in the region. According to the ZVEI, Germany's electro and digital industry turnover accounted for EUR 242 billion (USD 261.94 billion) in 2023, witnessing a CAGR of 7.56% compared to 2022. Also, in terms of production, the electro and digital industries registered a CAGR of 1.4% in 2022 compared to 2021.

- Hence, due to the factors mentioned above, the use of tin is increasing in the electronics industry.

Asia-Pacific to Dominate the Market

- Asia-Pacific has dominated the tin market. China is one of the largest producers and consumers of tin globally.

- The automotive industry, one of the major contributors to the tin market and the automotive sector, has been shaping up for product evolution. China is focusing on manufacturing products to ensure fuel economy and minimize emissions owing to the growing environmental concerns due to mounting pollution in the country.

- Tin, along with other metals, is used in numerous automotive applications, including fuel tanks, sealants, wiring, radiator, seat cushions, seams and welds, fasteners, screws, nuts, bolts, and roofing.

- Asia-Pacific is home to some of the world's most valuable vehicle manufacturers. Developing countries such as China, India, Japan, and South Korea have been working hard to strengthen the manufacturing base and develop efficient supply chains for greater profitability.

- China remains the world's largest automotive market in annual sales and manufacturing output. According to OICA, vehicle production in China reached a total of 30.16 million units in 2023, a double-digit increase of 16% annually.

- According to the Society of Indian Automobile Manufacturers (SIAM), in FY 2022-2023 (April 2022 to March 2023), the country's automotive industry produced a total of 2,59,31,867, an increase of about 12.55% compared to FY 2021-2022. As per OICA, the country registered a record increase of 33% in vehicle production in 2023 compared to 2022.

- In addition, the other major end-user industries for tin include electrical and electronics, heavy engineering, and packaging. China's information and communication technology (ICT) sector has grown rapidly in the past decade, owing to the government's support and favorable digitization plans and policies.

- Therefore, due to all such factors, the market for tin in the region is expected to have steady growth during the forecast period.

Tin Industry Overview

The Tin market is highly consolidated. The major players (not in any particular order) include YUNNAN TIN COMPANY GROUP LIMITED, Timah, MINSUR, Malaysia Smelting Corporation Berhad, and Yunnan Chengfeng Nonferrous Metals Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Surging Demand from the Electric Vehicle Market

- 4.1.2 Increasing Applications in the Electrical and the Electronics Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Presence of Subsitutes

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

- 4.5 Price Analysis

5 MARKET SEGMENTATION (Market Size by Volume)

- 5.1 Product Type

- 5.1.1 Metal

- 5.1.2 Alloy

- 5.1.3 Compounds

- 5.2 Application

- 5.2.1 Solder

- 5.2.2 Tin Plating

- 5.2.3 Chemicals

- 5.2.4 Other Applications (Specialized Alloys and Lead-acid Batteries)

- 5.3 End-user Industry

- 5.3.1 Automotive

- 5.3.2 Electronics

- 5.3.3 Packaging (Food and Beverage)

- 5.3.4 Glass

- 5.3.5 Other End-user Industries (Chemical, Tool Making, Medical Devices)

- 5.4 Geography

- 5.4.1 Production Analysis

- 5.4.1.1 Australia

- 5.4.1.2 Bolivia

- 5.4.1.3 Brazil

- 5.4.1.4 Burma

- 5.4.1.5 China

- 5.4.1.6 Congo (Kinshasa)

- 5.4.1.7 Indonesia

- 5.4.1.8 Malaysia

- 5.4.1.9 Peru

- 5.4.1.10 Vietnam

- 5.4.1.11 Other Countries

- 5.4.2 Consumption Analysis

- 5.4.2.1 Asia-Pacific

- 5.4.2.1.1 China

- 5.4.2.1.2 India

- 5.4.2.1.3 Japan

- 5.4.2.1.4 South Korea

- 5.4.2.1.5 Rest of Asia-Pacific

- 5.4.2.2 North America

- 5.4.2.2.1 United States

- 5.4.2.2.2 Canada

- 5.4.2.2.3 Mexico

- 5.4.2.3 Europe

- 5.4.2.3.1 Germany

- 5.4.2.3.2 United Kingdom

- 5.4.2.3.3 Italy

- 5.4.2.3.4 France

- 5.4.2.3.5 Austria

- 5.4.2.3.6 Rest of Europe

- 5.4.2.4 South America

- 5.4.2.4.1 Brazil

- 5.4.2.4.2 Argentina

- 5.4.2.4.3 Rest of South America

- 5.4.2.5 Middle East and Africa

- 5.4.2.5.1 South Africa

- 5.4.2.5.2 United Arab Emirates

- 5.4.2.5.3 Rest of Middle East and Africa

- 5.4.1 Production Analysis

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ArcelorMittal

- 6.4.2 Aurubis AG

- 6.4.3 Avalon Advanced Materials Inc.

- 6.4.4 Indium Corporation

- 6.4.5 Jiangxi New Nanshan Technology Co. Ltd

- 6.4.6 Malaysia Smelting Corporation Berhad

- 6.4.7 MINSUR

- 6.4.8 Thailand Smelting and Refining Co. Ltd

- 6.4.9 Timah

- 6.4.10 Yunnan Chengfeng Non-ferrous Metals Co. Ltd

- 6.4.11 YUNNAN TIN COMPANY GROUP LIMITED

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shifting Focus toward Recycling of Tin

- 7.2 Other Opportunities

샘플 요청 목록