|

시장보고서

상품코드

1686664

아프리카의 농업기계 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Africa Agricultural Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

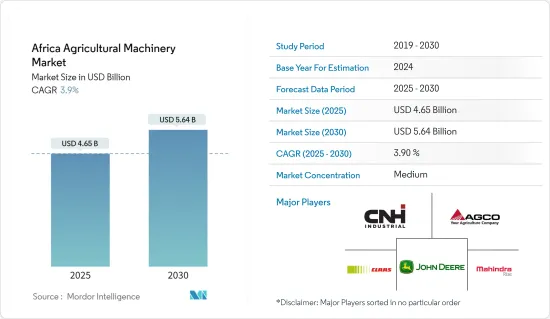

아프리카의 농업기계 시장 규모는 2025년에 46억 5,000만 달러로 추정되고, 예측기간 2025년부터 2030년까지 CAGR 3.9%로 성장할 전망이며, 2030년에는 56억 4,000만 달러에 달할 것으로 예측됩니다.

주요 하이라이트

- 아프리카의 농업기계 시장은 농법의 현대화를 추진하는 아프리카 대륙의 뒷받침을 받아 꾸준히 확대되고 있습니다. 이 근대화는 생산성을 향상시키고 임박한 식량 안보 문제를 해결하기 위한 것입니다. 예를 들어 유엔 아프리카 경제위원회에 따르면 아프리카 인구는 1960년 2억 8,300만 명에서 2023년에는 15억 명 이상으로 5배 이상으로 확대되었으며, 2050년에는 9억 5,000만 명 증가하여 25억 명에 이를 것으로 예측되고 있습니다. 이러한 성장은 식량 수요를 증가시키고 현대적인 기계는 작물의 수율을 증가시켜 이 증가하는 수요를 충족시키기 위한 매우 중요한 해결책이 됩니다.

- 남아프리카공화국에서는 상업 농부가 농업 부문에서 중요한 역할을 합니다. 최근 위스콘신주 경제개발공사에 따르면 약 32,000개의 상업농가가 이 나라의 농업가치의 80%를 생산하고 있습니다. 이 농부들은 기계화를 이익을 높이고 경영의 지속가능성을 보장하기 위한 초석으로 간주합니다. 이 관점은 시장의 성장 궤도에 좋은 징후입니다. 남아프리카 농업기계협회(SAAMA)는 2022년 트랙터 판매 대수를 약 9,181대, 복합 수확기 판매 대수를 약 373대로 하고 있으며, 이 나라의 농업 기계화에 대한 꾸준한 행보를 이야기하고 있습니다.

- 에티오피아에서는 대부분의 농가들이 소규모 토지에서 농업을 운영하고 있으며 대규모 기계화는 여전히 드물지만 정부는 농업과 기계 부문의 성장을 적극적으로 추진하고 있습니다. 에티오피아의 주요 시책 중 하나인 성장 및 변혁 계획(GTP II)은 이러한 분야의 활성화를 목표로 하고 있습니다. 이 계획에서 중요한 전략은 광범위한 경작지를 국제 기업에 임대하고 대규모 상업 농업으로가는 길을 여는 것입니다. 이 움직임은 장비 판매를 강화할 뿐만 아니라 에티오피아에서 농업기계 시장의 확대를 뒷받침합니다. 정부 추진과 대기업 투자 확대로 이 지역은 농업기계화의 강력한 성장을 목격하고 있습니다.

아프리카의 농업기계 시장 동향

제품 유형별로 트랙터가 주요 부문

농업은 아프리카의 경제 개발에 매우 중요합니다. 세계 최대의 미경작 경지 면적을 자랑함에도 불구하고, 아프리카의 농업 생산성은 다른 개발 도상 지역에 뒤처져 있습니다. 현재 아프리카의 농작물 수율은 세계 평균의 56%에 불과합니다. 인구 증가와 급속한 도시화로 가속화되는 식량 수요 증가에 대응하기 위해 아프리카는 향후 수십년 동안 작물 수율을 증가시켜야 합니다. 기계화, 특히 트랙터에 의한 기계화는 이 수율 갭을 채우는 실행 가능한 솔루션을 제시합니다.

아프리카에서 트랙터는 경작에서 심기, 수확까지 모든 것을 용이하게 하는 필수적인 존재입니다. 아그리 에볼루션 얼라이언스의 조사는 아프리카에서 농업기계의 큰 가능성을 강조하고 있으며, 트랙터가 그 견인 역할을 하고 있습니다. 정부의 지원은 이 분야의 발전을 촉진할 것으로 예상됩니다. 예를 들어, 가나 정부는 트랙터를 대여하고 정비하는 89개 센터를 운영하는 기업에게 트랙터 보조금을 제공합니다.

트랙터의 동향은 최근 증가 추세에 있습니다. 남아프리카 농업기계협회(SAAMA)의 보고서에 따르면 남아프리카의 트랙터 판매량은 2021년 7,680대에서 2022년 9,181대로 증가했습니다. 아프리카에서는 영세 농가가 많기 때문에 보통 100마력 이하의 컴팩트한 트랙터가 주류가 되고 있습니다. 제조업체 각 회사는 아프리카의 요구에 맞게 저렴한, 내구성 및 유지 보수 용이성을 선호하는 모델을 사용자 정의합니다. 아프리카의 단편적인 토지 소유에서는 대형, 고가의 기계가 아니라 소형 및 중형 트랙터가 빛나고 있습니다.

2021년 유럽농업기계공업회(CEMA)와 유엔식량농업기관(FAO)은 지속 가능한 농업기계화에 관한 각서를 2025년까지 연장하였습니다. 이 새로운 합의는 특히 아프리카 국가에서 자동화 및 지능형 농업 기계, 정밀 농업, 디지털 데이터 관리 및 농업 기계 사용에 대한 정확한 통계 데이터의 중요성을 강조합니다. 이러한 노력은 트랙터를 포함한 농업 기계 시장의 성장을 자극하는 것으로 보입니다.

남아프리카가 시장을 독점

아프리카 국가들 중 남아프리카공화국이 가장 큰 시장으로 돋보입니다. 역사적으로 남아프리카공화국의 농업 경제는 식량 원조에 의존하는 것으로부터 국내 생산을 중시하는 것으로 전환되었습니다. 남아프리카는 현재 농업 및 농업 기계 시장의 성장에 큰 잠재력을 가지고 있습니다.

또한 남아프리카는 사하라 이남의 아프리카에서 주요 곡물 생산국의 지위를 차지하고 있습니다. 옥수수의 생산량은 압도적이며 밀, 콩, 해바라기 씨앗이 이어집니다. FAOSTAT에 따르면 남아프리카의 곡물 총 생산량은 2022년 1,870만 톤에 이르렀고, 그 중 옥수수는 약 1,610만 톤을 차지했습니다. 이러한 견조한 생산 수준은 기계화 추진과 최첨단 농업 기계 투자에 박차를 가하고 있습니다. 게다가 남아프리카는 기계화율로 대륙의 기타 국가를 능가하고 있으며 트랙터의 보급률이 현저하고 수확기, 플랜터, 관개 시스템이 널리 사용되고 있습니다. 이러한 첨단 기계화로 남아프리카 농부들은 효율성과 생산성을 높일 수 있습니다. 특히 대규모 작물 재배에서는 인건비가 다른 많은 아프리카 국가를 능가합니다.

존디어, 마힌드라, AGCO 코퍼레이션 등 여러 세계 기업이 존재하기 때문에 남아프리카 시장에 제품 도입이 용이하다고 생각됩니다. 2022년 존디어는 NAMPO Harvest Day 2022에서 X9 시리즈 콤바인을 발표했습니다. 그 이후로 남아프리카 해안에 도착하는 완전히 새로운 클래스 11 조합의 놀라운 작업 능력과 성능에 대해 큰 화제를 부르고 있습니다.

아프리카의 농업기계 산업 개요

아프리카의 농업기계 시장은 비교적 통합되어 있습니다. 시장의 주요 기업은 Deere & Company, AGCO Corporation, CNH Industrial NV, Mahindra & Mahindra Ltd, Claas KGaA mbH 등입니다. 시장의 주요 기업은 시장의 지위를 유지하기 위해 제품 포트폴리오를 확대하고 사업의 폭을 넓히고 있습니다. 혁신적인 신제품을 시장에 투입하여 제품 포트폴리오를 확대하는 것은 이들 기업이 가장 채택한 전략입니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 농업 노동력 감소

- 기술 진보 증가

- 농업기계화 강화를 위한 정부 지원 확대

- 시장 성장 억제요인

- 농업 지출 증가

- 현대 농업기계의 보안 우려

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자 및 소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 제품 유형별

- 트랙터

- 경작 및 재배 기계

- 식부 및 시비 기계

- 수확 기계

- 목초 및 사료 기계

- 관개 기계

- 기타 제품 유형

- 지역별

- 남아프리카

- 기타 아프리카

제6장 경쟁 구도

- 가장 채용된 전략

- 시장 점유율 분석

- 기업 프로파일

- Tractors and Farm Equipment Limited(TAFE)

- Claas KGaA mbH

- AGCO Corporation

- Mahindra & Mahindra Ltd

- Deere & Company

- CNH Industrial NV

제7장 시장 기회 및 앞으로의 동향

AJY 25.04.04The Africa Agricultural Machinery Market size is estimated at USD 4.65 billion in 2025, and is expected to reach USD 5.64 billion by 2030, at a CAGR of 3.9% during the forecast period (2025-2030).

Key Highlights

- Africa's agriculture machinery market is steadily expanding, fueled by the continent's push to modernize farming practices. This modernization aims to enhance productivity and tackle pressing food security challenges. For instance, according to the United Nations Economic Commission for Africa, its population expanded from 283 million in 1960 to more than 1.5 billion in 2023 - a more than five-fold increase-and is projected to increase by 950 million and touch 2.5 billion by 2050. Such growth amplifies the demand for food, and modern machinery stands as a pivotal solution to boost crop yields and meet this escalating demand.

- In South Africa, commercial farmers play a crucial role in the agricultural sector. Recently, according to the Wisconsin Economic Development Corporation, approximately 32,000 commercial farmers produce 80% of the country's agricultural value. These farmers view mechanization as a cornerstone for enhancing profits and ensuring the sustainability of their operations. This perspective bodes well for the market's growth trajectory. The South African Agricultural Machinery Association (SAAMA) has sales of about 9,181 tractors and 373 combined harvesters for 2022, underscoring the nation's steady march towards agricultural mechanization.

- In Ethiopia, while most farmers operate on small landholdings and large-scale mechanization remains rare, the government is actively promoting growth in both agriculture and the machinery sector. One of its flagship initiatives, the Growth and Transformation Plan (GTP II), aims to invigorate these sectors. A key strategy under this plan involves leasing vast arable lands to international entities, paving the way for large-scale commercial farming. This move is not only bolstering equipment sales but also propelling the agricultural machinery market's expansion in Ethiopia. With government backing and heightened investments from major players, the region witnesses robust growth in agricultural mechanization.

Africa Agricultural Machinery Market Trends

Tractors is the Significant Segment by Product Type

Agriculture is pivotal to Africa's economic development. Despite boasting the world's largest expanse of uncultivated arable land, Africa's agricultural productivity lags behind other developing regions. Current crop yields in Africa stand at just 56% of the global average. To meet the rising food demand spurred by population growth and swift urbanization, Africa must boost its crop yields in the coming decades. Mechanization, particularly through tractors, presents a viable solution to bridge this yield gap.

In Africa, tractors are indispensable, facilitating everything from plowing and tilling to planting and harvesting. Research by Agri Evolution Alliance underscores the vast potential for agricultural machinery in Africa, with tractors leading the charge. Government support is anticipated to drive sector development. For instance, the Ghanaian government provides subsidized tractors to entrepreneurs operating 89 centers for tractor rental and servicing.

Tractor sales have shown an upward trend in recent years. The South African Agricultural Machinery Association (SAAMA) reports that tractor sales in South Africa increased from 7,680 units in 2021 to 9,181 units in 2022. Given Africa's predominant smallholder farms, compact tractors, typically under 100 HP, reign supreme. Manufacturers are tailoring models to suit African needs-prioritizing affordability, durability, and ease of maintenance. In Africa's fragmented land holdings, small and medium-sized tractors shine, as opposed to larger, costlier machinery.

In 2021, the European Agricultural Machinery Industry Association (CEMA) and the Food and Agriculture Organization of the United Nations (FAO) extended their memorandum of understanding (MoU) on sustainable agricultural mechanization until 2025. This renewed agreement emphasizes the importance of automated and intelligent agricultural machinery, precision agriculture, digital data management, and accurate statistical data on agricultural machinery use, particularly in African countries. These initiatives are likely to stimulate growth in the agricultural machinery including tractor market.

South Africa Dominates the Market

Among African nations, South Africa stands out as the largest market. Historically, the South African agricultural economy transitioned from relying on food aid to emphasizing domestic production, a shift initiated by the Green Revolution, championed by the World Food Program of the United Nations. South Africa now has major potential for the growth of the agriculture and agriculture machinery market.

Moreover, South Africa holds the title of the leading cereal producer in Sub-Saharan Africa. Maize dominates its production, trailed by wheat, soybeans, and sunflower seeds. According to the FAOSTAT, the total cereal production in South Africa reached 18.7 million metric tons in 2022, with maize accounting for approximately 16.1 million metric tons. Such robust production levels have spurred a push towards mechanization and investments in cutting-edge agricultural equipment. Additionally, South Africa outpaces its continental counterparts in mechanization rates, showcasing notable tractor penetration and the prevalent use of harvesters, planters, and irrigation systems. This advanced mechanization empowers South African farmers to boost efficiency and productivity, particularly in large-scale crop farming, where labor costs surpass those in many other African nations.

The presence of several global companies, like John Deere, Mahindra, and AGCO Corporation, may enable the easy introduction of products in the South African market. In 2022, John Deere launched X9 Series combine harvesters at NAMPO Harvest Day 2022. It has since created a massive buzz around the incredible operational capacity and performance of the all-new class 11 Combine to arrive on South African shores.

Africa Agricultural Machinery Industry Overview

The African agricultural machinery market is relatively consolidated. The major players in the market include Deere & Company, AGCO Corporation, CNH Industrial NV, Mahindra & Mahindra Ltd, and Claas KGaA mbH. Major players in the market have extended their product portfolio and broadened their businesses to maintain their positions in the market. Expanding the product portfolio by introducing new and innovative products into the market is the most adopted strategy by these companies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Declining Agricultural Labor

- 4.2.2 Rising Technological Advancements

- 4.2.3 Growing Government Support to Enhance Farm Mechanization

- 4.3 Market Restraints

- 4.3.1 Increasing Farm Expenditure

- 4.3.2 Security Concerns in Modern farming Machinery

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Tractors

- 5.1.2 Plowing and Cultivating Machinery

- 5.1.3 Planting and Fertilizing Machinery

- 5.1.4 Harvesting Machinery

- 5.1.5 Haying and Forage Machinery

- 5.1.6 Irrigation Machineries

- 5.1.7 Other Product Types

- 5.2 Geography

- 5.2.1 South Africa

- 5.2.2 Rest of Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Tractors and Farm Equipment Limited (TAFE)

- 6.3.2 Claas KGaA mbH

- 6.3.3 AGCO Corporation

- 6.3.4 Mahindra & Mahindra Ltd

- 6.3.5 Deere & Company

- 6.3.6 CNH Industrial NV