|

시장보고서

상품코드

1686669

해저 생산 및 처리 시스템 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Subsea Production and Processing System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

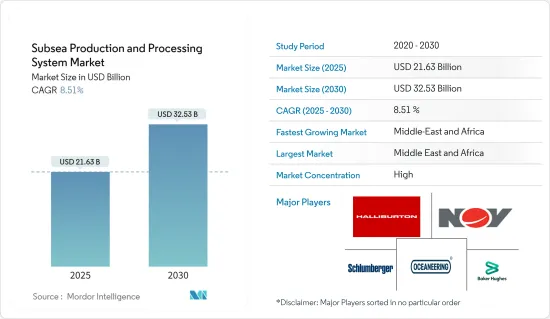

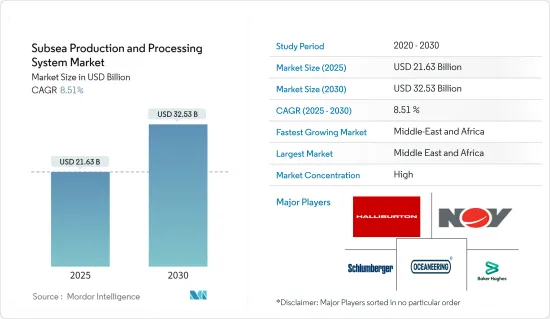

해저 생산 및 처리 시스템 시장 규모는 2025년에 216억 3,000만 달러에 달할 것으로 추정됩니다. 예측기간(2025-2030년)의 CAGR은 8.51%를 나타낼 것으로 전망되고, 2030년에는 325억 3,000만 달러에 이를 것으로 예상됩니다.

주요 하이라이트

- 중기적으로는 세계 굴착 및 완성 공사 증가가 조사 기간 중 해저 생산 및 처리 시스템 시장 수요를 견인하고 있습니다.

- 반면에 수급 격차, 지정학 및 기타 여러 요인으로 인한 최근 기간의 불안정한 석유 가격은 해저 생산 및 처리 시스템 수요 증가를 억제하고 있습니다.

- 그럼에도 불구하고 석유 및 가스 발견 증가와 세계 업계의 자유화가 결합되어 기업에게 새로운 투자 기회를 제공합니다. 새로운 신흥국 시장은 중동, 아프리카, 아시아태평양, 남미의 여러 개발 도상국입니다.

해저 생산 및 처리 시스템 시장 동향

심해와 초심해가 시장을 독점

- 세계 에너지 수요는 2030년까지 5% 증가할 것으로 예상되고 있으며, 석유·천연가스가 그 절반을 차지합니다. 기술 발전과 운영 최적화로 해외 업스트림 프로젝트의 비용이 크게 절감되었습니다. 수요 증가에 대응하기 위해 새로운 해외 업스트림 프로젝트의 도입률은 향후 몇년만에 상승할 것으로 예상됩니다.

- 최근, 세계의 석유 및 가스 업스트림 업계에서는 특히 심해나 초심해에서의 신규 오프쇼어 탐사·생산 활동이 크게 성장하고 있습니다. 세계의 석유 및 가스 기업은 현재 원유가격의 장기저락 시나리오를 이용하기 위해 신규 프로젝트의 섭취를 늘리려 하고 있습니다. 예측 기간 동안 해외 활동에서 석유, 가스 및 프로젝트의 성장이 증가할 것으로 예상됩니다.

- 예를 들어, 2022년 4월, 석유 및 가스 대기업인 Shell PLC와 TotalEnergies는 브라질의 최신 입찰 라운드의 일환으로 브라질 해안 산토스 해봉에서 6광구와 2광구의 해양 탐사 광구를 확보했습니다. 이 입찰에서는 6개의 해봉으로 59개의 탐광광구를 취득했습니다. 쉘 브라질은 제3회 탐광광구 입찰에서 획득한 탐광광구에 의해 이 나라에서 30개 이상의 석유 및 가스 개발 계약을 보유하고 있습니다. 한편 토탈에너지스는 SM-1711과 SM-1815의 각 탐광광구에서 100%의 권익을 확보했습니다. 이러한 개발은 해저 생산 및 처리 시스템에 대한 수요를 조장할 것으로 보입니다.

- 2022년 3월 영국의 석유 및 가스 회사 BP PLC는 인도네시아 정부가 실시한 2021년 석유 및 가스 작업지역(WK) 입찰 라운드의 두 번째 라운드의 일환으로 아군l광구와 아궁ll광구의 2개의 해양탐광광구를 획득했습니다. 이러한 광구는 상대적으로 미개척이며, 큰 자원 잠재력을 포함할 것으로 기대되기 때문에 해저 생산 및 처리 시스템 시장을 지원합니다.

- 전반적으로 에너지 수요 급증, 육상 매장량 고갈, 국가 정부의 해양 자원 탐사 노력으로 인한 해양 석유 및 가스 활동에 대한 투자 증가는 향후 수년간 심해 및 초심해 해저 프로덕션 및 처리 시스템 시장의 성장을 가속할 것으로 예상됩니다.

중동 및 아프리카가 시장을 독점

- 중동 및 아프리카의 석유 및 가스 업스트림 시장은 세계 에너지 산업의 주요 견인 역할입니다. 이 지역에는 세계 최대급의 석유 및 가스 매장량이 있으며, 그 지속적인 성장은 세계의 에너지 수요를 충족시키기 위해 필수적입니다.

- 최근 이 지역의 석유 및 가스 산업에서는 해저 시스템에 대한 수요가 대폭 증가하고 있습니다. 해저 시스템은 해저 유전에서 탄화수소를 생산, 처리 및 운송합니다. 해저 시스템은 심해 및 초심해의 매장량을 개발하기 위한 매우 효율적이고 비용 효율적인 솔루션임이 입증되었습니다.

- 중동 및 아프리카의 해저 시스템에 대한 수요는 매장량 회수의 극대화, 효율성과 생산성 향상, 비용 절감 등 여러 요인에 의해 야기되고 있습니다. 이 지역의 기존 육상 매장량의 대부분이 성숙화되는 가운데, 해저 시스템은 해양 매장량의 개발에 있어서 점점 중요한 툴이 되고 있습니다.

- 2023년 3월 중동 및 아프리카에 배치된 해양 리그 수는 44기였는데 COVID-19 팬데믹의 영향이 피크에 달한 2020년 10월 이후 약 57% 증가했습니다. 중동의 해양 장비 배치 증가는 해저 시스템 수요에 크게 영향을 미칩니다.

- 또한 기존의 화석연료를 대체하는 깨끗한 대체연료로서 액화천연가스(LNG)가 대두되고 있는 것도 이 지역의 해저시스템 수요를 끌어올리고 있습니다. 중동 및 아프리카에서는 현재 여러 대규모 LNG 프로젝트가 진행 중이며 기업은 천연 가스 수요 증가에 대응하기 위해 해저 인프라에 많은 투자를 하고 있습니다.

- 전반적으로 중동 및 아프리카의 해저 시스템 수요는 효율성과 생산성 향상, 비용 절감, 매장량 회수를 극대화할 필요성으로 향후 수년간 확대될 것으로 예상됩니다. 기업이 해저 인프라에 대한 투자를 계속하고 있기 때문에 이 지역은 예측 기간 동안에도 시장 최대급의 지역 부문인 것을 계속할 것으로 보입니다.

- 그러므로 이 지역의 석유 및 가스 활동 증가는 북미의 예측 기간 동안 해저 생산 및 처리 시스템 시장 수요를 증가시킬 것으로 예상됩니다.

해저 생산 및 처리 시스템 산업 개요

해저 생산 및 처리 시스템 시장은 부분적으로 통합됩니다. 이 시장의 주요 기업(특별한 순서 없음)에는 Schlumberger Limited, Halliburton Company, Aker Solutions ASA, National Oilwell Varc, Inc., Baker Hughes Company 등이 있습니다.

2022년 8월, 슐룸베르제는 아커 솔루션즈와 해저 7사와 합작회사를 설립하여 고객의 매장량 발굴과 사이클 타임 단축을 지원함으로써 해저 생산 혁신과 효율화를 추진할 계획을 발표했습니다. 이 합의는 해저가스 압축, 전 전기식 해저생산시스템, 기타 전동화 기능 등 혁신적인 기술 포트폴리오를 모아 고객이 탈탄소화 목표를 달성할 수 있도록 지원합니다.

마찬가지로 Arker Solutions는 해저 생산 사업을 발전시키기 위해 여러 합의와 제휴를 실시했습니다. 예를 들어, 2022년 2월 Arker Solutions와 Drill Quip은 탄소 회수, 이용, 저장 프로젝트에 해저 주입 시스템을 제공하는 계약을 체결했습니다. 이 계약에 따라 드릴 퀵은 CO2 주입을 위한 Xmas 트리와 갱구를 제공하며, 이는 대규모 해저 주입 시스템에 통합됩니다. 이 계약은 특히 영국의 노던 엔듀 런스 프로젝트를 대상으로 합니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트·지원

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 서론

- 시장 규모 및 수요 예측(-2028년, 단위 : 달러)

- 향후 예정된 주요 업스트림 프로젝트

- 최근 동향과 개발

- 정부의 규제와 정책

- 시장 역학

- 성장 촉진요인

- 해양 석유 및 가스 프로젝트의 실행 가능성 향상

- 성장 억제요인

- 여러 지역의 해외 탐사 및 생산 활동 금지

- 성장 촉진요인

- 공급망 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 강도

제5장 시장 세분화

- 프로덕션 시스템 구성 요소

- 해저 트리

- 해저 앰빌리칼, 라이저 및 유량선

- 해저 유정

- 기타

- 프로세싱 시스템 유형

- 부스팅

- 분리

- 주입

- 가스 압축

- 수심

- 얕은 물

- 심해 및 초심해

- 지역

- 북미

- 유럽

- 아시아태평양

- 남미

- 중동 및 아프리카

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 프로파일

- Aker Solutions ASA

- Baker Hughes Company

- Sri Energy Inc.

- Halliburton Company

- Kerui Group Co. Ltd

- National-Oilwell Varco, Inc.

- Oceaneering International

- Schlumberger Limited

- TechnipFMC PLC

- Subsea 7 SA

제7장 시장 기회와 앞으로의 동향

- 해저 생산 및 처리 시스템의 기술 진보

The Subsea Production and Processing System Market size is estimated at USD 21.63 billion in 2025, and is expected to reach USD 32.53 billion by 2030, at a CAGR of 8.51% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the increasing drilling and completion activities, globally, has been driving the demand for the subsea production and processing system market over the study period.

- On the other hand, the volatile oil prices over the recent period, owing to the supply-demand gap, geopolitics and several other factors has been restraining the growth in the demand for subsea production and processing systems.

- Nevertheless, the increasing oil and gas discoveries coupled with the liberalization in the industry globally, has been leading to creation of new opportunities for the players to invest in. The new emerging markets are several developing nations of Middle East and Africa, Asia-Pacific and South America.

Subsea Production and Processing System Market Trends

Deepwater and Ultra-Deepwater to Dominate the Market

- The global energy demand is expected to increase by 5% by 2030, with oil and natural gas contributing to approximately half the need. With the advancements in technology and optimization in operations, there is a significant reduction in the cost of offshore upstream projects. The uptake rate of new offshore upstream projects is expected to increase in the coming years to meet the rising demand.

- In recent years, the global oil & gas upstream industry is experiencing significant growth in new offshore exploration and production activities, especially in deep and ultra-deep waters. Oil & gas players worldwide are looking to increase the uptake of new projects to capitalize on the current lower-for-longer oil prices scenario. It is expected to increase the growth of oil & gas projects in offshore activities during the forecast period.

- For instance, in April 2022, oil and gas giants Shell PLC and TotalEnergies secured six and two offshore exploration blocks in the Santos Basin offshore Brazil as part of the country's latest bid round. In the auction, 59 exploration blocks were acquired in six basins. With the block acquired in the 3rd Permanent Offer of exploration areas, Shell Brazil holds more than 30 oil & gas contracts in the country. On the other hand, TotalEnergies secured a 100% interest in each exploration block, S-M-1711 and S-M-1815. These developments are likely to aid demand for subsea production and processing systems.

- In March 2022, British oil & gas company BP PLC won two offshore exploration blocks, Agung l, and Agung ll, in Indonesia, as part of the government's second round of the 2021 Oil & Gas Working Area (WK) Bid Round. These blocks are relatively unexplored and are expected to include significant resource potential, thus supporting the subsea production and processing system market.

- Overall, the rising investments in offshore oil & gas activities, owing to the surging energy demand, depleting onshore reserves, and efforts from governments across nations to explore their offshore resources are expected to drive the growth of the deepwater and ultra-deepwater subsea production and processing system market in the coming years.

Middle East and Africa to Dominate the Market

- The upstream oil and gas market in the Middle East & Africa is a key driver of the global energy industry. The region is home to some of the world's largest oil and gas reserves, and its continued growth is critical to meeting global energy demand.

- Recently, there is a significant increase in the demand for subsea systems in the region's oil and gas industry. Subsea systems produce, process, and transport hydrocarbons from offshore fields. They proved a highly efficient and cost-effective solution for developing deepwater and ultra-deepwater reserves.

- The demand for subsea systems in the Middle East & Africa is driven by several factors, including maximizing the reserves recovery, improving efficiency and productivity, and reducing costs. With many of the region's conventional onshore reserves maturing, subsea systems are becoming an increasingly important tool for developing offshore reserves.

- In March 2023, the offshore rig count deployed in the Middle East & Africa stood at 44, up by nearly 57% since October 2020, when the impact of the COVID-19 pandemic peaked. The rising offshore rig deployment in the Middle East significantly impacts the demand for subsea systems.

- Moreover, the rise of liquefied natural gas (LNG) as a cleaner alternative to traditional fossil fuels is also driving the demand for subsea systems in the region. With several major LNG projects currently underway in the Middle East & Africa, companies are investing heavily in subsea infrastructure to help meet the growing demand for natural gas.

- Overall, the demand for subsea systems in the Middle East & Africa is expected to grow in the coming years, driven by the need to increase efficiency and productivity, reduce costs, and maximize the recovery of reserves. As companies continue to invest in subsea infrastructure, the region will likely remain one of the largest geographical segments in the market during the forecast period.

- Therefore, increasing oil and gas activities in the region are expected to increase the demand for subsea production and processing system markets over the forecast period in the North American region.

Subsea Production and Processing System Industry Overview

The subsea production and processing system market is partially consolidated. Some key players in this market (in no particular order) include Schlumberger Limited, Halliburton Company, Aker Solutions ASA, National Oilwell Varc, Inc., and Baker Hughes Company., among others.

In August 2022, Schlumberger, has announced its plan to enter a joint venture with Aker Solutions and Subsea 7 to drive innovation and efficiency in subsea production by helping customers unlock reserves and reduce cycle time. The agreement will bring together a portfolio of innovative technologies such as subsea gas compression, all-electric subsea production systems, and other electrification capabilities that help customers meet their decarbonization goals.

Similarly, Aker Solutions has made several agreements and collaborations to develop its subsea production business. For example, in February 2022, Aker Solutions and Drill-Quip have entered into an agreement to provide subsea injection systems for carbon capture, utilization, and storage projects. As per the agreement, Drill Quip would provide CO2 injection Xmas trees and wellheads which will be integrated into a larger subsea injection system. The agreement is specifically made for the Northern Endurance Project in the United Kingdom..

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Major Upcoming Upstream Projects

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Improved Viability Of Offshore Oil And Gas Projects

- 4.6.2 Restraints

- 4.6.2.1 Ban On Offshore Exploration And Production Activities In Multiple Regions

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Production System Component

- 5.1.1 Subsea Trees

- 5.1.2 Subsea Umbilicals, Risers, & Flowlines

- 5.1.3 Subsea Wellhead

- 5.1.4 Other

- 5.2 Processing System Type

- 5.2.1 Boosting

- 5.2.2 Separation

- 5.2.3 Injection

- 5.2.4 Gas Compression

- 5.3 Water Depth

- 5.3.1 Shallow Water

- 5.3.2 Deepwater and Ultra-Deepwater

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 South America

- 5.4.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Aker Solutions ASA

- 6.3.2 Baker Hughes Company

- 6.3.3 Sri Energy Inc.

- 6.3.4 Halliburton Company

- 6.3.5 Kerui Group Co. Ltd

- 6.3.6 National-Oilwell Varco, Inc.

- 6.3.7 Oceaneering International

- 6.3.8 Schlumberger Limited

- 6.3.9 TechnipFMC PLC

- 6.3.10 Subsea 7 SA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technology Advancements in Subsea Production and Processing Systems