|

시장보고서

상품코드

1687049

군용 전기 광학 및 적외선 시스템 시장 : 시장 점유율 분석, 산업 동향, 성장 예측(2025-2030년)Military Electro-optical And Infrared Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

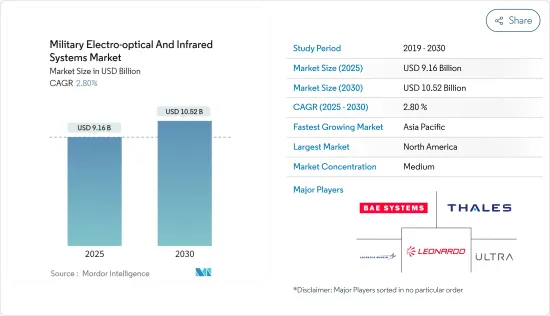

군용 전기 광학 및 적외선 시스템 시장 규모는 2025년에 91억 6,000만 달러로 추정되고, 예측 기간인 2025-2030년 CAGR 2.8%로 성장할 전망이며, 2030년에는 105억 2,000만 달러에 달할 것으로 예측됩니다.

주요 하이라이트

- COVID-19 팬데믹의 발생과 그 후의 운영 정지는 방위 제조 부문과 여러 국가의 군사 연구 개발 활동의 속도에 영향을 미쳤습니다. 팬데믹의 악영향은 몇몇 프로그램이 부품 공급업체의 독자적인 세계 네트워크에 의존했기 때문에 세계 방위 공급망에 나타났습니다.

- 다양한 유인 및 무인 시스템의 ISR 능력 강화에 대한 수요 증가에 따라, 예측 기간의 후반에 조사 대상 시장은 안정적으로 성장할 것으로 보입니다. 이러한 시스템은 전기 광학 및 적외선(EO/IR) 센서를 이용합니다. 각국은 상황 인식을 향상시키기 위해 이러한 시스템을 서서히 채택하고 있습니다.

- 그러나 다양한 설계 과제, 기술적 제약, 공급망 리스크, 세계적 위기의 진전, 전례가 없는 요인이 예측 기간 중 시장 성장을 억제할 것으로 예측되고 있습니다.

군용 전기 광학 및 적외선 시스템 시장 동향

예측 기간 동안 해상 기반 부문이 가장 높은 성장이 예상

- 시장의 해상 기반 부문은 예측 기간 동안 가장 높은 CAGR을 나타낼 것으로 예측됩니다. 영토 분쟁과 국경 문제가 증가함에 따라 군 해상 자산의 위험이 증가하고 해상 모니터링, 위협 감지 및 표적 식별이 중요해졌습니다. 현대 전투는 이러한 능력을 중시하기 때문에 군는 정교한 고급 센서 시스템을 함정에 통합하고 통합하는 데 중점을 둡니다.

- 해군의 함정은 전기 광학 및 적외선(EO/IR) 센서로부터 운동 이미지를 획득해야 하며, 주야간에 관계없이 장거리에 걸쳐 대상을 감시하고, 대상을 식별하는 능력을 향상시키며, 위협 평가를 수행하고, 교전 규칙에 의해 의도를 평가하며, 시선을 통해 자동 추적과 사격 통제 솔루션을 통해 무기 교전을 지원합니다. 따라서 해상 상황 인식을 향상시키기 위해 해상 순찰에 대한 신뢰성이 높고 정확한 센서 시스템이 더 필요해지고 있습니다.

- 게다가 함정은 지형으로부터 격리되어 있기 때문에 임박한 위협으로부터 장기간 살아남기 위해서는 고도의 위협 검지 및 대책 시스템을 보유하는 것이 중요하게 됩니다. 이것은 현재이 해상 기반 EO/IR 센서의 연구 개발 성장을 가속하고 있습니다. 일부 국가는 해군 EO/IR 센서 시스템을 업그레이드하고 있습니다. 예를 들면

- 2022년 3월, 해상 자위대는 신형 스텔스 프리게이트를 취역시켰습니다. 특기할 만한 것은, 미츠비시 중공업이 개발한 선진적인 통합 전투 정보 센터입니다. 이 시스템은 운영자가 모든 항행, 추진, 추적, 화기 관제 데이터를 볼 수 있는 큰 원형 스크린을 갖추고 있습니다. 이 시스템은 카메라를 통해 승무원에게 360도의 시야를 제공하고 사각없이 함의 주변을 바라볼 수 있습니다. 나머지 중요한 시스템에는 APY-2 액티브 전자 스캔 어레이(AESA) X 밴드 레이더, 고정식 및 예인식 소나, OAX-3EO/IR 센서가 포함됩니다. 미쓰비시 전기는 레이더와 EO/IR 센서를 공급했습니다.

- 미국 해군은 2022년 6월 L3 해리스 테크놀로지스(L3Harris Technologies)가 이끄는 팀을 선정하여 함대 방호 강화를 위한 함상 파노라마 광학 및 적외선(SPEIR) 시스템을 납품합니다. 초기 계약액은 2억 500만 달러로 2031년 3월까지 모든 옵션이 행사되었을 경우의 상한액은 5억 9,300만 달러가 됩니다.

- SPEIR 프로그램은 360도 전기 광학 및 적외선(EO/IR) 이미지와 상황 인식, 더욱 개선된 EO/IR 센서(무기 지원 센서에서 완전한 패시브 미션 솔루션 능력으로)의 사용에 있어서의 세대적 도약을 의미합니다. 이러한 개발은 향후 해상 기반 부문의 전망을 강화할 것으로 예상됩니다.

북미가 시장에서 상위를 차지

- 북미가 가장 큰 점유율을 차지한 것은 주로 EO/IR 시스템에 대한 미국 군으로부터의 높은 수요에 의한 것입니다. 전장에서 적의 능력 강화로 미국은 기술적으로 앞선 무기 시스템에 대한 투자를 늘릴 수밖에 없었습니다. 게다가 다양한 세계적 분쟁에 대한 미군 관여의 고조가, 군의 상황 인식을 강화하는 선진적인 ISR이나 그 외의 시스템의 조달 증가에 크게 공헌했습니다.

- 2022년 7월 미국 하원은 2023년 10월 1일에 시작되는 내년도 국방예산 8,400억 달러를 승인했습니다. 이에 따라 국방부 예산은 370억 달러 증가하였으며, 우크라이나군에 대한 자금 제공, 중국과의 경쟁, 아프가니스탄 철군 문제 대응에 중점을 둡니다. 한편 2022년 4월 미 하원은 전화가 끊이지 않는 우크라이나 및 다른 동유럽 국가들과의 방위장비 대여협정 기준을 완화하는 법안을 승인해 미국산 무기가 더 많이 이 지역에 들어갈 수 있는 길을 열었습니다.

- 2022년 2월, 미국 육군은 차세대 레이저 표적 감지기의 계획을 발표했습니다. 국방 블로그 웹사이트는 육군의 취득 기관인 브랜치가 업데이트된 성능 요건을 충족하는 자체 완결형 레이저 타겟 로케이터 모듈 III(LTLMI III)를 생산하고 제공하는 벤더의 능력을 결정하기 위해 업계에 손을 내밀고 있다고 보고했습니다. 경쟁 SPTD는 2023 회계연도 1분기에 경쟁 발주 계약을 검토하고 있으며, 기재된 타임라인 내에서 새로운 로케이터 모듈의 요건을 충족하는 실증된 역량에 대해 관심 있는 기업들의 정보를 요청하고 있습니다.

- 2021년 8월, L3Harris Technologies는 미국 특수 작전 사령부에서 WESCAM MX 전기 광학, 적외선, 레이저 디지그네이터 센서 스위트와 서비스를 조달하기 위해 5년간 9,600만 달러의 IDIQ 계약을 획득했다고 발표했습니다. 이 센서 시스템은 미 육군 특수작전 항공부대의 인벤토리 내 다양한 항공기에 멀티 스펙트럼 이미지와 지정 기능을 제공할 것으로 기대되고 있습니다. 새로운 전기 광학 센서에 대한 유사한 수주와 선진적인 EO/IR 센서에 의한 다양한 군용 시스템 업그레이드가 예측 기간 동안 이 지역의 시장 성장을 촉진할 것으로 예측되고 있습니다.

군용 EO/IR 시스템 산업 개요

군용 전기 광학 및 적외선 시스템 시장은 반 고유의 특성을 가지고 있으며 소수의 기업이 시장에서 큰 점유율을 차지하고 있습니다. 시장의 저명한 기업은 Leonardo SpA, BAE Systems plc, THALES, Ultra Electronics Holding, Lockheed Martin Corporation 등입니다. 저명한 시장 기업은 다면적인 제품 포트폴리오를 가지고 있습니다. 또한 지속적인 연구개발을 통해 현재의 능력을 수정 및 강화하고 부가가치가 높은 전기 광학 및 적외선(EO/IR) 솔루션을 최종 사용자에게 제공하기 위해 정교한 기능을 도입하려고 하고 있습니다. 이는 차별화가 낮은 제품을 경쟁력 있는 가격으로 도입하는 데에도 도움이 됩니다.

대부분의 통합 프로그램은 장기적이기 때문에 최종 사용자 사양에 따라 고급 EO/IR 센서의 설계 변경과 생산을 의미하는 IDIQ 계약이 현재 몇 가지 진행 중입니다. 최종 사용자의 요구는 다양하기 때문에 시장 관계자간의 전략적 협력이 촉진됩니다.

새로운 통합 플랫폼의 개발은 첨단 EO/IR 센서와 시스템의 통합에 대한 수요를 촉진하여 예측 기간 동안 시장에 밝은 전망이 생길 수 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 시장 성장 억제요인

- Porter's Five Forces 분석

- 구매자 및 소비자의 협상력

- 공급기업의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 플랫폼별

- 항공 기반

- 육상 기반

- 해상 기반

- 지역별

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 라틴아메리카

- 멕시코

- 브라질

- 기타 라틴아메리카

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 남아프리카

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 벤더의 시장 점유율

- 기업 프로파일

- BAE Systems plc

- Elbit Systems Ltd.

- Teledyne FLIR LLC

- Israel Aerospace Industries Ltd.

- L3Harris Technologies Inc.

- Leonardo SpA

- Lockheed Martin Corporation

- Raytheon Technologies Corporation

- Rheinmetall AG

- Saab AB

- THALES

- Ultra Electronics Holdings

- Other Players

- Danbury Mission Technologies

- System Controls

- Zygo Corporation

- Navitar

- Optikos

제7장 시장 기회 및 향후 동향

AJY 25.05.02The Military Electro-optical And Infrared Systems Market size is estimated at USD 9.16 billion in 2025, and is expected to reach USD 10.52 billion by 2030, at a CAGR of 2.8% during the forecast period (2025-2030).

Key Highlights

- The outbreak of the COVID-19 pandemic and the subsequent shutdowns affected the defense manufacturing sector and the pace of military R&D activities in several countries. The negative impacts of the pandemic were visible in the global defense supply chains, as several programs relied upon a unique global network of part suppliers.

- The market studied is likely to grow steadily during the latter half of the forecast period due to the growing demand for enhanced ISR capabilities for various manned and unmanned systems. These systems make use of electro-optical/infrared (EO/IR) sensors. Countries are progressively adopting these systems to increase their situational awareness.

- However, various design challenges, technological constraints, supply chain risks, the evolving global crisis, and unprecedented factors are projected to restrain the market growth during the forecast period.

Military Electro-optical and Infrared Systems Market Trends

The Sea-based Segment is Expected to Experience the Highest Growth During the Forecast Period

- The sea-based segment of the market is anticipated to register the highest CAGR during the forecast period. The growth of territorial conflicts and border issues increased the risk for maritime assets of militaries, which led to increasing emphasis on surveillance, threat detection, and target identification at sea. As modern combats emphasize these capabilities, armed forces mostly focus on incorporating and integrating sophisticated and advanced sensor systems into their naval vessels.

- Navy vessels need to obtain motion imagery from electro-optical/infrared (EO/IR) sensors that provide day-night and long-range eyes on the target, which improves their ability to identify targets, perform threat assessment, assess intent by the rules of engagement, and support weapon engagement through automatic tracking and fire control solutions through line-of-sight. Thus, the need for better sensor systems that are highly reliable and accurate for maritime patrol to improve sea-based situational awareness has increased.

- In addition, as the naval vessels are isolated from the terrain, it becomes important for them to possess advanced threat detection and countermeasure systems for their long-time survival from impending threats. This is driving the growth of research and development in these sea-based EO/IR sensors currently. Several nations are upgrading their naval EO/IR sensor systems. For instance,

- In March 2022, the Japan Maritime Self-Defense Force (JMSDF) commissioned a new stealth frigate into service. One notable feature is an advanced integrated combat information center developed by Mitsubishi Heavy Industries. This system has a large circular screen where operators may view all navigation, propulsion, tracking, and fire control data. The same system provides the crew 360 degrees of visibility through cameras, enabling them to see the areas around the ship without any blind spots. The remaining essential systems include an APY-2 active electronically scanned array (AESA) X-band radar, fixed and towed sonars, and an OAX-3 EO/IR sensor. Mitsubishi Electric supplied the radar and the EO/IR sensor.

- In June 2022, US Navy selected a team led by L3Harris Technologies to deliver a Shipboard Panoramic Electro-Optic/Infrared (SPEIR) system for enhancing fleet protection. The initial value of the contract is USD 205 million, with a ceiling value of USD 593 million if all the options are exercised until March 2031.

- The SPEIR program marks a generational leap in using 360-degree electro-optic and infrared (EO/IR) imagery and situational awareness, as well as improved EO/IR sensors - from a weapon support sensor to a completely passive mission solution capability. Such developments are expected to bolster the sea-based segment prospects in the future.

North America Held Highest Shares in the Market

- North America held the largest share, primarily due to high demand from the US armed forces for EO/IR systems. The enhanced capabilities of adversaries on the battlefield forced the US to increase its investment in technologically advanced weapon systems. Furthermore, the growing involvement of the US armed forces in various global conflicts significantly contributed to the increased procurement of advanced ISR and other systems that enhance the situational awareness of the military.

- In July 2022, the US House of Representatives recently approved the nation's USD 840 billion defense budget for the next fiscal year, which begins on October 1, 2023, for enhancing the mission readiness of various armed forces of the country. This will increase the Pentagon budget by USD 37 billion, focusing on providing funds to Ukraine's military, competing with China, and addressing the issues of Afghanistan's military withdrawal. Meanwhile, in April 2022, the US House of Representatives approved legislation that loosened the criteria for defense equipment lend-lease agreements with war-torn Ukraine and other countries in Eastern Europe, paving the path for more US weapons to enter the region.

- In February 2022, the US Army announced its plans for a next-generation laser target locator. The Defence Blog website reported that a branch of the Army's acquisition agency is reaching out to the industry to determine vendors' ability to produce and deliver a self-contained Laser Target Locator Module III (LTLM III) that meets updated performance requirements. The PdM SPTD is considering a competitively awarded contract in the first quarter of the fiscal year 2023 and is seeking information from interested companies on their demonstrated ability to meet the requirements for the new locator module within the stated timeline.

- In August 2021, L3Harris Technologies announced that it had received a five-year, USD 96 million IDIQ contract from the US Special Operations Command to procure WESCAM MX electro-optical, infrared, and laser designator sensor suites and services. The sensor systems are expected to provide multi-spectral imaging and designation capabilities for various aircraft within the US Army Special Operations Aviation Command inventory. Similar orders for new electro-optical sensors and the upgrading of various military systems with advanced EO/IR sensors are anticipated to propel the market growth in the region during the forecast period.

Military Electro-optical and Infrared Systems Industry Overview

The military electro-optical & infrared systems market is semi-consolidated in nature, with the presence of few players holding significant shares in the market. Some prominent players in the market are Leonardo S.p.A, BAE Systems plc, THALES, Ultra Electronics Holding, and Lockheed Martin Corporation. Prominent market players have multifaceted product portfolios. Additionally, they try to modify and enhance their current capabilities through continuous research and development and introduce sophisticated features to deliver value-added electro-optical/infrared (EO/IR) solutions to end users. This also helps them introduce low-differentiated products at competitive pricing.

Most of the integration programs are long-term; hence, several IDIQ contracts are currently underway, signifying design modification and production of sophisticated EO/IR sensors per end-user specifications. Since the end-user requirements are diverse, it encourages strategic collaboration between market players.

The development of new integration platforms drives the demand for the integration of sophisticated EO/IR sensors and systems, which, in turn, may create a positive outlook for the market during the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Platform

- 5.1.1 Air-based

- 5.1.2 Land-based

- 5.1.3 Sea-based

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Italy

- 5.2.2.5 Spain

- 5.2.2.6 Russia

- 5.2.2.7 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 Australia

- 5.2.3.5 South Korea

- 5.2.3.6 Rest of Asia-Pacific

- 5.2.4 Latin America

- 5.2.4.1 Mexico

- 5.2.4.2 Brazil

- 5.2.4.3 Rest of Latin America

- 5.2.5 Middle East and Africa

- 5.2.5.1 United Arab Emirates

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 South Africa

- 5.2.5.4 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 BAE Systems plc

- 6.2.2 Elbit Systems Ltd.

- 6.2.3 Teledyne FLIR LLC

- 6.2.4 Israel Aerospace Industries Ltd.

- 6.2.5 L3Harris Technologies Inc.

- 6.2.6 Leonardo S.p.A

- 6.2.7 Lockheed Martin Corporation

- 6.2.8 Raytheon Technologies Corporation

- 6.2.9 Rheinmetall AG

- 6.2.10 Saab AB

- 6.2.11 THALES

- 6.2.12 Ultra Electronics Holdings

- 6.3 Other Players

- 6.3.1 Danbury Mission Technologies

- 6.3.2 System Controls

- 6.3.3 Zygo Corporation

- 6.3.4 Navitar

- 6.3.5 Optikos