|

시장보고서

상품코드

1687085

생물학적 종자 처리 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Global Biological Seed Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

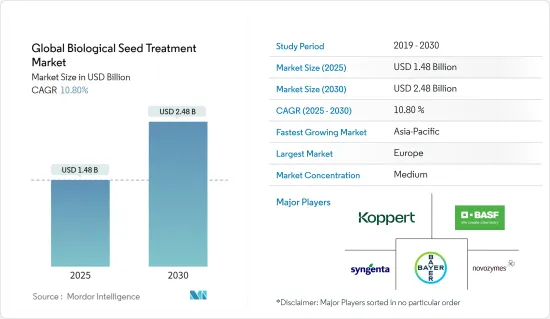

세계의 생물학적 종자 처리 시장 규모는 2025년에 14억 8,000만 달러로 추정되고, 2030년에는 24억 8,000만 달러에 달할 것으로 예측되며, 예측 기간(2025-2030년)의 CAGR은 10.8%를 나타낼 전망입니다.

생물학적 종자 처리 시장은 최근 몇 년 동안 눈에 띄게 성장했습니다. 자연 처리 방법은 점점 더 환경 친화적인 종자 처리 옵션으로 여겨지고 있습니다. 2024년 미국 농무부(USDA)는 새로운 프로그램, 파트너십, 보조금 수여, 1,000만 달러의 추가 자금 지원 등을 통해 유기농 농가에 대한 지원을 강화하기 시작했습니다. 이러한 프로그램은 국내 유기농 제품을 위한 더 나은 시장을 개발하고, 유기농 생산으로 전환하는 생산자를 위한 실습 교육을 제공하며, 유기농 인증 취득에 따른 재정적 부담을 완화하는 것을 목표로 합니다.

종자를 보호하기 위해 고안된 생물학적 종자 처리는 초기 육묘 단계에서 특정 해충과 곰팡이 질병을 표적으로 방제할 수 있습니다. 또한 이러한 처리법은 곡물, 시리얼, 유지 종자, 채소 등 다양한 작물에 사용되어 다양한 해충을 관리합니다. 생산성 향상과 투입 비용 절감을 위한 생물학적 종자 처리 기술의 사용이 증가함에 따라 생물학적 종자 처리의 광범위한 채택이 뒷받침되고 있습니다. 예를 들어, 인도 농업기술대학교 연구진의 2022년 연구에 따르면 지속 가능한 농업에서 바이오 프라이밍은 비용 효율적이고 환경 친화적인 것으로 나타났습니다.

생물학적 종자 처리 시장 동향

곡물 및 시리얼 부문이 시장을 선도

곡물 및 시리얼 부문에서 생물학적 종자 처리의 채택이 증가하여 화학적 방법에 대한 지속 가능한 대안을 제공하고 있습니다.이러한 추세는 친환경 농법에 대한 전 세계적인 추진과 유기농 농산물에 대한 수요 증가에 의해 주도되고 있습니다. 특히 밀, 콩, 옥수수와 같은 곡물과 곡물에서 식물성 단백질에 대한 수요가 증가함에 따라 수확량을 극대화하고 작물의 품질을 개선하기 위해 생물학적 처리가 활용되고 있습니다. 또한 밀, 보리, 옥수수와 같은 작물은 푸사리움 머리마름병, 묘목마름병, 뿌리썩음병 등 다양한 토양 매개성 질병에 걸리기 쉽습니다. 트리코데르마, 바실러스 종, 슈도모나스 종을 포함한 생물학적 종자 처리는 이러한 병원균으로부터 작물을 보호하여 작물을 더 건강하게 만들고 화학 살균제의 필요성을 줄여줍니다.

조사 기간 동안 유기농 곡물 재배 면적이 눈에 띄게 증가했습니다. 곡물 작물에 대한 유기농법과 통합 해충 관리(IPM)의 인기가 높아지면서 생물학적 종자 처리는 화학 물질 사용을 줄이는 핵심 요소로 자리 잡았고, 이 부문에서 생물학적 종자 처리를 사용하는 데 큰 도움이 되고 있습니다.

지속적인 연구 개발 노력은 생물학적 처리의 효능, 유통기한, 비용 효율성을 개선하는 데 초점을 맞추고 있습니다. 새로운 미생물 균주와 혁신적인 전달 방법이 생물학적 종자 처리의 성능을 향상시키고 있습니다. 2024년, Indigo Ag는 획기적인 CLIPS 장치를 출시했습니다. 이 자동 핸즈프리 시스템은 시간을 절약하고 종자 처리 과정의 번거로움을 없애며 표준 생물학적 종자 처리 용도를 혁신할 수 있는 잠재력을 가지고 있습니다. CLIPS는 농업 산업에 초점을 맞춘 최초의 생물학적 계약 개발 및 제조 조직인 3BarBio와 협력하여 설계되었습니다.

유럽이 시장을 독점

유럽은 지속 가능성, 환경 보호, 농업에서의 화학물질 투입량 감소에 중점을 두고 있는 생물학적 종자 처리제의 중요한 시장입니다. 유럽연합(EU)은 친환경 농업을 장려하는 데 앞장서며 생물학적 종자 처리제에 대한 수요를 크게 늘리고 있습니다. EU 그린 딜과 농장에서 식탁까지 전략은 2050년까지 EU를 기후 중립국으로 만드는 것을 목표로 합니다.

유럽 소비자들은 점점 더 적은 화학 물질과 환경 친화적인 방식으로 생산된 식품에 대한 수요가 증가하고 있습니다. 유기농 농산물에 대한 이러한 수요로 인해 농부들은 생물학적 종자 처리와 같은 지속 가능한 농업 기술을 채택하고 있습니다.

또한 시장에서 새로운 제품을 개발하기 위한 전략도 성장을 뒷받침하고 있습니다. 2023년 Syngenta Biologicals 와 Unium Bioscience는 협력하여 북서유럽 전역의 농부들에게 NUELLO iN을 기반으로 한 획기적인 생물학적 종자 처리 솔루션을 제공했습니다. 수확량을 늘리고 식물과 토양의 건강을 촉진하며 질소 관리 전략의 유연성을 높이는 동시에 농업이 환경에 미치는 영향을 줄입니다. 이 제품은 식물이 대기 중에 쉽게 구할 수 있는 질소를 전환하고 사용하는 능력을 자연스럽게 개선하여 질소 사용량을 10% 이상 줄일 수 있습니다.

생물학적 종자 처리 산업 개요

생물학적 종자 처리 시장은 적당히 통합되어 있으며, 주요 기업으로는 Syngenta, Bayer Crop Science, BASF, Novozymes, Koppert BV 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 지원

목차

제1장 서론

- 조사 상정과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 유기농 농업의 증가 추세

- 효율성 향상을위한 바이오 프라이밍 기술 사용

- R&D 활동에 투자 확대

- 시장 성장 억제요인

- 높은 비용과 낮은 가용성

- 정부의 규제 장벽

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 기능

- 종자 보호

- 종자 강화

- 기타

- 작물 유형

- 곡물 및 시리얼

- 유지 종자

- 채소

- 기타

- 지역

- 북미

- 미국

- 캐나다

- 멕시코

- 기타 북미

- 유럽

- 스페인

- 영국

- 프랑스

- 독일

- 러시아

- 이탈리아

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 태국

- 베트남

- 호주

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 가장 채용된 전략

- 시장 점유율 분석

- 기업 프로파일

- BASF SE

- Bayer Cropscience AG

- Verdesian Life Sciences LLC

- Syngenta AG

- Floridienne Group

- Germains Seed Technology

- Koppert Biological Systems

- Novozymes

- Bioceres Crop Solutions Corp

- Locus AG

제7장 시장 기회와 앞으로의 동향

HBR 25.05.02The Global Biological Seed Treatment Market size is estimated at USD 1.48 billion in 2025, and is expected to reach USD 2.48 billion by 2030, at a CAGR of 10.8% during the forecast period (2025-2030).

The biological seed treatment market has experienced notable growth in recent years. Natural treatment methods are increasingly viewed as environmentally friendly options for seed treatment. With rising concerns about the environmental impact of chemical fertilizers and pesticides, biological seed treatments provide a more sustainable, eco-friendly alternative. Consumers and governments are focusing more on reducing chemical residues in food production, aiding the usage of biological seed treatments. In 2024, the United States Department of Agriculture (USDA) started increasing its support for organic farmers through new programs, partnerships, grant awards, and an additional USD10 million in funding. These programs aim to develop better markets for domestic organic products, offer hands-on training for producers transitioning to organic production, and ease the financial burden of obtaining organic certification. This shift towards organic farming further encourages the adoption of biological seed treatments.

Biological seed treatments, which are designed to protect seeds, offer targeted control of specific pests and fungal diseases during the early seedling stage. Additionally, these treatments are used on various crops, such as grains, cereals, oilseeds, and vegetables, to manage a range of pests. The increasing use of bio-priming techniques to improve productivity and reduce input costs is supporting the widespread adoption of biological seed treatments. For instance, a 2022 study by researchers from the University of Agriculture and Technology, India indicated that bio-priming in sustainable agriculture is more cost-effective and environmentally benign. Therefore, the growing adoption of eco-friendly options, the trend towards organic farming, a favourable regulatory environment, and supportive initiatives are expected to drive the growth of the market during the forecast period.

Biological Seed Treatment Market Trends

Grains and Cereal segment leads the market

The adoption of biological seed treatments in cereals and grains is increasing, offering a sustainable alternative to chemical methods. This trend is driven by the global push for environmentally friendly farming practices and the rising demand for organic produce. As the demand for plant-based proteins grows, particularly in cereals and grains like wheat, soy, and corn, biological treatments are being utilized to maximize yields and improve crop quality. Additionally, crops such as wheat, barley, and corn are prone to various soil-borne diseases, including Fusarium head blight, seedling blight, and root rot. Biological seed treatments, which include Trichoderma, Bacillus species, and Pseudomonas species, protect against these pathogens, resulting in healthier crops and reducing the need for chemical fungicides.

During the study period, there has been a notable increase in the area under organic cereal farming. According to the Research Institute of Organic Agriculture (FiBL), the global organic area under cereal cultivation was 5.4 million hectares in 2021, which increased to 5.6 million hectares in 2022. The growing popularity of organic farming for cereal crops and integrated pest management (IPM) has made biological seed treatments a key component in reducing chemical use, thereby supporting their usage in the segment.

Ongoing research and development efforts are focused on improving the efficacy, shelf life, and cost-effectiveness of biological treatments. New microbial strains and innovative delivery methods are enhancing the performance of biological seed treatments. In 2024, Indigo Ag launched its ground-breaking CLIPS device. This automatic hands-free system saves time, eliminates the hassle in the seed treatment process, and has the potential to revolutionize standard biological seed treatment applications. CLIPS was designed in collaboration with 3BarBio, the first biological Contract Development and Manufacturing Organization focused on the agriculture industry. Therefore, the rising importance of organic produce, coupled with the expanding area of cereal farming and technological advancements, is driving market growth during the forecast period.

Europe Dominates the Market

Europe is a crucial market for biological seed treatments, driven by a strong focus on sustainability, environmental protection, and reducing chemical inputs in agriculture. The European Union (EU) leads in promoting eco-friendly farming practices, significantly increasing the demand for biological seed treatments. The EU has implemented stringent regulations on pesticide use to reduce chemical residues in food and minimize environmental impact. The EU Green Deal and the Farm to Fork Strategy aim to make the EU climate-neutral by 2050. These strategies emphasize sustainable food production and reducing reliance on chemical pesticides and fertilizers, encouraging the adoption of biological and organic farming practices and boosting the demand for biological seed treatments.

European consumers increasingly demand food produced with fewer chemicals and more environmentally friendly practices. According to the Research Institute of Organic Agriculture (FiBL), organic retail sales in Europe grew from USD 50.3 billion in 2019 to USD 55.8 billion in 2022. This demand for organic produce pushes farmers to adopt sustainable farming techniques, including biological seed treatments. The shift toward organic food, particularly in Germany, France, and the UK, has driven the adoption of biological solutions in both large-scale and small-scale farming operations.

Furthermore, strategies for developing new products in the market support growth. In 2023, Syngenta Biologicals and Unium Bioscience collaborated to bring breakthrough biological seed treatment solutions based on NUELLO iN to farmers across northwest Europe. The product naturally improves a plant's ability to convert and use nitrogen readily available in the atmosphere, potentially reducing nitrogen use by more than 10 percent. This innovation lowers the environmental impact of farming while increasing crop yield, promoting plant and soil health, and offering farmers greater flexibility in their nitrogen management strategies. Therefore, growing government support for sustainability, coupled with the demand for organic produce and supportive strategies, aids market growth during the forecast period.

Biological Seed Treatment Industry Overview

The Biological Seed Treatment Market is moderately consolidated, with major players such as, Syngenta, Bayer Crop Science, BASF, Novozymes, and Koppert B.V. in the market studied. The players are investing in the improvisation of products, partnerships, expansions, and acquisitions for business expansions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Trend of Organic Farming

- 4.2.2 Use of Bio-Priming Techniques for Improved Efficiency

- 4.2.3 Players Investing More in R&D Activities

- 4.3 Market Restraints

- 4.3.1 High Costs and Low Availability

- 4.3.2 Government Regulatory Barriers

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Function

- 5.1.1 Seed Protection

- 5.1.2 Seed Enhancement

- 5.1.3 Other Functions

- 5.2 Crop Type

- 5.2.1 Grains and Cereal

- 5.2.2 Oil Seeds

- 5.2.3 Vegetables

- 5.2.4 Other Crop Types

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Germany

- 5.3.2.5 Russia

- 5.3.2.6 Italy

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Thailand

- 5.3.3.5 Vietnam

- 5.3.3.6 Australia

- 5.3.3.7 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 BASF SE

- 6.3.2 Bayer Cropscience AG

- 6.3.3 Verdesian Life Sciences LLC

- 6.3.4 Syngenta AG

- 6.3.5 Floridienne Group

- 6.3.6 Germains Seed Technology

- 6.3.7 Koppert Biological Systems

- 6.3.8 Novozymes

- 6.3.9 Bioceres Crop Solutions Corp

- 6.3.10 Locus AG