|

시장보고서

상품코드

1687126

미생물 배양 시장(2025-2030년) : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측Microbial Culture - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

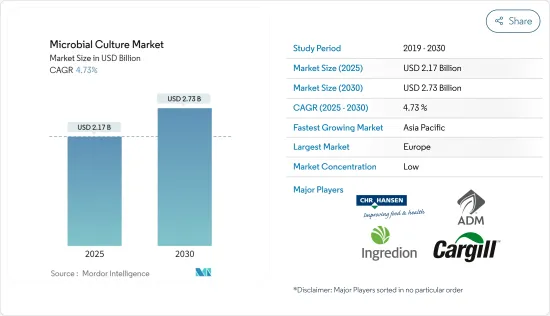

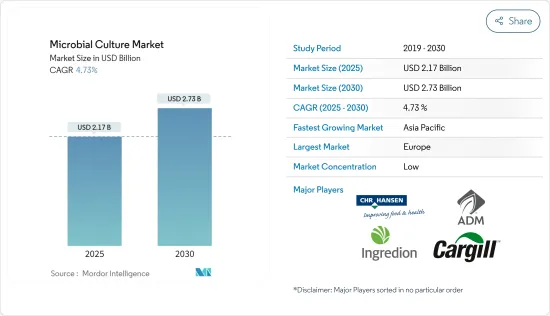

미생물 배양 시장 규모는 2025년 21억 7,000만 달러에서 예측 기간(2025-2030년) 동안 CAGR 4.73%로 성장하여 2030년에는 27억 3,000만 달러에 달할 것으로 예측됩니다.

주요 하이라이트

- 발효 식품은 최근 몇 년 동안 눈부신 성장을 이루며 수익성이 높은 식문화 시장을 형성하고 있습니다. 프로바이오틱스와 기능성 식품은 미국에서 신흥국 시장에 이르기까지 세계를 매료시키는 시장의 새로운 동향입니다. 기능성 유제품은 미생물 배양기업간에 큰 경쟁 환경을 조성하고 있습니다.

- 미생물 배양은 또한 생물 보존 개념이 받아들여지면서 제조자로부터도 주목을 받고 있습니다. 생물 보존은 화학적 및 물리적 보존을 대체하는 매력적인 방법입니다. 식품 발효는 생물 보존의 기본 원리와 메커니즘을 연구하기 위한 우수한 모델을 제공하며, 전통적인 발효는 생물 보존을 위한 신규 균주 발견에 중요한 자원이 될 수 있습니다.

미생물 배양 시장 동향

시동 배양이 시장의 주요 촉진요인으로 지속

발효 식품의 소비는 최근에 크게 증가하고 있으며 그 이유는 보존 가능 기간, 보존성 및 감각적 품질에 국한되지 않는 귀중한 특성 때문입니다. 발효 식품의 생산은 정확하고 예측 가능한 발효를 위해 주로 시동 배양을 사용하여 수행됩니다. 유산균(LAB)과 효모는 유제품, 고기, 발효 반죽, 채소와 같은 여러 발효 식품 제조 산업에서 응용되는 종균입니다. 유제품 배양은 시동 배양에서 가장 두드러진 범주입니다. 중국, 인도 및 기타 아시아 및 중동에서 유제품 배양 시장은 성장과 혁신의 붐을 경험하고 있습니다.

아시아태평양이 급성장시장으로 부상

아시아태평양은 중국 등 신흥국으로부터의 급격한 수요 급증으로 2018년 미생물 배양의 급성장 시장이었습니다. 제조업체 각사는 이 잠재적인 지역에 주목하고 이 지역 수요 증가에 대응하기 위해 최신의 혁신 도입과 생산 능력의 증강에 거액의 투자를 실시했습니다. 예를 들어, 2017년 미국에 본사를 둔 원료 제조업체인 듀폰은 미생물 식품 배양 생산을 보완하기 위해 베이징에 본사를 둔 공장 능력을 115% 확대했습니다.

미생물 배양 산업 개요

세계의 미생물 식품 배양 시장은 경쟁이 치열하고 여러 국내외 선도기업들이 지배하고 있기 때문에 세계 수준에서는 단편적이고 조직되지 않은 시장입니다. 시장의 주요 기업으로는 Chr. Hansen A/S, DuPont, Koninklijke DSM NV, Kerry Group 등이 있습니다. 대기업은 시장에서의 존재를 확대하고 브랜드 포트폴리오를 강화하며 제품 제조업체의 다양한 취향에 대응하기 위해 제품 혁신에 주력하고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

- 시장 개요

제4장 시장 역학

- 시장 성장 촉진요인

- 시장 성장 억제요인

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자 및 소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 유형별

- 시동 배양

- 보조 배양물 및 아로마 배양물

- 프로바이오틱스

- 최종 사용자 산업별

- 제빵 및 제과류

- 유제품

- 과일 및 채소

- 음료

- 기타 최종 사용자 산업

- 지역

- 북미

- 미국

- 캐나다

- 멕시코

- 기타 북미

- 유럽

- 스페인

- 영국

- 독일

- 프랑스

- 이탈리아

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 남아프리카

- 아랍에미리트(UAE)

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 가장 많이 채용된 전략

- 가장 활발한 기업

- 시장 점유율 분석

- 기업 프로파일

- Chr. Hansen

- DuPont De Numors Inc.

- Koninklijke DSM NV

- Mediterranea Biotecnologie SRL

- Himedia Laboratories

- Ingredion Incorporated

- Kerry Group

- Givaudan SA(Naturex)

제7장 시장 기회와 앞으로의 동향

CSM 25.04.07The Microbial Culture Market size is estimated at USD 2.17 billion in 2025, and is expected to reach USD 2.73 billion by 2030, at a CAGR of 4.73% during the forecast period (2025-2030).

Key Highlights

- Fermented foods have grown tremendously in recent years giving way to a profitable market of food culture. Probiotics and functional foods are the new trends in the market capturing the world across, from the US to developing regions. Functional dairy products have created a huge competition among microbial culture companies.

- Microbial culture is also gaining attraction from the manufacturers due to the growing acceptance of the bio-preservation concept. Bio-preservation is an attractive alternative to chemical and physical preservation. Food fermentations offer excellent models for studying the basic principles and mechanisms of bio-preservation, and traditional fermentations may be valuable resources of new strains for bio-preservation.

Microbial Culture Market Trends

Starter Cultures Remains the Major Driver of the Market

Consumption of fermented food has substantially increased in recent years, due to their valuable traits that extend well beyond shelf life, preservation, and sensory qualities. Fermented food production is mainly carried out using starter cultures for a precise and expectable fermentation. Lactic acid bacteria (LAB) and yeast are the highly studied starters applied in several fermented food production industries, such as dairy, meat, sourdough, vegetables, etc. Dairy cultures are the most prominent category of starter cultures. In China, India, and the rest of Asia, as well as the Middle East, the dairy culture markets are experiencing a boom in growth and innovation.

Asia-Pacific Emerges as the Fastest Growing Market

Asia-Pacific remains the fastest-growing market for microbial cultures in 2018 owing to strong demand surge from developed countries such as China. The manufacturers are eyeing on this potential region and heavily investing to bring the latest innovations and increase production capacity in order to address the growing demand in the region. For instance, in 2017, the US-based ingredient manufacturer Dupont, expanded their Beijing based plant capacity by 115% to supplement the production of microbial food cultures.

Microbial Culture Industry Overview

Global microbial food culture market is highly competitive and is dominated by several local and international players which leads in a fragmented and unorganised market at the global level. Major players in the market include Chr. Hansen A/S, DuPont, Koninklijke DSM N.V., and Kerry Group among others. Major players are focusing on product innovation in the market to expand their presence, to enhance their brand portfolio, and to cater to various preferences of product manufacturers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

- 3.1 Market Overview

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Starter Cultures

- 5.1.2 Adjunct and Aroma Cultures

- 5.1.3 Probiotics

- 5.2 By End-user Industry

- 5.2.1 Bakery and Confectionery

- 5.2.2 Dairy

- 5.2.3 Fruits and Vegetables

- 5.2.4 Beverages

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 Germany

- 5.3.2.4 France

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Most Active Companies

- 6.3 Market Share Analysis

- 6.4 Company Profiles

- 6.4.1 Chr. Hansen

- 6.4.2 DuPont De Numors Inc.

- 6.4.3 Koninklijke DSM NV

- 6.4.4 Mediterranea Biotecnologie SRL

- 6.4.5 Himedia Laboratories

- 6.4.6 Ingredion Incorporated

- 6.4.7 Kerry Group

- 6.4.8 Givaudan SA (Naturex)