|

시장보고서

상품코드

1687178

유럽의 플라스틱 병 및 용기 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Europe Plastic Bottles And Containers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

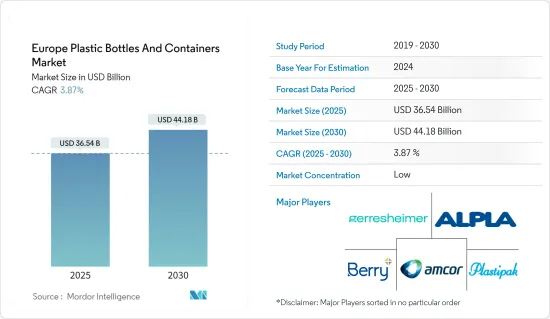

유럽의 플라스틱 병 및 용기 시장 규모는 2025년에 365억 4,000만 달러로 추정되고, 예측 기간인 2025-2030년 CAGR 3.87%로 성장할 전망이며, 2030년에는 441억 8,000만 달러에 이를 것으로 예측됩니다.

주요 하이라이트

- 폴리에틸렌 테레프탈레이트, 폴리프로필렌, 폴리에틸렌과 같은 재료로 제조되는 플라스틱 병과 용기가 포장 산업의 주류를 차지하고 있습니다. 가볍고 내구성이 뛰어나기 때문에 주로 비용 효율이 좋기 때문에 제조사에 선택되었습니다. 이것은, 세계의 식음료에 대한 의존과 맞물려, 향후 수년간의 플라스틱 병 및 용기 시장에 큰 영향을 주는 무대가 되고 있습니다.

- 플라스틱 채용의 급증은 그 경량 특성에 직접 연결되고 있습니다. 이것은 수송시의 에너지 절약을 도울 뿐만 아니라, 배출물의 삭감에도 연결됩니다. 플라스틱 무게의 우위성은 운송에 많은 횟수를 필요로 하는 유리와 같은 무거운 대체품과 비교하면 더 분명해집니다.

- 플라스틱 병과 용기는 다양한 재료로 만들어지지만, 폴리에틸렌테레프탈레이트(PET)제의 것은 내구성, 범용성, 비용 효율의 점에서 두드러지고 있습니다. 유럽의 식품, 식음료, 제약 분야가 확대되고 기술 혁신이 진행됨에 따라 플라스틱 포장, 특히 PET병의 수요도 이에 연동되어 높아지고 있습니다. 다양한 플레이버 및 포장 스타일로 새로운 음료를 도입하는 산업의 동향은 경질 플라스틱 병의 수요를 더욱 높이고 있습니다.

- 특히 음료 부문은 페트병이 들어간 식수와 비알코올 음료의 영속적인 수요에 따라 페트병에 크게 의존하고 있습니다. 소비자가 병에 든 물을 찾는 것은 오염 가능성이 있는 수돗물을 피하고 병에 든 물이 제공하는 편리성과 휴대성을 중시하기 때문입니다.

- 환경 문제를 강조하는 유럽 위원회의 조사에서는 해양 쓰레기에 페트병과 그 뚜껑이 많이 포함되어 있는 것이 밝혀졌습니다. 이에 따라 유럽 이사회는, 일회용 플라스틱의 사용을 억제해, 야심적인 재활용 목표를 설정하는 것을 목적으로 한 엄격한 규제를 전개했습니다.

- 플라스틱 오염에 대한 우려가 높아지는 가운데, 제조업체도 소비자도 에코 친화적인 대체 포장을 모색하고 있습니다. 이러한 변화는 재활용 가능하고 친환경적인 특성이 평가되고 있는 알루미늄이나 유리의 채택률이 상승하고 있는 것에서도 분명합니다.

- 2024년 3월 유럽의 브룩필드 드링크스는 100% 해양 플라스틱을 사용하지 않는 병의 출시를 발표하고 화제를 모았습니다. 이 혁신적인 병은, 이 회사의 NEOWTR 시리즈의 일부로, 테스코의 슈퍼 스토어 250 점포에서 발매될 예정입니다. 브룩필드 드링크스사의 노력은 산업 최초의 완전 재활용 해양 플라스틱 병에 재활용 가능한 캡과 라벨을 붙인 새로운 샘물 시리즈를 출시함으로써 주요 청량음료 브랜드를 능가하는 중요한 이정표가 될 것입니다.

유럽의 플라스틱 병 및 용기 시장 동향

음료 부문이 큰 시장 점유율을 차지할 전망

- 음료 산업이 조사 대상 시장의 큰 성장을 견인하고 있습니다. 플라스틱 용기와 병은 이 부문에서 인기를 모으고 있어, 제조업체가 음료 뿐만이 아니라 다른 최종사용자 산업에도 대응하도록(듯이) 촉구하고 있습니다. 경량 포장은 경제 효율과 환경에의 배려라고 하는 2개의 장점이 있기 때문에 포장 산업에서 매우 중요한 존재가 되고 있습니다. 경량이기 때문에 플라스틱 병 및 용기는 수송시의 에너지 소비를 삭감해, 연료 사용량의 삭감, 이산화탄소 배출량의 삭감, 유통업자나 소매업자의 비용 삭감으로 연결됩니다.

- 영국 청량 음료 협회의 2024년차 보고서에 따르면 영국에서는 2023년에 30억 2,700만 리터의 병이 들어간 식수가 소비되어 플라스틱 병이 95.2%의 압도적 점유율을 차지하고 있습니다. 병에 든 음료수의 소비량이 증가 경향에 있는 것으로부터, 음료 부문에서의 경질 플라스틱 병의 수요는 급증할 것으로 보입니다.

- 페트병은 그 비용 효과와 배리어성의 높이에서 영국의 음료 부문에서 압도적인 점유율을 차지하고 있습니다. 영국 청량음료협회 조사 결과에 따르면 청량음료의 68%, 탄산음료의 53%, 희석음료의 95%, 스포츠음료 및 에너지음료의 42%를 차지하고 있습니다.

- 유럽의 플라스틱 병 및 용기 시장에서는 지속가능성에 대한 노력이 현저하게 증가하고 있습니다. 여기에는 바이오플라스틱과 같은 지속가능한 원료로의 시프트나, 제품 라인으로의 재활용 재료의 통합이 포함되어, 이것들은 모두 혁신을 촉진하는 것을 목적으로 하고 있습니다. 2025년까지 25%, 2030년까지 30%의 재생 플라스틱을 사용하겠다는 단일 사용 플라스틱 지령의 야심찬 목표는 산업에 혁명을 일으키고자 합니다. 따라서 제조업체는 재활용 기술에 대한 투자를 피할 수 없게 되어 지속 가능성에 대한 확고한 약속을 보여주고 있습니다.

- 음료 소비량이 증가함에 따라 페트병이나 페트병 식수, 탄산 음료, 우유 등의 용기 수요가 급증하고 있습니다. 예를 들어 독일에서는 1인당 청량 음료 소비량이 2020년의 114.7리터에서 2023년에는 124.9리터로 증가할 것으로 예측되고 있어 플라스틱 포장에 대한 이 나라의 왕성한 의욕을 뒷받침하고 있습니다.

상당한 성장이 예상되는 독일

- 독일에서는 솔루션 제공업체와 최종 사용자 모두의 선진적인 노력으로 플라스틱 포장 솔루션의 도입이 진행되고 있습니다. '메이드 인 독일' 제품에 대한 소비자의 인식이 고조되고, 이 지역의 연질 포장 기업은 특히 호의적으로 받아들여지고 있습니다.

- 독일 정부는 플라스틱 포장 산업에 대해 엄격한 규제를 실시하고 있습니다. PET병은 다양한 부문으로 보급되고 있지만, 음료, 화장품, 위생 용품, 세제의 부문에서는 폴리에틸렌(PE)병이 압도적인 매출을 자랑하고 있습니다.

- 화장품 소비의 급증 및 플라스틱 포장 기술의 끊임없는 혁신으로 시장은 성장 태세에 있습니다. 가볍고 비용 대비 효과가 높으며 위생적인 특성으로 알려진 플라스틱은 특히 보존 기간이 짧은 화장품에 적합합니다. 투명하고 기밀성이 높으며 압축강도가 높고 성형하기 쉬운 PET병은 고급 화장품의 시각적 매력을 높이고 있으며, 이 부문의 장래가 유망함을 나타내고 있습니다.

- PET는 병과 병 모두에서 일반적으로 사용되며 특히 공격 화장품에 선호됩니다. 한편, 폴리염화비닐(PVC)은 유해 성분과의 관련은 말할 것도 없고, 재료와 반응해 변형될 가능성이 있기 때문에 일반적으로 꺼려지고 있습니다. 이 조사는, 스킨 케어, 헤어 케어, 경구 케어, 메이크업, 데오드란트, 프레이그런스 등, 다양한 용도를 대상으로 하고 있습니다.

- 독일은 견조한 미용 및 퍼스널케어 시장을 자랑해, 급성장을 이루고 있습니다. Personal Care and Detergent Industry Association e.V.에 따르면 시장 규모는 2021년 147억 2,290만 달러에서 2023년 171억 5,690만 달러로 급증했습니다. 이 퍼스널 케어 시장의 확대는, 플라스틱 병 및 용기의 성장에 있어서 독일의 중요성을 강조하고 있습니다.

유럽의 플라스틱 병 및 용기 산업 개요

조사한 시장은 세분화되어 있으며, 중요한 참여 기업은 Alpha Group, Amcor PLC, Gerresheimer AG, Berry Global Inc., Plastipak Holdings Inc., Graham Packaging Company LP 등입니다.

- 2023년 10월-Berry Global Group은 고급 물 브랜드 NEUE 전용 rPET 병을 출시했습니다. 이 출시는 베리글로벌이 NEUE의 프리미엄 아르테지안 생수에 100% 재활용 PET병을 제공하는 중요한 단계입니다. NEUE 워터는 현대적이고 속도가 빠른 라이프 스타일을 염두에 두고 디자인되었습니다. 환경친화적 구성과 더불어 혁신적인 평평한 형태의 병은 휴대가 편리하며 다양한 운송 포켓과 가방, 좌석 등받이에도 매끄럽게 밀착됩니다.

- 2023년 10월-Plastipak과 PVG Liquids는 20리터의 적층 가능한 용기에 맞춘 375G의 프리폼을 공동으로 설계해 향후 수년간 PET의 소비량을 500톤 대폭 삭감할 수 있도록 설계했습니다. 이 기술 혁신에 의해, CO2 배출량을 연간 약 200톤 삭감할 수 있을 것으로 예측되고 있습니다. 프라스티팩의 이탈리아 베르바니아 공장에서의 생산은 수송 중 배출을 최소화하기 위한 전략적인 움직임입니다. 컨테이너 자체는 혁신적인 프리폼과 조합된 새로운 저결정성 수지로 만들어져 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업의 매력-Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

- 산업 밸류체인 분석

제5장 시장 역학

- 시장 성장 촉진요인

- 경량 포장 방식의 채용 증가

- 인구동태 및 라이프스타일의 변화

- 시장 성장 억제요인

- 플라스틱의 사용을 둘러싼 높은 환경 문제

- 무역 시나리오

- EXIM 데이터

- 무역 분석(수출입 주요 5개국, 가격 분석, 주요 항구 등)

- 무역 분석(수출입 주요 5개국, 가격 분석, 주요 항구 등)

- 산업의 규제 및 시책과 규격

- 기술

- 가격 동향 분석

- 플라스틱 수지(현재 가격 및 과거 동향)

제6장 시장 세분화

- 수지별

- 폴리에틸렌(PE)

- 폴리에틸렌테레프탈레이트(PET)

- 폴리프로필렌(PP)

- 기타 수지 유형(폴리스티렌, PVC, 폴리카보네이트 등)

- 제품별

- 병

- 병

- 캐니스터

- 상자

- 갤런

- 탭

- 기타

- 최종 이용 산업별

- 식품

- 음료

- 병이 들어간 식수

- 탄산음료

- 우유

- 기타 음료

- 의약품

- 퍼스널케어 및 화장품

- 공업용

- 가정용 화학제품

- 페인트

- 기타

- 국가별

- 프랑스

- 독일

- 이탈리아

- 영국

- 스페인

- 폴란드

제7장 경쟁 구도

- 기업 프로파일

- Amcor Group GmbH

- Gerresheimer AG

- Plastipak Holdings Inc.

- ALPLA Group

- Berry Global Inc.

- Alpha Packaging Inc.

- Graham Packaging

- Resilux NV

- Greiner Packaging International GmbH

- Comar LLC

- 히트맵 분석

- 경쟁사 분석-신흥기업 및 기존기업

제8장 재활용 및 지속가능성의 정세

제9장 시장의 미래

AJY 25.05.02The Europe Plastic Bottles And Containers Market size is estimated at USD 36.54 billion in 2025, and is expected to reach USD 44.18 billion by 2030, at a CAGR of 3.87% during the forecast period (2025-2030).

Key Highlights

- Plastic bottles and containers manufactured from materials like polyethylene terephthalate, polypropylene, and polyethylene, dominate the packaging landscape. Their lightweight and durable nature makes them a preferred choice for manufacturers, primarily due to their cost-effectiveness. This, coupled with the global reliance on packaged foods and beverages, sets the stage for a significant impact on the plastic bottles and containers market in the coming years.

- The surge in plastic adoption is directly tied to its lightweight properties. This not only aids in energy conservation during transportation but also reduces emissions. Plastic's weight advantage becomes even more apparent when compared to heavier alternatives like glass, which necessitate more trips for transportation.

- While plastic bottles and containers can be crafted from various materials, those made from polyethylene terephthalate (PET) stand out for their durability, versatility, and cost-efficiency. As Europe's food, beverage, and pharmaceutical sectors expand and innovate, the demand for plastic packaging, especially PET bottles, rises in tandem. The industry's trend of introducing new beverages in diverse flavors and packaging styles further bolsters the demand for rigid plastic bottles.

- The beverage sector, in particular, heavily leans on plastic bottles, driven by the perpetual demand for bottled water and non-alcoholic drinks. Consumers seek bottled water for its perceived purity, shunning potentially contaminated tap water, and valuing the convenience and portability it offers.

- Highlighting environmental concerns, a European Commission study underscored the prevalence of PET bottles and their lids in ocean debris. In response, the European Council has rolled out stringent regulations, aiming to curb the use of single-use plastics and set ambitious recycling targets.

- Amid mounting worries over plastic pollution, both manufacturers and consumers are exploring eco-friendlier packaging alternatives. This shift is evident in the rising adoption rates of aluminum and glass, lauded for their recyclability and environmentally conscious attributes.

- Illustrating this trend, in March 2024, Europe's Brookfield Drinks made waves by announcing the launch of a 100% Prevented Ocean Plastic bottle. This innovative bottle, part of their NEO WTR range, is set to debut in 250 Tesco superstores. Brookfield Drinks' initiative marks a significant milestone, outpacing major soft drink brands by introducing a new spring water range in the industry's first fully recycled ocean-bound plastic bottle, complete with a recyclable cap and label.

Europe Plastic Bottles and Containers Market Trends

The Beverages Segment is Expected to Hold a Significant Market Share

- The beverage industry is driving significant growth in the market under study. Plastic containers and bottles are gaining popularity within this sector, prompting manufacturers to cater not only to beverages but also to other end-user industries. Lightweight packaging has emerged as a pivotal force in the packaging industry, owing to its dual benefits: economic efficiency and environmental friendliness. Given their lightweight nature, plastic bottles and containers reduce energy consumption during transportation, leading to lower fuel usage, reduced carbon emissions, and decreased costs for distributors and retailers.

- As per the 2024 Annual Report by the British Soft Drink Association, the United Kingdom consumed 3,027 million liters of bottled water in 2023, with plastic bottles representing a dominant 95.2% share. With bottled water consumption on the rise, the demand for rigid plastic bottles in the beverage sector is set to surge.

- Plastic bottles, due to their cost-effectiveness and barrier properties, hold a lion's share in the United Kingdom's beverage landscape. They make up 68% of soft drink consumption, 53% of carbonated drinks, 95% of dilutables, and 42% of sports and energy drinks, as highlighted in the British Soft Drink Association's findings.

- Across the European plastic bottles and containers market, there's a notable uptick in sustainability initiatives. These include a shift towards sustainable raw materials like bioplastics and integrating recycled content into product lines, all aimed at fostering innovation. The ambitious targets set by the Single-Use-Plastic Directive - 25% recycled content by 2025 and 30% by 2030 - are poised to revolutionize the industry. Manufacturers are thus compelled to invest in recycling technologies, signaling a steadfast commitment to sustainability.

- With beverage consumption on the rise, the demand for plastic bottles and containers for bottled water, carbonated drinks, or milk is surging. Germany, for instance, saw its per capita soft drink consumption climb from 114.7 liters in 2020 to a projected 124.9 liters in 2023, underscoring the country's robust appetite for plastic packaging.

Germany is Expected to Witness Significant Growth

- Germany is increasingly embracing plastic packaging solutions, driven by advancements from both solution providers and end users. The renowned consumer perception of "Made in Germany" products has notably favored the region's flexible packaging companies.

- The German government has implemented stringent regulations for the plastic packaging industry. While PET bottles are prevalent across various sectors, polyethylene (PE) bottles dominate sales in beverages, cosmetics, sanitary, and detergent segments.

- With a surge in cosmetic consumption and continuous innovation in plastic packaging technology, the market is poised for growth. Plastic, known for its lightweight, cost-effectiveness, and hygienic properties, is particularly well-suited for cosmetics, especially those with shorter shelf lives. Transparent, airtight, and easily moldable with good compressive strength, PET plastic bottles are enhancing the visual appeal of high-end cosmetics, indicating a promising future for this segment.

- PET finds common use in both bottles and jars, especially favored for aggressive cosmetics. On the other hand, polyvinyl chloride (PVC) is generally shunned due to its potential to react with and distort materials, not to mention its association with hazardous components. The study covers a range of applications, including skincare, haircare, oral care, makeup, deodorants, fragrances, and more.

- Germany boasts a robust beauty and personal care market, witnessing rapid growth. According to the Personal Care and Detergent Industry Association e. V., the market value surged from USD 14,722.9 million in 2021 to USD 17,156.9 million in 2023. This expanding personal care market underscores Germany's significance in the growth of plastic bottles and containers.

Europe Plastic Bottles and Containers Industry Overview

The market studied is fragmented, with some significant players such as Alpha Group, Amcor PLC, Gerresheimer AG, Berry Global Inc., Plastipak Holdings Inc., and Graham Packaging Company LP. These companies increase their market shares by launching new products and forming partnerships and mergers. Some of the recent developments are:

- October 2023 - Berry Global Group introduced a rPET bottle specifically for the upscale water brand, NEUE. This launch marks a significant step as Berry Globalprovides 100% recycled PET bottles for NEUE's premium artesian mineral water. NEUE Water is designed with the contemporary, fast-paced lifestyle in mind. In addition to its eco-friendly composition, the bottle's innovative flat shape ensures convenient portability, fitting seamlessly into pockets, bags, and even seatback storage on various modes of transport.

- October 2023 - Plastipak and PVG Liquids have jointly engineered a 375g preform tailored for a 20-liter stackable container, designed to significantly slash PET consumption by 500 tons in the coming years. This innovation is projected to curtail CO2 emissions by approximately 200 tons annually. The production, situated at Plastipak's Verbania plant in Italy, is a strategic move to minimize emissions during transit. The container itself is crafted from a novel low-crystallinity resin, paired with the innovative preform.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Lightweight Packaging Methods

- 5.1.2 Changing Demographic and Lifestyle Factors

- 5.2 Market Restraints

- 5.2.1 Growing Environmental Concerns Over the Use of Plastics

- 5.3 Trade Scenario

- 5.3.1 EXIM Data

- 5.3.2 Trade Analysis (Top 5 Import-Export Countries, Price Analysis, and Key Ports, Among others)

- 5.4 Trade Analysis (Top 5 Import-Export Countries, Price Analysis, and Key Ports, Among others)

- 5.5 Industry Regulation, Policy and Standards

- 5.6 Technology Landscape

- 5.7 Pricing Trend Analysis

- 5.7.1 Plastic Resins (Current Pricing and Historic Trends)

6 MARKET SEGMENTATION

- 6.1 By Resin

- 6.1.1 Polyethylene (PE)

- 6.1.2 Polyethylene Terephthalate (PET)

- 6.1.3 Polypropylene (PP)

- 6.1.4 Other Resin Type (Polystyrene, PVC, Polycarbonate, etc.)

- 6.2 By Product

- 6.2.1 Bottles

- 6.2.2 Jars

- 6.2.3 Canisters

- 6.2.4 Boxes

- 6.2.5 Gallons

- 6.2.6 Tubs

- 6.2.7 Other Products

- 6.3 By End-use Industries

- 6.3.1 Food

- 6.3.2 Beverage

- 6.3.2.1 Bottled Water

- 6.3.2.2 Carbonated Soft Drinks

- 6.3.2.3 Milk

- 6.3.2.4 Other Beverages

- 6.3.3 Pharmaceuticals

- 6.3.4 Personal Care & Toiletries

- 6.3.5 Industrial

- 6.3.6 Household Chemicals

- 6.3.7 Paints & Coatings

- 6.3.8 Other End-use Industries

- 6.4 By Country

- 6.4.1 France

- 6.4.2 Germany

- 6.4.3 Italy

- 6.4.4 United Kingdom

- 6.4.5 Spain

- 6.4.6 Poland

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Group GmbH

- 7.1.2 Gerresheimer AG

- 7.1.3 Plastipak Holdings Inc.

- 7.1.4 ALPLA Group

- 7.1.5 Berry Global Inc.

- 7.1.6 Alpha Packaging Inc.

- 7.1.7 Graham Packaging

- 7.1.8 Resilux NV

- 7.1.9 Greiner Packaging International GmbH

- 7.1.10 Comar LLC

- 7.2 Heat Map Analysis

- 7.3 Competitor Analysis - Emerging vs. Established Players