|

시장보고서

상품코드

1687185

판유리 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Flat Glass - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

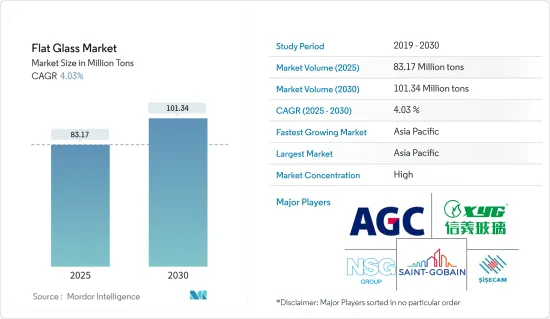

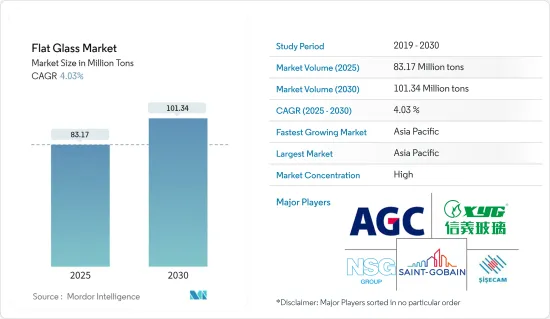

판유리 시장 규모는 2025년에 8,317만 톤으로 추정되고, 예측 기간인 2025-2030년 CAGR 4.03%로 성장할 전망이며, 2030년에는 1억 134만 톤에 달할 것으로 예측됩니다.

COVID-19는 시장에 부정적인 영향을 미쳤습니다. 팬데믹으로 인해 대부분의 제조 시설이 폐쇄되어 자동차 생산에 심각한 영향을 주었습니다. 게다가 팬데믹 발생으로 인한 경제 불안도 건설 산업의 침체로 이어졌습니다. 현재 시장은 팬데믹에서 회복되어 현저한 성장을 보이고 있습니다.

주요 하이라이트

- 단기적으로는 건설 분야에 대한 투자 확대 및 자동차 산업에서의 수요 증가가 시장 성장의 주요 요인입니다.

- 그러나 대체품의 이용가능성이 시장의 성장을 억제할 가능성이 높습니다.

- 그러나 태양에너지 부문에서 새로운 기회가 태어나면 세계 시장에 유리한 성장 기회가 곧 태어날 것으로 예상됩니다.

- 아시아태평양이 시장을 독점하고 예측 기간 중에 가장 높은 연간 성장률을 나타낼 것으로 예상됩니다.

판유리 시장 동향

건설 산업이 시장을 독점할 전망

- 건축 및 건설 산업의 요인인 판유리는 매우 중요한 역할을 하고 있습니다. 박판 유리는 투명하고 자연광을 도입하여 실내와 옥외의 갭을 메우는 역할을 합니다. 이로 인해 거주자의 복리후생이 향상되고 인공 조명의 필요성이 감소합니다.

- 판유리는 절단, 성형, 가공이 용이하고, 다양한 미적 및 기능적 요구를 만족시킬 수 있기 때문에 그 다양성이 빛납니다. 착색, 반사, 에너지 효율이 뛰어난 코팅 등 현대의 판유리는 강도, 내상성, 풍화에 대한 내구성이 돋보입니다. 또한 판유리는 재활용이 가능할 뿐만 아니라 재생재를 사용하는 것도 가능합니다.

- 아시아태평양은 세계 최대의 건설 산업으로 인구의 급증, 중간 소득층의 소득 증가, 급속한 도시화가 그 성장을 뒷받침하고 있습니다. 이 기세는 현재 진행 중인 다수의 주택 및 상업 프로젝트에 의해 더욱 강화되어 제품 수요를 뒷받침하고 있습니다.

- 인도의 뭄바이에서는 3,000만 달러 규모의 Arkade Aspire Residential Complex 프로젝트가 진행 중입니다. 총 면적 3만 5,366제곱미터의 18층짜리 주택 타워를 2개동 건설하겠다는 의욕적인 시도로 2022년 2분기에 착공해 2025년 1분기 완공을 목표로 하고 있습니다.

- 미국의 건축 및 건설 산업은 여전히 경제의 요인입니다. 미국 인구조사국에 따르면 2023년 건설 총액은 1조 9,787억 달러로 2022년 1조 8,487억 달러에서 7% 증가했습니다. 특히 주택 건설은 2023년에 8,649억 달러를 차지했습니다.

- 게다가 미국에서는 상업 건설 프로젝트가 급증하고 있으며, 산업 수요 증가가 예상되고 있습니다. 특히, 2024년 1월, 인디애나 주 정부는 Meta Platforms Inc.와 공동으로 후저 주에 8억 달러의 데이터 센터 캠퍼스를 건설하기 시작했습니다. 리버 리지 커머스 센터에 있는 이 70만 평방 피트의 시설은 2026년까지 완공될 예정입니다.

- 또한 남아프리카 정부는 중저소득자층에 저렴한 주택을 제공하기 위해 수많은 주택 프로젝트에 착수하고 있습니다.

- 2020년에 발표된 하우텐 주 무이크루프 메가시티 프로젝트도 그 중 하나입니다. 2023년 완료 예정인 1단계는 2030년까지 완성을 목표로 하는 더 큰 비전의 일부입니다. 이 야심찬 프로젝트는 주택, 상업 시설, 교육 시설을 포함한 5만 호를 상정하고 있습니다.

- 건설 산업에 있어서 이러한 사업의 규모와 기세를 생각하면, 판유리 수요는 향후 수년간 다양한 용도로 급증할 것으로 예상됩니다.

아시아태평양이 시장을 독점할 전망

- 아시아태평양은 건축 및 건설, 자동차, 태양 유리 등의 용도로 수요가 증가하고 있어 판유리 시장을 독점할 것으로 예상되고 있습니다.

- 중국 자동차 공업회(CAAM)의 최신 데이터에 의하면, 동국의 자동차 생산 대수는 2023년에 3,016만 대를 돌파했으며, 전년대비 11.6% 증가가 되었습니다. 2023년 승용차 판매량은 3,009만 대로 전년 대비 12% 증가했습니다.

- 게다가 인도자동차제조협회(SIAM)가 발표한 데이터에 따르면 2023년 회계연도에는 458만 대의 자동차가 제조된 반면 2022년 회계년도에는 365만 대가 제조되었습니다. 2023년도 자동차 생산량은 전년도 대비 약 25% 증가했습니다.

- 또, 국토교통성이 발표한 최신 데이터에 의하면, 2023년도에 착공한 신축 주택은 81만 9,620호에 올랐습니다.

- 게다가, 인도 정부는 2023년 11월, 전국 12주에서 합계 용량 약 3,749만 kW의 50의 솔라 파크를 승인했습니다. 2023년 1월부터 11월까지, 계통연계 야네카미 솔라 프로그램 하에서 741 MW이상의 용량이 설치되었습니다.

- 따라서, 자동차, 건설, 기타 산업의 성장이, 예측 기간 중 이 지역의 판유리 시장을 견인할 것으로 전망됩니다.

판유리 산업 개요

판유리 시장은 부분적으로 통합되어 있습니다. 주요 기업으로는 AGC Inc., Xinyi Glass Holdings Limited, Saint-Gobain, Nippon Sheet Glass, Sisecam이 포함됩니다.(순부동)

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 건설 산업에 대한 투자 확대

- 자동차 산업에서의 수요 증가

- 성장 억제요인

- 대체품의 이용가능성

- 산업 밸류체인 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

제5장 시장 세분화

- 제품 유형별

- 어닐링 유리

- 투명 유리

- 착색 유리

- 코터 유리

- 반사 유리

- 낮은 E 유리

- 가공 유리

- 적응 유리

- 강화 유리

- 미러 유리

- 패턴 유리

- 어닐링 유리

- 최종 사용자 산업별

- 건축 및 건설

- 자동차

- 태양 유리

- 기타

- 지역별

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- ASEAN 국가

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- M&A, 합작사업, 제휴 및 협정

- 시장 랭킹 분석

- 주요 기업의 전략

- 기업 프로파일

- Adamant Holding Company

- AGC Inc.

- Cardinal Glass Industries Inc.

- Central Glass Co. Ltd

- China Glass Holdings Limited

- Euroglas

- Guardian Industries

- Nippon Sheet Glass Co. Ltd

- Phoenicia

- Saint-Gobain

- SCHOTT

- Sisecam

- Taiwan Glass Ind. Corp.

- Vitro

- Xinyi Glass Holdings Limited

제7장 시장 기회 및 향후 동향

- 태양에너지의 새로운 기회

The Flat Glass Market size is estimated at 83.17 million tons in 2025, and is expected to reach 101.34 million tons by 2030, at a CAGR of 4.03% during the forecast period (2025-2030).

COVID-19 negatively impacted the market. Most manufacturing facilities were shut down due to the pandemic, severely affecting automotive production. Further, economic instability caused by the pandemic outbreak also led to a downfall in the construction industry. Currently, the market has recovered from the pandemic and is growing at a significant rate.

Key Highlights

- Over the short term, the growing investments in the construction sector and increasing demand from the automotive industry are major factors driving the growth of the market.

- However, the availability of alternatives is likely to restrain the growth of the market.

- However, emerging opportunities in the solar energy sector will likely create lucrative growth opportunities for the global market soon.

- Asia-Pacific is expected to dominate the market and is likely to witness the highest annual growth rate during the forecast period.

Flat Glass Market Trends

The Construction Industry is Expected to Dominate the Market

- Flat glass, a cornerstone of the building and construction industry, plays a pivotal role. It offers clarity, ushering in natural light, and bridges the gap between indoor and outdoor spaces. This enhances occupant well-being and reduces the need for artificial lighting.

- Its versatility shines as flat glass can be easily cut, shaped, and treated to meet diverse aesthetic and functional demands. Whether tinted, reflective, or energy-efficiently coated, modern flat glass stands out for its strength, scratch resistance, and durability against weathering. Additionally, flat glass is not only recyclable but can also be crafted with recycled content.

- Asia-Pacific boasts the world's largest construction industry, a growth primarily fueled by a burgeoning population, rising middle-class incomes, and rapid urbanization. This momentum is further bolstered by a slew of ongoing residential and commercial projects, underpinning the demand for the product.

- In Mumbai, India, the Arkade Aspire Residential Complex project, valued at USD 30 million, is underway. This ambitious endeavor involves erecting two 18-story residential towers covering a total area of 35,366 sq. m construction commenced in Q2 2022 and is slated for completion by Q1 2025.

- The building and construction industry in the United States remains a cornerstone of its economy. In 2023, the US Census Bureau reported a total construction value of USD 1,978.7 billion, marking a 7% increase from the USD 1,848.7 billion spent in 2022. Notably, residential construction accounted for USD 864.9 billion in 2023.

- In addition, the United States is witnessing a surge in commercial construction projects, promising a heightened demand for the industry. Notably, in January 2024, Indiana's government, in collaboration with Meta Platforms Inc., commenced the construction of a USD 800 million data center campus in Hoosier State. This 700,000-square-foot facility at the River Ridge Commerce Center is slated for completion by 2026.

- Moreover, the South African government has embarked on numerous residential projects to provide affordable housing to its middle and lower-income populations.

- One such initiative is the Mooikloof Mega City project in Gauteng, which was announced in 2020. Its Phase 1, set to conclude in 2023, is part of a larger vision that anticipates completion by 2030. The ambitious project envisions 50,000 units, encompassing residential spaces, commercial establishments, and educational facilities.

- Given the scale and momentum of such ventures in the construction industry, the demand for flat glass is set to surge across various applications in the coming years.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific is expected to dominate the market for flat glass with the increasing demand for applications in building and construction, automobiles, solar glasses, etc.

- According to the most recent data from the China Association of Automobile Manufacturers (CAAM), car production in the country surpassed 30.16 million units in 2023, marking an 11.6% increase compared to the previous year. A total of 30.09 million units of passenger cars were sold in the country in 2023, registering a 12% increase compared to the previous year.

- Further, according to the data released by the Society of India Automotive Manufacturing (SIAM), 4.58 million automotive vehicles were manufactured in the financial year 2023, compared to 3.65 million vehicles produced in the financial year 2022. The country saw a rise of around 25% in automotive production in 2023 compared to the previous year.

- In addition, according to the latest data released by the Ministry of Land Infrastructure, Transport and Tourism (MLIT) Japan, a total of 819.62 thousand new construction houses started in 2023.

- Also, the Government of India approved 50 solar parks with an aggregate capacity of around 37,490 MW in 12 states across the country in November 2023. More than 741 MW capacity was installed under the grid-connected rooftop solar program from January to November 2023.

- Therefore, the growth in automotive, construction, and other industries is likely to drive the market for flat glass in the region during the forecast period.

Flat Glass Industry Overview

The flat glass market is partially consolidated in nature. The major players (not in any particular order) include AGC Inc., Xinyi Glass Holdings Limited, Saint-Gobain, Nippon Sheet Glass Co. Ltd, and Sisecam.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Investments in the Construction Industry

- 4.1.2 Increasing Demand From the Automotive Industry

- 4.2 Restraints

- 4.2.1 Availability of Alternatives

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Annealed Glass

- 5.1.1.1 Clear Glass

- 5.1.1.2 Tinted Glass

- 5.1.2 Coater Glass

- 5.1.2.1 Reflective Glass

- 5.1.2.2 Low E Glass

- 5.1.3 Processed Glass

- 5.1.3.1 Laminated Glass

- 5.1.3.2 Tempered Glass

- 5.1.4 Mirror Glass

- 5.1.5 Patterned Glass

- 5.1.1 Annealed Glass

- 5.2 End-user Industry

- 5.2.1 Building and Construction

- 5.2.2 Automotive

- 5.2.3 Solar Glass

- 5.2.4 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Adamant Holding Company

- 6.4.2 AGC Inc.

- 6.4.3 Cardinal Glass Industries Inc.

- 6.4.4 Central Glass Co. Ltd

- 6.4.5 China Glass Holdings Limited

- 6.4.6 Euroglas

- 6.4.7 Guardian Industries

- 6.4.8 Nippon Sheet Glass Co. Ltd

- 6.4.9 Phoenicia

- 6.4.10 Saint-Gobain

- 6.4.11 SCHOTT

- 6.4.12 Sisecam

- 6.4.13 Taiwan Glass Ind. Corp.

- 6.4.14 Vitro

- 6.4.15 Xinyi Glass Holdings Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Opportunity in the Solar Energy