|

시장보고서

상품코드

1687216

중동 및 아프리카 배터리 시장 : 시장 점유율 분석, 산업 동향, 성장 예측(2025-2030년)Middle East And Africa Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

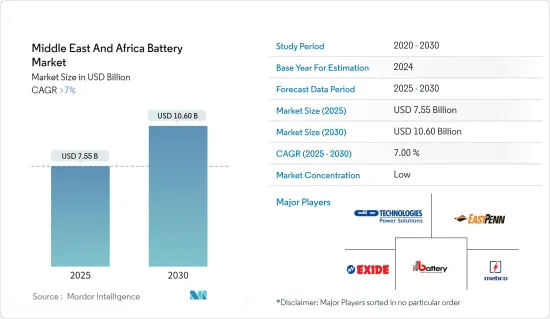

중동 및 아프리카의 배터리 시장 규모는 2025년에 75억 5,000만 달러로 추정되고, 예측 기간(2025-2030년) 중 CAGR 7%로 성장할 전망이며, 2030년에는 106억 달러에 달할 것으로 예측됩니다.

주요 하이라이트

- 중동 및 아프리카의 배터리 시장을 견인하는 주요 요인으로는 리튬 이온 배터리 가격 하락, 전기자동차의 보급 확대, 신재생 에너지 부문의 성장 등이 있습니다. 또한 데이터센터는 클라우드 서비스용 디지털 인프라를 진화시키고 있으며 차세대 클라우드 서비스에는 블록체인 네트워크가 통합될 수 있으므로 데이터센터 수요 증가가 시장을 견인할 것으로 보입니다.

- 그러나 원료 수급 불일치가 시장 성장을 방해할 가능성이 높습니다.

- 신흥 국가에서는 태양광 발전을 이용한 에너지 저장의 보급이 진행되고 있어 이것이 배터리 시장에 큰 기회를 가져올 것으로 예상됩니다.

- 아랍에미리트(UAE)은 젊고 다양한 국민성에 의한 스마트폰과 자동차를 포함한 소비자용 전자기기 제품의 구매로 시장을 독점할 것으로 예상됩니다.

중동 및 아프리카의 배터리 시장 동향

자동차 배터리가 크게 성장

- 자동차 부문은 리튬 이온 배터리를 중심으로 하는 배터리가 전기자동차에 사용되는대로 주요 최종 사용자 부문 중 하나가 될 것으로 예상됩니다. 전기차 보급은 리튬이온 배터리 산업 성장에 큰 원동력을 줄 것으로 예상됩니다.

- 하이브리드화나 전동화가 진행되어, 다양한 유형의 자동차가 세계적으로 판매되고 있습니다. 하이브리드 전기차, 플러그인 하이브리드 전기차, 전기차 등 다양한 유형의 자동차가 있습니다.

- 중동 및 아프리카의 후진국에서는 수요의 성장이 매우 적습니다. 중동에서는 대부분의 국가가 원유 생산에 의존하고 있습니다. 그러나 배기가스 규제에 맞춰 EV 수요는 예측 기간 동안 증가하고 배터리 소비량도 증가할 것으로 예상됩니다.

- 남아프리카는 아프리카의 주요 자동차 시장 중 하나이며 Nissan 리프가 2014년에 전기자동차를 출시했습니다. 2015년에는 BMW가 시장에 뛰어들어 i3와 i8 모델을 출시했습니다.

- 2023년 6월, BMW는 남아프리카의 프리토리아에 있는 플랜트 로슬린의 공장에 2억 1,800만 달러를 투입한다고 발표했습니다. 이 공장은 BMW에게 독일 외 첫 해외 공장이자 플러그인 하이브리드 모델 X3를 생산 및 수출하는 세계에서 두 번째 공장이 됐습니다.

- 2023년 7월, 벤가룰을 거점으로 하는 전기자동차 제조업체의 프라베이그는 사우디아라비아에 제조 시설을 설립하는 계약을 사우디아라비아 인디아 벤처 스튜디오와 체결했습니다. 조업 개시 후에는, 걸프, 유럽, 미국 시장의 수요에 대응해, 총 생산 능력은 최대 100만 대에 달했습니다.

- 따라서, 배터리 가격의 하락과 기술의 향상에 의해 가격 경쟁 전기자동차가 시장에 투입되어, 배터리 기술에 대한 수요가 창출될 것으로 예상됩니다.

아랍에미리트(UAE)에서 큰 수요가 예상

- 아랍에미리트(UAE)은 소비자용 전자 제품의 보급과 자동차 판매 증가에 의해 예측 기간 중에 큰 수요가 예상됩니다.

- 또한 인구가 증가함에 따라 건설 및 건축산업은 여전히 급성장하고 있는 부문 중 하나입니다. 인프라 개발 프로젝트(Abu Dhabi Metro나 Etihad Rail Network 등), 활황을 보이고 있는 공업화, 건설 활동이 동국에서는 증가 경향에 있어, 그 결과, 백업, 조명, 전동 공구등의 활동용 전지의 수요가 보충될 것으로 예상됩니다.

- 2023년 7월, 아랍에미리트(UAE) 정부는 2023년 말까지 EV 충전소의 수를 2배 이상으로 늘릴 계획을 발표했습니다.

- 아랍에미리트(UAE) 정부는 2050년까지 자동차 보유 대수의 50%를 전기자동차, 25%를 플러그인 하이브리드 자동차(PHEV)로 만들 계획을 세우고 있습니다. 한편, 버스는 70%가 전기자동차, 15%가 플러그인 하이브리드차, 나머지가 ICE, CNG, H2가 됩니다. 아랍에미리트에서 트럭의 목표는 10%가 PHEV, 40%가 하이브리드 차량입니다.

- 선도적인 EV 제조업체는 아랍 에미리트 연합에서 EV의 새로운 모델을 출시했습니다. BMW i8、Mercedes GLC350e、Renault Zoe、Chevrolet Bolt 등입니다. Tesla는 아랍에미리트의 EV 시장을 견인하고 있으며, PEV 보유 대수의 약 절반을 이 미국 브랜드가 차지하고 있습니다. 이러한 요인들이 예측 기간 동안 아랍에미리트의 EV 배터리 수요를 촉진할 것으로 예상됩니다.

- Exide Al Dobowi Ltd와 Energizer Middle East & Africa Ltd는 아랍 에미리트의 배터리 시장에서 주요 기업입니다. 따라서 위의 요인들로 볼 때 아랍에미리트가 중동 및 아프리카의 배터리 시장을 독점할 것으로 예상되는 것이 분명합니다.

중동 및 아프리카의 배터리 산업 개요

중동 및 아프리카의 배터리 시장은 세분화되어 있습니다. 주요 진출기업은 C&D Technologies Inc. Ltd., Exide Industries Ltd., First National Battery Pty Ltd, Middle East Battery Company(MEBCO) 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 조사 방법

제3장 주요 요약

제4장 시장 개요

- 서문

- 시장 규모 및 수요 예측(-2029년)

- 최근 동향 및 개발

- 정부의 규제 및 시책

- 시장 역학

- 성장 촉진요인

- 리튬 이온 배터리 가격 하락

- 전기자동차의 보급 확대

- 성장 억제요인

- 원료의 수급 미스매치

- 성장 촉진요인

- 공급망 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 세분화

- 유형별

- 1차 배터리

- 2차 배터리

- 기술별

- 납축배터리

- 리튬 이온 배터리

- 니켈 수소(NiMH) 배터리

- 기타 기술(니켈 카드뮴(NiCD) 배터리, 니켈 아연(NiZn) 배터리 등)

- 용도 부문별

- 자동차용 배터리

- 산업용 배터리(동력용, 거치형(전기 통신, UPS, 에너지 저장 시스템(ESS) 등))

- 휴대용 배터리(소비자용 전자 기기 제품 등)

- 기타

- 지역별

- 사우디아라비아

- 아랍에미리트(UAE)

- 남아프리카

- 기타 중동 및 아프리카

제6장 경쟁 구도

- M&A, 합작사업, 제휴 및 협정

- 주요 기업의 전략

- 기업 프로파일

- Panasonic Corporation

- SAFT GROUPE SA

- Middle East Battery Company(MEBCO)

- Amara Raja Batteries Ltd

- First National Battery Pty Ltd

- EnerSys

- C&D Technologies Inc.

- East Penn Manufacturing Co. Inc.

- Exide Industries Ltd

- 시장 점유율

제7장 시장 기회 및 향후 동향

- 태양광 발전 및 에너지 저장의 병용

The Middle East And Africa Battery Market size is estimated at USD 7.55 billion in 2025, and is expected to reach USD 10.60 billion by 2030, at a CAGR of greater than 7% during the forecast period (2025-2030).

Key Highlights

- The major factors driving the Middle-East and Africa battery market include declining lithium-ion battery prices, increasing adoption of electric vehicles, and growing renewable sector. Also, increasing demand from data centers is likely to drive the market as data centers are evolving digital infrastructures for cloud services, and the next generation of cloud services may be adapted to incorporate a blockchain network.

- However, the demand-supply mismatch of raw materials is likely to hinder the market growth.

- The use of energy storage with solar PV has been gaining popularity in developing countries, which is likely to create a huge opportunity for the battery market.

- The United Arab Emirates is expected to dominate the market, owing to its purchase of consumer electronics, including smartphones and automobiles, by the young and diverse population of the country.

Middle East And Africa Battery Market Trends

Automotive Batteries Segment to Witness Significant Growth

- The automotive sector is expected to be one of the major end-user segments for batteries, primarily lithium-ion batteries, as soon as they are used in EVs. The penetration of electric vehicles is anticipated to provide a massive impetus for the lithium-ion battery industry's growth.

- A range of different vehicle types are available globally, featuring increasing degrees of hybridization and electrification. There are various types of vehicles, including hybrid electric vehicles, plug-in hybrid electric vehicles, and electric vehicles.

- The demand has been growing at a negligible rate in the less developed nations of the Middle-East and Africa. In the Middle Eastern region, most of the countries are dependent on crude oil production. However, aligning with the emission norms, the demand for EVs is expected to increase over the forecast period, in turn leading to an increase in the consumption of batteries.

- South Africa is one of the major automotive markets in Africa, where Nissan Leaf launched the electric car in 2014. In 2015, BMW entered the market and launched the i3 and i8 models.

- In June 2023, BMW announced that it would inject USD 218 Million into its factory at Plant Rosslyn in Pretoria, South Africa, which was BMW's first foreign plant outside of Germany, making it the second in the world to produce and export its X3 plug-in hybrid model.

- In July 2023, Pravaig, a Bengaluru-based electric vehicle manufacturer, inked a pact with Saudi India Venture Studio to set up a manufacturing facility in Saudi Arabia. Upon commencement, it will cater to the demand in the Gulf, European, and US markets with a total capacity of up to one million units.

- Therefore, falling battery prices and improving technology are expected to bring price-competitive electric vehicles to the market, creating demand for battery technologies.

The United Arab Emirates to Witness Significant Demand

- The United Arab Emirates is likely to witness significant demand over the forecast period due to the increasing adoption of consumer electronic goods and increasing automotive sales, which in turn is expected to boost the overall battery demand, i.e., both primary and secondary, in the United Arab Emirates.

- Furthermore, the construction and building industry remains one of the fastest-growing sectors, owing to the increasing population. Infrastructure development projects (such as Abu Dhabi Metro and Etihad Rail Network), booming industrialization, and construction activities are expected to be on the higher side in the country, which, in turn, is expected to supplement the demand for batteries for activities, such as backup, lighting, and power tools.

- In July 2023, the UAE government announced plans to more than double the number of EV charging stations by the end of 2023.

- The United Arab Emirates government is planning the car fleet to be 50% electric vehicles by 2050 and 25% plug-in hybrids (PHEV). Meanwhile, buses are to be 70% electric, 15% plug-in hybrid, and the remainder to ICE, CNG, and H2; the target for trucks in the UAE is 10% PHEV and 40% hybrid.

- Major EV manufacturers are launching new EV models in the United Arab Emirates. Some of these are BMW i8, Mercedes GLC350e, Renault Zoe, and Chevrolet Bolt. Tesla has been driving the EV market in the United Arab Emirates, with the American brand being responsible for roughly half of the PEV fleet. These factors are expected to drive the demand for EV batteries in the United Arab Emirates over the forecast period.

- Exide Al Dobowi Ltd and Energizer Middle East & Africa Ltd are some of the top players in the UAE battery market. Therefore, from the above factors, it is evident that the United Arab Emirates is anticipated to dominate the battery market in the Middle-East and African region.

Middle East And Africa Battery Industry Overview

The Middle-East and Africa battery market is fragmented. Some of the key players include (in no particular order) C&D Technologies Inc., East Penn Manufacturing Co. Inc., Exide Industries Ltd, First National Battery Pty Ltd, and Middle East Battery Company (MEBCO).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Declining lithium-ion battery prices

- 4.5.1.2 Increasing adoption of electric vehicles

- 4.5.2 Restraints

- 4.5.2.1 Demand-supply mismatch of raw materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Primary Battery

- 5.1.2 Secondary Battery

- 5.2 Technology

- 5.2.1 Lead-acid Battery

- 5.2.2 Lithium-ion Battery

- 5.2.3 Nickel-metal Hydride (NiMH) Battery

- 5.2.4 Other Technologies (Nickel-cadmium (NiCD) Battery, Nickel-zinc (NiZn) Battery, etc.)

- 5.3 Application

- 5.3.1 Automotive Batteries

- 5.3.2 Industrial Batteries (Motive, Stationary (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- 5.3.3 Portable Batteries (Consumer Electronics, etc.)

- 5.3.4 Other Applications

- 5.4 Geography

- 5.4.1 Saudi Arabia

- 5.4.2 United Arab Emirates

- 5.4.3 South Africa

- 5.4.4 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Panasonic Corporation

- 6.3.2 SAFT GROUPE SA

- 6.3.3 Middle East Battery Company (MEBCO)

- 6.3.4 Amara Raja Batteries Ltd

- 6.3.5 First National Battery Pty Ltd

- 6.3.6 EnerSys

- 6.3.7 C&D Technologies Inc.

- 6.3.8 East Penn Manufacturing Co. Inc.

- 6.3.9 Exide Industries Ltd

- 6.4 Market Share

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Use of energy storage with solar PV