|

시장보고서

상품코드

1687217

자동차 프론트엔드 모듈 시장 : 시장 점유율 분석, 산업 동향, 성장 예측(2025-2030년)Automotive Front End Module - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

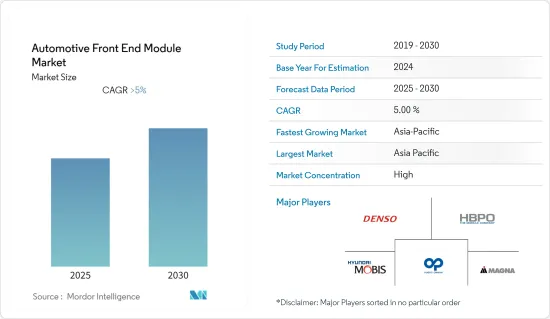

자동차 프론트엔드 모듈 시장은 예측 기간 동안 5% 이상의 CAGR을 나타낼 것으로 예측됩니다.

COVID-19 팬데믹은 2020년 제조시설 폐쇄 및 운영 중단으로 인해 전 세계적으로 자동차 생산 및 판매가 감소하여 프론트엔드 모듈 시장과 같은 자동차 산업 및 관련 부품 산업의 성장을 방해했습니다. 그러나 2021년 전반까지 주요 시장이 개방되어 주요 기업들이 다양한 국가에서 사업을 부활시키는 단기 전략을 취함으로써 시장은 기세를 되찾았습니다.

중기적으로는 자동차 산업의 확대와 세계 주요 지역의 자동차 안전성에 대한 의식 증가가 시장 수요를 견인할 것으로 예상됩니다. 또한, 차량의 경량화 요구 증가 및 기술적으로 선진적인 경량 프론트엔드 모듈에 대한 수요 증가는 시장 진출기업에게 유리한 기회를 제공할 것으로 예상됩니다. 그러나 자동차 프론트엔드 모듈 시장에서는 자동차 프론트엔드 모듈에 대한 소비자의 관심이 높아짐에 따라 제조업체가 상품의 소형화를 선택하고 있기 때문에 많은 지출이 이루어지고 예측 기간 동안 시장 성장이 제한될 가능성이 높습니다.

또한 주요 자동차 제조업체는 향후 수년간 시장 성장을 지원하는 경쟁을 얻기 위해 자동차에 최신 프론트엔드 모듈을 적극적으로 채택하려고 노력하고 있습니다. 또한 ADAS 기술과 자율주행 차량의 상승은 기존 자동차보다 더 많은 센서를 탑재하여 시장 전체의 성장을 가속합니다.

아시아태평양, 유럽에 이어 북미는 예측 기간 동안 시장 개척에 중요한 역할을 할 것으로 예상됩니다. 더불어 최신 프론트 모듈의 혁신과 지역 주요 업체들의 주요 자동차 OEM 출시로 시장 성장이 가속화될 것으로 보입니다.

자동차 프론트엔드 모듈 시장 동향

자동차 프론트엔드 모듈의 경량화 수요 증가

자동차의 경량화 수요 증가도 자동차용 프론트엔드 모듈(FEM) 시장의 원동력이 되고 있습니다. 경량 자동차 부품은 자동차 전체 무게를 줄이기 때문에 CO2 배출량과 비용을 줄일 수 있습니다. 그 때문에, 전세계의 몇개의 정부가, 기업 평균 연비(CAFE)나 BS-VI 기준등의 엄격한 배출 가스 및 연비 규제를 도입하고 있어, 이러한 규제는, 경량 금속, 복합 재료, 플라스틱등의 경량 재료의 사용을 늘리도록 자동차 OEM을 뒷받침하고 있습니다. 자동차 부품에 있어서의 프론트엔드 모듈 재료의 실험은, 차량의 중량을 20%-30% 삭감하는 것에 크게 공헌하고 있습니다.

현재는 무거운 강철이나 철의 캐리어 대신에, 연비 효율과 차량 성능의 향상에 공헌하는 경량 부품이 사용되고 있습니다. 경량 열가소성 플라스틱에 자주 사용되는 재료는 폴리프로필렌과 나일론입니다. 예를 들면

- 2020년 7월, 펜실베니아주 피츠버그의 랭크세스의 이유동성 유리 섬유 강화 나일론 6인 듀레탄 BKV30H2.0EF와 스틸 패널로, FordSUV '쿠가'용 '하이브리드' 플라스틱-금속 복합기술로 제조된 고집적 볼스터가 제조됩니다. 볼스터와 완전히 조립된 프론트엔드 모듈은 자동차 산업의 세계 시스템 공급업체인 독일 몬타플라스트사가 개발해 생산하고 있습니다.

복합재료와 금속의 하이브리드 설계는 중량급 차량에 바람직하게 사용됩니다. 그린 이니셔티브를 위한 환경 규제나 소비자의 디지털 라이프 스타일도, 경량 차량의 수요 증가, 나아가서는 복합재료 및 하이브리드 프론트엔드 모듈(FEM)의 수요 증가에 중요한 역할을 하고 있습니다. 예를 들면

- 2021년 4월, Webasto는 상하이 모터쇼에서 미래의 이동성의 비전으로 컨셉카를 발표했습니다. 이 콘셉트카는 자율주행, 전동화, 안락함을 위한 수많은 기술적 솔루션을 결집한 것으로 작동하는 라이다와 작동하는 카메라를 갖춘 루프 센서 모듈, 개폐 가능한 대형 파노라마 루프, 스마트한 경량 프론트엔드 모듈, 배터리와 충전 솔루션, 통합된 열관리 시스템 등이 포함돼 있습니다.

현재 복합재료제의 프론트엔드 모듈을 탑재한 차량이 몇 대 시장에 투입되고 있습니다. 최근 출시된 현대와 메르세데즈의 소형 부문 차량 2개 차종은 경량 프론트엔드 구조를 채택했으며, 컴포넌트에 추가 기능을 접목할 수 있어 조립 시간 단축, 비용 절감, 질량 절감을 실현하고 있습니다. 이 세 차종의 캐리어에는 사출 성형된 펠릿 형태의 LFT-PP가 사용되고 있습니다.

- 1.5 리터 터보 충전 가솔린 엔진을 탑재하고 엔진 프론트엔드 액세서리 드라이브(FEAD)에 내장된 48 볼트 벨트 스타터 발전기(BSG), 48 볼트 -12DC/DC 컨버터, 48 볼트의 리튬 이온 배터리 모듈과 배터리 관리 시스템(BMS), 리큐페레이션 브레이크 시스템과 하이브리드 모듈 제어 시스템에 의해 보완됩니다.

이러한 시장 개척의 동향과 기술을 고려하면, 자동차 부품의 경량화의 경향은 제조업체가 고객에게 혁신적인 솔루션을 제공하는 것을 뒷받침할 것으로 예상됩니다. 이러한 동향으로 예측 기간 동안 이 시장은 꾸준한 성장률을 보일 것으로 예상됩니다.

아시아태평양이 큰 성장을 이룰 전망

아시아태평양은 일본, 한국, 중국, 인도의 주요 프론트엔드 모듈 제조업체의 존재가 높기 때문에 자동차 프론트엔드 모듈 시장을 독점할 것으로 예상됩니다. 이 지역의 주요 국가에서 자동차 생산량이 증가하고 있는 것에 더해, 다양한 자동차 OEM 메이커가 경량차의 생산에 주력하고 있는 것도, 이 시장의 수요를 뒷받침하고 있습니다.

- 중국 기차공업협회(CAAM)에 따르면 2022년 7월 자동차산업의 PMI는 52.0%를 웃돌아 제조업 전체의 PMI보다 양호했습니다. 7월의 자동차 전체의 생산 대수는 245만 5,000대, 판매 대수는 242만 대로, 각각 전년 동월 대비 31.5% 증가, 29.7% 증가했습니다. 승용차 생산은 221만 대로 42.6% 증가, 판매는 217만 4,000대로 40.0% 증가했습니다. 1-7월의 승용차 생산 대수는 1,264만 5,000대, 전년 동기 대비 10.9% 증가, 판매 대수는 1,252만 9,000대, 동기 대비 8.3% 증가했습니다.

- SIAM에 따르면 인도의 승용차 총 판매 대수는 271만 1,457대에서 306만 9,499대로 증가했으며, 동기간 밴의 판매 대수는 11만 3,265대(2020년 4월-2021년 3월은 10만 8,841대)로 시장의 긍정적인 동향을 보였습니다.

중국과 인도 외에 한국과 일본도 Nissan과 같은 자동차 산업의 대기업의 존재에 의해 중요성을 늘리고 있습니다. 이 지역은 자동차용 프론트엔드 모듈(FEM) 시장에서 두 자릿수의 CAGR을 나타낼 것으로 예상됩니다. 또한 시장의 수요는 주요 기업의 확대 전략, 생산 설비의 확대 등에 의해 뒷받침될 것으로 예상됩니다. 예를 들면

- 2022년 3월 케다 주 크림의 Sime Darby의 조립 공장에서 Porsche 카이엔의 말레이시아 최초의 CKD 유닛이 생산 라인으로부터 롤 오프 했습니다. 베이스가 되는 카이엔은 현재, CKD 형식으로 현지 생산되고 있는 유일한 모델입니다. 현지에서 조달되는 6개의 주요 모듈에는 센터 콘솔과 콕핏(클라리온), 프론트 및 리어 액슬(ZF), 프론트 엔드 모듈 어셈블리가 포함됩니다.

예측 기간 동안 시장 전망은 밝을 것으로 예상됩니다.

자동차 프론트엔드 모듈 산업 개요

자동차 프론트엔드 모듈 시장은 적당히 통합되어 있으며, Denso Corporation, Faurecia SA, Group, Magna International, Plastic Omnium Group 등의 대규모 기업이 시장의 대부분을 차지하고 있습니다. 전 세계의 다양한 참가 기업이, 경쟁에서 이기기 위해서 새로운 연구 개발 프로젝트에 투자해, 합작 사업이나 파트너십을 맺고 있습니다.

- 2021년 5월-Mother son Group은 자회사인 Samvardhana Motherson Reflectec을 통해 튀르키예의 Plast Met Group 주식의 과반수를 취득합니다.

- 2020년 10월, Plastic Omnium은 100% 전기자동차용 다수의 새로운 프로그램이 시동한다고 발표했습니다. Plastic Omnium은 Tesla 모델 3와 모델 Y에 프론트 범퍼와 리어 범퍼, 프론트 엔드 모듈을 장착하고 있습니다. 이 모델들은 중국과 북미에서 제조되고 있습니다. 또, VW ID.3와 ID.4용의 프론트 엔드 모듈, 센터 콘솔, 프론트와 리어 범퍼도 제공하고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 성장 촉진요인

- 시장 성장 억제요인

- 산업의 매력-Porter's Five Forces 분석

- 신규 진입업자의 위협

- 구매자 및 소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 차종별

- 승용차

- 소형 상용차

- 대형 상용차

- 원료 유형별

- 금속

- 복합재

- 기타

- 지역별

- 북미

- 미국

- 캐나다

- 기타 북미

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 기타

- 남미

- 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 벤더의 시장 점유율

- 기업 프로파일

- Denso Corporation

- Hirschvogel Automotive Group

- HYUNDAI MOBIS CO. LTD

- Magna International Inc.

- Hanon Systems

- Compagnie Plastic Omnium SA

- SL Corporation

- Valeo SA

- Marelli Corporation

- MAHLE GmbH

- Calsonic Kansei Corporation

제7장 시장 기회 및 향후 동향

AJY 25.05.02The Automotive Front End Module Market is expected to register a CAGR of greater than 5% during the forecast period.

The COVID-19 pandemic hindered the growth of the automotive industry and associated component industry like the front-end module market as lockdowns and shutdown of manufacturing facilities in 2020 resulted in the decline of vehicle production and sales worldwide. However, key markets opening up by the first half of 2021 and key players' short-term strategies to revive their business operations across various countries have helped the market to regain its momentum.

Over the medium term, expanding the automotive industry and growing awareness about safety in vehicles across all major regions in the world are expected to drive demand in the market. In addition, the rising need for vehicle weight reduction and increasing demand for technically advanced lightweight front-end modules are likely to offer lucrative opportunities for players in the market. However, heavy expenditures are being made in the automotive front-end module market as manufacturers choose to miniaturize their goods in response to rising consumer interest in vehicle front-end modules likely to restrict market growth during the forecast period.

Further, as key automotive players are actively looking to adopt the latest front-end modules in their vehicles to gain competitive edge to support market growth in coming years. Besides, these rise in ADAS technology and autonomous cars to enhance overall market growth as they accomodate more sensors than conventional vehicles and hence more opportunity for conducting extensive research activities in this regard.

Asia-Pacific, Europe followed by North America region expected to play key role in the development of the market during the forecast period as growth across these regions is supported by notable vehicle production both passenger cars and commercial vehicles. In addition, the growth of market is likely to be spurred by key automotive OEM launches with latest front module innovations and key manufacturers in the region.

Automotive Front End Module Market Trends

Increasing Demand for Lightweight Automotive Front-End Modules

The growing demand for lightweight vehicles is also the driving force for the automotive front-end module (FEM) market. As lightweight auto parts reduce the overall weight of the vehicles, they can, in turn, reduce CO2 emissions and cost. So, as several governments across the globe have introduced stringent emission and fuel economy regulations such as corporate average fuel economy (CAFE), BS-VI norms, etc. such regulations are likely to encourage automotive OEMs to increase the usage of lightweight materials such as lightweight metals, composites, and plastics. Experimenting with front-end module materials in auto parts has predominately contributed to achieving 20%-30% of vehicle weight reduction.

Nowadays instead of heavy steel and iron carriers, lightweight components are used which are responsible for fuel efficiency and vehicle performance enhancement. Commonly used materials for lightweight thermoplastics are polypropylene and nylon. For instance,

- In July 2020, a highly integrated bolster produced with a 'hybrid' plastic-metal composite technology for the Ford Kuga SUV, is produced with steel panels and Durethan BKV30H2.0EF, an easy-flowing, fiberglass-reinforced nylon 6 from Lanxess, Pittsburgh, Penn. The bolster and the fully assembled front-end module were developed and are produced by Germany's Montaplast GmbH, a global system supplier of the automotive industry.

Hybrid composite/metal designs are preferably used for heavy-end vehicles. Environmental regulations for green initiatives and the digital lifestyle of consumers is also playing a vital part in increasing demand for lightweight vehicles and in turn the demand for composite/ hybrid front-end module (FEM). For example,

- In April 2021, Webasto announced that, at Auto Shanghai, it is presenting a concept vehicle as a vision of the mobility of the future. The concept car brings together numerous technical solutions for autonomous driving, electrification and comfort: roof sensor module with a working lidar and working camera, a large openable panorama roof, a smart lightweight front-end module, a battery and charging solution, and an integrated thermal management system.

Currently, several vehicles are launched in the market with front-end modules made of composite materials. The recently launched Hyundai and two small segment cars from Mercedes use a lightweight front-end construction that allows for the integration of additional functionality in components, which in turn saves assembly time, reduces costs, and lowers mass. Carriers for all three vehicles make use of injection-molded pelletized LFT-PP. For instance,

- In February 2020, Geely Philippines introduced its very own gasoline-electric hybrid technology into its upcoming compact SUV, which will pair with a 1.5-liter turbo-charged gasoline engine, complemented by a 48-volt belt-starter generator (BSG) integrated in the Front-End Accessory Drive (FEAD) of the engine, a 48-volt to 12 DC/DC converter, a 48-volt lithium-ion battery module and battery management system (BMS), along with a recuperation braking system and a hybrid module control system.

Considering such developments and technologies in the market, the trend of light weight components in vehicles anticipated to push manufacturers to offer innovative solutions for their customers. Owing to such trends , the market expected to grow at decent rate during the forecast period.

Asia-Pacific Region Expected to Witness Significant Growth in the Market

The Asia-Pacific region is expected to dominate the automotive front-end module market -owing to the strong presence of key front-end module manufacturers in Japan, South Korea, China, and India. The demand in the market is further supported by growing vehicle production across key countries in the region coupled with the growing focus of various automotive OEMs to produce lightweight vehicles. For instance,

- According to CAAM, the China Association of Automobile Manufacturers (CAAM) stated that in July 2022, the PMI of the automobile industry was higher than 52.0%, which was better than that of the overall manufacturing industry. Overall vehicle production and sales in July totaled 2.455 million units and 2.42 million units, representing a 31.5% and 29.7% y/y increase, respectively. Passenger vehicle production reached 2.21 million units, up 42.6% y/y, while sales were 2.174 million units, up 40.0% y/y. Passenger vehicle production for the January to July period totaled 12.645 million units, up 10.9% y/y, while sales were 12.529 million units, up 8.3% y/y.

- According to SIAM, total Passenger Vehicle Sales in India increased from 2,711,457 to 3,069,499 units and during the same period 113,265 units of Vans were sold compared to 108,841 units in April 2020 to March 2021 indicating positive trends in the market.

Apart from China and India South Korea, Japan are also gaining the importance owing to the presence of big players of automobile industry like Nissan. This region is expected to show strong double digit CAGR for the automotive front end module (FEM) market. Further, demand in the market expected to be supported by key players expansion strategy, production facilities expansion, etc. For instance,

- In March 2022, the first ever Malaysia-assembled CKD unit of Porsche Cayenne has rolled off the production line at Sime Darby's assembly plant in Kulim, Kedah, the first assembly facility for Porsche outside of Europe. The base Cayenne is currently the only model being produced locally in CKD form. Six key modules sourced locally include center console and cockpit (Clarion), front and rear axles (ZF), and the front-end module assembly.

Such developments, anticipated to create positive outlook for the market during the forecast period.

Automotive Front End Module Industry Overview

The Automotive front-end module market is moderately consolidated and the majority share of the market is dominated by major players, such as Denso Corporation, Faurecia SA, Group, Magna International, and Plastic Omnium Group, among others. Various players around the world are investing in new R&D projects, making joint ventures, and partnerships for being ahead of the competition. For instance,

- In May 2021, Mother son Group completes the acquisition of a majority stake in Turkey's Plast Met Group through its subsidiary Samvardhana Motherson Reflectec With the successful closure of this acquisition, Motherson Group now has access to the significant Turkish automotive market.

- In October 2020, Plastic Omnium announced that numerous new programs for 100% electric vehicles are coming on stream. Plastic Omnium equips the Tesla Model 3 and Model Y with front and rear bumpers and front-end modules. These models are manufactured in China and North America. It also provides front-end module, centre console, front and rear bumpers for VW ID.3 and ID.4.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD billion)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Light Commercial Vehicle

- 5.1.3 Heavy Commercial Vehicle

- 5.2 By Raw Material Type

- 5.2.1 Metal

- 5.2.2 Composite

- 5.2.3 Others

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Denso Corporation

- 6.2.2 Hirschvogel Automotive Group

- 6.2.3 HYUNDAI MOBIS CO. LTD

- 6.2.4 Magna International Inc.

- 6.2.5 Hanon Systems

- 6.2.6 Compagnie Plastic Omnium SA

- 6.2.7 SL Corporation

- 6.2.8 Valeo SA

- 6.2.9 Marelli Corporation

- 6.2.10 MAHLE GmbH

- 6.2.11 Calsonic Kansei Corporation