|

시장보고서

상품코드

1852056

스티렌계 블록 공중합체(SBC) 시장 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Styrenic Block Copolymers (SBCs) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

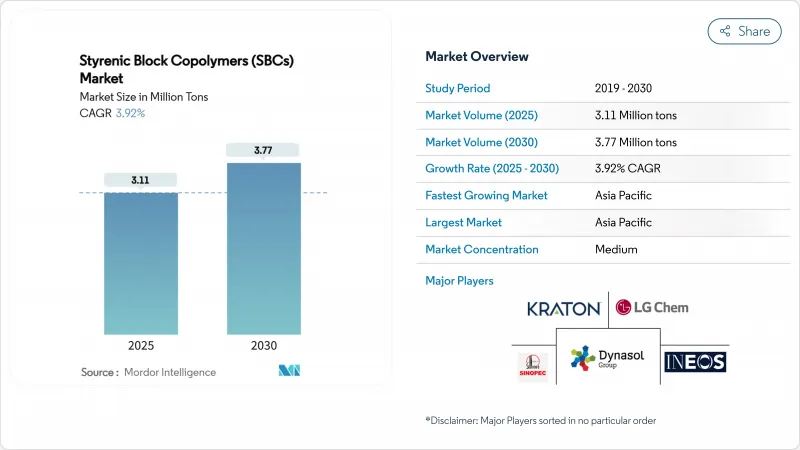

스티렌계 블록 공중합체 시장 규모는 2025년에 311만 톤으로 추정되고, 예측 기간(2025-2030년) CAGR 3.92%로 성장할 전망이며, 2030년에는 377만 톤에 달할 것으로 예측됩니다.

수요 기반은 성숙하고 있는 반면, 스티렌계 블록 공중합체 시장은 아스팔트 개질막이나 방수막으로부터 고부가가치의 유전체 필름에 이르기까지, 그 폭넓은 용도로부터 혜택을 계속 받고 있습니다. 다각화를 통해 생산자는 단일 분야의 순환성으로부터 보호되는 반면, 원료의 통합과 최종 사용자에 대한 지역적 근접성이 경쟁 우위를 좌우하게 되었습니다. 아시아태평양은 정부가 고분자 개질 아스팔트와 고분자 개질 멤브레인을 사용하는 고속도로, 철도 및 고층 빌딩 건설에 자본을 투입하고 있기 때문에 여전히 성장 엔진이 되고 있습니다. 동시에, 수소첨가 등급의 특허절감이 중견 공급업체에 활로를 열고, EV 커패시터용의 설폰화 케미스트리의 브레이크스루가 스티렌계 블록 공중합체 시장 전망의 프리미엄 틈새를 시사하고 있습니다.

세계의 스티렌계 블록 공중합체(SBC) 시장 동향 및 인사이트

아스팔트 재활용 의무화가 성능 요구 사항 뒷받침

EU와 미국의 입법 기관은 도로 건설 기준에 재활용 함량의 최소 기준을 통합하고 있으며, 설계자는 타이어 유래 또는 플라스틱 유래 오일이 버진 아스팔트를 대체해도 기계적 무결성을 유지하는 고분자 시스템을 선호합니다. 최근의 시험에서 SBS 개질 믹스는 동결-융해 사이클 및 산화 스트레스의 반복 하에서 개질되지 않은 아스팔트보다 우수하다는 것이 확인되었습니다. 재활용 원료의 변동이 배합의 복잡성을 증가시키기 위해, 스티렌계 블록 공중합체를 높은 불순물 부하에 맞추어 조정할 수 있는 공급자는 가격면에서의 프리미엄을 누리고 있습니다. 자금 조달 메커니즘은 시장 진입을 가속화하지만 지역 회수망의 격차와 열분해 장비 허가주기의 길이로 인해 단기 공급은 엄격합니다. 그 결과, 스티렌계 블록 공중합체 시장은 리사이클의 의무화가 연방법으로부터 지자체의 조달로 연쇄하는 가운데, 톤수 증가를 확보하고 있습니다.

아시아태평양 인프라 붐 방수 수요 가속

중국, 인도, 베트남, 인도네시아에서는 기록적인 공공 투자가 계속되고 있으며, 교량, 지하철, 집합 주택용 폴리머 개질막의 소비를 자극하고 있습니다. SCG Chemicals의 론슨 공장에서 7억 달러의 리노베이션 공사는 아스팔트 및 건축용 멤브레인에서 SBC의 구조적 수요를 예상하여 종합 제조업체가 유연한 에탄 원료로 축발을 옮기는 방법을 보여줍니다. 지역 계약자는 열대, 사막, 고산 기후를 가로 지르는 고속도로에 SBS 개질 바인더를 지정하여 저온에서의 균열 저항성 및 고온에서의 바퀴자국 패임 안정성을 보장합니다. 건설 거점에 가깝기 때문에 운임이 싸고, 납품까지의 리드 타임이 짧다는 이점이, 2024년의 스티렌계 블록 공중합체 시장에서 APAC의 점유율을 57% 이상으로 밀어 올렸습니다. 노동력 부족과 허가의 지연은 프로젝트 일정을 정체시킬 수도 있지만, 2030년까지 생산 능력 증강을 계획하고 있는 생산자에게는 다년간의 정부 예산이 전망을 지지하고 있습니다.

콜드 믹스 기술이 종래의 용도에 과제

캐나다, 독일 및 미국의 일부 주 정부 기관은 아스팔트 공장에서 온실 가스 배출을 줄이는, 주변 온도에서 경화되는 에멀젼 기반 콜드 믹스 포장을 테스트하고 있습니다. 초기 단계의 실지 성능은 폴리머를 사용하지 않는 레시피가 농촌 및 2차 도로의 사양을 충족할 수 있음을 시사하며, 교통 부하가 겸손한 곳에서는 SBS 수요를 침식할 수 있습니다. 그럼에도 불구하고 교통량이 많은 도시의 간선 도로에서는 SBS에 의한 바퀴자국 파임 저항성이 여전히 필요합니다. 도입 장벽에는 계약자의 익숙성, 검증되지 않은 장기 내구성, 특수 유화제 공급 제한 등이 있습니다. 따라서, 특정 하위 부문에서는 콜드 믹스 대체 재료가 상승으로 변하는 것, 스티렌계 블록 공중합체 시장은 고성능 포장의 핵심을 유지하고 있습니다.

부문 분석

스티렌-부타디엔 스티렌은 2024년 스티렌계 블록 공중합체 시장에서 72.12%의 압도적인 점유율을 유지했으며, 아스팔트, 신발류, 감압 접착제에서 비용에 맞는 성능을 발휘하고 있습니다. 이 폴리머는 확립된 공급망, 광범위한 가공 노하우 및 배합의 다양성으로 인해 대량 생산 용도에서 대체 위험을 억제합니다. SEBS나 SEPS와 같은 수소첨가 유형은 톤수 기준으로는 적지만, 자동차 제조업체, 가전 브랜드, 전선 및 케이블 제조업체가 보다 높은 내열성, 내자외선성, 내유성 임계값을 지정했기 때문에 2030년까지 연평균 복합 성장률(CAGR)은 가장 빠른 4.53%를 기록할 전망입니다. 수소첨가 등급의 스티렌계 블록 공중합체 시장 규모는 특허 관련 로열티의 붕괴와 등급 선택을 가속화하는 클라우드 대응 CAE 플랫폼의 상업화에 추진되어 예측 기간 동안 약 20만 톤 증가할 것으로 예측됩니다.

이와 병행하여 SIS는 용제형 감압 접착제, 인공 항문 케어 용품, 의료용 드레이프 테이프에 특화된 역할을 유지했습니다. 제조업체 각사는 핫멜트 가공 시의 산화 가교를 억제하기 위해서 수소 첨가 SIS를 최적화해, 위생 용도에 대한 적합을 넓히고 있습니다. 원료 믹스의 유연성, 특히 높은 가격의 부타디엔보다 이소프렌을 선호하는 능력은 SIS 제조업체에게 원료 변동에 대한 헤지를 제공합니다. 이러한 역학을 종합하면 폴리머의 다양화가 스티렌계 블록 공중합체 시장을 거시경제의 순환성으로부터 보호하는 동시에 장기적인 혁신 로드맵을 지원하게 됩니다.

스티렌계 블록 공중합체 보고서는 폴리머의 유형별(스티렌-부타디엔 스티렌(SBS), 스티렌-이소프렌 스티렌(SIS), 수소 첨가 SBC별(HSBC)), 용도별(아스팔트 개질, 신발, 폴리머 개질, 접착제 및 실란트, 기타), 지역별(아시아태평양, 북미, 유럽, 남미, 중동 및 아프리카)로 구분됩니다. 시장 예측은 수량(톤)으로 제공됩니다.

지역별 분석

아시아태평양의 스티렌계 블록 공중합체 시장에서의 2024년 점유율은 56.97%로 압도적이었는데, 이것은 세계적인 제조 거점으로서의 지위와 인프라의 핫스팟으로서의 지위를 겸비하고 있는 것을 반영하고 있습니다. 중국 연안부, 한국, ASEAN의 정유소 회랑 내에 있는 자본 집약적인 에틸렌 프로파일렌 콤플렉스가 경쟁력 있는 원료를 공급하는 한편, 국내의 청부업자가 여러 해에 걸친 고속도로, 항만, 지하철의 프로젝트를 통해 안정된 인취량을 확보하고 있습니다. 베트남이 에탄 분해 능력 개조를 결정한 것은 이 지역의 조달 유연성을 강조하는 것이며, 인도의 급속한 도시 이동은 방수막의 지속적인 수요를 지원하는 것입니다. 이 지역의 2030년까지 예상 CAGR은 4.29%로 성장이 전망되며 세계 평균을 웃돌고 있는데, 이는 정책 주도의 산업화, 일렉트로닉스의 집적, 자동차의 전동화의 가속에 의한 것으로, 이들은 모두 수소화 SBC의 보급을 촉진하는 촉매입니다.

북미는 주간 고속도로 개수 및 공항 활주로 재포장에 수십억 달러를 충당하는 연방 정부의 인프라 지출 계획에 뒷받침되고 있습니다. 스티렌계 블록 공중합체 시장은 INEOS Styrolution이 43만 톤의 Sarnia 공장을 영구 중단했기 때문에 국내 스티렌 공급이 감소하고 있습니다. 아스팔트의 재활용 의무화는 바인더 블렌드의 고분자 농도를 증가시키는 반면, 이 지역의 신흥 에코시스템은 EV 파워 일렉트로닉스를 위한 SBC 기반 유전체 필름을 뒷받침하고 있습니다. 그러나 셰일 가스 액체와 멕시코 걸프 허리케인과 관련된 원료의 변동은 확장 계획을 억제하는 불확실성을 초래합니다.

유럽은 스티렌계 블록 공중합체 시장에서 성숙하면서도, 기술적으로 세련되고, 지속가능성 및 순환성을 우선하고 있습니다. 높은 에너지 관세와 엄격한 환경 규제로 생산자는 최적의 가동률로 운영해야 하며 플랜트의 합리화로 이어지지만 공정 효율 향상도 촉진합니다. 그린딜 및 확대하는 생산자 책임의 틀 등 규제는 재활용 가능한 폴리머 시스템과 리사이클 적합 폴리머 시스템에 대한 수요를 자극하고, SEBS 및 설폰화 SBC는 식품 접촉 용도 및 의료용 튜브 용도로 지지되고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- EU와 미국에서의 아스팔트 트리사이클 의무화

- APAC 인프라 붐(고속도로, 방수재)

- 유행에 견인되는 일회용 위생 필름 대두

- 클레이튼의 HSBC 등급의 특허 만료에 의해 신규 참가 가능성 증가

- 차세대 EV 커패시터용 설폰화 SBC

- 시장 성장 억제요인

- 원유 연쇄 스티렌 및 부타디엔 원료의 변동성

- 아스팔트 프리 콜드 믹스 도로 기술

- 포장에서 SBC를 대체하는 POE/POP 엘라스토머

- 밸류체인 분석

- Porter's Five Forces

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 정도

제5장 시장 규모 및 성장 예측

- 폴리머 유형별

- 스티렌 부타디엔 스티렌(SBS)

- 스티렌-이소프렌 스티렌(SIS)

- 수소화 SBC(HSBC)

- 용도별

- 아스팔트 개질(포장 및 지붕재)

- 신발

- 폴리머 개질

- 접착제 및 실란트

- 기타 용도(의료기기, 전선 및 케이블)

- 지역별

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 말레이시아

- 태국

- 인도네시아

- 베트남

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 튀르키예

- 북유럽 국가

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 콜롬비아

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 카타르

- 이집트

- 나이지리아

- 남아프리카

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- 시장 집중도

- 전략적 움직임(M&A, JV, 용량)

- 시장 점유율(%) 및 랭킹 분석

- 기업 프로파일

- Asahi Kasei Corporation

- Avient Corporation

- Dynasol Group

- Eni SpA

- INEOS

- Kraton Corporation

- Kuraray Co., Ltd.

- LCY

- LG Chem

- Sibur

- Sinopec

- TSRC

- ZEON Corporation

제7장 시장 기회 및 향후 전망

AJY 25.11.26The Styrenic Block Copolymers Market size is estimated at 3.11 Million tons in 2025, and is expected to reach 3.77 Million tons by 2030, at a CAGR of 3.92% during the forecast period (2025-2030).

Despite a mature demand base, the styrenic block copolymers market continues to benefit from its wide application spread, ranging from asphalt modification and waterproofing membranes to high-value dielectric films. Diversification protects producers from single-sector cyclicality, while feedstock integration and regional proximity to end users increasingly dictate competitive advantage. The Asia-Pacific region remains the growth engine as governments channel capital toward expressways, rail links, and high-rise construction that specify polymer-modified bitumen and membranes. Simultaneously, patent expiries in hydrogenated grades open space for mid-tier suppliers, and breakthroughs in sulfonated chemistries for EV capacitors hint at future premium niches for the styrenic block copolymers market.

Global Styrenic Block Copolymers (SBCs) Market Trends and Insights

Asphalt-Recycling Mandates Drive Performance Requirements

Legislators in the EU and United States have embedded minimum recycled-content thresholds into road construction codes, prompting designers to favor polymer systems that preserve mechanical integrity when tire-derived or plastic-derived oils replace virgin bitumen. Recent trials confirm that SBS-modified mixes outperform unmodified asphalt under repeated freeze-thaw cycles and oxidative stress, thereby meeting tougher service-life criteria. Suppliers capable of tailoring styrenic block copolymers to higher impurity loads enjoy a pricing premium, because recyclate variability increases formulation complexity. Although funding mechanisms accelerate market pull, gaps in regional collection networks and lengthy permitting cycles for pyrolysis units keep short-term supply tight. Consequently, the styrenic block copolymers market secures incremental tonnage growth as recycling mandates cascade from federal statutes to municipal procurement.

APAC Infrastructure Boom Accelerates Waterproofing Demand

Record-level public spending across China, India, Vietnam, and Indonesia continues to stimulate consumption of polymer-modified membranes for bridges, subways, and mega-residential complexes. SCG Chemicals' USD 700 million upgrade at its Long Son complex illustrates how integrated producers pivot to flexible ethane feedstock in anticipation of structural demand for SBCs in asphalt and building membranes. Regional contractors specify SBS-modified binders for expressways that traverse tropical, desert, and alpine climates, thereby guaranteeing low-temperature crack resistance and high-temperature rutting stability. Proximity to construction centers lowers freight cost and shortens delivery lead times, advantages that push APAC's share of the styrenic block copolymers market beyond 57% in 2024. While labor shortages and permitting delays occasionally stall project timelines, multi-year government budgets underpin visibility for producers mapping capacity additions through 2030.

Cold-Mix Technologies Challenge Traditional Applications

Government agencies in Canada, Germany, and several U.S. states have trialed emulsion-based cold-mix pavements that cure at ambient temperature, reducing greenhouse-gas emissions from asphalt plants. Early-stage field performance suggests that polymer-free recipes can meet rural and secondary road specifications, potentially eroding SBS demand where traffic loads are modest. Nonetheless, heavy-traffic urban arterials still require the rutting resistance imparted by SBS. Implementation barriers include contractor familiarity, untested long-term durability, and limited supply of specialized emulsifiers. Hence, although cold-mix alternatives cap upside in certain subsegments, the styrenic block copolymers market retains its core in high-performance pavements.

Other drivers and restraints analyzed in the detailed report include:

- Pandemic-Driven Hygiene Film Applications Create New Demand Vectors

- Sulfonated SBCs Unlock High-Value EV Capacitor Space

- POE/POP Elastomers Replace SBCs in Flexible Packaging

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Styrene-Butadiene-Styrene retained a commanding 72.12% share of the styrenic block copolymers market in 2024, underscoring cost-aligned performance in asphalt, footwear, and pressure-sensitive adhesives. The polymer enjoys a well-established supply chain, broad processing familiarity, and formulation versatility that limit substitution risk in mass-volume applications. Hydrogenated members such as SEBS and SEPS contributed a smaller tonnage base but registered the fastest 4.53% CAGR to 2030 as automakers, consumer-electronics brands, and wire-and-cable producers specified higher thermal, UV, and oil-resistance thresholds. The styrenic block copolymers market size for hydrogenated grades is projected to increase by nearly 0.2 million tons during the forecast window, buoyed by the collapse of patent-related royalties and the commercialization of cloud-enabled CAE platforms that accelerate grade selection.

In parallel, SIS maintained a specialized role in solvent-borne pressure-sensitive adhesives, ostomy-care appliances, and medical drape tapes where intrinsic tack and bloom resistance outweigh price premiums. Producers have optimized hydrogenated SIS variants to cut oxidative cross-linking during hot-melt processing, broadening their fit for hygiene applications. Feedstock mix flexibility, especially the ability to favor isoprene over high-priced butadiene, gives SIS producers a hedge against raw-material volatility. Collectively, these dynamics ensure that polymer-type diversification shields the styrenic block copolymers market from macroeconomic cyclicality while anchoring long-term innovation roadmaps.

The Styrenic Block Copolymers Report is Segmented by Polymer Type (Styrene-Butadiene-Styrene (SBS), Styrene-Isoprene-Styrene (SIS), and Hydrogenated SBCs (HSBC)), Application (Asphalt Modification, Footwear, Polymer Modification, Adhesives and Sealants, and Others), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific's dominant 56.97% 2024 share of the styrenic block copolymers market reflects its combined status as a global manufacturing hub and infrastructure hot spot. Capital-intensive ethylene and propylene complexes along the Chinese coast, in South Korea, and within the ASEAN refinery corridor provide competitive feedstock; meanwhile, domestic contractors ensure stable off-take through multi-year freeway, port, and metro projects. Vietnam's decision to retrofit ethane cracking capacity underscores the region's flexibility in sourcing, while India's rapid urban migration underpins sustained waterproofing-membrane demand. The region's 4.29% projected CAGR to 2030 outpaces global averages thanks to policy-driven industrialization, electronics clustering, and accelerating vehicle electrification, all catalysts for hydrogenated SBC uptake.

North America is buoyed by federal infrastructure-spending packages that allocate billions toward Interstate rehabilitation and airport runway resurfacing. The styrenic block copolymers market faces reduced domestic styrene supply after INEOS Styrolution permanently idled its 430,000-ton Sarnia unit, tightening merchant monomer availability and advantaging vertically integrated players. Asphalt-recycling mandates drive higher polymer concentrations in binder blends, while the region's start-up ecosystem pushes SBC-based dielectric films for EV power electronics. However, feedstock volatility tied to shale gas liquids and hurricanes along the Gulf Coast introduces uncertainty that tempers expansion plans.

Europe commands a mature yet technologically sophisticated slice of the styrenic block copolymers market, prioritizing sustainability and circularity. High energy tariffs and strict environmental regulations compel producers to operate at optimized utilizations, leading to plant rationalizations but also encouraging process efficiency gains. Regulatory drivers such as the Green Deal and extended producer-responsibility frameworks stimulate demand for recyclable and recycled-compatible polymer systems, favoring SEBS and sulfonated SBCs in food-contact and medical tubing applications.

- Asahi Kasei Corporation

- Avient Corporation

- Dynasol Group

- Eni S.p.A.

- INEOS

- Kraton Corporation

- Kuraray Co., Ltd.

- LCY

- LG Chem

- Sibur

- Sinopec

- TSRC

- ZEON Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Asphalt-Recycling Mandates in EU and U.S.

- 4.2.2 APAC Infrastructure Boom (Expressways, Waterproofing)

- 4.2.3 Pandemic-Driven Rise in Single-Use Hygiene Films

- 4.2.4 Patent Expiry of Kraton's HSBC Grades Unlocking New Entrants

- 4.2.5 Sulfonated SBCs for Next-Gen EV Capacitors

- 4.3 Market Restraints

- 4.3.1 Volatility of Crude-Linked Styrene and Butadiene Feedstocks

- 4.3.2 Asphalt-Free Cold-Mix Road Technologies

- 4.3.3 POE/POP Elastomers Replacing SBCs in Packaging

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Polymer Type

- 5.1.1 Styrene-Butadiene-Styrene (SBS)

- 5.1.2 Styrene-Isoprene-Styrene (SIS)

- 5.1.3 Hydrogenated SBCs (HSBC)

- 5.2 By Application

- 5.2.1 Asphalt Modification (Paving and Roofing)

- 5.2.2 Footwear

- 5.2.3 Polymer Modification

- 5.2.4 Adhesives and Sealants

- 5.2.5 Other Applications (Medical devices and Wires and Cables)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 Turkey

- 5.3.3.8 Nordic Countries

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Qatar

- 5.3.5.4 Egypt

- 5.3.5.5 Nigeria

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (Mergers and Acquisitions, JV, Capacity)

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Asahi Kasei Corporation

- 6.4.2 Avient Corporation

- 6.4.3 Dynasol Group

- 6.4.4 Eni S.p.A.

- 6.4.5 INEOS

- 6.4.6 Kraton Corporation

- 6.4.7 Kuraray Co., Ltd.

- 6.4.8 LCY

- 6.4.9 LG Chem

- 6.4.10 Sibur

- 6.4.11 Sinopec

- 6.4.12 TSRC

- 6.4.13 ZEON Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment