|

시장보고서

상품코드

1687341

금속기복합재료 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Metal Matrix Composites - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

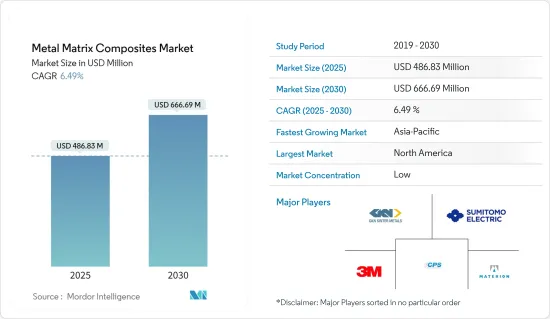

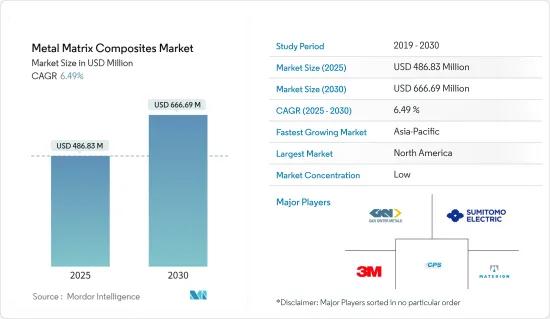

금속기복합재료 시장 규모는 2025년에 4억 8,683만 달러로 추정되며, 예측 기간(2025-2030년)의 CAGR은 6.49%로, 2030년에는 6억 6,669만 달러에 달할 것으로 예측됩니다.

COVID-19로 인한 2020년 팬데믹 기간 중 전 세계적인 봉쇄 및 사회적 거리두기 조치가 취해지면서 공급망의 혼란과 다양한 제조업의 폐쇄로 이어졌습니다. 이는 시장에 부정적인 영향을 미쳤습니다. 그러나 팬데믹 이후 시장은 정상 궤도에 진입하고 있습니다.

주요 하이라이트

- 항공우주 및 방위산업에서 경량 소재에 대한 수요 증가와 금속보다 우수한 특성을 가진 금속 기반 복합소재가 시장의 주요 촉진요인으로 작용하고 있습니다.

- 그러나 복잡한 제조 공정이 시장 성장의 걸림돌이 될 수 있습니다.

- 기관차 산업에서의 사용 확대와 전기자동차의 채택 증가는 시장에 새로운 기회를 가져올 것으로 예측됩니다.

- 북미가 가장 높은 시장 점유율을 차지하고 있습니다. 그러나 예측 기간 중 아시아태평양이 시장을 지배할 것으로 예측됩니다.

금속기복합재료 시장 동향

전기 및 전자 분야가 급성장

- 금속 기반 복합재료는 다양한 전기 및 전자 부품 및 장비에 사용됩니다. 예를 들어 알루미늄 흑연 복합재료는 우수한 열전도율, 조정 가능한 열팽창 계수, 낮은 밀도로 인해 파워 일렉트로닉스 모듈에 채택되고 있습니다.

- 알루미늄과 구리는 실리콘 카바이드(SiC)로 강화되어 낮은 열팽창계수(CTE), 높은 열전도율과 같은 우수한 열물성 및 비강도 향상, 우수한 내마모성, 비탄성률 향상과 같은 기계적 특성이 개선되어 다양한 산업 분야에서 사용되고 있습니다.

- 55%의 다이아몬드 입자(부피비)를 포함한 구리-은 합금기로 구성된 다이맬로이(Dymalloy)는 높은 열전도율로 인해 전자기기의 고출력, 고밀도 멀티칩 모듈의 기판으로 활용되고 있습니다.

- 또한 체적률이 높은 PRMMC(미립자 강화 금속 기반 복합재료)는 방열 패널, 파워 반도체 패키지, 마이크로파 모듈, 배터리 슬리브, 블랙박스 인클로저, 인쇄회로기판 방열판 등 전자 산업에서 폭넓게 활용되고 있습니다.

- 사단법인 전자정보기술산업협회(JEITA)가 발표한 세계 전자제품 통계에 따르면 2021년 세계 전자 및 IT 산업 생산은 전년 대비 11% 증가한 3조 3,602억 달러, 2022년에는 5% 증가한 3조 5,366억 달러에 달할 것으로 예상되고 있습니다. 예상되고 있습니다.

- 휴대폰, 휴대용 컴퓨팅 장비, 게임 시스템 및 기타 개인용 전자기기의 생산은 계속해서 전자 부품 수요를 자극하여 금속 기반 복합재료 수요를 증가시킬 것으로 예측됩니다.

- 위와 같은 요인으로 인해 전기 및 전자 장비에 대한 수요는 예측 기간 중 시장에서 수요를 증가시킬 수 있습니다.

아시아태평양 시장 독주

- 아시아태평양은 전 세계 전자제품 생산의 70% 이상을 차지하고 있으며, 한국, 일본, 중국 등의 국가들이 전 세계에서 다양한 전기 부품의 제조 및 다양한 산업에 공급하고 있습니다.

- 아시아태평양의 2021년 9개월간 자동차 생산량은 3,267만 대를 기록해 2020년 동기 대비 11% 증가했습니다.

- 전반적으로 중국, 인도, 일본, 한국 등 국가들의 지속적인 수요 증가는 이 지역의 금속 기반 복합재 시장을 촉진할 가능성이 높습니다.

- 2021년 12월 중국의 산업 생산은 전년 동월 대비 4.3% 증가했습니다. 따라서 중국의 산업 부문 확대는 예측 기간 중 금속 기반 복합재 시장의 성장에 도움이 될 것으로 예측됩니다.

- 중국 산업정보화부 데이터에 따르면 2022년 1-5월 전자정보 제조 부문은 안정적인 성장을 유지했습니다. 연간 영업 수입이 2,000만 위안(약 300만 달러) 이상인 전자정보 제조업체의 부가가치 생산액은 같은 기간 전년 동기 대비 9.9% 성장했습니다.

- 인도 정부는 PLI 제도를 도입하여 제조업체가 인도에서 생산을 확대할 경우 5년간 55억 달러의 인센티브를 제공할 가능성이 있습니다. 이는 인도내 전자기기 생산을 촉진하여 금속 기반 복합재료 수요에 긍정적인 영향을 미칠 것으로 보입니다.

- 인도 브랜드 에쿼티 재단(IBEF)에 따르면 항공우주 분야에서 인도 항공 산업은 향후 4년간 35,000억 루피(49억 9,000만 달러)를 투자할 것으로 예상하고 있습니다.

- 또한 2022년 1-4월 일본 전자산업 생산액은 3조 6,564억 4,000만 엔(326억 달러)으로 2021년 동기 대비 약 0.2%의 성장률을 기록했습니다.

- 위의 요인으로 인해 아시아태평양의 응용 산업 전반에 걸쳐 금속 기반 복합재에 대한 수요가 증가할 것으로 예측됩니다.

금속기복합재료 산업 개요

세계 금속 기반 복합재료 시장은 부분적으로 단편적인 특성을 가지고 있으며, 업계에는 수많은 세계 및 지역 기업이 존재합니다. 시장의 주요 기업에는 GKN Sinter Metals Engineering GmbH, Materion Corporation, 3 M, Sumitomo Electric Industries Ltd, CPS Technologies Corporation 등이 포함됩니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 개요

제4장 시장 역학

- 촉진요인

- 항공우주·방위 산업에서 경량 재료의 수요 증가

- 금속보다 우수한 금속기복합재료의 특성

- 억제요인

- 복잡한 제조 프로세스

- 기타 억제요인

- 업계 밸류체인 분석

- Porter's Five Forces 분석

- 공급 기업의 교섭력

- 소비자의 교섭력

- 신규 진출업체의 위협

- 대체품의 위협

- 경쟁의 정도

- 기술 스냅숏

제5장 시장 세분화

- 유형별

- 니켈

- 알루미늄

- 내화물

- 기타

- 필러

- 탄화규소

- 산화알루미늄

- 탄화 티타늄

- 기타

- 최종사용자 산업별

- 자동차·기관차

- 전기·전자

- 항공우주·방위

- 산업

- 기타

- 지역별

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 이탈리아

- 프랑스

- 스페인

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카공화국

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- M&A, 합병사업, 제휴, 협정

- 시장 순위 분석

- 주요 기업의 전략

- 기업 개요

- 3A Composites

- 3 M(Ceradyne Inc.)

- ADMA Products Inc.

- CPS Technologies Corp.

- DAT Alloytech

- Denka Company Limited

- GKN Sinter Metals Engineering GmbH

- Hitachi Metals Ltd

- Materion Corporation

- MTC Powder Solutions AB

- Plansee Group

- Sumitomo Electric Industries Ltd

- Thermal Transfer Composites LLC

- TISICS Ltd

제7장 시장 기회와 향후 동향

- 기관차 산업에서의 이용 확대

- 전기자동차의 보급 확대

The Metal Matrix Composites Market size is estimated at USD 486.83 million in 2025, and is expected to reach USD 666.69 million by 2030, at a CAGR of 6.49% during the forecast period (2025-2030).

During the pandemic period in 2020 due to COVID-19, there were nationwide lockdowns and social distancing mandates which led to supply chain disruption and the closure of various manufacturing industries. This impacted the market negatively. However, in the post-pandemic period, the market is getting back on track.

Key Highlights

- Increasing demand for lightweight materials in the aerospace and defense industry and superior properties of metal matrix composites over metals are the major driving factors for the market.

- However, the complicated manufacturing process is likely to hinder the market growth.

- Growing use in the locomotive industry and increasing adoption of electric vehicles are expected to provide new opportunities for the market.

- North America accounted for the highest market share. However, Asia-Pacific is projected to dominate the market during the forecast period.

Metal Matrix Composites Market Trends

Electrical and Electronics Segment to Register Fastest Growth

- Metal matrix composites are used in various electrical and electronic components and devices. For instance, aluminum-graphite composites are employed in power electronic modules due to their excellent thermal conductivity, tunable coefficient of thermal expansion, and low density.

- Al and Cu reinforced by SiC are used in various industries due to their excellent thermo-physical properties, such as low coefficient of thermal expansion (CTE), high thermal conductivity, and improved mechanical properties, such as higher specific strength, better wear resistance and specific modulus.

- Because of its high heat conductivity, dymalloy, a copper-silver alloy matrix containing 55% diamond particles (by volume), is utilized as a substrate for high-power, high-density multi-chip modules in electronics.

- In addition, PRMMCs (particulate reinforced metal matrix composites), with a high-volume fraction, have a wide range of applications in the electronics industry, including radiator panels, power semiconductor packages, microwave modules, battery sleeves, black box enclosures, printed circuit board heat sinks, and others.

- According to the global electronics statistics published by the Japan Electronics and Information Technology Industries Association (JEITA), the Production by the global electronics and IT industries is expected to grow 11% year on year in 2021 to reach USD 3,360.2 billion, with 2022 production too lifting 5% to USD 3,536.6 billion.

- The production of cellular phones, portable computing devices, gaming systems, and other personal electronic devices will continue to spark the demand for electronic components, which is expected to boost the demand for metal matrix composites.

- Owing to all the factors mentioned above, the demand for electrical and electronic equipment is likely to increase the demand in the market studied during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific accounts for more than 70% of global electronics production, with countries like South Korea, Japan, and China involved in manufacturing various electrical components and supplies to various industries globally.

- The Asia-Pacific region recorded 32.67 million of total automotive production in the nine months of 2021, an increase of 11% from the same period in 2020.

- Overall, the consistent growth in demand in countries like China, India, Japan, and South Korea is likely to boost the metal matrix composites market in the region.

- Industrial production in China increased by 4.3% year-on-year in December 2021. Thus, the expansion of the industrial sector in the country is anticipated to benefit the growth of the metal matrix composites market during the forecast period.

- According to China's data from the Ministry of Industry and Information Technology, the electronic information manufacturing sector maintained steady growth in the first five months of 2022. The value-added output of electronic information manufacturers with annual operating revenue of at least CNY 20 million (about USD 3 million) expanded 9.9 percent year-on-year during the period.

- The government launched the PLI scheme, which is likely to offer incentives as manufacturers increase production in India with USD 5.5 billion available over five years. This is likely to boost the production of electronics in the country, thus benefiting the demand for metal matrix composites.

- In the aerospace sector, according to the India Brand Equity Foundation (IBEF), the country's aviation industry is expected to witness INR 35,000 crore (USD 4.99 billion) investment in the next four years.

- Moreover, in the first four months of 2022, the production by the Japanese electronics industry accounted for JPY 3,656.44 billion (USD 32.60 billion), registering a growth rate of around 0.2% compared to the same period in 2021.

- The factors mentioned above are likely to ascend the demand for metal matric composites across the application industries in Asia-Pacific.

Metal Matrix Composites Industry Overview

The global metal matrix composites market is partially fragmented in nature, with the presence of a large number of global and local players in the industry. The major players in the market include GKN Sinter Metals Engineering GmbH, Materion Corporation, 3M, Sumitomo Electric Industries Ltd, and CPS Technologies Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Lightweight Materials in Aerospace and Defense Industry

- 4.1.2 Superior Properties of Metal Matrix Composites over Metals

- 4.2 Restraints

- 4.2.1 Compilicated Manufacturing Process

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Technological Snapshot

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Nickel

- 5.1.2 Aluminium

- 5.1.3 Refractory

- 5.1.4 Other Types

- 5.2 Fillers

- 5.2.1 Silicon Carbide

- 5.2.2 Aluminum Oxide

- 5.2.3 Titanium Carbide

- 5.2.4 Other Fillers

- 5.3 End-user Industry

- 5.3.1 Automotive and Locomotive

- 5.3.2 Electrical and Electronics

- 5.3.3 Aerospace and Defense

- 5.3.4 Industrial

- 5.3.5 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Spain

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3A Composites

- 6.4.2 3M (Ceradyne Inc.)

- 6.4.3 ADMA Products Inc.

- 6.4.4 CPS Technologies Corp.

- 6.4.5 DAT Alloytech

- 6.4.6 Denka Company Limited

- 6.4.7 GKN Sinter Metals Engineering GmbH

- 6.4.8 Hitachi Metals Ltd

- 6.4.9 Materion Corporation

- 6.4.10 MTC Powder Solutions AB

- 6.4.11 Plansee Group

- 6.4.12 Sumitomo Electric Industries Ltd

- 6.4.13 Thermal Transfer Composites LLC

- 6.4.14 TISICS Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Use in Locomotive Industry

- 7.2 Increasing Adoption of Electric Vehicles