|

시장보고서

상품코드

1687348

반사 방지 코팅 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Anti-Reflective Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

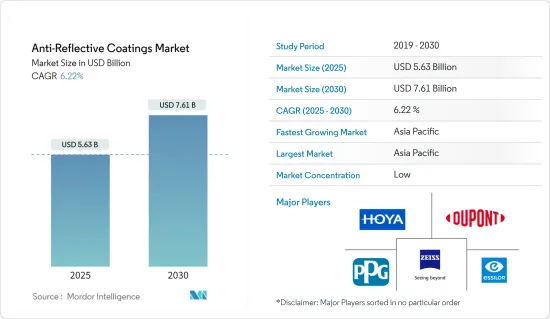

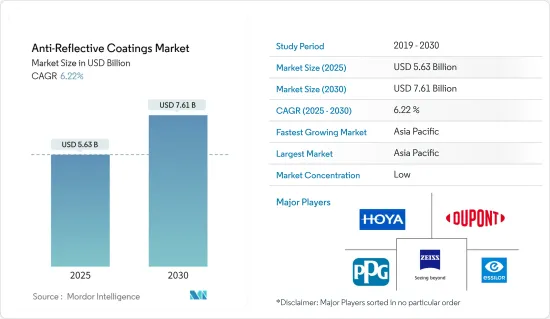

반사 방지 코팅 시장 규모는 2025년에 56억 3,000만 달러로 추정되며, 예측 기간(2025-2030년)의 CAGR은 6.22%로, 2030년에는 76억 1,000만 달러에 달할 것으로 예측됩니다.

각국이 특정 규칙과 규제를 부과함에 따라 COVID-19 유행 기간 중 다양한 분야 수요가 둔화되었습니다. 그러나 2021년에는 산업이 회복되고 시장 수요가 회복되었습니다.

주요 하이라이트

- 단기적으로는 안경용 수요 증가와 태양광 산업 수요 증가가 시장 성장을 촉진할 것으로 예측됩니다.

- 또한 반사 방지 코팅의 높은 비용과 엄격한 환경 규제가 시장 성장의 걸림돌이 될 것으로 예측됩니다.

- 그러나 박막 제조 기술의 발전은 시장에 유리한 성장 기회를 가져다 줄 것으로 보입니다.

- 아시아태평양은 반사 방지 코팅 시장을 장악하고 예측 기간 중 가장 빠르게 성장하는 시장이 될 것으로 예측됩니다.

반사 방지 코팅 시장 동향

안경 용도 수요 증가

- 반사 방지 안경은 컴퓨터 화면, TV, 평면 패널 등 다양한 전자 디스플레이의 눈부심을 줄일 수 있는 저렴한 솔루션을 제공합니다.

- 이 코팅은 눈부심을 줄이고, 디스플레이의 가독성을 높이고, 눈의 피로를 줄이고, 시각적 선명도를 향상시킵니다.

- 미국 보건복지부에 따르면 근시는 미국 40세 이상 인구의 약 23.9%(약 3,400만 명)가 앓고 있습니다.

- 세계보건기구(WHO)에 따르면 2023년 8월 현재 전 세계 약 22억 명이 근시 또는 원시 장애를 가지고 있습니다. 또한 시력 장애로 인한 생산성 손실로 인한 전 세계 비용은 4,110억 달러로 추산됩니다.

- Vision Council은 2023년 미국 안경 시장 규모가 656억 달러에 달할 것으로 예상하고 있으며, 그 중요성을 더욱 강조하고 있습니다. 미국에는 약 44,850개의 안경 매장이 있으며, 미국 성인의 93%가 안경을 착용하고 있습니다.

- 따라서 이러한 장애물에 대응하면서 각각의 아이렌즈에 대한 수요가 증가하여, 국내 반사 방지 코팅에 대한 수요가 더욱 증가할 것으로 예측됩니다.

중국이 아시아태평양을 지배할 것으로 예상

- 아시아태평양은 반도체, 전자기기, 태양전지판 및 기타 제조 업무에 대한 수요 증가로 인해 세계 시장을 독점하고 있습니다. 중국의 태양광 산업은 호황을 누리고 있지만, 과잉 생산 능력과 무역 마찰이 심화되고 있습니다. 유럽과 미국 국가들은 공급과잉을 우려해 중국에 수출을 제한하도록 압력을 가하고 있습니다. 국가에너지국(NEA)의 데이터에 따르면 2023년 중국은 다른 어떤 국가보다 더 많은 태양전지판을 설치했습니다. 이 실적은 이미 세계 재생에너지 상황에서 이미 선도적 인 지위를 확립 한 중국을 더욱 강화합니다. 놀랍게도 중국은 2023년에 216.9기가와트의 태양광발전을 추가하여 2022년에 기록한 87.4기가와트를 넘어섰습니다.

- 또한 2024년 1분기 현재 중국은 태양전지판 설치 모멘텀을 유지하고 있지만 2023년 154% 급증한 것에 비해 둔화되고 있으며, 2024년 3월 중국의 태양광발전 누적 용량은 660기가와트에 달하고, NEA가 보고한 2023년 말까지 미국 179 기가 와트와는 대조적입니다.

- 중국은 스마트폰, TV, 전선, 케이블, 휴대용 컴퓨팅 장비, 게임 시스템, 기타 개인용 전자기기 등의 전자기기 제품을 포함하여 세계 최대 전자기기 생산기지를 보유하고 있으며, 전자기기 분야에서 가장 높은 성장률을 기록했습니다. 중국은 전자제품의 국내 수요를 충족시키는 동시에 전자제품을 기타 국가에 수출하고 있습니다.

- 2023년 중국 반도체 산업은 강력한 성장세를 보이며 집적회로(IC) 총 생산량은 3,514억 개로 전년 대비 6.9% 증가했다(산업정보화부 발표).

- 또한 반도체 산업 협회는 반도체 제조 분야에서 중국의 비약적인 발전을 강조하고 있습니다. 예측에 따르면 2024년 중국의 세계 반도체 생산능력 점유율은 13% 급증하여 월 860만 장의 웨이퍼를 생산할 수 있을 것으로 보입니다.

- 이러한 요인들로 인해 중국은 아시아태평양 시장에서 우위를 유지할 수 있는 태세를 갖추고 있습니다.

반사방지 코팅 산업 개요

반사 방지 코팅 시장은 DuPont, PPG Industries Inc., Hoya Vision Care Company, Zeiss International, Essilor(무순서) 등의 주요 기업에 의해 단편화되고 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 개요

제4장 시장 역학

- 촉진요인

- 안경 용도로부터의 수요 증가

- 태양에너지 발전 산업으로부터의 수요 증가

- 기타

- 억제요인

- 반사 방지 코팅의 고비용

- 엄격한 환경 규제

- 기타

- 업계 밸류체인 분석

- Porter's Five Forces 분석

- 공급 기업의 교섭력

- 소비자의 교섭력

- 신규 진출업체의 위협

- 대체품의 위협

- 경쟁의 정도

제5장 시장 세분화

- 증착 방법별

- 화학 증착법

- 전자빔 증착법

- 스퍼터링법

- 기타

- 용도별

- 반도체

- 전자 디바이스

- 안경

- 태양전지판

- 자동차용 디스플레이

- 기타

- 지역별

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 말레이시아

- 태국

- 인도네시아

- 베트남

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 북유럽 국가

- 튀르키예

- 러시아

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 콜롬비아

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 카타르

- 아랍에미리트

- 나이지리아

- 이집트

- 남아프리카공화국

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- M&A, 합병사업, 제휴, 협정

- 시장 점유율(%)**/순위 분석

- 주요 기업의 전략

- 기업 개요(개요, 재무, 제품·서비스, 최근 동향)

- AccuCoat Inc.

- AGC Inc.

- Beneq

- DuPont

- Edmund Optics Inc.

- EKSMA Optics UAB

- ESSILOR OF AMERICA INC.

- Honeywell International Inc.

- HOYA

- Majestic Optical Coatings LLC

- Optical Coatings Japan

- Optics Balzers AG

- Optimum RX Group

- PPG Industries Inc.

- Spectrum Direct

- Torr Scientific Ltd

- ZEISS

- Zygo

제7장 시장 기회와 향후 동향

- 박막 제조 기술의 개발

- 기타 기회

The Anti-Reflective Coatings Market size is estimated at USD 5.63 billion in 2025, and is expected to reach USD 7.61 billion by 2030, at a CAGR of 6.22% during the forecast period (2025-2030).

Due to specific rules and regulations imposed by countries, the demand in various sectors slowed during the COVID-19 pandemic. However, the industry recovered in 2021, rebounding the demand in the market.

Key Highlights

- Over the short term, the increasing demand for eyewear applications and rising demand from the solar power generation industry are expected to boost the market's growth.

- Additionally, the high cost of anti-reflective coatings and stringent environmental regulations are expected to hinder the market's growth.

- However, developing thin-film fabrication technologies will likely create lucrative growth opportunities in the market.

- Asia-Pacific is expected to dominate the anti-reflective coatings market and be the fastest-growing market during the forecast period.

Anti-Reflective Coatings Market Trends

The Demand for Eyewear Applications is Increasing

- Anti-reflective glasses offer an affordable solution to glare from various electronic displays, including computer screens, televisions, and flat panels.

- These coatings reduce glare, enhance display readability, lessen eye strain, and improve visual clarity.

- According to the US Department of Health & Human Services, nearsightedness affects about 23.9% of the United States's population over 40 (about 34 million people).

- According to the World Health Organization (WHO), as of August 2023, around 2.2 billion people worldwide had near or distant vision impairment. Moreover, the global costs of productivity losses associated with vision impairment are estimated to be USD 411 billion.

- The Vision Council highlights that the United States optical market was valued at USD 65.6 billion in 2023, further underlining its significance. The country boasts approximately 44,850 brick-and-mortar optical retail outlets, with a striking 93% of US adults regularly sporting some form of eyewear.

- This is expected to enhance the demand for respective eye lenses while addressing these impairments, further enhancing the demand for anti-reflective coatings in the country.

China is Expected to Dominate the Asia-Pacific Region

- Asia-Pacific has dominated the global market due to the increasing demand for semiconductors, electronics, solar panels, and other manufacturing operations. While China's solar industry is experiencing a boom, it grapples with overcapacity and escalating trade tensions. Western nations are pressuring Beijing to limit exports, fearing a potential oversupply. According to data from the National Energy Administration (NEA), in 2023, China installed more solar panels than any other nation. This achievement bolstered its already leading position in the global renewable energy landscape. In a remarkable display, China added 216.9 gigawatts of solar power in 2023, surpassing its 2022 record of 87.4 gigawatts.

- Also, as of the first quarter of 2024, China maintained its momentum in solar panel installations, albeit slower than the 154% surge seen in 2023. In March 2024, China's cumulative solar capacity reached 660 gigawatts, a stark contrast to the United States' 179 gigawatts by the end of 2023, as reported by the NEA.

- China has the world's largest electronics production base, which includes electronic products, such as smartphones, TVs, wires, cables, portable computing devices, gaming systems, and other personal electronic devices, and recorded the highest growth in the electronics segment. The country serves the domestic demand for electronics and exports electronic output to other countries.

- In 2023, China's semiconductor industry witnessed robust growth, with the total output of integrated circuits (ICs) reaching 351.4 billion pieces, marking a 6.9% increase from the previous year, as per the Ministry of Industry and Information Technology.

- Additionally, the Semiconductor Industry Association highlights China's strides in semiconductor manufacturing. Projections suggest that China's global semiconductor capacity share could surge by 13% in 2024, reaching 8.6 million monthly wafers.

- Thus, due to the above-mentioned factors, China is poised to maintain its dominance in the Asia-Pacific market.

Anti-Reflective Coatings Industry Overview

The anti-reflective coatings market is fragmented due to major players, including DuPont, PPG Industries Inc., Hoya Vision Care Company, Zeiss International, and Essilor (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Eyewear Applications

- 4.1.2 Rising Demand from the Solar Power Generation Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Cost of Anti-reflective Coatings

- 4.2.2 Stringent Environmental Regulations

- 4.2.3 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Deposition Method

- 5.1.1 Chemical Vapor Deposition

- 5.1.2 Electronic Beam Deposition

- 5.1.3 Sputtering

- 5.1.4 Other Deposition Methods

- 5.2 By Application

- 5.2.1 Semiconductors

- 5.2.2 Electronic Devices

- 5.2.3 Eyewear

- 5.2.4 Solar Panels

- 5.2.5 Automotive Displays

- 5.2.6 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles (Overview, Financials, Products and Services, and Recent Developments)

- 6.4.1 AccuCoat Inc.

- 6.4.2 AGC Inc.

- 6.4.3 Beneq

- 6.4.4 DuPont

- 6.4.5 Edmund Optics Inc.

- 6.4.6 EKSMA Optics UAB

- 6.4.7 ESSILOR OF AMERICA INC.

- 6.4.8 Honeywell International Inc.

- 6.4.9 HOYA

- 6.4.10 Majestic Optical Coatings LLC

- 6.4.11 Optical Coatings Japan

- 6.4.12 Optics Balzers AG

- 6.4.13 Optimum RX Group

- 6.4.14 PPG Industries Inc.

- 6.4.15 Spectrum Direct

- 6.4.16 Torr Scientific Ltd

- 6.4.17 ZEISS

- 6.4.18 Zygo

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Thin Film Fabrication Technologies

- 7.2 Other Opportunities