|

시장보고서

상품코드

1851618

아세안의 상용차 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)ASEAN Commercial Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

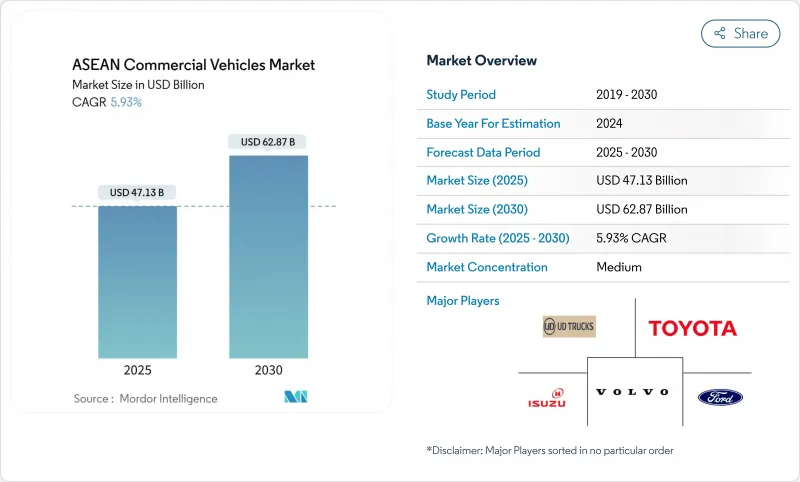

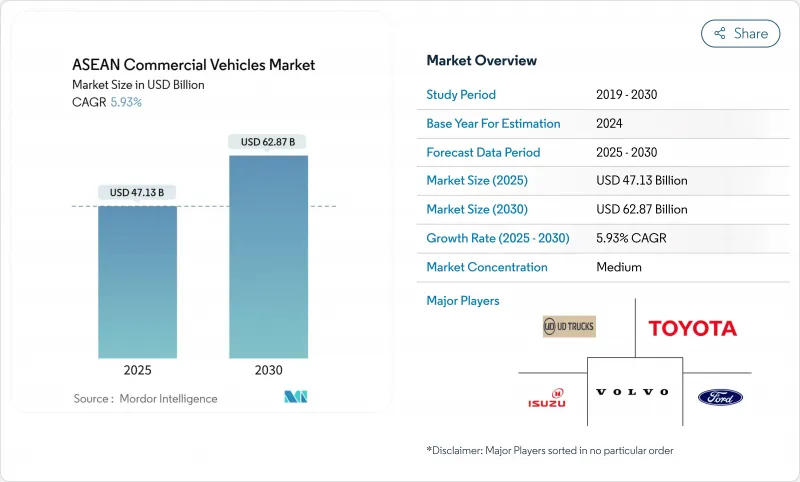

아세안 상용차 시장의 2025년 시장 규모는 471억 3,000만 달러로, CAGR 5.93%를 나타내 2030년에는 628억 7,000만 달러에 달할 것으로 예상되고 있습니다.

급증하는 인프라 투자, 국경을 넘어 무역의 급속한 디지털화, 가속하는 차량의 전동화에 의해 이 지역은 생산과 소비의 매우 중요한 허브로 자리매김하고 있습니다. 지역 세관의 조화는 국경 통과 시간을 단축하고 전자상거래 플랫폼은 마지막 원 마일의 유통 패턴을 재구성하여 민첩한 소형 모델 수요를 높입니다. 동시에 회원국은 유로 VI에 따른 배기가스 규제를 강화하여 파워트레인 업그레이드를 가속시킵니다. 중국의 OEM은 현지화를 심화시켜, 비용 우위성과 무관세의 아세안 역내 무역을 활용해, 오랜 세월에 걸쳐 정착해 온 일본 브랜드의 우위성을 침식합니다.

아세안의 상용차 시장 동향과 인사이트

전자상거래 붐과 마지막 마일 물류

온라인 소매의 폭발적인 성장은 선적 프로파일을 검토했고, 차량 사업자는 붐비는 도시 중심부를 빠져나가는 소형 밴, 픽업, 이륜차 화물 운송 차량을 선호하게 되었습니다. 쿨리에 네트워크는 2024년 태국 전역에서 서비스 거점을 두배로 늘리고 완성 창구를 좁히는 사업자의 긴급성을 강조했습니다. 모듈식 화물칸을 갖춘 전용 전기 소형 트럭은 특히 디젤 차량에 대한 접근 규제가 있는 곳에서 인기를 끌고 있습니다. 라이드 헤일링 플랫폼과 현지 조립업체와의 제휴로 아이들링 시간을 단축하고 자산 수명을 연장하는 1,000달러 이하의 배터리 교체 가능한 오토바이가 탄생하고 있습니다. 또한 소셜 커머스 플랫폼이 신선 식품의 처리 능력을 높이면서 수요는 온도 관리형 마이크로 딜리버리 장치에 기울어지고 있습니다. 이러한 변화를 종합하면 경상 플랫폼의 조달이 확대되고 멀티 드롭 라우팅을 최적화 할 수있는 텔레매틱스 공급업체에게 비즈니스 기회가 생깁니다.

인프라 메가 프로젝트 파이프라인

태국, 인도네시아, 말레이시아, 베트남에서는 2035년까지 43조 달러를 넘는 도로 및 교량 투자가 예정되어 있으며, 이는 아시아태평양의 운송 할당량의 63%에 해당합니다. 고속도로 업그레이드 및 채석장 확장으로 티퍼 트럭, 콘크리트 믹서 및 대형 채굴 운반 차량의 즉시 주문이 증가합니다. 렘차방과 클랜 주변에 탄생한 항만 중심의 물류 회랑도 컨테이너 트랙터를 뒷받침하고 있습니다. 프로젝트 승인이 안정적인 기준선을 형성하는 한편, 토지 취득 및 재정 제약에 얽힌 지연은 분기별 수요 변동을 가져오고 OEM은 모듈형 차체 프로그램과 유연한 변화 패턴을 추구해야 합니다. 차량 소유자가 구매 비용보다 가동 시간을 선호하기 때문에 드라이브 트레인 내구성 솔루션 및 현장 유지 보수 서비스 공급업체가 이익을 얻습니다.

유로 6 상당 기준의 엄격화

태국은 2024년 1월에 유로 5 디젤 사양을 시행했고, 늦어도 2030년까지는 유로 6에 적합하다고 밝혔습니다. 환경면에서의 이점은 분명하지만, 개량에 의해 엔진과 배기의 후처리 비용이 15-20% 상승해, 소량 생산 조립업자의 이폭이 압박됩니다. 회원국 간 디젤 연료의 황 함량에 격차가 있기 때문에 적응 작업이 복잡해지고 호모로게이션 사이클이 길어집니다. 선택적 촉매 환원(SCR) 포트폴리오가 있는 OEM은 판매량을 늘리지만 중소기업은 설비투자 수요가 밸런스시트의 능력을 상회하기 때문에 철수의 위험이 있습니다.

부문 분석

2024년 아세안의 상용차 시장 점유율은 소형 상용차가 56.25%를 차지하고 택배 기세와 대형 디젤차에 대한 지자체의 규제가 뒷받침되었습니다. 2030년까지 이 부문의 수익은 연간 6.78%로 증가하여 더 넓은 시장 세분화를 초과할 것으로 예측됩니다. 중국의 챌린저가 기존 제품보다 20% 미만인 배터리 전기 픽업을 투입하는 한편, 일본의 기존 기업은 마일드 하이브리드 업그레이드로 대항합니다. 방콕과 호치민을 중심으로 도시 지역의 혼재 센터가 급증하고 공장 출하시 선반과 텔레매틱스 밴드를 장비 한 패널 밴 수요를 환기하고 있습니다.

중형 트럭은 건설 물류 및 폐기물 처리의 틈새 시장에 대응하며 정체를 피하기 위해 개선된 토크 곡선과 자동 변속기에 의존합니다. 대형 트랙터는 여전히 아세안 지역 내 화물 운송에 필수적이지만, 본토 루트에서 철도 파이프라인이 보급됨에 따라 성장은 완만해집니다. 그 결과, 경량 복합재나 공력 특성의 강화를 모색하는 섀시 제조업체는 자본에 대한 신속한 리턴을 요구하는 연비 중시의 플리트에 있어서 경쟁 우위성을 확보하게 됩니다.

내연 엔진은 2024년 아세안 상용차 시장 규모의 94.26%를 차지했지만, 정책 인센티브에 의해 차량 경제가 기울어짐에 따라 그 점유율은 떨어졌습니다. 저수준에서 출발한 배터리 전기 모델은 2030년까지의 CAGR이 10.23%에 달하고, 아세안 상용차 시장에서의 공헌이 두배로 될 것으로 예측됩니다. 태국의 EV3.5 계획은 물품세 면제를 허용하고 OEM 육양 비용을 줄여 모델 라인 추가를 가속화합니다. 인도네시아에서는 2030년까지 전기자동차를 60만대로 만드는 의욕적인 목표가 니켈의 풍부한 국내 배터리 공급과 연관된 공급업체 파이낸스 패키지를 자극하고 있습니다.

플러그인 하이브리드 자동차는 저탄소이면서 항속거리 연장이 가능한 솔루션에 유리한 관세우대조치가 적용되는 교량의 역할을 담당하고 있습니다. 연료전지의 프로토타입은 항만 당국과 공동 개발한 짧은 수소 회랑을 활용하여 주로 말레이시아와 싱가포르 사이의 국경을 넘은 수송 시험으로 표면화하고 있습니다. ICE를 고수하는 고객에게는 유로 VI 하드웨어와 합성 디젤과의 호환성이 판매 포인트가 됩니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 전자상거래 붐과 마지막 원마일 물류

- 인프라·메가 프로젝트의 파이프라인

- 아세안 역내 무역의 성장

- 중국 EV-CV OEM의 현지화

- 콜드체인 수요의 급증

- 탄소 크레디트와 그린 플릿 규제

- 시장 성장 억제요인

- 유로 6 상당 기준의 엄격화

- EV-CV 충전과 TCO 벽

- 세분화된 선진 파워트레인의 애프터 세일즈

- 차량 갱신을 위한 중소기업 신용 수축

- 가치/공급망 분석

- 규제 상황

- 기술 전망

- Porter's Five Forces

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 기업 간 경쟁 관계

제5장 시장 규모와 성장 예측

- 차량 유형별

- 소형 상용차

- 중형 상용차

- 대형 상용차

- 추진별

- 내연기관

- 배터리 전기자동차

- 플러그인 하이브리드 전기자동차

- 연료전지 전기자동차

- 최종 용도별

- 물류 및 전자상거래 배달

- 건설 및 광업

- 농림업

- 대중교통(버스 및 코치)

- 공공사업 및 지자체 서비스

- 차체 구성별(신규)

- 리지드 트랙 및 밴

- 트랙터 트레일러

- 버스 및 코치

- 덤프 트럭

- 냉장 트럭

- 국가별

- 인도네시아

- 태국

- 베트남

- 말레이시아

- 필리핀

- 싱가포르

- 기타 아세안 국가

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Isuzu Motors

- AB Volvo

- Toyota Motor Corporation

- Ford Motor Company

- UD Trucks

- Iveco Group

- Tata Motors

- BYD Auto

- Chery Commercial Vehicles

- Foton Motor

- Dongfeng Trucks

- MAN Truck & Bus

- Daimler Truck(Mitsubishi Fuso & Mercedes-Benz Trucks)

- Hyundai Motor Company

- Ashok Leyland

- Suzuki Motor

제7장 시장 기회와 향후 전망

KTH 25.11.24The ASEAN commercial vehicles market is valued at USD 47.13 billion in 2025 and is forecast to reach USD 62.87 billion by 2030, reflecting a 5.93% CAGR.

Surging infrastructure spending, the rapid digitalization of cross-border trade, and accelerating fleet electrification position the region as a pivotal production and consumption hub. Regional customs harmonization trims border-crossing times, while e-commerce platforms reconfigure last-mile distribution patterns and lift demand for agile light-duty models. Simultaneously, member states tighten emissions rules in line with Euro VI, prompting accelerated powertrain upgrades. Chinese OEMs deepen localization, leveraging cost advantages and tariff-free intra-ASEAN trade to erode the dominance of long-entrenched Japanese brands.

ASEAN Commercial Vehicles Market Trends and Insights

E-commerce Boom and Last-Mile Logistics

Explosive online retail growth has redrawn shipment profiles, pushing fleet operators to favour compact vans, pickups, and two-wheeler cargo carriers that can slip through congested urban cores. Courier networks doubled service points across Thailand during 2024, underscoring operators' urgency to narrow fulfilment windows. Purpose-built electric light trucks featuring modular cargo bays are gaining traction, especially where access restrictions penalise diesel vehicles. Partnerships between ride-hailing platforms and local assemblers have yielded sub-USD 1,000 battery-swappable motorbikes that cut idle time and extend asset life. Demand also tilts toward temperature-controlled micro-delivery units as social-commerce platforms heighten fresh-food throughput. Collectively, these shifts amplify procurement of light commercial platforms and open opportunities for telematics suppliers that can optimise multi-drop routing.

Infrastructure Mega-Projects Pipeline

Across Thailand, Indonesia, Malaysia, and Vietnam, more than USD 43 trillion in road and bridge spending is earmarked through 2035, equal to 63% of Asia-Pacific transport allocations. Highway upgrades and quarry expansions lift immediate orders for tipper trucks, concrete mixers, and heavy-duty mining haulers. Port-centric logistics corridors spawning around Laem Chabang and Klang also boost container tractors. While project approvals create a steady baseline, delays tied to land acquisition or fiscal constraints introduce quarterly demand swings that compel OEMs to pursue modular body programmes and flexible shift patterns. Suppliers of drivetrain durability solutions and on-site maintenance services benefit as fleet owners prioritise uptime over outright acquisition cost.

Stricter Euro VI-Equivalent Standards

Thailand enforced Euro 5 diesel specifications in January 2024 and signalled Euro VI compliance no later than 2030, moves mirrored by Cambodia and the Philippines. While environmental gains are clear, the upgrades inflate engine and exhaust-after-treatment costs by 15-20%, squeezing margins for low-volume assemblers. Disparities in diesel sulphur content across member states complicate calibration work, lengthening homologation cycles. OEMs with selective catalytic reduction portfolios stand to gain volume, but smaller players risk exit as capital-expenditure demands outstrip balance-sheet capacity.

Other drivers and restraints analyzed in the detailed report include:

- Intra-ASEAN Trade Growth

- Localization by Chinese EV-CV OEMs

- Cold-Chain Demand Surge

- EV-CV Charging & TCO Barrier

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Light commercial vehicles held 56.25% of ASEAN commercial vehicles market share in 2024, buoyed by parcel-delivery momentum and municipal restrictions on heavy diesels. Segment revenue is projected to compound at 6.78% annually through 2030, outpacing the broader ASEAN commercial vehicles market. Chinese challengers introduce battery-electric pickups that undercut traditional offerings by 20%, while Japanese incumbents counter with mild-hybrid upgrades. Urban consolidation centres proliferate around Bangkok and Ho Chi Minh City, catalysing demand for panel vans equipped with factory-fitted shelving and telematics bundles.

The medium-duty cohort serves construction logistics and waste-management niches, relying on improved torque curves and automated transmissions to navigate congestion. Heavy-duty tractors remain vital for intra-ASEAN freight corridors, yet their growth moderates as rail pipelines gain traction on mainland routes. Consequently, chassis makers exploring lightweight composites and aerodynamics enhancements secure competitive advantage in fuel-efficiency-obsessed fleets seeking quick returns on capital.

Internal-combustion engines represent 94.26% of the ASEAN commercial vehicles market size in 2024, but their share erodes as policy incentives tilt fleet economics. Battery-electric models, starting from a low base, are expected to post a 10.23% CAGR to 2030, doubling their contribution within the ASEAN commercial vehicles market. Thailand's EV3.5 scheme grants excise waivers that reduce OEM landed costs, accelerating model-line additions. Indonesia's aspirational target of 600,000 electric vehicles by 2030 stimulates vendor finance packages tied to nickel-rich domestic battery supply.

Plug-in hybrids occupy a bridging role where duty concessions favour low-carbon yet range-extending solutions. Fuel-cell prototypes surface mainly in cross-border haulage pilots between Malaysia and Singapore, leveraging short hydrogen corridors co-developed with port authorities. For ICE holdouts, Euro VI hardware and synthetic-diesel compatibility become selling points as customers weigh future resale value against near-term capital outlay.

The ASEAN Commercial Vehicles Market Report is Segmented by Vehicle Type (Light Commercial Vehicles, Medium-Duty Commercial Vehicles, and More), Propulsion (Internal Combustion Engine, Battery Electric Vehicle, and More), Application (Logistics and E-Commerce Delivery, and More), Body Configuration (Rigid Truck and Van, and More) and by Country. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Isuzu Motors

- AB Volvo

- Toyota Motor Corporation

- Ford Motor Company

- UD Trucks

- Iveco Group

- Tata Motors

- BYD Auto

- Chery Commercial Vehicles

- Foton Motor

- Dongfeng Trucks

- MAN Truck & Bus

- Daimler Truck (Mitsubishi Fuso & Mercedes-Benz Trucks)

- Hyundai Motor Company

- Ashok Leyland

- Suzuki Motor

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-Commerce Boom and Last-Mile Logistics

- 4.2.2 Infrastructure Mega-Projects Pipeline

- 4.2.3 Intra-ASEAN Trade Growth

- 4.2.4 Localization by Chinese EV-CV OEMs

- 4.2.5 Cold-Chain Demand Surge

- 4.2.6 Carbon-Credit and Green-Fleet Mandates

- 4.3 Market Restraints

- 4.3.1 Stricter Euro VI-Equivalent Standards

- 4.3.2 EV-CV Charging and TCO Barrier

- 4.3.3 Fragmented Advanced-Powertrain After-Sales

- 4.3.4 SME Credit Tightening for Fleet Renewal

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD), Volume (Units))

- 5.1 By Vehicle Type

- 5.1.1 Light Commercial Vehicles

- 5.1.2 Medium-Duty Commercial Vehicles

- 5.1.3 Heavy-Duty Commercial Vehicles

- 5.2 By Propulsion

- 5.2.1 Internal Combustion Engine

- 5.2.2 Battery Electric Vehicle

- 5.2.3 Plug-in Hybrid Electric Vehicle

- 5.2.4 Fuel Cell Electric Vehicle

- 5.3 By Application / End-Use

- 5.3.1 Logistics and E-commerce Delivery

- 5.3.2 Construction and Mining

- 5.3.3 Agriculture and Forestry

- 5.3.4 Public Transportation (Bus & Coach)

- 5.3.5 Utilities and Municipal Services

- 5.4 By Body Configuration (NEW)

- 5.4.1 Rigid Truck and Van

- 5.4.2 Tractor-Trailer

- 5.4.3 Bus and Coach

- 5.4.4 Tipper and Dump

- 5.4.5 Refrigerated

- 5.5 By Country

- 5.5.1 Indonesia

- 5.5.2 Thailand

- 5.5.3 Vietnam

- 5.5.4 Malaysia

- 5.5.5 Philippines

- 5.5.6 Singapore

- 5.5.7 Rest of the ASEAN Countries

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Isuzu Motors

- 6.4.2 AB Volvo

- 6.4.3 Toyota Motor Corporation

- 6.4.4 Ford Motor Company

- 6.4.5 UD Trucks

- 6.4.6 Iveco Group

- 6.4.7 Tata Motors

- 6.4.8 BYD Auto

- 6.4.9 Chery Commercial Vehicles

- 6.4.10 Foton Motor

- 6.4.11 Dongfeng Trucks

- 6.4.12 MAN Truck & Bus

- 6.4.13 Daimler Truck (Mitsubishi Fuso & Mercedes-Benz Trucks)

- 6.4.14 Hyundai Motor Company

- 6.4.15 Ashok Leyland

- 6.4.16 Suzuki Motor