|

시장보고서

상품코드

1910495

석고 보드 : 시장 점유율 분석, 업계 동향 및 통계, 성장 예측(2026-2031년)Gypsum Board - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

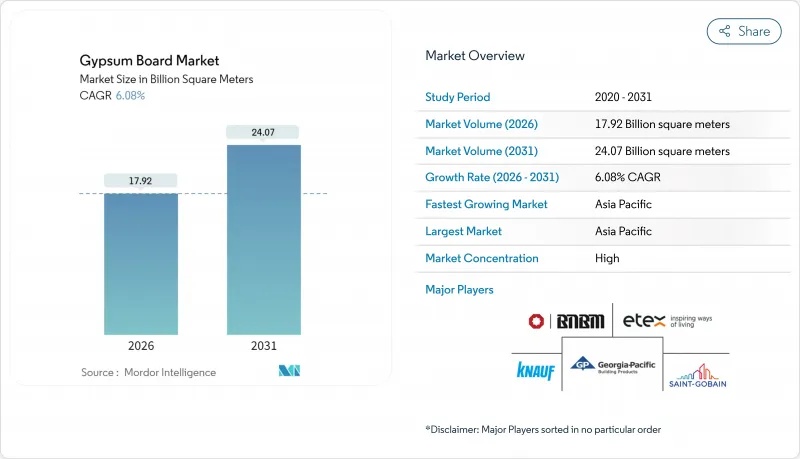

석고 보드 시장 규모는 2026년에는 179억 2,000만 평방미터에 달할 것으로 예측되고 있습니다.

2025년의 168억 9,000만 평방미터에서 성장하여 2031년에는 240억 7,000만 평방미터에 이를 전망으로, 2026년부터 2031년에 걸쳐 CAGR 6.08%를 나타낼 것으로 예상됩니다.

지속적인 방화 안전 기준과 에너지 절약 규제가 수요를 지지하는 한편, 아시아태평양의 건설 붐, 북미의 만성적인 주택 부족, 유럽에서의 매장 탄소 규제의 강화가 경쟁 환경을 형성하고 있습니다. 텍사스와 몬트리올의 생산 능력 확장 프로젝트는 제조업체가 비용 관리와 지속가능성에 대한 투자를 양립시키는 방법을 보여줍니다. 한편, 경량화 및 사전 장식 솔루션으로의 전환은 계약자들이 노동력 부족을 완화하는 데 도움이 되고, 석탄 화력 발전의 폐지가 예상 이상으로 빨라지는 가운데, 재생 원료와 합성 원료가 전략적으로 중요성을 늘리고 있습니다. 습윤지역에서의 섬유 시멘트 보드의 진출은 가격을 적정하게 유지하고 있지만, 광범위한 인프라 업데이트가 석고 보드 시장 전체의 수량 성장을 지지하고 있습니다.

세계의 석고 보드 시장 동향과 인사이트

아시아태평양의 주택 건설 급증

급속한 도시로의 인구 이동으로 개발자는 고밀도 주택을 추진하고 있으며, 석고 보드 시스템은 습식 좌관 공사에 비해 내부 마감 사이클의 단축에 기여하고 있습니다. 2024년 중국 시멘트 총 생산량이 10% 감소했음에도 불구하고 개발자가 현금흐름 확보를 위해 마무리 공사 가속화에 주력했기 때문에 벽판 수요는 견조하게 추이했습니다. 인도에서는 정부지원의 주택계획이 안정된 기반 수요를 낳고 있으며, 동남아시아에서는 학교나 교통거점에서 내화성이 입증된 석고가 대형 프로젝트로 지정되어 있습니다. 지역 전체의 노동력 부족으로 현장 작업을 줄일 수 있는 공장 마무리 보드 수요가 높아지고 있습니다.

성숙시장에서의 개수·리폼 수요의 가속

미국의 리노베이션 지출은 2025년 5,090억 달러에 이르렀으며, 2년간의 축소 경향을 반전시켰습니다. 미국 주택의 40%가 1970년 이전에 건설되었기 때문에 벽재 교체는 보다 엄격한 방화·단열 기준에의 적합을 수반해, 석고 수요를 직접 밀어 올리고 있습니다. 주택 소유자는 인테리어 리노베이션에 평균 4,700 달러를 지출하고 있으며, 곰팡이 방지 및 방습 보드가 구매 목록의 상위를 차지합니다. EU에서 유사한 개조 의무화는 단열성과 차음성을 결합한 고성능 패널의 주문을 촉진합니다. 이러한 동향에 의해 경기 감속기에도 석고 보드 시장의 안정된 수요 기반이 유지되고 있습니다.

변동하는 천연 석고와 에너지 가격

2024년 미국에서 채굴 석고의 생산량은 2,200만 톤에 달했지만, 채굴 심도나 운반 거리에 의해 단위 비용에 큰 편차가 생겼습니다. 소성 공정은 천연 가스에 크게 의존하기 때문에 연료 가격의 변동이 보드 가격에 영향을 미칩니다. 석탄화력발전소의 폐지에 따라 합성석고공급이 감소하는 가운데, 공장은 보다 먼 광상에 의존하지 않을 수 없고, 수송비 증가와 비용 리스크의 증대를 초래하고 있습니다. 에너지 절약형 킬른이나 지역 창고 허브가 영향을 일부 완화하는 것, 투입 비용의 변동성은 여전히 단기적으로는 석고 보드 시장의 성장 궤도를 억제하는 요인이 됩니다.

부문 분석

벽용 보드는 2025년 시점에서 석고 보드 시장 점유율의 59.62%를 유지했으며, 비용과 건축 기준 적합성이 사양 결정 요인이 되는 주택 내장 분야에서의 보편적인 수용에 지지되었습니다. 한편, 도장이 끝난 패널은 2031년까지 연평균 복합 성장률(CAGR) 7.39%를 나타낼 것으로 예측되고 있으며, 이는 석고 보드 시장 전체의 성장률을 1% 이상 웃도는 페이스입니다.

프리미엄 부문에서는 현재, PURPLE XP와 같은 방곰팡이·방습·내충격성을 강화한 보드가 주류입니다. 이들은 범용 유형 X보다 20-30% 비싸지만, 다운타임이 비용 증가로 이어지는 주방, 욕실, 의료시설의 복도 등에서 자주 채용되고 있습니다. 제조업체 각사는 이러한 특성을 공장 도장과 조합함으로써 고수익의 가치 획득을 도모하고 있습니다. 시공업자가 "도장 준비 완료"상태에서의 납품을 점점 요구하는 가운데, 프레데코레이티드보드는 석고 보드 시장 내에서 점유율 확대가 기대되고 있습니다.

석고 보드 보고서는 제품 유형(벽용 보드, 천장용 보드, 도장된 보드), 원재료(천연 석고, 합성(FGD) 석고, 재활용 석고), 용도(주택, 상업시설, 공공시설, 공업 시설), 지역(아시아태평양, 북미, 유럽, 남미, 중동 및 아프리카)별로 분류됩니다. 시장 예측은 수량(단위) 기준으로 제공됩니다.

지역별 분석

아시아태평양은 중국의 거대한 부동산 백로그와 인도의 "Housing for All" 프로그램을 통해 2025년 출하량의 46.10%를 차지했습니다. 2031년까지의 지역 성장률은 CAGR 7.31%로 예측되어 정치적·신용 리스크의 우려가 있음에도 불구하고, 석고 보드 시장은 수량 기준으로 이 지역에 중점을 둔 상태를 유지합니다.

북미는 리노베이션 수요에 의해 지원되는 안정성을 구현합니다. 유럽의 성장 경로는 규제 주도형이며, RE2020 등의 틀이 거시지표의 둔화에도 불구하고 탄소 최적화 설계에 대한 수요를 강화하고 있습니다. 이들 3개 지역이 경쟁 지도를 형성하는 반면 남미 및 중동 및 아프리카는 여전히 성장 기회가 있는 프론티어 지역이며 1인당 보급률이 낮기 때문에 미래의 석고 보드 시장 성장의 여지가 남아 있습니다.

제조체 각사는 환경 제품 선언(EPD)에 의한 차별화를 도모해, 입찰 요건을 만족시키기 위해 리사이클 소재를 배합하는 경우가 많습니다. 건설생산는 아시아태평양보다 늘어나고 있지만 ESG 중시의 프리미엄 가격설정이 단위 성장의 둔화를 상쇄하고 석고 보드 시장 내 수익 확대를 뒷받침하고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 애널리스트 지원(3개월간)

자주 묻는 질문

목차

제1장 서론

- 조사 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 아시아태평양의 주택 건설 급증

- 성숙시장에서의 개수·리모델링 수요의 가속

- 가볍고 고강도의 건식 벽면 솔루션으로의 전환

- 방화·차음·에너지 절약 건축에 대한 정부의 우대 조치

- 코스트 우위성이 있는 합성(FGD) 석고공급 상황

- 시장 성장 억제요인

- 천연 석고 및 에너지 가격의 변동성

- 섬유 시멘트 및 기타 대체 패널의 보급 확대

- 탄소 중립 의무화에 의한 매장 탄소량의 감시 강화

- 밸류체인 분석

- Porter's Five Forces

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 규모와 성장 예측

- 제품 유형별

- 벽 보드

- 천장 보드

- 사전 장식 보드

- 원재료별

- 천연 석고

- 합성(FGD) 석고

- 재생 석고

- 용도별

- 주택

- 상업

- 기관

- 산업

- 지역별

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 태국

- 말레이시아

- 인도네시아

- 베트남

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 튀르키예

- 북유럽 국가

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 콜롬비아

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 나이지리아

- 이집트

- 카타르

- 남아프리카

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- BNBM

- Etex Group

- Everest Industries Limited

- Georgia-Pacific Gypsum LLC

- Global Gypsum Board Co LLC(Gypcore)

- Holcim

- Jason New Materials

- Knauf Group

- National Gypsum Services Company

- Osman Group

- PABCO Gypsum

- Saint-Gobain

- Shandong Taihe Dongxin Co.,Ltd

- VANS Gypsum

- Volma

- Winstone Wallboards Limited

- YOSHINO GYPSUM CO.,LTD.

제7장 시장 기회와 향후 전망

KTH 26.01.22Gypsum Board Market size in 2026 is estimated at 17.92 Billion square meters, growing from 2025 value of 16.89 Billion square meters with 2031 projections showing 24.07 Billion square meters, growing at 6.08% CAGR over 2026-2031.

Ongoing fire-safety and energy-efficiency mandates anchor demand, while Asia-Pacific's construction boom, chronic housing shortages in North America, and tightening embodied-carbon rules in Europe shape the competitive field. Capacity expansion projects in Texas and Montreal illustrate how producers balance cost discipline with sustainability investments. Meanwhile, the shift toward lightweight and pre-decorated solutions helps contractors mitigate labor shortages, and recycled or synthetic feedstocks gain strategic importance as coal-powered electricity retires faster than expected. Fiber-cement's encroachment in wet areas keeps pricing rational, yet broad infrastructure renewal programs continue to backstop volume growth across the gypsum board market.

Global Gypsum Board Market Trends and Insights

Surging Residential Construction in APAC

Rapid urban migration pushes developers toward high-density housing, and gypsum board systems help shorten interior fit-out cycles compared with wet plaster. Although China's overall cement output fell 10% in 2024, wallboard volumes remained resilient because developers focused on accelerating finishing work to unlock cash flows. India's government-backed housing schemes add steady baseline demand, while Southeast Asian megaprojects specify gypsum for its proven fire resistance in schools and transit hubs. Labor shortages across the region strengthen the appeal of factory-finished boards that reduce on-site trades.

Accelerating Renovation and Remodeling Wave in Mature Markets

Renovation outlays in the United States climbed to USD 509 billion in 2025, reversing two years of contraction. Forty percent of U.S. dwellings pre-date 1970, so wall replacements align with tighter fire and insulation codes, directly lifting gypsum demand. Homeowners spent an average USD 4,700 on interior upgrades, with mold- and moisture-resistant boards ranking high on shopping lists. Similar retrofit mandates in the EU catalyze orders for high-performance panels that combine thermal and acoustic gains. These dynamics sustain a stable volume base for the gypsum board market during economic slowdowns.

Volatile Natural Gypsum and Energy Prices

Mined gypsum output touched 22 million tons in the United States during 2024, but unit costs varied widely by mine depth and haulage distance. Calcination relies heavily on natural gas, making board pricing sensitive to fuel swings. As decommissioning of coal plants removes synthetic supply, mills draw from deposits located farther afield, inflating freight bills and amplifying cost risk. Energy-efficient kilns and regional warehouse hubs partly soften the blow, yet input volatility still trims the gypsum board market growth trajectory in the near term.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward Lightweight and High-Strength Drywall Solutions

- Government Incentives for Fire, Sound, and Energy-Efficient Buildings

- Rising Penetration of Fibre-Cement and Other Panel Alternatives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Wall board retained 59.62% gypsum board market share in 2025, sustained by universal acceptance in residential interiors where cost and code compliance drive specification. Pre-decorated panels, however, are forecast to post 7.39% CAGR to 2031, a speed more than one percentage point above the overall gypsum board market.

Premium segments now favor mold-, moisture- or impact-modified boards such as PURPLE XP, priced at a 20-30% uplift over generic Type X, yet often selected for kitchens, baths, and healthcare corridors where downtime is costly. Manufacturers bundle these attributes with factory coatings to seize higher-margin value capture. As contractors increasingly pursue "paint-ready" delivery, pre-decorated formats are poised to widen their share within the gypsum board market.

The Gypsum Board Report is Segmented by Product Type (Wall Board, Ceiling Board, and Pre-Decorated Board), Raw Material (Natural Gypsum, Synthetic (FGD) Gypsum, and Recycled Gypsum), Application (Residential, Commercial, Institutional, and Industrial), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Units).

Geography Analysis

Asia-Pacific claimed 46.10% of 2025 shipments, thanks to China's massive real-estate backlog and India's Housing for All program. Regional growth at 7.31% CAGR through 2031 ensures the gypsum board market remains volume-weighted to this geography despite political and credit risk clouds.

North America embodies renovation-driven steadiness. Europe's pathway is more regulation-led, as RE2020 and similar frameworks reinforce demand for carbon-optimized designs despite slower macro indicators. Together, the three regions shape the competitive map, while South America, and Middle-East and Africa remain opportunity frontiers where lower per-capita penetration leaves headroom for future gypsum board market growth.

Manufacturers differentiate through environmental product declarations, often bundling recycled content to meet tender prerequisites. Although construction output is flatter than Asia-Pacific, premium ESG-minded pricing offsets slower unit growth, safeguarding revenue expansion inside the gypsum board market.

- BNBM

- Etex Group

- Everest Industries Limited

- Georgia-Pacific Gypsum LLC

- Global Gypsum Board Co LLC (Gypcore)

- Holcim

- Jason New Materials

- Knauf Group

- National Gypsum Services Company

- Osman Group

- PABCO Gypsum

- Saint-Gobain

- Shandong Taihe Dongxin Co.,Ltd

- VANS Gypsum

- Volma

- Winstone Wallboards Limited

- YOSHINO GYPSUM CO.,LTD.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Residential Construction in APAC

- 4.2.2 Accelerating Renovation and Remodeling Wave in Mature Markets

- 4.2.3 Shift Toward Lightweight and High-Strength Drywall Solutions

- 4.2.4 Government Incentives for Fire, Sound, and Energy-Efficient Buildings

- 4.2.5 Cost-Advantaged Synthetic (FGD) Gypsum Availability

- 4.3 Market Restraints

- 4.3.1 Volatile Natural Gypsum and Energy Prices

- 4.3.2 Rising Penetration of Fibre-Cement and Other Panel Alternatives

- 4.3.3 Carbon-Neutral Mandates Raising Embodied-Carbon Scrutiny

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Wall Board

- 5.1.2 Ceiling Board

- 5.1.3 Pre-decorated Board

- 5.2 By Raw Material

- 5.2.1 Natural Gypsum

- 5.2.2 Synthetic (FGD) Gypsum

- 5.2.3 Recycled Gypsum

- 5.3 By Application

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Institutional

- 5.3.4 Industrial

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Thailand

- 5.4.1.6 Malaysia

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 Turkey

- 5.4.3.8 Nordics

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Nigeria

- 5.4.5.4 Egypt

- 5.4.5.5 Qatar

- 5.4.5.6 South Africa

- 5.4.5.7 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)

- 6.4.1 BNBM

- 6.4.2 Etex Group

- 6.4.3 Everest Industries Limited

- 6.4.4 Georgia-Pacific Gypsum LLC

- 6.4.5 Global Gypsum Board Co LLC (Gypcore)

- 6.4.6 Holcim

- 6.4.7 Jason New Materials

- 6.4.8 Knauf Group

- 6.4.9 National Gypsum Services Company

- 6.4.10 Osman Group

- 6.4.11 PABCO Gypsum

- 6.4.12 Saint-Gobain

- 6.4.13 Shandong Taihe Dongxin Co.,Ltd

- 6.4.14 VANS Gypsum

- 6.4.15 Volma

- 6.4.16 Winstone Wallboards Limited

- 6.4.17 YOSHINO GYPSUM CO.,LTD.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment