|

시장보고서

상품코드

1687442

퍼플루오로알콕시알칸(PFA) 시장(2025-2030년) : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측Perfluoroalkoxy Alkane (PFA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

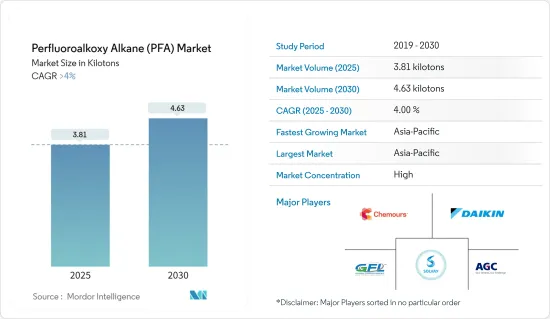

퍼플루오로알콕시알칸 시장 규모는 2025년 3.81킬로톤에서 2030년에는 4.63킬로톤에 이를 것으로 예측되며, 예측 기간(2025-2030년) 동안 CAGR는 4%를 초과할 것으로 예측됩니다.

COVID-19 팬데믹은 여행 제한으로 이어져 공급망 혼란을 유발했기 때문에 시장에 부정적인 영향을 미쳤으나 그 후 시장은 회복되었습니다. 그 이후 석유 및 가스, 화학처리, 반도체 산업의 꾸준한 성장이 시장을 견인하고 있습니다.

주요 하이라이트

- 주요 유체 수송 튜브 용도로 고순도 및 초고순도 PFA의 요구가 높아지고 있는 것이 시장 성장의 주된 촉진요인입니다. 또한 반도체 산업에서 PFA 수지의 사용 확대도 시장 성장을 높일 것으로 예상됩니다.

- 한편, PFA의 환경 및 건강 리스크는 시장의 성장을 둔화시킬 가능성이 높습니다.

- 리튬 이온 배터리에서 PFA의 사용 확대도 시장 성장을 밀어 올릴 수 있습니다.

- 화학처리, 석유 및 가스, 전기절연, 반도체 등의 산업에서의 수요가 높기 때문에 아시아태평양은 향후 수년간 PFA 시장을 리드할 가능성이 높습니다.

퍼플루오로알콕시알칸(PFA) 시장 동향

화학처리 용도가 시장을 독점할 전망

- 퍼플루오로알콕시알칸(PFA)은 고온, 기계적 충격, 열응력에 견디기 때문에 화학처리 산업에서 많이 사용되고 있습니다.

- PFA는 뛰어난 내약품성, 낮은 침투성, 높은 광투과성, 자외선이나 가시광선에 강한 특성, 매끄러운 표면, 낮은 표면에너지, 뛰어난 내후성, 높은 고온 열안정성, 뛰어난 발수성 및 방오성, 높은 순도, 뛰어난 전기 특성, 그리고 쉽게 타지 않으며 연기를 적게 발생시키는 특성으로 인해 부식 방지 라이닝 또는 코팅에 사용됩니다.

- 화학 처리 산업에서 PFA의 용도로는 Seal, O 링, 개스킷, 편조 패킹, 기계 씰, 밸브 시트, 밸브 스템 패킹, 라이닝 밸브, 피팅, 펌프, 현장 유리, 유량계, 라이닝 파이프, 딥 파이프, 컬럼, 탱크, 신축 조인트, 벨로우즈, 호스, 튜브, 컨볼루트 튜브, 필터, 라이닝과 트레이싱 등이 있습니다.

- 미국은 세계 최고의 화학제품 생산 국가입니다. 2022년 미국의 화학제품 생산지수는 95.5로 전년 대비 2.24% 증가했습니다.

- 경제분석국에 따르면 2022년 미국 화학제품산업의 부가가치는 약 5,013억 9,000만 달러로 전년 대비 12% 증가했습니다.

- 화학가공부문의 성장에 따라 세계 여러 대기업들이 사업을 전개하며 화학가공산업에 진입하고 있습니다. 예를 들어, 2022년 12월 Saudi Aramco는 프랑스 석유회사 TotalEnergies와 협력하여 사우디아라비아에 110억 달러를 투자하여 석유화학단지를 개발했습니다.

- 따라서 향후 몇 년 동안 화학처리 용도가 시장을 선도할 가능성이 높습니다.

아시아태평양이 시장을 독점할 전망

- 아시아태평양은 세계 화학 가공의 중심지로 성장해 왔습니다. 중국, 인도, 일본 등 국가의 화학 산업은 빠르게 성장하고 있습니다. 아시아는 세계 화학 시장에서 가장 큰 점유율을 차지합니다. 지난 10년간 이 지역은 세계 화학 시장의 절반 이상을 지속적으로 차지해 왔습니다.

- 중국은 가장 큰 화학 시장일 뿐만 아니라 가장 빠르게 성장하는 시장 중 하나입니다. VCI(Association of the Chemical Industry eV)에 따르면, 2022년 중국은 세계 3위의 화학제품 수출국이었으며 금액 기준으로 세계 화학제품 수출의 9.3%를 차지했습니다.

- 한편 인도는 세계 3위의 폴리머 소비국, 세계 4위의 농약 생산국, 세계 6위의 화학제품 생산국입니다. 화학제품 수요는 2025년까지 연률 9%의 확대가 전망되고 있습니다. IBEF에 따르면 화학산업은 2025년까지 인도 GDP에 3,000억 달러를 기여할 것으로 예상됩니다.

- 퍼플루오로알콕시알칸(PFA)은 부하가 변화하더라도 오래 지속되기 때문에 반도체에 사용됩니다. 또한 보다 우수한 전기적 특성과 응력 하에서의 내균열성으로 반도체 산업에 최적인 재료입니다. 인도전자반도체협회에 따르면 이 나라의 반도체 부품 사업은 2025년까지 323억 5,000만 달러를 달성할 전망입니다. 정부가 진행하고 있는 '메이크 인 인디아' 캠페인은 이 나라의 반도체 산업에 대한 투자로 이어질 가능성이 높습니다.

- 일본은 세계 반도체 제조 장비 및 재료 판매의 30% 이상을 차지하고 있습니다. 세미콘 재팬 2022는 2022년 12월에 도쿄 빅 사이트에서 되었으며 마이크로 일렉트로닉스 제조공급 체인에 관련된 국내외 기업이 한자리에 모여 최신 기술 혁신, 개발, 동향에 대한 견해를 제공했습니다. 일본에서는 반도체 제조에 대한 대처가 활발해지고 있으며, 이는 PFA 수요를 밀어 올리고 있습니다.

- PFA는 마찰 계수가 낮고 열과 화학제품에 강한 특성으로 석유 및 가스 업계의 씰, 개스킷, 미끄럼 베어링에 자주 사용되고 있습니다. 중국은 세계 2위의 석유 및 가스 소비국이면서 생산량은 6위입니다. 2023년 동국의 원유 생산량은 2억 800만톤에 이르렀으며 2022년 대비 1.6% 증가했습니다.

- 따라서 예측 기간 중에는 아시아태평양이 시장을 선도할 것으로 보입니다.

퍼플루오로알콕시알칸(PFA) 산업 개요

퍼플루오로알콕시알칸(PFA) 시장은 주요 기업에 의한 과점화가 진행되고 있으며, 상위 5-6사가 시장 점유율의 대부분을 차지하고 있습니다. 시장의 주요 기업으로는 The Chemours Company, Daikin Industries, Gujarat Fluorochemicals, Solvay, AGC Inc., 3M 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 반도체 산업에서 PFA 수지의 용도 확대

- 주요 유체 수송 튜브 용도에서 고순도 및 초고순도 PFA 수요 증가

- 억제요인

- PFA와 관련된 환경 및 건강 피해

- 기타 억제요인

- 업계 밸류체인 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

- 공급 개요

- 원재료 분석

제5장 시장 세분화

- 제품 유형

- 수성 분산액

- 펠렛/파우더

- 용도

- 석유 및 가스

- 화학처리산업

- 광섬유

- 반도체

- 조리기구와 베이킹 도구 코팅

- 전기 절연

- 기타 용도

- 지역

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 태국

- 베트남

- 말레이시아

- 인도네시아

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 북유럽 국가

- 러시아

- 터키

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 콜롬비아

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

- 이집트

- 카타르

- 나이지리아

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 시장 랭킹 분석

- 주요 기업의 전략

- 기업 프로파일

- 3M

- AGC Inc.

- Daikin Industries Ltd

- Gujarat Fluorochemicals

- Hubei Everflon Polymer Co. Ltd

- Li Chang Technology(Ganzhou) Co. Ltd

- RTP Company

- Solvay

- The Chemours Company

- Zeus Industrial Products Inc.

- Zibo Bainaisi Chemical Co. Ltd

제7장 시장 기회와 앞으로의 동향

- 리튬 이온 배터리에서 PFA의 사용 확대

The Perfluoroalkoxy Alkane Market size is estimated at 3.81 kilotons in 2025, and is expected to reach 4.63 kilotons by 2030, at a CAGR of greater than 4% during the forecast period (2025-2030).

The COVID-19 pandemic had a negative impact on the market because of the travel restrictions causing supply chain disruptions. However, the market has since recovered. Since then, steady growth in the oil and gas, chemical processing, and semiconductor industries has driven the market.

Key Highlights

- The growing need for high- and ultra-high-purity PFA in critical fluid transport tubing applications is one of the main drivers of market growth. The growing use of PFA resin in the semiconductor industry is also expected to increase market growth.

- On the other hand, the environmental and health risks of PFA are likely to slow the growth of the market.

- The growing use of PFA in lithium-ion batteries may also boost the growth of the market.

- Due to high demand from industries like chemical processing, oil and gas, electrical insulation, and semiconductors, Asia-Pacific is likely to lead the PFA market over the next few years.

Perfluoroalkoxy Alkane (PFA) Market Trends

Chemical Processing Applications are Expected to Dominate the Market

- Perfluoroalkoxy alkane, or PFA, is used a lot in the chemical processing industry because it can withstand high temperatures, mechanical shock, and thermal stress.

- PFA is used for corrosion protection liners and coatings because it has good chemical resistance and low permeation, good light transparency, good resistance to UV and visible light, smooth surface, low surface energy, good resistance to weathering, high temperature and thermal stability, water repellent and anti-staining, high purity, excellent electric properties, and does not burn and makes little smoke.

- Some of the applications of PFA in the chemical processing industry include seals, o-rings, gaskets, braided packing, mechanical seals, valve seats, valve stem packing, lined valves, fittings, pumps, sight glasses, flow meters, lined pipes, dip pipes, columns, tanks, expansion joints, bellows, hoses, tubing, convoluted tubing, filters, de-misters, strainers, column packing, heat exchanger tubing, and lining and tracing heating cables.

- The United States is one of the world's leading producers of chemical products. In 2022, the chemical production index in the country was 95.5, indicating a 2.24% growth over the previous year.

- According to the Bureau of Economic Analysis, the value added by the chemical products industry in the United States in 2022 was around USD 501.39 billion, a 12% rise over the previous year.

- With the rising chemical processing sector, several big firms throughout the world have begun to develop their operations or enter the chemical processing industry. For example, in December 2022, Saudi Aramco cooperated with TotalEnergies, a French oil company, to develop a petrochemical complex in Saudi Arabia for an anticipated USD 11 billion investment.

- Thus, it is likely that chemical processing applications will lead the market during the next few years.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific has grown to be the hub for chemical processing across the world. The chemical industry in countries such as China, India, and Japan has been growing rapidly. Asia holds the largest share of the global chemical market. Over the last decade, the region has continuously accounted for more than half of the global chemical market.

- China is not just the largest market for chemicals, but it is also one of the fastest expanding. According to the VCI (Association of the Chemical Industry e.V.), in 2022, China was the world's third-largest chemical exporting nation, with a share of 9.3% of global chemical exports based on value.

- India, on the other hand, is the third-largest consumer of polymers, the fourth-largest producer of agrochemicals, and the sixth-largest producer of chemicals in the world. The demand for chemicals is expected to expand by 9% per year by 2025. According to IBEF, the chemical industry is expected to contribute USD 300 billion to India's GDP by 2025.

- Perfluoroalkoxyalkane (PFA) is used in semiconductors because it lasts longer under changing loads. Also, its better electrical properties and resistance to cracking under stress make it a great choice for the semiconductor industry. According to the India Electronics and Semiconductor Association, the country's semiconductor component business will be valued at USD 32.35 billion by 2025. The government's ongoing "Make in India" campaign is likely to lead to investments in the country's semiconductor industry.

- Japan accounts for more than 30% of global semiconductor manufacturing equipment and material sales. SEMICON Japan 2022 brought together Japanese and international companies from across the microelectronics manufacturing supply chain in December 2022 at Tokyo Big Sight for insights into the latest technological innovations, developments, and trends. The growing efforts in the country to make more semiconductors are driving up the demand for PFA.

- PFA has a low coefficient of friction and is resistant to heat and chemicals. This makes it a popular choice for seals, gaskets, and slide bearings in the oil and gas industry. China is the world's second-largest consumer of oil and gas, yet it ranks just sixth in terms of production. The country's crude oil production rose to 208 million metric tons in 2023, marking a 1.6% increase compared to 2022.

- Thus, because of the above factors, it seems likely that Asia-Pacific will lead the market during the forecast period.

Perfluoroalkoxy Alkane (PFA) Industry Overview

The perfluoroalkoxy alkane (PFA) market is majorly consolidated in nature, with the top five or six players accounting for the majority of the share in the market. The major players in the market include The Chemours Company, Daikin Industries, Gujarat Fluorochemicals, Solvay, AGC Inc., and 3M, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Application of PFA Resin in the Semiconductor Industry

- 4.1.2 Increasing Demand for High- and Ultra High-purity PFA in Critical Fluid Transport Tubing Applications

- 4.2 Restraints

- 4.2.1 Environmental and Health Hazards Associated With PFA

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Supply Overview

- 4.6 Raw Material Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Aqueous Dispersion

- 5.1.2 Pellets/Powder

- 5.2 Application

- 5.2.1 Oil and Gas

- 5.2.2 Chemical Processing Industry

- 5.2.3 Fiber Optics

- 5.2.4 Semiconductor

- 5.2.5 Cookware and Bakeware Coatings

- 5.2.6 Electrical Insulation

- 5.2.7 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Thailand

- 5.3.1.6 Vietnam

- 5.3.1.7 Malaysia

- 5.3.1.8 Indonesia

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Nordic Countries

- 5.3.3.7 Russia

- 5.3.3.8 Turkey

- 5.3.3.9 Rest of the Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Egypt

- 5.3.5.5 Qatar

- 5.3.5.6 Nigeria

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 AGC Inc.

- 6.4.3 Daikin Industries Ltd

- 6.4.4 Gujarat Fluorochemicals

- 6.4.5 Hubei Everflon Polymer Co. Ltd

- 6.4.6 Li Chang Technology (Ganzhou) Co. Ltd

- 6.4.7 RTP Company

- 6.4.8 Solvay

- 6.4.9 The Chemours Company

- 6.4.10 Zeus Industrial Products Inc.

- 6.4.11 Zibo Bainaisi Chemical Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Use of PFA In Lithium-ion Batteries