|

시장보고서

상품코드

1687474

납축배터리 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Lead-acid Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

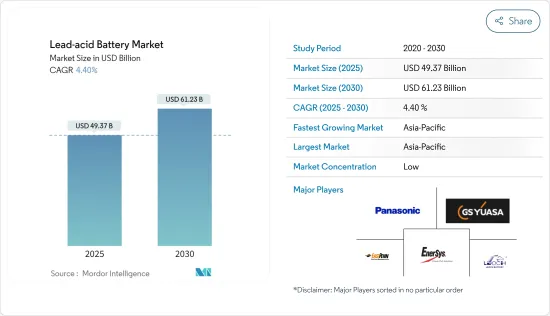

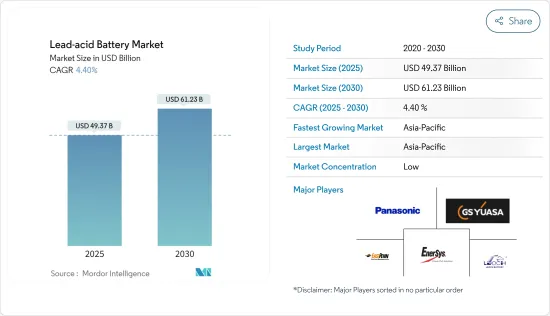

납축배터리 시장 규모는 2025년 493억 7,000만 달러로 추정되며, 예측 기간(2025-2030년) 동안 4.4%의 CAGR로 2030년에는 612억 3,000만 달러에 달할 것으로 예상됩니다.

2020년 COVID-19가 시장에 미친 부정적인 영향은 전염병이 유행하기 전 수준에 이르렀습니다.

주요 하이라이트

- 중기적으로는 자동차 판매 증가가 납축배터리 시장의 성장을 촉진할 것으로 예상됩니다.

- 반면, 비용 하락과 리튬이온 배터리 채택 증가는 예측 기간 동안 시장 성장을 저해하는 요인으로 작용할 것으로 예상됩니다.

- 납축배터리 시장은 AGM(Absorbed Glass Mat) 축전지 및 EFB(Enhanced Flooded Battery) 기술과 같은 몇 가지 기술 개발을 목격하고 있으며, 예측 기간 동안 시장에 큰 기회를 제공할 것으로 예상됩니다.

- 아시아태평양은 납축배터리 시장을 독점할 것으로 예상되며, 대부분의 수요는 중국, 일본, 인도에서 발생할 것으로 예상됩니다.

납축배터리 시장 동향

시장을 독점하는 SLI 배터리 부문

- SLI 배터리는 자동차 용으로 설계되어 항상 자동차 충전 시스템에 장착되어 있기 때문에 자동차를 사용하는 동안 항상 배터리가 충전과 방전을 반복합니다. 12V 배터리는 50 년 이상 동안 가장 일반적으로 사용되어 왔습니다. 그러나 그 평균 전압(차량 내에서 사용되며 교류 발전기로 충전되는 동안)은 14V에 가깝습니다.

- SLI 배터리는 2021년 75.32%의 시장 점유율을 차지했습니다. 자동차 부문의 세계 성장으로 인해 이 부문의 점유율은 예측 기간 동안 확대될 것으로 예상되며, OEM 및 애프터마켓의 수요 증가가 자동차 부문을 견인할 것으로 예상됩니다.

- SLI 배터리 시장 성장의 주요 요인은 고성능, 긴 수명, 비용 효율성을 보장하면서 시동 모터, 조명, 점화 시스템 및 기타 내연기관에 전력을 공급하는 배터리에 대한 수요가 증가하고 있기 때문입니다.

- 납축배터리는 전 세계 자동차 및 트럭과 같은 기존 내연기관 차량의 모든 SLI 배터리 애플리케이션에 선택되는 기술입니다.

- 국제자동차공업협회(OICA)에 따르면, 세계 자동차 판매량은 2020년 하락 후 회복세를 보이고 있으며, 2021년 세계 자동차 판매량은 2020년 대비 4.96% 증가하였습니다.

- 기존 내연기관 시장은 향후 30-40년 동안 축소될 것으로 예상되지만, 자동차의 대체 기술로 SLI형 납축배터리는 차량 내 다양한 전자기기와 안전 기능에 전력을 공급하기 위해 계속 사용될 것으로 예상됩니다.

아시아태평양이 시장을 장악

- 아시아태평양이 납축배터리 시장을 독점할 것으로 예상되며, 수요의 대부분은 중국, 일본, 인도에서 발생할 것으로 예상됩니다.

- 2021년 현재 중국은 가장 큰 전기자동차 시장으로 약 330만 대를 판매했습니다.

- 전기자동차의 채택이 증가하고 있는 것은 청정에너지 정책과 맞물려 있습니다. 중국 정부는 수요와 공급의 격차를 줄이기 위해 자동차 제조업체의 수입 규제를 완화할 계획입니다. 현재 외국계 자동차 제조업체는 25%의 수입 관세를 부과받거나 중국 내 공장을 건설해야 하며, 그 소유 비율은 50%로 제한되어 있습니다. 전기자동차 제조업체는 이 변화의 혜택을 가장 먼저 받을 것으로 예상됩니다.

- 또한 인도에서는 자동차 부문의 성장, 태양광발전 프로젝트의 증가, 통신 인프라의 지속적인 확장이 납축배터리 수요를 견인할 것으로 예상됩니다.

- 통신 부문은 인도에서 납축배터리 사용에 있어 가장 유망한 최종사용자 중 하나입니다. 인도의 통신 부문은 지난 10년간 강력한 성장세를 보이고 있습니다. 예를 들어, 인도 통신 규제 기관에 따르면 2022년 3월 무선 및 휴대 전화 가입자 수는 11억 4,208만 명에 달했습니다.

- 그러나 인도의 납축배터리 시장은 리튬이온 배터리 기술에 의해 도전에 직면하고 있으며, 납축배터리에 대한 연구개발 활동에 대한 관심이 높아지고 있습니다. 제조업체들은 리튬이온 배터리와의 경쟁을 유지하기 위해 유지보수가 적은 고품질의 장수명 배터리를 제공해야 할 필요성이 대두되고 있습니다.

납축배터리 산업 개요

납축배터리 시장은 세분화되어 있습니다. 이 시장의 주요 기업으로는 Panasonic Corporation, GS Yuasa Corporation, EnerSys, East Penn Manufacturing Co., Leoch International Technology Limited 등이 있습니다.

기타 특전:

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 범위

- 시장 정의

- 조사 가정

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 소개

- 2027년까지 시장 규모 및 수요 예측

- 최근 동향과 개발

- 정부 규제와 정책

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 공급망 분석

- Porter's Five Forces 분석

- 공급 기업의 교섭력

- 소비자의 협상력

- 신규 참여업체의 위협

- 대체품의 위협

- 경쟁 기업 간의 경쟁 관계

제5장 시장 세분화

- 용도별

- SLI(시동, 점등, 점화)용 배터리

- 고정형 배터리(통신, UPS, 에너지 저장 시스템(ESS) 등)

- 휴대용 배터리(가전제품 등)

- 기타 용도

- 기술별

- 침수형

- VRLA(밸브 제어 납축배터리)

- 지역별

- 북미

- 미국

- 캐나다

- 기타 북미

- 유럽

- 독일

- 프랑스

- 이탈리아

- 영국

- 러시아 연방

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트

- 남아프리카공화국

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- M&A, 합작투자, 제휴, 협정

- 주요 기업의 전략

- 기업 개요

- Johnson Controls International PLC

- Exide Technologies Inc.

- GS Yuasa Corporation

- EnerSys

- East Penn Manufacturing Co.

- C&D Technologies Inc.

- Amara Raja Batteries Ltd

- Leoch International Technology Limited

- Panasonic Corporation

제7장 시장 기회와 향후 동향

ksm 25.05.12The Lead-acid Battery Market size is estimated at USD 49.37 billion in 2025, and is expected to reach USD 61.23 billion by 2030, at a CAGR of 4.4% during the forecast period (2025-2030).

Though COVID-19 negatively impacted the market in 2020, it has reached pre-pandemic levels.

Key Highlights

- Over the medium term, the increasing sales of automobiles are expected to stimulate the growth of the lead-acid battery market.

- On the other hand, declining costs and increasing adoption of lithium-ion batteries are expected to hinder the growth of the market during the forecast period.

- The lead-acid battery market has witnessed several developments in technologies like AGM (Absorbed Glass Mat) batteries and EFB (Enhanced Flooded Battery) technology, which are expected to provide great opportunities for the market during the forecast period.

- Asia-Pacific is expected to dominate the lead-acid battery market, with most of the demand coming from China, Japan, and India.

Lead Acid Battery Market Trends

SLI Battery Segment to Dominate the Market

- SLI batteries are designed for automobiles and are always installed with the vehicle's charging system, which means there is a continuous cycle of charge and discharge in the battery whenever the vehicle is in use. The 12-volt batteries have been the most commonly used for over 50 years. However, their average voltage (while in use in the car and being charged by the alternator) is close to 14 volts.

- The SLI batteries segment held a 75.32% market share in 2021. Its share is expected to grow during the forecast period, owing to worldwide growth in the automotive sector. The growing demand from OEMs and aftermarkets has boosted the automotive sector.

- The major factors attributed to the growth of the SLI battery market are the increasing demand for these batteries to power start motors, lights, ignition systems, or other internal combustion engines while ensuring high performance, long life, and cost-efficiency.

- The lead-acid battery is the technology of choice for all SLI battery applications in conventional combustion engine vehicles, such as cars and trucks worldwide.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), motor vehicle sales globally have been recovering after a downfall in 2020. In 2021, the world witnessed a 4.96% rise in motor vehicle sales compared to 2020.

- Although the conventional combustion engine market is expected to decline over the next 30-40 years, replacement car technologies are expected to continue using SLI-type lead-acid batteries to provide power for various electronics and safety features within the vehicle.

Asia-Pacific to Dominate the Market

- The Asia-Pacific is expected to dominate the lead-acid battery market, with most demand coming from China, Japan, and India.

- As of 2021, China is the largest electric vehicle market, selling around 3.3 million vehicles.

- The increasing adoption of electric vehicles aligns with the clean energy policy. The Chinese government plans to ease restrictions on automakers importing cars into the country to reduce the demand-supply gap. Currently, foreign automakers face a 25% import tariff or have to build a factory in China with a cap of 50% ownership. Electric vehicle makers are expected to be the first to benefit from this change.

- Moreover, in India, the growing automobile sector, the increasing number of solar power projects, and the continuous expansion of telecommunication infrastructure are expected to drive the demand for lead-acid batteries in the country.

- The telecom sector remains one of India's most promising end users for lead-acid battery use. The Indian telecommunication sector has registered strong growth over the past decade. For instance, according to the Telecom Regulatory Authority of India, the total wireless or mobile telephone subscriber base reached 1142.08 million in March 2022.

- However, the lead-acid battery market in India faces challenges from lithium-ion battery technology, which has led to an increased focus on research and development activities pertaining to lead-acid batteries. Manufacturers are being forced to offer high-quality, long-lasting batteries with low maintenance to sustain the competition from lithium-ion batteries.

Lead Acid Battery Industry Overview

The lead-acid battery market is fragmented. Some of the key players in this market (in no particular order) include Panasonic Corporation, GS Yuasa Corporation, EnerSys, East Penn Manufacturing Co., and Leoch International Technology Limited, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 SLI (Starting, Lighting, Ignition) Batteries

- 5.1.2 Stationary Batteries (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- 5.1.3 Portable Batteries (Consumer Electronics, etc.)

- 5.1.4 Other Applications

- 5.2 By Technology

- 5.2.1 Flooded

- 5.2.2 VRLA (Valve Regulated Lead-acid)

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 Italy

- 5.3.2.4 United Kingdom

- 5.3.2.5 Russian Federation

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 United Arab Emirates

- 5.3.4.3 South Africa

- 5.3.4.4 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Johnson Controls International PLC

- 6.3.2 Exide Technologies Inc.

- 6.3.3 GS Yuasa Corporation

- 6.3.4 EnerSys

- 6.3.5 East Penn Manufacturing Co.

- 6.3.6 C&D Technologies Inc.

- 6.3.7 Amara Raja Batteries Ltd

- 6.3.8 Leoch International Technology Limited

- 6.3.9 Panasonic Corporation