|

시장보고서

상품코드

1850384

자동차 와이어 하네스 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Automotive Wiring Harness - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

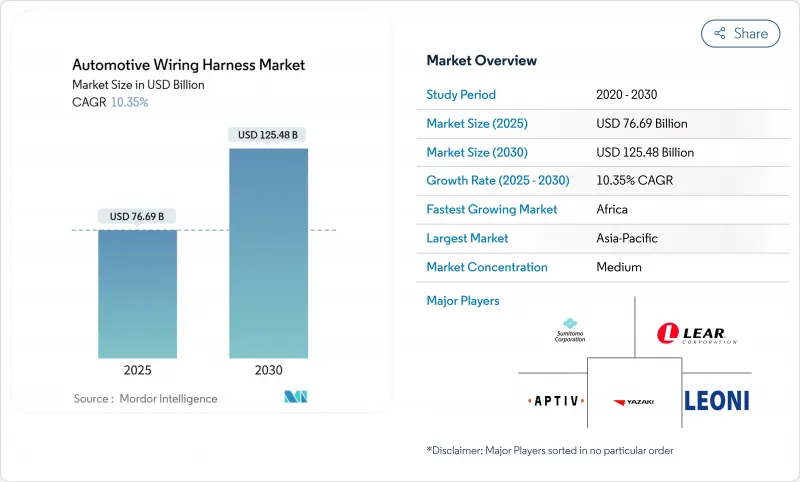

자동차 와이어 하네스 시장 규모는 2025년에 766억 9,000만 달러로 평가되었고 2030년에 1,254억 8,000만 달러에 이를 것으로 추정 및 예측되며, 예측기간(2025-2030년)의 CAGR은 10.35%를 나타낼 전망입니다.

이 시장은 자동차 1대당 전자 부품 증가에 힘입어 시장은 꾸준히 확장되고 있으나, 표면적인 성장세 뒤에는 상반된 두 흐름이 존재합니다. 배터리 전기차에 사용되는 고전압 하네스 수요는 두 자릿수 증가세를 보이는 반면, 기존 내연기관 차량용 저전압 로우즈는 가격 압박을 받고 있습니다. 지역별로는 아시아가 여전히 생산 및 소비 중심지이며, 아프리카는 유리한 노동 경제성과 현지 조달 규정 덕분에 신규 생산 능력을 유치하고 있습니다. 북미와 유럽의 성숙한 시장은 케이블 와이어 거리를 단축하면서도 잔여 와이어의 가치를 높이는 구역별 전기 아키텍처로 전환 중입니다.

세계의 자동차 와이어 하네스 시장 동향 및 인사이트

전기화 주도 고전압 하네스 수요 급증

배터리 팩 전압이 800V, 심지어 1000V로 상승함에 따라 더 큰 열 부하를 견디면서도 엄격한 전자기적 호환성(EMC) 목표를 충족하는 새로운 등급의 케이블 어셈블리가 등장하고 있습니다. 많은 중국 브랜드들이 이제 주 동력선에 알루미늄 기반 도체를 지정함으로써 소재 혁신을 전기차 비용 절감과 직접 연결하고 있습니다. 알루미늄은 새로운 접합 기술이 필요하기 때문에 공급업체들은 5년 전에는 볼 수 없었던 속도로 마찰 및 레이저 용접 셀에 투자하고 있습니다. 새로운 추론은 용접 노하우가 곧 원동박 조달을 제치고 핵심 경쟁 장벽으로 부상할 수 있다는 점입니다.

OEM의 경량 알루미늄 및 광학 하네스 추진

자동차 제조사들은 계속해서 무게 절감의 모든 그램을 추구하고 있으며, 프리미엄 차량에서 와이어은 20kg 이상을 차지할 수 있습니다. 알루미늄 도체는 구리에 비해 무게를 약 60% 절감할 뿐만 아니라 구리 가격 변동 위험도 줄여줍니다. 단점인 낮은 전도도는 다중 가닥 설계와 접촉 저항을 사양 범위 내로 유지하는 바이메탈 단자를 통해 상쇄되고 있습니다. 연결 기술이 성숙해짐에 따라 여러 OEM 업체들은 알루미늄 전원선과 데이터용 광섬유를 결합한 혼합 도체 하네스를 도입했으며, 이는 차세대 기술이 단일 금속 솔루션이 아닌 하이브리드 복합 번들에 있을 것임을 시사합니다.

구리와 수지의 가격 변동으로 인한 마진 압박

기존 와이어 묶음에서 구리는 총 부품 원가의 절반 이상을 차지하므로 최근 가격 변동으로 공급업체의 총마진이 압박받고 있습니다. 대부분의 라인 핏 계약에는 가격 전가 조항이 포함되어 있지만, 자동차 제조사들은 중간 주기 가격 인상을 수용하기를 점점 꺼리고 있습니다. 이에 공급업체들은 상품 거래소에서 헤징을 하고 위험 분산을 위해 알루미늄으로 다각화하고 있습니다. 이러한 상황은 수익성 확보에 있어 핵심 엔지니어링만큼 재무 공학과 조달 역량의 정교함이 중요해지고 있음을 시사합니다.

부문 분석

2024년 자동차 와이어 하네스 시장 규모에서 차체, 조명 및 실내 편의 시스템이 35.90%로 가장 큰 비중을 차지합니다. 높은 LED 채택률, 파워 리프트 게이트, 다중 구역 기후 모듈이 지속적인 수요를 설명합니다. 흥미로운 점은 판매량을 높이는 동일한 편의 기능이 최종 차량 조립을 복잡하게 만들어 OEM이 대시보드와 도어 패널에 바로 장착되는 사전 구성된 서브룸을 요구하게 만든다는 것입니다.

충전 및 전원 공급 시스템 하네스는 2030년까지 26.50%의 가장 빠른 연평균 복합 성장률(CAGR)을 보일 것으로 예상되며, 더 많은 전기차 모델이 출시됨에 따라 10% 중반대의 성장률을 기록할 것입니다. 이러한 하네스는 배터리 팩 주변의 급격한 온도 상승과 기계적 진동을 견뎌야 하므로 고등급 절연 재료가 주류로 자리 잡고 있습니다. 액체 냉각 슬리브와 저프로파일 차폐 기술을 보유한 공급업체들은 프리미엄 가격을 책정할 가능성이 높다. 시간이 지남에 따라 고전압 와이어 노하우를 바탕으로 배터리 관리 시스템(BMS)으로의 교차 판매 진입이 가능해질 수 있습니다.

구리는 탁월한 전도성과 1세기에 걸친 공정 노하우를 바탕으로 현재 자동차 와이어 하니스 시장의 약 93.90% 점유율을 유지하고 있습니다. 그러나 높은 밀도와 변동성 있는 비용 구조로 인해 OEM 구매 부서는 대체재 탐색 압박을 받고 있습니다. 신흥 트렌드는 동일한 트렁크 라인에 구리 데이터 페어와 알루미늄 전원 코어를 결합하여 신호 무결성을 유지하면서 무게를 경감하는 방식입니다.

알루미늄의 2030년까지 예상 연평균 성장률(CAGR)은 12.13%로, 자동차 와이어 하네스 산업 전반의 성장세를 가뿐히 앞지를 전망입니다. 부식 방지 단자 및 마찰 용접 접합 기술의 발전으로 초기 신뢰성 우려는 해소되었습니다. 알루미늄은 구리에 비해 가격이 안정적이어서 재무팀이 점점 더 헤지 수단으로 활용하는 모델을 구축하고 있습니다. 이러한 변화는 소재 과학 선택이 이제 대형 공급업체 내 재무 리스크 관리 전략과 직접적으로 교차함을 시사합니다.

지역 분석

아시아태평양 지역은 자동차 와이어 하네스 시장 점유율의 약 48.83%를 차지하며 가장 빠른 절대적 매출 성장을 기록하고 있습니다. 중국은 방대한 경차 생산량과 깊이 있는 전기차 공급망을 바탕으로 해당 지역을 주도하고 있으며, 일본과 한국은 데이터 및 고전압 애플리케이션을 위한 고급 연구개발(R&D)을 기여하고 있습니다. 인도와 동남아시아의 전기화 촉진을 위한 정부 인센티브는 글로벌 성장세가 정상화되더라도 지역 수요가 탄력성을 유지할 것임을 시사합니다. 주목할 만한 발전은 다수의 중국 OEM 업체들이 유럽으로 전기차를 수출하면서 유럽연합 규제 기준을 충족하는 통합 와이어 사양이 필요해져 아시아 기반 공급업체들이 글로벌 준수 기준으로 격상되고 있다는 점입니다.

아프리카는 2025-2030년 사이 11.97%라는 가장 높은 연평균 성장률(CAGR)을 기록할 전망입니다. 경쟁력 있는 노동 비용, 유럽연합과의 무역 협정 접근성, 정부의 산업단지 정책이 함께 새로운 하네스 투자를 유치하고 있습니다. 여러 유럽 1차 공급업체들이 노동 집약적 하위 조립 공정을 해당 지역에 배치함으로써, 자국 시장 공장을 자동화 공정 전용으로 전환하고 있습니다. 케이블 압착 및 품질 검사 분야의 현지 인력 기술 향상 프로그램이 등장하며, 인적 자본 전략이 지역 성장과 밀접하게 연계되고 있음을 시사합니다.

북미와 유럽은 성장세가 다소 완만하지만 여전히 기술 선도 지역으로 자리매김하고 있습니다. 구역별 아키텍처 시범 운영은 독일 럭셔리 브랜드와 북미 전기차 스타트업에 집중되어 있어 뮌헨, 슈투트가르트, 실리콘밸리의 설계 사무소가 차세대 로움 컨셉의 중추 역할을 수행합니다. 이는 지적재산권 창출이 노동집약적 생산과 분리되고 있음을 시사합니다. 이는 OEM 본사 인근에 R&D 클러스터가 형성되고 대량 조립은 비용 최적화 지역으로 이전되는 이중 속도 글로벌 발자국을 강화합니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 성장 촉진요인

- 전기화에 의한 고전압 하네스 수요 급증(아시아)

- 경량 알루미늄과 광학 하네스 OEM 추진

- 프리미엄 차량의 중앙 집중형 구역별 E/E 아키텍처 전환(유럽)

- ADAS 와이어 이중화에 대한 규제 의무화(미국, 일본)

- 현지화 규제로 인한 와이어 하네스 현지화 확대(인도, 멕시코)

- 자율주행차 개발로 인한 중복 회로 아키텍처 수요 증가

- 시장 성장 억제요인

- 구리와 수지 가격 변동에 의한 마진 압박

- 전기차 특유의 열 및 EMC 문제로 인한 검증 비용 증가

- 설계 복잡성과 숙련된 인력 확보 간의 불일치(아세안)

- 생산성 향상을 제약하는 제조 자동화의 한계

- 가치/공급망 분석

- 규제와 기술 전망

- Porter's Five Forces

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측

- 용도별

- 점화 시스템

- 충전 및 전원 공급 시스템

- 드라이브 트레인과 파워트레인(ICE)

- 고전압 트랙션 하네스(xEV)

- 인포테인먼트, 조종석, 텔레매틱스

- ADAS 및 안전제어

- 차체, 조명, 실내 편의 시설

- 도체 재료별

- 구리

- 알루미늄

- 정격 전압별

- 저전압(60V 미만)

- 고전압(60-1,000 V)

- 추진 유형별

- 내연 기관 차량

- 배터리 전기자동차

- 플러그인 하이브리드 자동차 및 하이브리드 자동차

- 차량 유형별

- 승용차

- 소형 상용차

- 대형 트럭과 버스

- 판매 채널별

- OEM

- 애프터마켓

- 지역별

- 북미

- 미국

- 캐나다

- 기타 북미

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 기타 아시아태평양

- 중동

- GCC

- 튀르키예

- 기타 중동

- 아프리카

- 남아프리카

- 이집트

- 기타 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 전략 이니셔티브

- 시장 점유율 분석

- 기업 프로파일

- Yazaki Corporation

- Sumitomo Electric Industries Ltd.

- LEONI AG

- Lear Corporation

- Motherson Wiring Harness Ltd.

- Furukawa Electric Co. Ltd.

- Fujikura Ltd.

- Kyungshin Corporation

- Draexlmaier Group

- Kromberg & Schubert

- Nexans Autoelectric

- PKC Group(Motherson)

- Coroplast Fritz Muller GmbH & Co.

- THB Group

- Prestolite Wire LLC

- Lear Yangzhou(China)

- Guangdong Hivolt Wiring Harness

- BizLink Holding Inc.

- Shanghai Shenglong Automotive Harness

- Samvardhana Motherson Reydel

- Korea Electric Terminal Co.

제7장 시장 기회와 장래의 전망

HBR 25.11.19The Automotive Wiring Harness Market size is estimated at USD 76.69 billion in 2025, and is expected to reach USD 125.48 billion by 2030, at a CAGR of 10.35% during the forecast period (2025-2030).

The market is expanding steadily on the back of rising electronic content per vehicle, but the headline growth masks two contrasting currents: demand for high-voltage harnesses used in battery-electric vehicles is rising at a double-digit pace, while traditional low-voltage ICE looms are seeing price compression. Regionally, Asia remains the production and consumption hub, Africa is attracting new capacity thanks to favorable labor economics and local-content rules, and mature markets in North America and Europe are pivoting toward zonal electrical architectures that shorten cable runs yet increase the value of each remaining line.

Global Automotive Wiring Harness Market Trends and Insights

Electrification-Driven Surge in High-Voltage Harness Demand

Rising battery pack voltages to 800 V and even 1000 V are spurring a new class of cable assemblies that carry greater thermal loads while meeting tight electromagnetic-compatibility (EMC) targets. Many Chinese brands now specify aluminum-based conductors for main traction lines, directly linking material innovation to EV cost reduction. Because aluminum requires revised joining techniques, suppliers are investing in friction and laser welding cells at a pace unseen five years ago. An emerging inference is that welding know-how may soon overshadow raw copper sourcing as the key competitive barrier.

OEM Push for Lightweight Aluminum and Optical Harnesses

Automakers continue to chase every gram of weight saving, and wiring can account for more than 20 kg in premium cars. Aluminum conductors slash mass by roughly 60% relative to copper and also cut exposure to copper-price swings. The downside-lower conductivity-is being offset through multi-strand designs and bimetal terminals that keep contact resistance within specification. As connection technology matures, several OEMs have introduced mixed conductor looms that pair aluminum power lines with optical fibres for data, hinting that the next frontier will lie in hybrid composite bundles rather than single-metal solutions.

Margin Pressure from Volatile Copper and Resin Prices

Copper accounts for well over half of total bill-of-materials cost in a conventional loom, so recent price gyrations have compressed supplier gross margin. Although most line-fit contracts include pass-through clauses, automakers are increasingly reluctant to accept mid-cycle price increases. Suppliers are therefore hedging on commodity exchanges and diversifying into aluminum as a risk-spreading measure. The situation underscores that financial engineering and procurement sophistication are becoming as important as core engineering in safeguarding profitability.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward Centralized Zonal E/E Architectures in Premium Cars

- Regulatory Mandates for ADAS Wiring Redundancy

- EV-Specific Thermal and EMC Challenges Raising Validation Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Body, Lighting, and Cabin Comfort systems command the largest share of the Automotive Wiring Harness market size in 2024, accounting for 35.90% of the market size. High LED adoption, power lift-gates, and multi-zone climate modules explain persistent demand. An interesting observation is that the same comfort features that boost volume also complicate final vehicle assembly, nudging OEMs to request pre-configured sub-looms that snap into dashboards and door panels.

Charging and power supply system harnesses show the fastest forecast CAGR expanding at an 26.50% through 2030, expanding in the mid-teens as more electric models reach showrooms. These harnesses must endure temperature spikes and mechanical vibration around battery packs, so higher-grade insulation materials are becoming mainstream. Suppliers that master liquid-cooling sleeves and low-profile shielding will likely command premium price points. Over time, expertise in high-voltage routing may provide cross-selling entry into battery management systems.

Copper retains around 93.90% of the Automotive Wiring Harness market share today, supported by unmatched conductivity and a century of process know-how. Yet its density and volatile cost profile keep pressure on OEM purchasing departments to pursue alternatives. An emerging pattern is the bundling of copper data pairs with aluminum power cores in the same trunk line, achieving weight reduction without sacrificing signal integrity.

Aluminum's forecast CAGR is 12.13% by 2030, easily outpacing the broader Automotive Wiring Harness industry trajectory. Advances in anti-corrosion terminals and friction-weld splice techniques have removed earlier reliability concerns. Because aluminum is price-stable relative to copper, finance teams increasingly model its use as a hedge. The shift indicates that material science choices now intersect directly with treasury risk management strategies inside large suppliers.

The Automotive Wiring Harness Market Report is Segmented by Application Type (Ignition System, and More), Conductor Material (Copper, and More), Voltage Rating (Low-Voltage [less Than 60V] and More), Propulsion Type (Internal Combustion Engine Vehicles and More), Vehicle Type (Passenger Cars and More), Sales Channel (OEM and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia Pacific holds almost 48.83% Automotive Wiring Harness market share and boasts the fastest absolute revenue expansion. China anchors the region through its vast light-vehicle output and deep EV supply chains, while Japan and South Korea contribute high-grade R&D for data and high-voltage applications. Government incentives for electrification in India and Southeast Asia suggest that regional demand will remain resilient even as global growth normalises. A noteworthy development is that multiple Chinese OEMs are exporting EVs to Europe, requiring harmonised wiring specifications that meet European Union regulatory norms and thus elevating Asia-based suppliers to global compliance standards.

Africa, records the highest CAGR of 11.97% between 2025-2030. Competitive labour costs, trade-agreement access to the European Union, and government industrial-park policies together attract fresh harness investment. Several European tier-1 firms are locating high-labour-content sub-assemblies in the region, freeing up home-market plants for automated processes. Local workforce up-skilling programs in cable crimping and quality inspection are emerging, indicating that human-capital strategy is entwined with regional growth.

North America and Europe grow more modestly but remain technology front-runners. Zonal architecture pilots are concentrated in German luxury brands and North American electric start-ups, so design offices in Munich, Stuttgart, and Silicon Valley serve as nerve centres for next-generation loom concepts. This pattern implies that intellectual property creation is decoupling from labour-intensive production. This reinforces the two-speed global footprint in which R&D clusters near OEM headquarters and large-batch assembly migrate to cost-optimised regions.

- Yazaki Corporation

- Sumitomo Electric Industries Ltd.

- LEONI AG

- Lear Corporation

- Motherson Wiring Harness Ltd.

- Furukawa Electric Co. Ltd.

- Fujikura Ltd.

- Kyungshin Corporation

- Draexlmaier Group

- Kromberg & Schubert

- Nexans Autoelectric

- PKC Group (Motherson)

- Coroplast Fritz Muller GmbH & Co.

- THB Group

- Prestolite Wire LLC

- Lear Yangzhou (China)

- Guangdong Hivolt Wiring Harness

- BizLink Holding Inc.

- Shanghai Shenglong Automotive Harness

- Samvardhana Motherson Reydel

- Korea Electric Terminal Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Drivers

- 4.1.1 Electrification-Driven Surge in High-Voltage Harness Demand (Asia)

- 4.1.2 OEM Push for Lightweight Aluminum & Optical Harnesses

- 4.1.3 Shift Toward Centralized Zonal E/E Architectures in Premium Cars (EU)

- 4.1.4 Regulatory Mandates for ADAS Wiring Redundancy (US, Japan)

- 4.1.5 Rising Local Content Rules Fueling Wire-Harness Localization (India, Mexico)

- 4.1.6 Autonomous Vehicle Development Driving Redundant Circuit Architectures

- 4.2 Market Restraints

- 4.2.1 Margin Pressure From Volatile Copper & Resin Prices

- 4.2.2 EV-Specific Thermal & EMC Challenges Raising Validation Costs

- 4.2.3 Mismatch Between Design Complexity & Skilled Labor Availability (ASEAN)

- 4.2.4 Manufacturing Automation Limitations Constraining Productivity Gains

- 4.3 Value / Supply-Chain Analysis

- 4.4 Regulatory & Technological Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Application

- 5.1.1 Ignition System

- 5.1.2 Charging & Power Supply System

- 5.1.3 Drivetrain & Powertrain (ICE)

- 5.1.4 High-Voltage Traction Harness (xEV)

- 5.1.5 Infotainment, Cockpit & Telematics

- 5.1.6 ADAS & Safety Control

- 5.1.7 Body, Lighting & Cabin Comfort

- 5.2 By Conductor Material

- 5.2.1 Copper

- 5.2.2 Aluminum

- 5.3 By Voltage Rating

- 5.3.1 Low-Voltage (<60 V)

- 5.3.2 High-Voltage (60-1,000 V)

- 5.4 By Propulsion Type

- 5.4.1 Internal Combustion Engine Vehicles

- 5.4.2 Battery Electric Vehicles

- 5.4.3 Plug-in Hybrid & Hybrid Vehicles

- 5.5 By Vehicle Type

- 5.5.1 Passenger Cars

- 5.5.2 Light Commercial Vehicles

- 5.5.3 Heavy-duty Trucks & Buses

- 5.6 By Sales Channel

- 5.6.1 OEM

- 5.6.2 Aftermarket

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Rest of North America

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Spain

- 5.7.2.5 Russia

- 5.7.2.6 Rest of Europe

- 5.7.3 Asia Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 India

- 5.7.3.4 South Korea

- 5.7.3.5 Rest of Asia Pacific

- 5.7.4 Middle East

- 5.7.4.1 GCC

- 5.7.4.2 Turkey

- 5.7.4.3 Rest of Middle East

- 5.7.5 Africa

- 5.7.5.1 South Africa

- 5.7.5.2 Egypt

- 5.7.5.3 Rest of Africa

- 5.7.6 South America

- 5.7.6.1 Brazil

- 5.7.6.2 Argentina

- 5.7.6.3 Rest of South America

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Strategic Initiatives

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Yazaki Corporation

- 6.3.2 Sumitomo Electric Industries Ltd.

- 6.3.3 LEONI AG

- 6.3.4 Lear Corporation

- 6.3.5 Motherson Wiring Harness Ltd.

- 6.3.6 Furukawa Electric Co. Ltd.

- 6.3.7 Fujikura Ltd.

- 6.3.8 Kyungshin Corporation

- 6.3.9 Draexlmaier Group

- 6.3.10 Kromberg & Schubert

- 6.3.11 Nexans Autoelectric

- 6.3.12 PKC Group (Motherson)

- 6.3.13 Coroplast Fritz Muller GmbH & Co.

- 6.3.14 THB Group

- 6.3.15 Prestolite Wire LLC

- 6.3.16 Lear Yangzhou (China)

- 6.3.17 Guangdong Hivolt Wiring Harness

- 6.3.18 BizLink Holding Inc.

- 6.3.19 Shanghai Shenglong Automotive Harness

- 6.3.20 Samvardhana Motherson Reydel

- 6.3.21 Korea Electric Terminal Co.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment