|

시장보고서

상품코드

1850988

중국의 핀테크 시장 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)China Fintech - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

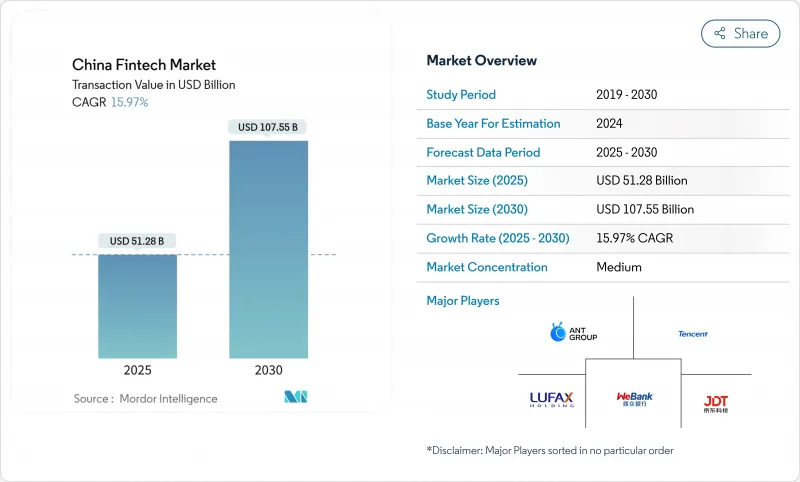

중국의 핀테크 시장은 2025년에 512억 8,000만 달러, 2030년에는 1,075억 5,000만 달러에 이르고, CAGR 15.97%로 성장할 전망입니다.

이러한 기세는 네이티브 아키텍처로 전환하여 서비스형 은행의 수익을 확보하고, 양 중심에서 API 주도의 지속 가능한 성장으로 규제가 급속히 성숙하면서 발생합니다. 경쟁 압력은 고객 획득에서 신용 점수, 로보 어드바이저 및 언더라이팅이 모두 AI 엔진으로 이동하는 데이터 레이어 통합으로 이동합니다. Tier2/Tier3 도시의 새로운 유통 회랑으로 인해 이전에는 그 범위에 상한이 있던 물리적 지점망이 없어도 거래량이 증가하고 있습니다. 한편, 은련 카드와 마스터 카드에 의한 국제 결제의 상호 운용성은 중국의 핀테크 시장에 대응할 수 있는 크로스보더 풀을 확대하고 있습니다.

중국의 핀테크 시장의 동향과 인사이트

디지털 결제의 보급을 가속화하는 PBOC의 전자 위안 전개

디지털 위안화 사슬의 거래 금액은 2024년 5월까지 상당한 성장을 보였으며 전년 대비 크게 증가했습니다. e-CNY의 점진적인 디자인은 기본 휴대기기에서 카드 기반 사용을 가능하게 했고, 이전 지갑에서는 제한된 스마트폰 요구사항을 제거했습니다. 그 결과, 농촌의 인터넷 유저의 15.3%가 2024년 4월까지 e-CNY를 이용한 것으로 보고되었고, 새로운 소비자층을 개척했습니다. 상업 은행은 PBOC의 듀얼 레이어 모델 하에서 전자 위안을 배포하고 레거시 지점을 핀테크 노드로 효과적으로 변환하고 중국의 핀테크 시장 전체의 디지털화를 강화하고 있습니다.

NetsUnion의 청산 의무화로 타사 결제량 증가

청산의 일원화에 의해 가맹점의 통합 비용이 내려 소규모 프로바이더가 살아가면서 소비자의 신뢰가 높아집니다. PBOC의 데이터에 따르면 2024년에 모바일 결제를 도입하는 60세 이상의 사용자가 46% 급증했습니다. 통일된 부정 감시 규칙에 의해 플랫폼은 기본적인 결제보다 부가가치 서비스에 자원을 돌릴 수 있게 되어, 중국의 핀테크 시장 전체의 지갑 처리 능력이 향상되고 있습니다.

데이터 보안법이 크로스보더 데이터 전송을 강화

2025년 1월 시행된 새로운 네트워크 데이터 보안 관리 규칙은 외부로 데이터를 이전하기 전에 국내 보안 심사를 의무화합니다. 2024년 3월 조정에서 적용 제외가 연간 100,000레코드로 인상된 SaaS형 핀테크는 여전히 데이터세트를 세분화하고 감사를 수행해야 합니다. 컴플라이언스 오버헤드는 프론트엔드 혁신에서 엔지니어의 재능을 배제하고 중국의 핀테크 시장의 단기 성장 슬로프를 둔화시키고 있습니다.

부문 분석

디지털 결제는 2024년 시장 점유율 59.1%를 차지하였고 중국의 핀테크 시장 규모에서 가장 큰 점유율을 차지합니다. Alipay와 WeChat Pay는 모바일 월렛 플로우의 주요 점유율을 차지하고 있으며, 그 집중은 규모의 경제성을 확고하게 하고 있습니다. 70개 시장에 걸친 Alipay의 크로스보더 확장은 도달범위를 더욱 확대합니다. 그럼에도 불구하고 1급 도시에서의 보급률은 완만하며 부가가치가 높은 마이크로 인슈어런스 투자 모듈이 동일한 지갑에 탑재되는 경향이 커지고 있습니다.

네오뱅킹은 2030년까지 예상 CAGR이 19.63%로, 이 분야에서 가장 높은 성장을 기록할 것으로 예측됩니다. WeBank는 현재 3억 명의 계좌 보유자에게 서비스를 제공하면서 은행보다 훨씬 낮은 영업 비용 대 자산 비율을 유지하고 있습니다. 클라우드 네이티브 코어는 신제품의 한계 비용이 0에 가까워져 네오뱅크의 플라이휠을 가속시킵니다. 또한 이 시프트는 레거시 메인프레임을 계속 가동하고 있는 지방은행의 경쟁력을 높여 핀테크 시장에서 BaaS 파트너십으로의 이행을 촉진하고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 중국 인민은행의 e-CNY 도입에 의해 2급 및 3급 도시에 있어서의 디지털 결제의 도입이 가속

- NetsUnion의 결제 위탁에 의해 제3자 결제량이 증가

- 중소기업의 자금 조달 갭이 P2P 및 공급망 핀테크 융자 플랫폼을 추진

- 웰스 매니지먼트 커넥트 스킴이 로보 어드바이저의 보급을 촉진

- 민간건강보험에 대한 세제우대조치가 인슈어테크의 성장을 가속

- 기존 은행의 클라우드 네이티브 코어 업그레이드에 의해 BaaS/API의 이용이 확대

- 시장 성장 억제요인

- SaaS 핀테크의 크로스보더 데이터 이전을 엄격화하는 데이터 보안법

- 마이크로 파이낸스에 있어서의 불량채권 비율의 상승이 자기 자본 비율의 부담을 증대

- 모바일 결제 포화로 거래량 증가가 제한됨

- 가치/공급망 분석

- 규제 또는 기술 전망

- Porter's Five Forces

- 신규 참가업체의 위협

- 공급기업의 협상력

- 구매자의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 투자 및 자금 조달 동향 분석

제5장 시장 규모와 성장 예측

- 서비스 프로포지션별

- 디지털 결제

- 디지털 대출과 금융

- 디지털 투자

- 인슈어테크

- 네오뱅킹

- 최종 사용자별

- 소매

- 기업

- 사용자 인터페이스별

- 모바일 애플리케이션

- 웹/브라우저

- POS/IoT 디바이스

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Ant Group(Alipay)

- Tencent Holdings(Tenpay)

- WeBank Co. Ltd.

- Lufax Holding Ltd.

- JD Technology(JD Digits)

- Ping An OneConnect Bank

- ZhongAn Online P&C Insurance

- Futu Holdings Ltd.

- Tiger Brokers(UP Fintech)

- 360 DigiTech Inc.

- LexinFintech Holdings Ltd.

- Qudian Inc.

- Xiaomi Finance

- Lakala Payment Corp.

- UnionPay Merchant Services

- Airwallex

- XTransfer Ltd.

- Du Xiaoman Financial

- Suning Finance

- Wanda Fintech Group

제7장 시장 기회와 미래 전망

CSM 25.11.20The China fintech market is valued at USD 51.28 billion in 2025 and is on track to climb to USD 107.55 billion by 2030, advancing at a 15.97% CAGR.

Momentum comes from three converging forces: (1) nationwide rollout of the digital yuan, which is triggering a new payment rail beyond traditional mobile wallets; (2) a pivot by incumbent banks toward cloud-native architecture that unlocks bank-as-a-service revenue; and (3) fast-maturing regulation that replaced volume-chasing tactics with sustainable, API-driven growth. Competitive pressure is shifting from customer acquisition to data-layer integration such as credit scoring, robo-advice, and underwriting all move onto AI engines. New distribution corridors in tier-2/3 cities are lifting transaction volumes without the physical branch networks that previously capped reach. Meanwhile, international payment interoperability through UnionPay and Mastercard is widening the addressable cross-border pool for the Chinese fintech market.

China Fintech Market Trends and Insights

PBOC e-CNY roll-out accelerating digital payments adoption

Transaction value on the digital yuan chain experienced significant growth by May 2024, showcasing a substantial increase compared to the previous year. The wallet's tiered design permits card-based usage on basic handsets, removing the smartphone requirement that limited earlier wallets. As a result, 15.3% of rural internet users reported e-CNY usage by April 2024, unlocking a fresh cohort of consumers. Commercial banks distribute the currency under a PBOC dual-layer model, effectively converting legacy branches into fintech nodes and reinforcing digitalization throughout the China fintech market.

NetsUnion clearing mandate boosting third-party payment volumes

Centralized clearing lowered merchant integration costs, aiding smaller providers and boosting consumer confidence. PBOC data shows a 46% jump in users aged 60+ adopting mobile payments in 2024. Uniform fraud-monitoring rules now let platforms turn resources toward value-added services rather than basic settlement, lifting overall wallet throughput across the China fintech market.

Data Security Law tightening cross-border data transfers

New Network Data Security Management Regulations, effective January 2025, require domestic security reviews before external data transfers. Although March 2024 adjustments raised exemptions to 100,000 records per year, SaaS fintech's must still segment datasets and stage audits. Compliance overhead diverts engineering talent away from front-end innovation, trimming the near-term growth slope for the China fintech market.

Other drivers and restraints analyzed in the detailed report include:

- SME financing gap driving P2P & supply-chain fintech platforms

- Wealth Management Connect schemes fueling robo-advisor uptake

- Rising NPL ratio in micro-lending elevating capital-adequacy burdens

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Digital Payments held a 59.1% share of the market in 2024, giving the category the largest stake in the China fintech market size. Alipay and WeChat Pay collectively process a major share of mobile wallet flows, a concentration that cements their scale economics. Cross-border expansion through Alipay+ across 70 markets further extends reach. Nevertheless, penetration in tier-1 cities is flattening, and incremental growth is tilting toward value-added micro-insurance and investment modules housed within the same wallets.

Neobanking is projected to record a 19.63% forecast CAGR through 2030, the fastest in the sector. WeBank now serves 300 million account holders while maintaining an operating cost-to-asset ratio well below joint-stock banks. Cloud-native cores mean the marginal cost of new products approaches zero, accelerating the neobank flywheel. The shift also raises the competitive bar for regional banks that still run legacy mainframes, nudging them toward BaaS partnerships as a defensive posture within the China fintech market.

The China Fintech Market is Segmented by Service Proposition (Digital Payments, Digital Lending and Financing, Digital Investments, Insurtech, and Neobanking), by End-User (Retail and Businesses), and by User Interface (Mobile Applications, Web / Browser, and POS / IoT Devices). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Ant Group (Alipay)

- Tencent Holdings (Tenpay)

- WeBank Co. Ltd.

- Lufax Holding Ltd.

- JD Technology (JD Digits)

- Ping An OneConnect Bank

- ZhongAn Online P&C Insurance

- Futu Holdings Ltd.

- Tiger Brokers (UP Fintech)

- 360 DigiTech Inc.

- LexinFintech Holdings Ltd.

- Qudian Inc.

- Xiaomi Finance

- Lakala Payment Corp.

- UnionPay Merchant Services

- Airwallex

- XTransfer Ltd.

- Du Xiaoman Financial

- Suning Finance

- Wanda Fintech Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 PBOC e-CNY Roll-out Accelerating Digital Payments Adoption Across Tier-2/3 Cities

- 4.2.2 NetsUnion Clearing Mandate Boosting Third-Party Payment Volumes

- 4.2.3 SME Financing Gap Driving P2P & Supply-Chain Fintech Lending Platforms

- 4.2.4 Wealth Management Connect Schemes Fueling Robo-advisor Uptake

- 4.2.5 Commercial Health Insurance Tax Incentives Propelling InsurTech Growth

- 4.2.6 Cloud-native Core Upgrades by Joint-stock Banks Expanding BaaS/API Consumption

- 4.3 Market Restraints

- 4.3.1 Data Security Law Tightening Cross-border Data Transfers for SaaS Fintechs

- 4.3.2 Rising NPL Ratio in Micro-lending Elevating Capital-adequacy Burdens

- 4.3.3 Saturation of Mobile Payments Limiting Incremental Volume Growth

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory or Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

- 4.7 Investment & Funding Trend Analysis

5 Market Size & Growth Forecasts (Value)

- 5.1 By Service Proposition

- 5.1.1 Digital Payments

- 5.1.2 Digital Lending and Financing

- 5.1.3 Digital Investments

- 5.1.4 Insurtech

- 5.1.5 Neobanking

- 5.2 By End-User

- 5.2.1 Retail

- 5.2.2 Businesses

- 5.3 By User Interface

- 5.3.1 Mobile Applications

- 5.3.2 Web / Browser

- 5.3.3 POS / IoT Devices

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for Key Companies, Products & Services, and Recent Developments)

- 6.4.1 Ant Group (Alipay)

- 6.4.2 Tencent Holdings (Tenpay)

- 6.4.3 WeBank Co. Ltd.

- 6.4.4 Lufax Holding Ltd.

- 6.4.5 JD Technology (JD Digits)

- 6.4.6 Ping An OneConnect Bank

- 6.4.7 ZhongAn Online P&C Insurance

- 6.4.8 Futu Holdings Ltd.

- 6.4.9 Tiger Brokers (UP Fintech)

- 6.4.10 360 DigiTech Inc.

- 6.4.11 LexinFintech Holdings Ltd.

- 6.4.12 Qudian Inc.

- 6.4.13 Xiaomi Finance

- 6.4.14 Lakala Payment Corp.

- 6.4.15 UnionPay Merchant Services

- 6.4.16 Airwallex

- 6.4.17 XTransfer Ltd.

- 6.4.18 Du Xiaoman Financial

- 6.4.19 Suning Finance

- 6.4.20 Wanda Fintech Group

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment