|

시장보고서

상품코드

1687784

세포 표면 마커 검출 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Global Cell Surface Markers Detection - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

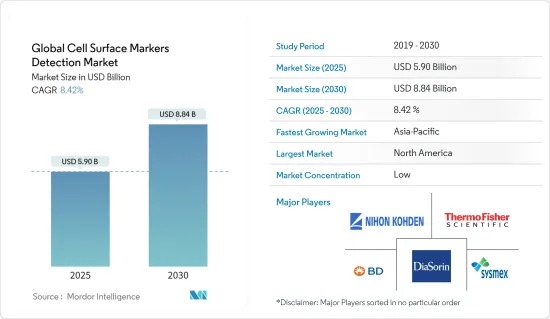

세계의 세포 표면 마커 검출 시장 규모는 2025년에 59억 달러로 추정되고, 예측 기간인 2025-2030년 CAGR 8.42%로 성장할 전망이며, 2030년에는 88억 4,000만 달러에 달할 것으로 예측됩니다.

COVID-19 팬데믹은 시장에 큰 영향을 미쳤습니다. 코로나19 항체와 세포 표면 마커의 상호작용에 관한 많은 연구 프로젝트가 실시되었습니다. 예를 들어 2021년 2월 'Frontiers in Immunology'에 게재된 연구 논문은 코로나19 환자의 단구와 정상 대조자의 단구의 세포 표면 마커 발현을 조사 및 비교한 것입니다. 이 연구에서는 코로나19 환자에서는 진균의 2차 감염률이 상승하고 있는 것으로 나타났습니다. 코로나19 환자의 대부분은 면역력이 저하되어 있기 때문에 진균의 2차 감염 비율이 증가하고 있었습니다.

또한, 2021년 12월 미국 국립의학 도서관에서 발표된 논문에 따르면 면역반응의 차이는 질병의 중증도와 상관되는 COVID-19 특이적 면역마커를 가리키며 COVID-19의 진단 및 진행 모니터링을 위한 유동세포계측법 분석을 최적화하기 위해 채택되었습니다. 이 연구는 또한 이러한 마커는 과거의 유사한 감염력과 유전적, 개인차 및 환경 차이로 인해 발생할 수있는 다른 반응의 근본 원인을 밝힐 수 있다고 말합니다. 따라서, 이러한 장점은 세포 표면 마커 검출에 대한 수요가 COVID-19 팬데믹성 동안 증가하고 향후 일정 기간 동안 성장할 것으로 예상됩니다.

시장 성장을 가속하는 주요 요인으로는 정밀의료에 대한 수요 증가, 진단제 사용 증가, 처리량 향상 및 자동화와 관련된 기술 발전 등이 있습니다. 예를 들어, 2021년 1월에 Frontiers in Cell and Developmental Biology 잡지에 게재된 연구에 따르면, 하이컨텐츠 스크리닝은 암세포, 특히 유기체 표적, 신규 후보 분자에 대한 전반적인 세포 반응의 효율적인 추정, 신호전달의 불균일성의 평가 등, 복수의 치료에 대한 다양한 하류 효과의 이해를 돕고 있습니다. 신규 약제에 대한 암세포의 반응을 이해하기 위한 이용이 증가하고 있어 시장 성장의 원동력이 될 것으로 예상됩니다.

게다가 혁신적인 제품 개발도 시장 성장에 기여하고 있습니다. 예를 들어 2021년 6월 라이카 마이크로시스템즈는 실험의 성공률을 높이고 재현성을 향상시키며 광전자현미경(EM)의 통합을 간소화하도록 설계된 새로운 라이브셀 상관광전자현미경(CLEM) 워크플로우 솔루션인 Leica Nano 워크플로우를 발표했습니다. 또, 2021년 10월, BD 라이프 사이언스-바이오사이언스는, Christian Medical College, Vellore와 공동으로, 인도의 임상 연구를 위한 플로우 사이트 메트리에 있어서의 2번째 센터·오브·엑설런스(CoE)를 시작했습니다. 이러한 개발은 세포 표면 마커 검출의 수요를 끌어올려 시장의 성장을 촉진합니다.

그러나 장비의 높은 비용과 기술의 복잡성은 시장 성장을 억제합니다.

세포 표면 마커 검출 시장 동향

유동 세포 계측 부문은 예측 기간 동안 상당한 성장이 예상됩니다.

유동 세포 계측법은 세포를 액체 흐름에 현탁하고 검출 장치에 통과시킴으로써 세포 계수, 바이오 마커 검출, 세포 선별, 단백질 공학에 사용되는 레이저 또는 임피던스 기반 기술입니다. 유동 세포 계측은 줄기세포나 전구세포의 동정, 특성해석, 분리에 이상적인 도구로 조사 및 임상 용도 가능성이 있습니다. 줄기세포 연구에서 유동 세포 계측의 채용 확대나, 임상 연구에 있어서 유동 세포 계측 용도 확대가, 예측 기간 이 분야의 성장을 견인할 것으로 기대되고 있습니다. 예를 들어, National Clinical Trial Registry(NCT)에 따르면 2021년 4월 21일 현재 독일에서는 줄기세포 치료와 관련된 다양한 개발 단계에 걸친 약 320건의 임상시험이 등록되어 있습니다. 이와 같이 줄기세포 치료에 대한 조사의 증가는 예측 기간에 걸쳐 흐름 측정의 수요를 촉진할 것으로 예측되고 있습니다.

또한 출시, 승인, 제휴, 공동 연구 등 시장 진출 기업이 수행하는 주요 전략이이 부문의 성장에 기여하고 있습니다. 예를 들어 2021년 7월, Becton, Dickinson, and Company 사는 사용자와 그 조달 팀에게 강화된 온라인 구매 경험을 제공하기 위해 유동 세포 계측용 재구축된 디지털 마켓플레이스를 출시했습니다. 새로운 BD 바이오사이언스 마켓플레이스에서는 BD의 연구용, 임상용, 싱글셀 멀티오믹스용 제품 전 라인업이 제공되며, 가장 포괄적인 유동 세포 계측 사용자를 위한 온라인 데스티네이션이 되고 있습니다.

따라서, 상기 요인들로부터, 유동 세포 계측 분야는 예측 기간 동안 세포 표면 마커 검출 시장에서 성장할 가능성이 높습니다.

북미가 시장을 독점하고 예측 기간 동안에도 시장 점유율을 유지할 전망

북미는 예측 기간을 통해 세포 표면 마커 검출 시장 전체의 패권을 유지할 것으로 예측됩니다. 질병 진단에서의 용도 급성장, 확립된 연구기관의 존재, 바이오 테크놀로지 산업이 큰 시장 점유율의 배경에 있는 주된 요인입니다. 연구 개발에 대한 정부 이니셔티브의 증가가 시장 성장에 기여하고 있습니다. 예를 들면, 노스다코타 대학의 2021년의 갱신에 의하면, 숙주-병원체 상호작용(HPI)의 UND 생물의학 연구 탁월 센터(CoBRE)는, 프로젝트의 국면 2까지 미국 국립 위생 연구소(NIH)의 자금 제공을 계속 받는 것으로 나타났습니다. 이번 갱신액은 급성 및 만성 염증성 질환의 원인이 되는 바이러스, 세균, 기생충 감염에 대한 숙주 응답을 보다 깊이 이해하기 위한 다년간의 프로젝트에 대해 UND에 대해 미화 1,070만 달러 이상이었습니다. 이 센터는 또, 유동세포계측을 포함한 기존의 3개의 국면 1 핵심 시설을 지원함으로써, 의학 및 건강 과학부(SMHS)와 UND의 혁신적 연구 능력을 강화합니다. 이러한 개발은 이 지역의 시장 성장에 기여할 것으로 예상됩니다.

덧붙여, 대기업 시장 기업의 존재나, 제휴 및 협력 등의 주요 전략도 시장 성장에 기여하고 있습니다. 예를 들어 2021년 9월 북미 PHC Corporation과 Screen Holdings는 Screen Cell imager 시리즈의 세포 이미징 시스템을 북미에서 판매하기 위해 제휴했습니다. 마찬가지로 2021년 8월, 벡톤 디킨슨 앤 컴퍼니는 새로운 벤치탑형 세포 분석 장치 BD FACSymphony A1 Cell Analyzer를 출시했습니다. 이 형광 활성화 셀 애널라이저는 모든 규모의 랩에 세련된 플로우 사이트 메트리 기능을 장착할 것으로 기대되고 있습니다. 이러한 개발은 예측 기간에 시장의 성장을 촉진할 것으로 예상됩니다.

세포 표면 마커 검출 산업 개요

세포 표면 마커 검출 시장은 세계적 및 지역적으로 사업을 전개하는 여러 기업이 존재하기 때문에 그 성격상 단편화되고 있습니다. 경합 정세에는, Becton, Dickinson and Company, Nihon Kohden Corporation, Sysmex Corporation, Diasorin SpA (Luminex Corporation), and Thermo Fisher Scientific Inc. 등 시장 점유율을 보유해, 지명도가 높은 국제 기업이나 현지 기업의 분석이 포함되어 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 진단에서의 세포 표면 마커 검출 이용 증가

- 처리량 향상 및 자동화에 관한 기술 진보

- 정밀의료에 대한 수요 증가

- 시장 성장 억제요인

- 기기의 고비용

- 기술의 복잡성

- Porter's Five Forces

- 신규 참가업체의 위협

- 구매자 및 소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 제품별

- 플로우 사이토메트리

- 헤마트로지 분석 장치

- 세포 이미징 시스템

- 시약 및 키트

- 기타 제품

- 용도별

- 병 진단 및 동정

- 연구 및 창약

- 기타 용도

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 기업 프로파일

- Abbott Laboratories

- Danaher Corporation(Beckman Coulter Inc.)

- Becton, Dickinson and Company

- Bio Rad Laboratories Inc.

- F. Hoffmann-La Roche Ltd

- Diasorin SpA(Luminex Corporation)

- Nihon Kohden Corporation

- Qiagen NV

- Siemens Healthineers

- Thermo Fisher Scientific Inc.

- Grifols SA

- Nexcelom Bioscience LLC

- IVD Medical Holding Limited(Immucor Inc.)

- Agilent Technologies Inc.

- Sysmex Corporation

제7장 시장 기회 및 향후 동향

AJY 25.05.07The Global Cell Surface Markers Detection Market size is estimated at USD 5.90 billion in 2025, and is expected to reach USD 8.84 billion by 2030, at a CAGR of 8.42% during the forecast period (2025-2030).

The COVID-19 pandemic had a significant impact on the market. Many research projects were carried out that involved the interaction of COVID-19 antibodies with cell surface markers. For instance, in February 2021, a research article published in Frontiers in Immunology studied and compared the cell surface marker expression on the monocytes of COVID-19 patients with healthy controls. The study found an increased rate of fungal co-infections in COVID-19 patients. The rate of secondary fungal infections increased in many COVID-19 patients due to their decreased immunity.

Additionally, according to an article published by the National Library of Medicine in December 2021, differences in the immune response point towards different COVID-19-specific immune markers that correlate with disease severity and are employed for the optimization of flow cytometry assays for the diagnosis and monitoring of COVID-19 progression. The study further stated that these markers could elucidate the underlying causes of different responses that could arise from a history of previous similar infections or genetic, individual, and environmental differences. Therefore, due to the advantage, the demand for cell surface markers detection increased during the COVID-19 pandemic and is expected to grow in the coming period.

The major factors driving the market's growth include the increasing demand for precision medicine, increased use of diagnostics, and technological advances related to increased throughput and automation. For instance, according to the study published in Frontiers in Cell and Developmental Biology in January 2021, high-content screening has aided in the comprehension of varied downstream effects for multiple treatments on cancer cells, specifically organelle targets, estimating the overall cellular response efficiently for new candidate molecules, and evaluating signaling heterogeneity. The rising use in understanding cancer cell response to novel drugs is expected to drive market growth.

Furthermore, the development of innovative products is also contributing to market growth. For instance, in June 2021, Leica Microsystems launched the Leica Nano workflow, a new live-cell correlative light, and electron microscopy (CLEM) workflow solution designed to increase experimental success rates, improve reproducibility, and simplify light and electron microscopy (EM) integration. Also, in October 2021, BD Life Sciences-Biosciences, in collaboration with Christian Medical College, Vellore, launched its second Center of Excellence (CoE) in flow cytometry for clinical research in India. Such developments boost the demand for cell surface markers detection, thereby driving the market growth.

However, the instruments' high cost and the techniques' complexity restrain the market growth.

Cell Surface Markers Detection Market Trends

Flow Cytometry Segment is Expected to Show a Significant Growth Over the Forecast Period.

Flow cytometry is a laser or an impedance-based technology used in cell counting, detecting biomarker, cell sorting, and protein engineering by suspending the cell in a stream of fluid and then passing it through a detection apparatus. It is the ideal tool to identify, characterize, and isolate stem and progenitor cells for research and potential clinical use. The growing adoption of flow cytometry in stem cell research and increasing applications of flow cytometry in clinical research are expected to drive the segment's growth over the forecast period. For instance, according to the National Clinical Trial Registry (NCT), as of April 21, 2021, there were about 320 registered clinical trials across different phases of development related to stem cell therapy in Germany. Thus, the growing research in stem cell therapy is anticipated to drive the demand for flow cytometry over the forecast period.

Additionally, the key strategies implemented by market players, such as launch, approval, partnerships, and collaborations, contribute to the segment's growth. For instance, in July 2021, Becton, Dickinson, and Company launched the reimagined digital marketplace for flow cytometry to provide an enhanced online purchasing experience for users and their procurement teams. The new BD Biosciences marketplace offers a full array of BD's research, clinical, and single-cell multi-omic products, making it an online destination for the most comprehensive flow cytometry users.

Hence, as per the factors mentioned above, the flow cytometry segment will likely grow in the cell surface markers detection market over the forecast period.

North America Dominates the Market and is Expected to Retain its Market Share During the Forecast Period

North America is expected to maintain its overall cell surface markers detection market supremacy throughout the forecast period. Rapidly growing applications in disease diagnostics, the presence of well-established research institutions, and the biotech industry are the primary factors behind the significant market share. The increase in government initiatives toward R&D is contributing to market growth. For instance, as per a 2021 update by the University of North Dakota, the UND Center of Biomedical Research Excellence (CoBRE) in Host-Pathogen interactions (HPI) learned that it will continue to receive National Institutes of Health (NIH) funding through the project's Phase 2. The renewal amount was more than USD 10.7 million to UND for the multi-year project for obtaining a better understanding of the host responses to viral, bacterial, and parasitic infections that cause acute and chronic inflammatory disorders. The Center will also enhance the innovative research capabilities of the School of Medicine & Health Sciences (SMHS) and UND by supporting three existing Phase 1 Core facilities, including flow cytometry. Such developments are anticipated to contribute to the growth of the market in the region.

Additionally, the presence of major market players and key strategies implemented by them such as partnerships and collaborations are also contributing to the market growth. For instance, in September 2021, PHC Corporation of North America and Screen Holdings Co., Ltd partnered to market the Screen Cell imager series of cell imaging systems in North America. Similarly, in August 2021, Becton, Dickinson and Company launched a new benchtop cell analyzer, BD FACSymphony A1 Cell Analyzer. The fluorescence-activated cell analyzer is expected to equip laboratories of all sizes with sophisticated flow cytometry capabilities. Such development is expected to drive the growth of the market over the forecast period.

Cell Surface Markers Detection Industry Overview

The cell surface markers detection market is fragmented in nature due to the presence of several companies operating globally as well as regionally. The competitive landscape includes an analysis of a few well-known international and local companies that hold market shares and are well-known, including Becton, Dickinson and Company, Nihon Kohden Corporation, Sysmex Corporation, Diasorin SpA (Luminex Corporation), and Thermo Fisher Scientific Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased Use of Cell Surface Markers Detection in Diagnostics

- 4.2.2 Technological Advances Related to Increased Throughput and Automation

- 4.2.3 Increasing Demand for Precision Medicine

- 4.3 Market Restraints

- 4.3.1 High Cost of Instruments

- 4.3.2 Complexity of Techniques

- 4.4 Porter Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Million)

- 5.1 Product

- 5.1.1 Flow Cytometry

- 5.1.2 Hematology Analyzers

- 5.1.3 Cell Imaging Systems

- 5.1.4 Reagents and Kits

- 5.1.5 Other Products

- 5.2 Application

- 5.2.1 Disease Diagnosis and Identification

- 5.2.2 Research and Drug Discovery

- 5.2.3 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Abbott Laboratories

- 6.1.2 Danaher Corporation (Beckman Coulter Inc.)

- 6.1.3 Becton, Dickinson and Company

- 6.1.4 Bio Rad Laboratories Inc.

- 6.1.5 F. Hoffmann-La Roche Ltd

- 6.1.6 Diasorin SpA (Luminex Corporation)

- 6.1.7 Nihon Kohden Corporation

- 6.1.8 Qiagen NV

- 6.1.9 Siemens Healthineers

- 6.1.10 Thermo Fisher Scientific Inc.

- 6.1.11 Grifols SA

- 6.1.12 Nexcelom Bioscience LLC

- 6.1.13 IVD Medical Holding Limited (Immucor Inc.)

- 6.1.14 Agilent Technologies Inc.

- 6.1.15 Sysmex Corporation