|

시장보고서

상품코드

1851014

데이터센터 액침 냉각 시장 : 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Data Center Immersion Cooling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

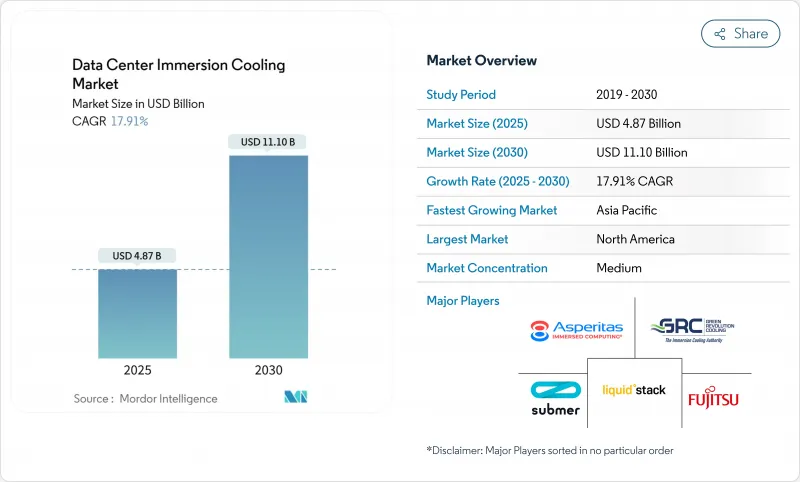

2025년 데이터센터 액침 냉각 시장 규모는 48억7,000만 달러, 2030년에는 111억 달러에 이를 것으로 예측되며 CAGR은 17.91%를 나타낼 전망입니다.

이러한 급성장은 AI 및 머신러닝 작업 부하가 랙당 50kW를 초과하여 랙의 전력 밀도가 급격히 상승함에 대한 업계의 반응을 반영합니다. 운영자는 침지 기술을 성능을 유지하고 시설의 풋 프린트를 줄이고 PFAS 기반 냉각수에 대한 향후 규정을 준수하기 위한 경로로 간주합니다. 북미에서는 하이퍼스케일 클라우드 프로바이더에 의한 프로덕션 스케일의 전개가 채택의 중심이 되고 있으며, 아시아태평양에서는 일본, 중국, 남미가 액냉 AI 클러스터를 지지해, 급성장을 나타내고 있습니다. 기술 측면에서는 설치가 용이한 단상 시스템이 압도적인 점유율을 유지하고 있지만, 극한의 밀도와 펌프 불필요한 아키텍처가 필수적인 파일럿에서는 2상 설계가 승리를 거두고 있습니다.

세계 데이터센터 액침 냉각 시장 동향과 통찰

하이퍼스케일 데이터센터의 보급

일반 AI 서비스에 대한 수요가 급증함에 따라 선도적인 클라우드 공급업체는 100kW 이상의 랙 밀도를 목표로 하는 하이퍼스케일 사이트를 신설해야 합니다. Google의 액침 냉각 TPU 포드를 사용하면 대규모 공급자가 건물 확장을 위한 부동산 요구사항과 자본 투자를 줄이기 위해 액체 기술을 표준화하고 있음을 보여줍니다. Microsoft는 워싱턴 주 퀸시 캠퍼스에서 밀도 확장이 용이하고 총 소유 비용 메트릭스가 유리한 것으로 생산형 2상 탱크를 검증했습니다. 포트폴리오 수준에서 액침 냉각을 적용하면 운영자는 동일한 면적에 10-15배의 컴퓨트를 채울 수 있어 AI 서비스 수익화까지의 시간 단축에 직결됩니다. 하이퍼스케일의 도입은 평방 피트당 이용률을 향상시킬 수 있다는 것이 여전히 가장 큰 경제적 요인이 되고 있습니다.

AI/ML 워크로드로 랙 파워 밀도 상승

KDDI의 컨테이너형 사이트의 실지 데이터에서는 단상 침지에 의해 서버 랙의 소비 전력이 43% 삭감되어 PUE는 1.07 미만입니다. 에너지제약이 있는 지역사업자는 전기요금의 상승과 탄소세를 상쇄하기 위해 이러한 절약을 이용하고 있습니다. 유럽의 시설에서는 2030년까지 에너지 사용량을 11.7% 삭감하는 것이 EU 에너지 효율 지령으로 의무화되고 있습니다. PUE 값 1.1 이하를 달성하는 침지 능력은 실용적인 컴플라이언스 경로를 제공합니다. PUE 값이 1.1 미만을 달성할 수 있는 침지 기술은 현실적인 컴플라이언스에 대한 경로를 제공합니다. 지속적인 부스트 주파수 향상으로 인해 와트당 연산량이 증가하므로 서버 수준에서도 추가적인 이점이 생깁니다.

5G/IoT용 에지 마이크로 데이터센터 확장

통신 사업자 및 산업 기업은 5G의 대기 시간 목표를 달성하기 위해 최종 사용자당에 마이크로 모듈을 배포합니다. HVAC 인프라가 제한된 지역과 혹독한 기후 지역에서는 밀폐된 단상 탱크가 냉수 플랜트 없이 작동하는 자율 에지 노드를 제공합니다. 동남아시아의 초기 시험 운용은 기존의 공냉식 랙을 기능부전에 빠지는 먼지, 습도, 온도 변동에도 침지 시스템이 견딜 수 있음이 입증되었습니다.

부문 분석

2024년에는 단상 시스템이 80.9%의 점유율을 차지했지만, 2030년까지는 2상 시스템이 연률 21.6%로 증가할 것으로 예측됩니다. 이 가속은 저압 비등에 의한 우수한 열 흐름 제거를 반영하며, 수동 커패시터는 펌프나 2차 루프 없이 열을 제거할 수 있습니다. Microsoft의 퀸시 배포는 상 변화 탱크로 100kW 생산 랙을 유지하는 방법을 보여줍니다.

특히 미네랄 오일과 합성 탄화수소가 예측 가능한 점성과 다양한 구성 요소와의 호환성을 제공하는 경우입니다. 그러나 최신 1kW GPU로 구축된 AI 팹에서는 펌프의 고장을 없애고 데이터센터의 폐열을 지역 난방 방식에 이용하기 때문에 2상 셋업을 선택하는 경우가 늘고 있습니다. 공급업체가 탱크 설치 면적을 줄이고 프리차지 카세트를 도입함에 따라 학습 곡선이 단축되고 2상 시스템이 미래에 점유율을 확대할 무대가 갖추어지고 있습니다. 그 결과, 데이터센터 액침 냉각 시장은 단상이 레거시의 리프레시 비용을 지배하는 한편, 2상이 극도의 밀도에 대응한 신설 풋 프린트를 획득한다는 2개 세운 에코시스템으로 진화합니다.

합성 탄화수소 유체는 저점도와 강력한 재료 적합성으로 인해 2024년 매출의 41.2%를 차지하며 대부분의 단상 배치에 있어서 사실상의 기준선이 되고 있습니다. 과거 암호화폐 광산으로 쫓겨났던 광유는 다시 주류가 되어 정제업자가 수명의 연장목표를 충족하는 보다 깨끗한 컷을 제공하기 때문에 2030년까지 18.4%의 성장이 예측되고 있습니다. 이에 불소 화합물 혼합물은 PFAS 규제 하에서 엄격한 감독 대상이 되고 있으며, 바이오 유도체를 시험 단계로 끌어 올리는 촉매 역할을 하고 있습니다.

루브리졸의 CompuZol 패밀리는 170℃ 이상의 인화점을 유지하면서 열전도율을 0.15W/m·K까지 밀어 올리는 합성탄화수소를 실증하고 있습니다. TotalEnergies의 BioLife 제품은 추적성이 있는 식물 유래 스톡이 석유화학제품에 필적하는 성능을 가지면서 EU 폐기물 규제를 충족하는 신속한 생분해를 실현한다는 것을 보여줍니다. 쿨런트의 선택은 씰의 적합성, 절연 내력, 폐기 경로를 좌우하기 때문에 사업자는 장시간의 적격성 확인 프로그램을 계속 실시해, 유체 공급자가 데이터센터 액침 냉각 시장의 궤적에 대한 영향력을 강화하고 있습니다.

데이터센터의 액침냉각시장은 유형별(단상 액침냉각시스템, 2상 액침냉각시스템), 냉각유체별(광유, 탈이온수, 기타), 용도별(고성능 컴퓨팅(HPC), 엣지컴퓨팅, 기타), 데이터센터 유형별(하이퍼스케일/자작, 코로케이션/홀세일, 기타), 지역별로 분류되어 있습니다. 시장 예측은 금액(달러)으로 제공됩니다.

지역별 분석

북미는 2024년 매출의 44.8%를 차지하며, 하이퍼스케일 설비 투자와 파일럿에서 프로덕션으로의 전환을 신속하게 받아들이는 혁신 문화에 지지되고 있습니다. LiquidStack의 새로운 텍사스 시설은 현지 탱크 생산량을 3배로 늘리고 리드 타임을 단축하고 국내 공급망을 강화합니다. 규정된 장비의 의무가 아닌 자발적인 효율성 목표에 초점을 맞춘 정책의 틀로 인해, 사업자는 규제의 지연 없이 침수를 시도할 여유가 있습니다.

아시아태평양은 CAGR 19.6%에서 가장 급성장하고 있으며, 정부가 지원하는 AI 슈퍼컴퓨터와 데이터 주권 구상이 이에 박차를 가하고 있습니다. 일본의 KDDI는 컨테이너형 단상 리그를 도입한 결과 PUE 값이 1.05에 가까워졌습니다는 것을 기록하고 통신 에지 이용 사례에 있어서의 액침의 유효성을 실증했습니다. 중국 해안 수중 데이터센터의 개념 증명은 부식과 습도를 줄이기 위해 침지에 의존하는 참신한 설치 전략을 보여줍니다.

유럽에서는 규제가 주요 채용 요인입니다. 2024년 EU의 지속가능성에 대한 정보공개 요건은 사업자에게 에너지와 물 사용량을 줄이도록 촉구하고 침수를 매력적으로 하고 있습니다. 네덜란드에서는 급기온도 27 ° 덴마크의 수영장에 전원을 공급하는 것과 같은 열 재사용 파일럿 사업은 침지 프로젝트의 경제성을 더욱 향상시키고 운영자가 열 인수 계약을 통해 비용을 회수 할 수 있도록 합니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 하이퍼스케일 데이터센터의 보급

- AI/ML 워크로드에 의한 랙 파워 밀도의 상승

- 공냉보다 우수한 에너지 효율과 PUE를 실현

- PFAS가 없는 바이오 기반 냉각제에 대한 규제 추진

- 5G/IoT를 위한 엣지 마이크로 데이터 센터 확장

- TDP1kW를 넘는 액침 대응 실리콘 패키지의 발매

- 시장 성장 억제요인

- 고액의 초기 투자와 시설 재설계 비용

- 분산화 된 규격과 벤더의 상호 운용성의 갭

- 불소화 유전체의 공급망 위험

- 보증을 무효로 하는 재료 적합성의 우려

- 공급망 분석

- 규제 상황

- 기술의 전망

- 데이터센터 냉각의 진화

- 에너지 소비와 연산 밀도의 지표

- 유체, 프로세서, GPU, 랙, 인프라 분해

- Porter's Five Forces

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 경쟁도

- 대체품의 위협

- 시장의 거시경제 요인 평가

제5장 시장 규모와 성장 예측

- 유형별

- 단상 액침 냉각 시스템

- 2상 액침 냉각 시스템

- 냉각액별

- 광물유

- 탈이온수

- 플루오로카본계 작동유

- 합성 탄화수소 유체

- 바이오 유체

- 용도별

- 고성능 컴퓨팅(HPC)

- 엣지 컴퓨팅

- 인공지능과 머신러닝

- 암호화폐 채굴

- 클라우드 및 하이퍼스케일 데이터센터

- 기타 용도

- 데이터센터 유형별

- 하이퍼스케일/셀프 빌드

- 코로케이션/홀세일

- 엔터프라이즈/에지 데이터센터

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 유럽

- 독일

- 영국

- 프랑스

- 네덜란드

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 호주 및 뉴질랜드

- 기타 아시아태평양

- 중동 및 아프리카

- 중동

- 아랍에미리트(UAE)

- 사우디아라비아

- 튀르키예

- 기타 중동

- 아프리카

- 남아프리카

- 이집트

- 나이지리아

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Fujitsu Limited

- Green Revolution Cooling(GRC) Inc.

- Submer Technologies SL

- LiquidStack Inc.

- Asperitas

- LiquidCool Solutions

- Midas Green Technologies

- Iceotope Technologies Ltd.

- Wiwynn Corporation

- DCX Ltd.

- Dell Technologies

- Intel Corporation

- Schneider Electric SE

- Vertiv Holdings Co.

- NVIDIA Corporation

- Asetek A/S

- Shell plc(Immersion Cooling Fluids)

- Cargill Inc.(NatureCool)

- 3M Company

- Chemours Company

- Molex LLC

- Hypertec Group

- Alibaba Cloud

- Tencent Cloud

제7장 시장 기회와 장래의 전망

SHW 25.11.11The data center immersion cooling market is valued at USD 4.87 billion in 2025 and is forecast to reach USD 11.10 billion by 2030, registering a 17.91% CAGR.

This rapid climb mirrors the industry's response to soaring rack power densities driven by AI and machine-learning workloads that regularly exceed 50 kW per rack. Operators view immersion technology as a route to maintain performance, shrink facility footprints, and comply with upcoming restrictions on PFAS-based coolants. North America anchors adoption through production-scale rollouts by the hyperscale cloud providers, while Asia-Pacific exhibits the steepest growth as Japan, China, and South Korea champion liquid-cooled AI clusters. On the technology front, single-phase systems retain the lion's share because of installation familiarity, yet two-phase designs are winning pilots where extreme density and pump-free architectures are essential.

Global Data Center Immersion Cooling Market Trends and Insights

Proliferation of Hyperscale Data Centers

Surging demand for generative-AI services compels the leading cloud providers to erect new hyperscale sites that often target rack densities above 100 kW. Google's use of immersion-cooled TPU pods illustrates how large providers are standardizing liquid technologies to curtail real-estate requirements and capex for building expansion. Microsoft has validated production two-phase tanks at its Quincy, Washington, campus, citing easier density scaling and favorable total-cost-of-ownership metrics. When applied atthe portfolio level, immersion cooling enables operators to pack 10-15X more compute into the same footprint, directly translating into faster time-to-revenue for AI services. The ability to drive higher utilization from every square foot remains the strongest economic lever motivating hyperscale adoption.

Rising Rack-Power Densities from AI/ML Workloads

Field data from KDDI's containerized sites shows single-phase immersion cutting server-rack power draw by 43% while achieving PUE below 1.07. Operators in energy-constrained locales exploit such savings to offset rising electricity tariffs and carbon taxes. European facilities face the EU Energy Efficiency Directive's mandated 11.7% reduction in energy use by 2030; immersion's ability to hit sub-1.1 PUE values provides a practical compliance pathway. Further benefits emerge at the server level, as sustained higher boost frequencies translate into more compute per watt.

Expansion of Edge Micro-Data Centers for 5G/IoT

Telecom carriers and industrial firms are rolling out micro-modules close to end-users to meet 5G latency targets. In regions with limited HVAC infrastructure or hostile climates, sealed single-phase tanks enable autonomous edge nodes that run without chilled-water plants. Early pilots across Southeast Asia illustrate that immersion systems can survive dust, humidity and temperature swings that cripple traditional air-cooled racks.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Push Toward PFAS-Free, Bio-Based Coolants

- Fragmented Standards and Vendor Interoperability Gaps

- High Upfront CAPEX and Facility-Redesign Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Single-phase systems dominated 2024 with 80.9% share; however, two-phase designs are forecast to compound at 21.6% annually to 2030. That acceleration reflects superior heat-flux removal through low-pressure boiling, which allows passive condensers to reject heat without pumps or secondary loops. Microsoft's Quincy deployment showcases how phase-change tanks sustain 100 kW racks in production.

In enterprise pilots, operators prefer single-phase solutions for ease of maintenance and established supply chains, particularly where mineral oil or synthetic hydrocarbons offer predictable viscosity and broad component compatibility. Yet AI fabs built on the latest 1 kW GPUs increasingly select two-phase setups to eliminate pump failures and tap datacenter waste heat for district-heating schemes. As suppliers shrink tank footprints and introduce pre-charged cassettes, the learning curve shortens, setting the stage for two-phase systems to claim incremental share over the forecast horizon. The data center immersion cooling market consequently evolves toward a dual-track ecosystem where single-phase dominates legacy refresh spend while two-phase captures new-build footprints geared for extreme density.

Synthetic hydrocarbon fluids held 41.2% of 2024 revenue thanks to their low viscosity and strong material compatibility, making them the de-facto baseline across most single-phase deployments. Mineral oils, once relegated to cryptocurrency mines, re-enter mainstream consideration and are projected to grow 18.4% through 2030 as refiners deliver cleaner cuts that meet extended service-life targets. In comparison, fluorocarbon blends face heightened scrutiny under PFAS regulation, a headwind that propels bio-derivatives into pilot stages.

Lubrizol's CompuZol family demonstrates synthetic hydrocarbons pushing thermal conductivity to 0.15 W/m-K while preserving flash points above 170 °C. TotalEnergies' BioLife products illustrate how traceable plant-based stocks can equal petrochemical performance yet biodegrade rapidly, satisfying EU waste directives. Because coolant selection dictates seal compatibility, dielectric strength and disposal pathways, operators continue to conduct lengthy qualification programs, reinforcing fluid suppliers' influence over the data center immersion cooling market trajectory.

Data Center Immersion Cooling Market is Segmented by Type ( Single-Phase Immersion Cooling System, Two-Phase Immersion Cooling System), Cooling Fluid ( Mineral Oil, De-Ionized Water, and More), Application ( High-Performance Computing (HPC), Edge Computing, and More), Data Center Type (Hyperscale/Self-Built, Colocation / Wholesale, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 44.8% of 2024 revenue, underpinned by hyperscale capital expenditure and an innovation culture that embraces pilot-to-production transitions rapidly. LiquidStack's new Texas facility triples local tank output, shortening lead times and reinforcing domestic supply chains Policy frameworks focused on voluntary efficiency goals rather than prescriptive equipment mandates grant operators leeway to trial immersion without regulatory delays.

Asia-Pacific is the fastest-growing region at 19.6% CAGR, spurred by government-backed AI supercomputers and data-sovereignty initiatives. Japan's KDDI recorded PUE values approaching 1.05 after deploying containerized single-phase rigs, validating immersion for telecom edge use cases. China's coastal underwater data center proofs of concept illustrate novel siting strategies that rely on immersion to mitigate corrosion and humidity.

Europe leans on regulation as the primary adoption driver. The 2024 EU sustainability disclosure requirement pushes operators to cut both energy and water usage, making immersion attractive. The Netherlands enforces 27 °C supply-air ceilings that air-cooling systems struggle to meet, accelerating liquid retrofits in Amsterdam facilities. Heat-reuse pilots, such as feeding swimming pools in Denmark, further improve immersion project economics, enabling operators to recoup costs via heat-offtake agreements.

- Fujitsu Limited

- Green Revolution Cooling (GRC) Inc.

- Submer Technologies SL

- LiquidStack Inc.

- Asperitas

- LiquidCool Solutions

- Midas Green Technologies

- Iceotope Technologies Ltd.

- Wiwynn Corporation

- DCX Ltd.

- Dell Technologies

- Intel Corporation

- Schneider Electric SE

- Vertiv Holdings Co.

- NVIDIA Corporation

- Asetek A/S

- Shell plc (Immersion Cooling Fluids)

- Cargill Inc. (NatureCool)

- 3M Company

- Chemours Company

- Molex LLC

- Hypertec Group

- Alibaba Cloud

- Tencent Cloud

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of hyperscale data centers

- 4.2.2 Rising rack-power densities from AI/ML workloads

- 4.2.3 Superior energy-efficiency and PUE gains over air cooling

- 4.2.4 Regulatory push toward PFAS-free, bio-based coolants

- 4.2.5 Expansion of edge micro-data-centers for 5G/IoT

- 4.2.6 Launch of immersion-ready silicon packages greater than1 kW TDP

- 4.3 Market Restraints

- 4.3.1 High upfront CAPEX and facility-redesign costs

- 4.3.2 Fragmented standards and vendor interoperability gaps

- 4.3.3 Supply-chain risk for fluorinated dielectrics

- 4.3.4 Material-compatibility concerns voiding warranties

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.6.1 Evolution of Data-Center Cooling

- 4.6.2 Energy-consumption and compute-density metrics

- 4.6.3 Teardown of fluids, processors, GPUs, racks and infra

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Degree of Competition

- 4.7.5 Threat of Substitutes

- 4.8 Assesment of Macroeconomic Factors on the Market

5 MARKET SIZE and GROWTH FORECASTS(VALUE)

- 5.1 By Type

- 5.1.1 Single-Phase Immersion Cooling System

- 5.1.2 Two-Phase Immersion Cooling System

- 5.2 By Cooling Fluid

- 5.2.1 Mineral Oil

- 5.2.2 De-ionized Water

- 5.2.3 Fluorocarbon-based Fluids

- 5.2.4 Synthetic Hydrocarbon Fluids

- 5.2.5 Bio-based Fluids

- 5.3 By Application

- 5.3.1 High-Performance Computing (HPC)

- 5.3.2 Edge Computing

- 5.3.3 Artificial Intelligence and Machine Learning

- 5.3.4 Cryptocurrency Mining

- 5.3.5 Cloud and Hyperscale Data Centers

- 5.3.6 Other Applications

- 5.4 By Data Center Type

- 5.4.1 Hyperscale/Self-Built

- 5.4.2 Colocation / Wholesale

- 5.4.3 Enterprise/Edge Data Centers

- 5.5 By Geography (Value)

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Netherlands

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Nigeria

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Fujitsu Limited

- 6.4.2 Green Revolution Cooling (GRC) Inc.

- 6.4.3 Submer Technologies SL

- 6.4.4 LiquidStack Inc.

- 6.4.5 Asperitas

- 6.4.6 LiquidCool Solutions

- 6.4.7 Midas Green Technologies

- 6.4.8 Iceotope Technologies Ltd.

- 6.4.9 Wiwynn Corporation

- 6.4.10 DCX Ltd.

- 6.4.11 Dell Technologies

- 6.4.12 Intel Corporation

- 6.4.13 Schneider Electric SE

- 6.4.14 Vertiv Holdings Co.

- 6.4.15 NVIDIA Corporation

- 6.4.16 Asetek A/S

- 6.4.17 Shell plc (Immersion Cooling Fluids)

- 6.4.18 Cargill Inc. (NatureCool)

- 6.4.19 3M Company

- 6.4.20 Chemours Company

- 6.4.21 Molex LLC

- 6.4.22 Hypertec Group

- 6.4.23 Alibaba Cloud

- 6.4.24 Tencent Cloud

7 MARKET OPPORTUNITIES and FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment