|

시장보고서

상품코드

1687902

멸균 장비 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Global Sterilization Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

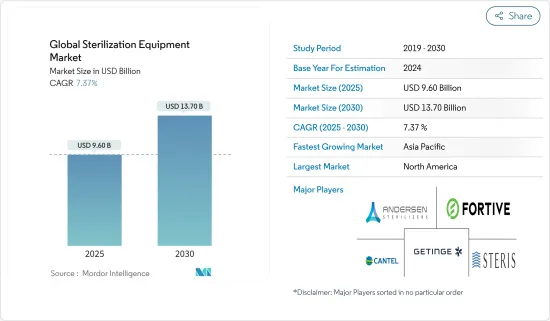

세계의 멸균 장비 시장 규모는 2025년에 96억 달러로 추정되고, 예측 기간인 2025-2030년 CAGR 7.37%로 성장할 전망이며, 2030년에는 137억 달러에 달할 것으로 예측됩니다.

COVID-19 팬데믹은 의료의 우선 순위를 바꾸고 의료 관리에 악영향을 미쳤습니다. 팬데믹 초기에는 몇몇 국가가 봉쇄 상태에 있었습니다. 타국과의 무역을 중단하고 도항 제한을 실시했기 때문에 2020년 전반에는 치료, 진단, 외과 수술 등의 의료 서비스가 저하되었습니다. 코로나19 임상 관리에서는 병원 내 감염을 막는 것이 중요했습니다. 2021년 8월 발표된 '영국의 첫 번째 코로나19 팬데믹 물결에서의 병원 내 사스-CoV-2 감염'이라는 제목의 연구에 따르면 영국의 314개 병원에서 코로나19에 감염된 환자의 11.3%가 입원 후 감염되었습니다. 이 비율은 2020년 5월에는 15.8%로 증가했습니다. 이처럼 이 유행은 의료 시설의 원내 감염관리 능력에 영향을 미쳐 멸균 장비 수요를 크게 증가시켰습니다. 코로나19 증례가 증가함에 따라 정부 관련 단체들도 코로나19의 영향을 경감하기 위해 노력하고 있습니다. 예를 들면, 미국 식품의약국(USFDA)에 의한 2020년 3월 갱신, 산업과 식품의약국 스탭용 가이던스에 의하면 멸균 또는 소독된 의료 장비의 신속한 회전을 촉진하고, 코로나19 팬데믹 시 공중위생상의 긴급사태 때문에 환자나 의료 종사자가 SARS-CoV-2에 바이러스 노출될 위험을 저감하는데 도움이 되는 멸균 장비, 소독 장치, 공기청정기의 공급을 유지하는 것이 적절하다고 합니다. USFDA는 이 공중보건 비상사태에서 멸균 장비, 소독 장치, 공기청정기의 이용 가능성을 높임으로써 이러한 긴급한 공중보건 우려에 대처할 수 있다고 생각합니다.

세계 인구가 증가함에 따라 다양한 감염의 유행이 급속히 증가하고 있습니다. 이 질병의 대부분은 의료 개입과 수술을 필요로 합니다. 수술에 사용되는 기구나 장비는 멸균해야 합니다. 또한 감염된 기구가 질병의 상호 감염을 일으킬 가능성도 있습니다. 미국성형외과학회에 따르면 '전미성형외과 통계 2020'에 따르면 2020년에는 미국에서 231만 4720건의 성형외과 수술이 진행됐고, 2019년에는 267만 8302건의 수술이 이뤄졌습니다. 또한 2020년과 2019년에 진행된 재건 수술의 총 수는 각각 687만 8,486건과 665만 2,591건이었습니다. 이러한 수술에는 멸균된 기구가 필요하기 때문에 시장은 향후 몇 년간 큰 성장이 예상됩니다.

이러한 요인에 의해 감염증의 추가 만연을 막기 위한 멸균 장비의 요구가 높아지고 있습니다. 제약회사의 진출도 시장 성장의 큰 요인이 되고 있습니다. 그러나 이들 장치의 승인이나 제조에 관한 엄격한 규제기준이나 일부 장치에 화학멸균제로 사용되고 있는 약제가 눈이나 피부에 잠재적인 손상을 줄 가능성이 있다는 결점이 시장의 성장을 억제하고 있습니다.

멸균 장비 시장 동향

고온 살균 장치가 시장을 독점

고온 장비는 가장 널리 사용되며 가장 신뢰할 수 있는 멸균 장비입니다. 고온 멸균은 일반적으로 환자, 직원, 환경에 무해하며 높은 살미생물 효과가 있습니다. 또 의료장치 깊숙이 침투해 다른 멸균 장비에 비해 비용이 낮아 비용 대비 효과도 높습니다. 이러한 요인들이 시장에서 이 부문의 우위성의 요인이 되고 있습니다. 고온 멸균 장비는 증기 멸균과 건식 멸균으로 더욱 세분화됩니다.

일부 수술 증가는 그 과정에서 사용되는 수술 장비의 고온 멸균을 뒷받침하며,이 부문의 성장을 가속할 수 있습니다. American Joint Replacement Registry의 Annual Report 2020에 따르면 미국에서는 2012-2019년 189만 7,050건의 일차와 재치환 고관절 및 슬관절 형성술이 시행되었습니다. 또한 미국에서는 2012-2019년 약 99만 5,410건의 인공 슬관절 전치환술과 62만 5,097건의 인공 고관절 전치환술이 시행되었습니다.

미국 대사 및 비만외과학회 통계에 의하면, 미국만으로 2019년에 약 25만 6,000건, 2018년에 약 25만 2,000건의 수술이 행해졌습니다.이러한 통계는 비만 수술 건수 증가를 나타내고 있어 시장 전체의 성장을 견인하고 있습니다.

게다가 이 부문에서 신제품 출시는 시장 성장을 가속할 수 있습니다. 예를 들면, 2020년 5월, Esco는 Esco CelCulture CO2 Incubator with High Heat Sterilization(CCL-HHS)을 발매했습니다. 이는 작업 공간을 오염시킬 수 있는 내성진균, 세균 포자, 식물 세포를 사멸시키는 데 효과적인 것으로 증명되었습니다. 따라서 이러한 요인이 예측 기간 동안 동일 부문의 성장을 뒷받침할 것으로 예상됩니다.

북미가 가장 빠른 성장을 이룹니다.

북미는 멸균 장비 시장에서 플러스의 성장을 이루고 있으며, 예측 기간 중에도 대폭적인 성장이 예상됩니다. 2차 오염과 병원 내 감염 위험 증가, 수술 건수 증가, 대형 시장 진입 기업의 존재, 연구개발 절차 증가가 이 지역 시장을 견인할 것으로 예측됩니다. 미국은 북미 시장을 독점할 것으로 예상되고 있습니다.

미국 질병 예방 관리 센터가 발표한 '2020 HAI Progress Report Executive Summary' 보고서에 따르면 미국 환자의 약 31명 중 1명이 적어도 1건의 원내 감염에 영향을 받고 있으며, 이 나라 의료 시설에서 환자 케어의 실천을 개선할 필요성이 부각되고 있습니다. 이와 같이, 이 나라에서는 병원내 감염에 의해서, 병원의 커튼을 적시에 교환하는 등, 적절한 위생 유지와 멸균의 필요성이 높아지고 있습니다.

또, 노인층은 수술을 받기 쉽고, 면역력이 저하되어 있기 때문에 감염증의 리스크가 높다고 합니다. World Ageing Report 2019에 따르면 이 나라 노인은 2019년 5334만 명에서 2050년 8381만 3,000명으로 증가할 전망이어서 감염병 발생률이 높아지고 시장 성장에 기여합니다.

이 분야의 기술 진보도 시장을 견인하고 있습니다. 예를 들어, 2020년 9월 Midmark Corporation은 새로운 멸균 장비 데이터 로거와 업데이트된 Midmark M3 Steam Sterilizer를 출시하여 미국 치과 클리닉의 기구 처리 속도, 간편성, 컴플라이언스를 가져왔습니다.

따라서 의료기기 및 기타 기구 수요가 급증하고 멸균 장비 수요가 증가하고 있습니다.

멸균 장비 산업 개요

멸균 장비의 대부분은 세계 기업이 제조하고 있습니다. 더 많은 연구 자금과 우수한 유통 시스템을 가진 시장 리더가 시장에서의 지위를 확립하고 있습니다. 주요 시장 진입 기업은 Getinge AB, Fortive Corporation, Anderson Products, Cantel Medical, Steris PLC입니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 감염의 위험 증가

- 수술 건수 증가

- 제약 및 바이오테크놀러지 산업의 성장

- 시장 성장 억제요인

- 장비와 관련된 높은 비용

- 장치내의 화학제품에 대한 노출

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자 및 소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 장치별

- 고온 멸균

- 습식 및 증기 멸균

- 드라이 멸균

- 저온 멸균

- 산화에틸렌(ETO)

- 과산화수소

- 오존

- 기타 저온 살균 장치

- 여과 멸균

- 전리 방사선 멸균

- 전자빔 살균

- 감마선 멸균

- 기타 전리 방사선 멸균 장비

- 고온 멸균

- 최종 사용자별

- 병원 및 클리닉

- 제약 및 바이오테크놀러지 기업

- 교육 및 연구기관

- 음식 및 식품 산업

- 기타

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC 국가

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 기업 프로파일

- Fortive Corporation(Advanced Sterilization Products)

- Anderson Products

- Metal Zug Group(Belimed)

- Cantel Medical

- Getinge AB

- Matachana Group

- MMM Group

- STERIS PLC

- Systec GmbH

- Stryker Corporation(TSO3 INC.)

제7장 시장 기회 및 향후 동향

AJY 25.05.07The Global Sterilization Equipment Market size is estimated at USD 9.60 billion in 2025, and is expected to reach USD 13.70 billion by 2030, at a CAGR of 7.37% during the forecast period (2025-2030).

The COVID-19 pandemic has altered healthcare priorities, adversely impacting healthcare management. In the initial days of the pandemic, several countries were in lockdown. They suspended trade with other countries and implemented travel restrictions, leading to a decline in healthcare services such as treatments, diagnosis, and surgical procedures in the first half of 2020. Preventing hospital-acquired infections is a critical aspect of the clinical management of COVID-19, as hospital-acquired infections have been a common feature of such outbreaks. According to the study titled 'Hospital-acquired SARS-CoV-2 infection in the UK's first COVID-19 pandemic wave', published in August 2021, 11.3% of patients with COVID-19 in 314 UK hospitals became infected after hospital admission. This rate increased to 15.8% in May 2020. Thus, the outbreak has impacted the healthcare facilities' ability to manage hospital-acquired infections, significantly increasing the demand for sterilizers. Due to the rising COVID-19 cases, government associations also worked toward reducing the COVID-19 impact. For instance, as per a March 2020 update by the US Food and Drug Administration (USFDA), Guidance for Industry and Food and Drug Administration Staff, it is adequate to maintain the supply of sterilizers, disinfectant devices, and air purifiers that can facilitate the rapid turnaround of sterilized or disinfected medical equipment and help reduce the risk of viral exposure for patients and healthcare providers to SARS-CoV-2 for public health emergency during the COVID-19 pandemic. The USFDA believes that the policy outlined will help address these urgent public health concerns by increasing the availability of sterilizers, disinfectant devices, and air purifiers during this public health emergency.

With the growing global population, the prevalence of various infectious diseases has rapidly increased. Many of these diseases require medical interventions and surgeries. The instruments and devices used in the surgeries need to be sterilized. Moreover, the infected instruments may give rise to the cross-transmission of diseases. According to the National Plastic Surgery Statistics 2020 by the American Society of Plastic Surgeons, 2,314720 cosmetic surgical procedures were performed in the United States in 2020, and 2,678,302 surgeries were performed in 2019. Additionally, the total number of reconstructive procedures performed in 2020 and 2019 were 6,878,486 and 6,652,591, respectively, in the United States. As these surgeries require sterilized instruments, the market is expected to witness significant growth in the coming years.

These factors have given rise to the need for sterilization equipment to prevent the further spread of infectious diseases. The expansion of pharmaceutical companies has also been a major factor in the market's growth. However, stringent regulatory standards for approval, production of these devices, and disadvantages of chemical agents used as chemical sterilants in some equipment, which may cause potential damage to the eyes and skin, have been restraining the market's growth.

Sterilization Equipment Market Trends

High-temperature Sterilization Equipment Dominates the Market

High-temperature equipment is the most widely used and the most dependable sterilization equipment. High-temperature sterilization is usually nontoxic to patients, staff, and the environment and is highly microbicidal. It also penetrates deep into the medical devices and is less costly than other sterilization equipment, thus making it cost-effective. These factors are responsible for the dominance of this segment in the market. High-temperature sterilization equipment is further sub-segmented into steam sterilization and dry sterilization.

The increasing number of several surgical procedures is boosting the high-temperature sterilization of surgical devices used in the process, which may drive the segment's growth. As per the American Joint Replacement Registry's Annual Report 2020, 1,897,050 primary and revision hip and knee arthroplasty procedures were performed between 2012 and 2019 in the United States. About 995,410 total knee arthroplasty and 625,097 total hip arthroplasty were also performed from 2012 to 2019 in the United States.

According to the American Society for Metabolic and Bariatric Surgery Statistics, around 256,000 surgeries and 252,000 surgeries were performed in 2019 and 2018, respectively, in the United States alone. These statistics show an increase in the number of bariatric surgeries, which is driving the growth of the overall market.

Moreover, the launch of new products in the segment may drive the market's growth. For instance, in May 2020, Esco launched Esco CelCulture CO2 Incubator with High Heat Sterilization (CCL-HHS). It has proven effective in killing resistant fungi, bacterial spore, and vegetative cells that may contaminate the workspace. Thus, such factors are expected to boost the segment's growth during the forecast period.

North America to Witness the Fastest Growth

North America experienced positive growth in the sterilization equipment market, and it is estimated to witness significant growth over the forecast period. The increasing risk of cross-contamination and hospital-acquired infections, rising number of surgeries, the presence of major market players, and growth in R&D procedures are expected to drive the market in the region. The United States is expected to dominate the North American market.

According to the '2020 HAI Progress Report Executive Summary' report published by the Centers for Disease Control and Prevention, approximately one in 31 US patients contract at least one hospital-acquired infection, highlighting the need for improvements in patient care practices in the country's healthcare facilities. Thus, hospital-acquired infections in the country are driving the need for proper hygiene maintenance and sterilization, including timely changing of hospital curtains.

In addition, the elderly population is prone to surgeries and is at higher risk of infections due to a weakened immune system. According to the World Ageing Report 2019, the country's elderly population is expected to increase from 53.340 million in 2019 to 83.813 million in 2050, thus increasing the incidence of infectious diseases and contributing to the market's growth.

The technological advancements in the field are also driving the market. For instance, in September 2020, Midmark Corporation launched the new Sterilizer Data Logger and the updated Midmark M3 Steam Sterilizer, bringing speed, simplicity, and compliance to instrument processing in dental practices in the United States.

Hence, there has been a surge in demand for medical devices and other instruments, increasing the demand for sterilization equipment.

Sterilization Equipment Industry Overview

The majority of sterilization equipment is being manufactured by global players. Market leaders with more funds for research and a better distribution system established their positions in the market. Major market players are Getinge AB, Fortive Corporation, Anderson Products, Cantel Medical, and Steris PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Risks of Cross-transmission

- 4.2.2 Increasing Number of Surgical Procedures

- 4.2.3 Growth in Pharmaceutical and Biotechnology Industries

- 4.3 Market Restraints

- 4.3.1 High Cost Associated with the Device

- 4.3.2 Exposure to Chemicals in Equipments

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Equipment

- 5.1.1 High-temperature Sterilization

- 5.1.1.1 Wet/Steam Sterilization

- 5.1.1.2 Dry Sterilization

- 5.1.2 Low-temperature Sterilization

- 5.1.2.1 Ethylene Oxide (ETO)

- 5.1.2.2 Hydrogen Peroxide

- 5.1.2.3 Ozone

- 5.1.2.4 Other Low-temperature Sterilization Equipment

- 5.1.3 Filtration Sterilization

- 5.1.4 Ionizing Radiation Sterilization

- 5.1.4.1 E-beam Radiation Sterilization

- 5.1.4.2 Gamma Sterilization

- 5.1.4.3 Other Ionizing Radiation Sterilization Equipment

- 5.1.1 High-temperature Sterilization

- 5.2 By End User

- 5.2.1 Hospitals and Clinics

- 5.2.2 Pharmaceutical and Biotechnology Companies

- 5.2.3 Education and Research Institutes

- 5.2.4 Food and Beverage Industries

- 5.2.5 Other End Users

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle-East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle-East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Fortive Corporation (Advanced Sterilization Products)

- 6.1.2 Anderson Products

- 6.1.3 Metall Zug Group (Belimed)

- 6.1.4 Cantel Medical

- 6.1.5 Getinge AB

- 6.1.6 Matachana Group

- 6.1.7 MMM Group

- 6.1.8 STERIS PLC

- 6.1.9 Systec GmbH

- 6.1.10 Stryker Corporation (TSO3 INC.)