|

시장보고서

상품코드

1852125

DNA 시퀀싱 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)DNA Sequencing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

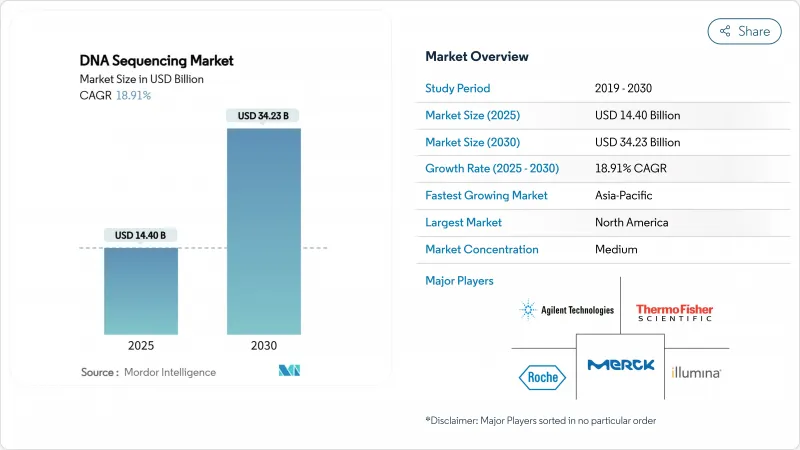

DNA 시퀀싱 시장 규모는 2025년에 144억 달러에 달하고, 2030년에는 342억 3,000만 달러에 이를 것으로 예상되며, 예측 기간 중 CAGR은 18.91%를 나타낼 전망입니다.

수요는 학술적 발견에서 종양학, 희귀질환, 감염성 감시에서 일상적인 임상 검사로 이동하고 있습니다. 유전체당 비용의 지속적인 하락, 상환의 꾸준한 확대, 정부 출자의 정밀의료 프로그램에 의해 환자에 대한 접근이 확대되는 한편, 장치의 설치 대수도 증가하고 있습니다. 나노포어를 비롯한 롱 리드 플랫폼은 복잡한 유전체 영역을 해명함으로써 짧은 리드의 아성을 무너뜨리고 있으며, 클라우드 바이오인포매틱스와 AI 파이프라인은 해석을 합리화하고 소요 시간을 단축하고 있습니다. 그럼에도 불구하고 단편화된 데이터 프라이버시 규칙과 지정 학적 공급 체인 위험은 컴플라이언스 비용을 높이고 시약 연속성을 위협하기 때문에 성장 추세가 약해졌습니다.

세계의 DNA 시퀀싱 시장 동향과 인사이트

유전체 당 비용 저하가 접근에 혁명을 가져옵니다.

인간 전체 유전체의 시퀀싱 비용은 2007년 100만 달러에서 2025년 600달러 이하로 떨어졌으며 지역 병원에서 일상적인 사용이 가능해졌습니다. 일루미나의 NovaSeq X는 이 숫자를 200달러 이하로 낮추고 Ultima Genomics는 100달러의 유전체을 판매하고 데이터 분석 도구에 대한 예산 배분을 바꿉니다. 영국의 종양센터는 현재 소아암에 전체 유전체 시퀀싱를 도입하고 있으며, 독일과 스웨덴도 비슷한 프로그램을 시험적으로 실시했습니다. 공급업체는 하드웨어 판매에서 용도 특화된 솔루션으로 액슬을 옮겨가고 있으며, 일루미나의 Fluent BioSciences 인수는 단일세포 분석 포트폴리오를 강화하고 보다 이익률이 높은 소프트웨어가 풍부한 제품으로의 전환을 명확하게 보여줍니다. 비용이 상품 수준에 가까워짐에 따라 경쟁의 초점은 차별화된 화학 및 생체 정보학 생태계에 있습니다.

보다 광범위한 보험 상환으로 임상 도입 가속

메디케어 & 메디케이드 서비스센터는 2024년 고형암에서 차세대 시퀀싱의 보험 적용을 확대하여 도입의 주요 장벽을 제거했습니다. National Comprehensive Cancer Network는 현재 급성 골수성 백혈병에 대한 전체 유전체 시퀀싱을 권장하고 있으며 임상 수요가 더욱 높아지고 있습니다. 그러나 민간 보험 회사와 유럽 보험 회사의 상환은 여전히 불안정하기 때문에 공급업체는 의료 경제적 증거 패키지와 보험 회사 교육 팀에 투자를 촉구하고 있습니다. 현지 커버리지 의사결정은 폐결절의 위험 계층화와 같은 가치 있는 용도를 대상으로 하고 있으며, 더욱 추풍이 되고 있습니다.

높은 자본 비용으로 시장 진입 장벽

최상급의 높은 처리량 장치는 100만 달러를 초과할 수 있으며 연간 유지보수 계약에는 상당한 오버헤드가 걸립니다. 소규모 연구소에서는 장비 구매를 연장하거나 대여 모델 및 중앙 집중식 핵심 시설에 의존합니다. 엘리먼트 바이오사이언시스는 28만 9,000달러의 AVITI 시스템으로 접근의 민주화를 시도하고 있습니다. 따라서 자본 요건은 저자원 환경에서의 확대를 늦추고 기존 벤더의 규모 경제를 강화하고 있습니다.

부문 분석

소모품은 2024년 매출의 58.11%를 차지했는데, 이는 독점 플로우 셀과 시약 키트에 의한 것으로, 사용자는 런마다 재주문해야 하며, DNA 시퀀싱 시장을 지원하는 면도기와 칼날의 모델이 부각되고 있습니다. 케미스트리의 마진은 일상적으로 장치의 마진을 웃돌아 제품의 갱신 사이클을 가속시키고 있습니다. 시퀀싱 아즈 어 서비스와 데이터 분석을 포함한 서비스는 검사실이 복잡한 정보학 및 컴플라이언스 업무를 아웃소싱하고 있기 때문에 CAGR 18.21%로 상승하고 있습니다.

소모품 기술 혁신은 현재 비용 절감과 처리량 향상에 중점을 둡니다. Altima Genomics는 리소그래피 비용을 줄이고 스케일 아웃 제조를 용이하게하는 언 패턴 웨이퍼로 전환하고 있습니다. 한편, DNAnexus와 같은 서비스 제공업체는 클라우드 컴퓨팅, 컴플라이언스, AI 해석을 결합하여 원시 데이터가 아닌 엔드 투 엔드 실용적인 보고서를 제공하여 고객 밀착성을 높입니다. 이러한 변화가 결합되어 경상 소모품과 관리 서비스가 DNA 시퀀싱 시장의 생명선으로 자리매김하고 있습니다.

차세대 단시간 판독기는 검증된 임상 워크플로우, 고정밀, 광범위한 분석 메뉴를 통해 2024년 매출의 81.51%를 차지했습니다. 나노포어 시퀀싱은 CAGR 28.41%로 가장 급성장하는 하위 부문이며, 구조 변이와 메틸화 패턴을 해명하는 실시간 롱 리드가 뒷받침하고 있습니다. PacBio의 SPRQ Chemistry는 HiFi 인간 유전체의 비용을 500달러 이하로 낮추어 집단 연구의 합리적인 가격을 개선했습니다.

옥스포드 나노포어의 PromethION 2 Integrated는 온보드 컴퓨팅을 통해 플로우 셀당 최대 290Gb를 제공하며, 99.7%의 단일 염기 정밀도는 임상 신뢰성을 강화합니다. 벤더는 쇼트 리드 이코노미와 롱 리드 컨텍스트를 융합시킨 하이브리드 파이프라인을 추진하는 움직임을 강화하고 있으며, 종양학부터 군유전체학나 전사체학에 이르기까지 사용 시나리오의 폭을 넓히고 있습니다. 그러므로 경쟁이 치열해지면 두 리드 길이 레지엄에서 기술 혁신의 속도가 가속화되고 있습니다.

지역 분석

북미는 2024년 매출액의 45.11%를 차지하며 메디케어 적용 확대, 풍부한 벤처캐피탈, FDA 지원 체제 등이 그 요인이 되었습니다. 미국 국립위생연구소(National Institutes of Health)는 희귀질환과 암 유전체에 대한 대처에 다년간의 보조금을 제공하고, 인프라 정비법은 바이오 제조에 인센티브를 부여하고 있습니다. 그러나 미국에서 제안된 중국의 유전체 공급업체를 제한하는 법률은 시약 흐름을 위협하고 국내 실험실 재고 비용을 증가시킵니다.

아시아태평양은 집단 시퀀싱 프로젝트와 헬스케어 지출 증가에 견인되어 CAGR 19.63%로 가장 급성장하는 지역이 될 전망입니다. 중국은 병원암 등록과 소비자용 직접 검사를 통해 그 양을 독점하고 있습니다. 한편, 싱가포르의 긴 리드 집단 프로그램은 지역 분석을 지원하는 고품질의 아시아 기준 유전체을 만드는 것을 목표로 합니다. 인도는 국가 유전체 미션 하에서 바이오뱅크 네트워크를 발표하고 있지만, 진료 보상 격차가 임상 전개를 방해하고 있습니다.

유럽에서는 루틴 케어에 유전체 검사를 통합한 공적 자금에 의한 의료 시스템에 의해 큰 점유율을 유지하고 있습니다. 일반 데이터 보호 규칙(General Data Protection Regulation)에 의해 엄격한 동의 프로토콜과 국경을 넘은 데이터 규칙이 시행되어 컴플라이언스 비용이 상승합니다. 영국의 Genomics England는 총 500만 유전체을 목표로 하고 있으며 독일은 유전체 데이터 통합을 위한 병원 디지털화에 자금을 제공하고 프랑스의 국가 계획은 신생아 스크리닝의 시험적 규모를 확대하고 있습니다. 중동 및 아프리카, 남미의 신흥 시장은 아직 개발 도상이지만 비용이 낮아 모바일 랩이 원격지 클리닉에 보급됨에 따라 종양학 시퀀싱과 감염증 감시에 투자하고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 높은 처리량 플랫폼에 의한 유전체 당 비용 저하

- 클리니컬 시퀀싱에 대한 보다 광범위한 상환 및 승인

- 정부의 정밀의료와 집단 유전체학 프로그램

- 유전체학에 기초한 신약 개발과 동반진단의 보급

- 롱 리드, 싱글 셀, 멀티오믹스 워크플로우의 확대

- Sequencing-As-A-Service와 클라우드 바이오인포매틱스의 성장

- 시장 성장 억제요인

- 높은 처리량 시스템의 높은 자본 비용과 운영 비용

- 바이오인포매틱스 인재 부족과 분석의 병목

- 단편화하는 세계의 규제와 데이터 프라이버시 정세

- 중요 시약과 플로우 셀공급 체인 변동성

- 규제와 기술적 전망

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 규모와 성장 예측

- 제품 및 서비스별

- 기기

- 소모품

- 서비스

- 시퀀싱 기술별

- 산가 시퀀싱

- 차세대 시퀀싱(NGS)

- 일루미나 SBS

- 이온 반도체

- 기타 기술

- 제3세대 시퀀싱

- 워크플로우 단계별

- 시료 준비

- 라이브러리 준비

- 시퀀싱

- 데이터 분석 및 저장

- 용도별

- 임상 진단

- 종양학

- 생식 건강(NIPT, 보인자 검사)

- 감염성 질환

- 희귀 및 유전 질환

- 맞춤형 의료

- 신약 개발 및 연구

- 기타 용도

- 임상 진단

- 최종 사용자별

- 병원 및 임상 실험실

- 학술 및 연구 기관

- 제약 및 바이오테크놀러지 기업

- 기타 최종 사용자

- 지리

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 시장 점유율 분석

- 기업 프로파일

- Agilent Technologies Inc.

- Bio-Rad Laboratories Inc.

- Danaher Corp.(IDT)

- F. Hoffmann-La Roche Ltd.

- Illumina Inc.

- Merck KGaA

- PerkinElmer Inc.

- Thermo Fisher Scientific Inc.

- QIAGEN

- Macrogen Inc.

- Myriad Genetics Inc.

- Eurofins Scientific

- Hamilton Thorne Biosciences

- Pacific Biosciences of California Inc.

- Oxford Nanopore Technologies PLC

- BGI Genomics Co. Ltd.(MGI Tech)

- 10x Genomics Inc.

- GenScript Biotech Corp.

제7장 시장 기회와 향후 전망

KTH 25.11.25The DNA sequencing market size reached USD 14.40 billion in 2025 and is projected to touch USD 34.23 billion by 2030, reflecting an 18.91% CAGR over the forecast window.

Demand is shifting from academic discovery toward routine clinical testing in oncology, rare disease, and infectious-disease surveillance. A sustained drop in cost-per-genome, steady reimbursement expansion, and government-funded precision-medicine programs are widening patient access while enlarging installed instrument bases. Nanopore and other long-read platforms are eroding the short-read stronghold by resolving complex genomic regions, whereas cloud bioinformatics and AI pipelines streamline interpretation and cut turnaround times. Nevertheless, fragmented data-privacy rules and geopolitical supply-chain risks raise compliance costs and threaten reagent continuity, tempering growth momentum.

Global DNA Sequencing Market Trends and Insights

Declining Cost-Per-Genome Revolutionizes Access

Sequencing a whole human genome has fallen from USD 1 million in 2007 to under USD 600 in 2025, unlocking routine use across community hospitals. Illumina's NovaSeq X cuts that figure below USD 200, and Ultima Genomics markets a USD 100 genome, altering budget allocation toward data interpretation tools. United Kingdom oncology centers now deploy whole-genome sequencing for pediatric cancers, and Germany and Sweden are piloting similar programs. Vendors are pivoting from hardware sales to application-specific solutions; Illumina's acquisition of Fluent BioSciences strengthens single-cell assay portfolios, underscoring a shift toward higher-margin, software-rich offerings. As costs approach commodity levels, competitive focus centers on differentiated chemistry and bioinformatics ecosystems.

Broader Reimbursement Accelerates Clinical Adoption

Centers for Medicare & Medicaid Services expanded national coverage for next-generation sequencing in solid tumors in 2024, removing a primary barrier to uptake. The National Comprehensive Cancer Network now recommends whole-genome sequencing for acute myeloid leukemia, further cementing clinical demand. Yet reimbursement remains patchy across private payers and European insurers, prompting vendors to invest in health-economics evidence packages and payer-education teams. Local Coverage Determinations increasingly target high-value uses such as indeterminate pulmonary-nodule risk stratification, creating incremental tailwinds.

High Capital Costs Create Market Entry Barriers

A top-tier high-throughput instrument can exceed USD 1 million, with annual maintenance contracts adding significant overhead. Smaller laboratories defer acquisition or rely on reagent-rental models and centralized core facilities. Element Biosciences attempts to democratize access with the USD 289,000 AVITI system that features per-gigabase operating costs of USD 2-USD 5, yet the razor-and-blade economics still favor incumbents that control consumable supply. Capital requirements therefore slow expansion in low-resource settings and reinforce economies of scale for established vendors.

Other drivers and restraints analyzed in the detailed report include:

- Government Precision-Medicine Programs Drive Infrastructure

- Genomics-Based Drug Discovery Expands Applications

- Bioinformatics Bottlenecks Constrain Value Extraction

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Consumables generated 58.11% of revenue in 2024 owing to proprietary flowcells and reagent kits that users must reorder for every run, underscoring the razor-and-blade model that supports the DNA sequencing market. Margins on chemistry routinely outpace those on instruments, funding accelerated product refresh cycles. Services, including sequencing-as-a-service and data analytics, are climbing at an 18.21% CAGR as laboratories outsource complex informatics and compliance workloads.

Consumable innovation now focuses on lowering cost and increasing throughput. Ultima Genomics is moving to unpatterned wafers that shrink lithography expense and facilitate scale-out manufacturing. Meanwhile, service providers such as DNAnexus couple cloud compute, compliance, and AI interpretation to deliver end-to-end actionable reports rather than raw data, enhancing customer stickiness. Together these shifts position recurring consumables and managed services as the lifeblood of the DNA sequencing market.

Next-generation short-read instruments captured 81.51% of revenue in 2024 thanks to validated clinical workflows, high accuracy, and wide assay menus. Nanopore sequencing is the fastest-growing subsegment at a 28.41% CAGR, propelled by real-time long reads that resolve structural variants and methylation patterns. PacBio's SPRQ chemistry drops HiFi human genome costs below USD 500, improving affordability for population studies.

Oxford Nanopore's PromethION 2 Integrated delivers up to 290 Gb per flowcell with onboard compute, while its 99.7% single-nucleotide accuracy strengthens clinical credibility. Vendors increasingly promote hybrid pipelines that merge short-read economy with long-read context, broadening use scenarios from oncology to metagenomics and transcriptomics. Competitive intensity is therefore accelerating innovation pace across both read-length regimes.

The DNA Sequencing Market Report is Segmented by Product & Service (Instruments, and More), Sequencing Technology (Sanger Sequencing, and More), Workflow Step (Sample Preparation, and More), by Application (Clinical Diagnostics, and More), by End User (Hospitals, and More), Geography (North America, Europe, Asia-Pacific, The Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 45.11% of 2024 revenue, fueled by Medicare coverage expansion, abundant venture capital, and a supportive FDA framework. The National Institutes of Health channel multi-year grants into rare-disease and cancer-genome initiatives, while infrastructure laws incentivize bio-manufacturing. Proposed US legislation restricting Chinese genomic suppliers, however, threatens reagent flow and increases inventory costs for domestic labs.

Asia Pacific is poised to be the fastest-growing territory with a 19.63% CAGR, driven by population-scale sequencing projects and rising healthcare spend. China dominates volume through hospital cancer registries and direct-to-consumer tests, whereas Singapore's long-read population program aims to create a high-quality Asian reference genome that underpins regional assays. India announces biobank networks under its National Genomics Mission, though disparate reimbursement hinders clinical roll-out.

Europe maintains significant share through publicly funded health systems that embed genomic testing into routine care. The General Data Protection Regulation enforces strict consent protocols and cross-border data rules, raising compliance costs. The UK's Genomics England targets 5 million whole genomes, Germany funds hospital digitalization for genomic data integration, and France's national plan scales newborn-screening pilots. Emerging markets in the Middle East, Africa, and South America remain nascent but invest in oncology sequencing and infectious-disease surveillance as costs fall and mobile labs spread to remote clinics.

- Agilent Technologies

- Bio-Rad Laboratories

- Danaher Corp. (IDT)

- Roche

- Illumina

- Merck

- PerkinElmer

- Thermo Fisher Scientific

- QIAGEN

- Macrogen

- Myriad Genetics

- Eurofins

- Hamilton Thorne

- Pacific Bioscience

- Oxford Nanopore Technologies PLC

- BGI Genomics Co. Ltd. (MGI Tech)

- 10x Genomics Inc.

- GenScript Biotech Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Declining Cost-Per-Genome with Higher-Throughput Platforms

- 4.2.2 Broader Reimbursement and Approvals For Clinical Sequencing

- 4.2.3 Government Precision-Medicine and Population Genomics Programs

- 4.2.4 Genomics-Based Drug Discovery and Companion Diagnostics Uptake

- 4.2.5 Expansion of Long-Read, Single-Cell and Multi-Omics Workflows

- 4.2.6 Growth of Sequencing-As-A-Service and Cloud Bioinformatics

- 4.3 Market Restraints

- 4.3.1 High Capital and Operating Costs of High-Throughput Systems

- 4.3.2 Bioinformatics Talent Shortage and Analysis Bottlenecks

- 4.3.3 Fragmented Global Regulatory and Data-Privacy Landscape

- 4.3.4 Supply-Chain Volatility for Critical Reagents and Flow Cells

- 4.4 Regulatory & Technological Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product & Service

- 5.1.1 Instruments

- 5.1.2 Consumables

- 5.1.3 Services

- 5.2 By Sequencing Technology

- 5.2.1 Sanger Sequencing

- 5.2.2 Next-Generation Sequencing (NGS)

- 5.2.2.1 Illumina SBS

- 5.2.2.2 Ion Semiconductor

- 5.2.2.3 Other Technologies

- 5.2.3 Third-Generation Sequencing

- 5.3 By Workflow Step

- 5.3.1 Sample Preparation

- 5.3.2 Library Preparation

- 5.3.3 Sequencing

- 5.3.4 Data Analysis & Storage

- 5.4 By Application

- 5.4.1 Clinical Diagnostics

- 5.4.1.1 Oncology

- 5.4.1.2 Reproductive Health (NIPT, Carrier)

- 5.4.1.3 Infectious Disease

- 5.4.1.4 Rare & Genetic Disorders

- 5.4.2 Personalized Medicine

- 5.4.3 Drug Discovery & Development

- 5.4.4 Other Applications

- 5.4.1 Clinical Diagnostics

- 5.5 By End User

- 5.5.1 Hospitals & Clinical Laboratories

- 5.5.2 Academic & Research Institutes

- 5.5.3 Pharmaceutical & Biotechnology Companies

- 5.5.4 Other End Users

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East & Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East & Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Agilent Technologies Inc.

- 6.3.2 Bio-Rad Laboratories Inc.

- 6.3.3 Danaher Corp. (IDT)

- 6.3.4 F. Hoffmann-La Roche Ltd.

- 6.3.5 Illumina Inc.

- 6.3.6 Merck KGaA

- 6.3.7 PerkinElmer Inc.

- 6.3.8 Thermo Fisher Scientific Inc.

- 6.3.9 QIAGEN

- 6.3.10 Macrogen Inc.

- 6.3.11 Myriad Genetics Inc.

- 6.3.12 Eurofins Scientific

- 6.3.13 Hamilton Thorne Biosciences

- 6.3.14 Pacific Biosciences of California Inc.

- 6.3.15 Oxford Nanopore Technologies PLC

- 6.3.16 BGI Genomics Co. Ltd. (MGI Tech)

- 6.3.17 10x Genomics Inc.

- 6.3.18 GenScript Biotech Corp.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment