|

시장보고서

상품코드

1687922

항공우주 및 방위 분야 M&A - 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Mergers And Acquisitions (M&A) In Aerospace And Defense - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

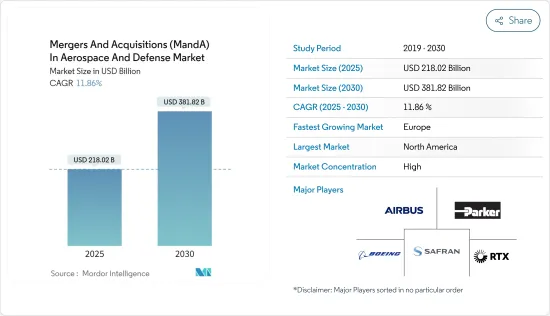

항공우주 및 방위 분야 M&A 시장 규모는 2025년에 2,180억 2,000만 달러에 이르고 2030년에는 3,818억 2,000만 달러에 달할 것으로 예상되며, 예측기간(2025-2030년)의 CAGR은 11.86%를 나타낼 것으로 전망됩니다.

항공우주 및 방위 분야 M&A는 상업적으로 실행 가능한 비즈니스 전략으로 부상했습니다.

최근 항공우주 및 방위 분야는 눈부신 성장을 이루고 있습니다.항공교통량 증가, 도시화의 진전, 항공기수 증가는 항공우주부문의 중요한 원동력의 일부입니다. 양 부문의 지출 증가는 상대방 상표 제품 제조업체와 소규모 참가 기업이 시장에 진출하여 사업을 확대하기 위한 보다 좋은 기회를 창출합니다.

항공우주 및 방위 분야에서는 M&A에 관한 개발이 이루어지고 있지만, M&A와 관련된 규제의 고조가 장기적으로는 시장의 성장을 방해할 가능성이 있습니다. 그러면 M&A에 관한 규제는 연방정부 뿐만 아니라 대상 기업이 법인화되고 있는 각 주의 관할하에 있습니다.

항공우주 및 방위 분야 M&A 동향

예측기간 동안 항공우주 부문이 가장 높은 성장을 보일 것으로 예측

항공우주 부문은 최근 기술과 혁신의 현저한 진보로 현저한 확대를 경험해 왔습니다. 폭이 줄어들면서, 이 부문은 미맹유의 과제에 직면했습니다.

항공우주 부문이 발전함에 따라 대기업은 인수를 통한 사업 확대에 주력하고 있습니다. 예를 들어, 2024년 2월 BAE Systems PLC는 Ball Corporation으로부터 55억 달러에 Ball Aerospace 인수를 완료했습니다. 이 인수에 의해 BAE Systems는 새로운 우주·미션 시스템 부문의 아래, 과학, 우주, 방위의 기능을 포트폴리오에 추가하게 됩니다. 마찬가지로, 2022년 9월 모션 및 제어 기술 회사인 Parker-Hannifin Corp.는 항공우주 및 방위 부품 제조업체인 Meggitt PLC를 약 63억 파운드에 인수했습니다.

인수 외에도 다양한 항공우주 기업이 세계 시장에서의 지위를 강화하기 위해 합병에 참여하고 있습니다. Airplane에서 민간 항공 운송에 혁명을 일으키는 데 주력하고 있습니다. 마찬가지로 2024년 1월 Vistara는 Tata Group 산하 Air India와의 합병안에 대해, 모든 법적 승인을 받을 전망이라고 발표했습니다. 이 수속은 2024년 전반까지 완료되었습니다. 이 합병은 2022년 11월에 싱가포르 항공이 제안했습니다.

예측 기간 동안 유럽이 가장 높은 성장을 보일 것으로 예상

예측 기간 동안 유럽은 가장 높은 성장을 기록할 것으로 예상됩니다.

항공 여행자 증가, 새로운 공항 건설 증가, 항공기 납품 증가가 지역 민간 항공 시장을 견인하고 있습니다.

항공우주 부문의 주요 기업은 사업 확장을 위해 M&A에 주력하고 있습니다. 예를 들어 2023년 1월, 에어버스 헬리콥터는 독일에 본사를 둔 ZF 루프트파르트테크닉 인수를 완료했습니다. 이 회사는 세계 고객 기반을 가지고 있으며 관련 서비스를 포함하여 소형 및 중형 헬리콥터용 다이나믹 구성 요소를 제조하고 있습니다.

또한 2022년 4월 Airbus Defence and Space는 DSI Datensicherheit GmbH(DSI DS)의 인수를 발표했습니다. GmbH라는 새로운 회사명으로 운영됩니다. 이 인수는 Airbus의 암호화 기술을 강화하고 엔드 투 엔드의 안전한 시스템 개발을 향상시키고 있습니다.

국경을 넘어서는 분쟁, 정치적 분쟁, 이웃 국가들 사이의 긴장 증가는 유럽에 전화를 가져왔습니다. 커뮤니케이션을 11억 달러로 인수했습니다.

이와 같이 제품 포트폴리오를 확대하기 위해 공급업체 및 타사로부터의 사업 조달에 대한 지출이 증가함으로써 기업 전체의 실적과 고객 기반이 개선되고 예측 기간 동안 시장 성장이 촉진될 것으로 예상됩니다.

항공우주 및 방위 분야 M&A 개요

항공우주 및 방위 산업은 여러 진출 기업으로 구성되어 있으며 시장 경쟁은 치열합니다.

각 회사는 중요한 계약을 획득하고 시장에서의 존재감과 우위성을 높이기 위해 적극적인 인수 전략을 채용하고 있습니다. 시장의 기존 기업이 여러 경쟁 제품 포트폴리오를 인수하는 방아쇠가 되고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 시장 성장 억제요인

- Porter's Five Forces 분석

- 구매자/소비자의 협상력

- 공급기업의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁의 강도

제5장 시장 세분화

- 분야

- 항공우주

- 방위

- 지역

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

제6장 경쟁 구도

- 기업 프로파일

- The Boeing Company

- RTX Corporation

- Airbus SE

- General Electric Company

- Safran SA

- BAE Systems PLC

- Parker Hannifin Corporation

- L3Harris Technologies Inc.

- Leonardo SpA

- THALES

- Elbit Systems Ltd

- Rolls-Royce PLC

- Honeywell International Inc.

- Rheinmetall AG

제7장 시장 기회와 앞으로의 동향

KTH 25.05.12The Mergers And Acquisitions In Aerospace And Defense Market size is estimated at USD 218.02 billion in 2025, and is expected to reach USD 381.82 billion by 2030, at a CAGR of 11.86% during the forecast period (2025-2030).

Mergers and acquisitions (M&A) in the aerospace and defense (A&D) sector have emerged as a commercially viable business strategy. They help the participants enhance their technological know-how while dividing the risks associated with technological disruptions. An M&A facilitates the sustenance of both firms and, in most cases, helps the major players foster comparatively faster growth than their competitors.

In recent years, the aerospace and defense sector has showcased tremendous growth. The increasing air traffic, growing urbanization, and the rising number of aircraft are some of the critical drivers of the aerospace sector. The growing defense budget, increasing focus on strengthening military capabilities, and rising war situations are boosting the market's growth in the defense sector. Increasing expenditure in both sectors will create better opportunities for original equipment manufacturers and small players to enter the market and expand their operations. Thus, key players in the aerospace and defense sector focus on business expansion through various strategies, such as mergers and acquisitions, new contracts, agreements, and partnerships.

Although there have been several developments in mergers and associations in the aerospace and defense sector, rising regulations associated with mergers and acquisitions may hamper the market's growth in the long run. Various regulations have been implemented to regulate mergers and acquisitions within the aerospace and defense sector. In countries with a federal government, the regulations for merger and acquisition activities fall within the dual jurisdiction of the federal government as well as the individual state in which the target company has been incorporated. Despite these factors, rising air passenger traffic, new aircraft deliveries, rising geopolitical tensions, and corresponding new technological innovations are expected to support the market's growth.

Mergers And Acquisitions (M&A) In Aerospace And Defense Market Trends

The Aerospace Segment is Projected to Witness the Highest Growth During the Forecast Period

The aerospace sector has experienced a notable expansion in recent years, marked by significant advancements in technology and innovation. The sector, however, encountered unprecedented challenges due to the pandemic, which resulted in sharp declines in air travel and a significant decrease in demand for aircraft. Nevertheless, the sector demonstrated remarkable resilience and a strong recovery post-pandemic in 2022 and 2023.

As the aerospace sector evolves, major companies focus on business expansion through acquisitions. These strategic initiatives aim to enhance their capabilities, improve their market position, and drive growth in the highly competitive global market. For instance, in February 2024, BAE Systems PLC completed the acquisition of Ball Aerospace from Ball Corporation for USD 5.5 billion. Through this acquisition, BAE Systems will add science, space, and defense capabilities to its portfolio under the new Space and Mission Systems division. Similarly, in September 2022, Parker-Hannifin Corp., a motion and control technologies company, completed the acquisition of Meggitt PLC, an aerospace and defense components manufacturer, for approximately GBP 6.3 billion. With this acquisition, the Parker Aerospace Group aims to expand its portfolio with Meggitt's global defense and aerospace technologies.

Apart from acquisitions, various aerospace companies have been involved in mergers to solidify their position in the global market. For instance, in March 2024, XTI Aircraft Company and Inpixon merged their business units to form XTI Aerospace Inc. Through this merger, the companies are focusing on revolutionizing private air transportation with its TriFan 600 Vertical Lift Crossover Airplane. Similarly, in January 2024, Vistara announced that it expects to receive all legal approvals for its proposed merger with Tata Group-owned Air India. The process is expected to be completed by the first half of 2024. The merger was proposed by Singapore Airlines in November 2022. Thus, the increasing focus of aerospace companies to acquire start-ups or business domains of other companies is expected to drive the market's growth during the forecast period.

Europe is Expected to Exhibit the Highest Growth During the Forecast Period

Europe is expected to record highest growth during the forecast period. Europe has a well-flourished aviation and defense sector due to the massive demand from end users and the presence of top aviation and defense companies in the region. Airbus SE, Saab AB, THALES, BAE Systems, Dassault Aviation SA, and Safran SA are major players with significant market shares in the aerospace and defense sector.

An increasing number of air travelers, the growing construction of new airports, and rising aircraft deliveries are driving the regional commercial aviation market. The rising demand for business jets and general aviation aircraft and increasing procurement of helicopters for numerous applications are driving the aviation sector.

The key players in the aerospace sector focus on mergers and acquisitions to expand their business. For instance, in January 2023, Airbus Helicopters completed the acquisition of German-based ZF Luftfahrttechnik. The company has a global customer base and manufactures dynamic components for light and medium helicopters, including related services. In addition, the company is the MRO components supplier for military helicopters. With this acquisition, Airbus Helicopters expanded its range of MRO capabilities and secured additional competencies in dynamic systems.

Also, in April 2022, Airbus Defence and Space announced the acquisition of DSI Datensicherheit GmbH (DSI DS). This German-based company provides cryptography and communication systems for airborne, space, naval, and ground, certified by the Federal Office for Information Security (BSI). The company will operate under a new name: Aerospace Data Security GmbH. The acquisition would strengthen Airbus' cryptography capabilities and improve the development of end-to-end secured systems.

Growing cross-border conflicts, political disputes, and tensions among neighboring countries created a warfare situation in Europe. The Russia-Ukraine War and the growing expenditure from NATO countries to enhance defense capabilities aided the market's growth across the region. For instance, in February 2024, THALES acquired Cobham Aerospace Communications for USD 1.1 billion. THALES is expected to create a significant trend toward connected cockpits through this acquisition.

Thus, increasing expenditure on procurement by vendors and businesses from other companies to expand product portfolios is expected to improve the company's overall performance and customer base, driving the market's growth during the forecast period.

Mergers And Acquisitions (M&A) In Aerospace And Defense Industry Overview

The A&D sector comprises several players, and the market is highly competitive. Some prominent players in the market include Parker Hannifin Corporation, The Boeing Company, Airbus SE, RTX Corporation, and Safran, amongst others.

Companies are adopting aggressive acquisition strategies to gain significant contracts and increase their market presence and dominance. A diversified growth strategy protects a firm from country-specific economic slumps. This has triggered market incumbents' acquisition of several competitor product portfolios to gain a competitive advantage in the market. Moreover, several other M&A transactions were expected to be completed by the end of FY 2024, resulting in substantial market consolidation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Sector

- 5.1.1 Aerospace

- 5.1.2 Defense

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Latin America

- 5.2.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 The Boeing Company

- 6.1.2 RTX Corporation

- 6.1.3 Airbus SE

- 6.1.4 General Electric Company

- 6.1.5 Safran SA

- 6.1.6 BAE Systems PLC

- 6.1.7 Parker Hannifin Corporation

- 6.1.8 L3Harris Technologies Inc.

- 6.1.9 Leonardo SpA

- 6.1.10 THALES

- 6.1.11 Elbit Systems Ltd

- 6.1.12 Rolls-Royce PLC

- 6.1.13 Honeywell International Inc.

- 6.1.14 Rheinmetall AG