|

시장보고서

상품코드

1851829

유럽의 셀프 스토리지 시장 : 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Europe Self-storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

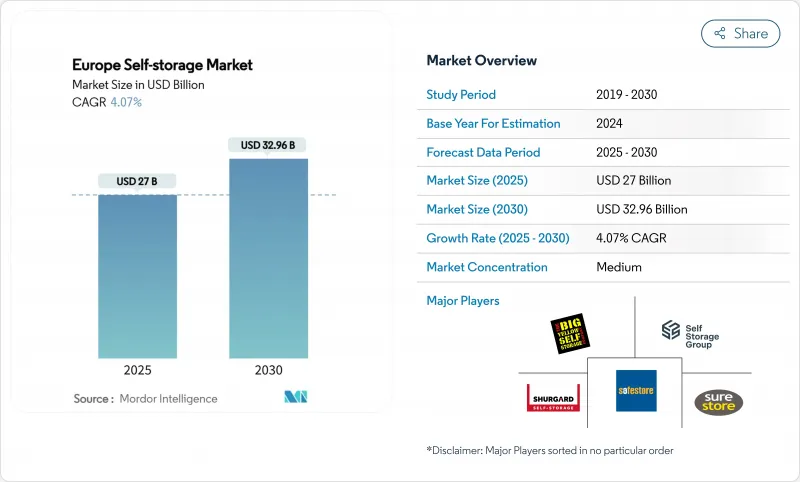

유럽의 셀프 스토리지 시장은 2025년 270억 달러에 이르고, 2030년까지 CAGR 4.07%로 확대되어 329억 6,000만 달러에 이를 것으로 예측됩니다.

확대 배경에는 꾸준한 도시 인구 증가, 주택 이동성 향상, 스토리지 자산을 주변 부동산이 아닌 인프라로 취급하는 기관 투자자의 자금 유입이 있습니다. 런던, 파리, 베를린 및 유사한 Tier 1 도시에서는 도시가 고령화 사회의 축소와 함께 축소되고 있으며 입주율과 임대 수준은 경기 주기를 넘어 회복력을 유지하고 있습니다. 중소 전자상거래 기업은 마이크로 웨어하우징 전략을 채택하는 경향이 강해지고 있으며, 학생과 주재원의 이동은 예측 가능한 계절 수요를 공급하고 있습니다. 기후정책에 근거한 리노베이션은 비용이 많이 드는 것, 에너지 효율을 개선하고, 적합 시설의 수익률을 높이는 프리미엄 부문을 창출합니다.

유럽 셀프 스토리지 시장 동향과 통찰

도시의 압축과 마이크로 거실

지가의 상승으로 인해 도시의 평균 주거 면적은 축소되어, 거주자는 지역의 수납 시설을 외부의 방으로서 취급하게 되어 있습니다. 영국에서는 3년간 100개가 넘는 새로운 복합시설이 개방되어 임차인이 가구와 계절용품을 보관해 운영회사는 연간 10억 파운드를 벌고 있습니다. 하이브리드 리스와 24시간 365일의 디지털 액세스가 이 서비스를 일상적인 도시 생활에 더욱 정착시키고 있습니다.

고령화 사회에 의한 대규모 주택으로부터의 다운사이징

독일, 이탈리아, 영국에서는 노인 주택 소유자가 더 작은 주택으로 전환하고 있으며 가보와 부피가 큰 가구의 중간 보관 수요가 탄생했습니다. OECD 예측은 2050년까지 65세 이상의 인구가 G7 도시 거주자의 25%에 달하여 내구성 있는 요구 기반 고객 기반을 고정화합니다.

엄격한 화재 안전 기준

북유럽 규정은 고급 소화 시스템과 검증된 위험 평가를 요구하므로 개조 예산이 최대 25% 증가하고 시장 진입이 지연됩니다.

부문 분석

2024년 유럽 셀프 스토리지 시장 수익의 70%는 개인 사용자가 차지했니다. 가구의 이동, 마이크로리빙, 퇴직 후의 다운사이징에 의해 장기 계약이 확보되어, 매크로적인 쇼크 중에서도 입주가 안정됩니다. 중소기업이 종량제 재고 공간을 도입하고 있기 때문에 비즈니스 코호트는 소규모이면서 연률 7.5%로 확대하고 있습니다. 사업자는 현재 개인용으로는 라이프스타일 메시지, 법인용으로는 턴키 물류 기능이라는 두 가지 브랜드 전략을 마련해 두 흐름을 효과적으로 수익화하고 있습니다.

개인 임대의 유럽 셀프 스토리지 시장 규모는 단기간 예약을 간소화하는 디지털 예약 플랫폼에 의해 지원되며 2030년까지 압도적인 점유율을 유지할 것으로 예측됩니다. 한편, 택배 픽업, 래킹, 보험 등의 교차 판매 서비스는 주변 도시에서 전자상거래의 침투가 증가함에 따라 법인 고객 1인당 평균 매출을 밀어 올립니다.

2024년 유럽 셀프 스토리지 시장 점유율의 60%는 비기후 제어 유닛이 차지합니다. 그러나 센서, HVAC, 보다 엄격한 입퇴실 관리는 표준 방보다 25-40% 높은 요금이 요구되므로 CAGR 9%에서 성장하는 공조 관리된 재고가 금리 확대를 지원합니다.

이미 클래스 E 기준을 충족하는 시설은 임대료의 상승과 해지율의 저하에 의해 개수 비용을 회수하고 있습니다. 유럽의 셀프 스토리지 공조 관리 유닛 시장 규모는 2030년까지 100억 달러를 넘는 기세이며, 전자기기, 미술품, 아카이브 문서에 특화된 보험 제공을 지원하고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 유럽 Tier1 도시의 도시 압축과 마이크로리빙 동향

- 독일, 이탈리아, 영국에서 고령화가 진행되어 대형 주택으로부터 다운사이징이 진행

- 전자상거래 중소기업 붐이 유연한 마이크로웨어 하우스의 필요성을 높인다

- 솅겐 내에서 급증하는 학생 및 주재원의 이동

- 하이브리드 근무 대두가 만들어내는 홈 오피스의 난잡함

- 대안 부동산 수익률에 대한 기관 투자가의 의욕

- 시장 성장 억제요인

- 북유럽의 시설 전환을 제한하는 엄격한 방화 안전 기준

- 역사적 도심 지역의 적합한 구획 지정 산업용 부지 부족

- 프랑스와 스페인의 인플레이션 연동형 임대료 캡

- 에너지 효율 의무화 증가에 의한 개수 비용 증가

- 소비자 분석

- 규제 전망

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 투자분석

제5장 시장 규모와 성장 예측

- 사용자 유형별

- 개인

- 비즈니스

- 스토리지 유형별

- 기후 제어

- 비기후 제어

- 공간 사이즈별

- 90평방피트 이하

- 91-150평방피트

- 151-300제곱피트

- 300평방피트 이상

- 용도별

- 가정용품

- 전자상거래 및 마이크로풀필멘트

- 문서 및 아카이브 보관

- 차량 보관

- 국가별

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Shurgard Self Storage SA

- Safestore Holdings PLC

- Big Yellow Group PLC

- Self Storage Group ASA

- Lok'nStore Group PLC

- SureStore Ltd

- Access Self Storage Ltd

- Lagerboks

- Nettolager

- Pelican Self Storage

- 24Storage AB

- Casaforte(SMC Self-Storage Management)

- W Wiedmer AG

- MyPlace SelfStorage GmbH

- BlueSpace Self-Storage SL

- Space Station Ltd

제7장 시장 기회와 장래의 전망

JHS 25.11.25The Europe self-storage market stands at USD 27 billion in 2025 and is forecast to reach USD 32.96 billion by 2030 at a 4.07% CAGR.

Expansion rests on steady urban population growth, rising residential mobility, and institutional capital inflows that treat storage assets as infrastructure rather than peripheral real-estate plays. Urban compression in London, Paris, Berlin, and similar Tier-1 cities, coupled with ageing populations downsizing, keeps occupancy and rental levels resilient across economic cycles. Small and medium e-commerce businesses increasingly adopt micro-warehousing strategies, while student and expatriate mobility supplies predictable seasonal demand. Climate-policy-driven retrofits, although costly, improve energy efficiency and create a premium segment that lifts yields for compliant facilities

Europe Self-storage Market Trends and Insights

Urban compression and micro-living

Intensifying land prices have shrunk average city dwellings, prompting residents to treat local storage facilities as an external "room." Over 100 new complexes opened in the UK in three years, earning operators GBP 1 billion annually as renters off-load furniture and seasonal goods. Hybrid leases and 24/7 digital access further embed the service into day-to-day urban living.

Ageing population downsizing from larger homes

Older homeowners in Germany, Italy, and the UK are shifting to smaller dwellings, creating interim storage demand for heirlooms and bulky furniture. OECD projections show the 65+ cohort reaching 25% of G7 city dwellers by 2050, locking in a durable, needs-based customer base

Stringent fire-safety codes

Nordic rules require advanced suppression systems and verified risk assessments, adding up to 25% to conversion budgets and delaying market entry

Other drivers and restraints analyzed in the detailed report include:

- E-commerce SMB boom driving flexible micro-warehousing

- Student & expat mobility

- Heightened energy-efficiency mandates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Personal users accounted for 70% of Europe self-storage market revenue in 2024. Household moves, micro-living, and retirement downsizing secure long-tenure contracts that stabilise occupancy during macro shocks. The business cohort, while smaller, is expanding at 7.5% annually as SMEs embrace pay-as-you-go inventory space. Operators now tailor dual-branding strategies-lifestyle messaging for individuals and turnkey logistics features for corporations-to monetise both streams effectively.

The Europe self-storage market size attached to personal tenancy is forecast to maintain a dominant share through 2030, helped by digital reservation platforms that simplify short-cycle booking. Meanwhile, cross-selling services such as courier pick-up, racking, and insurance lift average revenue per business customer as e-commerce penetration deepens in peripheral cities.

Non-climate units delivered 60% of Europe self-storage market share in 2024 thanks to lower fit-out costs. Yet climate-controlled stock, growing at 9% CAGR, underpins margin expansion because sensors, HVAC, and stricter access controls command fees 25-40% above standard rooms.

Regulatory upgrades accelerate the pivot: facilities that already meet class E standards recoup retrofit spending via higher rents and lower churn. The Europe self-storage market size for climate-controlled units is on track to surpass USD 10 billion by 2030, supporting specialised insurance offerings for electronics, art, and archival documents.

Europe Self Storage Market Report is Segmented by User Type (Personal and Business), Storage Type (Climate-Controlled, Non-Climate-Controlled), Space Size (Up To 90 Sq Ft, 91-150 Sq Ft, and More), Application (Household Goods, E-Commerce Micro-Fulfilment, and More), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Shurgard Self Storage SA

- Safestore Holdings PLC

- Big Yellow Group PLC

- Self Storage Group ASA

- Lok'nStore Group PLC

- SureStore Ltd

- Access Self Storage Ltd

- Lagerboks

- Nettolager

- Pelican Self Storage

- 24Storage AB

- Casaforte (SMC Self-Storage Management)

- W Wiedmer AG

- MyPlace SelfStorage GmbH

- BlueSpace Self-Storage S.L.

- Space Station Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Urban Compression and Micro-Living Trends in Tier-1 European Cities

- 4.2.2 Aging Population Downsizing from Larger Homes in Germany, Italy and UK'

- 4.2.3 E-commerce SMB Boom Driving Need for Flexible Micro-Warehousing

- 4.2.4 Surging Student & Expat Mobility Within the Schengen Region

- 4.2.5 Rise of Hybrid Work Creating Home Office Clutter

- 4.2.6 Institutional Investor Appetite for Alternative Real-Estate Yields

- 4.3 Market Restraints

- 4.3.1 Stringent Fire-Safety Codes Limiting Facility Conversions in Nordics

- 4.3.2 Scarcity of Suitable Zoned Industrial Stock in Historic City Centres

- 4.3.3 Inflation-Linked Rental Index Caps in France and Spain

- 4.3.4 Heightened Energy-Efficiency Mandates Increasing Retrofit Costs

- 4.4 Consumer Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By User Type

- 5.1.1 Personal

- 5.1.2 Business

- 5.2 By Storage Type

- 5.2.1 Climate-Controlled

- 5.2.2 Non-Climate-Controlled

- 5.3 By Space Size

- 5.3.1 Up to 90 sq ft

- 5.3.2 91-150 sq ft

- 5.3.3 151-300 sq ft

- 5.3.4 Above 300 sq ft

- 5.4 By Application

- 5.4.1 Household Goods

- 5.4.2 E-commerce Micro-Fulfilment

- 5.4.3 Document & Archive Storage

- 5.4.4 Vehicle Storage

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Shurgard Self Storage SA

- 6.4.2 Safestore Holdings PLC

- 6.4.3 Big Yellow Group PLC

- 6.4.4 Self Storage Group ASA

- 6.4.5 Lok'nStore Group PLC

- 6.4.6 SureStore Ltd

- 6.4.7 Access Self Storage Ltd

- 6.4.8 Lagerboks

- 6.4.9 Nettolager

- 6.4.10 Pelican Self Storage

- 6.4.11 24Storage AB

- 6.4.12 Casaforte (SMC Self-Storage Management)

- 6.4.13 W Wiedmer AG

- 6.4.14 MyPlace SelfStorage GmbH

- 6.4.15 BlueSpace Self-Storage S.L.

- 6.4.16 Space Station Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment