|

시장보고서

상품코드

1689728

광생물자극 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Photobiostimulation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

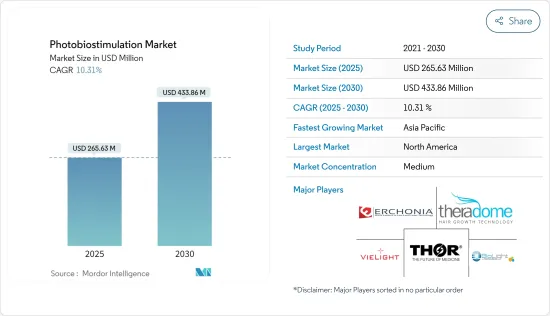

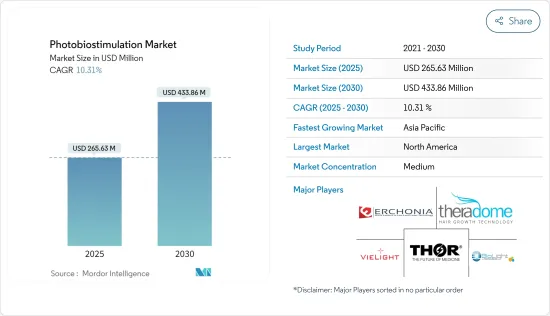

세계의 광생물자극 시장 규모는 2025년 2억 6,563만 달러로 추정되고, 2030년 4억 3,386만 달러에 이를 것으로 예측되며, 예측기간 중(2025-2030년) CAGR 10.31%로 예상됩니다.

시장 성장의 중요한 요인은 만성 질환의 이환율 증가이며, 광생물자극법을 사용하여 치료를 받는 환자 수 증가로 이어집니다. 또한 관절염과 골다공증 등 만성 통증 질환의 유병률 상승, 노년 인구 증가 등의 요인도 예측 기간 동안 광생물자극 시장을 견인할 것으로 보입니다. 예를 들어, Osteoarthritis Action Alliance가 2024년 1월에 발표한 보고서에 따르면 미국 성인 5명 중 1명이 어떤 관절염을 앓고 있는 것으로 추정되며, 변형성 관절증(OA)은 가장 흔한 관절염으로 미국 성인 3,250만 명이 앓고 있습니다. 따라서 미국에서 골관절염의 유병률이 높아지면서 이 지역의 예측 기간 동안 광생물자극 수요를 촉진할 것으로 예상됩니다.

광생물자극은 당뇨병의 상처 치유 치료에도 이용되고 있습니다. 세포가 방사선에 노출되면 광생물 조절 반응이 일어나 세포 기능을 변화시켜 당뇨병 상처의 치유를 촉진합니다. 많은 세포 및 분자 과정을 변화시킴으로써 적색 및 근적외선(NIR) 파장을 이용한 광생물 조절 요법(PBMT)은 당뇨병 상처의 치유 속도를 가속화하고 통증을 없애고 염증을 억제하는 유망한 치료법으로 보입니다. 국제당뇨병연합(IDF)이 2022년에 발표한 보고서에 따르면 2021년에는 세계에서 5억 3,700만명이 당뇨병을 앓고 있으며, 북미에서는 5,100만명 이상, 2045년에는 6,300만명으로 증가합니다. 미국에서는 당뇨병 인구가 많기 때문에 결국 당뇨병성 발궤양의 수가 많아집니다. 이로 인해 치료법으로서의 광생물자극법에 대한 수요가 높아지고 예측기간 동안 시장의 성장이 예상됩니다.

또한, 광생물자극법에 주력하는 시장 기업에 의한 기술의 진보나 신제품의 발매도 예측 기간 중 조사 시장의 성장을 뒷받침하고 있습니다. 예를 들어 2023년 6월 헬스텍 기업인 Lumaflex는 신제품 Lumaflex Body Pro를 출시했습니다. 이 획기적인 적색광 치료기는 현재 생산 중이며 FDA 클래스 2 인증을 받았습니다. 보디 빌더나 종합 격투기(MMA) 선수 등의 피트니스계에서 근육 회복을 위한 인기 치료가 되고 있습니다.

게다가 2024년 2월, BIOPTRON AG는 두바이 세계 피부과학회에서 창상 치유를 위한 광생물자극 치료 장치의 사용에 관한 긍정적인 임상 데이터를 발표했습니다. 이 연구는 이 치료법이 치유 시간을 극적으로 단축하고 환자의 결과를 개선하는 것으로 나타났습니다. 이 때문에 임상시험이나 기업활동이 활발해지고 시장 성장에 박차가 걸릴 것으로 보입니다.

따라서 당뇨병과 같은 만성 질환의 이환율 증가와 신제품 출시와 관련된 기술의 진보는 광생물자극 시장의 성장을 가속할 것으로 예상됩니다. 그러나 대체 치료의 가용성이 증가하는 것은 예측 기간 동안 시장 성장을 방해할 것으로 보입니다.

광생물자극 시장 동향

예측 기간 동안 통증 관리가 시장의 주요 점유율을 차지할 전망

광생물자극은 통증 관리를 위해 연구되었으며, 유망한 결과를 얻고 있습니다. 그 장점은 통증의 힘, 염증의 완화, 조직 수리의 촉진 등입니다. 이 응용에서 저수준 광치료는 세포 과정을 조절하고 엔돌핀 방출에 영향을 미치며 염증 매개체를 감소시킵니다. 근골격통, 관절염, 신경 병증 통증 등의 증상에는 광 자극이 효과적입니다.

저수준 광치료(LLLT)는 항염증 작용이 있는 것으로 나타났으며, 부종을 감소시키고, 염증 상태에 따른 통증을 완화하며, 신체의 자연적인 진통제인 엔돌핀의 방출을 유도합니다.

관절염과 수술과 같은 통증을 증가시키는 질병 부담이 증가하고 통증 관리에서 LLLT의 응용이 확대되고 있음이 예측 기간 동안이 분야의 성장에 기여할 것으로 예상됩니다. 신체의 통증은 지난 10년간 세계적으로 증가하는 경향이 있습니다. 예를 들어 2024년 1월 Economic and Human Biology에 발표된 연구에 따르면 세계 146개국의 통증 유병률은 2019년 33.3%, 2020년 32.8%, 2021년 32.5%, 2022년 34.1%임이 밝혀졌습니다. 이와 같이 전 세계적으로 통증 유병률이 증가함에 따라 광생물자극 수요가 증가하여 이 분야의 성장이 촉진될 것으로 예상됩니다.

게다가 2022년 7월에 발표된 미국 통증재단의 보고서에 따르면 5천만 명의 미국인이 만성 통증과 3개월 이상 매일 지속되는 통증을 가지고 생활하고 있습니다. 따라서, 만성 상처의 부담이 크고, 상처 치료에서 광생물자극의 응용이 초기 기간의 부문 성장을 증가시킬 것으로 예상됩니다.

통증으로 이어지는 질병의 부담 증가는 부문의 성장에 기여할 것으로 예상됩니다. 예를 들어, 2022년 12월에 발표된 호주 통계국에 따르면, 2022년에는 약 370만명(14.5%)이 관절염을 앓고 있습니다. 이 비율은 45-54세에서는 0-44세의 약 7배(2.5%에 대해 16.2%)입니다. 관절염을 앓고있는 환자는 심각한/매우 심한 신체 통증을 경험합니다. 따라서 고통과 관련된 질병 부담이 증가하고 있다는 것도이 부문의 성장을 뒷받침합니다.

예측기간 중 북미가 시장에서 큰 점유율을 차지할 전망

북미는 첨단 기술을 갖춘 첨단 병원과 수술 시설의 광범위한 네트워크를 갖춘 고도로 정교한 건강 관리 인프라를 가지고 있으며, 광생물자극의 보급을 촉진하고 있습니다. 이 지역은 주로 골다공증이나 관절염과 같은 만성질환의 유병률이 상승하고 있기 때문에 예측기간 중에 큰 시장성장이 예상되고 있으며, 기술진보 증가가 예측기간 중 시장성장을 뒷받침할 것으로 예측되고 있습니다. 게다가 노인 인구 증가, 비침습적 치료에 대한 관심 증가, 통증 관리 치료에 대한 수요 증가, 스포츠 의학에 대한 관심 증가도 시장 성장의 원동력이 되고 있습니다. 이 지역의 스포츠 관련 부상 증가와 상처로 인한 부상 증가는 궁극적으로 다양한 광생물자극에 대한 수요를 증가시킵니다. 예를 들어 미국 국가안전위원회가 제공하는 부상 사실에 따르면 스포츠 및 레크리에이션으로 인한 부상은 2022년 12% 증가했습니다. 운동 및 운동기구에 대한 부상은 2021년 409,224건에서 2022년 445,642건으로 2021년보다 약간 증가했습니다. 이러한 스포츠 관련 부상 발생률의 상승이 스포츠 선수의 회복 촉진 및 통증 관리를 위한 효과적이고 비침습적인 치료 수단으로서 광생물자극 수요를 촉진하고 있습니다.

게다가, 환자들 사이에서 저침습 수술(MIS)에 대한 수요가 증가하고 있는 것도 시장 성장을 뒷받침하고 있습니다. MIS 수술에 대한 선호도 증가는 회복 시간 단축, 통증 완화, 절개창 축소 등 MIS의 장점이 인식되고 있는 것에 뿌리를 두고 있으며, 이들 모두가 광생물자극의 수용과 수요 증가에 기여하고 있습니다. 예를 들어 2023년 9월 미국 성형외과학회가 발표한 보고서에 따르면 미국에서는 2022년에 2,620만 건의 외과적 및 침습적인 미용·재건 수술이 이루어졌습니다.

이 지역의 인구 역학의 노화는 수술 개입의 필요성을 더욱 증폭시켜 광생물자극과 같은 침습성이 낮은 옵션에 대한 수요를 부추깁니다. 예를 들어, 2023년 12월 미국 헬스 랭킹스(America's Health Rankings)가 발표한 보고서에 따르면, 2022년에는 미국에 65세 이상의 성인이 5,800만 명 가까이 살고 있으며, 미국 인구의 약 17.3%를 차지하고 있습니다. 2040년까지 이 비율은 22%로 확대될 것으로 예상됩니다. 이러한 추세는 광생물자극의 지속적인 기술 발전과 일치합니다. 결론적으로 북미의 광생물자극 시장은 스포츠 관련 부상 증가, 낮은 침습 수술에 대한 수요 증가, 인구동태 고령화, R&D 활동에 대한 엄청난 투자로 견인되고 있습니다.

광생물자극 산업의 개요

광생물자극 시장은 통합되어 있으며 소수의 대기업으로 구성되어 있습니다. 현재 여러 회사의 대기업이 시장 점유율로 시장을 독점하고 있습니다. 일부 유력 기업들은 세계 시장에서의 지위를 굳히기 위해 타사와의 인수나 신제품의 발매를 정력적으로 실시했습니다. BioLight Technologies LLC, THOR Photomedicine Ltd, BIOFLEX, Vielight Inc., Erchonia Corporation은 현재 시장을 독점하고 있습니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 골다공증과 관절염의 이환율 상승

- 비침습적 치료에 대한 수요 증가

- 시장 성장 억제요인

- 대체 치료의 가용성

- Porter's Five Forces 분석

- 구매자/소비자의 협상력

- 공급기업의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 용도별

- 상처 케어

- 통증 관리

- 화장품 용도

- 기타 용도

- 파장 유형별

- 적외선

- 적색광

- 기타 파장 유형

- 최종 사용자별

- 전문 클리닉

- 연구기관

- 기타 최종 사용자

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 기업 프로파일

- BioLight Technologies LLC

- THOR Photomedicine Ltd

- BIOFLEX

- Erchonia Corporation

- Ingeneus

- Vielight Inc.

- HairMax

- TheraDome Inc.

- LumiWave

- Omega Laser Systems

- iGrow Laser

- Pulse Laser Relief

제7장 시장 기회와 앞으로의 동향

JHS 25.04.07The Photobiostimulation Market size is estimated at USD 265.63 million in 2025, and is expected to reach USD 433.86 million by 2030, at a CAGR of 10.31% during the forecast period (2025-2030).

The significant factor attributing to the market growth is the growing incidence of chronic diseases, leading to an increase in the number of patients being treated using methods of photobiostimulation. Additional factors, such as the rising prevalence of chronic pain disorders such as arthritis, osteoporosis, and the increasing geriatric population, will drive the market for photobiostimulation during the forecast period. For instance, according to a report published by the Osteoarthritis Action Alliance in January 2024, it is estimated that 1 in 5 United States adults have some form of arthritis, and osteoarthritis (OA) is the most common form of arthritis, affecting 32.5 million United States adults. Hence, the high prevalence of osteoarthritis in the United States is expected to drive the demand for photobiostimulation therapy in the forecasted period in the region.

Photobiostimulation therapy has also been utilized in diabetic wound healing treatment. A photobiomodulation response is produced when cells are exposed to radiation, which changes cellular functions and promotes the healing of diabetic wounds. By modifying many cellular and molecular processes, photobiomodulation therapy (PBMT) employing red and near-infrared (NIR) wavelengths is considered a promising treatment for accelerating the rate of diabetic wound healing, eliminating pain, and reducing inflammation. According to a report published by the International Diabetic Federation (IDF) in 2022, 537 million people have diabetes worldwide in 2021, and more than 51 million people will be in the North American region; by 2045, it will rise to 63 million. The diabetic population is high in the United States, which ultimately results in a higher number of diabetic foot ulcers. This is likely to increase the demand for photobiostimulation therapy as a cure, and it is expected to grow in the market over the forecast period.

Advancements in technology and new product launches by the market players focusing on photobiostimulation therapy are also aiding the growth of the studied market over the forecast period. For instance, in June 2023, Lumaflex, a health tech company, launched its new Lumaflex Body Pro. This revolutionary red light therapy device is currently in production and has achieved FDA Class 2 Certification. It has become a popular treatment for muscle recovery among fitness communities such as bodybuilders and mixed martial arts (MMA) athletes.

Moreover, in February 2024, BIOPTRON AG presented positive clinical data on using photobiostimulation treatment devices for wound healing at the Dubai World Dermatology Congress. The study discovered that the therapy dramatically decreased healing time while improving patient outcomes. Therefore, rising clinical trials and company activities are likely to add to the market growth.

Thus, the growing incidence of chronic diseases like diabetes and technological advancements accompanied by new products launched are expected to propel the growth of the photobiostimulation market. However, the rising availability of alternative treatments will hinder the market's growth over the forecast period.

Photobiostimulation Market Trends

Pain Management is Expected to Hold the Major Market Share in the Market Over the Forecast Period

Photobiostimulation has been explored for pain management with promising results. The benefits include the reduction of pain intensity, inflammation, and the promotion of tissue repair. In this application, low-level light therapy helps modulate cellular processes, influencing the release of endorphins and reducing inflammatory mediators. Conditions like musculoskeletal pain, arthritis, and neuropathic pain may benefit from photobiostimulation.

Low-level light therapy (LLLT) has been shown to have anti-inflammatory effects, helping to decrease swelling, alleviate pain associated with inflammatory conditions, and trigger the release of endorphins, the body's natural painkillers, providing a natural way to manage pain without relying solely on medication.

The growing burden of several diseases that elevate pain, such as arthritis and surgeries, and the growing application of LLLT in pain management is expected to contribute to the segment growth over the forecast period. Physical pain has trended upward globally over the last decade. For instance, according to the study published in Economic and Human Biology in January 2024, the pain prevalence across 146 countries worldwide revealed that 33.3% of people were in pain in 2019, 32.8% in 2020, 32.5% in 2021, and 34.1% in 2022. Thus, growing pain prevalence across the world is expected to increase demand for photobiostimulation therapy, thereby boosting the segment growth.

Moreover, according to the United States Pain Foundation report published in July 2022, 50 million Americans live with chronic pain or pain that lasts most days or every day for three months or more. Thus, the high burden of chronic wounds and the application of photobiostimulation therapy in wound care is anticipated to boost segment growth over the first period.

The growing burden of diseases that lead to pain is expected to contribute to segment growth. For instance, according to the Australian Bureau of Statistics published in December 2022, approximately 3.7 million (14.5%) people had arthritis in 2022. The proportion is almost seven times higher for people aged 45-54 years than for those aged 0-44 years (16.2% compared to 2.5%). Severe/very severe bodily pain was experienced by the patient suffering from arthritis. Thus, the growing burden of pain-related diseases also propels the growth of the segment.

North America is Expected to Hold a Significant Share in the Market During the Forecast Period

The North American region possesses a highly sophisticated healthcare infrastructure with an extensive network of advanced hospitals and surgical facilities well-equipped with cutting-edge technology, facilitating the widespread adoption of photobiostimulation treatment. The region is expected to have significant market growth over the forecast period, mainly attributed to the rising prevalence of chronic diseases like osteoporosis and arthritis, and the increase in technological advancements is expected to boost market growth over the forecast period. In addition, market growth is also fueled by the increasing geriatric population, rising focus on non-invasive treatments, growing demand for pain management treatments, and increasing focus on sports medicine. The increasing prevalence of sports-related injuries and the rise in the number of wound injuries in the region eventually increase the demand for various photobiostimulation treatments, for instance, according to the injury facts provided by the National Safety Council of the United States, sports and recreational injuries increased by 12% in 2022. The injuries related to exercise and exercise equipment increased slightly from 2021, from 409,224 injuries in 2021 to 445,642 injuries in 2022. This rising incidence of sports-related injuries is driving the demand for photobiostimulation as an effective and non-invasive therapeutic modality for accelerated recovery and pain management in athletes.

Moreover, rising demand for minimally invasive surgery (MIS) among patients also propels the market's growth. The rise in the preference for MIS surgeries is rooted in the perceived advantages of MIS, such as faster recovery times, reduced pain, and smaller incisions, all of which contribute to the increasing acceptance and demand for photobiostimulation. For instance, according to a report published by the American Society of Plastic Surgeons in September 2023, 26.2 million surgical and minimally invasive cosmetic and reconstructive procedures were performed in the United States in 2022.

The aging demographic in the region further amplifies the need for surgical interventions, thereby fueling the demand for less invasive options like photobiostimulation treatment. For instance, according to a report published by America's Health Rankings in December 2023, nearly 58 million adults ages 65 and older were living in the United States in 2022, accounting for about 17.3% of the nation's population. By 2040, that proportion is projected to grow to 22%. This trend aligns with continuous technological advancements in photobiostimulation treatment. In conclusion, the photobiostimulation market in North America is driven by the increasing prevalence of sports-related injuries, rising demand for minimally invasive surgery, the aging demographic, and significant investments in research and development activities.

Photobiostimulation Industry Overview

The photobiostimulation market is consolidated and consists of a few major players. A few of the major players are currently dominating the market in terms of market share. Some prominent players vigorously make acquisitions and new product launches with other companies to consolidate their global market positions. BioLight Technologies LLC, THOR Photomedicine Ltd, BIOFLEX, Vielight Inc., and Erchonia Corporation are currently dominating the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Incidence of Osteoporosis and Arthritis

- 4.2.2 Rising Demand for Non-Invasive Treatments

- 4.3 Market Restraints

- 4.3.1 Availability of Alternative Treatments

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Application

- 5.1.1 Wound Care

- 5.1.2 Pain Management

- 5.1.3 Cosmetic Application

- 5.1.4 Other Applications

- 5.2 By Wavelength Type

- 5.2.1 Infrared Light

- 5.2.2 Red Light

- 5.2.3 Other Wavelength Types

- 5.3 By End-User

- 5.3.1 Specialty Clinics

- 5.3.2 Research Institutes

- 5.3.3 Other End-Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 BioLight Technologies LLC

- 6.1.2 THOR Photomedicine Ltd

- 6.1.3 BIOFLEX

- 6.1.4 Erchonia Corporation

- 6.1.5 Ingeneus

- 6.1.6 Vielight Inc.

- 6.1.7 HairMax

- 6.1.8 TheraDome Inc.

- 6.1.9 LumiWave

- 6.1.10 Omega Laser Systems

- 6.1.11 iGrow Laser

- 6.1.12 Pulse Laser Relief