|

시장보고서

상품코드

1851198

미국의 디지털 사이니지 시장 : 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)United States Digital Signage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

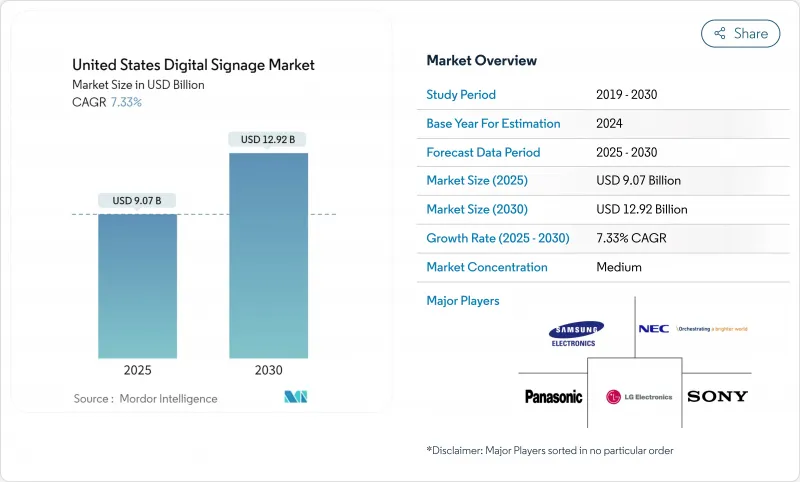

미국의 디지털 사이니지 시장은 2025년 90억 7,000만 달러로, 2030년까지 129억 2,000만 달러에 달할 것으로 예측되며, CAGR은 7.33%로 예상됩니다.

디지털 아웃 오브 홈(DOOH) 재고의 프로그래매틱 구매 증가, 대규모 소매의 디지털 변혁, 스마트 빌딩 플랫폼에 디스플레이 통합이 미국의 디지털 사이니지 시장의 현재 확대를 지원하는 3개의 구조적 성장 엔진입니다. 미국의 DOOH 광고비는 2025년 초에 총 수입이 90억 달러를 넘어 현재의 약 3분의 1을 디지털 형식에서 얻고 있는 보다 광범위한 아웃 오브 홈 부문과 연동하여 확대하고 있습니다. 하드웨어는 여전히 수익의 대부분을 차지하지만, 성능 분석, 구독 기반 컨텐츠 관리 시스템 및 크리에이티브 서비스를 통해 이익 풀은 경상 소프트웨어 및 서비스 라인으로 이동하고 있습니다. 에너지 효율적인 OLED, 고휘도 LCD, 반사형 전자 종이 디스플레이는 최종 사용자에게 광범위한 기술 옵션을 제공하여 장소별 시각적 목표, 지속가능성 및 비용 목표에 정확하게 맞출 수 있습니다.

미국의 디지털 사이니지 시장 동향과 통찰

미국 DOOH 광고비 급증

DOOH의 프로그래매틱 거래를 통해 광고주는 노출을 거의 실시간으로 거래할 수 있게 되었으며, 정적 옥외 미디어에서는 실현할 수 없었던 측정 가능성과 기여도가 향상되었습니다. 조사 대상 소비자의 4분의 3 이상이 DOOH의 메시지를 보고 행동을 취했다고 응답해 이 형식에 대한 광고주의 신뢰가 높아지고 있습니다. 이동통신사는 전국 규모의 광섬유 및 5G 네트워크가 연결뿐만 아니라 광고에서도 수익을 창출할 수 있음을 보여주는 관심 인수를 통해 이 분야에 진출했습니다. AI가 생성하는 광고 소재를 반복하면 캠페인 설정 시간이 단축되고 컨텐츠가 지역 날씨, 교통 상황 및 시청자 속성에 맞게 조정될 수 있으므로 광고비 수익이 더욱 향상됩니다. 같은 데이터 레이어가 커넥티드 TV의 구매를 지원하기 때문에 크로스 스크린의 게재빈도와 도달범위 관리가 일상적으로 되고 있으며, DOOH는 옴니채널 마케팅의 핵심 기둥으로 확고한 지위를 구축하고 있습니다.

소매업의 디지털 변혁

미국에서는 실제 매장에서의 쇼핑이 여전히 대부분을 차지하고 있기 때문에 체인 각사는 통로, 선반, 금전 등록기 지역에 디스플레이를 내장, 구매 증가를 촉구하거나 전자상거래 프로모션과 연동하고 있습니다. 소매업체는 재고, 고객 관계 도구 및 시각적 메시지를 모두 공유된 실시간 데이터 레이크에서 가져오도록 매장을 재구성합니다. 퀵 서비스 레스토랑의 디지털 메뉴 보드, 대형 상점의 무한 매대 키오스크, 식료품점의 전자가격표시기(ESL) 같은 요청이 눈에 보이게 나타납니다. 남부와 서부의 초기 도입 사례에서는 판촉 SKU의 수익 향상이 입증되고 있으며, 다른 지역에서의 전개를 위한 예산 승인이 가속화되고 있습니다.

데이터 프라이버시 및 옵트인 컴플라이언스 장애물

여러 주에서는 캘리포니아 소비자 프라이버시법과 병행하는 법령이 제정되어 생체 데이터나 행동 데이터를 취득 및 처리하기 전에 명시적인 동의를 얻는 것이 회장 운영자에게 의무화되어 있습니다. 예를 들어 필라델피아에서는 디스플레이의 최대 휘도를 주간에는 6,500 니트, 야간에는 450 니트로 제한하여 자동 디밍 제어를 의무화하고 있습니다. 이러한 요구사항을 통해 통합자는 보안 데이터 파이프라인, 감사 로그 및 프라이버시 바이 디자인 원칙을 통합해야 하며 엔지니어링과 법적 비용을 모두 추가합니다. 전국 광고주는 이후 각 지역의 표준 패치워크에 맞게 캠페인을 조정해야 하며 규모의 경제성이 저하됩니다.

부문 분석

시장 세분화에서 판매 점유율의 64.8%는 하드웨어 부문입니다. 서비스 매출은 CAGR 8.2%를 보일 것으로 예측되며 미국의 디지털 사이니지 시장의 가치 획득을 재구축하고 있습니다. 2024년 매출의 거의 3분의 2를 하드웨어가 차지했지만 구매자는 임시 자본 지출을 예측 가능한 영업 비용으로 변환하는 클라우드 기반 컨텐츠 관리, 네트워크 모니터링 및 분석을 점점 선호하고 있습니다. 따라서 많은 제조업체들은 디스플레이, 미디어 플레이어 및 현장 유지보수를 여러 해의 구독에 번들로 제공합니다. 전국적인 체인 배포는 임시 트랙 롤을 제거하고 수천 개의 스크린 컨텐츠 업데이트를 자동화함으로써 서비스가 총 소유 비용을 낮출 수 있음을 보여줍니다.

관리형 서비스에는 광고 소재 개발, 데이터 통합 및 캠페인 최적화도 포함됩니다. 이러한 기능은 내부에 디자인이나 IT 리소스가 없어도 참여를 극대화하고자 하는 소매업체, 의료 제공업체, 지자체에 매력적입니다. AI 도구가 트래픽 패턴과 데모 그래픽을 감지하면 서비스 파트너는 캠페인 관련성을 향상시키는 컨텍스트에 특화된 재생목록을 배포할 수 있습니다. 서비스로의 지속적인 전환은 미국의 디지털 사이니지 시장을 보다 조율적인 프로파일로 유도하고 전국 지원 네트워크에 자금을 공급할 수 있는 기업 간의 통합을 강화할 것으로 예측됩니다.

매출액의 71.5%는 계속해서 LCD와 직시형 LED가 차지하고 있지만, OLED의 CAGR 9.9%는 프리미엄인 비주얼 성능으로의 명확한 시프트를 강조하고 있습니다. 소매점의 플래그십 점포, 기업 로비, 고급 접객시설에서는 OLED의 무한에 가까운 콘트라스트와 초광시야각이 브랜드의 차별화 요인으로 꼽힙니다. Fortune 500대 회사로 선정된 구미 지역의 일부 캠퍼스에서는 입구 로비의 비디오 월을 LED에서 타일형 OLED 캔버스로 전환하여 월렛 점유율을 확대하고 있습니다.

OLED의 에너지 효율은 기업의 지속가능성 프로그램과도 일치합니다. 플렉서블 기판은 건축가가 디스플레이를 기둥 주위로 커브하거나 천장에 부착하는 리본을 만들 수 있게 하여 리지드 LCD에서는 실현할 수 없었던 디자인의 가능성을 풀어 놓고 있습니다. 프로젝션은 여전히 강당용 틈새 시장이며, 전자 종이는 태양을 향하거나 배터리 구동 자산을 수용합니다. OLED 제조의 지속적인 비용 절감은 대응 가능한 용도를 확대하고 이 기술이 미국의 디지털 사이니지 시장 내에서 발판을 굳힐 것으로 예측됩니다.

미국의 디지털 사이니지 시장 보고서는 컴포넌트별(하드웨어, 소프트웨어, 서비스), 디스플레이 기술별(LCD/LED, OLED, 프로젝션, 기타), 스크린 사이즈별(32인치 미만, 32-52인치, 기타), 설치장소별(실내, 옥외), 최종사용자별(소매, 운수, 접객 및 QSR, 은행, 금융서비스 및 보험(BFSI), 교육, 헬스케어, 기타), 지역별(북동부, 중서부, 남부, 서부)으로 분류됩니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 미국 DOOH 광고비 급증

- 소매업의 디지털 전환 의무

- 서비스형 턴키 사이니지 제공

- 컨텍스트 어웨어 광고와 프로그래매틱 광고의 성장

- 스마트 빌딩과 사이니지 네트워크의 통합

- 저소비 전력 전자 페이퍼와 반사형 디스플레이의 채용

- 시장 성장 억제요인

- 데이터 프라이버시와 옵트인 컴플라이언스의 장애물

- 대형 및 인터랙티브 디스플레이를 위한 고액 설비 투자

- 중소기업의 컨텐츠 관리에서 발생하는 운영 복잡성

- 옥외의 밝기 및 야간 조명에 관한 도시 조례의 엄격화

- 생태계 분석

- 기술의 전망

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측

- 컴포넌트별

- 하드웨어

- LCD/LED 디스플레이

- OLED 디스플레이

- 미디어 플레이어

- 프로젝션 스크린 및 프로젝터

- 기타 하드웨어

- 소프트웨어

- 서비스

- 하드웨어

- 디스플레이 기술별

- LCD/LED

- OLED

- 프로젝션

- e-Paper 및 반사재

- 스크린 사이즈별

- 32인치 미만

- 32-52인치

- 52인치 이상

- 설치 장소별

- 실내

- 옥외

- 최종 사용자별

- 소매

- 운송

- 접객 및 QSR

- BFSI

- 교육

- 정부 및 공공기관

- 헬스케어

- 기업 및 상업 사무소

- 엔터테인먼트 및 스포츠 회장

- 지역별

- 북동부

- 중서부

- 남부

- 서부

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Samsung Electronics Co., Ltd.

- LG Display Co., Ltd.

- NEC Corporation

- Stratacache, Inc.

- Daktronics, Inc.

- Sony Group Corporation

- Panasonic Holdings Corporation

- Sharp NEC Display Solutions of America, Inc.

- Christie Digital Systems USA, Inc.

- Barco NV

- Planar Systems, Inc.

- BrightSign LLC

- Four Winds Interactive LLC

- Broadsign International, LLC

- Navori Labs SA

- Cisco Systems, Inc.

- Goodview Electronics Co., Ltd.

- Toshiba America Business Solutions, Inc.

- Peerless-AV(Peerless Industries, Inc.)

- Watchfire Signs, LLC

- Rise Vision, Inc.

제7장 시장 기회와 장래의 전망

JHS 25.11.21The United States digital signage market is valued at USD 9.07 billion in 2025 and is projected to reach USD 12.92 billion by 2030, translating into a 7.33% CAGR.

Rising programmatic buying of digital-out-of-home (DOOH) inventory, large-scale retail digital transformation, and the embedding of displays into smart-building platforms are the three structural growth engines behind the current expansion of the United States digital signage market. National DOOH ad spending is scaling in tandem with the broader out-of-home sector, which crossed USD 9 billion in total revenue in early 2025 and now derives roughly one-third of that revenue from digital formats. Hardware continues to dominate revenue, yet proof-of-performance analytics, subscription-based content management systems, and creative services are shifting profit pools toward recurring software and services lines. Energy-efficient OLED, high-brightness LCD, and reflective e-paper displays give end users a widening menu of technology choices, enabling more precise alignment with venue-specific visual, sustainability, and cost objectives

United States Digital Signage Market Trends and Insights

Surge in United States DOOH Ad-Spend

DOOH programmatic exchanges now allow advertisers to trade impressions almost in real time, elevating measurability and attribution in ways previously unattainable in static outdoor media. More than three-quarters of surveyed consumers reported taking action after seeing a DOOH message, reinforcing advertiser confidence in the format. Telecommunications operators have entered the space through high-profile acquisitions, a signal that nationwide fiber and 5G networks can be monetized through advertising as well as connectivity. AI-generated creative iterations cut campaign setup times and allow content to adjust to local weather, traffic, or audience demographics, which further boosts return on ad spend. Because the same data layers power connected-TV buying, cross-screen frequency and reach management are becoming routine, solidifying DOOH as a critical pillar in omnichannel marketing.

Retail Digital-Transformation Mandates

Brick-and-mortar still captures the majority of U.S. shopping activity, prompting chains to embed displays into aisles, shelves, and checkout zones to encourage incremental purchases and to synchronize with e-commerce promotions. Retailers are re-architecting stores so that inventory, customer-relationship tools, and visual messaging all draw from a shared real-time data lake. Digital menu boards in quick-service restaurants, endless-aisle kiosks in big-box stores, and electronic shelf labels in grocery stores are visible manifestations of the same imperative: curate, inform, and transact in context. Early deployments in the South and West demonstrate revenue uplifts on promoted SKUs, which are accelerating budget approvals for rollouts across other regions.

Data-Privacy and Opt-In Compliance Hurdles

Multiple states have enacted statutes that parallel the California Consumer Privacy Act, compelling venue operators to obtain explicit consent before capturing or processing biometric and behavioral data. Municipal codes now regulate display luminance - for instance, Philadelphia limits maximum brightness to 6,500 nits by day and 450 nits at night while mandating automated dimming controls. Such requirements force integrators to embed secure data pipelines, audit logs, and privacy-by-design principles, adding both engineering and legal costs. National advertisers must subsequently tailor campaigns for a patchwork of local standards, dampening scale economies.

Other drivers and restraints analyzed in the detailed report include:

- Turnkey Signage-as-a-Service Offerings

- Context-Aware and Programmatic Advertising Growth

- High Capex for Large-Format/Interactive Displays

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The hardware segment accounts for 64.8% of the revenue market share. Services revenue is forecast to grow at an 8.2% CAGR, reshaping value capture inside the United States digital signage market. Although hardware generated almost two-thirds of 2024 revenue, buyers increasingly favor cloud-based content management, network monitoring, and analytics that convert one-time capital expense into predictable operating expense. Many manufacturers, therefore, bundle displays, media players, and field maintenance under multi-year subscriptions. National chain rollouts illustrate that services lower the total cost of ownership by eliminating ad-hoc truck rolls and by automating content updates across thousands of screens.

Managed services also encompass creative development, data integration, and campaign optimization. These capabilities appeal to retailers, healthcare providers, and municipalities lacking in-house design or IT resources yet seeking to maximize engagement. With AI tools detecting traffic patterns and demographics, service partners can deploy context-specific playlists that improve campaign relevance. Continued migration toward services is expected to nudge the United States digital signage market toward higher gross margin profiles, reinforcing consolidation among firms able to fund nationwide support networks.

LCD and direct-view LED continue to account for 71.5% of revenue, yet OLED's 9.9% CAGR underscores a discernible shift toward premium visual performance. Retail flagships, corporate lobbies, and high-end hospitality venues cite OLED's near-infinite contrast and ultra-wide viewing angles as brand differentiation levers. Several Fortune 500 campuses in the West region have migrated entrance lobby video walls from LED to tiled OLED canvases, evidencing wallet share gains.

OLED's energy efficiency also dovetails with corporate sustainability programs, a factor that carries weight in jurisdictions employing emissions reporting. Flexible substrates allow architects to curve displays around pillars or create ceiling-mounted ribbons, unlocking design possibilities unattainable with rigid LCD. Projection remains a niche for auditoriums, while e-paper addresses sun-facing or battery-powered assets. Continued cost declines in OLED manufacturing are anticipated to expand addressable applications, giving the technology a growing footprint within the United States digital signage market.

United States Digital Signage Market Report is Segmented by Component (Hardware, Software and Services), Display Technology (LCD/LED, OLED, Projections, and More), Screen Size (Less Than 32-Inch, 32-Inch - 52-Inch, and More), Installation Location (Indoor, and Outdoor), End User (Retail, Transportation, Hospitality and QSR, BFSI, Education, Healthcare, and More) and Geography (Northeast, Midwest, South, and West).

List of Companies Covered in this Report:

- Samsung Electronics Co., Ltd.

- LG Display Co., Ltd.

- NEC Corporation

- Stratacache, Inc.

- Daktronics, Inc.

- Sony Group Corporation

- Panasonic Holdings Corporation

- Sharp NEC Display Solutions of America, Inc.

- Christie Digital Systems USA, Inc.

- Barco NV

- Planar Systems, Inc.

- BrightSign LLC

- Four Winds Interactive LLC

- Broadsign International, LLC

- Navori Labs SA

- Cisco Systems, Inc.

- Goodview Electronics Co., Ltd.

- Toshiba America Business Solutions, Inc.

- Peerless-AV (Peerless Industries, Inc.)

- Watchfire Signs, LLC

- Rise Vision, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in United States DOOH ad-spend

- 4.2.2 Retail digital-transformation mandates

- 4.2.3 Turnkey signage-as-a-service offerings

- 4.2.4 Context-aware and programmatic advertising growth

- 4.2.5 Smart-building integration with signage networks

- 4.2.6 Low-power e-paper and reflective displays adoption

- 4.3 Market Restraints

- 4.3.1 Data-privacy and opt-in compliance hurdles

- 4.3.2 High capex for large-format/interactive displays

- 4.3.3 Operational complexity for SME content management

- 4.3.4 Stricter city ordinances on outdoor brightness/curfews

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.1.1 LCD/LED Displays

- 5.1.1.2 OLED Displays

- 5.1.1.3 Media Players

- 5.1.1.4 Projection Screens and Projectors

- 5.1.1.5 Other Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.1.1 Hardware

- 5.2 By Display Technology

- 5.2.1 LCD/LED

- 5.2.2 OLED

- 5.2.3 Projection

- 5.2.4 e-Paper and Reflective

- 5.3 By Screen Size

- 5.3.1 Less than 32-inch

- 5.3.2 32-inch to 52-inch

- 5.3.3 Greater than 52-inch

- 5.4 By Installation Location

- 5.4.1 Indoor

- 5.4.2 Outdoor

- 5.5 By End User

- 5.5.1 Retail

- 5.5.2 Transportation

- 5.5.3 Hospitality and QSR

- 5.5.4 BFSI

- 5.5.5 Education

- 5.5.6 Government and Public Institutions

- 5.5.7 Healthcare

- 5.5.8 Corporate and Commercial Offices

- 5.5.9 Entertainment and Sports Venues

- 5.6 By Geography

- 5.6.1 Northeast

- 5.6.2 Midwest

- 5.6.3 South

- 5.6.4 West

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Samsung Electronics Co., Ltd.

- 6.4.2 LG Display Co., Ltd.

- 6.4.3 NEC Corporation

- 6.4.4 Stratacache, Inc.

- 6.4.5 Daktronics, Inc.

- 6.4.6 Sony Group Corporation

- 6.4.7 Panasonic Holdings Corporation

- 6.4.8 Sharp NEC Display Solutions of America, Inc.

- 6.4.9 Christie Digital Systems USA, Inc.

- 6.4.10 Barco NV

- 6.4.11 Planar Systems, Inc.

- 6.4.12 BrightSign LLC

- 6.4.13 Four Winds Interactive LLC

- 6.4.14 Broadsign International, LLC

- 6.4.15 Navori Labs SA

- 6.4.16 Cisco Systems, Inc.

- 6.4.17 Goodview Electronics Co., Ltd.

- 6.4.18 Toshiba America Business Solutions, Inc.

- 6.4.19 Peerless-AV (Peerless Industries, Inc.)

- 6.4.20 Watchfire Signs, LLC

- 6.4.21 Rise Vision, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment