|

시장보고서

상품코드

1689769

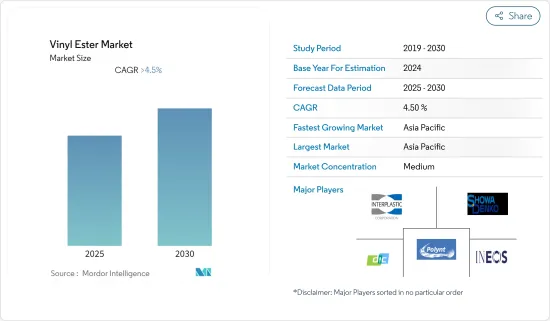

비닐에스테르 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Vinyl Ester - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

비닐에스테르 시장은 예측 기간 동안 4.5% 이상의 CAGR을 나타낼 것으로 예측됩니다.

2020년에는 COVID-19의 대유행이 시장에 부정적인 영향을 주었지만, 대유행 전의 수준에 이른 것으로 추정되고 있으며, 예측 기간 중(2022-2027년)에는 안정된 성장이 전망됩니다.

시장을 견인하는 주요 요인은 섬유 강화 플라스틱의 탱크 및 용기 제조에 있어서의 용도의 확대와, 내부식성 기기의 제조에 있어서의 용도의 확대입니다.

반면 비닐에스테르 수지의 독성은 시장 성장을 방해하고 있습니다.

배연 탈황 용도 확대는 예측 기간 동안 시장 성장에 다양한 기회를 제공할 것으로 기대됩니다.

아시아태평양은 비닐에스테르 시장을 독점하고 있으며, 중국, 인도, 일본이 시장 수요에 크게 기여하고 있습니다.

비닐에스테르 시장 동향

파이프 및 탱크 분야가 시장을 독점할 전망

부식 산업에서는 유지 보수 및 수리에 많은 시간을 빼앗기는 것을 피하기 위해 강도와 내구성을 잃지 않고 내식성이 있고 고온에도 견딜 수있는 복합재료가 선택되고 있습니다.

파이프 및 탱크에서 섬유 강화 플라스틱(FRP)의 애플리케이션은 최근 몇 년동안 증가하고 있습니다. 비닐에스테르 수지는 내화학성이 우수하고 침투성이 낮기 때문에 많은 산업에서 널리 사용되고 있습니다.

섬유 강화 플라스틱(FRP) 저장 탱크, 파이프라인, 오리 시스템의 제조에 널리 사용됩니다. 파이프 및 탱크 분야는 비닐에스테르 시장에서 가장 큰 점유율을 차지할 것으로 추정됩니다.

비닐에스테르 기반의 FRP 파이프 및 탱크는 크롤링, 알칼리, 화학공업, 발전공업, 광업, 금속공업, 공업용수, 폐수공업, 식품가공공업, 펄프, 제지공업 등의 산업에서 널리 사용되고 있습니다.

비닐에스테르 계 FRP 배관은 전력 산업에서 많은 용도에 사용됩니다. 예를 들어, 슬러리 배관, 탈황 장치의 스프레이 헤더, 저장 탱크 등입니다.

비닐에스테르계 배관은 장기적인 유지보수 비용이나 펌프 운전 비용을 삭감할 수 있기 때문에 산업 폐수 용도로도 인기가 있습니다.

이러한 점에서 파이프 및 탱크 분야가 시장을 독점할 것으로 예상됩니다.

중국이 아시아태평양시장을 독점할 전망

아시아태평양에서는 중국이 GDP에서 가장 큰 경제 강국입니다.

중국 석유 집단(CNPC)에 따르면 중국의 가스 소비량은 2020년 3,200억 입방미터(BCM)로 증가할 전망이며, 2040년에는 약 600 BCM으로 급증할 것으로 예상됩니다. 증가하는 가스 수요에 대응하기 위해 2040년까지 가스 생산량을 2배인 325 BCM으로 늘릴 계획입니다.

이 나라에서는 향후 5년 이내에 수많은 화학 플랜트의 건설이 예정되어 있습니다. BASF는 중국의 광동성 남부에 위치한 100억 달러의 종합 석유화학 프로젝트를 건설하기 시작했습니다. 이 플랜트의 제1단계는 2022년 말까지 가동을 시작할 예정입니다.

중국은 세계 최대의 자동차 생산국입니다. 2021년 1-9월기의 생산 대수는 2020년 동기 대비 53% 증가했습니다.

이러한 점에서 중국은 아시아태평양 시장을 독점할 것으로 예상됩니다.

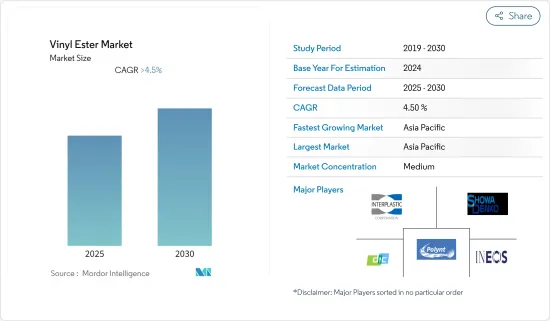

비닐에스테르 산업 개요

비닐에스테르 시장은 부분적으로 통합되어 있으며 주요 기업이 큰 점유율을 차지합니다. 상위 5개 기업이 전체 시장의 60% 이상 점유율을 차지하고 있습니다. 주요 기업(순부동)로는 Polynt, INEOS, DIC CORPORATION, Interplastic Corporation, SHOWA DENKO K.K. 등을 들 수 있습니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트·지원

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 섬유 강화 플라스틱 탱크와 용기의 제조 용도 확대

- 내부식성 기기의 제조에서의 용도 증가

- 억제요인

- 수지의 독성

- 기타 억제요인

- 산업 밸류체인 분석

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁도

- 수출입 동향

- 원료 분석

- 기술 스냅샷

- 가격 분석

제5장 시장 세분화

- 유형

- 비스페놀 A 디글리시딜 에테르(DGEBA)

- 에폭시페놀 노볼락(EPN)

- 기타 유형

- 용도

- 파이프 및 탱크

- 페인트 및 코팅

- 수송

- 기타 용도

- 지역

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 시장 점유율(%)**/랭킹 분석

- 주요 기업의 전략

- 기업 프로파일

- AOC

- Bkdj Polymers India

- DIC CORPORATION

- INEOS

- Interplastic Corporation

- Poliya

- Polynt

- Scott Bader Company Ltd

- SHOWA DENKO KK

- Sino Polymer Co. Ltd

- Swancor

제7장 시장 기회와 앞으로의 동향

- 배연 탈황에 있어서의 응용의 성장

The Vinyl Ester Market is expected to register a CAGR of greater than 4.5% during the forecast period.

The COVID-19 pandemic impacted the market negatively in 2020; however, it has been estimated to have reached pre-pandemic levels and is expected to grow at a steady rate during the forecast period (2022-2027).

The major factors driving the market are growing application in the manufacture of fiber-reinforced plastic tanks and vessels and increasing application in making corrosion-resistant equipment.

On the flip side, the toxicity of vinyl ester resin is hindering the growth of the market studied.

The growing application in flue gas desulphurization is expected to offer various opportunities for the growth of the market studied over the forecast period.

The Asia-Pacific region dominated the market for vinyl ester, with China, India, and Japan being the major contributors to the market demand.

Vinyl Ester Market Trends

The Pipes and Tanks Segment is Expected to Dominate the Market

To avoid losing a large amount of time to maintenance and repairs, the corrosion industry is choosing composite materials that are resistant to corrosion and can withstand high temperatures without losing their strength or durability.

The fiber-reinforced plastic (FRP) application in pipes and tanks has been rising in recent years. Vinyl ester resins are widely used in many industries due to their superior chemical resistance and low permeability.

They are being extensively used to fabricate fiber-reinforced plastic (FRP) storage tanks, pipelines, and duck systems. The pipes and tanks segment is estimated to have the largest share in the vinyl ester market.

Vinyl ester-based FRP pipes and tanks are widely used in industries such as the chlor-alkali and chemical industry, power generation industry, mining and metal industry, industrial water and wastewater industry, food processing industry, and pulp and paper industry.

Vinyl ester-based FRP pipings are used for many applications in the power industry. Some of these include slurry piping, FGD absorber spray headers, and storage tanks.

Vinyl ester-based pipes are also popular in industrial wastewater applications as they reduce long-term maintenance and pump operating costs.

Based on the above-mentioned aspects, the pipes and tanks segment is expected to dominate the market.

China is Expected to Dominate the Asia-Pacific Market

In the Asia-Pacific region, China is the largest economy in terms of GDP.

According to China National Petroleum Corp. (CNPC), the gas consumption in China was expected to rise to 320 billion cubic meters (BCM) in 2020; gas consumption is expected to surge to around 600 BCM by 2040. In order to meet the growing gas demand, the country is planning to double its gas production to 325 BCM by 2040.

There are numerous chemical plants lined up for construction within the period of the next five years in the country. BASF started the construction of its USD 10 billion integrated petrochemicals project, located in the southern province of Guangdong in China. The first phase of this plant is scheduled to come online by the end of 2022.

China is the world's largest automotive producer. The production increased by 53% in the first nine months of 2021 in comparison to the same period of 2020.

Based on the aforementioned aspects, China is expected to dominate the Asia-Pacific market.

Vinyl Ester Industry Overview

The vinyl ester market is partially consolidated, with the top players holding a significant share. The top five players account for a share of more than 60% of the total market. Some of the major players (in no particular order) include Polynt, INEOS, DIC CORPORATION, Interplastic Corporation, and SHOWA DENKO K.K., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Application in the Manufacture of Fiber Reinforced Plastic Tanks and Vessels

- 4.1.2 Increasing Application in Making Corrosion-resistant Equipment

- 4.2 Restraints

- 4.2.1 Toxicity of the Resin

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

- 4.5 Import-export Trends

- 4.6 Feedstock Analysis

- 4.7 Technological Snapshot

- 4.8 Price Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Bisphenol A Diglycidyl Ether (DGEBA)

- 5.1.2 Epoxy Phenol Novolac (EPN)

- 5.1.3 Other Types

- 5.2 Application

- 5.2.1 Pipes and Tanks

- 5.2.2 Paints and Coatings

- 5.2.3 Transportation

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AOC

- 6.4.2 Bkdj Polymers India

- 6.4.3 DIC CORPORATION

- 6.4.4 INEOS

- 6.4.5 Interplastic Corporation

- 6.4.6 Poliya

- 6.4.7 Polynt

- 6.4.8 Scott Bader Company Ltd

- 6.4.9 SHOWA DENKO K.K

- 6.4.10 Sino Polymer Co. Ltd

- 6.4.11 Swancor

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Application in Flue Gas Desulphurization