|

시장보고서

상품코드

1910673

공압 장비 시장 : 점유율 분석, 업계 동향 및 통계, 성장 예측(2026-2031년)Pneumatic Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

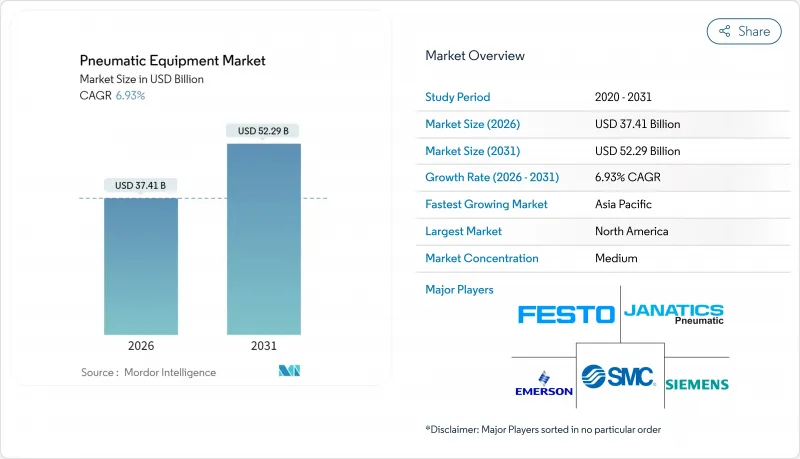

세계의 공압 장비 시장 규모는 2026년 374억 1,000만 달러로 추정되며, 2025년 349억 9,000만 달러에서 성장했으며, 2031년에는 522억 9,000만 달러에 이를 것으로 예측됩니다. 2026년부터 2031년까지는 CAGR 6.93%로 확대될 전망입니다.

산업 자동화의 고도화, 에너지 절약형 압축공기 시스템의 개수, 공압 하드웨어와 IIoT 진단 기술의 융합이 주요 성장 요인이 되고 있습니다. 반도체 클린룸, 전기자동차 배터리 생산 라인, 위생 식품 공장 수요 급증은 이 분야의 적용 범위 확대를 뒷받침하고 있습니다. 시장 리더 기업이 다운타임과 에너지 손실을 줄이기 위해 기존의 공압 기술과 디지털 감시를 결합하여 경쟁이 치열해지고 있습니다. 동시에 주요 경제권의 효율성 규제 강화가 하이브리드 전기 공압 솔루션으로의 전환을 가속화하고 있으며 공급업체에게 새로운 차별화의 길을 열고 있습니다.

세계의 공압 장비 시장 동향과 통찰

산업을 통한 자동화의 진전

대규모 공장의 디지털화는 공압 설계를 재구성하고 있으며 공급업체는 예측 분석을 가능하게 하는 센서 및 무선 모듈의 통합을 촉진합니다. SMC의 EXW1 무선 노드는 밸브 매니폴드의 크기를 86% 줄이고 주요 산업용 이더넷 프로토콜을 지원하며, 소형화와 연결성이 단일 패키지로 융합되는 실례를 보여줍니다. 플랜트 관리자의 경우 실린더 및 밸브의 실시간 건강 데이터는 예기치 않은 정지 감소와 근본 원인 분석의 가속화로 이어집니다. 특히 전자기기, 자동차, 포장 제품 공장에서 신규건설의 '무인화' 라인 구축에 따른 도입이 현저합니다. ISO 11011을 기반으로 한 적합성 감사는 압축 공기의 기준선을 정량화하는 솔루션의 중요성을 높이고 디지털 대응 공압 시스템은 매력적인 투자 대상입니다. 측정 가능한 OEE 향상을 입증할 수 있는 공급업체는 기존 제품과의 경쟁 입찰로 우위를 차지하고 있습니다.

에너지 절약형 압축 공기 시스템에 대한 수요

압축 공기는 산업용 전력 부하의 약 10%를 차지하고 있으며, 2025년 1월 시행의 미국 에너지부(DOE) 신효율 규제에 의해 기존 설비 전체의 갱신이 강요되고 있습니다. Atlas Copco의 하이브리드 컴프레서 제품군은 고정 속도 모드와 가변 속도 구동(VSD) 모드를 전환할 수 있어 압력 안정성을 ±0.1bar 이내로 유지하면서 1대당 연간 9톤의 CO2 배출 감축을 실현합니다. 유럽에서는 ASHRAE 90.1-2022 표준에 압축 공기가 추가되어 건축 설계자의 요구 수준도 높아지고 있습니다. 재무면에서는 누설률이 30% 이상의 경우가 많고 공장마다 연간 수만 달러의 전력 손실이 발생하고 있기 때문에 단기간에 투자 회수가 가능한 개수가 촉진되고 있습니다. 기업의 지속가능성 담당자는 누출 감지 프로그램을 쉽게 실현할 수 있는 탈탄소화 시책으로 자리매김하여 고효율 공압 장비에 대한 수요를 더욱 가속화하고 있습니다.

높은 평생 유지비와 에너지 비용

총 소유 비용 감사에 따르면 에너지 비용은 컴프레서 수명주기 비용의 77%를 차지하며 자본 지출을 크게 초과합니다. 누출 방지 프로그램은 소비를 줄이지만 소규모 공장에서는 부족하기 쉬운 측정 장비와 인력이 필요합니다. 호주 정부 조사에서는 평균 누설률이 30%로 보고되어 세계의 비효율성 패턴이 확인되었습니다. IIoT 센서는 자동 유출 추적을 약속하지만 초기 하드웨어 및 분석 서비스 구독 비용이 가격에 민감한 사업자를 망설이고 있습니다. 일부 유럽에서 2자리 전력 가격 상승이 지속됨에 따라 공압 시스템 비용에 대한 모니터링이 강화되고 가동 사이클이 허용되는 경우 구매자는 대체 구동 방식으로의 전환을 촉구합니다.

부문 분석

2025년 업스윙 밸브는 공압 장비 시장 점유율의 33.02%를 차지했고 자동화 라인 내의 압력 및 유량 제어에 있어서 핵심적인 역할을 부각시켰습니다. 픽 앤 플레이스 로봇에서 벌크 컨베이어에 이르는 모든 회로가 동작 순서를 조정하기 위한 방향 제어 밸브와 비례 밸브에 의존하고 있기 때문에 그 우위성은 지속되고 있습니다. 성장은 설치 시간을 단축하고 스마트 팩토리 구조에 맞는 컴팩트하고 프로토콜 독립적 인 매니 폴드를 기울입니다.

액추에이터는 CAGR 7.46%로 가속화되었으며, 이는 제조업체가 더 높은 적재 정밀도와 고속 사이클 속도를 필요로 함을 반영합니다. Emerson의 XV 시리즈는 슬림한 설치 면적에서 분당 350NL의 유량을 실현하여 설계자가 처리량을 희생하지 않고 캐비닛을 소형화할 수 있습니다. 클린 에어 규제의 강화에 따라, 공기 준비 유닛과 정밀 조인트가 컴포넌트 구성을 보완해, 예지 보전의 도입에 의해 센서 액세서리가 활발해지고 있습니다. 이러한 결과로 공압 장비 시장은 단품 부품에서 완전 통합된 데이터 풍부한 어셈블리로 이행을 계속하고 있습니다.

2025년 공압 장비 시장에서 수요의 40.02%를 모션 컨트롤이 차지했으며, 리니어 슬라이드, 회전 테이블, 프레스 스테이션 등의 높은 보급도를 반영하고 있습니다. 이 분야는 공기압의 우수한 출력 중량비와 밀리초 단위의 응답성이라는 고속 조립 라인에서 중시되는 특성을 활용하고 있습니다. 현재, 추적성을 위해 스트로크 데이터를 MES 플랫폼에 전송하는 피드백 가능 실린더가 중요합니다.

자재관리는 전자상거래 물류가 자동 분류 센터를 견인하는 가운데 7.95%라는 가장 빠른 CAGR을 기록하고 있습니다. 협동 로봇과의 연계 인증을 취득한 SMC의 RMH 그리퍼는 소프트 터치 파지가 새로운 SKU 처리 능력을 개척하는 좋은 예입니다. 유체 제어는 공정 산업에서 틈새 시장을 유지하는 반면 진공 발생 장치는 반도체 웨이퍼 이송 분야에서 확대되고 있습니다. 융합의 경향이 현저하고, 선진적인 매니폴드는 위치결정, 파지 및 진공 제어를 단일 노드에 통합하여 공압 장비 시장에서 공급자의 고객 정착률을 강화하고 있습니다.

지역별 분석

북미는 고사양 솔루션을 필요로 하는 항공우주, 제약, 자동차 산업의 성숙으로 2025년 세계 수익의 34.21%를 차지했습니다. Siemens가 텍사스와 캘리포니아의 신 공장에 100억 달러를 투자한 것은 이 지역의 지속적인 리쇼어링 동향을 보여 주며, 모션, 밸브, 컴프레서 패키지의 부품 수주를 밀어 올리고 있습니다. 미국 에너지부(DOE)의 컴프레서 규제가 다가오는 가운데, 설비 갱신 사이클을 안정시키는 개수의 물결이 일어나고 있습니다.

아시아태평양은 7.66%라는 가장 높은 CAGR을 나타내고 있으며, 중국, 인도, ASEAN 국가에 있어서 새로운 팹이나 배터리 공장의 건설에 의해 2031년까지 그 차이를 줄일 전망입니다. Atlas Copco의 한국 Kyungwon Machinery 4,650만 달러의 인수는 공급의 현지화와 급증하는 지역 수요에 대응하는 전략적 움직임을 보여줍니다. 인도와 베트남에서 반도체 자급 자족을 향한 정부의 우대 조치는 초청정 공압 장비에 대한 새로운 수요를 불러일으킵니다.

유럽은 엄격한 에너지 및 지속가능성 지령에 힘입어 견조한 점유율을 유지하고 있습니다. Bosch Rexroth의 멕시코 1억 6,000만 유로 규모의 공장 건설은 유럽 OEM 제조업체의 양극화 전략을 돋보이게 합니다. 즉, 연구 개발은 본국에 유지하면서 미국 고객 기반에 가까운 지역에 비용 효율적인 생산 능력을 구축하는 전략입니다. 남미와 중동의 소규모 성장에 대한 기회는 견고한 고압 공압 어레이를 필요로 하는 석유화학 다각화 프로젝트에 의존하며, 공압 장비 시장에 점진적인 수요량을 제공합니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 애널리스트에 의한 3개월간의 지원

자주 묻는 질문

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 산업 전체에서 자동화의 진전

- 에너지 절약형 압축공기 시스템에 대한 수요

- 위생적인 식품 및 음료 가공 라인의 급속한 성장

- 전기자동차 제조 시설의 확대

- 마이크로 액추에이터에 대한 마이크로플루이딕스 어셈블리 수요

- IIoT를 활용한 예지보전의 개수

- 시장 성장 억제요인

- 높은 수명주기 유지비 및 에너지 비용

- 정밀 작업에서 전동 액추에이터에 대한 대체

- 압축공기 누설에 대한 ESG 기준에 따른 벌칙

- 반도체 제조 공장용 초청정 압축 공기 부족

- 규제 상황

- 기술의 전망

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 거시경제의 영향 분석

제5장 시장 규모와 성장 예측

- 컴포넌트별

- 액추에이터

- 밸브

- 공기 준비 유닛(FRL)

- 피팅 및 튜브

- 에어 컴프레서

- 진공발생장치

- 액세서리

- 기능별

- 모션 컨트롤

- 유체제어

- 자재관리

- 진공 생성

- 발전 및 공기 공급

- 최종 사용 산업별

- 자동차

- 식음료 가공 및 포장

- 항공우주 및 방위

- 생명과학(제약 및 의료기기)

- 전자기기 및 반도체

- 화학제품 및 석유화학제품

- 포장 기계

- 기타 최종 사용 산업

- 압력 범위별

- 저압(7bar 미만)

- 중압(7-15bar)

- 고압(15bar 이상)

- 지역별

- 북미

- 미국

- 캐나다

- 남미

- 브라질

- 아르헨티나

- 칠레

- 기타 남미

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- ASEAN-5

- 기타 아시아태평양

- 중동 및 아프리카

- 중동

- 사우디아라비아

- 아랍에미리트(UAE)

- 튀르키예

- 기타 중동

- 아프리카

- 남아프리카

- 나이지리아

- 이집트

- 기타 아프리카

- 중동

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Festo SE and Co. KG

- Emerson Electric Co.

- SMC Corporation

- Parker-Hannifin Corporation

- Siemens AG

- Ingersoll Rand Inc.

- Atlas Copco AB

- Bosch Rexroth AG

- Norgren Ltd.(IMI plc)

- Airtac International Group

- CKD Corporation

- Camozzi Automation SpA

- Danfoss A/S

- Honeywell International Inc.

- Eaton Corporation plc

- ROSS Operating Valve Co.

- Bimba Manufacturing LLC(IMI)

- Janatics India Pvt Ltd

- Chicago Pneumatic Tool Co. LLC

- Koki Holdings Co., Ltd.

- Yamaha Motor Co., Ltd.(Robotics)

제7장 시장 기회와 미래 전망

SHW 26.01.26The pneumatic equipment market size in 2026 is estimated at USD 37.41 billion, growing from 2025 value of USD 34.99 billion with 2031 projections showing USD 52.29 billion, growing at 6.93% CAGR over 2026-2031.

Industrial automation upgrades, energy-efficient compressed-air retrofits, and the fusion of pneumatic hardware with IIoT diagnostics are the primary growth catalysts. Demand spikes from semiconductor clean rooms, electric-vehicle battery lines, and hygienic food plants underscore the sector's expanding application scope. Competitive intensity is rising as market leaders pair traditional pneumatics with digital monitoring to cut downtime and energy loss. At the same time, tightening efficiency rules in major economies are accelerating the shift toward hybrid electro-pneumatic solutions, giving suppliers a new avenue for differentiation.

Global Pneumatic Equipment Market Trends and Insights

Increasing Automation Across Industries

Mass-scale factory digitalization is reshaping pneumatic design, prompting suppliers to embed sensors and wireless modules that allow predictive analytics. SMC's EXW1 wireless node trims valve-manifold size by 86% and supports leading industrial Ethernet protocols, demonstrating how miniaturization and connectivity now converge in a single package. For plant managers, real-time health data on cylinders and valves translates into fewer unplanned stops and faster root-cause analysis. Adoption momentum is especially strong in electronics, automotive, and packaged-goods plants building greenfield "lights-out" lines. Compliance audits under ISO 11011 give added weight to solutions that quantify compressed-air baselines, making digitally enabled pneumatics a compelling investment. Suppliers able to prove measurable OEE gains are winning head-to-head bids against legacy offerings.

Demand for Energy-Efficient Compressed-Air Systems

Compressed air accounts for roughly 10% of industrial electricity load, and new U.S. DOE efficiency rules effective January 2025 are forcing upgrades across the installed base. Atlas Copco's hybrid compressor portfolio, which toggles between fixed-speed and VSD modes, can trim annual CO2 output by 9 tons per unit while keeping pressure stability within +-0.1 bar. In Europe, ASHRAE 90.1-2022 inclusion of compressed air raises the bar for building designers as well. From a financial angle, leak rates often exceed 30% and cost individual factories tens of thousands of dollars in wasted power each year, incentivizing rapid payback retrofits. Enterprise sustainability officers now view leak-detection programs as low-hanging decarbonization wins, further accelerating demand for high-efficiency pneumatics.

High Lifetime Maintenance and Energy Costs

Total cost-of-ownership audits reveal that energy can make up 77% of compressor lifecycle expense, dwarfing capital outlay. Leak-fix programs cut consumption, yet they demand instrumentation and staff hours that smaller plants often lack. Government studies in Australia report average leakage at 30%, confirming a global inefficiency pattern. While IIoT sensors promise automated leak tracking, initial hardware and analytics subscriptions deter price-sensitive operators. The persistence of double-digit electricity inflation in parts of Europe amplifies scrutiny on pneumatic bills and nudges buyers toward alternative actuation modes when duty cycles permit.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of EV Manufacturing Facilities

- IIoT-Enabled Predictive Maintenance Retrofits

- Substitution by Electric Actuators in Precision Tasks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Upswing Valves captured 33.02% of the pneumatic equipment market share in 2025, underscoring their central role in pressure and flow governance inside automated lines. Their dominance persists because every circuit, from pick-and-place robots to bulk conveyors, relies on directional and proportional valves to orchestrate motion sequences. Growth leans toward compact, protocol-agnostic manifolds that shorten installation time and align with smart-factory architectures.

Actuators are accelerating with a 7.46% CAGR, reflecting manufacturers' need for higher payload accuracy and faster cycle rates. Emerson's XV Series pushes 350 NL/min in a slim footprint, allowing designers to shrink cabinets without sacrificing throughput. Air preparation units and precision fittings round out the component mix as clean-air mandates intensify, while sensor accessories flourish thanks to predictive-maintenance adoption. As a result, the pneumatic equipment market continues to migrate from stand-alone parts to fully integrated, data-rich assemblies.

Motion control held 40.02% of 2025 demand across the pneumatic equipment market, reflecting its ubiquity in linear slides, rotary tables, and pressing stations. The segment benefits from pneumatics' favorable power-to-weight ratio and millisecond response, assets prized on high-speed assembly lines. Emphasis is now on feedback-ready cylinders that feed stroke data to MES platforms for traceability.

Material handling posts the swiftest 7.95% CAGR as e-commerce logistics fuels automated sortation centers. SMC's RMH grippers, certified for cobot collaboration, illustrate how soft-touch gripping opens new SKU handling capabilities. Fluid control retains a niche in process industries, while vacuum generation expands in semiconductor wafer transport. Convergence is evident: advanced manifolds are combining positioning, gripping, and vacuum logic in one node, fortifying supplier stickiness in the pneumatic equipment market.

The Pneumatic Equipment Market Report is Segmented by Component (Actuators, Valves, Air Preparation Units, Fittings and Tubing, and More), Function (Motion Control, Fluid Control, Material Handling, and More), End-User Industry (Automotive, Food and Beverage Processing and Packaging, Aerospace and Defense, and More), Pressure Range (Low, Medium, and High), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 34.21% of global 2025 revenue owing to mature aerospace, pharmaceutical, and automotive sectors that demand high-specification solutions. Siemens' USD 10 billion commitment to new Texas and California plants illustrates the region's ongoing reshoring trend, which lifts component orders for motion, valve, and compressor packages. Imminent DOE compressor rules are sparking retrofit waves that stabilize equipment replacement cycles.

Asia Pacific posts the steepest 7.66% CAGR and is set to narrow the gap by 2031 as China, India, and ASEAN states erect new fabs and battery plants. Atlas Copco's USD 46.5 million purchase of Korea-based Kyungwon Machinery signals strategic moves to localize supply and meet skyrocketing regional demand. Government incentives for semiconductor self-reliance in India and Vietnam add fresh pull for ultra-clean pneumatics.

Europe maintains a solid share, buoyed by stringent energy and sustainability directives. Bosch Rexroth's EUR 160 million plant in Mexico underscores European OEMs' split-market strategy: retain R&D at home while building cost-effective capacity near the U.S. customer base. Smaller but rising opportunities in South America and the Middle East hinge on petrochemical diversification projects that require rugged high-pressure pneumatic arrays, adding incremental volume to the pneumatic equipment market.

- Festo SE and Co. KG

- Emerson Electric Co.

- SMC Corporation

- Parker-Hannifin Corporation

- Siemens AG

- Ingersoll Rand Inc.

- Atlas Copco AB

- Bosch Rexroth AG

- Norgren Ltd. (IMI plc)

- Airtac International Group

- CKD Corporation

- Camozzi Automation S.p.A.

- Danfoss A/S

- Honeywell International Inc.

- Eaton Corporation plc

- ROSS Operating Valve Co.

- Bimba Manufacturing LLC (IMI)

- Janatics India Pvt Ltd

- Chicago Pneumatic Tool Co. LLC

- Koki Holdings Co., Ltd.

- Yamaha Motor Co., Ltd. (Robotics)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing automation across industries

- 4.2.2 Demand for energy-efficient compressed-air systems

- 4.2.3 Rapid growth of hygienic FandB processing lines

- 4.2.4 Expansion of EV manufacturing facilities

- 4.2.5 Micro-fluidic assembly demand for micro-actuators

- 4.2.6 IIoT-enabled predictive maintenance retrofits

- 4.3 Market Restraints

- 4.3.1 High lifetime maintenance and energy costs

- 4.3.2 Substitution by electric actuators in precision tasks

- 4.3.3 ESG-driven penalties on compressed-air leakage

- 4.3.4 Shortage of ultra-clean compressed air for semicon fabs

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Macroeconomic Impact Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Actuators

- 5.1.2 Valves

- 5.1.3 Air Preparation Units (FRLs)

- 5.1.4 Fittings and Tubing

- 5.1.5 Air Compressors

- 5.1.6 Vacuum Generators

- 5.1.7 Accessories

- 5.2 By Function

- 5.2.1 Motion Control

- 5.2.2 Fluid Control

- 5.2.3 Material Handling

- 5.2.4 Vacuum Creation

- 5.2.5 Power Generation / Air Supply

- 5.3 By End-user Industry

- 5.3.1 Automotive

- 5.3.2 Food and Beverage Processing and Packaging

- 5.3.3 Aerospace and Defense

- 5.3.4 Life Sciences (Pharma and Medical Devices)

- 5.3.5 Electronics and Semiconductor

- 5.3.6 Chemical and Petrochemical

- 5.3.7 Packaging Machinery

- 5.3.8 Other End-user Industries

- 5.4 By Pressure Range

- 5.4.1 Low Pressure (less than 7 bar)

- 5.4.2 Medium Pressure (7 - 15 bar)

- 5.4.3 High Pressure (above 15 bar)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 ASEAN-5

- 5.5.4.6 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Festo SE and Co. KG

- 6.4.2 Emerson Electric Co.

- 6.4.3 SMC Corporation

- 6.4.4 Parker-Hannifin Corporation

- 6.4.5 Siemens AG

- 6.4.6 Ingersoll Rand Inc.

- 6.4.7 Atlas Copco AB

- 6.4.8 Bosch Rexroth AG

- 6.4.9 Norgren Ltd. (IMI plc)

- 6.4.10 Airtac International Group

- 6.4.11 CKD Corporation

- 6.4.12 Camozzi Automation S.p.A.

- 6.4.13 Danfoss A/S

- 6.4.14 Honeywell International Inc.

- 6.4.15 Eaton Corporation plc

- 6.4.16 ROSS Operating Valve Co.

- 6.4.17 Bimba Manufacturing LLC (IMI)

- 6.4.18 Janatics India Pvt Ltd

- 6.4.19 Chicago Pneumatic Tool Co. LLC

- 6.4.20 Koki Holdings Co., Ltd.

- 6.4.21 Yamaha Motor Co., Ltd. (Robotics)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment