|

시장보고서

상품코드

1689779

PD-1 및 PD-L1 억제제 시장 : 점유율 분석, 산업 동향, 성장 예측(2025-2030년)PD-1 And PD-L1 Inhibitors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

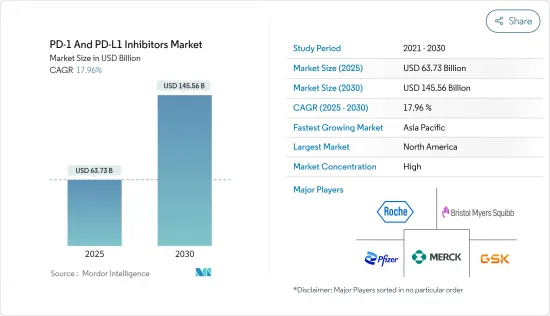

세계의 PD-1 및 PD-L1 억제제 시장 규모는 2025년 637억 3,000만 달러로 추정되며, 예측 기간 중(2025-2030년) CAGR 17.96%로 확대되어, 2030년에는 1,455억 6,000만 달러에 이를 것으로 예측됩니다.

PD-1 및 PD-L1 억제제 시장의 성장을 가속하는 요인은 몇 가지 있다고 예측됩니다. 이것에는 연구개발(R&D) 투자 증가, 바이오 제약 기업에 의한 임상 검사 증가, 규제 당국으로부터의 승인의 신속화, 세계의 암 부담의 증대 등이 포함됩니다.

수많은 기업과 연구기관이 다양한 암을 대상으로 한 새로운 PD-1 억제제의 개발을 위한 노력을 강화하고 있습니다. 2023년 6월 Cancer Focus Fund, LP는 텍사스 대학 MD Anderson Cancer Center와 제휴하여 450만 달러의 투자를 발표했습니다. 이번 투자는 특히 MD Anderson에 대한 IMGS-001의 멀티 사이트 제1a/1b상 임상 검사를 지원하는 것입니다.

예측 기간 중, 시장은 세계의 암 환자의 대폭적인 증가로부터 혜택을 받을 것으로 예상됩니다. PD-L1과 같은 단백질과 결합하면 T세포가 암세포를 포함한 다른 세포를 공격하는 것을 저해합니다. 이처럼 암 환자 증가는 유망한 효과로 알려진 PD-1 및 PD-L1 억제제 수요를 증가시켜 예측 기간 중 시장 성장을 가속할 것으로 예상됩니다.

게다가 주요 기업의 제품 승인과 활발한 임상 검사가 시장을 더욱 자극할 것으로 예상됩니다. 이 승인은 tislelizumab과 플루오로피리미딘과 백금 제제에 의한 화학요법과의 병용에 대한 것으로, PD-L1 고발현의 국소 진행 절제 불능 또는 전이성 소화관선암 환자에 대한 제1선택 치료로서 승인되었습니다.

개요를 정리하면 연구개발 활동의 강화, 암 이환율의 상승, 제품 승인에 견인되어 시장은 성장하는 태세에 있습니다.

PD-1 및 PD-L1 억제제 시장 동향

PD-1 억제제 부문은 예측 기간 동안 상당한 성장이 예상됩니다.

면역요법제의 일종인 PD-1(프로그램 세포사단백질 1) 억제제는 암 치료 시장에 큰 영향을 주고 있습니다. 이러한 치료는 다양한 암종에서 실질적인 임상 효과를 나타내며, 특히 진행성 및 전이성 질환의 환자에 대한 치료 상황을 일변시키고, 종종 기존 화학요법을 능가하고 있습니다.

PD-1 억제제에는 많은 이점이 있습니다. 즉, 면역 반응의 향상, 생존율의 개선, 독성의 경감, 주효 기간의 연장의 가능성입니다. 사선요법, 표적요법, 기타 면역요법 등, 다른 암치료와 효과적으로 병용할 수 있습니다.

현재 진행중인 조사에서는 다양한 질병에 있어서의 PD-1 억제제의 폭넓은 가능성이 모색되고 있습니다.

마찬가지로, 2023년 8월에 ASH 출판물에 의해 발표된 연구에서는 비맹검 1/2상 검사가 강조되어 있습니다. 이 검사에서는 항 PD-1 치료 후 재발 호지킨 림프종 환자를 대상으로 fabezelimab(항 LAG-3)과 pembrollizumab의 병용 요법이 검토되었습니다. 그 결과 항 PD-1 치료 후 cHL이 진행한 전 치료력이 많은 환자에 있어서, 관리 가능한 안전성을 유지하면서 유의한 항종양 활성이 나타난 것으로 나타났습니다.

예측기간 중 북미가 큰 시장 점유율을 차지할 전망

북미는 PD-1 및 PD-L1 억제제 시장에서 예측 기간 동안 큰 성장을 이룰 전망입니다. 피부암, 요로 상피암, 폐암 등의 암 이환율의 상승에 기인하고 있습니다. 또한, 이 지역 시장 확대는 활발한 제품 출시와 진행중의 조사 연구에 의해 뒷받침되고 있습니다.

미국에서는 흑색종 환자 수가 증가하고 있기 때문에 PD-1 억제제와 PD-L1 억제제 수요가 확대되어, 이 지역 시장 성장에 박차가 걸릴 것으로 보여지고 있습니다. 미국임상종양학회의 2023년 데이터에서는 미국의 성인 9만 7,610명이 2023년에 침윤성 피부 흑색종으로 진단될 것으로 예측되고 있습니다.

PD-1 억제제의 조사 강화는 시장 성장의 매우 중요한 촉진요인입니다. Cancer에서는 미국의 2개의 독립 환자 코호트의 분석 결과가 발표되었습니다. 이 환자는 진행 NSCLC로 진단되었으며, PD-L1 종양 비율 점수(TPS)가 50% 이상이며, PD-1 억제제에 의한 치료가 이루어졌습니다. TPS가 90% 이상의 환자에게 장기 생존에 큰 이점을 제공한다는 것을 강조했습니다.

게다가, 이 지역에서 제품 출시의 급증은 약물의 이용가능성을 높여 시장 성장을 가속합니다. 미국 FDA는 2022년 9월 국소 진행성 또는 전이성 담도암(BTC) 성인 환자를 대상으로 듀르발맙(임핀지, AstraZenecaUK)과 겜시타빈과 시스플라틴의 병용 요법을 승인했습니다.

이러한 역학을 근거로 하면, 동 시장은 예측 기간 중에 현저한 성장을 이룰 것으로 보이며, 그 원동력은 동 지역 전체에 있어서의 연구개발 노력의 고조와 암 치료의 진보입니다.

PD-1 및 PD-L1 억제제 산업 개요

PD-1 및 PD-L1 억제제 시장은 통합되어 있으며, 유명한 시장 진출 기업으로 구성되어 있습니다. 질병 부담의 미충족 과제를 해결하기 위해 기존 약물로 다른 적응증의 치료를 확대하는 임상 검사에 투자하는 기업도 있습니다. 주요 시장 참여 기업에는 Bristol-Myers Squibb Company, Merck and Co., AstraZeneca PLC, Pfizer Inc., GSK plc, F. Hoffmann-La Roche AG 등을 들 수 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 바이오제약기업에 의한 연구개발과 임상검사에 대한 투자 증가

- 규제 당국에 의한 호의적인 승인이나 특별 지정에 의한 장려 이니셔티브 증가

- 다양한 암 증가

- 시장 성장 억제요인

- 고액의 암 치료에 수반되는 합병증의 위험

- 규제 프로세스의 불확실성과 번거로운 임상 검사의 고비용에 의한 개발 과제

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자/소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 억제제의 유형별

- PD-1 억제제

- PD-L1 억제제

- 용도별

- 호지킨 림프종

- 신장암

- 흑색종

- 비소세포 폐암

- 기타

- 유통 채널별

- 병원 약국

- 소매 약국

- 온라인 약국

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC 국가

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 기업 프로파일

- Bristol-Myers Squibb Company

- Merck & Co.

- F. Hoffmann-La Roche AG

- GSK plc

- Amgen Inc.

- Eli Lilly and Company

- AstraZeneca PLC

- BeiGene LTD

- Pfizer Inc.

- Regeneron Pharmaceuticals Inc.

제7장 시장 기회와 앞으로의 동향

JHS 25.05.07The PD-1 And PD-L1 Inhibitors Market size is estimated at USD 63.73 billion in 2025, and is expected to reach USD 145.56 billion by 2030, at a CAGR of 17.96% during the forecast period (2025-2030).

Several factors are projected to drive the growth of the PD-1 and PD-L1 inhibitors market. These include increased investments in research and development (R&D), a rise in clinical trials by bio-pharmaceutical companies, faster approvals from regulatory authorities, and a growing global cancer burden.

Numerous companies and research institutions are intensifying their efforts to develop new PD-1 inhibitors for various cancers. This strengthened pipeline, along with an increase in approvals, is expected to fuel market growth. For instance, in June 2023, Cancer Focus Fund, LP, in partnership with The University of Texas MD Anderson Cancer Center, announced a USD 4.5 million investment. This funding was allocated for the Phase 1a/1b clinical trial of ImmunoGenesis' lead candidate, IMGS-001. IMGS-001, a dual-specific PD-L1/PD-L2 antibody developed by ImmunoGenesis, targets immune-excluded tumors resistant to current immunotherapies. The investment specifically supports the multi-site Phase 1a/1b clinical trial of IMGS-001 at MD Anderson. Such an increase in trials underscores the heightened R&D activities in the PD-1 and PD-L1 inhibitors market, indicating a robust therapy pipeline and encouraging further exploration of innovative therapeutic approaches, thus driving market growth.

Over the forecast period, the market is expected to benefit from a significant rise in global cancer cases. For instance, data from the American Cancer Society (ACS) projects that by January 2024, the U.S. cancer patient count will reach 2.0 million, up from 1.95 million in 2023. PD-1, when binding to proteins like PD-L1, inhibits T cells from attacking other cells, including cancerous ones. Thus, the rising cancer cases are anticipated to increase the demand for PD-1 and PD-L1 inhibitors, known for their promising results, thus driving market growth over the forecast period.

Additionally, product approvals and active clinical trials by key players are expected to further stimulate the market. For instance, in February 2023, BeiGene's PD-1 inhibitor, tislelizumab, received approval from China's National Medical Products Administration (NMPA). This approval was for tislelizumab's use in combination with fluoropyrimidine and platinum chemotherapy, marking it as a first-line treatment for patients with high PD-L1 expression diagnosed with locally advanced unresectable or metastatic gastrointestinal adenocarcinoma.

In summary, driven by intensified R&D activities, a rising cancer incidence, and product approvals, the market is poised for growth. However, challenges such as the high costs and associated complications of oncology treatments, uncertainties in the regulatory landscape, and the steep expenses of clinical trials could temper this growth trajectory.

PD-1 And PD-L1 Inhibitors Market Trends

PD-1 Inhibitors Segment is Expected to Witness Significant Growth Over the Forecast Period

PD-1 (programmed cell death protein 1) inhibitors, a class of immunotherapy drugs, are significantly impacting the cancer treatment market. These agents have demonstrated substantial clinical benefits across various cancer types and have transformed the treatment landscape, particularly for patients with advanced or metastatic diseases, often outperforming traditional chemotherapy.

PD-1 inhibitors offer numerous advantages: they enhance the immune response, improve survival rates, reduce toxicity, and provide the potential for prolonged responses. Additionally, these inhibitors can be effectively combined with other cancer treatments, including chemotherapy, radiation, targeted therapies, and other immunotherapies. Such combinations have frequently shown synergistic effects, improving response rates and patient outcomes.

Ongoing research is exploring the broader potential of PD-1 inhibitors across various diseases. For instance, in February 2024, a collaborative effort led by researchers from the University of Hong Kong's Department of Microbiology and other esteemed institutions revealed that PD-1-boosted DNA vaccinations could sustain virus-specific CD8+ T cell immunity in an AIDS monkey model.

Similarly, an August 2023 study published by ASH publications highlighted an open-label phase 1/2 trial. This trial examined the combination of Favezelimab (anti-LAG-3) and Pembrolizumab in patients with relapsed Hodgkin lymphoma (cHL) post anti-PD-1 treatment. The findings indicated that heavily pretreated patients, whose cHL progressed after anti-PD-1 therapy, exhibited significant antitumor activity with manageable safety. Furthermore, research from the National Institute of Health in August 2022 emphasized the benefits of adding pembrolizumab (Keytruda) for select patients battling advanced triple-negative breast cancer. Such robust R&D supporting PD-1 therapies is expected to drive market growth.

North American is Expected to Hold a Significant Market Share during the Forecast Period

North America is poised for substantial growth in the PD-1 and PD-L1 inhibitors market over the forecast period. This surge is attributed to the rising incidence of cancers, including skin cancer, urothelial carcinomas, and lung cancers, across the United States, Canada, Mexico, and other regional nations. Furthermore, the region's market expansion is bolstered by active product launches and ongoing research studies.

As the United States grapples with a rising number of melanoma cases, the demand for PD-1 and PD-L1 inhibitors is set to escalate, fueling regional market growth. For context, the American Society of Clinical Oncology's 2023 data projected that 97,610 adults in the United States would be diagnosed with invasive skin melanoma in 2023. Notably, melanoma ranks as the fifth most prevalent cancer in the United States, underscoring the swift uptick in its cases.

Intensified research on PD-1 inhibitors stands as a pivotal driver for market growth. For instance, at the IASLC 2023 World Conference on Lung Cancer in November 2023, results were presented from an analysis of two independent patient cohorts from the United States. These patients, diagnosed with advanced NSCLC and possessing a PD-L1 tumor proportion score (TPS) of 50% or higher, were treated with a PD-1 inhibitor. The findings underscored that PD-1 monotherapy offers a significant long-term survival advantage for patients with advanced NSCLC, especially those with a PD-L1 TPS of 90% or more.

Furthermore, a surge in product launches across the region is set to enhance drug availability, propelling market growth. For instance, in March 2023, the United States FDA greenlit Zynyz (retifanlimab-dlwr), a humanized monoclonal antibody targeting PD-1, for adults battling metastatic or recurrent locally advanced cell carcinoma. In a similar vein, the United States FDA, in September 2022, sanctioned the combination of durvalumab (Imfinzi, AstraZeneca UK Ltd) with gemcitabine and cisplatin for treating adults with locally advanced or metastatic biliary cancer (BTC).

Given these dynamics, the market is set for notable growth during the forecast period, driven by heightened R&D efforts and advancements in cancer treatments across the region.

PD-1 And PD-L1 Inhibitors Industry Overview

The PD-1 and PD-L1 inhibitors market is consolidated and consists of prominent market players. Some companies are expanding their market position by adopting various strategies such as acquisitions, mergers, and research collaboration, while others are investing in clinical trials to extend the treatment of other indications with the existing drugs to address the unmet challenges of the disease burden driving the market share. Some of the key market players in the PD-1 and PD-L1 inhibitors market are Bristol-Myers Squibb Company, Merck and Co., AstraZeneca PLC, Pfizer Inc., GSK plc, and F. Hoffmann-La Roche AG among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Investments in R&D and Clinical Trials by Bio-pharmaceutical Industries

- 4.2.2 Increased Encouragement Initiatives by the Regulatory Authorities with Favorable Approvals and Special Designations

- 4.2.3 Growing Burden of Different Cancers

- 4.3 Market Restraints

- 4.3.1 Risk of Complications Associated with the Highly Expensive Oncology Treatment

- 4.3.2 Challenges in Development with Uncertainty in Regulatory Process and High Costs of Tedious Clinical Trials

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Type of Inhibitors

- 5.1.1 PD-1 Inhibitors

- 5.1.2 PD-L1 Inhibitors

- 5.2 By Application

- 5.2.1 Hodgkins Lymphoma

- 5.2.2 Kidney Cancer

- 5.2.3 Melanoma

- 5.2.4 Non-small Cell Lung Cancer

- 5.2.5 Other Applications

- 5.3 By Distribution Channel

- 5.3.1 Hospital Pharmacies

- 5.3.2 Retail Pharmacies

- 5.3.3 Online Pharmacies

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United states

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Bristol-Myers Squibb Company

- 6.1.2 Merck & Co.

- 6.1.3 F. Hoffmann-La Roche AG

- 6.1.4 GSK plc

- 6.1.5 Amgen Inc.

- 6.1.6 Eli Lilly and Company

- 6.1.7 AstraZeneca PLC

- 6.1.8 BeiGene LTD

- 6.1.9 Pfizer Inc.

- 6.1.10 Regeneron Pharmaceuticals Inc.